Market

Which Are the Top DePIN Altcoins to Watch in December 2024?

As November ends and December 2024 begins, investors are likely to shift their focus toward portfolio rebalancing or exploring new altcoin opportunities. The Decentralized Physical Infrastructure Network (DePIN) narrative is gaining attention, making it a key sector to watch. Here are some top DePIN altcoins to keep an eye on.

In this analysis, BeInCrypto discusses five top DePIN altcoins to watch next month, highlighting why these cryptos may garner a lot of attention in the market. They include Filecoin (FIL), Arweave (AR), Grass (GRASS), io.net (IO), and NetMind Token (NMT).

Filecoin (FIL)

Filecoin, which has a market capitalization of $3.44 billion, tops the list of DePIN altcoins to watch in December. For an altcoin that lost a chunk of its value during the second and third quarters, Filecoin has shown strength within the last 30 days.

Over this mentioned period, the price has increased by 56.22%. However, it is still largely down from its all-time high, suggesting that it still has more room to grow.

From a technical point of view, the Awesome Oscillator (AO), which measures momentum, has continued to remain in the positive region. Typically, when the AO is negative, momentum is bearish.

But when it is positive, it is bullish, which is the case with FIL. If this remains the case, the altcoin’s price might climb to $6.50 within the first few days in December. However, if momentum turns bearish, that may not happen, and Filecoin could drop to $4.96.

Arweave (AR)

Second on the list of the top DePIN coins to watch is Arweave, a project focused on a decentralized storage network. Over the last seven days, AR’s price has increased by 20.98%, making it one of the best-performing altcoins in the top 100.

At press time, the token’s price is $21.13. The daily chart shows that the altcoin hit this price due to the formation of an inverse head-and-shoulders pattern.

This pattern is a bearish to bullish reversal that was validated after AR bottomed at $133. However, the token currently faces resistance at $22.05 but could help AR breach this obstacle.

Should this happen, the Arweave’s price could climb to $24.57 in the short term. If buying pressure increases, this might be higher. However, if bears have the upper hand, the price could decrease to $18.96.

Grass (GRASS)

In October, BeInCrypto named GRASS one of the top DePIN altcoins to watch in November. Interestingly, the recently launched project did not disappoint, climbing by 300% within the last 30 days.

Currently, GRASS’ price is $3.48 and has been hitting lower highs (LH) on the 4-hour chart. Due to this price movement, the altcoin’s value could likely hit a new all-time high in December, surpassing $3.90 in the process.

If that happens, then it might not be out of place to see GRASS at $5. On the flip side, if the altcoin loses this bullish momentum, this prediction might not come to pass. Instead, it could decrease to $2.81.

io.net (IO)

Another DePIN altcoin to watch in December is io.net, which prides itself on being the world’s largest decentralized AI computing network. Within the last 30 days, IO’s price has increased by 65.13% while trading at $2.93.

On the daily chart, IO’s price has risen above the 20-day Exponential Moving Average (EMA). This position means that the trend around the altcoin is bullish, and the price might continue to climb.

If the token continues to hold this position, its value could rise above $4 in December. On the other hand, if interest in IO drops, the prediction might be invalidated, and the token could decline below $2.

NetMind Token (NMT)

The top DePIN altcoins to watch will be incomplete without mentioning NetMind Token, which is a token built on the BNB Chain. Today, NMT’s price is $3.76, while its trading volume has increased by 350% in the last 24 hours.

This surge in volume indicates rising interest in the token. NMOR’s value has increased by 76.10% since yesterday. Between September 25 and November 5, NetMind Token’s price dropped from $3.89 to $1.29.

But since then, bulls have been pushing the value higher. In December, the altcoin’s price is likely to go higher. If that is the case, the cryptocurrency could climb above $5.

But if profit-taking rises, this might not happen. Instead, NMT’s price could drop to $2.72.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Are Buying These Altcoins Post Tariffs Pause

Crypto whales are making bold moves following Donald Trump’s 90-day tariff pause, with Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) drawing significant accumulation.

ETH whales pushed holdings to their highest level since September 2023, while OM holders are quietly increasing exposure amid the growing real-world asset narrative. XCN, meanwhile, saw a sharp spike in whale activity alongside a 50% price surge in just 24 hours.

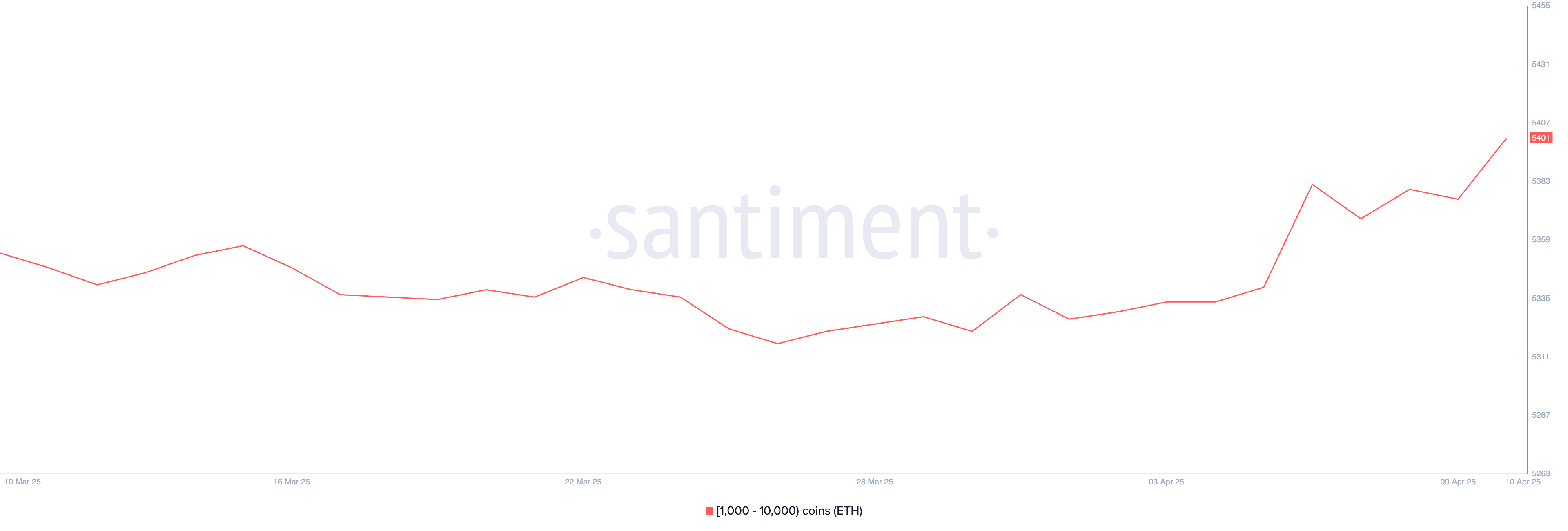

Ethereum (ETH)

The broader crypto market rallied after Donald Trump announced a 90-day pause on tariffs—excluding China—boosting investor sentiment across risk assets.

Ethereum followed suit, with on-chain data showing a rise in crypto whales activity; the number of addresses holding between 1,000 and 10,000 ETH climbed from 5,376 to 5,417 between April 9 and 10, reaching its highest level since September 2023.

If Ethereum can maintain this renewed momentum, it may test key resistance levels at $1,749 and potentially rally further toward $1,954 and $2,104. However, macroeconomic uncertainty still looms.

A sentiment reversal could see Ethereum price retesting the $1,412 support zone. If that level fails, a deeper decline toward $1,200—or even $1,000—is possible.

Some analysts have gone as far as comparing Ethereum’s decline to Nokia’s historical collapse, warning of long-term structural weakness.

Mantra (OM)

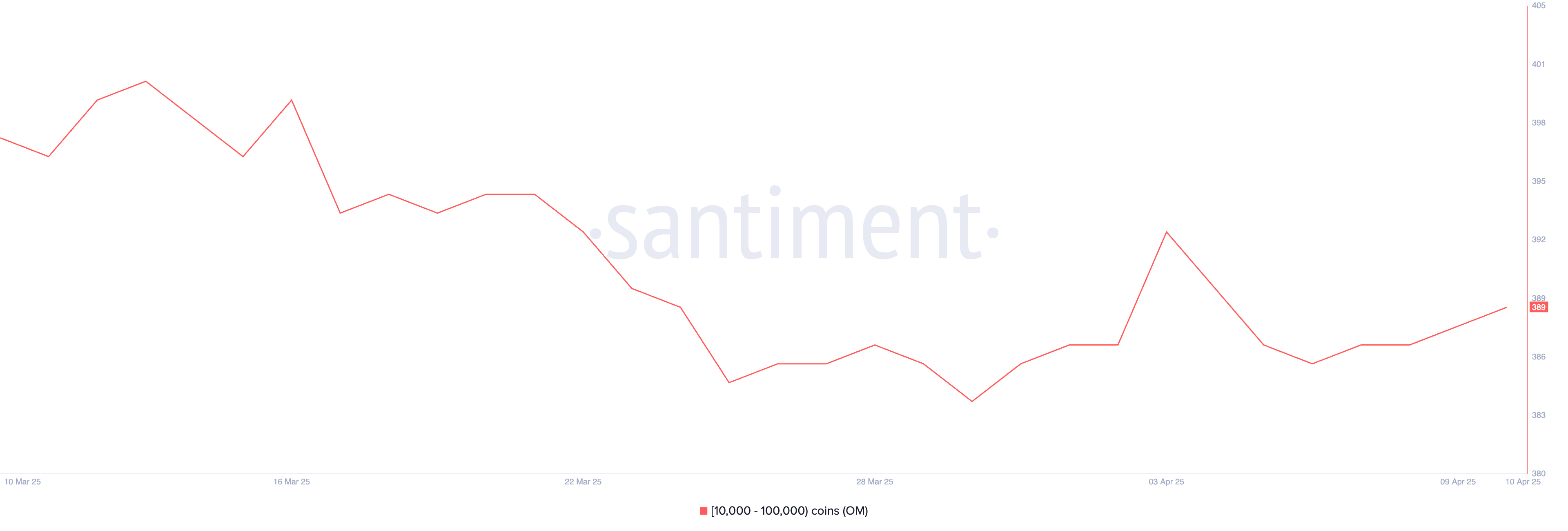

Real-world assets (RWAs) on the blockchain have hit a new all-time high, surpassing $20 billion in total value, reinforcing their growing importance as a crypto narrative and sector.

Binance Research also highlighted that RWA tokens have shown more resilience than Bitcoin during tariff-related volatility, further boosting confidence in the sector.

With the RWA narrative gaining traction, OM could see significant upside. Between April 6 and April 10, the number of OM whale addresses holding between 10,000 and 100,000 tokens rose from 386 to 389, signaling quiet accumulation.

If OM breaks past the resistance levels at $6.51 and $6.85, it could climb above $7. However, if the momentum fades, a correction could push the token down to $6.11, with further downside risk toward $5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has surged over 50% in the past 24 hours, breaking above the $0.02 mark as whale accumulation intensifies.

Between April 7 and April 10, the number of addresses holding between 1 million and 10 million XCN rose from 503 to 532, signaling renewed interest from large holders.

If this strong bullish momentum continues, XCN could rally toward resistance levels at $0.026, $0.033, and even $0.040. However, given the rapid price increase in a short timeframe, a correction may follow.

In that case, XCN could retest support at $0.020, with potential downside extending to $0.014 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

Market

This is Why The Federal Reserve Might Not Cutting Interest Rates

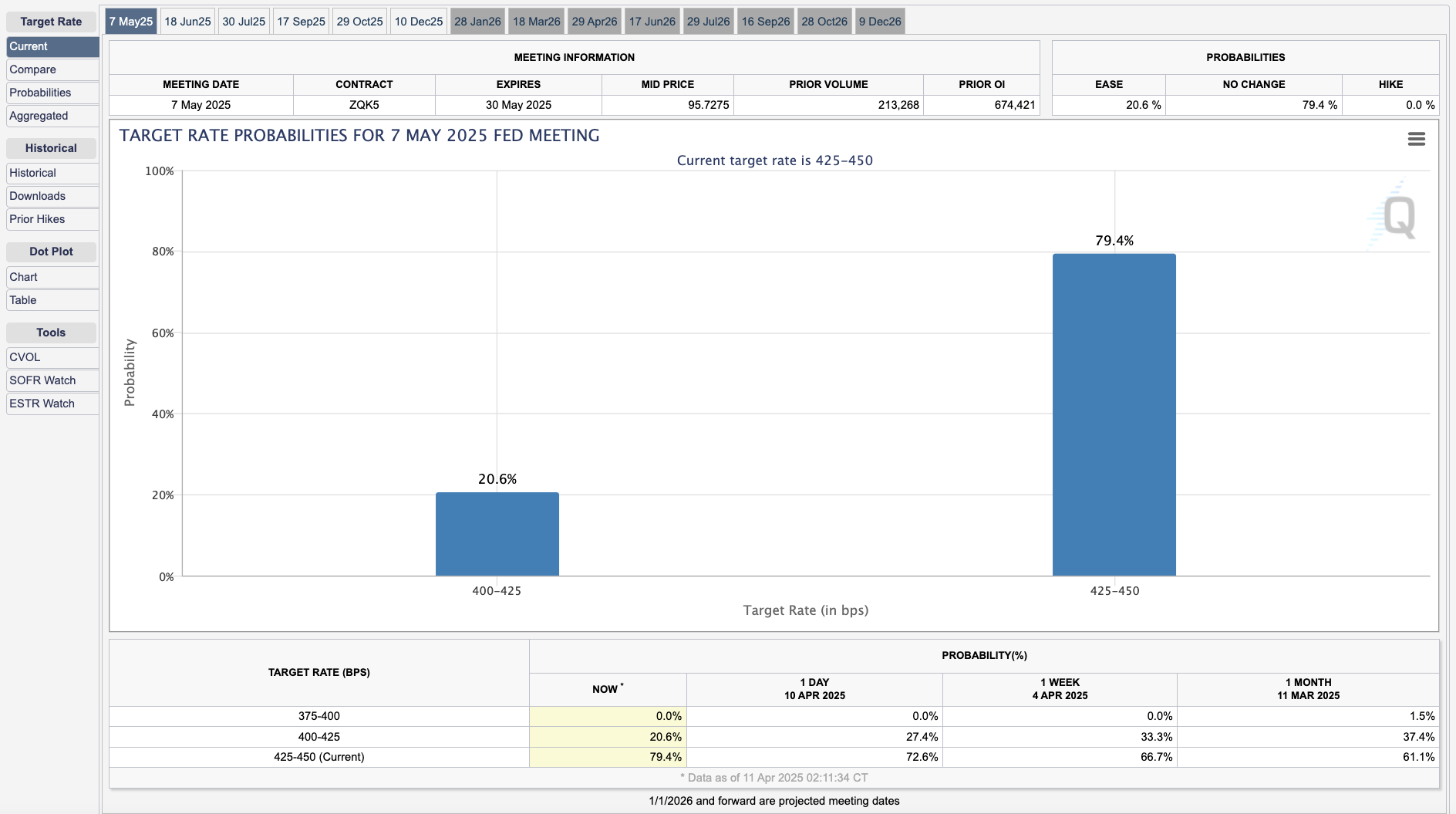

Several crypto-related social media accounts are circulating rumors that the Federal Reserve will cut interest rates soon. These center around an out-of-context quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis.

Susan Collins, President of another regional Fed bank, reiterated the low likelihood of any rate cuts. Currently, the CME Group estimates a 20.6% chance of them happening in the next month.

Federal Reserve Rate Cut Rumors Go Wild

As Trump’s tariffs have caused a huge amount of market instability, the crypto space has been desperate for a bullish narrative. A recurring hope has been that the Federal Reserve would cut interest rates, which seems highly unlikely.

Today, in a CNBC interview, a quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, fueled new rumors:

“There are tools there to provide more liquidity to the markets on an automatic basis that market participants can access, in addition to the swap lines you talked about for global financial institutions. Those tools are absolutely there,” Kashkari claimed.

Soon after this interview, several prominent crypto accounts began circulating pieces of this quote out of context. They implied that the Federal Reserve was on the brink of lowering interest rates to stave off potential economic turmoil.

Some of these erroneous claims managed to accumulate thousands of views and reposts on the idea that the Fed will “print money.”

However, in the full interview, Kashkari clearly stated what he meant by “tools.” He emphasized that the Fed is not concerned with global trade and that its “dual mandate” is to focus on inflation and employment within the US.

In other words, the tariff situation does not change the Federal Reserve’s low probability of cutting interest rates.

After these rumors began circulating, another higher-up discussed the Federal Reserve’s tools regarding interest rates.

In a subsequent interview with the Financial Times, Susan Collins, President of the Federal Reserve Bank of Boston, stated the Fed’s policy in very direct language:

“We have had to deploy quite quickly, various tools [to address the situation.] We would absolutely be prepared to do that as needed. The core interest rate tool we use for monetary policy is certainly not the only tool in the toolkit, and probably not the best way to address challenges of liquidity or market functioning,” Collins claimed.

Both Collins and Kashkari have roughly equivalent positions, heading one of the 12 Federal Reserve Banks distributed throughout the country. Both tried to clearly communicate that the Federal Reserve is not considering cutting interest rates at this time.

Despite this, social media rumors can quickly get out of hand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market18 hours ago

Market18 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market19 hours ago

Market19 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market17 hours ago

Market17 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Altcoin17 hours ago

Altcoin17 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market23 hours ago

Market23 hours agoHow SEC Chair Paul Atkins Will Reset US Crypto Policy

-

Market14 hours ago

Market14 hours agoHow Vitalik Buterin Plans to Enhance Ethereum’s Privacy

-

Altcoin14 hours ago

Altcoin14 hours agoWhy Pi Network Price Should Hit $10, Or Its Over for Pi Coin