Market

XRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

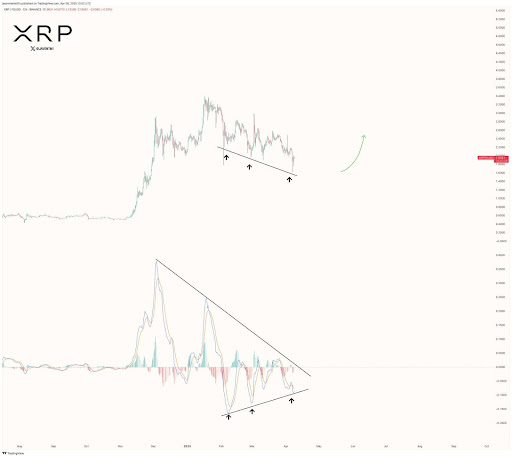

XRP’s recent recovery has sparked fresh optimism among traders, but what’s happening behind the scenes tells an even more compelling story. This isn’t just a typical bounce; the charts reveal a calculated shift in momentum. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are beginning to align, suggesting that XRP is approaching a crucial decision zone.

Following the recent downturn in the market, the price is now on a bullish recovery after testing the $1.7 key support level with increasing conviction. If the current momentum continues and resistance zones give way, XRP could be on the verge of a significant breakout. However, failure to build on this momentum could trap the token in another consolidation phase or a deeper retracement.

MACD Signals Brewing Bullish Pressure For XRP

In a recent post on X, crypto analyst Javon Marks pointed out that XRP’s MACD is approaching a critical breaking point, potentially signaling a shift in market momentum. He emphasized that this MACD indicator is showing signs of a bullish crossover, which could mark the start of a strong upward movement.

Coupled with this, Marks highlighted that XRP is currently holding a key Regular Bullish Divergence, where the price has been making lower lows while the MACD is showing higher lows. This indicates a weakening of bearish pressure, setting the stage for a potential reversal.

Marks suggested that this technical setup could be the catalyst for the bulls to take control, potentially leading to a powerful move that breaks through current resistance levels. With this convergence of bullish signals, XRP may be primed for a rally back toward the $3.30+ range, continuing its previous uptrend.

Key Levels to Watch: The Exact Breakout And Rejection Zones That Matter

In order to fully understand the future movements of XRP, it’s crucial to pinpoint the key levels that will either drive the price higher or cause a reversal. Firstly, the breakout zone for the altcoin lies around the $1.97 resistance level.

If the price manages to surpass this threshold with strong volume, it could trigger a surge towards higher levels, including $2.64 and $2.92. This breakout would likely confirm the upward momentum suggested by the MACD and the regular bullish divergence.

On the other hand, a rejection at the $1.97 resistance level might signal a lack of buying interest. Should the asst fail to break above this level, the price could pull back toward lower support levels like $1.7 or even $1.34. A failure to hold these support levels would trigger the potential for a more substantial downturn, with bears regaining control.

Market

Top 3 AI Coins To Watch: RENDER, IP, and CLANKER

AI coins continue to draw attention as April nears its end, with Render (RENDER), Story Protocol (IP), and CLANKER standing out. RENDER has led the pack, surging nearly 17% this week and reclaiming a $2 billion market cap.

In contrast, Story (IP) is down 6.5%, the worst performer among the top 10 AI tokens, while CLANKER dropped over 7% in the last 24 hours. With momentum shifting across the sector, all three tokens are positioned at key technical levels that could define their next move.

RENDER

Render Network provides decentralized GPU computing power for creators, developers, and artificial intelligence applications. Its infrastructure supports rendering for 3D graphics, visual effects, and artificial intelligence model training.

RENDER, the network’s native token, has surged nearly 17% over the past week, pushing its market cap back above $2 billion. It was the top performer among the ten largest AI coins in the market.

If the bullish momentum holds, RENDER could test resistance levels at $4.065 and $4.21, and a breakout could open the path to $4.63.

However, if the trend reverses, key support lies at $3.82 and $3.68—losing these could trigger a deeper decline toward $3.47 or even $3.14 in a stronger correction.

Story (IP)

Story Protocol is a decentralized infrastructure designed to manage and monetize intellectual property (IP) on-chain, with a strong focus on artificial intelligence.

It allows creators to register stories, characters, and other digital assets, enabling collaborative development, licensing, and programmable royalties—all while integrating AI into the creation and distribution process.

Despite its explosive 477% rally between February 16 and 26, Story’s native token, IP, is down 6.5% over the last seven days—the largest drop among the top 10 AI coins.

If the current correction continues, IP could test support at $3.82, and a break below that may push the price under $3. However, if bullish momentum returns, IP could retest resistance at $4.49 and then aim for $5.04.

A strong rebound could eventually lift the token back toward the $6.61 zone, reclaiming some of its earlier hype.

tokenbot (CLANKER)

Tokenbot is a coin launchpad built on the Base chain. Its native token, CLANKE, has been down over 7% in the last 24 hours.

Notably, Base has climbed to the fourth spot in weekly DEX volume, reaching $4.7 billion—just behind BNB, Ethereum, and Solana—although its volume is down 7.73% in the last week.

Interest remains around Base’s recent push into “Content Coins,” with the community watching closely to see how the narrative evolves.

If CLANKER’s current downtrend deepens, it could test support at $27.97 and potentially fall to $22.84, dropping below $25 for the first time since April 6.

On the upside, a recovery could lead to a test of the $36 resistance, followed by $40. If sentiment around Base tokens strengthens, CLANKER could rally toward $47 as momentum builds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Struggles Under $0.17 Despite Strong Support

Hedera (HBAR) is up more than 5% in the last 24 hours, showing signs of short-term relief after a rough start to April.

Despite the bounce, technical indicators still point to a weak overall trend, with bearish EMA alignment and a flat ADX reading. Momentum remains uncertain, but bulls have managed to defend key support levels so far.

Hedera Shows Early Signs of Bullish Shift, But Trend Still Weak

Hedera’s DMI indicator shows its ADX at 19.8—slightly up from 18.49 two days ago but down from a recent high of 21.94 earlier today.

The ADX (Average Directional Index) measures the strength of a trend, regardless of its direction. Values below 20 typically indicate a weak or consolidating market, while readings above 25 suggest a strong trend is developing.

HBAR’s current ADX near 20 suggests momentum is still relatively soft, with no clear directional strength in place.

Looking at the directional indicators, the +DI (Directional Indicator) has risen from 13.42 to 14.2, showing a slight increase in bullish pressure. Meanwhile, the -DI has declined from 19.89 to 17.15, indicating weakening bearish momentum.

This narrowing gap between +DI and -DI may signal a potential shift in favor of the bulls, but with ADX still under 25, the trend remains unconfirmed.

If +DI continues to climb and crosses above -DI, Hedera could attempt a short-term reversal—but for now, the market remains in a cautious, sideways phase.

HBAR Enters Cloud Zone as Trend Momentum Stalls

The Ichimoku Cloud chart for HBAR reflects a mostly neutral to slightly bearish trend.

The price is currently trading below the Kijun-sen (red line) and very close to the Tenkan-sen (blue line), indicating weak short-term momentum and a lack of clear direction.

Both lines are flat, which often signals consolidation and market indecision.

Looking ahead, the Kumo (cloud) is relatively thick and bearish, with the Senkou Span A below the Senkou Span B. However, price action has entered the cloud zone, suggesting possible trend exhaustion or transition.

The Chikou Span (lagging green line) is overlapping with recent price candles, reinforcing the sideways outlook.

Unless HBAR breaks cleanly above the cloud and reclaims the Kijun-sen, the market is likely to remain in a holding pattern.

Hedera Holds Key Supports, But Bearishness Still Lingers

Hedera’s EMA lines are currently showing a bearish structure, with short-term averages positioned below the long-term ones—typically a sign of ongoing downward momentum.

Despite this, HBAR price has recently tested and held support at both $0.156 and $0.153, signaling that buyers are still defending key levels. If the trend reverses from here, HBAR could begin a recovery move, first targeting resistance at $0.168.

A break above that level could open the path to $0.178, and if bullish momentum strengthens further, a move toward $0.201 could follow.

On the flip side, if selling pressure resumes, Hedera could retest the same support zones at $0.156 and $0.153.

Losing these levels would weaken the technical structure significantly and could trigger a deeper drop.

In that case, the next major support comes all the way down near $0.124, which would represent a substantial decline and reinforce the current bearish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How One Trader Caused MANTRA OM’s $5.5 Billion Crash

The recent OM collapse at MANTRA has left the community confused. In a series of instant drops, $5.5 billion was erased. According to several analyses, the incident was caused by one trader manipulating two exchanges.

This whole incident highlights the fragility of many token projects. Despite an ostensibly huge market cap, a comparatively tiny amount of liquidity triggered a complete collapse.

Exploring the OM Crash

When MANTRA’s OM token collapsed earlier this week, it left a huge number of unanswered questions. It sparked allegations of foul play, and rumors of insider activity have dogged the company since.

According to a new analysis, the initial trigger of the OM crash was a single trader:

“This was due to an entity(s) on Binance perpetuals market. That’s what triggered the entire cascade. The initial drop below $5 was triggered by a ~1 million USD short position being market sold. This caused over 5% of slippage in literal microseconds. That was the trigger. This seems intentional to me. They knew what they were doing,” he stated.

After triggering this initial anomaly, this OM trader continued dumping short positions at five-second intervals, which powered the overall crash. As these continual dumps continued on Binance, the OKX spot market saw a discount of nearly 20%.

The Seller Finds Exit Liquidity

This strange behavior on OKX was caused by a massive whale. A limit sell order allows the seller to specify the minimum price they are willing to sell a crypto asset for. The order will only execute if the market price reaches or exceeds the limit price. Until then, the order remains open in the order book.

This person single-handedly kept the price fixed on OKX for over a minute, causing market makers and arbitrage bots to buy the assets despite panic selling in the broader market. By this method, the perpetrator was able to dump OM tokens while the crash was underway.

The issue, then, is not that OM fell because of a nefarious actor trying to engineer a crash. Instead, the problem is that a single entity could manipulate the markets so thoroughly.

For an attack like this to work, OM’s ostensible market cap had to be substantially more fragile than anticipated.

In other words, even though OM’s market cap was theoretically very high, it took a comparatively small investment to crash the RWA token like a house of cards. Some have even speculated that this trader wasn’t even trying to cause a crisis.

Rather, they may have been investors who were forced to sell due to loan terms or risk limits. Some slight manipulation could’ve led to a larger catastrophe.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

-

Market21 hours ago

Market21 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market20 hours ago

Market20 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum19 hours ago

Ethereum19 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Market19 hours ago

Market19 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?

-

Altcoin17 hours ago

Altcoin17 hours agoCrypto Whales Bag $20M In AAVE & UNI, Are DeFi Tokens Eyeing Price Rally?

-

Market23 hours ago

Market23 hours agoXRP Slides Into Bearish Zone Amid Weak Trading Signals

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Reveals Hurdles For Ripple And The SEC Ahead Of Final Resolution