Market

Why Bulls Are Losing Grip

SUI, the native token of the Layer-1 Move-programmed Sui blockchain, is facing heightened selloff pressure. The recent drop has pushed SUI’s price to $1.92, marking a 5% decline in the past 24 hours.

As bullish sentiment fades, SUI’s struggle to maintain support above the $2 level intensifies. This analysis explores the factors contributing to this challenge.

Sui Bulls Begin to Exit Market

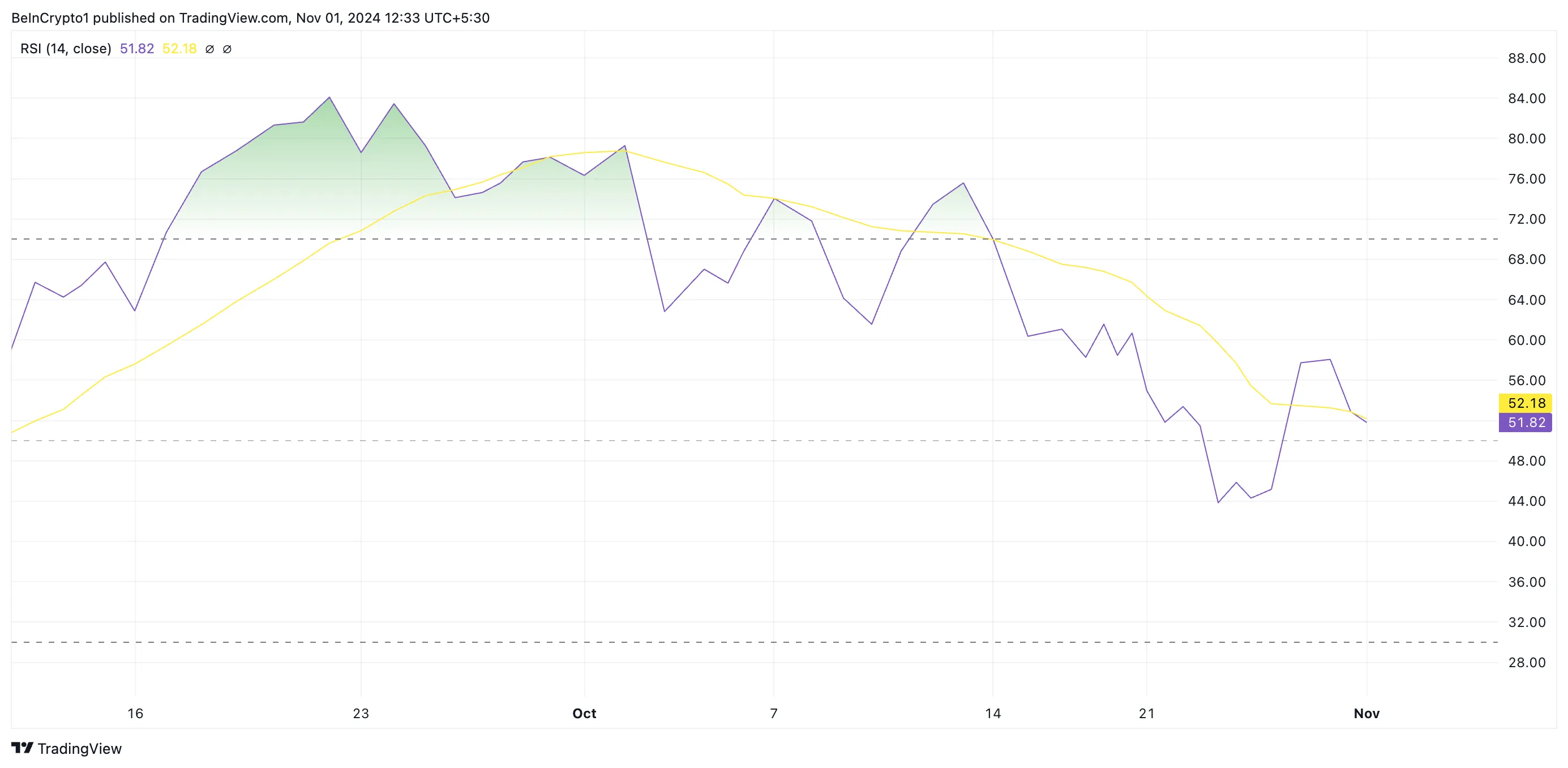

The downward trend of SUI’s Relative Strength Index (RSI) is a notable indicator of the drop in demand for altcoin. As of this writing, this stands at 51.82, poised to breach the 50-neutral line and extend its decline.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges from 0 to 100, with values above 70 suggesting that the asset is overbought and due for a pullback. In contrast, values under 39 indicate that the asset is oversold and may witness an upward reversal.

An RSI reading of 51.85, moving toward 50, suggests that market momentum for the asset is shifting toward a more bearish outlook. Traders often interpret this as a signal to prepare for potential declines.

Read more: Everything You Need to Know About the Sui Blockchain

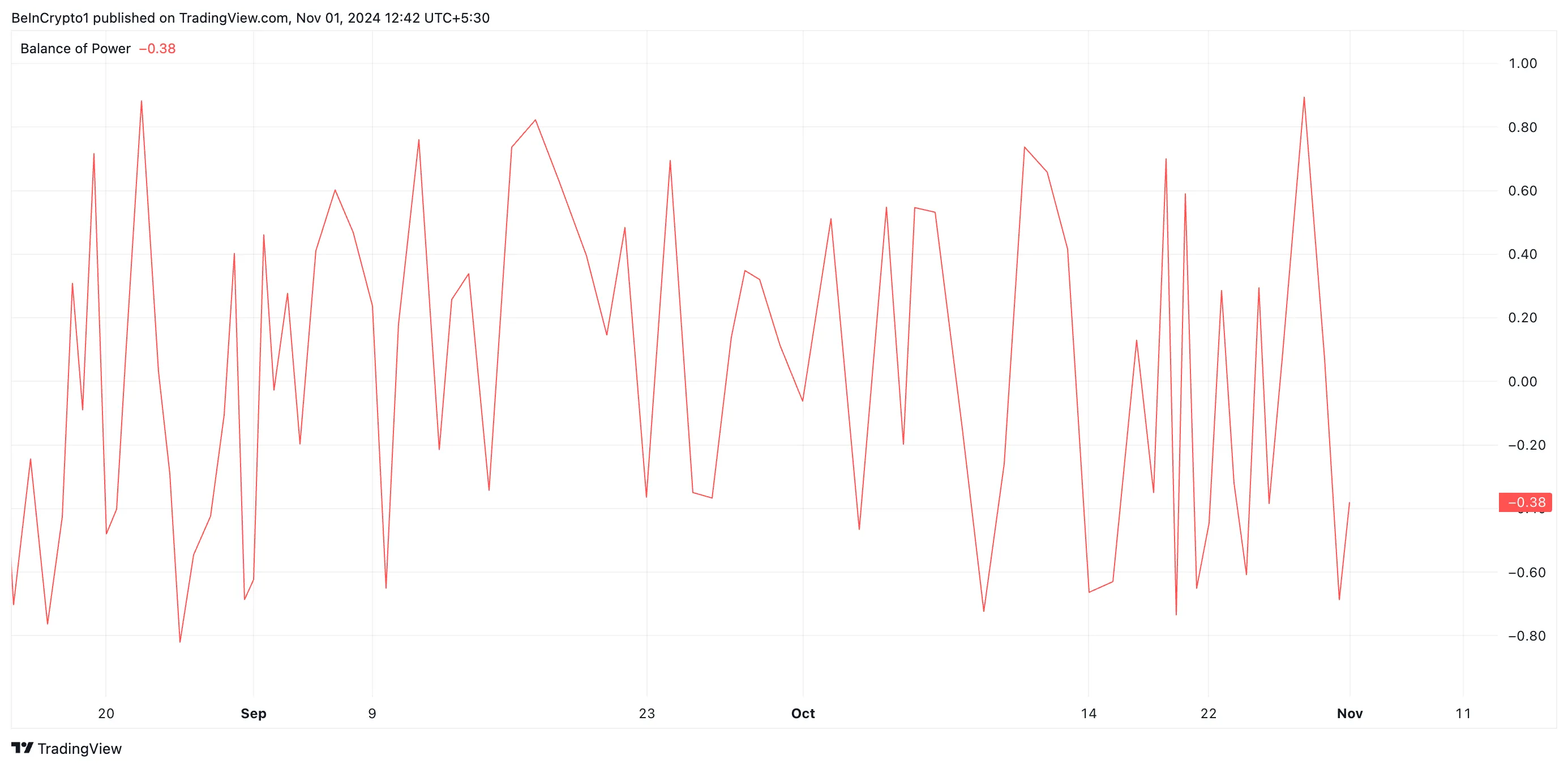

Furthermore, the coin’s plummeting Balance of Power (BoP) supports this bearish outlook. BeInCrypto’s assessment of the SUI/USD one-day chart reveals that this indicator, which measures the strength of buyers versus sellers in the market, has been in decline since October 29.

As of this writing, SUI’s BoP is -0.38. A negative BoP suggests sellers are in control and attempting to extend the SUI price drop.

SUI Price Prediction: The 20-Day EMA Level Is Critical

SUI currently trades just above its 20-day exponential moving average (EMA), which provides critical support at $1.94. The 20-day EMA, reflecting the asset’s average price over the past 20 trading days, often signals an uptrend when prices sit above it and serves as a key support level.

However, SUI’s proximity to this level suggests that support could be weakening. A decisive break below the 20-day EMA would signal short-term bearish momentum, indicating that the uptrend has lost strength.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

If SUI bulls fail to maintain this support, the price may fall to $1.64, with further declines potentially driving it down to $0.91. Conversely, if $1.94 holds, it could propel SUI toward reclaiming its all-time high of $2.36.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin and D.O.G.E – Elon Musk’s Billionaire Crypto Experiment

Originally launched as a parody of crypto speculation, Dogecoin has since become the kind of speculative asset it was meant to mock — largely due to Elon Musk’s influence. His social media activity and public endorsements have played a central and ongoing role in shaping DOGE’s trajectory.

BeInCrypto spoke with Erwin Voloder, Head of Policy of the European Blockchain Association, to discuss how Musk blurred the lines between parody and promotion, leading people to assign real-world value to a meme and generating ethical concerns along the way.

The Genesis of Dogecoin

Toward the end of 2013, software engineers Billy Markus and Jackson Palmer joined forces to create Dogecoin, the first meme coin in crypto history. Its primary purpose was to serve as a lighthearted parody of the chaotic crypto hype.

Born from the “Doge” internet meme, which prominently featured a Shiba Inu, the meme coin was intended as a humorous jab at the often illogical nature of crypto speculation.

Despite its satirical origins, Dogecoin quickly gained a dedicated online following—so much so that even Tesla CEO Elon Musk became drawn to it.

Today, he’s considered a key figure in the community, and Dogecoin, contrary to its initial philosophy, has become a speculative asset.

“Musk’s involvement transformed Dogecoin from a satirical internet token into a speculative asset class by bestowing it with perceived legitimacy and entertainment value. His tweets and appearances turned Dogecoin into a cultural product rather than a financial one—a kind of performance art with real economic consequences. The irony is that a coin created to mock irrational investing became the poster child of irrational investing,” Voloder told BeInCrypto.

In addition to symbolic endorsements, Musk has exerted concrete influence. A prime example is Tesla’s early 2022 decision to accept Dogecoin for select merchandise, significantly strengthening its position and indicating its practical potential.

Musk also didn’t hesitate to use social media to convey his love for Dogecoin.

How Did Musk’s Tweets Impact Dogecoin’s Market?

Throughout the years, Elon Musk, a prolific Twitter user even before he bought the platform, has shared numerous posts referencing Dogecoin. Each of these tweets has substantially impacted the meme coin’s visibility and price performance.

When Musk referred to Dogecoin in an April 2019 tweet as his favorite cryptocurrency, the market went berserk. In two days, the coin’s price went from $0.002 on April 1 to as high as $0.004.

Two years later, Musk’s X posts declaring “Dogecoin is the people’s crypto” triggered an overnight trading volume surge of over 50%.

Soon enough, retail investors started to follow Musk’s endorsements mindlessly. But it wasn’t all butterflies and roses. Musks’s unpredictable pronouncements also came with extreme volatility.

“Musk blurred the line between parody and promotion, which led people to assign real-world value to a meme. Without him, it may have remained a niche internet joke but with him, it became a symbol of speculative absurdity,” Voloder said.

When Musk called Dogecoin ‘a hustle’ on Saturday Night Live in May 2021, the coin lost more than a third of its price in a few hours.

“Dogecoin has no clear roadmap, no underlying yield or utility, and limited development activity, meaning its valuation is especially sentiment-driven. In such an environment, a single individual’s actions can drive or destroy market perception, particularly when that individual is one of the world’s most followed and wealthiest people,” he added.

Then, in January 2025, President Trump appointed Musk as the head of a newly created agency tasked with cutting federal spending.

Musk called it the Department of Government Efficiency, or D.O.G.E. for short. The name was intentional, and the internet broke accordingly.

D.O.G.E. and the Price Plunge: What’s the Correlation?

President Trump launched the D.O.G.E. department by executive order on his first day on the job. After D.O.G.E. launched its official government website, Dogecoin’s price surged by 13% in 15 minutes, breaking its previous short-term downtrend.

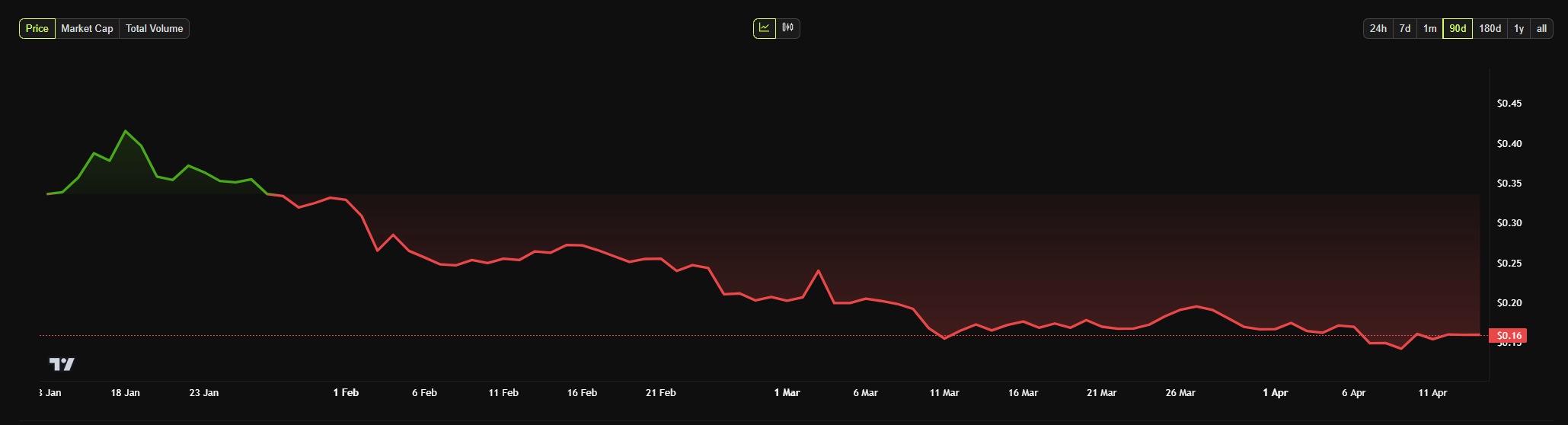

Yet, since the official establishment of the Department of Government Efficiency, DOGE’s price has been freefalling. While valued at $0.36 on January 20, its price has since fallen to $0.15 today.

Findings from a recent Finbold report have also revealed that Musk might now be having the opposite effect on Dogecoin’s value and sentiment.

According to the data, the number of Dogecoin millionaire addresses has plunged by over 41% between January 21 and March 31. In just over two months, the cryptocurrency has decreased by 964 addresses.

Notably, the report indicated a massive proportional decline in the number of the wealthiest Dogecoin addresses. The count of addresses holding $1 million to $9.99 million decreased by 40.21% in Q1 2025.

Even more significantly, the number of addresses holding over $10 million plummeted by 47%, from 400 to 212.

In short, Dogecoin whales are dumping the token.

“Musk’s influence remains a key variable in Dogecoin’s valuation, and the timing of the drop in high-value addresses closely aligns with his D.O.G.E. announcement, suggesting a correlation. However, attributing the entire reversal to Musk overlooks broader macro factors like rising interest rates, tighter crypto regulation, and waning retail enthusiasm post-2021,” Voloder explained.

Despite the difficulty of assessing the precise impact of Elon Musk’s D.O.G.E. leadership on Dogecoin’s performance, his significant influence on the cryptocurrency has become evident.

The ethical considerations accompanying Musk’s influence have also become difficult to ignore.

The Ethical Concerns of a Billionaire’s Influence

According to Voloder, the Dogecoin case illustrates the perils of parasocial investing, a behavior in which people mistakenly assign credibility to famous personalities based on their celebrity status or charisma.

It further shows the damaging effects of uncritical reliance on endorsements, potentially leading to substantial financial losses for retail investors.

The ethics of a billionaire influencing a volatile market like cryptocurrency also present significant complexities.

“On one hand, Musk has the right to express personal views and participate in public discourse, including around assets like Dogecoin. On the other, his outsized influence means that his commentary can trigger real financial harm or euphoria in retail investors who often lack access to sophisticated risk models. Ethically, when you wield that kind of influence, there’s a strong argument for assuming a higher standard of responsibility—especially in a market with minimal guardrails,” Voloder told BeInCrypto.

Given the unregulated nature of the cryptocurrency industry, it’s currently challenging to pinpoint the degree to which Musk’s actions can be held responsible.

Does Musk’s Influence Constitute Market Manipulation?

Although presented as personal opinions, Musk’s tweets demonstrably affect Dogecoin’s price, creating a legal gray area regarding potential market manipulation under US securities and commodities laws.

“Under SEC rules, market manipulation involves intentional conduct designed to deceive or defraud investors by controlling or artificially affecting market prices. While Dogecoin is not officially deemed a security, and thus outside the SEC’s traditional remit, the CFTC could still scrutinize it under its anti-manipulation powers for commodities,” Voloder explained.

The Dogecoin case isn’t the first time a high-profile figure has influenced markets in ways that were manipulative, though not explicitly illegal.

Voloder highlighted two instances at different points in the 20th century: when prominent banker JP Morgan steered markets during the panic of 1907 and investor George Soros broke the Bank of England in 1992.

Though their maneuvers were technically legal, they managed to sway market outcomes. However, this was the 20th century, and their impact was proportionally much smaller.

“The difference today is that social media provides instantaneous reach to millions of investors, amplifying the potential impact. So even if Musk’s tweets are framed as personal musings, their predictable effect on price can be seen as a form of market signaling—intentional or not,” Voloder told BeInCrypto.

In fact, the SEC and legal experts are already debating Elon Musk’s potential influence on Dogecoin’s financial market activities.

A $258 Billion Lawsuit

Elon Musk currently faces a $258 billion class action lawsuit for running a Dogecoin pyramid scheme.

The lawsuit, filed in June 2022, claims that Musk intentionally promoted Dogecoin through his tweets, public appearances, and media interactions, creating hype and driving up demand.

According to the plaintiffs, this artificial inflation of Dogecoin’s price allowed Musk and his companies to profit while leaving other investors with substantial losses when the price inevitably declined.

Due to the SEC’s unclear legal classification of cryptocurrencies like Dogecoin, Voloder anticipates a difficult path for these claims in court. Nevertheless, the lawsuit indicates increased attention to market manipulation by influential figures.

“Still, the lawsuit signals increased legal pressure to define where promotional enthusiasm ends and financial misconduct begins. If regulators or courts decide Musk knowingly manipulated the market or misled investors, he could face civil penalties or be forced into settlements. The SEC’s earlier scrutiny of Musk’s Tesla tweets, resulting in a consent decree, shows that regulators are willing to act when market-moving speech crosses certain lines,” Voloder explained.

Musk’s influence on Dogecoin continues unabated, and the long-term effects on the Dogecoin community remain a subject of debate.

The rapid 40% decrease in Dogecoin whale addresses within two months has raised questions about the meme coin’s future strength and resilience.

However, DOGE’s fundamental strength still remains intact – it’s community.

“While the initial hype has faded, Dogecoin still retains a loyal base of enthusiasts, many of whom appreciate its meme-driven culture, low transaction fees, and iconic branding. But the big speculative crowd that initially drove its [all-time high] has largely left the field in absence of sustained bullish narratives or meaningful tech upgrades,” Voloder concluded.

In the future, traders will be watching to see if Dogecoin’s ‘cult following’ eventually dwindles or if a strong community will sustain the ‘OG meme coin’.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Arthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

Arthur Hayes, co-founder of BitMEX, has urged market participants to “buy everything” following recent signals from the US Federal Reserve.

In an April 11 post on X, Hayes suggested that investors consider broad exposure to the crypto markets as central banks show signs of stepping in to stabilize the system.

Hayes Sees Market Stress as Cue to Buy Bitcoin

Hayes previously pointed to rising bond yields, particularly the 10-year US Treasury rate climbing above 4.5%, as a potential trigger for government intervention.

He argued that such pressure could force the Fed to inject fresh liquidity, creating favorable conditions for risk assets—especially Bitcoin. According to Hayes, this scenario could lead to a prolonged upward move in crypto and broader markets.

“We will be getting more policy response this weekend if this keeps up. We are about to enter UP ONLY mode for BTC,” Hayes stated.

The Fed’s stance appears to support this view. Susan Collins, President of the Boston Federal Reserve, recently told the Financial Times that while the markets are still functioning properly, the Fed stands ready to act if liquidity becomes strained.

Collins emphasized that the central bank has tools in place to ensure market stability if disruptions emerge. However, She stressed that the rate cuts are not the Fed’s first line of defense as other tools are available to stabilize financial markets when needed.

“The core interest rate tool we use for monetary policy is, certainly not the only tool in the toolkit and probably not the best way to address challenges of liquidity or market functioning,” she said.

These developments come at a time when the global economy is already under stress. President Donald Trump’s new wave of tariffs has added fresh uncertainty to financial markets.

Though the administration paused its new tariff schedule for 90 days, it sharply increased duties on Chinese goods to 145%. China has since responded with its own tariff hikes, lifting rates on American imports from 84% to as much as 125%.

These tit-for-tat measures have raised fears of an inflation spike in the US, along with possible job losses and weaker economic growth. Wall Street has already experienced a significant selloff, and US Treasury markets are showing signs of strain.

Meanwhile, despite the short-term suspension of new trade penalties, underlying tensions remain high. For Hayes, however, the combination of macro stress and central bank intervention presents a clear signal: this may be the moment to accumulate assets before the tide turns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Long-Term Holders Fuel Surge, Could BTC Hit $85,000?

Leading coin Bitcoin has had a turbulent past few weeks, with its price troubles prompting many short-term investors—often referred to as “paper hands”—to exit the market.

However, amidst the price volatility, the coin’s long-term holders (LTHs) remain resolute and show no signs of backing down as they attempt to push BTC back above $85,000. How soon can they realize this?

Bitcoin Long-Term Holders Shift From Selling to Stacking

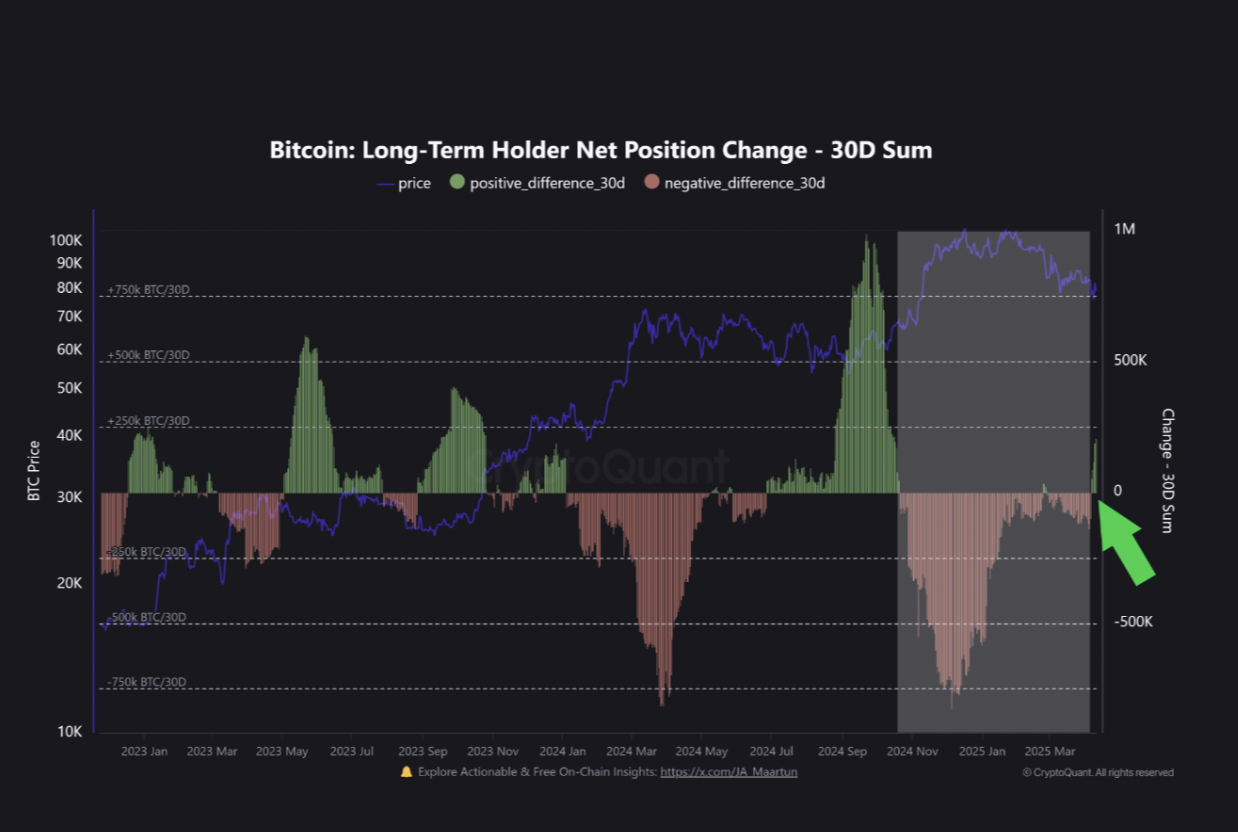

In a recent report, CryptoQuant analyst Burak Kesmeci assessed BTC’s Long-Term Holder Net Position Change (30d sum) and found that since April 6, the metric has turned positive, showing clear upward momentum. As a result, Kesmeci wrote, BTC has risen by approximately 12%.

BTC’s Long-Term Holder Net Position Change tracks the buying and selling behavior of LTHs (those who have held their assets for at least 155 days) to measure the shift in the number of coins held by these investors over a specific period.

When its value is positive, it indicates that LTHs are not selling, and remain optimistic about BTC’s future price performance. Conversely, when it turns negative, it suggests that these holders are selling or distributing their coins, often in response to market pressures, which is a bearish signal.

According to Kesmeci, BTC’s Long-Term Holder Net Position Change (30d sum) flipping positive is notable. This metric had remained below zero since October last week, signaling that LTHs were consistently selling their BTCs.

The sellofs reached their lowest point on December 5, prompting a 32% dip in BTC’s price and marking the peak of a 6-month period of distribution by LTHs.

However, this trend has changed since April 6. The metric now sits above zero and is in an uptrend. Speaking on what this means, Kemesci added:

“While it’s too early to say definitively, the growing positive momentum in this metric could be a sign that long-term conviction is returning to the market.”

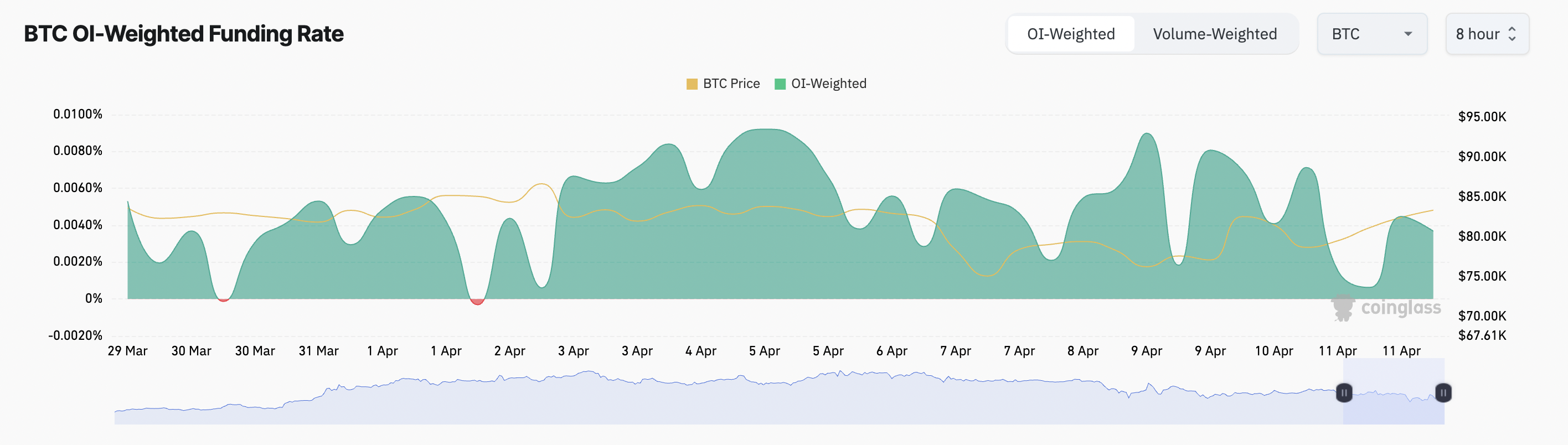

Moreover, BTC’s funding rate has remained positive amid its price troubles, confirming the bullish outlook above. At press time, this is at 0.0037%.

The funding rate is the periodic payment exchanged between long and short traders in perpetual futures markets. It is designed to keep the futures price close to the underlying asset’s spot price.

When it is positive like this, long traders are paying short traders. This indicates a bullish market sentiment, as more traders are betting on BTC’s price to climb.

Long-Term Holders Set the Stage for $87,000 Run

The surge in accumulation from BTC LTHs has pushed the coin’s price above the key resistance at $81,863. At press time, the king coin trades at $83,665.

As the market responds to these sustained buying pressures from LTHs, the coin’s price may be primed for a significant rally in the near future.

If retail traders follow suit and increase their coin demand, BTC could break above $85,000 to $87,730.

However, if the accumulation trend ends and these LTHs begin to sell for gains, BTC could resume its decline, fall below $81,863, and drop toward $74,389.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

-

Market22 hours ago

Market22 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady

-

Market24 hours ago

Market24 hours agoMiCA Boosts Gemini’s Expansion Plans Across Europe

-

Regulation18 hours ago

Regulation18 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market17 hours ago

Market17 hours ago3 Altcoins to Watch for Binance Listing This April

-

Altcoin24 hours ago

Altcoin24 hours ago6.96 Billion Dogecoin In 24 Hours As DOGE Price Adds 1%

-

Altcoin23 hours ago

Altcoin23 hours agoSonic Surges to $1 Billion TVL in 66 Days Amid DeFi Market Slump

-

Bitcoin22 hours ago

Bitcoin22 hours agoIs Bitcoin Ready for Another Surge?