Market

Will Bitcoin Benefit from DXY Decline After FOMC’s Latest Move?

The US Dollar Index (DXY) fell following the latest Federal Open Market Committee (FOMC) meeting. This turnout triggered discussions about its implications for Bitcoin (BTC) and broader liquidity conditions.

Meanwhile, Bitcoin price reclaimed the $85,000 range. However, prospects for more gains remain debatable as the pioneer crypto continues in a horizontal chop.

Fed Revises Economic Projections Amid Growth Concerns

Market analysts and crypto experts suggest the declining dollar could create a more favorable environment for Bitcoin’s price recovery. This optimism comes despite lingering macroeconomic concerns.

On one hand, President Donald Trump is putting political pressure on the Federal Reserve (Fed), urging it to cut rates.

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump wrote on Truth Social.

These remarks indicate potential political battles over monetary policy, further affecting risk asset performance.

However, the FOMC rejected further interest rate cuts, and the Fed made significant downward revisions to its 2025 economic projections. This painted a picture of weaker growth and persistent inflation.

The Fed cut its GDP growth forecast from 2.1% to 1.7% while raising its unemployment projection to 4.4%. Inflation expectations also increased, with PCE inflation forecasted at 2.7% and core PCE inflation at 2.8%. Notably, both of these were higher than previous estimates.

These revisions suggest a more challenging economic environment, with the DXY dropping in the aftermath.

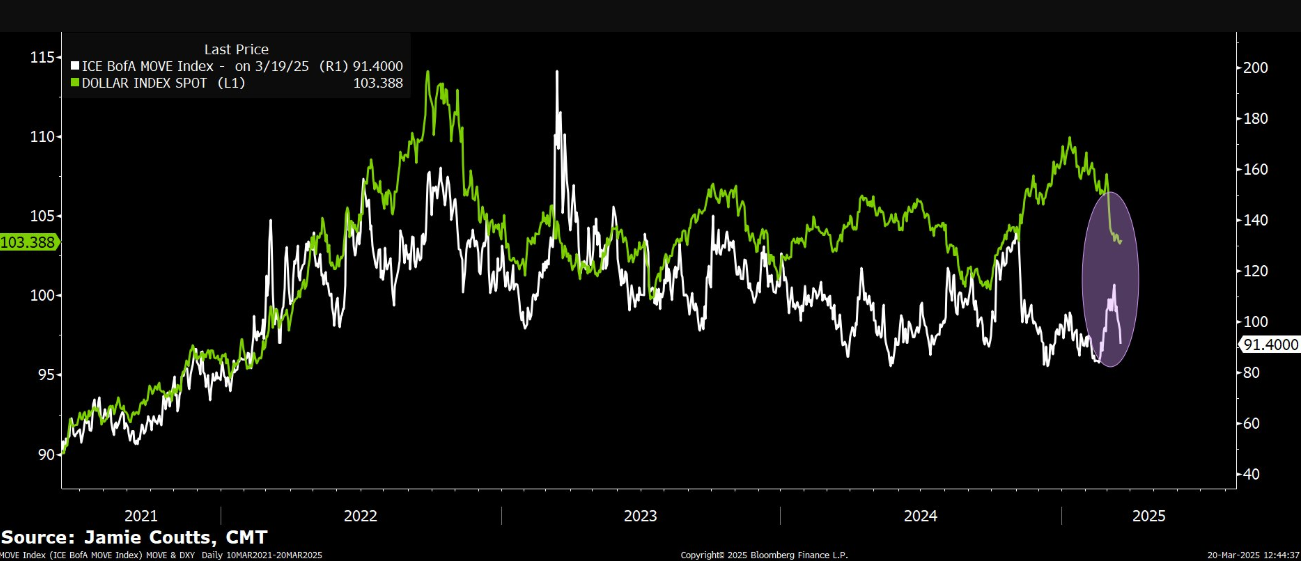

Real Vision’s chief crypto analyst, Jamie Coutts, who also built the crypto research product at Bloomberg Intelligence, commented on the turnout. In a post on X (Twitter), the analyst argued that quantitative tightening (QT) is effectively dead for the near future.

Coutts points to the decline in Treasury yield volatility and its correlation with the DXY downturn. He says these are key indicators of increased liquidity, which is generally bullish for Bitcoin.

“After last night, QT is effectively dead (for some time). Treasury volatility has backed right off and is now mirroring the decline in DXY from earlier this month. This is all extremely liquidity-positive,” Coutts noted.

However, not everyone agrees on the extent of QT’s slowdown. Analyst Benjamin Cowen cautions that QT is still ongoing, albeit at a reduced pace.

“QT is not ‘basically over’ on April 1st. They still have $35 billion per month coming off from mortgage-backed securities. They just slowed QT from $60 billion per month to $40 billion per month,” Cowen wrote.

Bitcoin and the Dollar: A Delayed Reaction?

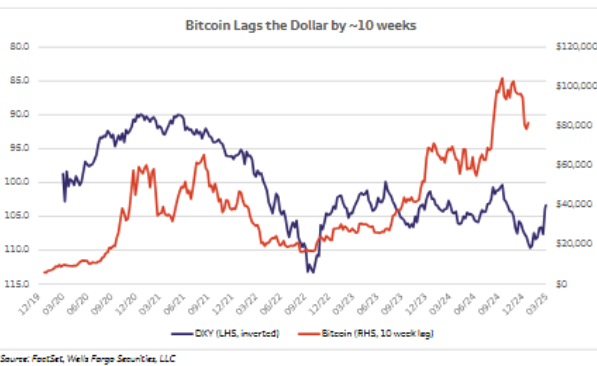

One of the most compelling arguments for Bitcoin’s potential recovery comes from VanEck’s Head of Digital Assets Research, Mathew Sigel. He points out that Bitcoin has historically tracked an inverted DXY on a 10-week lag. This suggests that the current downturn in BTC prices could be a delayed reaction to the strong dollar in late 2024.

If the pattern holds, the recent weakness in DXY could set the stage for a bullish phase in Bitcoin over the coming months.

Meanwhile, BitMEX co-founder Arthur Hayes is more cautious about Bitcoin’s trajectory. While he acknowledges that QT is slowing, he questions whether liquidity injections in the European Union—driven by military spending—could overshadow the US’s financial shifts.

“Will the re-arming of the EU paid for with printed EUR overwhelm the near-term negative fiscal impulse of the US? That’s the big macro question. If yes, correction over. If no, hold on to your butts,” Hayes wrote.

Hayes also speculated that Bitcoin’s recent drop to $77,000 might have marked the bottom. However, he warned that traditional markets might face further downside, which could influence crypto in the short term.

Based on these, the post-FOMC environment presents a mixed outlook for Bitcoin. On the one hand, falling DXY, lower Treasury yield volatility, and slowing QT point to increasing liquidity, a historically positive signal for BTC.

On the other hand, macroeconomic risks—including rising corporate bond spreads and potential instability in traditional markets—could still create headwinds.

With Bitcoin’s historical lag behind DXY movements, the coming weeks will reveal if a delayed rally materializes. Meanwhile, global liquidity conditions and political developments remain key factors that could influence Bitcoin’s next major move.

BeInCrypto data shows BTC was trading for $85,832 at press time. This represents a modest gain of almost 4% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Integrates With Telegram’s Crypto Wallet

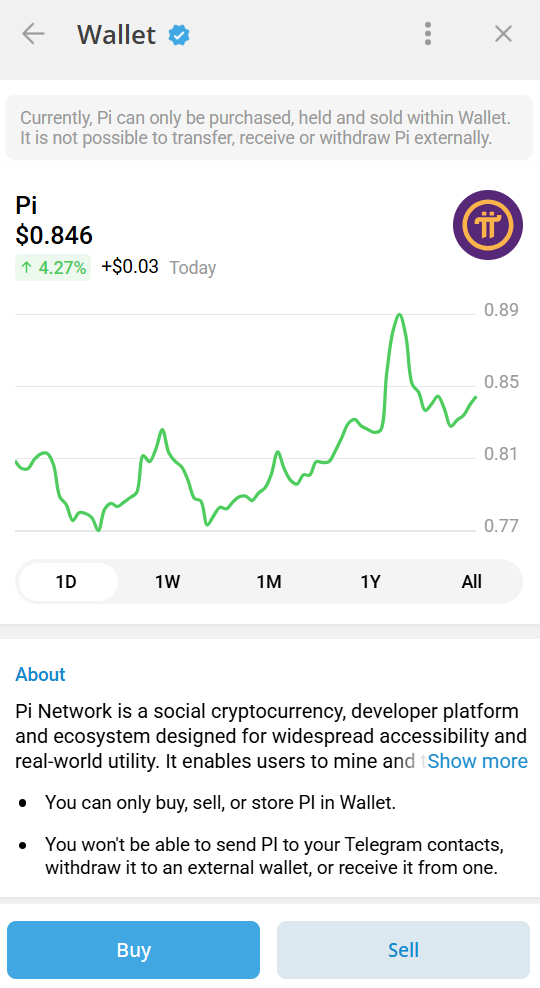

Pi Network is now integrated with Telegram’s crypto wallet, potentially giving it access to a massive new customer base. Telegram CEO Pavel Durov claims that the messaging app has reached over 1 billion monthly users in 2025.

This means that Telegram users will now be able to buy PI through the app’s integrated crypto wallet. While it certainly boosts the token’s visibility, Pi Network still lacks listing from tier-1 exchanges like Binance and Coinbase, which could improve its credibility in the market.

Pi Network is On the Telegram Wallet

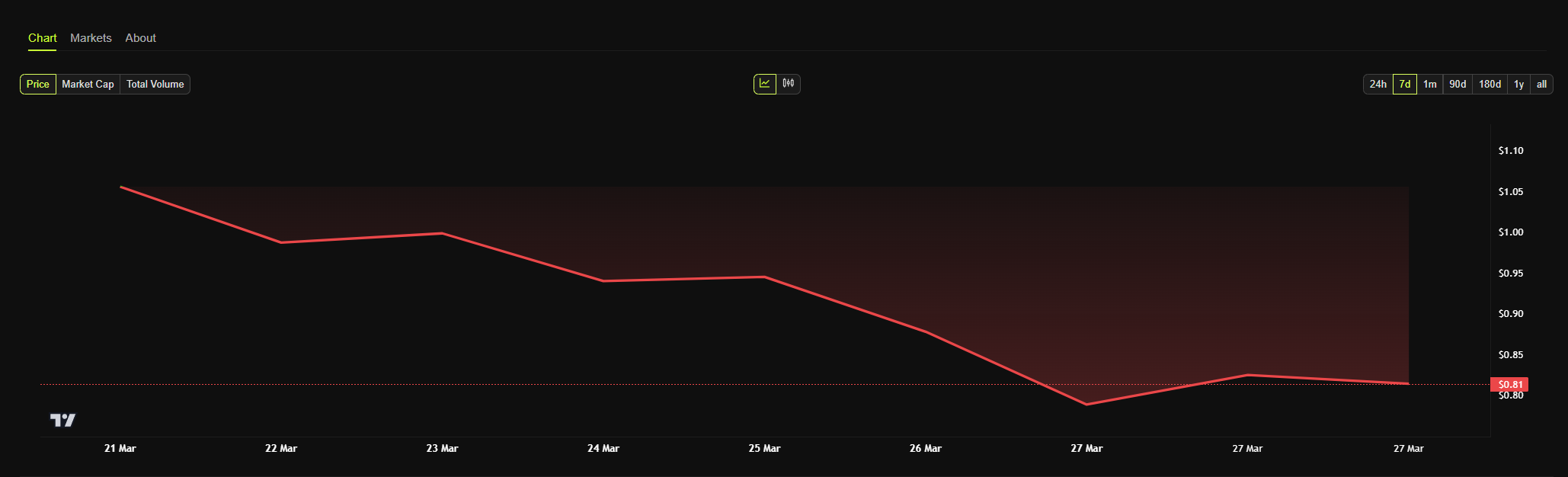

PI made an explosive entry into the crypto market, surging nearly 100% in its first week and hitting a peak of $2.92 on February 27. However, the altcoin has seen continuous liquidations since then. Scrutiny from the big exchanges is delaying major listings, and demand is drying up in a big way.

Yet, today’s Telegram integration provides some optimism for the PI community.

Integration into Telegram’s crypto wallet is a particularly useful development for Pi Network for a few reasons. Telegram’s CEO, Pavel Durov, was released this month after being arrested in August 2024. Now that he’s resumed his activities, he posted notable statistics about the platform’s user base:

“Telegram now has significantly over 1 billion monthly active users, becoming the second most popular messaging app in the world (excluding the China-specific WeChat.) User engagement is also rising, [and] our revenue growth has exploded. We are just getting started,” Durov claimed via Telegram.

In other words, Pi Network is now able to reach one billion Telegram users at a time when the average user spends 41 minutes on the platform daily. This could potentially be a huge pool of new customers, and Pi fans are calling it a “historic step toward mass adoption of decentralized finance.”

However, it’s important to note that Telegram’s crypto functionality, while growing in usage, remains largely underutilized. Despite today’s announcement, the PI price has remained over 25% down in the past week. This reflects declining consumer interest in the project.

Major crypto exchanges like Binance and Coinbase may be dragging their feet with Pi Network, but Telegram has its own substantial user base. If the project can convince a decent chunk of these users to invest, it would be huge.

If it cannot, however, then Pi Network’s losing streak may continue for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price remained supported above the $86,000 zone. BTC is now consolidating and might aim for a move above the $88,000 resistance zone.

- Bitcoin started a fresh recovery wave above the $86,800 zone.

- The price is trading below $87,200 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $88,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 and $88,200 levels.

Bitcoin Price Faces Key Resistance

Bitcoin price remained stable above the $85,500 level. BTC formed a base and recently started a recovery wave above the $86,500 resistance level.

The bulls pushed the price above the $87,200 resistance level. There was even a move above the 61.8% Fib retracement level of the downward move from the $88,260 swing high to the $85,852 swing low. However, the bears seem to be active below the $88,000 level.

Bitcoin price is now trading below $87,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,700 level and the 76.4% Fib retracement level of the downward move from the $88,260 swing high to the $85,852 swing low.

The first key resistance is near the $88,000 level. There is also a key bearish trend line forming with resistance at $88,000 on the hourly chart of the BTC/USD pair. The next key resistance could be $88,250.

A close above the $88,250 resistance might send the price further higher. In the stated case, the price could rise and test the $88,800 resistance level. Any more gains might send the price toward the $90,000 level or even $90,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $86,800 level. The first major support is near the $86,400 level.

The next support is now near the $85,850 zone. Any more losses might send the price toward the $85,000 support in the near term. The main support sits at $84,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $86,400, followed by $85,850.

Major Resistance Levels – $88,000 and $88,250.

Market

Why BTC Price Stayed Unchanged

GameStop’s announcement that it would invest in Bitcoin drove excitement across the crypto community. Within hours, the video game and electronics retailer experienced a significant hike in stock prices. However, Bitcoin’s price remained the same.

In a conversation with BeInCrypto, representatives from Quantum Economics and CryptoQuant explained that Bitcoin’s price was bound to be indifferent to this type of announcement. GameStop lacks the size and scale to meaningfully impact the asset’s trading value, while overall hawkish market sentiment limited significant price movements.

Understanding GameStop’s Bitcoin Move

On March 26, GameStop announced an update to its investment policy, revealing that it had added Bitcoin as a Treasury Reserve Asset. Mirroring MicroStrategy’s Bitcoin plan, GameStop gambled on crypto exposure to strengthen its financial position in 2025.

“GameStop adding Bitcoin to their balance sheet is a huge win for corporate adoption of the world’s leading cryptocurrency,” Mati Greenspan, Founder and CEO of Quantum Economics, told BeInCrypto in response.

The company’s stock prices jumped as high as 12% in a matter of hours before seeing corrections. Community members reacted favorably, including high-profile figures like Scottie Pippen, six-time NBA champion.

As Pippen’s tweet suggests, GameStop’s announcement parallels recent efforts by different institutional players to acquire Bitcoin holdings. However, unlike previous cases, the company’s initiative did not impact Bitcoin’s price performance.

Market Indifference Explained

A day before GameStop’s announcement, the price of Bitcoin peaked at $88,474. Yesterday, it fell to a high of $88,199. At the time of press, Bitcoin’s price rests at $86,691. In other words, Bitcoin’s trading value has remained unphased by GameStop’s acquisition.

On previous occasions, these announcements have pushed BTC’s price by significant percentage points, unleashing a wave of bullish sentiment in trading activity.

When Tesla, for example, announced in February 2021 that it had bought $1.5 billion worth of Bitcoin, the move briefly pushed up the cryptocurrency’s price by as much as 20%.

Other major players like Strategy (formerly MicroStrategy) and BlackRock and nation-states like El Salvador and Bhutan have also acquired massive amounts of Bitcoin. But in yesterday’s announcement, GameStop failed to mention how much BTC it was eyeing.

The firm did mention that it would be issuing $1.3 billion in 0% convertible senior notes to finance this acquisition. Yet, compared to the broader trend of publicly listed firms buying Bitcoin, this figure is rather underwhelming.

“The announcement lacked key details —most importantly, how much Bitcoin they’re actually buying. While they’re sitting on about $4.8 billion in cash, we’ve seen no indication of what portion, if any, will be allocated to BTC,” Greenspan told BeInCrypto.

As a result, the market was left guessing. Without a clear figure, investors had no reason to react strongly. Instead, the statement served as a message of intent rather than a concrete market-moving event.

But even if GameStop had clarified just how much Bitcoin it was willing to buy, it still wouldn’t have made much of a difference in Bitcoin’s price. This is because of the underlying macroeconomic factors that have kept BTC below $90,000 for nearly a month now.

Why Didn’t GameStop’s Announcement Move Bitcoin’s Price?

According to its most recent quarterly report, GameStop has a nearly $4.8 billion cash balance. Per yesterday’s announcement, the company plans to raise $1.3 billion through a private offering of convertible senior notes.

It clarified, however, that the net proceeds from this offering will be used for “general corporate purposes,” which may include the acquisition of Bitcoin.

However, this remains to be seen. This vagueness creates a situation with much speculation but no concrete information.

For Greenspan, even if GameStop used its entire cash balance to purchase Bitcoin, BTC’s overall price would remain unchanged.

“To put things in perspective, Bitcoin’s on-chain volume alone averages around $14 billion per day — and that’s not even counting exchanges or ETFs. So even if GameStop went all-in, it still wouldn’t make a dent,” he said.

Meanwhile, the announcement must also be considered in light of the larger sentiment surrounding the crypto market at the moment.

A Bearish Moment for Bitcoin

Market sentiment has been particularly cautious lately. Between Trump’s tariff announcements and rumors about a possible recession, Bitcoin’s price has remained stagnant.

“Overall market sentiment remains the least bullish since January 2023 as measured by CryptoQuant’s Bitcoin Bull Score Index. The index goes from 0 (least bullish) to 100 (most bullish), and it has been at 20 since late February,” Julio Moreno, Head of Research at CryptoQuant, told BeInCrypto.

While major event announcements have driven Bitcoin prices up in the past, the wider market has been focused on other factors affecting trading behaviors.

“Bitcoin spot demand growth remains in contraction territory, declining by 297K Bitcoin in the last 30 days, the largest contraction for such a period since December 2023. The market is more focused on the macro developments, given expectations of a slowing down economy and the uncertainty regarding Trump’s Administration tariffs and trade policy,” Moreno added.

Given the greater pessimism dampening overall market sentiment, announcements of corporate purchases are unable to garner enough force to impact Bitcoin prices positively.

Meanwhile, given how far institutional adoption of crypto has come, corporate announcements don’t have the same impact as they used to.

Has Corporate Adoption Become Old News?

There’s a case to be made that the general public has become desensitized to corporate Bitcoin treasury announcements. According to data from Bitcoin Treasuries, private companies worldwide hold 381,560 BTC worth over $33.2 billion, twice as large as public companies.

“More pertinently, institutional adoption is so last cycle,” Greenspan said.

Many more recent announcements that extend beyond the scope of BTC holdings in private companies have rocked the market, causing prices to surge.

The market went berserk when spot Bitcoin ETFs began trading in January last year. For the first time, Bitcoin became available to a much wider pool of institutional investors who were previously hesitant to invest directly in the cryptocurrency.

This event led to a significant influx of capital into the Bitcoin market, driving up demand and prices.

Almost a year later, when Trump, a presidential candidate who promised to make the United States a cryptocurrency pioneer, won the elections, Bitcoin prices reached new highs.

Other, more recent events, like Trump’s announcement of a national strategic crypto reserve, had similar impacts on the market.

According to Greenspan, events like this last one will create future spikes in BTC’s price. For him, the new adoption cycle will focus on Bitcoin acquisition by entire nations.

National BTC Reserves Set to be Newest Market Driver

While countries like the United States, China, and Ukraine currently hold stockpiles of Bitcoin mainly seized from law enforcement activities, more countries are deliberately purchasing additional Bitcoin for strategic purposes.

El Salvador, for example, has gradually increased purchases of Bitcoin. Today, it holds a little over 6,000 in holdings. Meanwhile, Bhutan’s Bitcoin stockpile has already surpassed the $1 billion mark.

Other jurisdictions, such as Brazil, Poland, Hong Kong, and Japan, have also had lawmakers consider adding Bitcoin to their fiscal reserves.

For Greenspan, these announcements will generate real change in BTC’s future trading activity.

“This bull run is mainly about nation-state adoption. Let’s face it: as fun and nostalgic as GameStop is, it simply can’t compete with the scale and significance of entire countries stepping into the Bitcoin arena,” he said.

In the grand scheme of Bitcoin’s market, GameStop’s announcement, though notable, pales in comparison to the potential impact of large-scale events such as national policy changes or major economic shifts.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

-

Altcoin17 hours ago

Altcoin17 hours agoLinear Finance Ceases Operations As ‘Notice Of Closure’ Announced

-

Market22 hours ago

Market22 hours agoBNB Price Eyes Upside—Key Levels to Watch for a Breakout

-

Market21 hours ago

Market21 hours agoSend Direct Message to Crypto Leaders

-

Market14 hours ago

Market14 hours agoHow the LIBRA Scandal is Undermining Milei’s Trust in Argentina

-

Altcoin21 hours ago

Altcoin21 hours agoPepe Coin Whale Bags 500M Tokens; PEPE Price Breakout Ahead?

-

Bitcoin20 hours ago

Bitcoin20 hours agoWill Bitcoin’s Rally Continue or Just Be a Temporary Surge?

-

Market13 hours ago

Market13 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure