Market

XRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

Renowned market analyst Egrag Crypto has shared another puzzling XRP price prediction stating the altcoin is at a major technical crossroads. This development follows a resilient price performance in the past week during which XRP gained by 2.07% as the broader crypto market stands bullish despite the announcement of new US trade tariffs.

Ascending Wedge Signals Incoming Volatility — Which Way Will XRP Break?

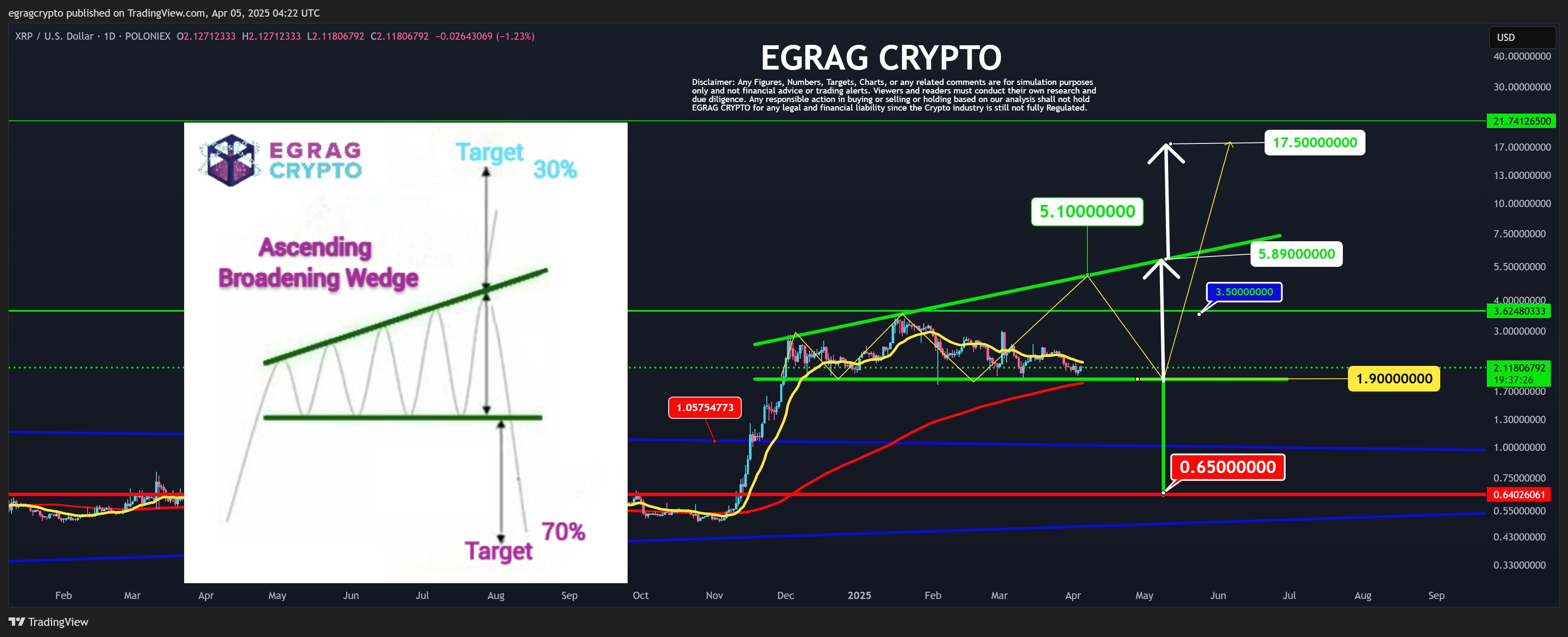

In an X post on April 5, Egrag Crypto issued a dual price forecast on the XRP market based on the potential implications of a forming Ascending Broadening Wedge pattern. Also known as the megaphone pattern, the chart formation signals increasing volatility and investor indecisions. It looks like a widening triangle with two diverging trendlines, as seen in the chart below.

The Ascending Broadening Wedge presents high unpredictability and offers a 70% chance of a downside breakout and a 30% probability of an upside breakout. However, despite this statistical bias, the analyst postulates the chances of an upside remain valid if certain conditions are met.

According to the analyst, XRP must first close above $3.50 for a bullish scenario to start taking shape. In doing so, the altcoin would surpass the local peak of the current bull cycle and confirm intentions of an upward momentum. Following this move, XRP bulls should then aim for the $5 range—another key resistance level that could determine the asset’s next major move.

Interestingly, Egrag explains that a failure to convincingly close above $5 would only be a critical development that completes the formation of the Ascending Wedge Pattern and increases the likelihood of a breakout. If this rejection occurs, XRP is expected to retest the $1.90 area and make a second push toward the $5, this time breaking through and closing above $6.

Egrag states the breakout above $6 would validate the bullish run and likely spark a surge toward double-digit territory with a potential target at $17.50 based on the Ascending Wedge Pattern. However, should XRP bulls fail to meet these conditions or follow this sequence, the historical 70% chance of a breakdown points to a downside target of around $0.65.

XRP Price Overview

At the time of writing, XRP trades at $2.14 reflecting a price gain of 0.60% in the past day. Meanwhile, the token’s trading volume is down by 62.92% in the past day indicating a fall in market engagement and a declining buying pressure following the recent market gain. In making any significant uptrend, XRP bulls must first reclaim the following resistances at $2.47 and $2.61 while avoiding any slip below the $2 support zone.

Market

Over $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is making headlines this month as whale activity surges across the network. In a surprising twist, reports indicate that XRP whales have dumped more than $700 million worth of tokens just this April. This sudden shift in whale behavior raises the question of what these big players are really up to.

XRP Whales Offload 370 Million Tokens In April

On April 15, prominent crypto analyst Ali Martínez reported on X (formerly Twitter) that XRP whales have begun dumping the popular cryptocurrency in large volumes. Following a period of substantial token accumulation, these large-scale investors have sold over 370 million XRP since the beginning of April.

Related Reading

Notably, this massive whale sell-off amounts to over $700 million, triggering a wave of speculation about the intentions behind this move. More interestingly, the XRP dumps appear to align with recent price fluctuations, as whales tend to heavily influence market dynamics, especially during a downturn.

The Santiment chart provided by Martinez reveals a clear trend, from April 3 to 14, 2025, that XRP wallets holding between 100 million to 1 billion tokens have drastically reduced their holdings. As this large-scale whale dumping progressed, the XRP price dropped to new lows around April 8 and then began a steady climb, reaching $2.1 at the time of writing.

While the reason behind such large-scale exits is unclear, a few plausible explanations exist. Whales might be capitalizing on earlier price gains to lock in profits while the market conditions for XRP remain relatively stable. These investors could also be responding to heightened market volatility, pushing them to shift their holdings into alternative assets to hedge risks and safeguard against losses.

Another possibility is that these big players are selling tokens between wallets or transferring them to exchanges in anticipation of a significant event — perhaps the final legal decision between Ripple and the United States Securities and Exchange Commission (SEC). In less optimistic scenarios, such coordinated whale activity, which tends to influence prices, may be indicative of market manipulation, often aimed at achieving strategic gains.

Although it’s uncertain whether the above motives are driving recent whale dumps, one thing is clear: large-scale XRP movements always warrant close attention. With XRP now hovering around $2, the market waits to see just how these sell-offs will influence the future price of the cryptocurrency.

Update On Latest XRP Price Action

According to crypto analyst Andrew Griffiths, the current XRP price analysis indicates a notably bullish trend. This momentum emerged after the cryptocurrency surpassed two key resistance levels and established a solid support level, signaling a potential upward movement.

Related Reading

As a result, the analyst predicts that XRP could record a massive gain of over 20% in the coming weeks. With the token currently trading at $2.10, a 20% increase would bring it to approximately $2.589. Based on the upward trajectory within the Ascending Channel seen on the price chart, the analyst predicts that XRP could climb as high as $3.3.

Featured image from Pixabay, chart from Tradingview.com

Market

XRP Price Finds Stability Above $2 As Opposing Forces Collide

XRP’s price has faced a struggle to recover in recent weeks, with broader market conditions remaining bearish. Despite these challenges, XRP has managed to hold steady above the $2 mark.

This stability is largely driven by long-term holders (LTHs), who are working to prevent the price from falling below this key level.

XRP Investors Capitalize On Low Prices

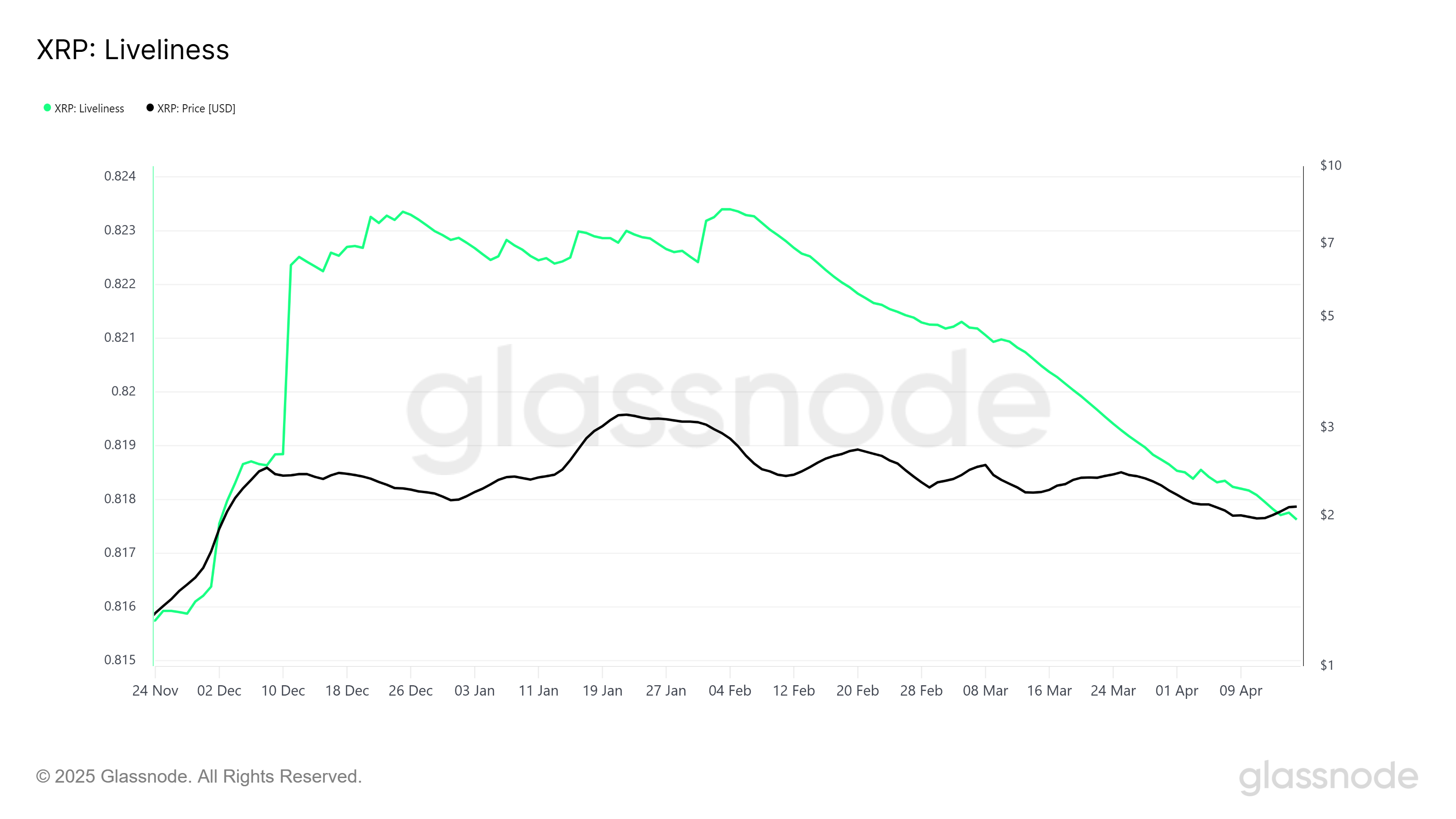

The Liveliness metric, which tracks the frequency of transactions, has been on a steady decline since February. This suggests that fewer tokens are changing hands, a sign that long-term holders are accumulating more XRP at lower prices.

This trend could be a positive indicator, showing that these investors believe in the future potential of XRP and are positioning themselves for long-term gains. Despite the accumulation of LTHs, market sentiment remains mixed due to the broader bearish environment.

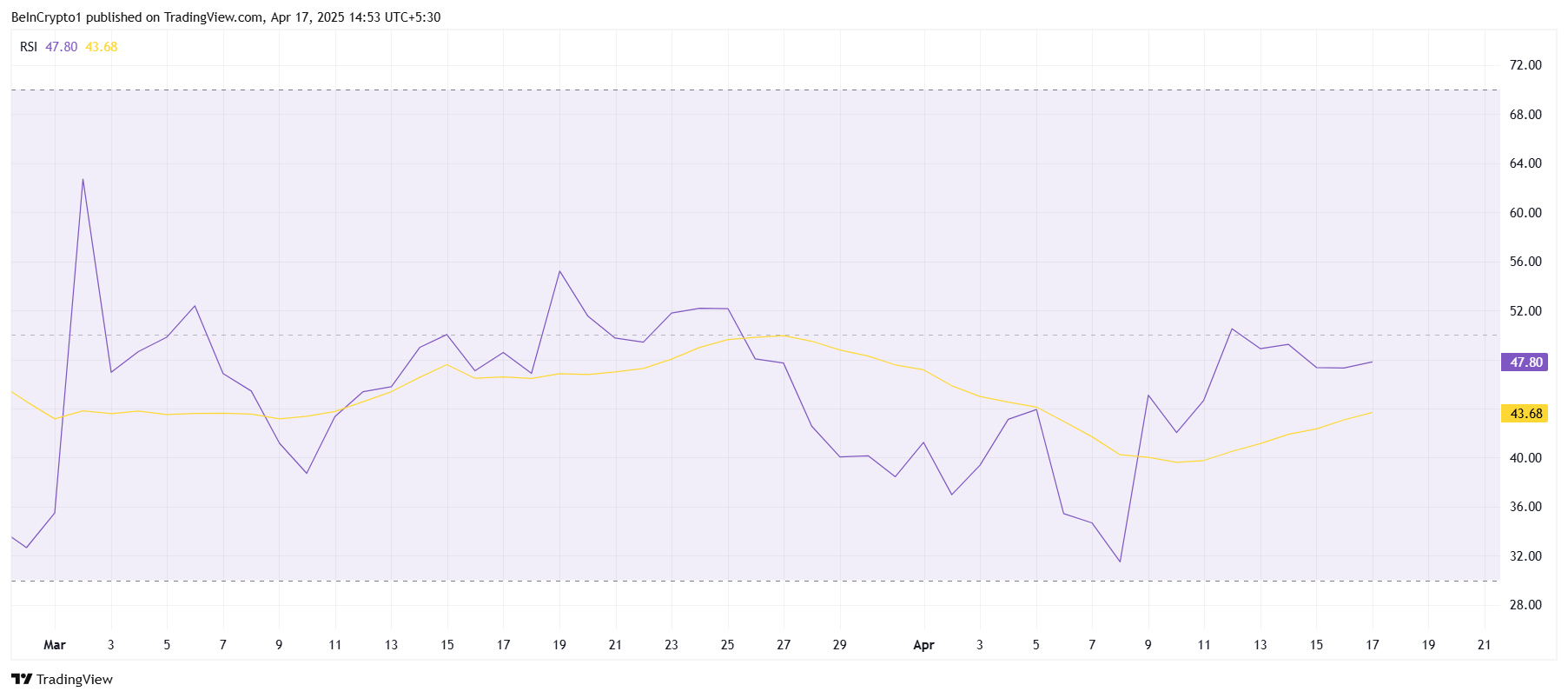

From a technical perspective, the Relative Strength Index (RSI) for XRP has been stuck in the bearish zone for the past two months. While it has occasionally spiked above the neutral line at 50, it has largely remained below, signaling a lack of bullish momentum. This persistent bearish trend has countered the efforts of long-term holders to push the price up.

The RSI’s failure to maintain upward momentum suggests that XRP is still struggling to gain traction. This is exacerbated by the overall bearish market conditions, which have kept investor sentiment subdued.

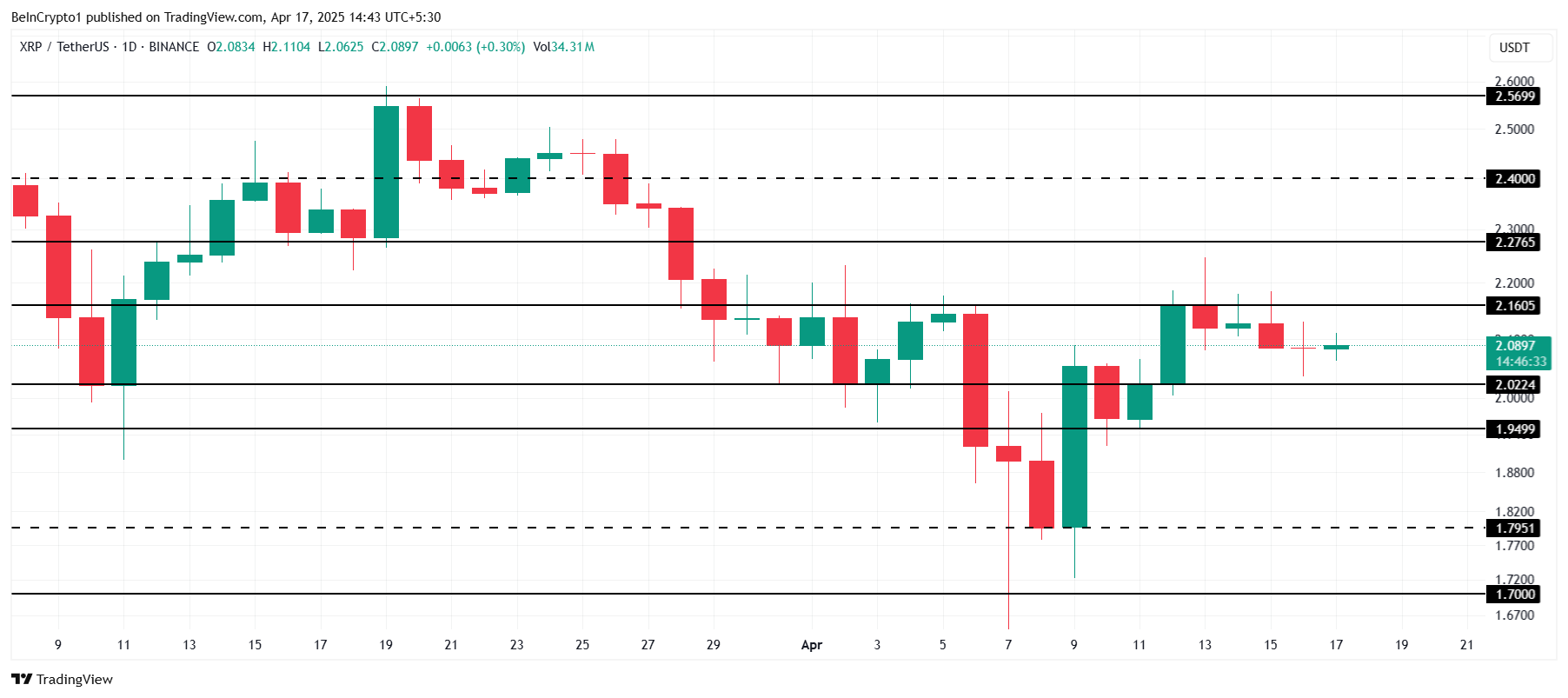

XRP Price Is Holding

At the time of writing, XRP is trading at $2.08, holding above the support level of $2.02. This indicates that the altcoin is stabilizing despite the recent dip. The support from long-term holders appears to be keeping the price afloat, preventing a further decline.

However, the mixed signals from both technical indicators and market sentiment suggest that XRP is likely to hover under the $2.16 resistance until stronger bullish cues emerge. This range-bound price action could persist, leaving investors uncertain about the next major move.

If XRP fails to hold the $2.02 support, the altcoin could fall to $1.94, or potentially even as low as $1.79. A drop below these levels would invalidate the current bullish outlook and could extend the losses for investors, signaling further market weakness.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MANEKI Leads With 333% Rally

The crypto market is going nowhere at the moment, stabilizing instead of rallying or crashing. However, this is not stopping meme coins from noting extravagant rallies as displayed by MANEKI.

BeInCrypto has analyzed two other meme coins that, while not experiencing explosive growth, are still generating enough market movement to make them important assets to watch.

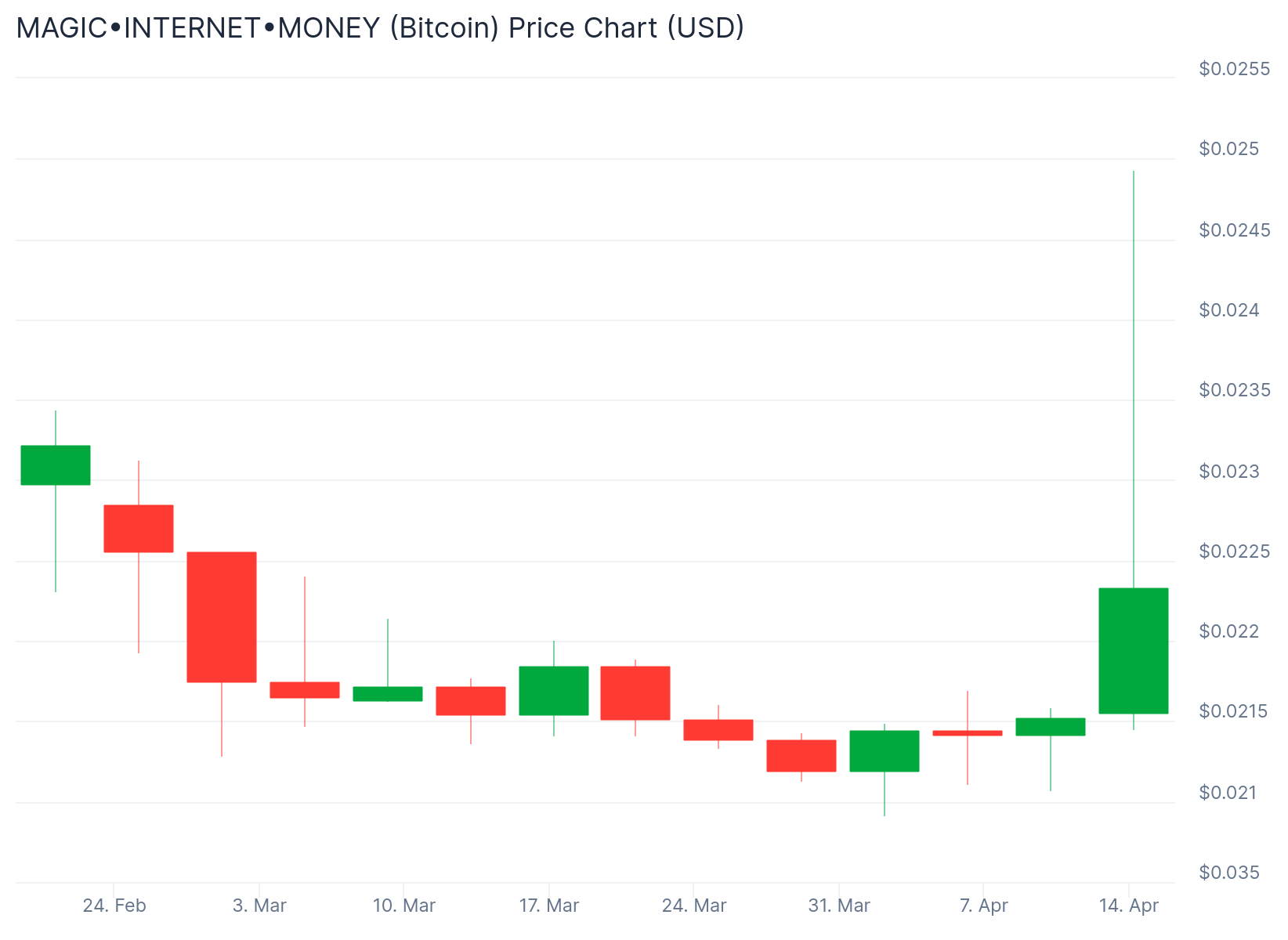

MAGIC•INTERNET•MONEY (Bitcoin) (MIM)

- Launch Date – February 2025

- Total Circulating Supply – 21 Billion MIM

- Maximum Supply – 21 Billion MIM

- Fully Diluted Valuation (FDV) – $65.54 Million

MIM experienced an eventful week with sharp rallies early on, followed by slight declines in the past few days. Currently trading at $0.003026, this meme coin has garnered attention due to its performance as a Bitcoin-based token.

Despite recent declines, MIM has surged by 64% over the past week. The token’s unique positioning as a meme coin on Bitcoin adds to its intrigue, especially as meme coins expand into different blockchain ecosystems. This trend indicates growing investor interest and speculation in such assets.

MIM remains primed for further gains, potentially reaching $0.004000 or higher. However, if investors decide to sell, the price could fall back to $0.00200, reflecting the volatility of meme coins. Traders should carefully monitor market sentiment and any signs of selling pressure.

Shiba Inu (SHIB)

- Launch Date – August 2020

- Total Circulating Supply – 589.2 Trillion SHIB

- Maximum Supply – 589.5 Trillion SHIB

- Fully Diluted Valuation (FDV) – $7.01 Billion

Shiba Inu’s price is currently at $0.00001189, continuing its downtrend since the start of the year. While the meme coin shows signs of potential recovery, the reduced burn rate has contributed to limiting upward momentum. A continuation of this trend could hinder any substantial gains for SHIB.

The burn rate for Shiba Inu has dropped significantly, falling by 98% over the last 24 hours. A high burn rate usually helps reduce inflation and supports price growth. The current decline in burn rate presents challenges, as it reduces demand and further limits SHIB’s ability to recover in the short term.

SHIB is holding above the support level of $0.00001141 and may continue to consolidate around this price point. However, if it breaches the $0.00001252 resistance, it could invalidate the bearish-neutral outlook.

Small Cap Corner : MANEKI (MANEKI)

- Launch Date – April 2024

- Total Circulating Supply – 8.85 Billion MANEKI

- Maximum Supply – 8.88 Billion MANEKI

- Fully Diluted Valuation (FDV) – $38.45 Million

MANEKI has emerged as one of the top-performing tokens this month, gaining 33% over the past week. In the last 24 hours alone, the meme coin surged by more than 30%, showing strong potential for further upward movement. The growth in the cat-themed token market is fueling this momentum.

Despite being a small-cap token, MANEKI has caught the attention of investors. The growing interest in cat-themed tokens has added to its appeal. Currently trading at $0.0043, the coin is on the verge of breaching the $0.0047 resistance. A successful breakthrough could push the price to $0.0055.

However, if the price fails to breach $0.0047, the coin could fall back to $0.0036. Losing this support would invalidate the bullish thesis, causing a drop to $0.0022. Investors need to monitor the price closely to determine the next potential move for MANEKI.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market23 hours ago

Market23 hours agoPi Network Drops10% as Outflows Surge, Death Cross Looms

-

Market21 hours ago

Market21 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Market18 hours ago

Market18 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Ethereum21 hours ago

Ethereum21 hours agoOver 1.9M Ethereum Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?

-

Bitcoin20 hours ago

Bitcoin20 hours agoETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

-

Market19 hours ago

Market19 hours agoBase Meme Coin Wipes $15 Million After Official Promotion

-

Market17 hours ago

Market17 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says