Market

Will Celestia’s (TIA) Price Crash Just to Fulfill Investors’ Demand?

Celestia’s (TIA) price rise in the last few days made it one of the best-performing assets this week and in the last 24 hours.

But instead of imbuing confidence and optimism, the rally inspired investors to take a different, more bearish path to churn profits.

Celestia Investors Want a Crash

Celestia’s price had a good run this week as the altcoin recovered most of its recent losses. But as this happened, TIA holders got the idea to take a more destructive idea of shorting the altcoin heavily. Signs of the same are visible in the Open Interest and Funding Rate.

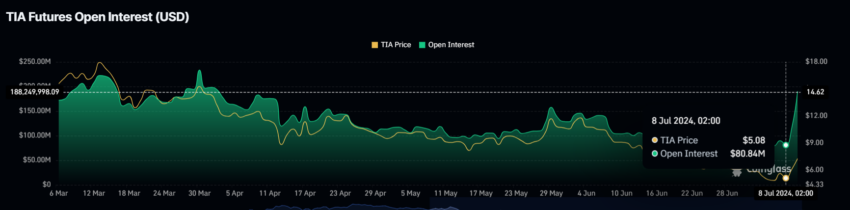

Celestia’s Open Interest has spiked significantly in the last two days, doubling from $80 million to $190 million. This sharp increase indicates a substantial surge in trading activity and investment in the altcoin.

The rapid rise in Open Interest generally highlights growing interest and confidence among traders and investors. But this is not the case with Celestia. TIA traders are pining for a price decline, which can be noted in the direction of the funding rate.

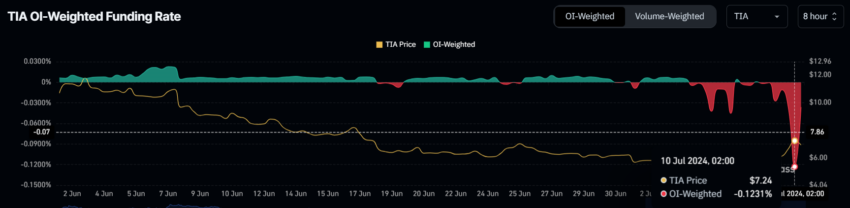

TIA’s Funding rate has turned negative from positive, reaching the highest point since its inception. A negative funding rate typically indicates that short positions are paying long positions, reflecting a bearish sentiment among traders.

Read More: Best Upcoming Airdrops in 2024

Combining the two metrics, it becomes evident that the surge in OI is showcasing the rise in short contracts, bringing the funding rate down to historic lows. This shows that TIA holders are expecting and demanding a price drawdown following the rally.

TIA Price Prediction: Where Could It End Up?

Celestia’s price can take two directions. One is as per the demand of the investors, and the second is the one that the market suggests. IF TIA follows investors’ demand, it could end up losing the recent gains and drop to $4.9.

Trading at $6.6, this could result in a 24% decline, signs of which are already visible in the 8% decline today.

Read More: Top 10 Aspiring Crypto Coins for 2024

On the other hand, if the price jumps back up to breach and flips $7.2 into a support level, a rise beyond $8.1 is likely. This would push Celestia’s price to $10 and invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Price Rally Faces Risk as Bearish Momentum Builds

Solana has posted a 7% increase in the past 24 hours, aligning with the broader market’s recovery. While this surge may appear promising, technical and on-chain data suggest that the coin could face significant resistance.

Despite the recent rally, SOL risks shedding these gains and could fall below the $100 mark if bearish pressures dominate.

Solana’s Price Surge Lacks Momentum

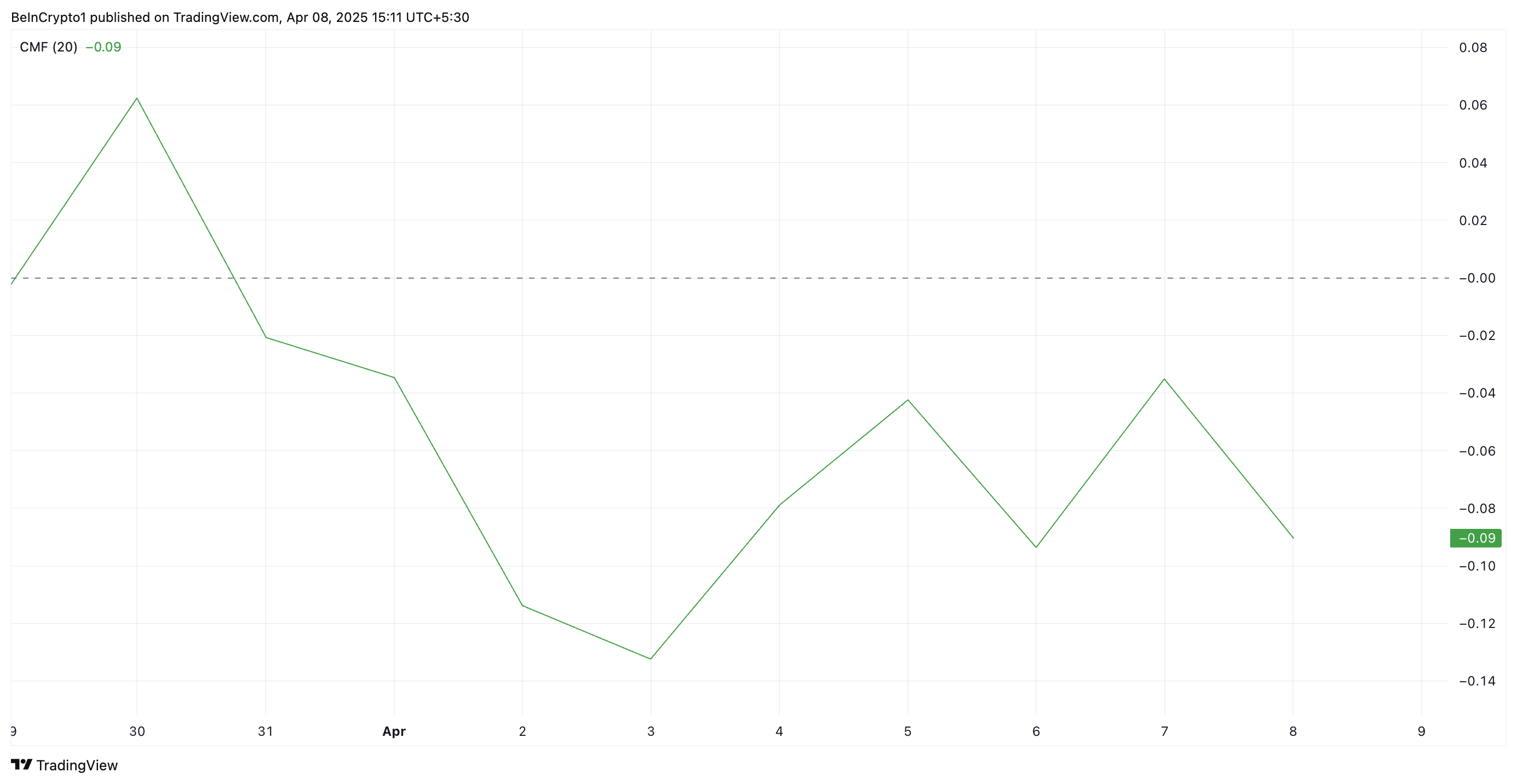

While impressive, SOL’s current rally largely reflects the broader market trend rather than demand for the altcoin. The bearish divergence formed by its Chaikin Money Flow (CMF) shows this.

At press time, SOL’s CMF is below the zero line at -0.09, indicating a lack of buying momentum among SOL market participants.

The CMF indicator measures money flow into and out of an asset. A bearish divergence emerges when the CMF is negative while the price is climbing. The divergence signals that despite the upward movement, there is more selling pressure than buying interest, suggesting weak bullish momentum.

This indicates that SOL’s current price rally may lack sustainability and could be at risk of reversing or stalling as new demand remains scarce.

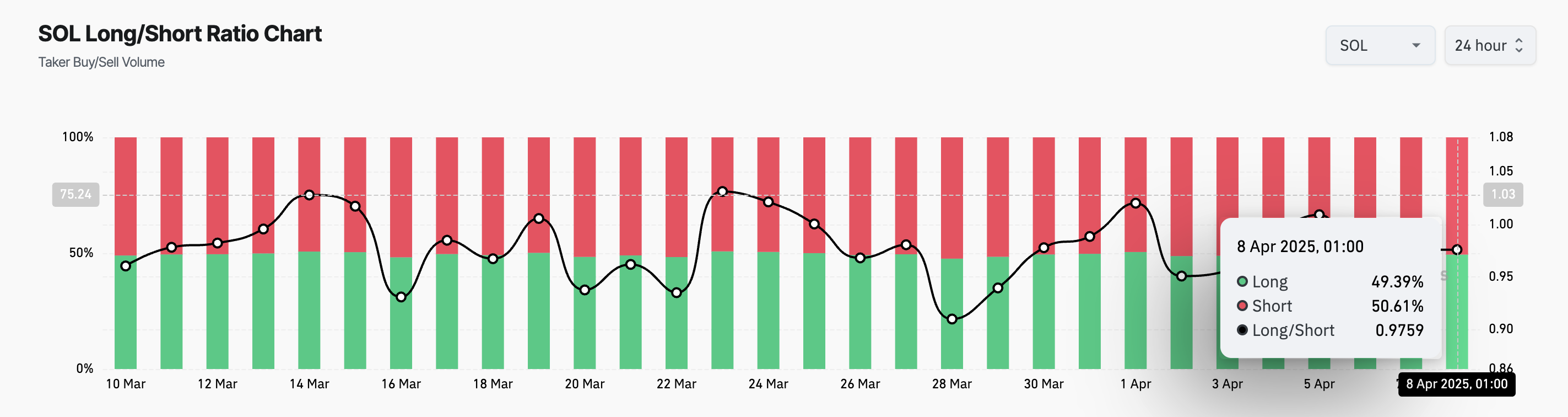

Further, the coin’s long/short ratio highlights that its market participants lean more heavily toward the short side. At press time, this stands at 0.97.

The long/short ratio measures the balance between long positions (betting on price increases) and short positions (betting on price decreases) in the market. When the ratio is below zero like this, it indicates that there are more short positions than long positions.

This suggests that bearish sentiment remains dominant in the SOL market, and its futures traders are anticipating a decline in the asset’s price.

Solana in Crucial Zone: Will $95 Hold or Lead to a Steeper Decline?

During Monday’s intraday trading session, SOL plummeted to a 12-month low of $95.26. Although it has since rebounded to trade at $108.77 at press time, the lingering bearish bias leaves the coin at risk of shedding these gains.

If SOL witnesses a pullback, it could break below the support at $107.88. If it falls back below $100, the coin’s price could fall toward $79.

On the other hand, if the uptrend continues, backed by a surge in new demand, SOL’s price could breach the resistance at $111.06 and climb toward $130.82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Briefly Recovers 5% Due To US-China Tariff Deal Optimism

Crypto and TradFi markets had a strong opening today, as Bitcoin briefly jumped 5% due to optimism about a tariff deal. China and institutional investors in the US wish to avoid a trade war if possible.

Despite these encouraging signs, no deal has actually been reached, and Bitcoin also suffered subsequent losses. The whole market is in a state of flux until the situation becomes more clear.

How Will Bitcoin Perform Under Tariffs?

The crypto markets are full of fear right now, and it’s difficult to determine a safe bet moving forward. Since the market suffered huge liquidations yesterday, it opened with cautious optimism today.

This trend was particularly influenced by Bitcoin, which briefly jumped around 5% due to hopes about a potential deal on Trump’s tariffs.

The price of Bitcoin has fluctuated wildly due to the tariffs as speculation about a sell-off increases. However, the whole market is in a chaotic state right now.

Today, the Dow Jones Industrial Average surged 1,285 points, or 3.4%, while the S&P 500 and Nasdaq Composite both jumped 3.4% and 3.3%, respectively. Nonetheless, hundreds of stocks have fallen 20% or more.

Meanwhile, Bitcoin has a few advantages that can protect it from tariff volatility. For example, a recent report from Binance Research claims that the least risky cryptoassets are the most insulated from drops.

This includes RWAs and centralized exchanges, but Bitcoin is a close third.

Furthermore, the markets are very optimistic about a deal to avoid the tariffs. Yesterday, rumors of a pause triggered a trillion-dollar rally, highlighting traders’ desperation for good news.

Despite the retaliatory tariffs, China is similarly eager to avoid a full-blown trade war with the US. Trump claimed that he is making progress with China and South Korea, fueling optimism.

Nonetheless, it’s important not to overstate Bitcoin’s chances of success under tariffs. Despite the hopes on both sides of the Pacific, China confirmed that it’s prepared to fight a trade war if Trump forces its hand.

This might explain Bitcoin’s price drops despite its strong performance since yesterday. Ultimately, all we can do is wait and hope.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple Labs has announced a major acquisition to shock the market out of an otherwise dreadful week. Taking to X (formerly Twitter), the crypto firm announced that it has acquired Hidden Road, a brokerage, clearing, and financing firm as it moves forward in its mission to become the leader for institutional investors moving into the digital assets space.

Ripple Acquires Hidden Road For $1.25 Billion

The Tuesday announcement by Ripple has further solidified the mission that the crypto firm has long put forward, and that is to provide instant and quick transfer of value for traditional and institutional investors coming into the digital assets space.

Related Reading

As CEO Brad Garlinghouse explained in a separate X post, the decision to acquire Hidden Road for $1.25 billion comes after a long-standing customer relationship with the company. Garlinghouse revealed that Ripple understands the breadth of Hidden Road’s expertise, making it a prime candidate for the acquisition.

The integration of the XRP Ledger by Hidden Road will allow for cheap and fast movement of value to the brokerage’s customers, which moves over $3 trillion annually. A portion of this massive value is expected to move through the ledger, as well as using the RLUSD stablecoin as collateral for brokerage services.

Additionally, Hidden Road will be able to expand its capacity for value transfer, allowing Ripple to process even more volume. “With this deal and the backing of Ripple’s significant balance sheet, Hidden Road will exponentially expand its capacity to service its pipeline and become the largest non-bank prime broker globally,” Garlinghouse’s post read.

This acquisition comes after Ripple acquired Standard Custody back in February 2024. Standard Custody provided an online platform offering clients digital asset custody solutions, enabling Ripple to move into the custody market as well.

XRP Price Responds

Despite the Ripple announcement, the XRP price has remained muted as it continues to struggle below $2, which has since turned to resistance. At the time of writing, XRP is still holding at $1.96, despite its almost 10% in the last 24 hours.

Related Reading

According to data from Coinmarketcap, the XRP daily trading volume has seen a notable decline, dropping approximately 24% in the last day. This suggests a decline in participation from investors, due to the bearish headwinds that continue to blow through the crypto market.

A recovery from here is highly dependent on Bitcoin, which continues to dominate the market and lead the charge.

Chart from Tradingview.com

-

Market23 hours ago

Market23 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Market21 hours ago

Market21 hours agoXRP Targets Rebound After Hitting Oversold Territory

-

Market20 hours ago

Market20 hours ago3 Altcoins to Watch in the Second Week of April 2025

-

Market22 hours ago

Market22 hours agoCan the Fed Rescue Crypto Markets With Interest Rate Cuts?

-

Market19 hours ago

Market19 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Altcoin18 hours ago

Altcoin18 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Bitcoin19 hours ago

Bitcoin19 hours agoWhy Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

-

Altcoin19 hours ago

Altcoin19 hours agoRipple Whale Moves $355 Million To Binance, XRP Price To Dip Further?