Market

US Parents are Increasingly Choosing Bitcoin for College Savings

According to reports, more parents in the US are abandoning traditional 529 college savings plans in favor of Bitcoin.

This shift stems from Bitcoin’s historical price appreciation, which has outpaced conventional investment options like stocks.

Parents Identify Bitcoin’s Appeal as a Long-Term Investment

Many of these parents view Bitcoin as a hedge against inflation and economic uncertainty, seeing its long-term growth potential as an advantage. Despite concerns about its volatility, these investors remain confident in Bitcoin’s ability to preserve value over time.

Still, some parents view Bitcoin as a diversification strategy rather than a complete replacement for traditional savings plans. Many believe their children will have ample time to ride out Bitcoin market fluctuations before they need to access the funds for their College tuition.

“If you’re saving for your kids, add Bitcoin to the portfolio. Buying $10-$100 of Bitcoin per month over 18 years will set your kids up for an excellent life. It will massively outperform the rest of the portfolio,” wrote Rajat Soni, a popular financier on X (formerly Twitter).

Bitcoin’s recent price action has reinforced investor confidence. The cryptocurrency reached a new all-time high of nearly $110,000 this year, marking a staggering 500% surge from its 2022 low of under $20,000.

Supporters argue that Bitcoin still holds significant growth potential, which has fueled its adoption across retail and institutional investors alike.

However, choosing Bitcoin over 529 plans comes with trade-offs. While Bitcoin offers the potential for significant gains, parents who opt for cryptocurrency investments forego the tax advantages of 529 plans, which provide benefits like tax-free withdrawals for educational expenses.

Growing Institutional and Political Support for BTC

Meanwhile, Bitcoin’s rising adoption extends past individual investors. Over the past year, institutional interest has surged, with more than 70 publicly traded companies now holding over 600,000 BTC. This accumulation signals confidence in Bitcoin’s long-term value and role as a viable store of wealth.

Beyond institutional adoption, Bitcoin’s rising popularity has also been fueled by political shifts. US President Donald Trump’s transition from a crypto skeptic to a pro-Bitcoin advocate has further legitimized the asset.

His plan for a Bitcoin stockpile has intensified global interest, with nations such as the Czech Republic and Hong Kong also exploring Bitcoin reserves.

Market experts believe these moves are unsurprising because of the top asset’s core attributes. According to them, BTC’s decentralized nature, fixed supply, and global accessibility position it as a strong alternative to traditional investment options.

Travis Kling, founder and chief investment officer of Ikigai Asset Management, has highlighted Bitcoin’s role as protection against central bank mismanagement.

“Eventually you come to Bitcoin and you can squint a little bit and actually put together a cogent argument that Bitcoin would be a better collateral foundation than Treasuries,” Kling wrote.

He explained that Bitcoin is built to absorb a large portion of global money supply growth. This feature makes it a strong alternative to fiat-based investments.

While Bitcoin remains volatile, Kling predicted that it would become more stable and widely accepted over the next decade. By 2035, he projected Bitcoin’s market capitalization could reach $15 trillion, with an annual trading volume of $200 trillion.

If realized, this could position Bitcoin as superior collateral compared to traditional investment vehicles like US Treasury bonds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Has Bitcoin (BTC) Price Topped For This Cycle?

Bitcoin (BTC) is at a critical point in its current cycle, with signs that it may be diverging from past halving patterns. Unlike previous cycles, where strong rallies followed halvings, this one has been more uncertain. Bitcoin’s market movements are now largely shaped by macroeconomic shifts and new institutional influences.

Political factors, such as Trump’s pro-crypto stance and state-level Bitcoin adoption, have also added unexpected variables. With these new dynamics in play, the question remains: has Bitcoin already topped the cycle? Or is there still room for another rally beyond $100,000?

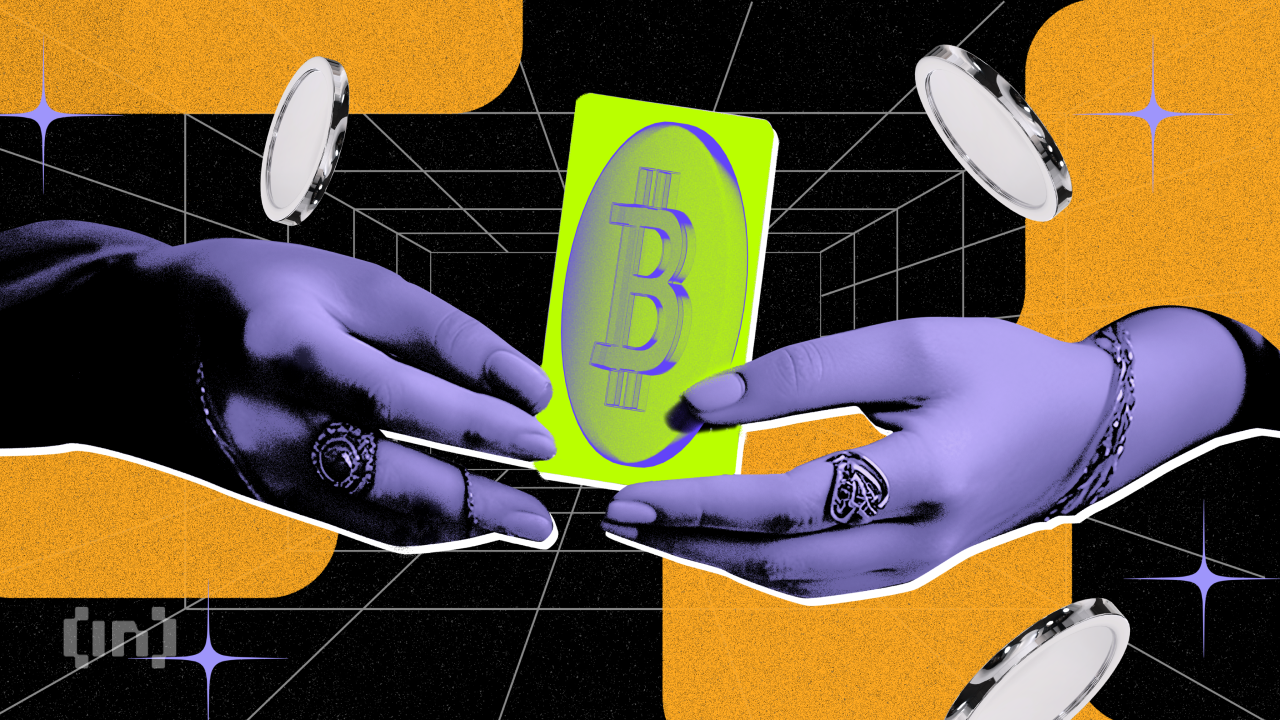

Has BTC Detached From Other Cycles?

The current Bitcoin cycle appears to be diverging from previous ones. It’s showing a different price trajectory compared to past halvings.

Historically, Bitcoin experienced strong rallies at this point in the cycle, particularly in the 2012-2016 and 2016-2020 phases.

However, this cycle saw a surge beginning in October 2024 and December 2024, followed by consolidation in January 2025 and a correction by late February.

This contrasts with prior cycles, where Bitcoin continued rallying aggressively post-halving. The deviation suggests that macroeconomic factors, market structure changes, and the growing presence of institutional investors may be altering Bitcoin’s traditional cycle dynamics.

Unlike the retail-driven speculative booms of past halvings, Bitcoin is now treated as a more mature asset class, which influences its price movement.

Another key factor is the diminishing strength of Bitcoin’s surges as cycles progress. The exponential rallies seen in 2012-2016 and 2016-2020 far exceeded those of the 2020-2024 cycle and the current one.

While this is expected due to Bitcoin’s increasing market capitalization, it also reflects the growing influence of institutional investors, banks, and even governments. In the long term, it’s likely to introduce more stability and structured market behavior.

Despite these shifts, previous cycles also had periods of consolidation and correction before resuming their uptrend. If Bitcoin follows that precedent, this phase could be a temporary reset before another upward move.

However, given the structural changes in the market, this cycle could unfold differently, with less extreme volatility but a more prolonged and sustainable price appreciation rather than the explosive parabolic tops of the past.

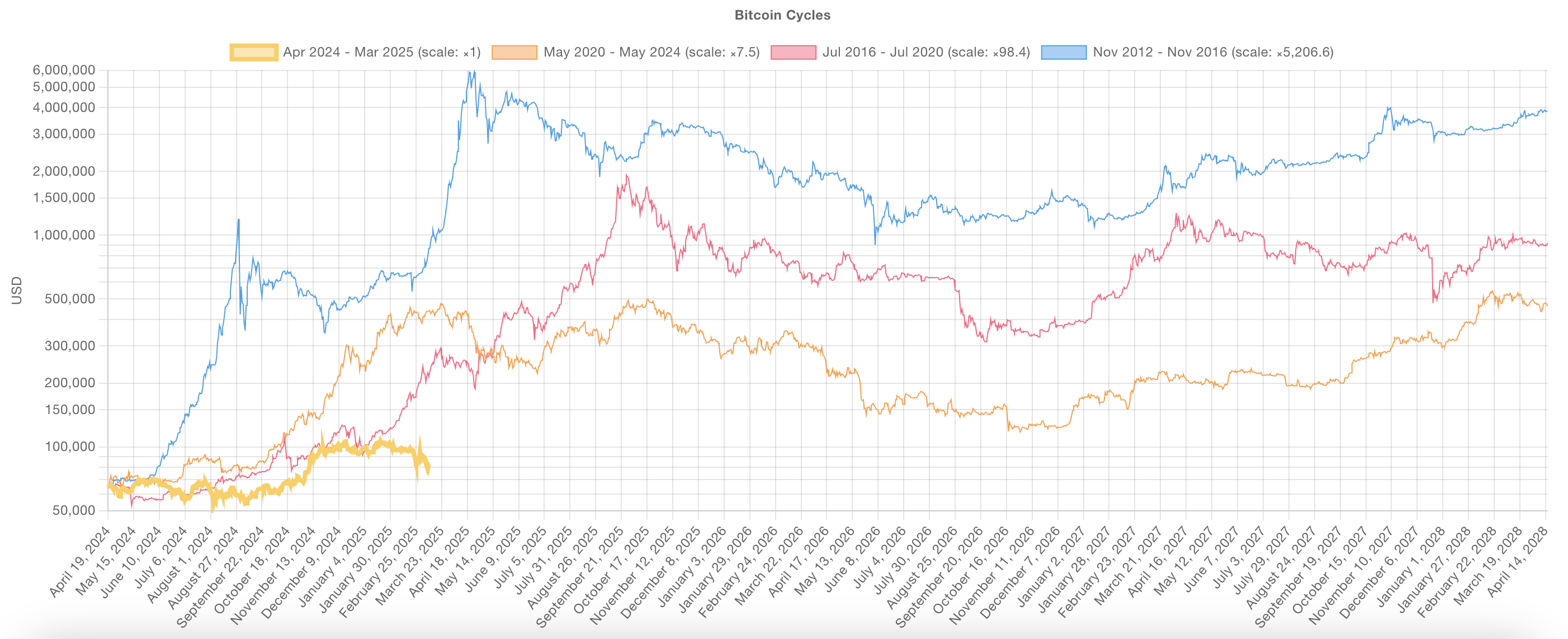

Long-Term Holder MVRV Signals a Shift in Cycle Dynamics

Bitcoin’s Long-Term Holder (LTH) MVRV ratio clearly demonstrates a pattern of diminishing returns across cycles. In the 2016-2020 cycle, LTH MVRV peaked at 35.8, reflecting an extreme level of unrealized profit among long-term holders before distribution began.

By the 2020-2024 cycle, this peak had dropped significantly to 12.2. It showed a lower overall multiple of unrealized profits despite Bitcoin reaching new all-time highs.

In the current cycle, LTH MVRV has so far only peaked at 4.35, indicating that long-term holders have not seen nearly the same level of liquid profits as in past cycles.

This sharp decline across cycles suggests that Bitcoin’s upside potential is compressing over time, which aligns with the broader trend of diminishing returns as the asset matures and market structure changes.

This data implies that Bitcoin’s cyclical growth phases are becoming less explosive. This is likely due to the increasing influence of institutional investors and a more efficient market.

As the market cap expands, significantly more capital inflows are required to drive the same percentage gains seen in early cycles.

While this could suggest that Bitcoin’s long-term growth is stabilizing, it does not necessarily confirm that the cycle has already peaked.

Previous cycles have had periods of consolidation before reaching final highs. Also, institutional participation could lead to more prolonged accumulation phases rather than sudden blow-off tops.

However, if diminishing MVRV peaks continue, it could mean Bitcoin’s ability to deliver extreme cycle-based returns is fading, and this cycle may already be past its most aggressive growth phase.

Bitcoin’s Long-Term Outlook

Despite the differences in this cycle, experts remain optimistic about Bitcoin’s long-term prospects, particularly with increasing adoption at the state level.

Harrison Seletsky, director of business development at SPACE ID, told BeInCrypto:

“Expectations were running high ahead of Friday’s White House Crypto Summit, but the aftermath was somewhat anticlimactic. The market didn’t react with as much excitement since the US is currently holding their confiscated BTC instead of actively buying more. However, there’s a lot more to be excited about than the market is pricing in. It’s encouraging to see that not only has President Trump signed an executive order for a crypto reserve – whatever it may look like in practice – but we’re also seeing this conversation moving ahead at the state level. The day before the Summit also saw Texas pass Senate Bill 21, which allows it to establish a state-controlled crypto reserve, consisting of Bitcoin and other digital assets. A year ago, none of us could have dreamed of this. Texas’s move could open the floodgates for other states to follow suit, as well as state and local level municipalities internationally.”

Nic Puckrin, founder of The Coin Bureau, told BeInCrypto that Bitcoin’s short-term trajectory remains tied to macroeconomic conditions. He points to the fact that investors in the current cycle had unrealistic expectations from the Bitcoin crypto reserve.

Notably, there was a growing perception that the US government would buy billions worth of new BTC, causing a supply shock. From any economic or political concept, that would not have been possible.

It’s hard to imagine Congress approving such a purchase with taxpayers’ money to invest in risk assets. This unrealistic expectation was a catalyst behind the current price corrections.

“The current crypto sell-off reveals a mismatch between expectations and reality. The reserve will now only constitute crypto that the US government already has in its ownership and it won’t be buying new BTC on the market. It’s also important to point out that neither crypto nor stock prices are at the top of Trump’s agenda. In fact, he even dismissed stock price crashes as being the work of globalists. Meanwhile, the improving regulatory landscape and promise of integration with traditional finance rails will cement crypto’s important role in the US financial landscape. It’s worth celebrating this progress, instead of complaining about the gloomy short-term backdrop,” said Puckrin.

Based on all that, this cycle appears to be different from previous ones. So, despite recent corrections, BTC may not have topped yet.

New factors like institutional adoption, Trump’s crypto stance, and geopolitical tensions make historical comparisons less reliable. Unlike past cycles, Bitcoin price action isn’t following a clear post-halving rally.

At the same time, uncertainty is higher than ever. Macro conditions, the trade war, and changing US policies are adding complexity. With Bitcoin now part of the global financial system, its price is reacting to more than just halving cycles. The path forward is unclear, but the cycle isn’t necessarily over.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Lists Aethir, Prompting 8% ATH Price Spike

Coinbase is listing Aethir, the DePIN “GPU-as-a-service” network, prompting an 8% price spike in its ATH token. The DePIN industry is performing generally well, but broader market conditions look bearish.

Coinbase passed up the chance to list ATH in June 2024, and the token has peaked and crashed two times since. Aethir’s price has been stagnant for over a month, and it may be difficult to build strong momentum in this environment.

Coinbase Lists Aethir During Stagnation Period

Aethir, the DePIN “GPU-as-a-service” network, has been relatively quiet recently. It has conducted a couple of major partnerships in the last few months but hasn’t made too many headlines otherwise.

Today, however, Coinbase announced that it’s listing Aethir’s ATH token, causing a burst of new enthusiasm.

“Coinbase will add support for Aethir (ATH) on the Ethereum (ERC-20 token) network. Trading will begin on or after 9AM PT on 13 March, 2025 if liquidity conditions are met. Once sufficient supply of this asset is established trading on our ATH-USD trading pair will launch in phases,” the exchange claimed via social media.

Coinbase, one of the world’s leading crypto exchanges, is a little behind the curve on listing Aethir. Last June, 16 centralized exchanges listed the ATH token, but Coinbase and Binance didn’t go for it.

DePIN revenues grew over 100x in 2024, however, and the industry has continued making advancements in 2025. Market conditions may be more favorable now.

Thanks to the “Coinbase Effect,” token projects typically see massive jumps after they get listed on the exchange. Aethir has also benefitted from this, jumping over 8% after Coinbase made the announcement.

ATH’s price has stagnated for a little over a month, and a bit of bullish momentum could help it grow again.

Still, Coinbase won’t solve all of Aethir’s problems. After the exchange refused to list it in 2024, it spiked the following month before leading to a crash.

It rebuilt this momentum to reach a new all-time high in December, but bearish market conditions have taken their toll. Aethir will need a lot of fresh interest to rebound a third time, but it’s an achievable goal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Price Surge Incoming? Buyers Gain Momentum

Hedera (HBAR) has dropped nearly 20% in the past seven days, but in the last 24 hours, it has rebounded by almost 5%, signaling a potential trend shift. While the broader trend remains bearish, key indicators suggest that buying pressure is increasing, and a reversal could be forming.

If HBAR breaks resistance at $0.219, it could climb toward $0.258 and even $0.287, but failure to sustain upward momentum could see it retesting $0.179 or lower.

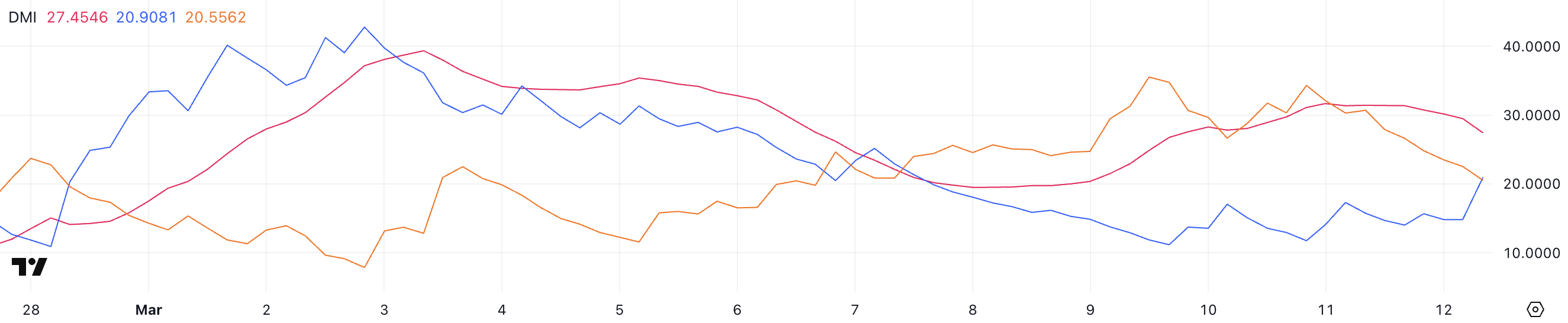

HBAR DMI Shows Buyers Are Taking Control

The Average Directional Index (ADX) for HBAR is currently at 27.4, down from 31.4 yesterday, indicating that the downtrend strength is weakening.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 typically signaling a strong trend, while anything below 20 suggests a weak or non-trending market.

Despite the decline, ADX remains above the key 25 threshold, meaning HBAR downtrend is still intact but losing momentum.

Meanwhile, the +DI (Directional Indicator) has risen to 20.9 from 11.7, while the -DI has dropped from 30.3 to 20.5. This shift suggests that selling pressure is fading while buying pressure is increasing.

However, with ADX declining and both directional indicators still close to each other, Hedera has not confirmed a trend reversal yet.

The price remains in a downtrend, but if +DI continues rising above -DI, it could signal the beginning of a shift toward bullish momentum.

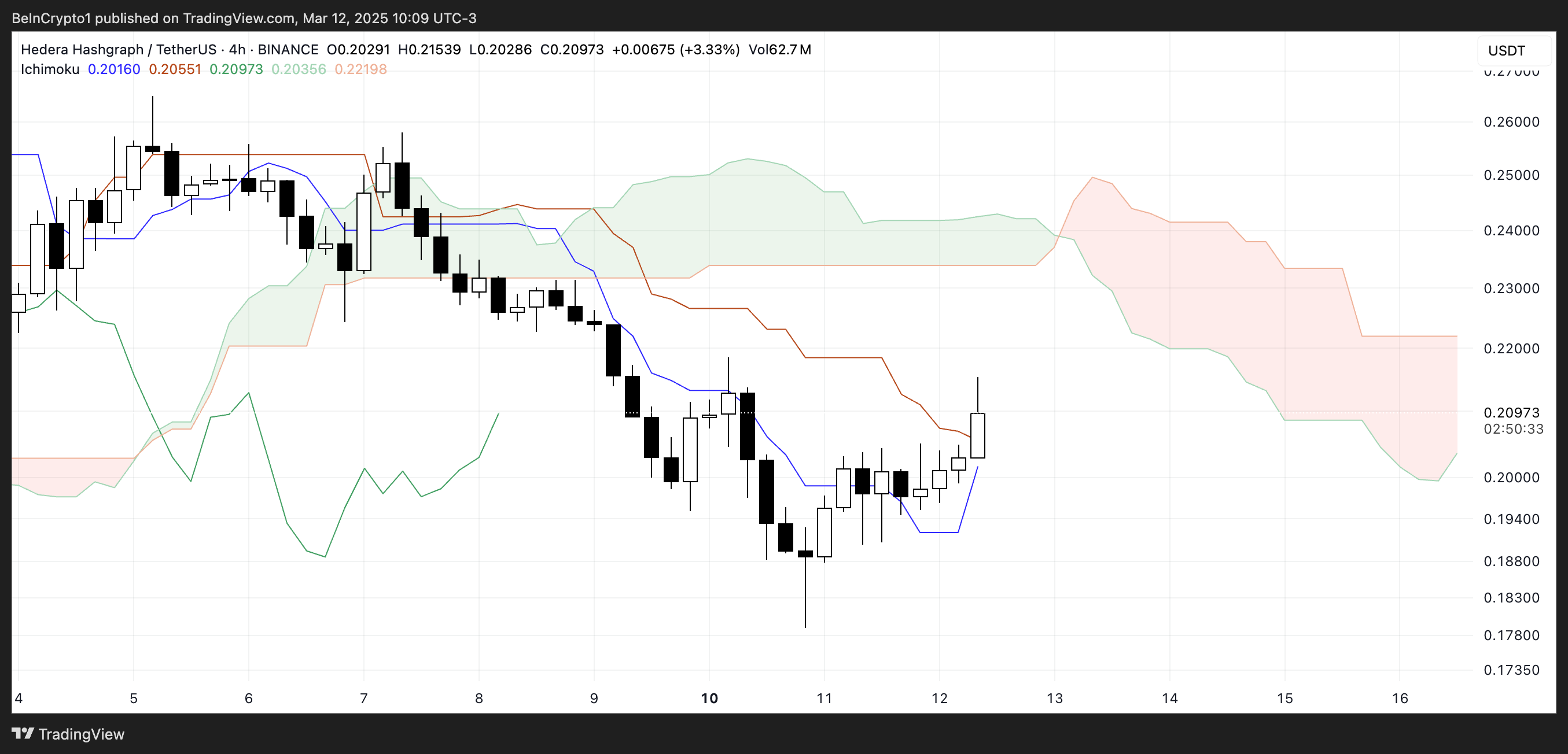

Hedera Ichimoku Cloud Suggests The Trend Could Shift Soon

The Ichimoku Cloud chart shows that Hedera price has recently moved above the blue Tenkan-Sen (conversion line), a short-term trend indicator.

This suggests that momentum is shifting, but the price remains below the Kijun-Sen (baseline) and inside the cloud’s resistance zone.

The cloud itself is red ahead, signaling that bearish pressure still dominates. Until the price clears this resistance, the trend remains uncertain.

While the recent price action indicates a potential short-term reversal, the Kumo (cloud) remains bearish, suggesting that the overall trend is still downward.

HBAR would need to break above the cloud to confirm a trend shift more strongly. If the price faces rejection here, it could indicate continued weakness, leading to another downward move.

The battle between buyers and sellers at this level will determine whether HBAR can sustain this rebound or resume its broader downtrend.

Will Hedera Get Close To $0.30 Soon?

Hedera’s EMA lines indicate that the trend is still bearish, as short-term EMAs remain below long-term ones. However, the short-term EMAs are starting to turn upward, suggesting that a trend reversal could be forming.

If HBAR breaks the key resistance at $0.219, it could trigger a rally toward $0.258 and even $0.287, representing a potential 40% upside.

On the downside, if the trend fails to reverse, HBAR could continue its decline and test the $0.179 support level.

A break below that would open the door for a drop below $0.17, marking its lowest price since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Market20 hours ago

Market20 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Ethereum18 hours ago

Ethereum18 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Bitcoin18 hours ago

Bitcoin18 hours agoCrypto Market Recovers After Liquidations: Here’s Why

-

Market24 hours ago

Market24 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Market23 hours ago

Market23 hours agoEthereum (ETH) Might Test $1,700

-

Altcoin22 hours ago

Altcoin22 hours agoWill Ethereum Price Crash Below $1,500 Before Market Rebound

-

Market16 hours ago

Market16 hours agoPi Coin Centralization Raises Serious Questions About the Future