Market

Trump’s Tariffs and Inflation to Fuel Market Uncertainty, JPMorgan

Global traders, including those in crypto, should brace for volatility as tariffs and inflation take center stage in shaping market trends, according to a new survey by JPMorgan Chase.

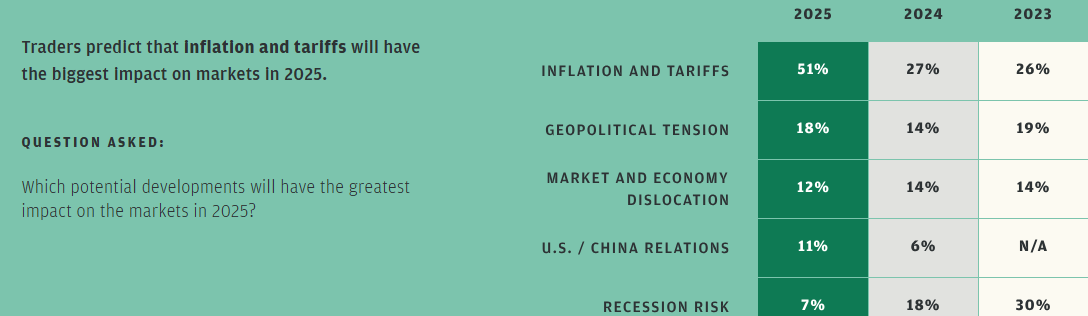

The survey’s findings indicated a significant rise in concern compared to the previous year when only 27% of respondents cited inflation as a major issue.

Tariffs To Stir Market Uncertainty, JP Morgan Survey Says

Over the past week, US President Donald Trump introduced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China, only to delay some of these measures shortly afterward.

“…We further agreed to immediately pause the anticipated tariffs for one month…,” Trump revealed in a post.

Before the pause, however, the tariffs had triggered significant market fluctuations, with stocks, currencies, and commodities all responding to policy announcements.

Against this backdrop, an annual survey featuring institutional trading clients from JPMorgan Chase revealed that 51% of traders believe inflation and tariffs will be the most influential factors in global markets for 2025.

The survey cites the back-and-forth nature of these policies, saying that it has led to sharp market movements. This engagement alludes to China’s move to announce a 10% tariff on US crude oil and agricultural machinery in response to US tariffs on all Chinese imports.

On the inflation front, traders view Trump’s tariff policies as inherently inflationary, pushing prices higher across multiple sectors. Additionally, fewer traders are worried about a potential recession. Only 7% of those surveyed cited it as a major concern compared to 18% in 2024.

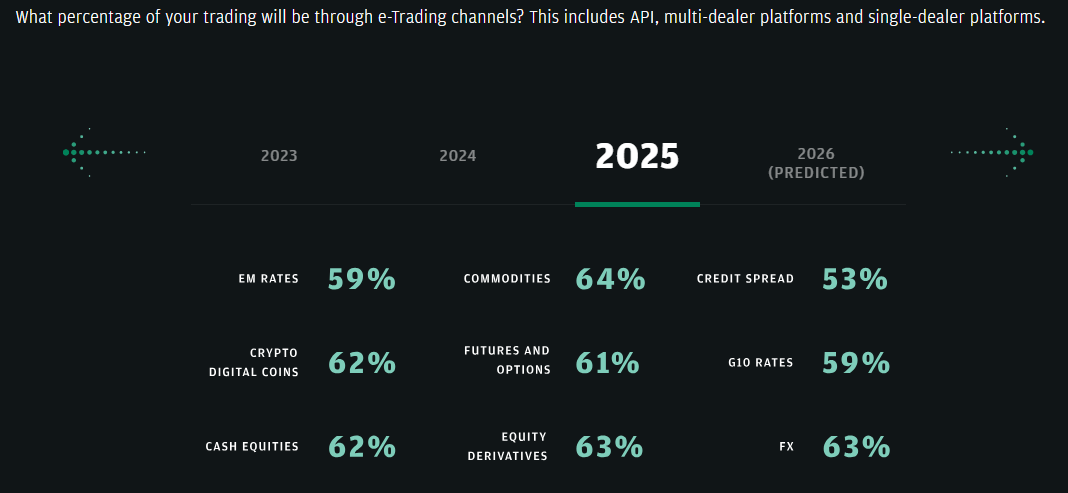

The report also highlights changing market structures. It emphasizes that electronic trading is expected to expand across all asset classes, including emerging markets like crypto.

Volatility Remains a Core Concern

JPMorgan’s survey also identified market volatility among the challenges to watch in 2025. Specifically, 41% of respondents named it their primary concern, up from 28% in 2024. Unlike in previous years when volatility was expected around key scheduled events, traders are now experiencing sudden market swings driven by unpredictable political and economic news.

“What distinguishes this year is the somewhat unexpected timing of volatility. Unlike in the past, when volatility was tied to scheduled events like elections or nonfarm payroll data, we’re seeing more sudden fluctuations in response to news headlines around the administration’s plans, leading to knee-jerk reactions in the marketplace,” Reuters reported, citing Eddie Wen, global head of digital markets at JPMorgan.

Meanwhile, the broader financial markets are not the only ones reacting to Trump’s tariff policies. Bitcoin and the crypto sector have also felt the impact of these economic shifts. When Trump delayed tariffs on Canada and Mexico, the Coinbase Bitcoin premium index surged to a new 2025 high.

Likewise, the news triggered a rebound in Bitcoin prices. Traders interpreted the delay as a sign of potential economic stability. Additionally, when the US paused tariffs on Mexico, XRP saw a significant recovery. This highlights the direct influence of trade policies on the digital asset market.

However, China’s retaliation to Trump’s tariffs introduced fresh instability, further exacerbating market fluctuations.

“[Ethereum would fall] Back to 2200-2400 if China trade war is real,” crypto analyst Andrew Kang wrote.

Elsewhere, Glassnode highlighted the unusual nature of the current Bitcoin cycle. As BeInCrypto reported, the blockchain analytics firm noted how macroeconomic factors—including tariffs—play an outsized role. Unlike previous cycles that primarily followed internal crypto industry trends, the 2025 cycle could realize significant influence from global economic policies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Early Investors Continue To Sell As Price Holds Above $2

XRP has struggled to secure growth in recent days, with the altcoin failing to maintain key support levels. Despite an attempted price rally, XRP has been unable to break through the $2.32 level, leaving the price hovering just above $2.00.

Those who bought during XRP’s three-week bull run are now facing losses after the failed breach of crucial barriers.

XRP Holders Are Facing Challenges

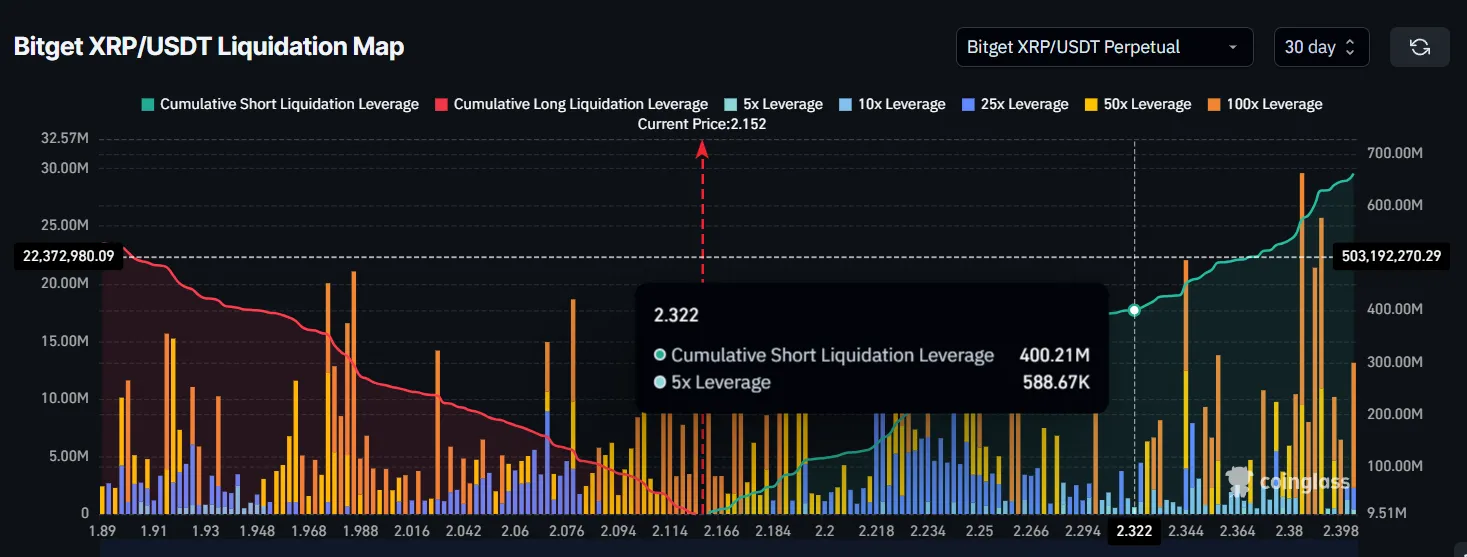

The liquidation map shows that a significant amount of short positions—around $400 million worth—are at risk of liquidation should XRP’s price rise to $2.32. However, even with XRP trading at $2.15, just 8% away from the threshold of $2.32, the potential for liquidations does not appear imminent.

The behavior of XRP’s investors suggests that these liquidations may not take place in the short term. This is because XRP holders are primarily leaning towards selling over HODLing at the moment.

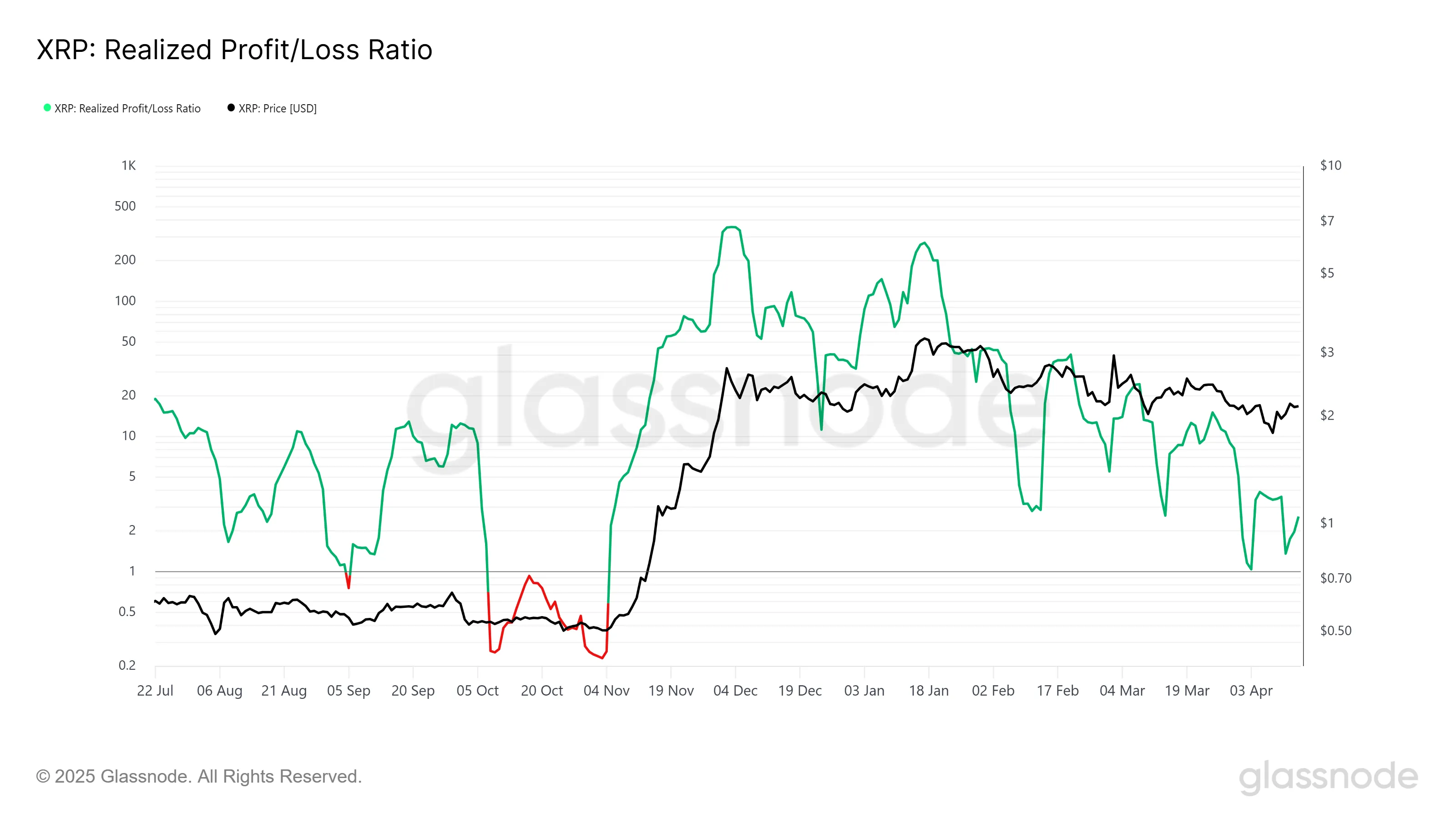

XRP’s overall momentum is showing signs of weakening, as reflected by the Realized Profit/Loss ratio. This indicator suggests that realized profits are declining and may soon turn into losses. The supply being sold likely originated from purchases made during XRP’s November 2024 bull run when the price surged to $2.

XRP formed a new high back in January; however, since then, XRP’s price has dropped back to $2, and many investors who bought at higher levels are now selling to offset losses. This ongoing selling pressure is keeping XRP from experiencing any significant uptick, further dampening bullish sentiment.

XRP Price Looks To Breakout

XRP is currently trading at $2.15, just below the $2.16 local resistance level, which it failed to secure as support earlier this month. The altcoin is consolidating beneath $2.27, a resistance level that has been a point of contention since the end of March. If the price remains above the $2.00 support, it could stabilize at these levels, preventing further losses for investors.

The chances of continued consolidation seem high, as XRP holds above $2.00. This could keep the market relatively stable as investors wait for further signals to confirm the next move. With a lack of major catalysts, the price may fluctuate within this range.

However, should XRP breach the $2.27 resistance and rise toward $2.40, the earlier-mentioned liquidations could trigger a new wave of buying, potentially driving the price upward. This would provide a more bullish outlook and shift the market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Omri Ross on How eToro Stands Out in the Crypto Exchange Arena

On the opening day of the 2025 edition of the Paris Blockchain Week, BeInCrypto had the opportunity to interview Omri Ross, Chief Blockchain Officer for eToro. He revealed that despite the current market condition, the firm’s upcoming IPO is still in the pipeline.

We discussed how the company positions itself in the crypto exchange market and how it tackles the security question for its users.

Omri Ross Sheds Light on the Positioning of eToro

eToro has been, for many years, a very innovative player in this market. All areas around are following and creating a social network for trading.

There is the idea that people would like to copy-trade each other and be happy to share information about their portfolios. I think the way, for example, that our popular investors are working together with the community is absolutely fascinating.

I remember, for example, my discussion at some of our client events; we see a lot of the investors are actually being in contact with people who follow them. There is much less distance. There is much more discussion about why they follow specific portfolios.

And eToro also helps with this element. eToro actually creates events where popular investors and customers meet each other. As a platform, we also have an educational element with the eToro Academy. We also do some podcasts together with them. I think this is really innovative and awesome.

In terms of products, you know, our CEO has always been very pro-crypto. We have had Bitcoin trading available at eToro since 2013, so it is fairly early. And for me, it’s always been a pleasure to be in a place where you want to kind of push the funds; you want to bring to, in a regulated way, as many products as possible.

You know, customer protection and personal protection, but we are also trying to see how we can expose our customers to new products and innovations. And I think that that’s pretty unique, and we’re very proud of that.

How many Cryptos are Trading on eToro Right now?

We have more than 100 at the moment, with most of the big ones. However, we still don’t have so many stablecoins, but this is because we sort of see ourselves as a financial institution. We are looking into extending it and looking for ways to sort of allow our customers to reach more elements.

We also have an experimental area where you can experiment with more assets that may not necessarily be mature enough to be without the disclaimers. A big element for us is really how to communicate. On the one hand, we offer a lot of opportunities, but we are also trying to have people explore and understand what they investigate and work closely with regulators.

Is Copy Trading the Key Element of eToro?

100%. Also, many customers come to the discussions that appear on eToro to learn and discuss crypto with other people.

We also have smart portfolios where you follow specific trends and make it easier for people to invest. For example, we have a DeFi portfolio and a MetaMask portfolio. It’s also a very simple way for people to get exposed to a bigger sort of industry, which is also very transparent.

Yeah, so I think there is a lot of innovation around that, but it’s really helping retail [investors] get information and be able to easily, even in fiat, sort of invest in all of that.

Which Asset Category Seems to Have the Most Potential for eToro to Expand?

I would touch upon two subjects in this regard. The first element is we are a multi-asset platform.

One of, I think, the biggest advantages of using eToro is your ability to get exposed to many, many different sorts of asset classes in one place. You can also have the eToro money credit card in some countries that we support. We’re also seeing that when our customers use a larger amount of our products, they really benefit from that. So I think that’s a big part of the element.

I would also mention, in that regard, that a lot of our investors are somehow maybe Gen Z. We really see the potential of people to really follow what happens in the market, where they’re really interested in what happens in the market. Social networks are a big part of that.

You can follow others that you are interested in, you can comment on yourself and engage, as well as the fact that the world is a very interesting place, and things are changing daily. And to know that you can do crypto at eToro if that’s interesting, but also they are like, if they’re interested in oil and gas prices, or any other things, you have that as well. I think this is what is really special, that you can get exposed to a lot of stuff, learn about it, and all in one place.

Is Education the main Drive of how eToro Recruits new Customers?

Not necessarily. We mostly see that part of our goal as a company is to open financial markets for everybody and invest in a simple and transparent place. And for us, education is part of that.

We want to help our customers educate themselves, and with the hope that they choose to stay with us for many, many years to come. So this is a way for us to create a lot of opportunities.

We want to build a longer-term relationship and help customers prosper. Yeah, how we recruit different people really depends. Part of it is related to marketing, brand awareness, and many other aspects.

How eToro Focuses on the Security of the Platform

First, we work with top-net security experts, including ex-secret service people. Some of them are employed by eToro to deal with that element.

Secondly, especially around crypto, I can’t expose too much information because some of it is really classified. However, we work on different layers of security within a customer infrastructure. We try to keep a lot of client assets in what we describe as a “deep vault” with very secure elements. And it’s a big part of our infrastructure. It’s a big part of our discussion.

For any project, we take the fact that customers trust us extremely seriously with the funds. And we feel extremely fortunate for it.

Luckily for us, until today, we never had any issue with that. But there are a lot of elements around it. When you ask about innovation, it’s also one of the reasons why it may take a little bit longer for us to issue new projects; it is also because we take security extremely seriously with every element. That is a major part of the design.

Does eToro Use B2B Solutions For Security?

We think there are good B2B solutions. Again, when we work with vendors, also based on our size, they usually adapt to our requirements.

We work with some vendors who are from a security background, working in secret services, and building really insane secure elements. I learned a lot working with them and with their background. I wish I could tell you more about it, but for me, as an individual and not as a potential sort of employee, I think that it’s very interesting.

Because there are also discussions about the “not your keys, not your money” element. But also, having your own money has its risks. Holding a really large amount of money in some place at home can get ruined or stolen. There are so many risks; you can also have the risk of someone putting a gun to your head.

There are many social elements. And when I see the work that is done in the program, I’m very proud and impressed by the seriousness we take about that element. I think that’s part of the value we bring in. You know, being regulated and also really taking the customers’ funds and interests seriously.

What eToro Expects to Achieve During the Paris Blockchain Week?

I’ve been here some years back. And it’s grown so much I’m shocked!

I’ve been here for less than an hour today, and I’m like: “Wow!”. And you can really see the adoption here. Also, the French regulation is getting more into that, which is absolutely amazing.

And being at the Louvre, what else can you ask for? But I would also love to talk to a lot of companies to learn about innovation. Part of my role is building new products at eToro within crypto. But it’s also about talking to a lot of founders and crypto providers and seeing what else we can collaborate on and integrate with eToro. And always learn.

I’m very passionate about this specific market and blockchain. So I’m really looking forward to it. I may also catch up with some old friends that I haven’t seen for a while.

How can one Launch Their Crypto on eToro?

You don’t necessarily have to reach out to anyone. We are obviously following the market very closely.

As I mentioned before, being regulated, we’ve taken our clients’ interests very seriously. Often, our processes may be a bit longer than those of some unregulated blockchain platforms.

First, you’d be invited to talk to me or some of our listing or trading committee members. We’re always excited to hear and learn about your new crypto.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Rise To $1 is Now In The Hands Of Bitcoin

Pi Network’s price has shown signs of recovery in recent days, reaching a two-week high after a notable uptrend.

However, despite this progress, the cryptocurrency’s growth appears heavily dependent on external factors, particularly Bitcoin’s price movements. As a result, its future direction remains closely tied to the crypto king’s performance.

Pi Network Could Keep The Uptrend Going

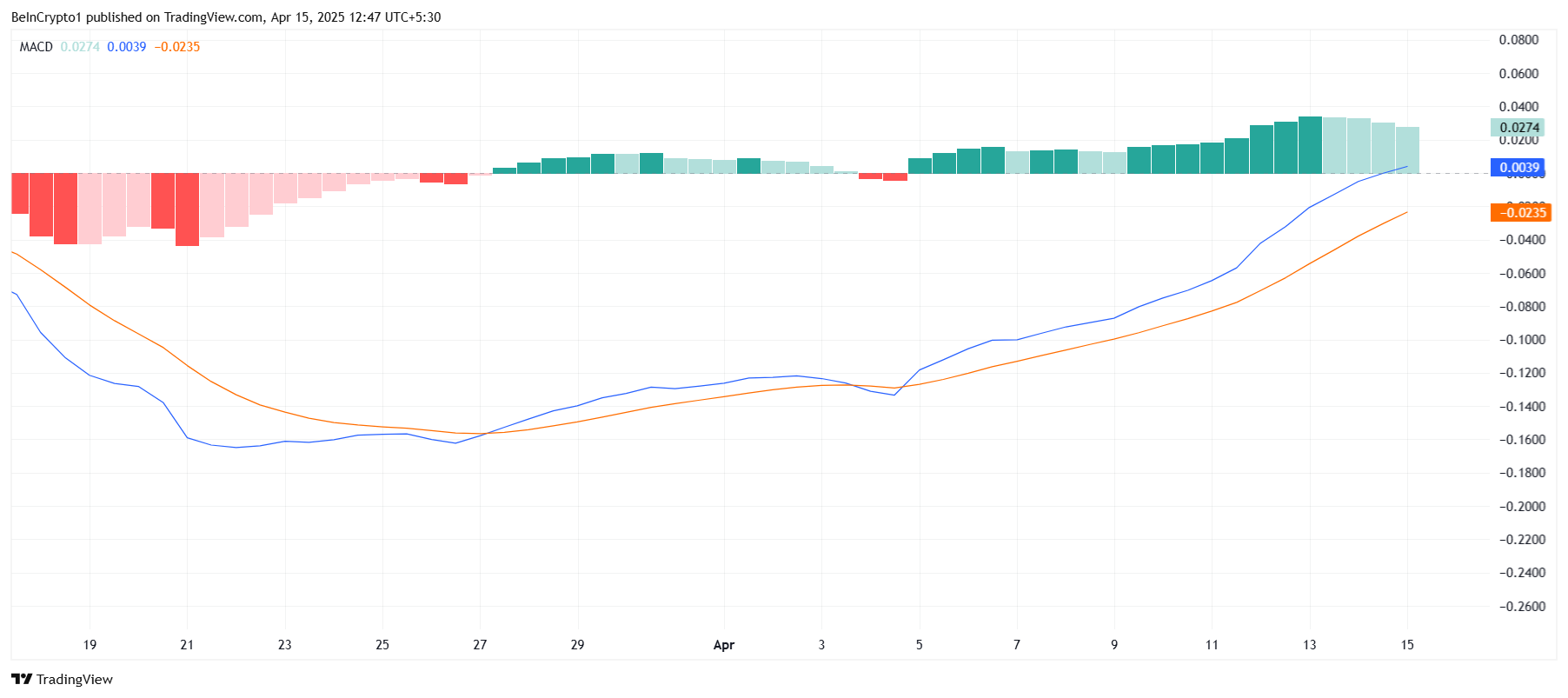

The Moving Average Convergence Divergence (MACD) indicator suggests that while Pi Network’s bullish momentum is beginning to fade, it has not yet reversed course. The indicator remains in positive territory, signaling that there is still potential for continued upward movement. The MACD is far from a bearish crossover, which could suggest that Pi still has room to rise in the short term.

Despite a slight weakening in bullish momentum, the overall outlook for Pi Network remains positive. The current trend still shows that there is enough strength for the altcoin to maintain its uptrend and push higher, particularly if market conditions support its growth.

Pi Network has shown a strong correlation with Bitcoin, standing at 0.84. This suggests that Pi closely follows the movements of Bitcoin, with its price trajectory highly influenced by the performance of the crypto market leader. As Bitcoin holds steady above $85,000, it could act as a strong catalyst for Pi’s price growth.

Given Bitcoin’s ongoing strength, Pi Network has the potential to experience a similar upward movement, especially if BTC continues to see positive price action. Pi’s dependence on Bitcoin’s market performance is evident, and any sustained rise in Bitcoin could trigger a corresponding rise in Pi Network’s value.

PI Price is Aiming At $1

Pi Network is currently trading at $0.74, up by 26% over the past five days. To maintain this positive momentum, Pi must hold above the $0.70 support level. A bounce off this level would allow the altcoin to continue its rise and potentially test the next resistance level at $0.87.

If Pi successfully breaches $0.87, it could open the door for further gains, with a potential move toward $1.00. The market sentiment and Bitcoin’s continued strength could fuel this upward momentum, bringing Pi closer to its key target. A break above this resistance would signify the start of a more substantial rally.

However, should Bitcoin experience a decline, Pi Network may follow suit. A drop through the $0.70 support level could lead Pi to test the $0.60 mark, and a further fall through this point would likely bring the price down to $0.51. This would invalidate the bullish outlook and signal a potential reversal in Pi’s price trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoMENAKI Leads Cat Themed Tokens

-

Market21 hours ago

Market21 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market20 hours ago

Market20 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market17 hours ago

Market17 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market15 hours ago

Market15 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market23 hours ago

Market23 hours agoStrategy and Metaplanet Buy Bitcoin Despite Recession Fears

-

Altcoin22 hours ago

Altcoin22 hours agoCanada Approves Multiple Spot Solana ETFs To Launch This Week