Market

Understanding the Dominance of Tether’s USDT

Stablecoins have become an essential part of the blockchain space, offering stability in a highly volatile market. Although there are dozens of stablecoins with different collateral available to investors today, Tether’s USDT remains the to-go choice for most crypto users.

In this article, we explore the importance of stablecoins, focusing on USDT and its unconditional dominance.

The Need for Stability

Stablecoins are digital assets designed to maintain a stable value by being pegged to a reserve asset, such as the US dollar, euro, or even commodities like gold. They achieve this stability through various mechanisms, including fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins, the most common type, back each token issued with reserves of the corresponding fiat currency, ensuring support by a real-world asset.

While many crypto investors enjoy a bit of volatility, the level seen in most crypto assets can make it difficult to use them for payments or trading. Stablecoins address this issue by offering a stable and reliable alternative, facilitating their use in a wide range of applications, including base trading pairs, remittances, and decentralized finance (DeFi).

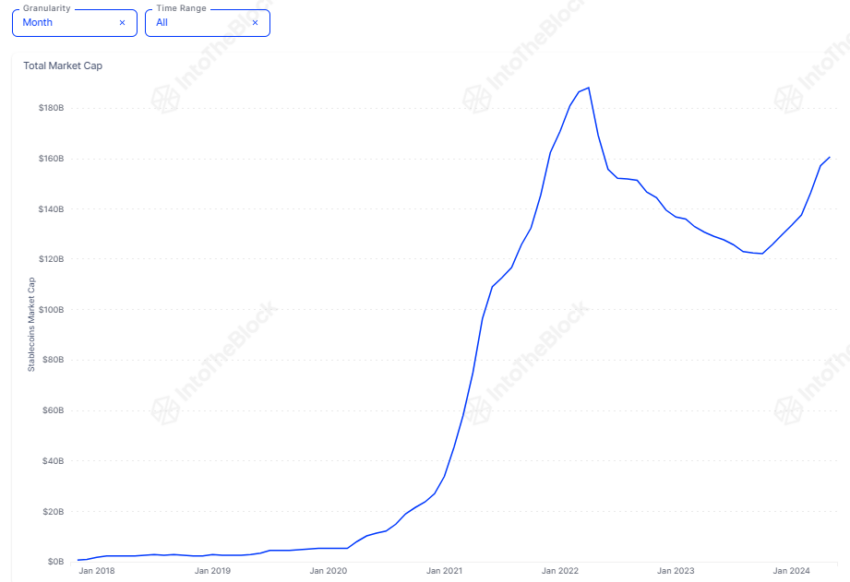

This has resulted in substantial growth for stablecoins, now boasting a combined market capitalization of $161 billion. The chart below highlights this significant increase, which began in 2020.

Read more: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

“While some of this growth is due to the rising interest in cryptocurrencies, it is primarily driven by the growing importance of DeFi and the crucial role stablecoins play in DeFi primitives like lending protocols and automated market makers (AMMs),” Vincent Maliepaard, Marketing Director at IntoTheBlock, told BeInCrypto.

USDT: The Undisputed Market Leader

Despite strong competition, Tether (USDT) has established itself as the most important stablecoin in the cryptocurrency market. Launched in 2014, USDT is pegged to the US dollar, with each token purportedly backed by an equivalent amount of fiat currency held in reserve.

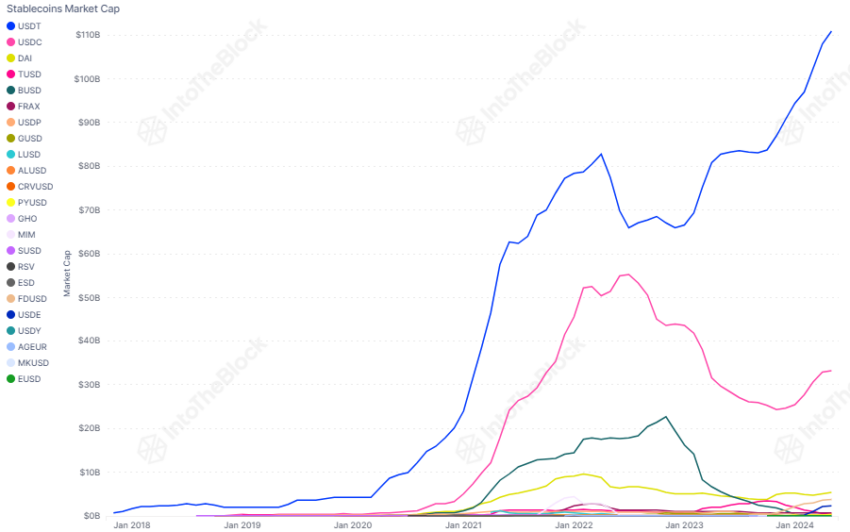

Data from IntoTheBlock shows that USDT, with a market cap of $111 billion, accounts for just over 70% of the total stablecoin market capitalization. In contrast, the second largest stablecoin, USDC, accounts for just 21%.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

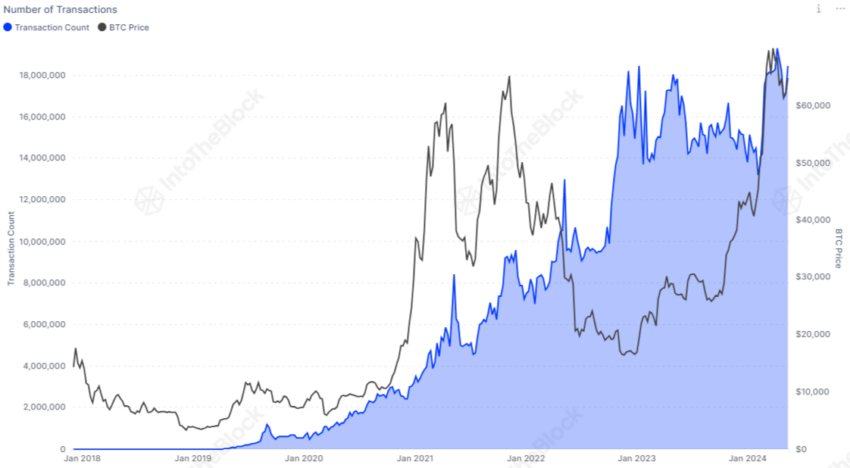

Furthermore, there is no sign that this growth is slowing down soon. The number of USDT transactions has significantly increased since the start of the year and is approaching new highs.

Maliepaard notes USDT’s dominance is attributed to several factors:

- Liquidity and Accessibility: USDT boasts the highest trading volume among stablecoins and is available on most centralized and decentralized exchanges as a base trading pair.

- Integration with DeFi: Many DeFi protocols and platforms use USDT for transactions, lending, and borrowing, enabling participation without exposure to price volatility.

- Cross-Border Transactions: USDT facilitates fast and cost-effective cross-border transactions, offering an efficient alternative to traditional banking systems.

- Stable Store of Value: In regions experiencing hyperinflation or economic instability, USDT offers a reliable store of value.

Comparing Usage of USDT Across Different Chains

While USDT activity is booming across all chains, not all are created equal. Data suggests that users utilize stablecoins differently across various networks. By examining their behavior on different chains, we can see how USDT is utilized in diverse ways. Whether it’s for trading, transferring value, or acting as a stable store of value, USDT’s versatility is evident.

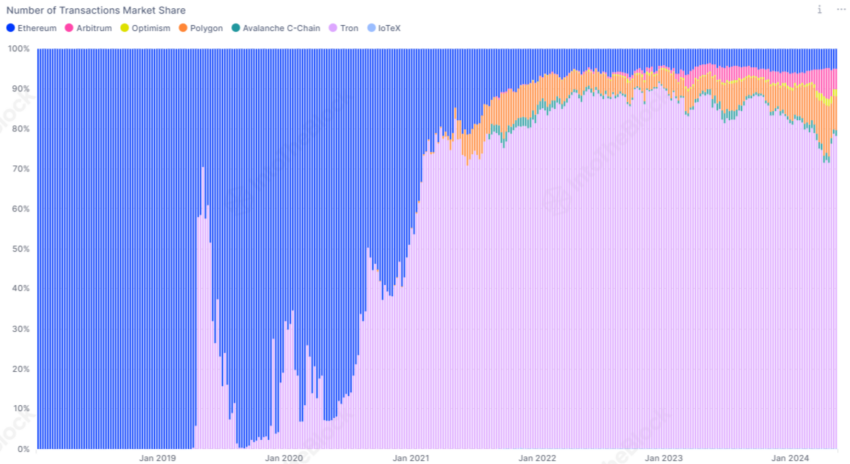

TRON Dominates USDT Transactions

TRON leads in transaction volume with a dominant 78% share. The chart below highlights its superiority compared to other blockchain networks.

This prominence is primarily due to TRON’s low transaction costs and high availability for deposits and withdrawals on major centralized exchanges, making it the preferred option for cross-border Tether’s USDT transactions. Surprisingly, the runner-up isn’t Ethereum but Polygon, which has over 8% of the total USDT transactions.

Transaction Volume Comparison

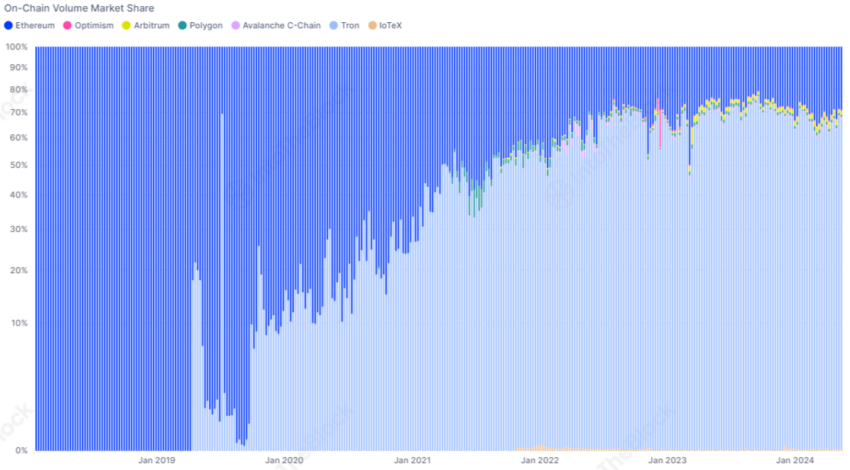

Examining the stablecoin’s volume market share reveals that Ethereum’s transaction volume far exceeds its number of transactions, highlighting its role in facilitating higher-value transfers. In contrast, chains like Polygon, Optimism, and Avalanche have a higher number of transactions but contribute less to the overall volume, indicating their use for smaller, more frequent transactions.

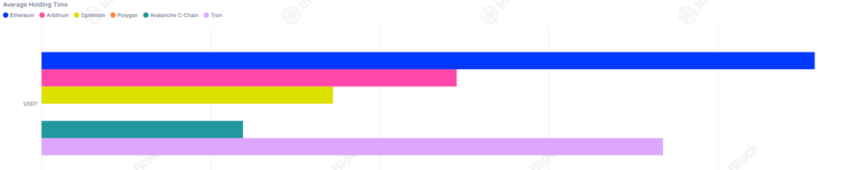

Holding vs. Transacting

The average holding time of USDT on each chain further supports this finding. Data shows that Ethereum users typically keep USDT for 228 days, nearly three times longer than holders on Optimism. TRON addresses also maintain USDT for an extended period, averaging 183 days.

These insights indicate that on Ethereum and TRON, USDT is primarily held to mitigate market volatility, serving as a stable store of value. Conversely, on chains like Optimism and Arbitrum, USDT is frequently used for transactions, likely in DeFi-related applications where quick access to liquidity and transfer speed are crucial.

The Future of USDT

Stablecoins, particularly USDT, play a vital role in the blockchain industry by providing stability and enhancing the utility of digital assets. The recent growth of USDT across various blockchain networks solidifies its position in the cryptocurrency market. As the industry widens, the importance of stablecoins will likely grow, driven by their role in DeFi, trading, and bridging the gap between traditional finance and blockchain.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CoinGecko Refreshes Brand During Crypto Black Monday Chaos

CoinGecko unveiled a refreshed brand identity and two new mascots, marking the 11th anniversary of the crypto data aggregator.

The changes come amid a bruising “Crypto Black Monday,” with CoinGecko’s brand revitalization presenting as a show of optimism despite sour sentiment.

CoinGecko Resets Its Brand on 11th Anniversary

CoinGecko leaned into Monday’s turbulence with the message that growth is still on the table despite sour crypto market sentiment. Marking its 11th anniversary, the crypto data aggregator introduced a new visual identity.

The change features a modernized logo, a more interactive and user-friendly design system, and a cohesive brand refresh. These changes extend to GeckoTerminal, its DEX aggregator that tracks real-time trading data from over 1,500 decentralized exchanges.

CoinGecko users will henceforth encounter Gekko and Rex as two new mascots. In a statement shared with BeInCrypto, CoinGecko said these mascots embody the duality of the crypto experience.

On the one hand, Gekko is a playful and geeky friend offering insights. On the other hand, Rex is sharp, analytical, and always on the hunt for alpha.

“This brand refresh marks a new chapter for CoinGecko, as we continue building for the decentralized future,” an excerpt in the statement read, citing TM Lee, CEO and co-founder of CoinGecko.

Lee explained that this refresh was for the crypto community, which has continuously leveraged CoinGecko’s crypto data aggregator across market cycles. The changes are intended to make CoinGecko more relatable and forward-looking, emulating the industry’s spirit of resilience and innovation.

Refresh in the Face of Crypto Black Monday

This show of optimism comes in time to boost user sentiment after a weekend bloodbath that set the pace for crypto’s black Monday narrative. Liquidations swept the crypto market over the weekend, triggering millions of losses.

The company acknowledged the market stress in a post teasing the launch just hours before the unveiling.

“We know it’s not the easiest day for crypto. Still, something new is on the way,” wrote CoinGecko on X (Twitter).

CoinGecko was founded in April 2014. It has grown from a price-tracking site into a comprehensive crypto data platform serving millions worldwide. The aggregator reportedly monitors over 17,000 cryptocurrencies and NFTs (non-fungible tokens) across over 1,200 exchanges.

Its on-chain analytics platform, GeckoTerminal, launched in 2022, has since become an expansive DEX aggregator. According to the report, GeckoTerminal tracks over 6 million tokens across more than 200 blockchain networks.

Meanwhile, CoinGecko’s brand update is more than cosmetic. It reflects the platform’s consistent effort to stay relatable to its user base.

Recently, it has been a go-to source for key market insights. Among them was a 2025 sentiment survey, which revealed mixed investor moods and highlighted a strong belief in the rise of crypto-AI.

CoinGecko has also been instrumental in reflecting changing user behavior in the industry. Recently, the platform shared a 2024 analysis showing crypto perpetuals trading volumes reaching all-time highs. Similarly, the data aggregator shared a report pointing out that publicly listed crypto companies account for just 5.8% of the market cap.

By launching a branding overhaul during one of the year’s harshest market downturns, CoinGecko sends a clear message that beyond surviving, crypto is also preparing for what is next.

As the dust settles from the weekend sell-off and key US economic indicators are in the pipeline, CoinGecko’s refreshed look suggests the next chapter is always around the corner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh decline below the $83,500 zone. BTC is consolidating losses and might start another decline below the $80,000 level.

- Bitcoin started a fresh decline below the $82,000 zone.

- The price is trading below $81,200 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $80,500 zone.

Bitcoin Price Dips Below Support

Bitcoin price failed to settle above the $83,500 level and started a fresh decline. BTC traded below the $83,000 ad $82,000 levels to enter a bearish zone.

There was a break below a connecting bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair. The pair even dived below the $80,000 support zone. A low was formed at $77,057 and the price started a recovery wave.

There was a move above the $78,800 level. The price climbed above the 23.6% Fib retracement level of the recent decline from the $83,680 swing high to the $77,057 low. However, the price is struggling to continue higher.

Bitcoin price is now trading below $81,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $80,000 level. The first key resistance is near the $80,500 level or the 50% Fib retracement level of the recent decline from the $83,680 swing high to the $77,057 low.

The next key resistance could be $81,500. A close above the $81,500 resistance might send the price further higher. In the stated case, the price could rise and test the $82,500 resistance level. Any more gains might send the price toward the $83,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $80,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $77,500 level. The first major support is near the $77,000 level.

The next support is now near the $76,500 zone. Any more losses might send the price toward the $75,000 support in the near term. The main support sits at $74,200.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $77,500, followed by $77,000.

Major Resistance Levels – $80,000 and $80,500.

Market

Will ADA Drop to $0.44?

Cardano (ADA) has faced a sharp price decline amid heightened volatility and widespread liquidations across the broader crypto market. Over the past 24 hours, ADA has shed more than 10% of its value, marking one of its steepest single-day losses in recent months.

ADA is now trading at $0.52, levels last seen in November 2024. This reinforces the growing bearish sentiment against the altcoin.

Death Cross and Heavy Outflows Weigh on ADA

ADA’s downturn in the past day has pushed its price into precarious territory, with a death cross now appearing on its daily chart. This marks the first time the pattern will appear on ADA charts since May 2024.

The death cross pattern—where the 50-day moving average falls below the 200-day moving average—is viewed as a long-term bearish signal, often preceding extended periods of price weakness.

When a death cross is formed, it indicates a definitive shift in market sentiment from bullish to bearish, leading to increased selling pressure and a possible further decline in price. This suggests ADA could face continued downward pressure in the near term if the bulls remain in the shadows.

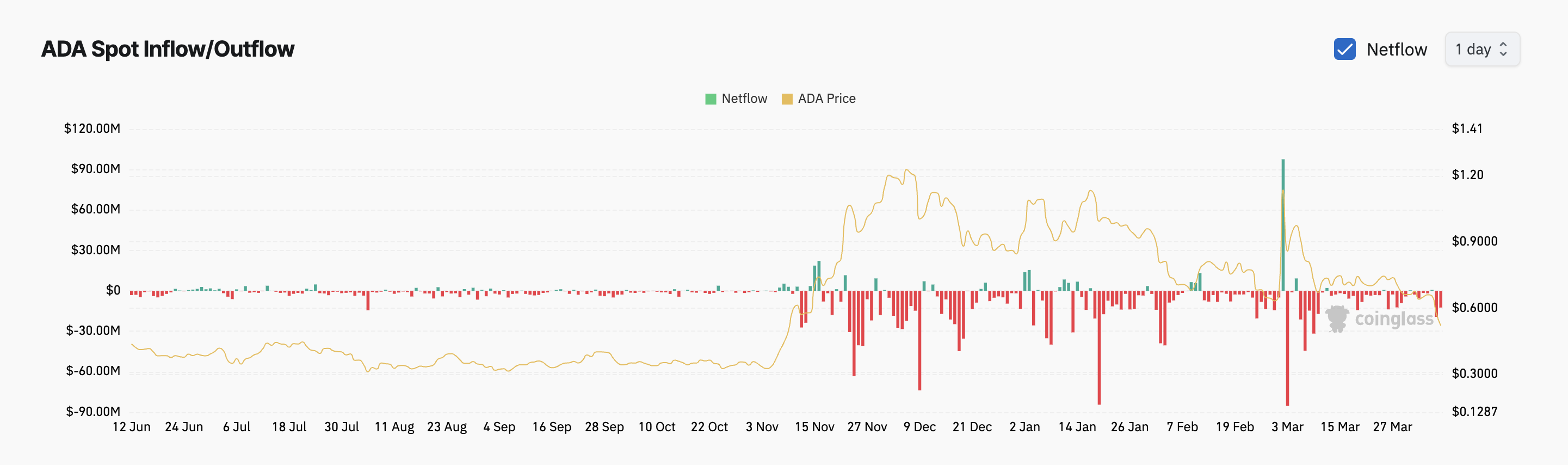

Moreover, the steady outflows from the ADA spot markets add to the downward pressure on its price. According to Coinglass, ADA spot outflows have totaled $12 million so far today.

Over the past month, capital exit from the ADA spot markets has exceeded $150 million.

Spot outflows like this indicate bearish sentiment, as they suggest that investors are pulling their capital in anticipation of further price drops or moving funds into other assets.

This persistent trend signals a loss of confidence among ADA traders as they continuously liquidate their positions. This has worsened the market’s selling pressure and contributed significantly to ADA’s price troubles.

Cardano’s Downward Trend Deepens: Death Cross Threatens More Drop

While broader market instability has impacted many altcoins, ADA’s price drop is notable due to the formation of the Death Cross. The emergence of this technical indicator, combined with a multi-month price low as buying activity falls, suggests ADA could face continued downward pressure in the near term.

In this scenario, its value could dip to $0.44, marking a 14% decline from its current value.

On the other hand, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that scenario, ADA’s price could regain its losses and attempt to break above resistance at $0.54.

If successful, it could extend its gains to $0.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Bitcoin20 hours ago

Bitcoin20 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Market20 hours ago

Market20 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market17 hours ago

Market17 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Market23 hours ago

Market23 hours agoCelestia (TIA) Price’s 30% Crash Prolonging Could Bring Recovery

-

Market22 hours ago

Market22 hours agoRipple Highlights UK’s Potential to Become Global Crypto Hub

-

Market21 hours ago

Market21 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise