Regulation

Coinbase Provides Blueprint For US SEC On Digital Assets Regulation

As parties sheath their swords after a protracted legal saga, Coinbase has presented a blueprint to the US SEC for digital asset regulation. The proposal involves suggestions to the SEC for regulating digital securities ahead of its Crypto Task Force roundtables.

A Four-Point Blueprint For Digital Asset Regulation

Coinbase Chief Legal Officer Paul Grewal revealed on X (formerly Twitter) that the US-based exchange has put forward a blueprint for digital securities regulation. According to Grewal, Coinbase’s proposal is a response to a raft of questions presented by SEC Commission Hester Pierce on the best way to regulate digital securities.

While the law is crystal clear on traditional securities, digital securities are a gray area for the Commission given the novelty of the concept. To address Pierce’s questions, Coinbase presented a detailed blueprint to assist the securities watchdog.

The first step in Coinbase’s proposal is for the SEC to create a “clear taxonomy” for the distinction between cryptocurrency commodities and securities. Secondly, the SEC is encouraged to declare that secondary market sales of commodities are not securities transactions. As the regulatory haze clears, the SEC has dismissed its Ripple lawsuit, shuttering similar actions against Coinbase and Kraken.

Thirdly, rather than creating rules on the go, Coinbase wants the SEC to seek Congressional opinion in areas of ambiguity. Lastly, the blueprint urges the SEC to make rules that recognize the potential of Web 3 and tokenized securities.

“If we get this right, we will finally see a real tokenized securities market led by the US,” said Grewal.

A Rising Trend Of Collaborating With The SEC

The US SEC is changing stances toward the cryptocurrency industry following the departure of Gary Gensler. A newly minted Crypto Task Force led by Pierce is inching toward a series of roundtables to define security status.

Several key ecosystem players have indicated a desire to collaborate with the SEC in its “Spring Sprint Toward Crypto Clarity.” While Coinbase is collaborating with the SEC, it has filed a FOIA request against the Commission, seeking clarity for its enforcement actions.

“The previous SEC spent four years attacking a lawful industry, and American taxpayers were left holding the bill,” said Coinbase.

Outside of its row with US regulators, Coinbase has re-entered India to offer retail trading services. The largest cryptocurrency exchange in the US is expanding to new frontiers to keep pace with its peers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

Hawk Tuah girl Hailey Welch, known for her association with the controversial $HAWK token, has been cleared of any wrongdoing after a lengthy investigation by the U.S. Securities and Exchange Commission (SEC). The SEC has decided not to press charges against Welch in connection with the rapid rise and subsequent collapse of the meme-based cryptocurrency.

US SEC Investigation Into Hawk Tuah Girl Concludes Without Charges

The SEC had launched an investigation into the $HAWK token after its dramatic price drop. The token, which was linked to Welch’s viral persona, initially saw a market cap surge to $490 million before crashing by over 90%. Investors who were impacted by the crash filed a lawsuit against those behind the project, alleging that the coin had been promoted and sold without proper registration.

Hawk Tuah girl Hailey Welch, who cooperated fully with the investigation, expressed relief after the SEC’s decision. “For the past few months, I’ve been cooperating with all the authorities and attorneys, and finally, that work is complete,” Welch told TMZ.

Her attorney, James Sallah, confirmed that the SEC had closed the case without any findings against her, adding that there would be no monetary sanctions or restrictions on Welch’s future involvement in cryptocurrency or securities.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Sonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

Barely a week after hinting at launching an algorithmic USD stablecoin, Sonic Labs is shuttering its plans. Sonic Labs co-founder Andre Cronje revealed that incoming stablecoin regulation in the US contributes to the change of stance.

Sonic Labs Makes U-Turn Over Algorithmic USD Stablecoin

In mid-March, Sonic Labs disclosed plans for a yield-generating algorithmic stablecoin for its blockchain. However, new developments in the US regulatory landscape are forcing the company to ditch its algorithmic stablecoin ambitions.

Sonic Labs co-founder Andre Cronje confirmed the change in direction via an X post following the release of the full draft of the STABLE Act by Congress for clearer oversight. According to the text, lawmakers are pushing for a two-year moratorium on algorithmic stablecoin, souring Sonic Labs plans.

Unlike mainstream stablecoins backed by fiat or other commodities, algorithmic stablecoins rely on smart contracts to maintain their peg. The 2022 implosion of Terra’s ecosystem following the de-pegging of its TerraUSD (UST) algorithmic stablecoin stunned regulators.

“We will no longer be releasing a USD-based algorithmic stablecoin,” said Cronje.

In a light-hearted note, community members teased potential strategies for Sonic Labs to sidestep incoming stablecoin regulation. Apart from the loophole of launching the algorithmic stablecoin before the regulation goes live, Cronje teased an algorithmic dirham that will be denominated in USD.

Industry Players Are Bracing For New Stablecoin Regulations

Stablecoin issuers are steeling themselves for incoming stablecoin regulations in the US. While the GENIUS Act and STABLE Act continue to inch forward, there are common denominators in both bills.

For starters, there is the requirement for equivalent reserves at a 1:1 ratio with both bills steering clear of algorithmic stablecoins. The White House is favoring the GENIUS Act over the STABLE Act as lobbyists rally to stifle the possibility of a Conference Committee.

Authorities are targeting stablecoin regulation to reach Trump in two months as issuers jostle for position. Tether, Circle, and Ripple are staking their claims to lead the US government’s ambitions to rely on stablecoins to maintain the dollar’s dominance.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

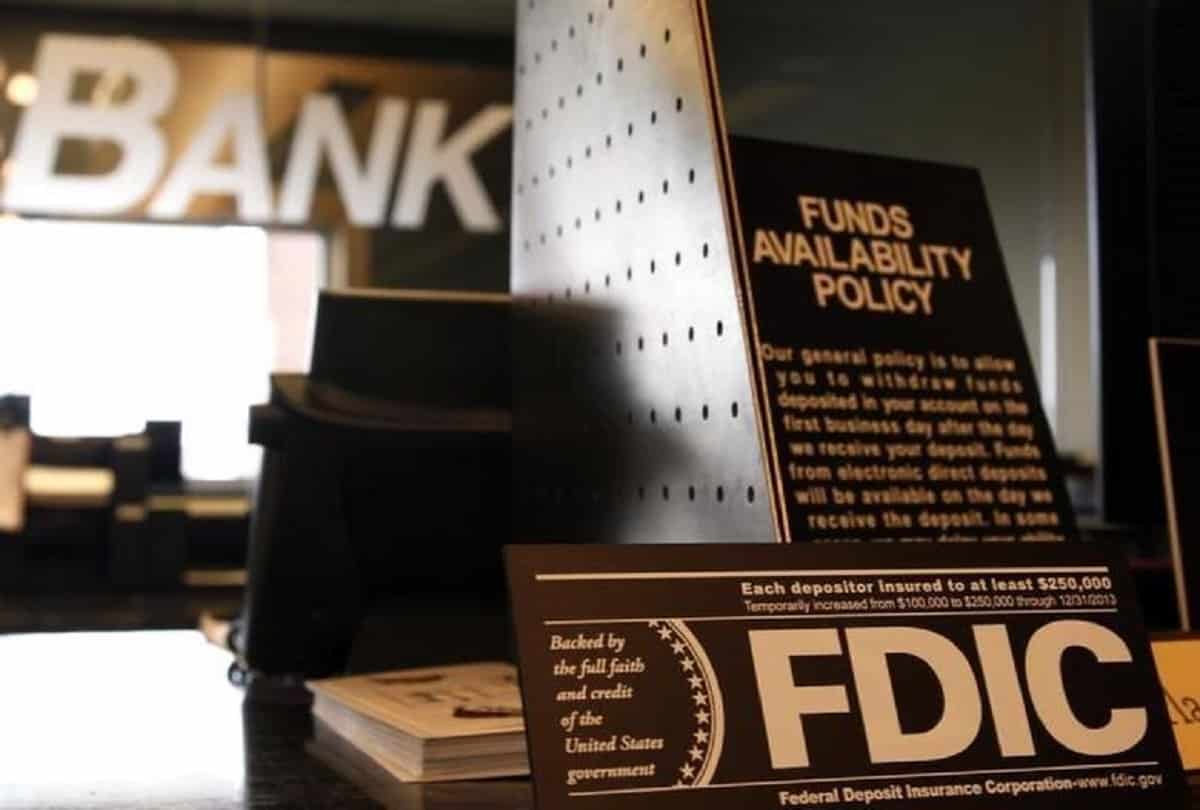

FDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

The Federal Deposit Insurance Corporation (FDIC) has updated its guidelines, enabling banks to engage in cryptocurrency-related activities without seeking prior approval. This new policy shift signals a change in the FDIC’s approach to the growing role of digital assets in the banking sector.

New FDIC Guidelines on Crypto-Related Activities

The FDIC has issued a new Financial Institution Letter (FIL-7-2025), which provides updated guidance for banks looking to engage in cryptocurrency activities. The new guidance rescinds the previous policy set out in FIL-16-2022, which required banks to notify the FDIC before engaging in such activities.

Under the new rules, banks can now participate in permissible crypto-related activities without waiting for FDIC approval, as long as they manage the risks appropriately.

This change is seen as a shift in the FDIC’s stance, following the agency’s earlier stance that required prior approval for crypto engagements. FDIC Acting Chairman Travis Hill expressed that this new approach aims to establish a more consistent framework for banks to explore and adopt emerging technologies like crypto-assets and blockchain.

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years,” said Hill in a statement.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Cup And Handle Pattern Signals Recovery To $0.4, Here’s How

-

Market20 hours ago

Market20 hours agoWhy BTC Price Stayed Unchanged

-

Market19 hours ago

Market19 hours agoBitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?

-

Market23 hours ago

Market23 hours agoOnyxcoin (XCN) Nears Oversold After a 30% Monthly Drop

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Reveals Why The XRP Price Will Dominate Bitcoin & Ethereum

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Bet Grows Bigger: The Blockchain Group Snaps Up 580 BTC

-

Market22 hours ago

Market22 hours agoHyperLiquid Responds to JELLY Crisis Amid Community Backlash

-

Market21 hours ago

Market21 hours agoBinance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

✓ Share: