Market

What to Expect From Bitcoin (BTC) in September

The Bitcoin (BTC) price was moderately disappointing in August, following the drop at the beginning and end of the month.

The broader outlook for the king crypto asset is still bearish, but certain macro-financial developments could alter this outcome.

Up Next for Bitcoin

Bitcoin’s price is hovering under $60,000 at the moment after noting a 7.5% decline over the last week. The coming month could continue this streak until “Uptober” arrives when the investors expect BTC’s recovery to resume.

“September is a historically negative month for Bitcoin, as data shows it has an average value depletion rate of 6.56%. Thus far this month, the investor sentiment around Bitcoin has been negative as the coin has traded between $49,000 and $66,000,” Innokenty Isers, Founder and CEO at Paybis, told BeInCrypto.

However, Isers also factored in the potential for a rate cut, which the macro-financial market highly anticipates.

“Should the Feds cut the interest rate in September, it might help Bitcoin re-write its negative history. This is because rate cuts generally lead to excessive US Dollar flow in the economy. This reduces the Dollar’s purchasing power, further strengthening the outlook of Bitcoin as a store of value. Many institutional investors are already proving this point with massive Bitcoin accumulations. If the Fed’s policies weaken the dollar, switching to risk assets with higher growth potential might be inevitable,” Isers explained.

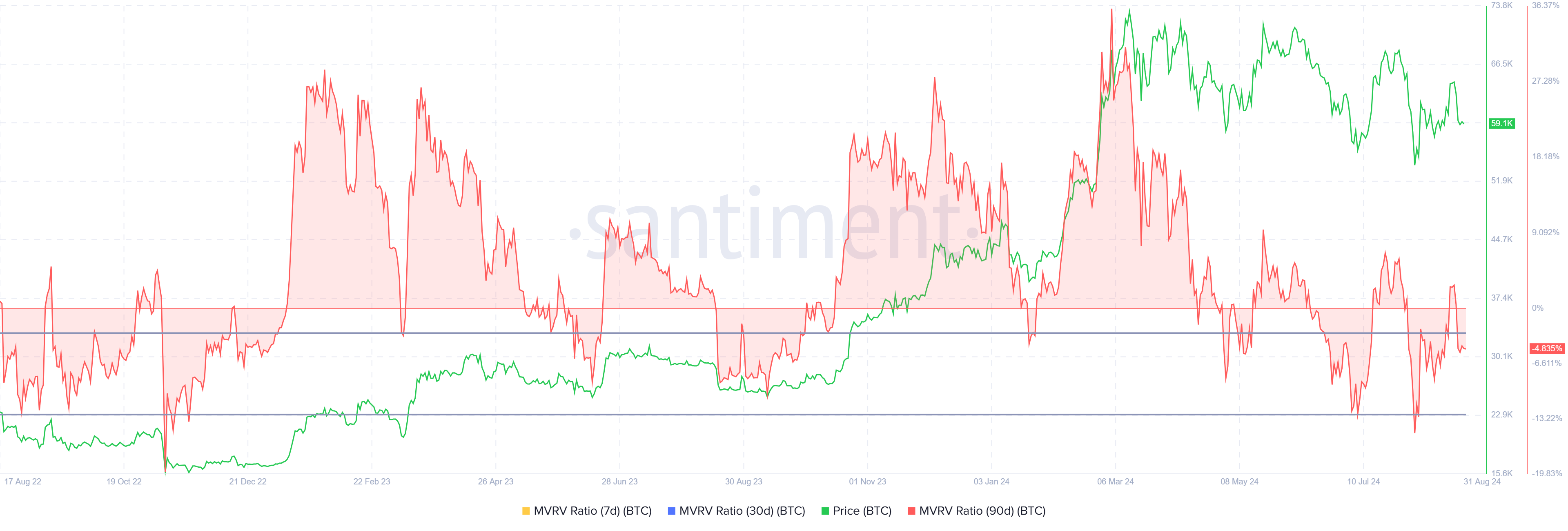

This outcome falls in line with the macro Market Value to Realized Value (MVRV) Ratio’s position. The MVRV ratio assesses investor profit and loss. Currently, Bitcoin’s 90-day MVRV stands at -4.8%, indicating profitability and possible buying pressure.

Historically, Bitcoin MVRV between -2% and -12% have signaled the start of recoveries and rallies. These instances were noted in mid-June 2023, early October 2023, and more recently at the beginning of July this year.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Since investors tend to capitalize on the low prices, they move to add BTC to their wallets during such instances, marking -2% to -12% as an accumulation opportunity zone. If history repeats itself, BTC would be on track to note an uptick and prepare for a significant increase towards the end of the month.

BTC Price Prediction: Rise Ahead but Not a Breakout

There are two outcomes for Bitcoin’s price in September. The first is a more practical approach based on recent cues, which suggest BTC will remain under $68,300. This barrier has kept the crypto king from breaking out multiple times and considering the bearish conditions, this could happen again.

The second outcome is a breakout from the descending broadening wedge above $68,300. In effect since early March, this pattern suggests a break out could result in a 22% rise. While this is not likely, BTC could establish a new all-time high above $73,800.

Read more: Bitcoin Halving History: Everything You Need To Know

For the same, the aforementioned factors of accumulation and interest rate cut must occur, and only a rise above $70,000 would confirm this bullish outcome.

However, if Bitcoin’s price fails to breach even $65,000, consolidation under this barrier and above $57,040 is likely. This could invalidate the bullish thesis, delaying BTC’s rally to early or mid-October.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How SEC Chair Paul Atkins Will Reset US Crypto Policy

On April 9, 2025, the US Senate confirmed Paul Atkins as the new Chair of the SEC with a majority 52–44 vote. This marked a new chapter for the crypto industry in the US.

The crypto community welcomed the news enthusiastically. Atkins is widely seen as someone who will bring transparency and support innovation—unlike the heavy-handed approach of his predecessor, Gary Gensler.

Paul Atkins Will Bring Clarity and New Direction to the US Crypto Industry

In Wednesday’s episode of the Crypto in America podcast, Republican Congressman Tom Emmer—House Majority Whip and Co-Chair of the Congressional Crypto Caucus—shared his optimistic expectations for Atkins’ role in reshaping crypto policy.

Emmer expressed strong confidence that Paul Atkins will steer the SEC back to its core mission: ensuring that all Americans have access to the world’s greatest financial markets, including digital assets.

“I think Paul Atkins will bring the clarity and certainty that we need. I’ve been saying for over nine years, we need to understand what is currency, what is security, and what is a commodity. I’m sick and tired of hearing about the case law and that, oh well, you know, the attorneys, the courts—why are we doing that? We’re Congress. Why don’t we act? And I think it’ll start with the new SEC Chair, but he will give us direction much like Trump is doing with executive orders.” Emmer said.

This statement reflects the long-standing demand from the crypto industry for a clear legal framework.

Paul Atkins is well-acquainted with the SEC and the financial sector. He served as an SEC Commissioner from 2002 to 2008 under President George W. Bush. During that time, Atkins gained recognition for his pro-free market stance and efforts to reduce regulatory burdens.

After his tenure at the SEC, Atkins founded Patomak Global Partners, a consulting firm that helps crypto companies navigate complex regulatory frameworks.

Notably, since 2017, he has served as Co-Chair of the Token Alliance, an initiative of the Digital Chamber of Commerce, where he has led efforts to develop best practices for the issuance and trading of digital assets.

Atkins’ career demonstrates a deep understanding of the intersection between technology and finance. Emmer expects him to adopt a “light-touch” approach—one that focuses on supporting innovation rather than stifling it.

“I think he’s gonna make sure that that’s the SEC that we believe it should be. Gary Gensler took it off mission. What it’s supposed to do is make sure that every single American has access to the greatest financial markets on the face of the planet. And what Gary Gensler was doing was saying, well, if you’re traditional finance, you can have access. But if you’re this new digital stuff, this is bad. We’re gonna make sure that we stop you from doing anything.” Emmer said.

Emmer added that this shift in leadership could pave the way for critical legislation like the FIT 21 Act, which passed the House in May 2024 to provide clear rules for digital assets.

With support from Atkins and the Trump administration—who had pledged to make America the “crypto capital of the world”—Emmer believes Congress can soon codify these reforms into law, creating a lasting impact on the market.

Criticism of Gary Gensler: A Legacy of Obstruction

In contrast to his optimism about Atkins, Emmer did not hesitate to criticize Gary Gensler, saying that he had set “a pretty low bar” for the SEC.

“We need to have clarity and certainty in the system so investors, entrepreneurs, can, you know, take risk and innovate. And what was Gary Gensler doing? He was stopping all of that. He was telling people, my door is open. Bring any idea you got, we’re happy to talk to you about it. Well, if you were naive enough to do that, he usually sued you, or he sent you a letter that you’re under investigation afterward.” Emmer criticized.

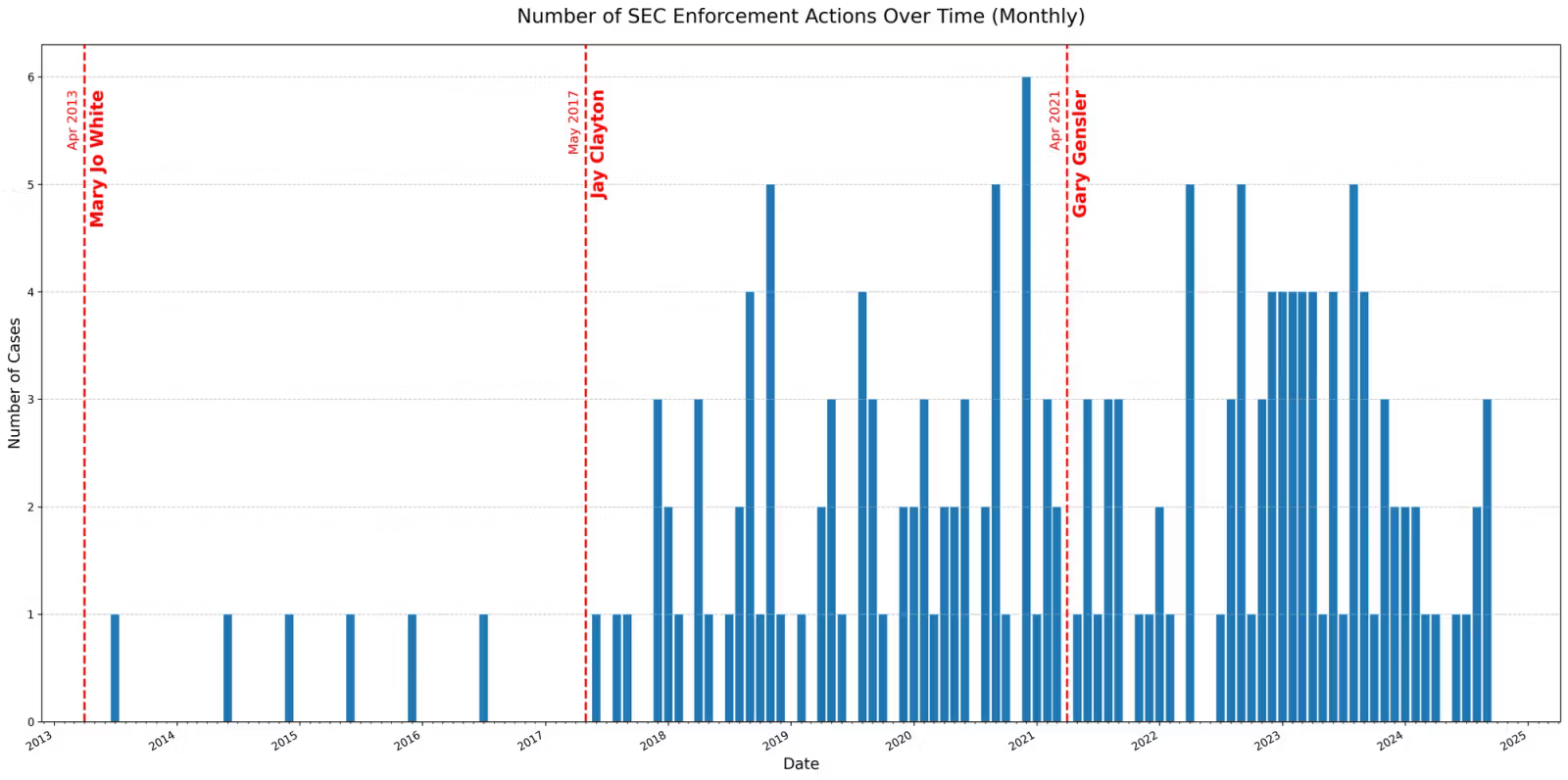

According to a report by Paradigm, since the SEC’s first crypto-related enforcement in 2015, the agency has taken action against 171 projects and individuals.

These actions spanned three presidential terms and three confirmed SEC chairs. Nearly half of them—88 cases—occurred under Gensler’s leadership.

Emmer also pointed out a striking contradiction in Gensler’s approach to meme coins, often criticized as vehicles for fraud.

“I heard a lot of complaints about meme coins yesterday during the hearing… But you realize Gary Gensler is the one that said, this is what we could use meme coins for. He’s the one that actually empowered the creation of meme coins the way we see it right now… If you don’t like it, stop complaining about it, and let’s figure out how we can put some guardrails on that.” Emmer revealed.

His remarks emphasized Gensler’s failure to provide guidance—instead choosing to criticize and punish. With Atkins, Emmer hopes to reverse that trend. He envisions an SEC that doesn’t just enforce but enables the crypto industry to grow within the United States.

A New Era for Crypto Policy

According to Tom Emmer, Paul Atkins’ appointment is more than a change in leadership. It’s an opportunity to reset crypto policy in America. Atkins could be the catalyst for Congress to turn reforms into reality—and, more importantly, to keep crypto businesses in the US rather than driving them overseas.

With a clear and supportive approach, Atkins could transform the SEC into an agency that champions the digital financial future rather than blocking it.

If successful, the crypto industry may be entering a new era of unprecedented growth under his leadership.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Controversy Follows Babylon’s BABY Token Launch and Airdrop

Babylon launched its BABY token today after a brief delay from Binance. The toke quickly surged 40% to hit $0.15. driven by the listing hype, but airdrop sell-offs and profit-taking saw BABY crash shortly after.

Over the past week, Babylon’s airdrop has been subjected to much controversy. At the time of reporting, the token’s market cap stands just below $185 million.

BABY Airdrop and Token Launch

Token staking is a popular way to gain passive income in the space, and it’s growing noticeably. Last year, Babylon began offering Bitcoin staking and added on-chain yields soon after.

Today, Babylon launched its new BABY token, which began trading on Binance.

“Binance is excited to announce that Babylon (BABY) will be added to Binance Simple Earn, ‘Buy Crypto,’ Binance Convert, Binance Margin, and Binance Futures,” the exchange claimed in its announcement.

Binance, the world’s largest crypto exchange, was a natural candidate for Babylon’s BABY launch. It dominates the vast majority of crypto airdrops, and it offers very popular listings. The firm had to delay the official launch for a few hours, but it went off smoothly.

BABY was also listed by several other exchanges, including MEXC, which conducted an exclusive BTC Fixed Saving Event offering an Annual Percentage Rate (APR) of up to 99% in anticipation of the BABY token listing.

Babylon is a decentralized protocol that enables native, self-custodial Bitcoin staking. It allows holders to stake directly on the Bitcoin network to enhance security without relinquishing control of their assets.

Last week, the project airdropped 600 million tokens ahead of the token launch. The initial airdrop represented 6% of the total supply of BABY tokens, which were distributed to early adopters in several categories.

These include Phase 1 stakers, Pioneer Pass NFT holders, and contributing developers.

However, shortly after this airdrop, over $21 million worth of Bitcoin was unstaked from the Babylon protocol within 24 hours.

Increasing Concerns About Tokenomics

Also, its tokenomics indicate that nearly 66% of the total supply is controlled by insiders or the foundation. The substantial allocation raises concerns about potential centralization and the influence insiders may have on the project’s future.

Yet, there are community members refuting these concerns and backing the project. While insider allocation is high, access to that allocation is gated and structured to avoid market abuse.

Compared to recent examples where insiders had early staking rights and sold off rewards, such as EigenLayer, Babylon has deliberately built protections into its tokenomics to maintain fairness and avoid token dumping dynamics.

VCs, team, and advisors have no token unlocks in Year 1. This prevents early investors from front-running the market and dumping tokens during the protocol’s most fragile growth phase.

Most importantly, locked insider tokens are not allowed to be staked, which is rare.

Overall, the long-term performance of the token will reflect how sustainable this tokenomics is. Babylon’s approach to Bitcoin staking has gained significant attention, but the airdrop and subsequent unstaking activities highlight the dynamic nature of user engagement in response to incentive programs

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple And The SEC File Joint Motion for Final Settlement

The SEC and Ripple filed a joint motion today, asking a US Appeals Court to halt any appeals and cross-appeals between the two parties. This is a prelude to a formal settlement, which both parties are inclined towards.

The filing notes that any further procedural developments may take up to 60 days despite expectations that the outcome is largely predetermined. In the meantime, the XRP market appears to have priced in the likelihood of a resolution.

Ripple and The SEC Move To Settle

The SEC vs Ripple case has been one of crypto’s most important legal battles over the last few years. After months of hints and credible rumors, the Commission finally dropped its lawsuit last month.

Today, both parties are getting close to a final agreement, filing a joint motion regarding one of the case’s remaining loose ends:

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” claimed James Filan, a lawyer and Ripple supporter who is in no way directly affiliated with the firm’s legal efforts.

Specifically, the loose end between Ripple and the SEC regards Ripple’s cross-appeal, which was filed last October. With this new joint motion, the two parties have “reached an agreement-in-principle” to resolve all outstanding business.

This includes the SEC’s initial appeal, the aforementioned cross-appeal, and any other claims involving individual actors.

Technically, both parties publicly announced that they were ready to settle over two weeks ago. It’s unclear why Ripple and the SEC took so long to file this joint motion.

The price of XRP has persistently been less impacted by lawsuit updates since the comission first dropped its case, and this development seems fully priced in.

The joint motion also mentions that further progress may take another 60 days. When they completely finalize a settlement, it could likely have landmark implications for US crypto policy.

However, based on the way that the SEC is improving relations with Ripple, Coinbase, Kraken, etc., a favorable outcome seems extremely likely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market24 hours ago

Market24 hours agoTop 3 Exchange Tokens to Keep An Eye For April 2025

-

Market22 hours ago

Market22 hours agoTHORWallet CEO Explains Why DeFi is Here to Stay

-

Altcoin21 hours ago

Altcoin21 hours agoMost Altcoins Now In ‘Opportunity’ Zone, Santiment Reveals

-

Market19 hours ago

Market19 hours agoIs Trump’s Tariff Delay Masking a Crypto Dead Cat Bounce?

-

Altcoin16 hours ago

Altcoin16 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

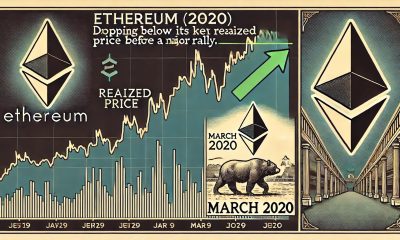

Ethereum22 hours ago

Ethereum22 hours agoEthereum Drops Below Key Realized Price: Last Time Was March 2020 Before A Rally

-

Market21 hours ago

Market21 hours agoExperts Reveal What Could Drive Ethereum’s Price Recovery