Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

Market

PI Coin Recovers 80% From All-time Low — Will It Retake $1?

PI has staged a remarkable comeback after plunging to an all-time low of $0.40 on April 5. Amid a broader market recovery over the past week, the altcoin has seen a resurgence in demand, driving its price up 84% from its recent bottom.

With the bulls attempting to strengthen market control, PI could extend its gains in the short term.

PI Recovers From Crash With Strong Bullish Setup

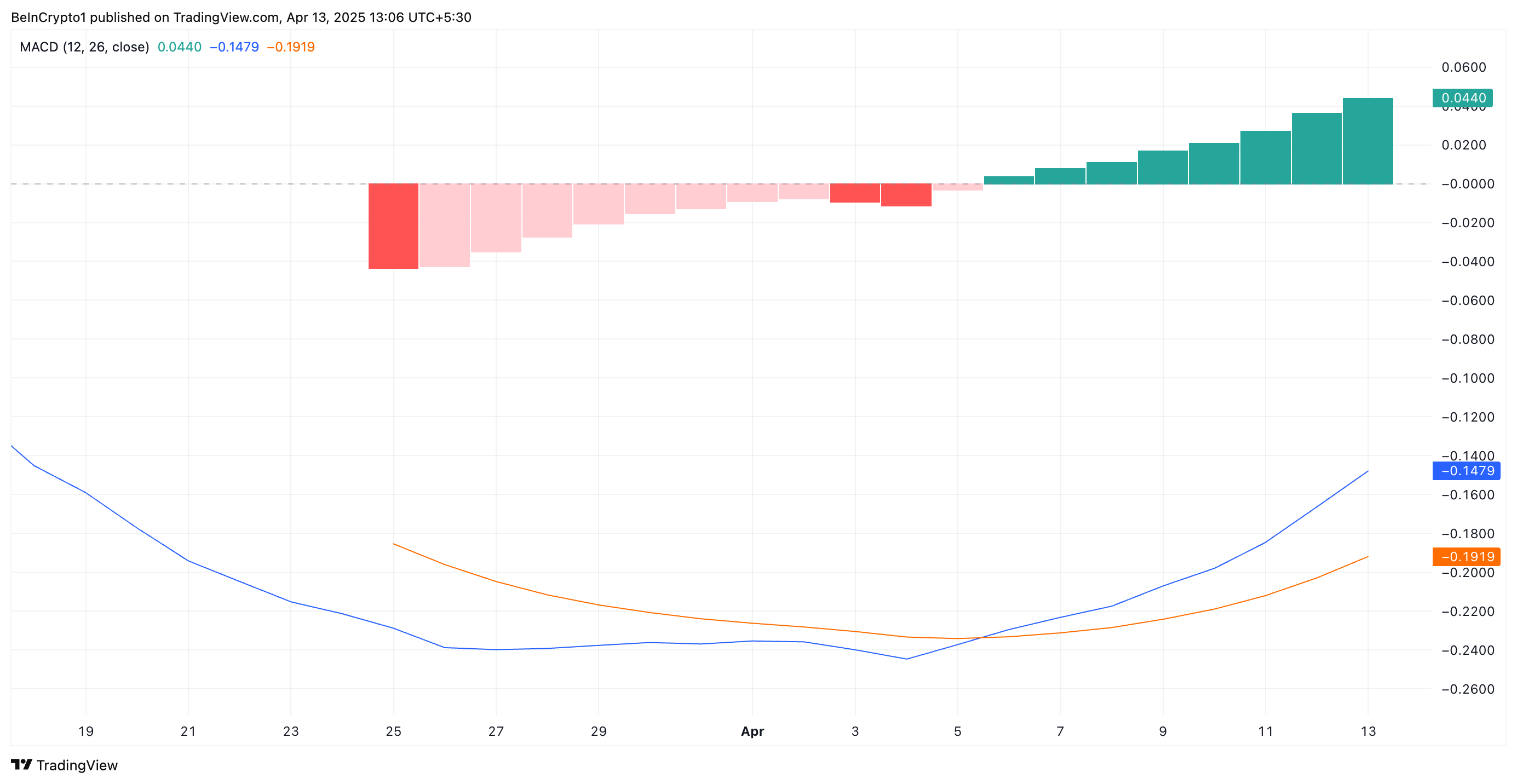

PI’s Moving Average Convergence Divergence (MACD) indicator has flashed a bullish signal. On the daily chart, the MACD line (blue) crossed above the signal line (orange) on April 5, indicating a positive shift in momentum right after it bottomed at $0.40.

Additionally, the histogram bars, which reflect the strength of that momentum, have gradually increased in size over the past few days, highlighting the growing demand for the altcoin.

When an asset’s MACD is set up this way, upward momentum is building, and buyers are gaining control. PI’s MACD crossover is a bullish signal, suggesting the potential for continued price gains as buying pressure increases.

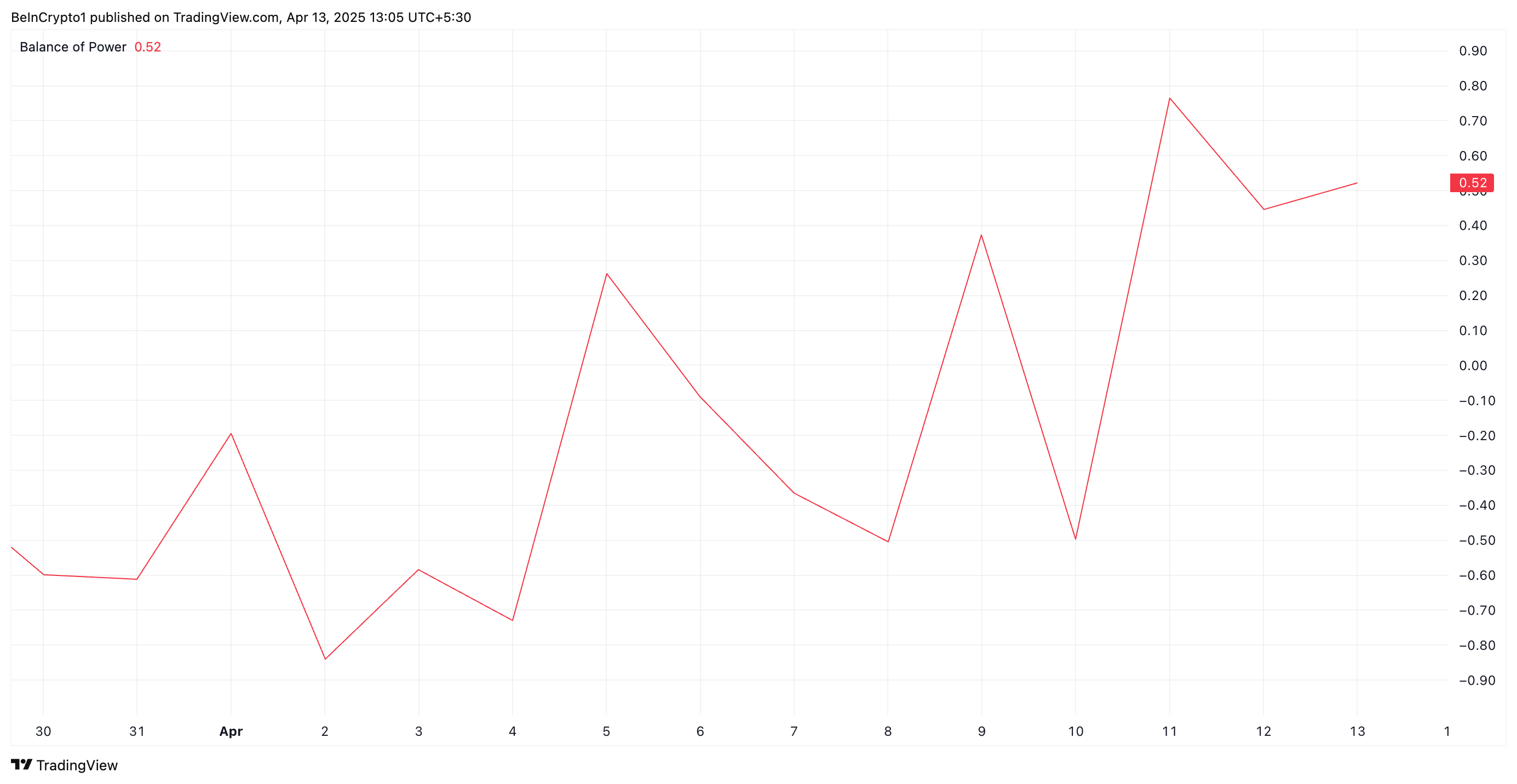

In addition, PI’s positive Balance of Power (BoP) reflects the growing demand for the altcoin. As of this writing, the indicator is at 0.52.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is positive, buyers are dominating the market over sellers and driving newer price gains.

Is $1 Within Reach?

PI’s ongoing rally has caused its price to trend within an ascending parallel channel. This bullish pattern is formed when an asset’s price consistently moves between two upward-sloping, parallel trendlines.

It signals a sustained uptrend, with PI buyers gradually gaining control while allowing short-term pullbacks. If the rally continues, PI could exchange hands at $0.95.

However, if the altcoin reverses its current trend and sheds recent gains, its value could fall to $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?

Since plunging to its year-to-date low of $1.61 on April 7, XRP holders have taken full advantage of the dip, ramping up accumulation efforts. This buying pressure has steadily increased the asset’s value over the past week.

At press time, XRP trades at a seven-day high of $2.19 and technical indicators show that it’s positioned to extend the gains.

XRP Golden Cross Drives Bullish Momentum

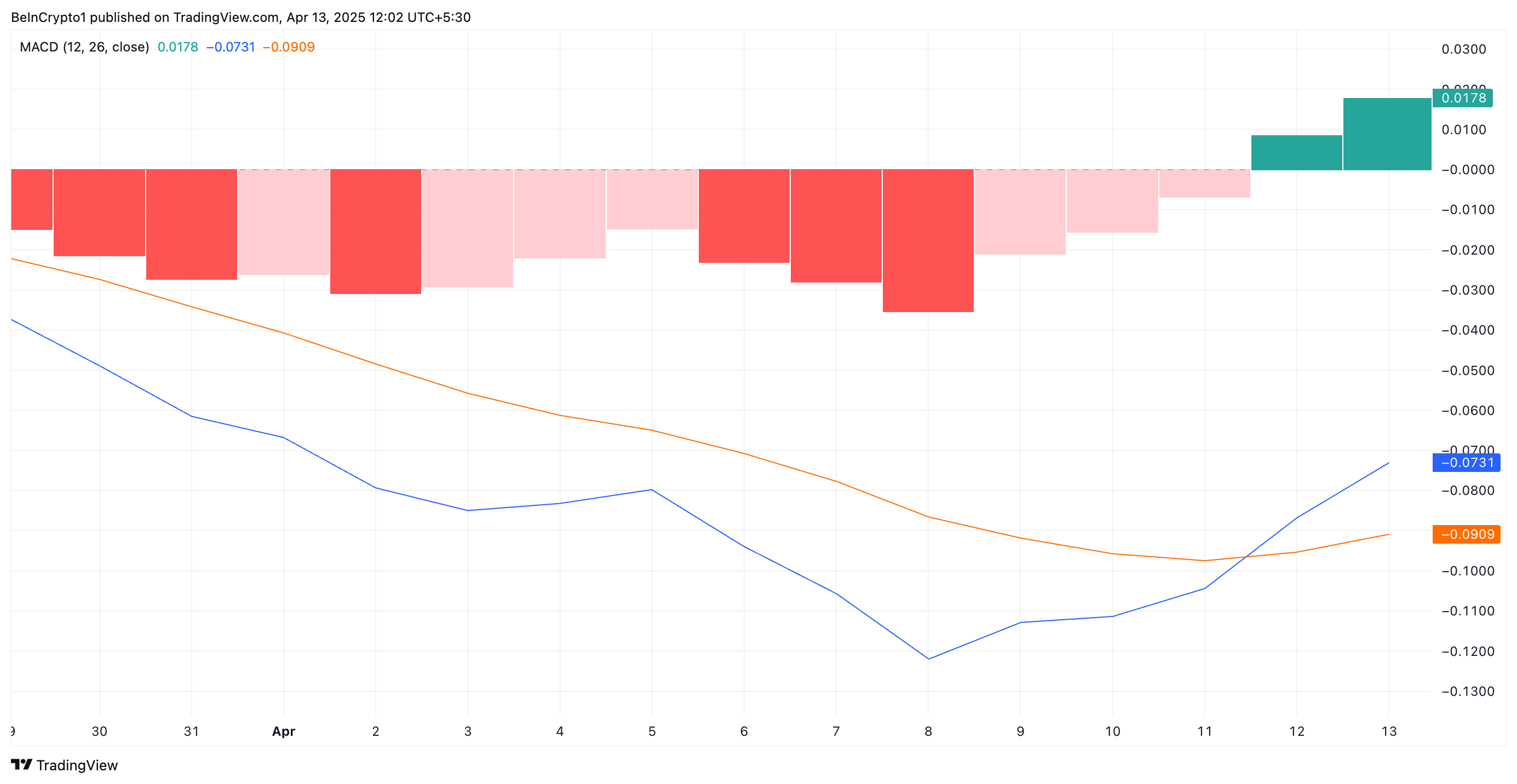

On the daily chart, a golden cross has formed on XRP’s Moving Average Convergence Divergence (MACD) indicator, which is often viewed as a key signal of a shift toward long-term upside.

The MACD indicator measures an asset’s price trends and momentum, and identifies reversal points. It forms a golden cross when its MACD line (blue) crosses above its signal line (orange).

When a golden cross emerges like this, it signals a positive shift in investor sentiment. Traders interpret it as a cue that buying pressure outpaces selling activity, which can attract even more inflows and drive the price higher.

For XRP, this golden cross occurred on April 11, reinforcing the growing bullish sentiment surrounding the asset. This pattern confirms that the altcoin’s recent price rebound is not just a short-lived reaction but may mark the beginning of a more sustained uptrend.

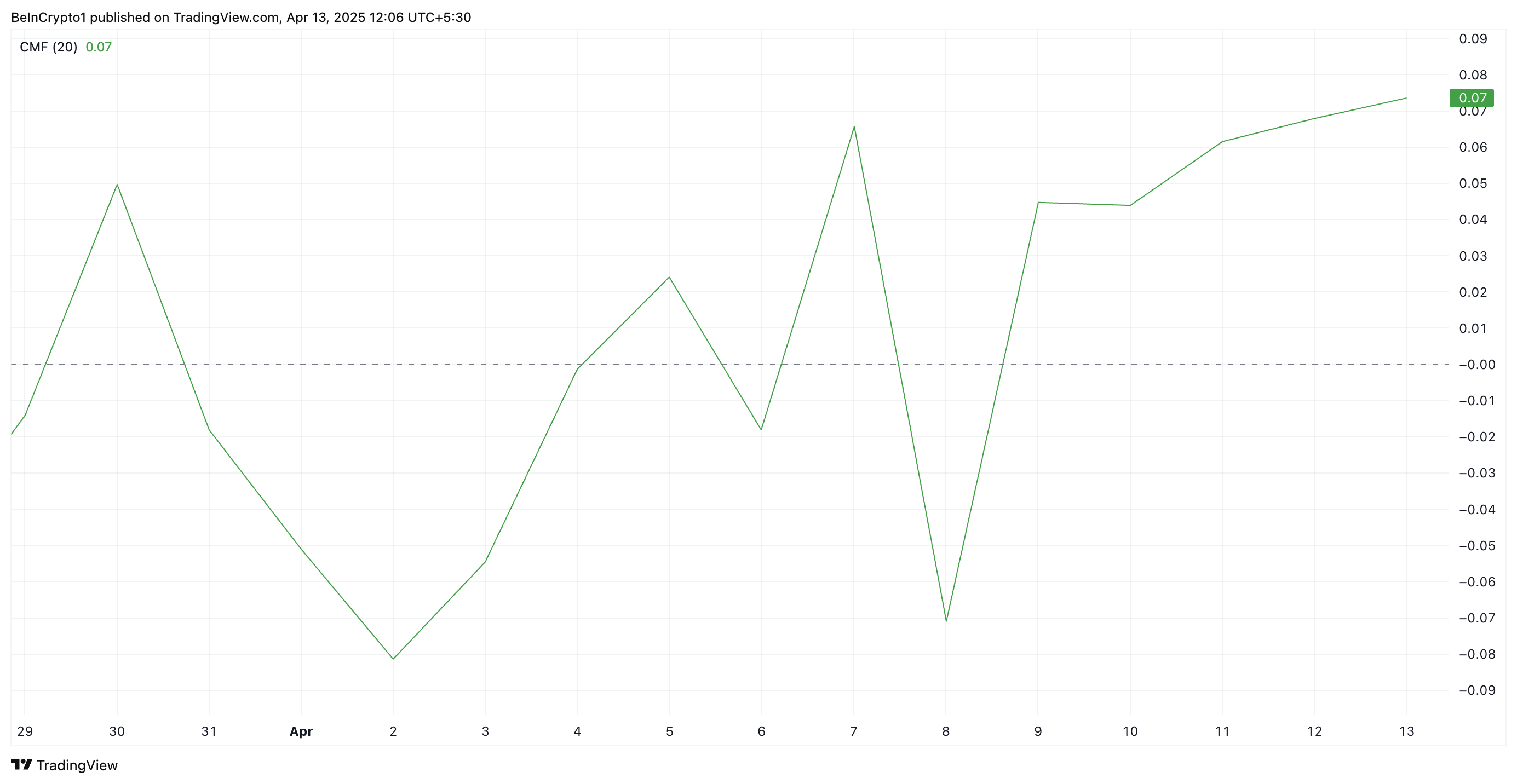

Further, the token’s positive Chaikin Money Flow (CMF) supports this bullish outlook. At press time, it rests above the center line and in an uptrend at 0.07.

The CMF indicator measures how money flows into and out of an asset. A positive CMF reading, as with XRP, means buying pressure is stronger than selling pressure over a given period. It suggests capital is flowing into the token, signaling accumulation and potential price growth.

XRP Maintains Uptrend—Next Stop: $2.50 or Back to $1.99?

Since its rally began on April 7, XRP has traded above an ascending trend line. This bullish pattern emerges when an asset forms higher lows over time, creating an upward-sloping support line.

It signals sustained buying interest in XRP and suggests that momentum is building in favor of the bulls as the token’s price continues to climb.

If demand soars, XRP could extend its gains and climb to $2.29. A successful flip of this resistance into a support floor could propel XRP to $2.50.

However, if profit-taking resumes and selling pressure rises, XRP could reverse its uptrend and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

New York Proposes Bill to Accept Bitcoin Payments for Tax

New York is taking a bold step toward mainstream crypto adoption. A new legislative proposal seeks to allow residents to use digital assets like Bitcoin, Ethereum, and Litecoin to pay for government-related services.

Although New York has yet to propose a Bitcoin reserve bill like its neighboring states, this proposal could pave the way for wider adoption in a state where crypto has been strictly regulated for years.

New York Could Soon Accept Tax and Rents in Bitcoin

The proposed legislation, known as Assembly Bill A7788, was introduced by Assemblyman Clyde Vanel.

The bill seeks to amend New York’s state finance law to allow government agencies to accept cryptocurrencies for a variety of payments. These include taxes, rent, fines, fees, and other state-imposed obligations.

“Each state agency is authorized to enter into agreements with persons to provide the acceptance, by offices of the state, of cryptocurrency as a means of payments of fines, civil penalties, rent, rates, taxes, fees, charges, revenue, financial obligations or other amounts including penalties, special assessments and interest, owed to state agencies,” the bill stated.

Under the bill, state agencies would be allowed—but not required—to enter agreements to accept crypto payments. This flexibility gives each agency the choice to determine whether accepting digital assets aligns with its operations.

If passed, it will also allow the government departments to impose a service fee on crypto transactions. This fee would only cover the actual cost to the state, including network transaction charges or other fees incurred during processing.

A7788 has now advanced to the Committee on Governmental Operations. If approved, the bill will go into effect 90 days after being signed into law.

Some Lawmakers Still Want Tighter Regulations

While the bill signals a more crypto-friendly stance in New York, not all state leaders support unrestricted adoption.

Attorney General Letitia James recently urged federal lawmakers to enact stronger regulatory frameworks for the crypto industry.

She cautioned that without clear federal oversight, digital assets could erode the dominance of the US dollar. She also warned they may expose national security risks and facilitate illegal financial activity.

“A strong dollar is in America’s national interest. It means there is demand for and confidence in US institutions and the US economy. America should defend the prime position of the US dollar for global transactions—a position that Bitcoin, which can instantly transfer value globally, threatens,” James stated.

James emphasized that bad actors can use cryptocurrencies to bypass traditional financial systems, fund adversarial regimes, or support criminal enterprises.

Although she acknowledged blockchain’s innovative potential, James outlined key principles for federal crypto regulation.

These include requiring platforms to comply with anti-money laundering laws, enforcing registration for issuers and intermediaries, and disallowing crypto in retirement accounts.

Her recommendations aim to protect investors, promote market transparency, and safeguard the broader economy.

“As Congress takes the mantle to propose legislation governing the cryptocurrency industry, we hope it also takes action to mitigate the risks posed by the industry to America’s national security, financial stability, and citizens,” James concluded.

While the state considers expanding crypto use, officials remain divided on how best to balance innovation with long-term financial security.

New York’s move could set a precedent if it aligns with safeguards that protect both the public and the economy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoSEC Signals Readiness to Rethink Crypto Trading Oversight

-

Market22 hours ago

Market22 hours agoEthereum ETFs See Seventh Consecutive Week of Net Outflows

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Market21 hours ago

Market21 hours agoRipple May Settle SEC’s $50 Million Fine Using XRP

-

Altcoin20 hours ago

Altcoin20 hours agoBankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

-

Bitcoin15 hours ago

Bitcoin15 hours agoBitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means

-

Market20 hours ago

Market20 hours agoSolana Bulls Lead 17% Recovery, Targeting $138