Market

Tornado Cash Sanctions Overturned; TORN Token Spikes 400%

A US federal appeals court struck down sanctions imposed by the Treasury Department on Tornado Cash. This popular crypto-mixing service enables users to anonymize their cryptocurrency transactions through smart contracts.

The ruling, delivered by the Fifth Circuit Court of Appeals, marks a significant victory for decentralized technology proponents and privacy advocates. At the same time, it reignites debates about how to regulate the use of blockchain tools in connection with criminal activities.

Treasury Department’s Sanctions Against Tornado Cash Overturned

The Treasury’s Office of Foreign Assets Control (OFAC) had sanctioned Tornado Cash in 2022. According to the agency, the platform was a key tool for illicit actors, including North Korea’s Lazarus Group, to launder stolen funds.

However, the court ruled that OFAC overstepped its authority. It emphasized that the immutable smart contracts underpinning Tornado Cash cannot be considered property under the International Emergency Economic Powers Act (IEEPA).

The appellate court’s decision hinged on the nature of Tornado Cash’s smart contracts. These are autonomous lines of code designed to function without human intervention.

These contracts, deployed on the Ethereum blockchain, are unalterable and accessible to anyone. The court found that such contracts do not meet the legal definition of “property” because they cannot be owned, controlled, or restricted.

“The immutable smart contracts at issue are not property because they are not capable of being owned,” the court wrote.

The court further noted that while sanctions might block certain individuals from using Tornado Cash, the technology’s decentralized nature ensures that no one, including North Korean hackers, can be entirely prevented from accessing it. Paul Grewal, Coinbase’s Chief Legal Officer, hailed the ruling.

“This is a historic win for crypto and all who cares about defending liberty…These smart contracts must now be removed from the sanctions list and US persons will once again be allowed to use this privacy-protecting protocol. Put another way, the government’s overreach will not stand… No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury’s authority beyond recognition, and the Fifth Circuit agreed.” Grewal wrote on X (formerly Twitter),

Grewal also emphasized the importance of distinguishing between tools and their misuse. Of note, Coinbase, a leading cryptocurrency exchange, was among the entities that sued the government over the sanctions.

Broader Implications for Crypto Regulation

The ruling exposes the challenges of applying existing legal frameworks to decentralized technologies. Crypto-mixing services like Tornado Cash occupy a legal gray area, prompting calls for scrutiny by US lawmakers.

They are neither traditional financial (TradFi) institutions nor entities capable of being controlled by a central authority. Critics of the ruling argue that it could embolden bad actors to exploit blockchain technology further.

“If you think Tornado Cash has been used by good people for worthwhile purposes then make your case…If privacy protects good people it’s good, if it protects bad people it’s bad. The vast majority of people that Tornado Cash has protected are doing bad,” one user on X quipped.

Some lawmakers have previously pressed the Treasury to adopt stricter measures against crypto mixers. In 2022, members of Congress highlighted concerns about their role in facilitating money laundering and funding terrorism. A bipartisan push aimed to ensure that tools like Tornado Cash, often associated with criminal networks, face regulatory scrutiny.

However, privacy advocates argue that targeting the tools rather than the actors undermines the principles of decentralization and privacy. Bill Hughes, a lawyer at ConsenSys, applauded the court’s nuanced understanding of the issue but highlighted a key issue. He cautioned that regulatory risks remain.

“This does NOTmean that the rest of Tornado Cash is out of bounds for Treasury/OFAC too. The issue was about smart contracts with no admin key,” Hughes wrote.

This means that the court’s decision does not shield Tornado Cash from other legal challenges, particularly those concerning its founders. As BeInCrypto reported, they face accusations of facilitating money laundering. Moreover, the broader debate over how to regulate decentralized technologies remains unresolved.

Following the ruling, however, Tornado Cash’s native token, TORN, is up almost 400% to trade for $17.63 as of this writing.

This surge reflects investor optimism about the protocol’s potential resurgence and its implications for decentralized finance (DeFi) projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Weakens—Can Bulls Prevent a Major Breakdown?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started another decline and traded below the $1,880 level. ETH is now consolidating and remains at risk of more losses.

- Ethereum struggled to continue higher above the $2,000 resistance level.

- The price is trading below $1,880 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,820 and $1,880 resistance levels to start a decent increase.

Ethereum Price Dips Again

Ethereum price failed to continue higher above $2,100 and started another decline, like Bitcoin. ETH declined below the $1,920 and $1,880 support levels.

It tested the $1,765 zone. A low was formed at $1,767 and the price recently attempted a fresh upward move. There was a move above the $1,800 level but the price is still below the 23.6% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low.

Ethereum price is now trading below $1,880 and the 100-hourly Simple Moving Average. There is also a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,820 level. The next key resistance is near the $1,880 level and the 50% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low. The first major resistance is near the $1,920 level.

A clear move above the $1,920 resistance might send the price toward the $2,000 resistance. An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,880 resistance, it could start another decline. Initial support on the downside is near the $1,780 level. The first major support sits near the $1,765 zone.

A clear move below the $1,765 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,765

Major Resistance Level – $1,880

Market

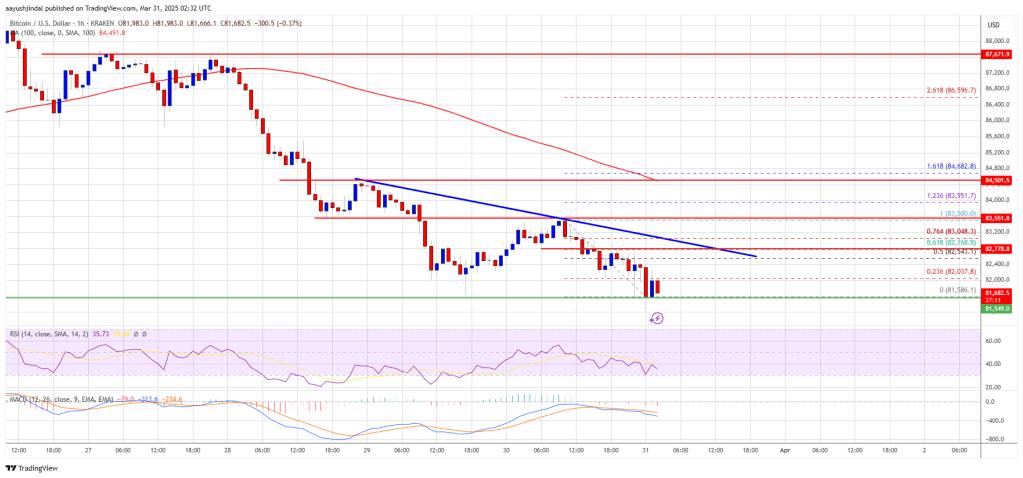

Bitcoin Bears Tighten Grip—Where’s the Next Support?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started another decline below the $85,000 zone. BTC is now consolidating and might struggle to recover above the $83,500 zone.

- Bitcoin started a fresh decline below the $83,500 support zone.

- The price is trading below $83,200 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $82,750 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it stays below the $83,500 resistance zone.

Bitcoin Price Dips Further

Bitcoin price failed to remain above the $85,500 level. BTC started another decline and traded below the support area at $85,000. The bears gained strength for a move below the $83,500 support zone.

The price even declined below the $82,000 level. A low was formed at $81,586 and the price is now consolidating losses below the 23.6% Fib retracement level of the downward move from the $83,500 swing high to the $81,586 swing low.

Bitcoin price is now trading below $82,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,000 level. The first key resistance is near the $82,750 level. There is also a connecting bearish trend line forming with resistance at $82,750 on the hourly chart of the BTC/USD pair.

The trend line is near the 61.8% Fib retracement level of the downward move from the $83,500 swing high to the $81,586 swing low. The next key resistance could be $83,500. A close above the $83,500 resistance might send the price further higher. In the stated case, the price could rise and test the $84,200 resistance level. Any more gains might send the price toward the $84,800 level or even $85,000.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,800 level. The first major support is near the $81,500 level.

The next support is now near the $80,650 zone. Any more losses might send the price toward the $80,000 support in the near term. The main support sits at $78,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $81,500, followed by $80,650.

Major Resistance Levels – $82,750 and $83,500.

Market

Solana (SOL) Price Risks Dip Below $110 as Bears Gain Control

Solana (SOL) has dropped over 6% in the past seven days and has been trading below $150 since March 6. The current trend shows clear bearish signals across multiple indicators.

From a death cross to a rising ADX and a red Ichimoku Cloud, technicals suggest growing downside pressure. With SOL nearing key support, the next few days could be critical for its price direction.

SOL Ichimoku Cloud Paints A Bearish Picture

The Ichimoku Cloud chart for Solana shows a clear bearish structure, with price action trading below both the Kijun-sen (red line) and Tenkan-sen (blue line).

The Lagging Span (green line) is also positioned below the price candles and the cloud, reinforcing the negative outlook. The Kumo ahead is red and descending, suggesting that resistance remains strong in the near term.

Solana has struggled to break above short-term resistance levels and remains stuck in a downward channel. The thin nature of the current cloud suggests weak support, making the price vulnerable to further downside if bearish momentum continues.

For a reversal, Solana would need to break above the Kijun-sen and push decisively toward the cloud, but for now, the trend remains tilted to the downside.

Solana DMI Shows Sellers Are In Control

Solana’s DMI chart shows a sharp rise in the ADX, now at 40.87—up from 19.74 just three days ago.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and values above 40 signaling a very strong one.

This surge confirms that the current downtrend in SOL is gaining momentum.

At the same time, the +DI has dropped from 17.32 to 8.82, while the -DI has climbed to 31.09, where it has held steady for the past two days.

This setup suggests that the sellers are firmly in control, and the downtrend is strong and also strengthening.

As long as the -DI remains dominant and ADX stays elevated, SOL is likely to remain under pressure in the short term.

Can Solana Drop Below $110 Soon?

Solana recently formed a death cross, a bearish signal where short-term moving averages cross below long-term ones.

It’s now approaching key support at $120—if that level breaks, Solana price could drop to $112, and possibly below $110 for the first time since February 2024.

If bulls step in and buying pressure returns, SOL could rebound toward resistance at $136.

A breakout above that level may lead to a push toward $147, which acted as strong resistance just five days ago.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Playing Catch-Up? Bloomberg Examines ETH’s Struggles In New Report

-

Market12 hours ago

Market12 hours agoTop 3 Made in USA Coins to Watch This Week

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

-

Market17 hours ago

Market17 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Bitcoin16 hours ago

Bitcoin16 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos