Market

This Is How Stacks (STX) Price Action Is Affecting the Investors

The price of Stacks (STX) is making its way back up to where it was before the bearish cues took over the crypto market.

The investors see the potential that the asset has and change their tone, as does the market.

Stacks of Green Candlesticks

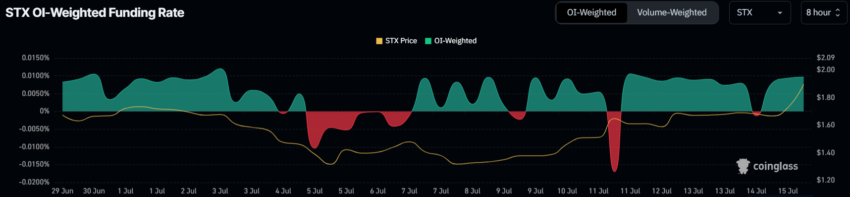

STX price is set to benefit from investors’ optimism after a positive last couple of days. The altcoin’s funding rate indicates that investors are still skeptical. However, this sentiment could be changing as the rate is turning positive after fluctuating from negative.

This positive shift in the funding rate suggests a potential change in market sentiment towards STX. A positive funding rate typically indicates that traders are willing to pay a premium for long positions, reflecting growing optimism.

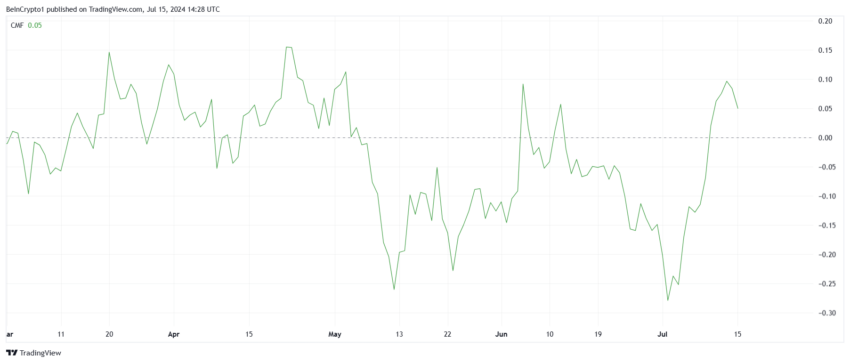

The Chaikin Money Flow (CMF) for STX also highlights increasing inflows. This trend suggests that more capital is entering the market, supporting the idea that investors are becoming more confident.

Read More: What Are Decentralized Exchanges and Why Should You Try Them?

As indicated by the CMF, the growing inflows substantiate investors’ willingness to witness a surge in STX’s price. This increased capital inflow is a positive sign for the future price action of STX.

STX Price Prediction: Up Next, $2

The STX price, which is trading at $1.86 at the time of writing, has risen by close to 8% in the last 24 hours. The altcoin is close to breaching the resistance at $2.00, which is possible if the $1.80 support is cemented as a support floor.

The aforementioned factors point towards an extended rally that could send the crypto asset beyond $2.00. This would help in reclaiming the profits lost during the recent crash.

Read More: Top 10 Aspiring Crypto Coins for 2024

But if the investors decide to book profits following further surge in price, the rally could be halted. STX price could decline to lose the support of $1.80 resulting consolidation and invalidation of bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR’s Long/Short Ratio Hits Monthly Peak

Hedera’s Long/Short ratio has soared to a 30-day high, signaling a bullish shift in market sentiment.

This comes amid severe market volatility and huge long liquidations across many assets. With growing bullish sentiment, HBAR could reverse its downward trend and record gains in the near term.

HBAR Shows Bullish Signs as Long Positions Surge

Despite a broader market downturn that has weighed on altcoin prices, HBAR is bucking the trend in terms of investor positioning.

Coinglass data shows that many traders are entering long positions on the token, indicating growing confidence in a potential upside move. This is reflected by its Long/Short, which currently sits at a 30-day high of 1.06 at press time.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market. A ratio below one means there are more short positions than long positions.

Conversely, as with HBAR, when an asset’s long/short ratio is above one, more traders are holding long positions than short positions, indicating a bullish market sentiment.

Further, HBAR’s open interest has climbed, supporting this bullish outlook. As of this writing, it is at $142 million, rising 3% in the past 24 hours. Notably, during this period, HBAR’s price is down 2%.

When an asset’s price falls, but open interest rises, it suggests that traders are still actively entering new positions, potentially anticipating a future price rebound despite the current decline.

A combined reading of HBAR’s long/short ratio and rising open interest amid falling prices signals that the majority of its traders have a bullish outlook. This indicates that even with price declines, HBAR traders anticipate an upward trend in the near future.

Profit-Taking Threatens HBAR’s Rally

At press time, HBAR exchanges hands at $0.15. The gradual resurgence in bullish sentiment and new demand could reverse its current downtrend and push HBAR toward $0.17.

However, if profit-taking continues and bullish pressure becomes subdued again, HBAR could contain its decline and fall to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Rallies After Trump’s 90-Day Pause on Tariffs

Donald Trump announced today that he’s instituting a 90-day pause on all tariffs except those on China. Bitcoin has surged over $80,000, while altcoins like XRP, Solana, and Cardano surged more than 10% in just minutes of the announcement.

The Dow Jones and stock market reacted similarly, surging by 2,000 points after the news. The US President has now added a total of 125% tariff on China, while pausing others.

Trump Reverses Tariff Plan

Since Donald Trump has made huge tariffs a cornerstone of his financial policy, the markets have reacted with a huge amount of uncertainty. After imposing 104% tariffs against China last night, however, Trump has made a shocking reversal. Although the tariffs against China will still stand, he is repealing those on all other nations.

This news immediately caused a substantial rally in the markets. The Dow Jones responded at 1:30 PM Eastern Time by shooting upwards over 2000 points, and this was mirrored in other high-profile stocks. The markets have been desperate for a form of relief, and it looks like it’s here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Futures To Launch LDUSDT Reward-Bearing Margin Asset

Binance Futures is launching LDUSDT, a reward-bearing margin asset based on Tether’s popular stablecoin. This product will focus on offering flexibility to the user, who can trade LDUSDT while reaping APR rewards.

This is the second product of this nature that Binance Futures has offered following its BFUSD launch last November. LDUSDT is scheduled to launch this month, and its success may encourage similar margin offerings in the future.

Binance Futures To Launch LDUSDT

Binance, the world’s largest crypto exchange, continues to expand its product offerings. It dominates crypto trading and the vast majority of staking rewards, but it also offers several margin assets.

Binance Futures added another such asset today: LDUSDT, a reward-bearing margin asset that lets users earn APR rewards from Simple Earn USDT Flexible Products.

“After the launch of our first reward-bearing margin asset BFUSD was positively received by users, we are pleased to introduce yet another product to bring more utility to our users. LDUSDT increases capital efficiency for users and lets users put their assets to work for them,” Jeff Li, VP of Product at Binance, said in an exclusive press release shared with BeInCrypto.

Binance’s new asset is based on Tether’s USDT, the world’s leading stablecoin, but LDUSDT is a totally different asset. Its main focus is on giving Binance users more flexibility, as they can trade this asset while continuing to reap passive income from APR.

This option is available to all users that have USDT on Binance Earn’s Simple Earn Flexible Products. LDUSDT is Binance’s second reward-bearing non-stablecoin margin asset, following BFUSD, which was launched last November.

Although the firm recently delisted USDT from its European operations due to regulatory concerns, this product is centered around the popular stablecoin.

According to the announcement, the exchange will launch LDUSDT “soon” without a specific release date. The exclusive press release claimed that the asset will be released sometime this April.

The company did not indicate whether it would offer more margin assets like this in the future. However, LDUSDT gives Binance Futures’ users a huge level of flexibility, which will hopefully encourage users to experiment.

A success here could encourage the firm to follow this up with similar products in the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Makes Important Move in Ripple Case, Here’s All

-

Market21 hours ago

Market21 hours agoCardano (ADA) Surges 8% as Bulls Push for Breakout

-

Market20 hours ago

Market20 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows

-

Market23 hours ago

Market23 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is XRP Price Falling After ETF Hype?

-

Bitcoin13 hours ago

Bitcoin13 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US