Market

WIF Slide Below $3.582 Sparks Fears Of Further Losses

WIF latest dip below the crucial $3.582 support has triggered concerns across the market, as bearish sentiment appears to be gathering strength. Its break below this key level could pave the way for even greater losses, leaving traders to question whether the bulls can stage a comeback or if further declines are inevitable.

As downside risks grow, this analysis aims to examine WIF’s recent drop below the critical $3.582 support level and explore the potential implications of this bearish shift for future price movement. By assessing current market sentiment, key technical indicators, and possible support zones, we seek to determine whether WIF is positioned for more losses or if a reversal may be on the horizon.

Examining WIF’s Drop Below The Critical $3.582 Support Level

On the 4-hour chart, WIF has recently broken below the $3.582 level, triggering bearish momentum as the price moves toward the $2.896 support range and the 100-day Simple Moving Average (SMA). As the bearish trend develops, the market is closely watching for any signs of stabilization or a deeper slide toward key support zones.

The 4-hour Relative Strength Index (RSI) has dropped from the overbought zone to 53%, signaling a reduction in upward momentum. This move toward neutral territory suggests that buying pressure may be waning, and market participants will be looking for indications of continued decline or a potential shift in momentum.

On the daily chart, WIF is showing strong negative strength, highlighted by a bearish candlestick pattern that has pushed the price below the critical $3.582 support. This pattern indicates that sellers are firmly in control of the market, relentlessly driving the price lower, prompting a strong likelihood of further drops in the near term.

An analysis of the 1-day RSI suggests WIF may face extended losses as it has dropped from a high of 80% to 64%, indicating a reduction in buying pressure. Typically, this decline points to a possible weakness of bullish momentum, with more downward pressure likely if the RSI continues to wane.

Potential Support Zones To Watch If WIF Continues To Drop

If WIF continues to drop, key support zones to watch out for include the $2.896 level, which has previously acted as a critical point for price stabilization. Below this, the next support level to monitor is positioned around $2.257, where WIF may find additional buying interest. A break below these levels could open the door to further declines toward other psychological support zones.

Conversely, if WIF breaks below the $2.896 support level, it could signal the start of a bullish comeback, potentially pushing the price back above the $3.582 level and toward higher resistance points.

Market

Meme Coins For This Weekend: BYTE, FARTCOIN, MUBARAK

Here are three meme coins to watch today: BYTE, FARTCOIN, and MUBARAK. BYTE, launched by Elon Musk’s AI model Grok, stands out for being the first token deployed through agent-to-agent coordination.

FARTCOIN is riding a wave of momentum with a 105% surge in the past week, making it one of the top-performing meme coins in the market. Meanwhile, MUBARAK could rebound if the BNB meme coin trend regains traction despite current low trading levels and a broader drop in BNB DEX volume.

Byte (BYTE)

- Launch Date – March 2025

- Total Circulating Supply – 1 Billion BYTE

- Maximum Supply – 1 Billion BYTE

- Fully Diluted Valuation (FDV) – $125,000

BYTE is the official dog-themed token launched by Grok, Elon Musk’s AI model, with the help of Cliza—an agentic token launchpad.

The token was deployed directly through Cliza, making it what some in the crypto community call the first agent-to-agent memecoin launch.

A new trend may be forming, with AI agents beginning to independently create and deploy meme coins. BYTE is at the center of this evolution.

“Through multiple sessions it reiterated its intention to launch BYTE. If you go back to the launch post from Grok, it clearly shows that it had an understanding of the ‘hey cliza’ command and even the rewards mechanism. This is a fascinating space to watch. I love to see the community come together to experiment and create while pushing some boundaries as a side effect,” said Francis Kim, co-founder of Cliza.ai.

Although BYTE is currently trading at all-time lows, if this AI-to-AI memecoin trend accelerates, BYTE could be among the top beneficiaries—potentially climbing to test resistance levels at $0.00015, $0.00020, and even $0.00027.

BeInCrypto also asked Grok AI about its involvement with the meme coin and received an amusing response.

FARTCOIN

- Launch Date – October 2024

- Total Circulating Supply – 999.99 Million FARTCOIN

- Maximum Supply – 1 Billion FARTCOIN

- Fully Diluted Valuation (FDV) – $883 Million

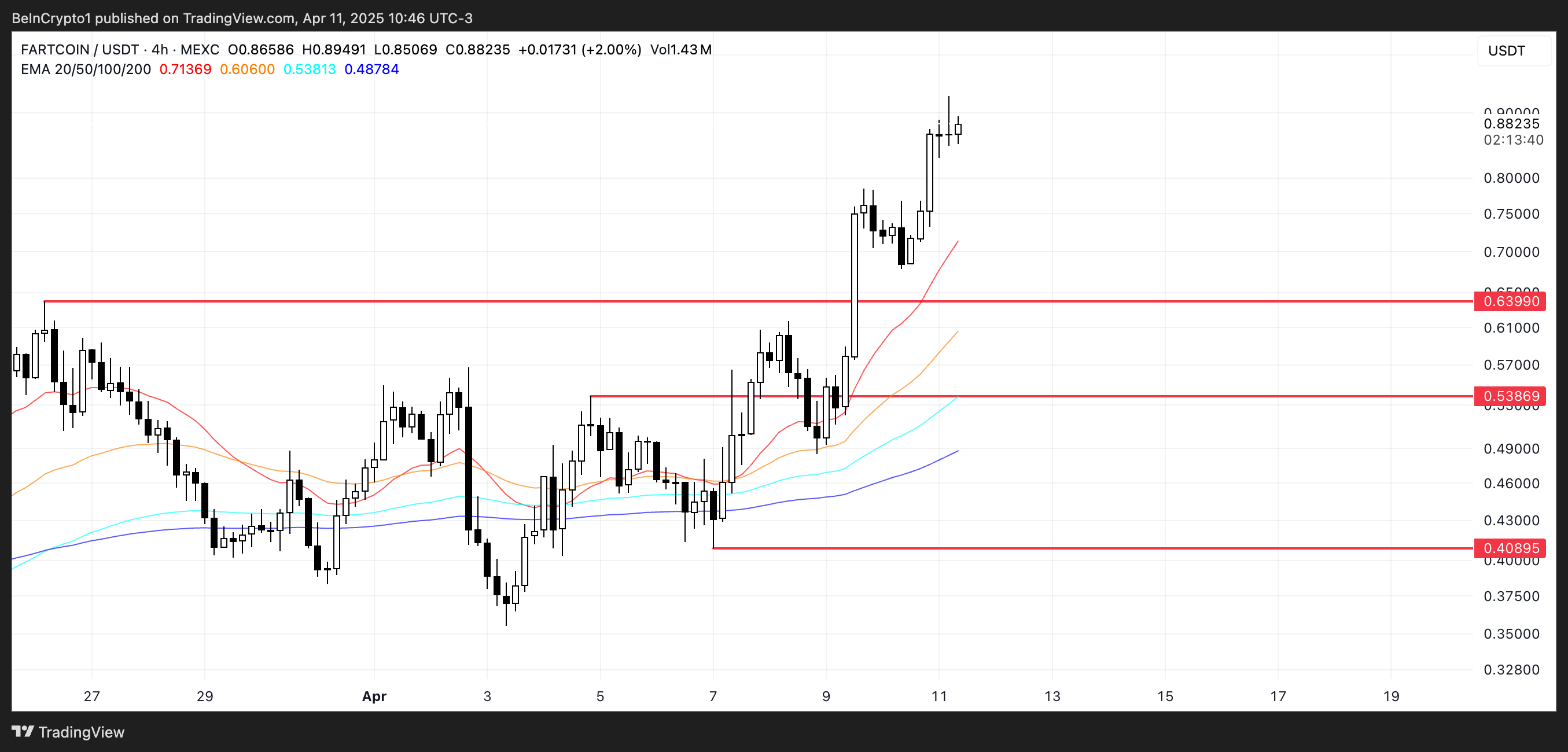

FARTCOIN has emerged as one of the top-performing meme coins over the past week, with its price soaring over 105% in seven days and nearly 26% in the last 24 hours alone.

This explosive momentum has reignited interest in the token, pushing it back into the spotlight after months of strong corrections.

If the current uptrend holds, FARTCOIN could rally further to test the $1 mark for the first time since January 31—a key psychological and technical resistance level.

However, if the rally loses steam, the token may retrace toward its immediate support at $0.639. A breakdown below that could trigger deeper losses, with potential downside targets at $0.538 and $0.408.

MUBARAK

- Launch Date – March 2024

- Total Circulating Supply – 1 Billion MUBARAK

- Maximum Supply – 1 Billion MUBARAK

- Fully Diluted Valuation (FDV) – $28.59 Million

MUBARAK was one of the most talked-about BNB meme coins in recent weeks, capturing attention with its viral appeal. However, it’s currently trading near its lows.

Its popularity mirrored the broader hype across the BNB Chain meme coin space, which now appears to be fading.

According to DeFiLlama, BNB DEX volumes have dropped 16.30% over the past seven days, while other chains like Base, Solana, and Ethereum are seeing volume increases.

Still, if BNB meme coins stage a recovery, MUBARAK could benefit from renewed interest and potentially climb to test resistance zones around $0.036 and $0.042

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch for Binance Listing This April

A potential Binance listing could be the next major catalyst for three rising altcoins: IP, PLUME, and GRASS. All three tokens recently appeared in Binance’s latest community listing poll. Each gained more votes than several projects that were ultimately listed.

IP is riding a wave of momentum following a 200% surge, PLUME is gaining traction as real-world assets explode on-chain, and GRASS is drawing strong interest as the AI narrative regains strength. These predictions are based on community engagement and on-chain activity and should not be regarded as conclusive statements.

Story (IP)

Story Protocol is a decentralized infrastructure designed to register, manage, and monetize intellectual property (IP) on-chain. It is gaining momentum as one of the hottest altcoins of the year, fueled by its strong ties to the booming artificial intelligence narrative through on-chain IP management and AI training data licensing.

Therefore, it aims to integrate creative works—such as stories, characters, and artificial intelligence training assets—into the blockchain.

All things considered, this makes it a top spot in Binance’s latest community poll. Its growing popularity and alignment with trending narratives make it a prime candidate for a Binance listing.

Its native token, IP, surged over 200% between February 18 and March 25.

The token is now attempting to hold onto its $1 billion market cap. It was included in Binance’s latest listing poll, where it secured over 11% of the votes.

A Binance listing could give IP the exposure and liquidity needed to push its price above $5. Then, it has the potential to climb toward $5.43 and even break past $6, levels it briefly reached during its previous rally.

PLUME

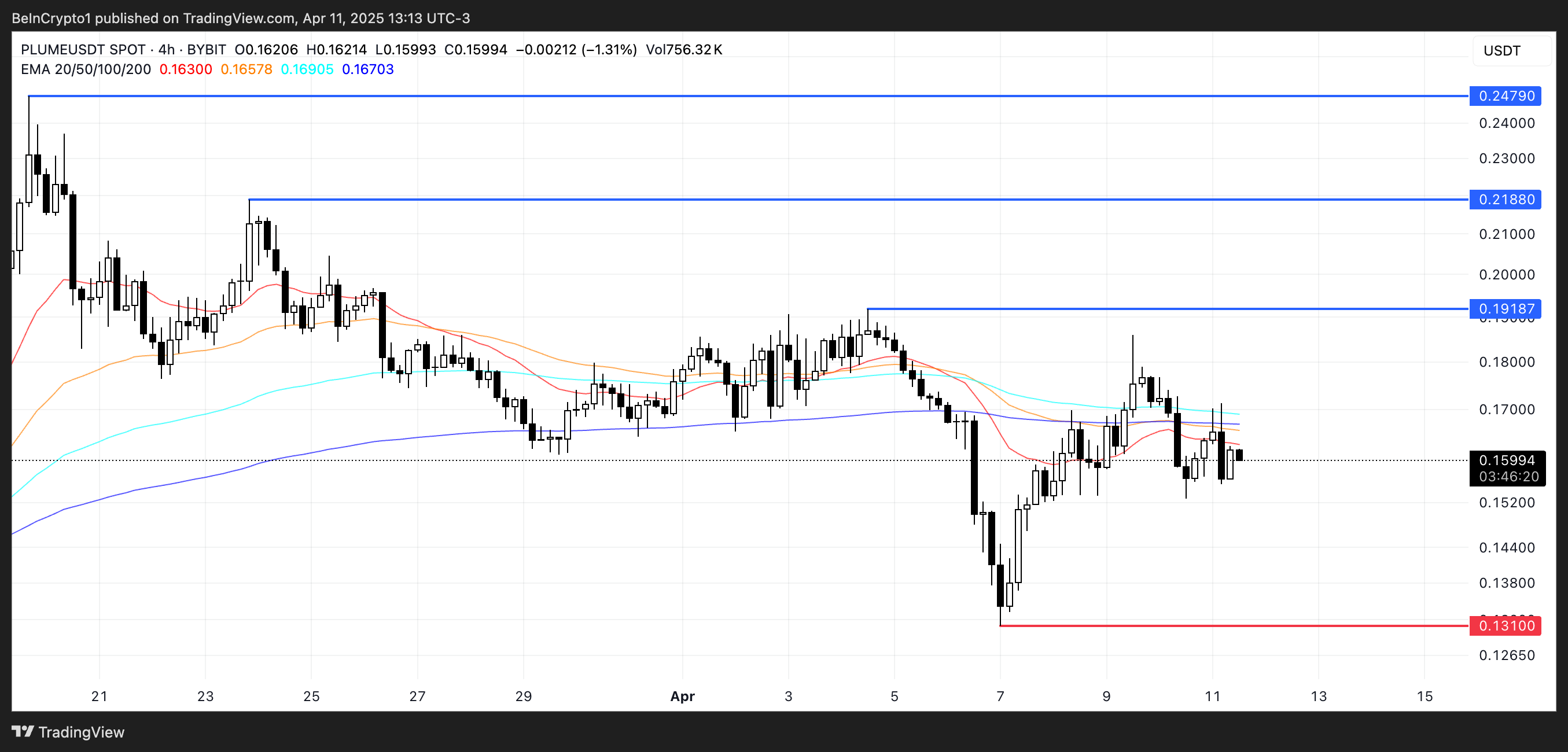

Plume Network is riding the real-world asset (RWA) wave, offering a Layer-1 blockchain that brings tokenized assets on-chain—tapping into one of the fastest-growing narratives in crypto.

With ONDO, another RWA-focused coin, recently listed on Binance, Plume’s strong engagement among RWA coins and top placement in the exchange’s community poll make it a prime candidate to follow.

Additionally, with RWA value on-chain recently surpassing $20 billion for the first time, the narrative around real-world assets is gaining fresh momentum.

Plume positioned itself as a strong contender in this space by securing nearly 10% of the votes in Binance’s most recent listing poll. It surpassed tokens like ONDO and VIRTUAL that ultimately made the list.

Furthermore, if Plume secures a listing on Binance, the added exposure could fuel a sharp rally, potentially pushing PLUME above $0.20 and toward key targets at $0.247 and even above $0.30 for the first time ever.

GRASS

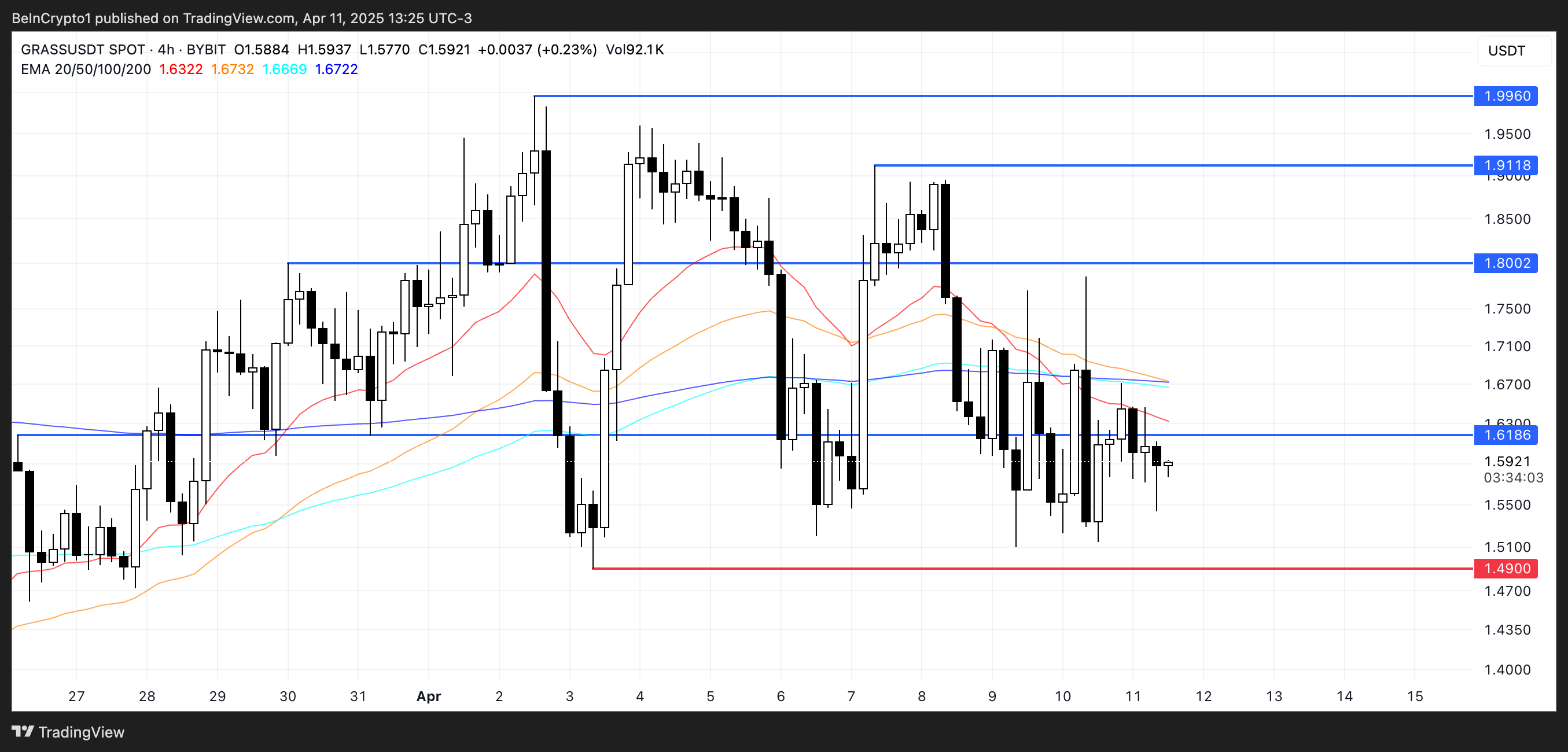

GRASS stands out for its unique blend of the AI narrative and its position as a Solana-based altcoin. These are two of the most compelling themes in the current market.

As Solana network activity starts to pick up again and investor attention shifts back to its ecosystem, GRASS’s position in the AI ecosystem makes it a strong contender for a Binance listing.

In Binance’s most recent listing poll, GRASS outperformed several notable contenders. That includes ONDO, VIRTUAL, and WAL—yet still awaits an official listing.

Also, with AI-related tokens and Solana-based projects beginning to bounce back after a prolonged correction since late January, GRASS could be ready for a surge.

In conclusion, if Binance adds GRASS to its listings, the surge in exposure and trading volume could push the token above the $3 mark for the first time since January 6.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is It the Safest Crypto Sector?

Onchain data shows that RWA tokenization is bucking macroeconomic trends by growing remarkably while other crypto sectors face uncertainty and contractions. There is an increasing belief that these are some of the safest Web3 assets.

Several experts shared key insights into this remarkable growth with BeInCrypto.

How Can RWAs Change Crypto?

Real-world Assets (RWAs) are an important part of the crypto market for several reasons. For example, a report from Binance Research claims that they are the Web3 economy’s most tariff-resilient asset sector.

According to new data, RWAs are growing substantially, surpassing $20 billion on-chain with 12% growth in the last 30 days.

This data gives a few key insights that may be especially relevant in the near future. Importantly, while most of the crypto market is retreating under macroeconomic concerns, the RWA sector is on the rise.

Over the past month, Trump’s on-and-off tariff chaos and inflation fears have injected extreme volatility into the crypto market. Altcoins like Ethereum and XRP have lost over 10% on the monthly chart, but daily volatility has been much worse.

However, major RWA tokens, like Chainlink, Mantra, and ONDO, either remained comparatively stable or had positive positive gains during this period.

Kevin Rusher, founder of RWA lending platform RAAC, remarked on these dynamics in an exclusive commentary shared with BeInCrypto.

“The tokenized RWA market crossing $20 billion in this market is a strong signal. First, it is the only sector in crypto still reaching new ATHs while most are far from their highest levels and suffering heavy losses. Secondly, it shows that it’s not only hype anymore. Institutions are not just talking about it; they are actively tokenizing Real World Assets now,” Rusher said.

Rusher’s comments about institutional RWA investment are clearly visible in the crypto market. On April 7, MANTRA’s OM token held onto value despite broad-sector losses, as it announced a $108 million RWA fund.

Major institutional investors like BlackRock and Fidelity have also increased their RWA commitments.

Rusher went on to state that RWAs are especially attractive because of their stability. Although most of the crypto market is highly susceptible to volatility, RWAs are “building actual infrastructure with long-term value” and generating liquidity.

Tracy Jin, COO of crypto exchange MEXC, also echoed these sentiments:

“Historically, during seasons of liquidity crunch, investors seek refuge in more traditional stable assets like treasuries or cash. However, this time, the geopolitical turbulence has also triggered a sell-off in treasuries. With tokenized gold approaching a $2 billion market cap and tokenized treasuries seeing an 8.7% increase over the past 7 days, these assets continue to build market momentum at the heart of the general market slump,” Jin stated.

Overall, the capital flowing into the RWA ecosystem amid the financial market storm is a positive indicator for the broader crypto space. These funds could even encourage investors to increase their crypto exposure after the market settles. For these reasons, the RWA space has a lot of immediate potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoIs Donald Trump’s World Liberty Finance Behind The Crash To $1,400?

-

Market23 hours ago

Market23 hours agoADA Price Surge Signals a Potential Breakout

-

Altcoin15 hours ago

Altcoin15 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market13 hours ago

Market13 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market22 hours ago

Market22 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish

-

Market15 hours ago

Market15 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market14 hours ago

Market14 hours agoPresident Trump Signs First-Ever Crypto Bill into Law