Market

This Is How Stacks (STX) Price Action Is Affecting the Investors

The price of Stacks (STX) is making its way back up to where it was before the bearish cues took over the crypto market.

The investors see the potential that the asset has and change their tone, as does the market.

Stacks of Green Candlesticks

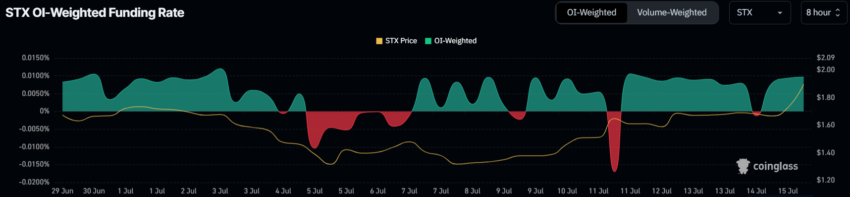

STX price is set to benefit from investors’ optimism after a positive last couple of days. The altcoin’s funding rate indicates that investors are still skeptical. However, this sentiment could be changing as the rate is turning positive after fluctuating from negative.

This positive shift in the funding rate suggests a potential change in market sentiment towards STX. A positive funding rate typically indicates that traders are willing to pay a premium for long positions, reflecting growing optimism.

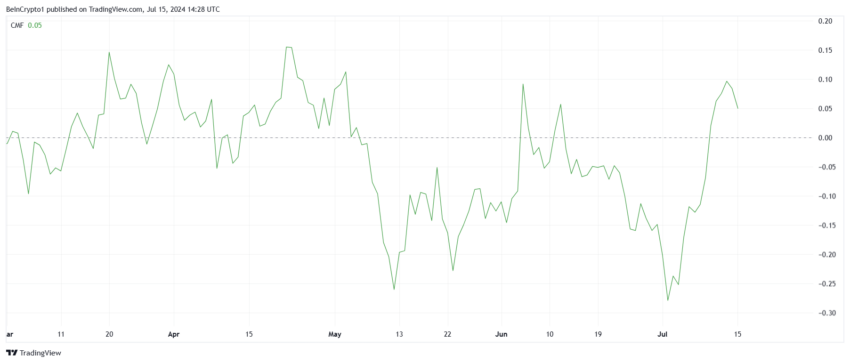

The Chaikin Money Flow (CMF) for STX also highlights increasing inflows. This trend suggests that more capital is entering the market, supporting the idea that investors are becoming more confident.

Read More: What Are Decentralized Exchanges and Why Should You Try Them?

As indicated by the CMF, the growing inflows substantiate investors’ willingness to witness a surge in STX’s price. This increased capital inflow is a positive sign for the future price action of STX.

STX Price Prediction: Up Next, $2

The STX price, which is trading at $1.86 at the time of writing, has risen by close to 8% in the last 24 hours. The altcoin is close to breaching the resistance at $2.00, which is possible if the $1.80 support is cemented as a support floor.

The aforementioned factors point towards an extended rally that could send the crypto asset beyond $2.00. This would help in reclaiming the profits lost during the recent crash.

Read More: Top 10 Aspiring Crypto Coins for 2024

But if the investors decide to book profits following further surge in price, the rally could be halted. STX price could decline to lose the support of $1.80 resulting consolidation and invalidation of bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.