Market

Will the SEC Approve Ethereum ETF Staking?

Since early 2025, exchanges such as Cboe BZX and NYSE Arca have submitted proposals to the US SEC to incorporate staking services into existing spot ETFs. If approved, these funds could accelerate crypto adoption by giving traditional investors streamlined access to ETH.

Brian Fabian Crain, CEO and Co-founder of Chorus One, told BeInCrypto he remains “cautiously optimistic” about the proposals gaining approval before the end of President Trump’s first term. Still, he emphasized that the SEC will likely focus on ensuring strict investor protections before moving forward.

The Push for Staked Ethereum ETFs in the US

In mid-February, both Cboe BZX Exchange and NYSE Arca took steps towards Ethereum staking ETFs. Cboe BZX filed to amend the 21Shares ETF, while NYSE Arca followed two days later with a similar proposal for Grayscale’s ETF offerings.

Staking is a fundamental component of Proof-of-Stake (PoS) blockchains. Instead of relying on energy-intensive mining, such as in Proof-of-Work blockchains like Bitcoin, PoS networks select participants.

These participants act as validators and are in charge of verifying and adding new transactions, or blocks, to the blockchain based on the amount of cryptocurrency they have “staked” or locked up.

If approved, these Ethereum ETFs would allow traditional investors to gain exposure to the cryptocurrency while also earning passive income by contributing to the security of the Ethereum network through staking.

This move would also represent another significant step forward for institutional crypto adoption.

“The approval of an Ethereum staking ETF would mark a watershed for institutional adoption. Indeed, a staking-enabled ETF provides a regulated, easy-to-access exposure to ETH that includes its native yield, all within the familiar ETF framework. This means asset managers and pensions could gain passive ETH exposure without handling private keys or navigating crypto exchanges, significantly lowering operational barriers,” Crain told BeInCrypto.

It would also enhance Ethereum’s market position relative to other crypto assets.

Can Staking Yield Revitalize Ethereum’s Market Position?

Throughout much of 2024 and early 2025, Ethereum’s price appreciation lagged significantly behind Bitcoin. The ETH/BTC ratio hit a record low in early April 2025, indicating that Bitcoin was outperforming Ethereum.

Fluctuations in the broader crypto market further complicated Ethereum’s market position. Earlier this month, the network reached its lowest price in two years, eroding investor confidence.

With increasing support from exchanges and asset managers for an Ethereum-staking ETF, a development of this scale can potentially reposition Ethereum.

“One key differentiator of Ethereum is its ability to generate yield through staking — something Bitcoin doesn’t offer. Enabling that feature within an ETF makes Ethereum-based products more attractive and competitive. Ethereum’s ~3% annual staking yield is a major draw for investors and a clear distinction from Bitcoin. It means that even if ETH’s price growth trails Bitcoin’s, staked ETH can still deliver higher total returns thanks to the yield. By packaging this yield into an ETF, Ethereum becomes a more compelling investment option for institutions focused on income,” Crain explained.

Allowing staking within an ETF structure would spur greater ETH demand and investor appetite and enhance Ethereum’s security by expanding the validator pool and decentralizing staking across a wider range of holders.

Increased total staked ETH would further strengthen the network against attacks.

With other jurisdictions already legally permitting staking services, the United States might see their early adoption as a reason to act quickly and maintain a competitive edge.

How Hong Kong’s Staking Approval Impacts the US SEC

This week, Hong Kong’s Securities and Futures Commission (SFC) announced new guidance allowing licensed crypto exchanges and funds in the city to offer staking services. Platforms must meet strict conditions before providing these services.

“The SFC’s framework emphasizes investor protection while embracing innovation. For example, Hong Kong requires that platforms retain full control of client assets (no outsourcing) and disclose all staking risks transparently,” Crain explained.

Hong Kong set itself apart from other jurisdictions like Singapore, which banned retail staking in 2023, and the previous SEC’s administration on Gary Gensler, which took a historically restrictive approach.

Crain believes this new development will primarily exert competitive pressure on the SEC to follow accordingly.

“As a major international financial hub, Hong Kong’s adoption of regulated staking sends a message: it is possible to allow staking in a compliant manner. US regulators often watch regimes like Hong Kong as bellwethers for emerging best practices. The SEC will take note that Hong Kong is not only allowing staking but even paving the way for staking services in ETFs (the SFC’s rules mention authorized virtual asset funds can offer staking under certain caps and conditions),” he said.

Incorporating staking into Hong Kong-listed crypto ETFs would put US funds and exchanges at a competitive disadvantage if the SEC maintains its prohibition.

When reviewing the 21Shares and Grayscale applications, the SEC may need to consider that global investors could turn to international markets to access these staking ETF products if the US doesn’t eventually allow them.

While the competitive aspect is a factor, the SEC will also need to address various complexities inherent in Ethereum staking, which may be obstacles to final approval.

The “Investment Contract” Conundrum

Among the most important factors the SEC will consider is whether staking programs constitute investment contracts.

The previous administration’s SEC targeted centralized exchanges like Kraken and Coinbase for operating staking services considered unregistered profit schemes and violating US securities laws.

In centralized exchanges, users must effectively transfer custody of their cryptocurrency to a third-party entity that manages staking and the distribution of rewards. However, this model is distinct from the process inherent in Ethereum, a decentralized blockchain.

“Unlike exchange staking programs, an ETF staking its own assets isn’t ‘selling’ a staking service to others, it’s directly participating in network consensus. This nuance, emphasized in recent filings and comment letters, is contributing to the SEC’s willingness to reconsider its stance. Essentially, the argument is that staking is a core technical feature of Ethereum, not an ancillary investment product,” Crain told BeInCrypto.

While an ETF staking its assets presents a different model, the SEC will look closely for security violations. Addressing this concern requires demonstrating that protocol rewards originate inherently from the decentralized network, not the sponsor’s business efforts.

This issue, though largely conceptual, is critical; SEC approval hinges on satisfying securities law requirements regarding staking.

Meanwhile, slashing risks are another issue of concern.

Slashing Risks: A Unique Challenge for Ethereum Staking ETFs?

A key difference from traditional commodity funds is that a staking ETF must actively participate in network consensus, exposing it to the potential for slashing.

Slashing is a penalty where a portion of the staked ETH can be destroyed if a validator acts improperly or makes mistakes. For investors, the ETF’s principal could suffer partial losses due to operational errors, a risk not present in non-staking ETFs.

“The SEC will assess how significant this risk is and whether it’s been mitigated. Filings note that the Sponsor will not cover slashing losses on behalf of the trust, meaning investors bear that risk. This forces the SEC to consider if average investors can tolerate the possibility of losing funds not due to market movement but due to a technical protocol penalty. This risk must be transparently disclosed and managed in any approved product,” Crain explained.

Typically, custodians have insurance for asset loss due to theft or cyberattacks. However, slashing is a protocol-enforced penalty, not traditional “theft,” and many custody insurance policies might not cover it. Therefore, the SEC will likely inquire about the safeguards should a slashing event occur.

This novel aspect of Ethereum staking creates certain ambiguities in accounting treatment.

“The SEC will scrutinize how the custodian reports on staked holdings. The ETF’s [net asset value accounting needs to capture both the base ETH and the accumulated rewards. Custodians will likely provide reporting on how much ETH is staked versus liquid, and any rewards received. The SEC will require independent audits or attestations confirming that the custodian indeed holds the ETH it claims (both original and any newly awarded ETH) and that controls around staking are effective,” Crain explained.

Liquidity risks associated with Ethereum staking are another factor to consider.

Further SEC Considerations

A key detail the SEC will examine is that staked ETH lacks instant liquidity.

Even after the Shanghai upgrade enabled withdrawals in 2023, the Ethereum protocol still incorporates delays and queues that prevent staked ETH from being instantly liquid upon initiating the unstaking process.

“The SEC will examine how the fund handles redemption requests if a large portion of assets are locked in staking. For example, exiting a validator position can take from days to weeks if there’s a backlog (due to the network’s exit queue and “churn limit” on how many validators can unlock per epoch),” Chain told BeInCrypto.

During heavy outflows, the fund might not immediately access all its ETH to meet redemptions. The SEC sees this as a structural complexity that could harm investors if not planned for.

“In a worst-case scenario, if the ETF had to wait days or weeks to fully exit staking positions, an investor redeeming could either wait longer for their proceeds or get paid in-kind with staked ETH (which they then must figure out how to redeem themselves). This isn’t a typical concern in ETFs and is a potential downside for investors expecting high liquidity,” Crain added.

Finally, there are also security risks that must be addressed responsibly.

The “Point-and-Click” Model

Securing custody for Ethereum in an ETF is already crucial, and adding staking will increase the SEC’s scrutiny.

“The SEC will examine how the ETF’s custodian secures the ETH private keys, especially since those keys (or derivative keys) will be used to stake. Normally, custodians use cold storage for crypto assets, but staking requires keys to be online in a validator. The challenge is to minimize exposure while still participating in staking,” Crain said.

Recognizing the vulnerability of keys during validator activation, the SEC will most likely require custodians to use cutting-edge security modules to prevent hacking. Any prior incidents of security breaches involving a custodian would raise serious concerns.

Aiming to lessen these risks, some exchanges have proposed that the ETH for staking remain within the custodian’s control at all times. This model is largely referred to as a “point-and-click” mechanism.

“NYSE Arca’s proposal to allow the Grayscale Ethereum Trust (and a smaller ‘Mini’ trust) to stake its Ether via a ‘point-and-click’ mechanism is a test case that will significantly inform the SEC’s evaluation of staking in an ETF context. The point-and-click staking model is essentially a way to stake without altering the fundamental custody or introducing extra complexities for investors. In practice, this means the trust’s custodian would simply enable staking on the held ETH through an interface. The coins don’t leave the custody wallet, and the process is as straightforward as clicking a button,” Crain explained.

The proposal directly tackles the SEC’s security worries by emphasizing that the ETH never leaves the custodian, thereby minimizing the theft risk. Furthermore, it clarifies that the yield is generated automatically by the network, not through the entrepreneurial endeavors of a third party.

When Will the SEC Approve Staking in Ethereum ETFs?

Despite the complexities and technical details of staking in Ethereum ETFs, the prevailing political climate in the US could lead to a more favorable environment for their eventual approval.

“On balance, it now seems more likely than not that the SEC will approve a staking feature for Ethereum ETFs in the relatively near future. A more receptive SEC leadership post-2025, strong political backing for staking in ETPs, and well-crafted proposals addressing earlier concerns — such as the point-and-click model — all tilt the odds toward approval. A year or two ago, the SEC was firmly opposed. Now, the conversation has shifted to ‘how to do this safely,’ which marks a significant change,” Crain told BeInCrypto.

That said, Crain cautioned that the SEC will not approve an ETF of this kind until it’s fully satisfied with the investor protections in place. Even so, the overall outlook remains positive.

“Considering all the factors discussed, the outlook for an Ethereum staking ETF approval appears cautiously optimistic. The likelihood of eventual approval is growing, though the timing remains a subject of debate,” Crain concluded.

In the best-case scenario, an Ethereum staking ETF could gain approval by the end of 2025.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

Market

$7 Million Hack Hits Binance-Backed Project

KiloEx, a newly launched perpetual trading platform backed by YZi Labs (formerly Binance Labs), has suffered a cross-chain exploit resulting in the theft of approximately $7 million.

The attack, which began on April 14, is ongoing and has impacted operations across BNB Smart Chain, Base, and Taiko networks.

Hackers Drain $7 Million from KiloEx Using Tornado Cash

Cyvers analysts report that the attacker used a Tornado Cash-funded address to execute a series of coordinated transactions. It exploited potential access control flaws in KiloEx’s price oracle system.

On-chain evidence shows rapid fund movements between multiple chains. This raises concerns over systemic vulnerabilities in multi-chain DeFi architecture.

KiloEx launched its Token Generation Event (TGE) on March 27 in partnership with Binance Wallet and PancakeSwap. It’s currently listed on Binance Alpha.

“Root cause was a potential price oracle access control vulnerability. The attacker is still actively exploiting the system, and USDC may be subject to blacklisting,” wrote Cyvers.

The project was incubated by YZi Labs, an investment and innovation division previously branded as Binance Labs.

The launch attracted significant attention due to its backing and integration with BNB Smart Chain.

Following the attack, KiloEx has suspended its platform and is collaborating with security partners to investigate the breach and track stolen funds.

The team has announced plans to launch a bounty program to encourage white hat assistance and recover user assets.

The incident has triggered sharp market reactions. The KILO token plummeted by 30%, with its market capitalization dropping from $11 million to $7.5 million within hours of the attack.

Security teams are actively monitoring the attacker’s wallet addresses. The situation remains fluid as remediation efforts continue and the vulnerability is further assessed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MANTRA (OM) Charts Look Worse than LUNA – No Buying Activity

Yesterday, MANTRA (OM) suffered a staggering 90% crash, and it’s still spiraling down today. Most notably, OM charts and indicators seem as bad as the 2022 Terra LUNA collapse, if not worse.

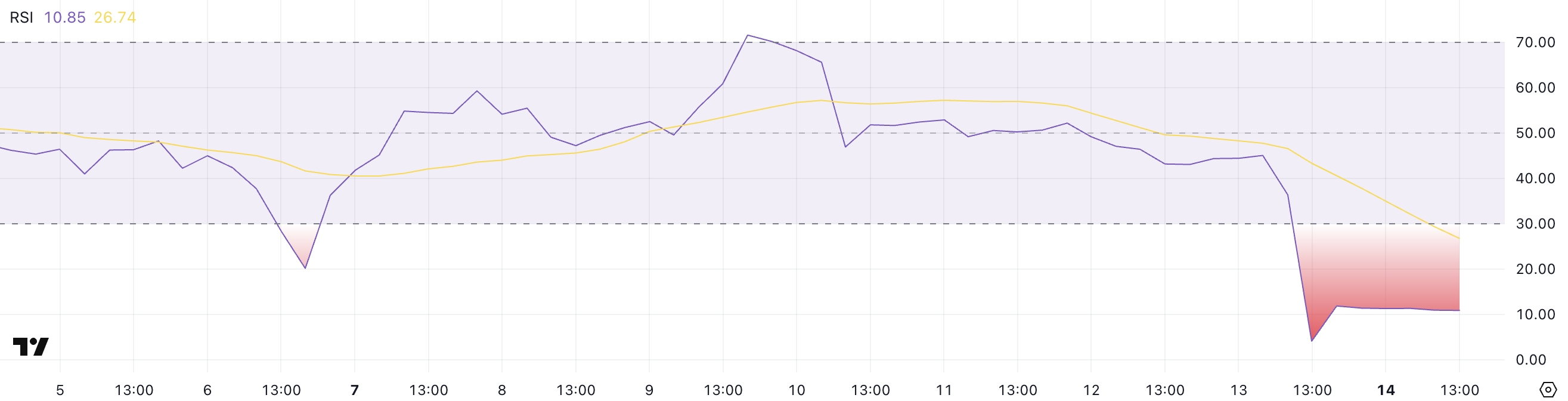

OM’s RSI is hovering near extreme oversold levels, and indicators reflect there’s barely any buying activity. When LUNA collapsed, a large number of traders bought the crash for a short-term pump. But, even this seems unlikely for MANTRA, based on current charts.

OM RSI Reached Levels Below 10

After crashing more than 90% in a matter of hours, some traders may be eyeing MANTRA’s OM token as a potential “buy the crash” opportunity.

However, the Relative Strength Index (RSI) tells a different story—OM’s RSI plummeted from 45 to 4 during the collapse and has only slightly recovered to 10.85.

The RSI is a momentum indicator that measures the speed and magnitude of price changes on a scale from 0 to 100. Typically, values below 30 indicate oversold conditions, while levels above 70 suggest the asset is overbought.

Despite bouncing from extreme lows, OM’s RSI has hovered around 10.85 for several hours, signaling that very few buyers are stepping in to support the price.

This lack of follow-through buying pressure shows that sentiment remains heavily bearish, and traders are not yet confident enough to accumulate the token—even at these steeply discounted levels.

Recently, talking to BeInCrypto, analysts warned about Mantra’s potential lack of true on-chain value.

OM is potentially setting up for further downside or a prolonged period of stagnation as the market waits for a catalyst or clearer recovery signals.

Mantra DMI Shows Buying Activity Is Almost Non-existent

Mantra’s DMI (Directional Movement Index) chart clearly shows intense bearish momentum. The ADX, which measures the strength of a trend regardless of direction, is currently at 47.23—well above the 25 threshold and showing no signs of weakening.

The -DI, which tracks selling pressure, has decreased from its peak of 85.29 to 69.69, indicating that while the panic sell-off may be slowing, it remains dominant.

Meanwhile, the +DI, which measures buying pressure, has dropped from 3.12 to just 2.42, highlighting a complete lack of bullish response to the collapse.

This imbalance reveals that although the worst of the immediate selling may be over, virtually no meaningful buying activity is stepping in to support OM’s price.

The fact that +DI remains extremely low suggests traders are still avoiding the token, hesitant to buy even after a massive discount.

As long as this dynamic continues—strong trend strength, high selling pressure, and near-zero buying pressure—OM is likely to stay under severe bearish pressure, with any recovery attempt extremely unlikely unless sentiment shifts dramatically.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market18 hours ago

Market18 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Market17 hours ago

Market17 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Altcoin15 hours ago

Altcoin15 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market21 hours ago

Market21 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Altcoin14 hours ago

Altcoin14 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Bitcoin16 hours ago

Bitcoin16 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market16 hours ago

Market16 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry