Market

Top Crypto News From Latin America

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about El Salvador’s Bitcoin adoption anniversary, the Cardano Foundation’s alliance with the Entre Rios province of Argentina, and more.

El Salvador Celebrates 3 Years of Bitcoin Adoption

In June 2021, El Salvador’s President Nayib Bukele announced plans to adopt Bitcoin as legal tender. On September 7, the country officially became the first in the world to enact the “Bitcoin Law,” making BTC a legal currency.

Currently, El Salvador remains the only nation where Bitcoin is legal tender. Over the past three years, the value of Bitcoin has fluctuated significantly, dropping to $16,464 by the end of 2022 after reaching an all-time high of $73,079 in March.

Since adopting Bitcoin, El Salvador has accumulated 5,772.76 BTC worth $411 million. Additionally, President Bukele won re-election for a second term, continuing to lead the country.

Read more: Who Owns the Most Bitcoin in 2024?

Paraguayan Congresswoman Proposes a Bill to Regulate Bitcoin Mining

Paraguayan Deputy María Constancia Benítez de Benítez introduced a bill to regulate Bitcoin mining in Paraguay. Titled “That regulates cryptomining in the Republic of Paraguay,” the proposal aims to create a secure legal and economic environment for cryptocurrency mining.

Benítez highlighted that mining could boost the country’s economic development. The bill highlights that Paraguay can harness its substantial hydroelectric energy production capacity for mining operations.

The bill has been presented to the Chamber of Deputies. Several committees, including those on economic and financial affairs, legislation and codification, industry, commerce and tourism, budget, drug trafficking prevention, science and technology, and energy and mining, will now review it.

Read more: Is Crypto Mining Profitable in 2024?

Latam Trading Platform BTR Shutdown as Users Allege Ponzi Scheme

The BTR crypto trading platform has allegedly ceased operations, sparking accusations from its users of an exit scam. What was initially seen as a temporary glitch has quickly escalated into a significant scandal.

Investors from Venezuela and other parts of Latin America had entrusted substantial sums of money to the BTR platform. Now, they find themselves in a precarious situation.

Many were drawn by promises of high returns and the perceived stability of the project. However, the lack of transparency and evasive responses from BTR’s administrators have fueled suspicions of a deliberate exit scam.

“#BTR the pyramid scheme has fallen. Its users report that there is no longer access to the website, there are no withdrawals, there are no official announcements from its CEO,” pseudonymous trader from Venezuela said.

Read more: 15 Most Common Crypto Scams To Look Out For

Bitcoin Embassy Bar in Mexico Closes in July, Leaves Crypto Networking Legacy

The Bitcoin Embassy Bar, a central hub for blockchain projects and Bitcoin initiatives, will close its doors at the end of July. This venue has been an ideal space for the crypto community in Mexico to network and collaborate.

Lorena Ortiz, the bar’s founder, announced on social media that the closure is due to health issues she faced earlier this year. However, she emphasized that while the physical location is closing, the “Bitcoin Embassy Bar” concept remains alive.

The community reacted swiftly, praising the bar’s efforts to educate people about cryptocurrency. Many expressed their appreciation for their experiences as consumers and exhibitors at the venue. Others encouraged the continuation of the project, optimistic that the business aspect and concept could be revived.

Read more: Best Crypto Community To Join for Beginners

Cardano Foundation Seals Alliance with Entre Rios Province of Argentina

The Cardano Foundation, a non-profit organization dedicated to promoting and developing the Cardano blockchain, has allied with the Entre Ríos province of Argentina. The agreement, signed at the Entre Ríos House in Buenos Aires, marks a milestone in their collaboration, which began with the Cardano Foundation delegation’s visit to the province in March.

Entre Ríos has been selected as a key jurisdiction to lead the adoption of blockchain technologies in the region. The agreement includes plans to advance digital identity solutions in the initial phase and facilitate access to Web3 knowledge. This joint initiative represents a significant effort to modernize and digitize processes in Entre Ríos, using decentralized technology as a foundation.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

Strike CEO Jack Mallers Seeks to Increase Investment in El Salvador

Jack Mallers, CEO of the payment platform Strike, announced plans to boost investment in El Salvador. Last year, Strike moved its headquarters to El Salvador and expanded Bitcoin payments to 65 countries.

Mallers noted El Salvador’s improvements and expressed the company’s intention to support more local projects and enhance the country’s crypto ecosystem, stating, “Chicago does not change as much as El Salvador changes.”

He emphasized that investing in El Salvador is a “good investment” in any area, whether technology or land. Strike is licensed as a digital asset provider and receives government support for its products and services.

“This country has been great. To come back and see all the changes is amazing. We see El Salvador improving and want to invest more to support and bring benefits here,” Mallers said.

Read more: A Guide to Crypto Payrolls: Exploring Salary Payments in Web3

As the Latin American crypto scene grows, these stories highlight the region’s increasing influence in the global market. From El Salvador’s bursting Bitcoin economy to Argentina’s new partnerships, LATAM is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

Solana started a fresh decline below the $112 support zone. SOL price is now consolidating and might struggle to stay above the $100 support zone.

- SOL price started a fresh decline below $112 support zone against the US Dollar.

- The price is now trading below $105 and the 100-hourly simple moving average.

- There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could accelerate lower if there is a break below the $100 support zone.

Solana Price Dips Over 15%

Solana price started a fresh decline below the $122 and $115 levels, like Bitcoin and Ethereum. SOL even declined below the $112 support level to enter a bearish zone.

There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair. The price declined over 15% and traded close to the $102 level. A low was formed at $102 and the price recently started a consolidation phase.

The current price action is still very bearish below 23.6% Fib retracement level of the downward move from the $121 swing high to the $102 low. Solana is now trading below $105 and the 100-hourly simple moving average.

On the upside, the price is facing resistance near the $105 level. The next major resistance is near the $112 level or the 50% Fib retracement level of the downward move from the $121 swing high to the $102 low. The main resistance could be $116.

A successful close above the $116 resistance zone could set the pace for another steady increase. The next key resistance is $120. Any more gains might send the price toward the $125 level.

Another Decline in SOL?

If SOL fails to rise above the $105 resistance, it could start another decline. Initial support on the downside is near the $102 zone. The first major support is near the $100 level.

A break below the $100 level might send the price toward the $92 zone. If there is a close below the $92 support, the price could decline toward the $84 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $102 and $100.

Major Resistance Levels – $105 and $112.

Market

Bitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

Bitcoin fell below the $80,000 mark on Sunday as investor sentiment weakened across global markets. The move came alongside a spike in daily liquidations, which totaled $590 million.

Heightened anxiety over former President Donald Trump’s proposed tariffs and escalating geopolitical tensions weighed heavily on risk assets.

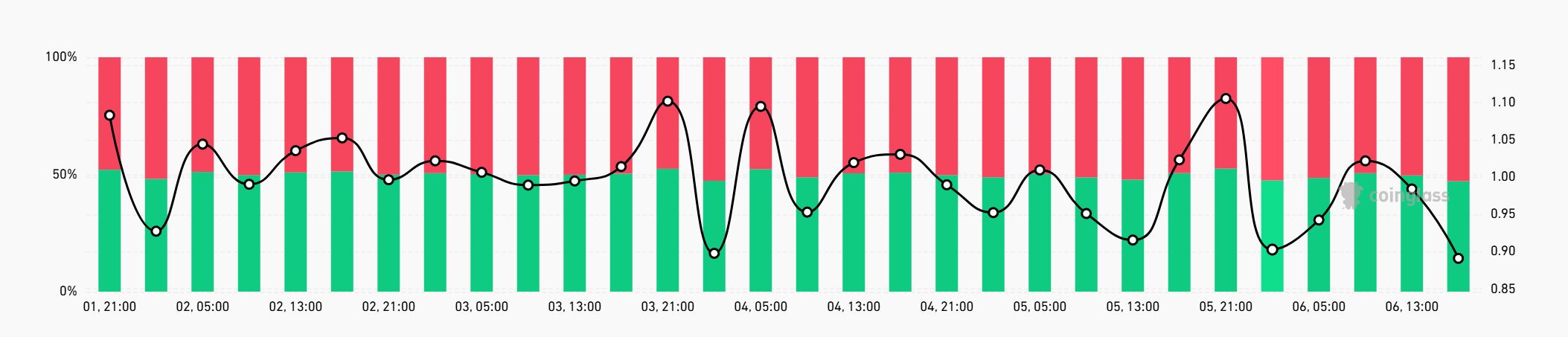

More Traders are Shorting Bitcoin After the Worst Q1 In a Decade

The long-short ratio for Bitcoin dropped to 0.89, with short positions now accounting for nearly 53% of activity. The shift reflects growing skepticism about Bitcoin’s short-term direction.

Traditional markets also suffered sharp losses. The Nasdaq 100, S&P 500, and Dow Jones all entered correction territory last week, posting their worst weekly performance since 2020.

Bitcoin closed the first quarter with a loss of 11.7%, making it the weakest Q1 since 2014.

The broader crypto market lost 2.45% on Sunday, reducing total market capitalization to $2.59 trillion. Bitcoin remains the dominant asset, holding 62% of the market share. Ethereum follows with 8%.

Sunday’s selloff triggered $252.79 million in crypto derivatives liquidations. Long positions made up the bulk of that figure at $207 million. Ethereum traders accounted for about $72 million in long liquidations alone.

Bitcoin’s price remains closely tied to shifts in global liquidity, often reflecting broader macro trends. With U.S. markets set to open Monday, this weekend’s activity signals continued volatility ahead.

Investors may face more pressure after Federal Reserve Chair Jerome Powell warned that Trump’s tariff plans could push inflation higher while slowing economic growth.

That combination raises the risk of stagflation, a situation where policy tools become less effective. Efforts to stimulate the economy can worsen inflation, while measures to control prices can limit growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Avalanche Price Holds Under $20, Low Selling Can’t Lift Price

Avalanche (AVAX) price has been unable to reclaim the $20.00 support level after falling through it in the recent correction. The altcoin is now trading well below that key mark despite a noticeable decline in selling pressure.

However, bullish momentum has not been strong enough to counter prevailing bearish cues.

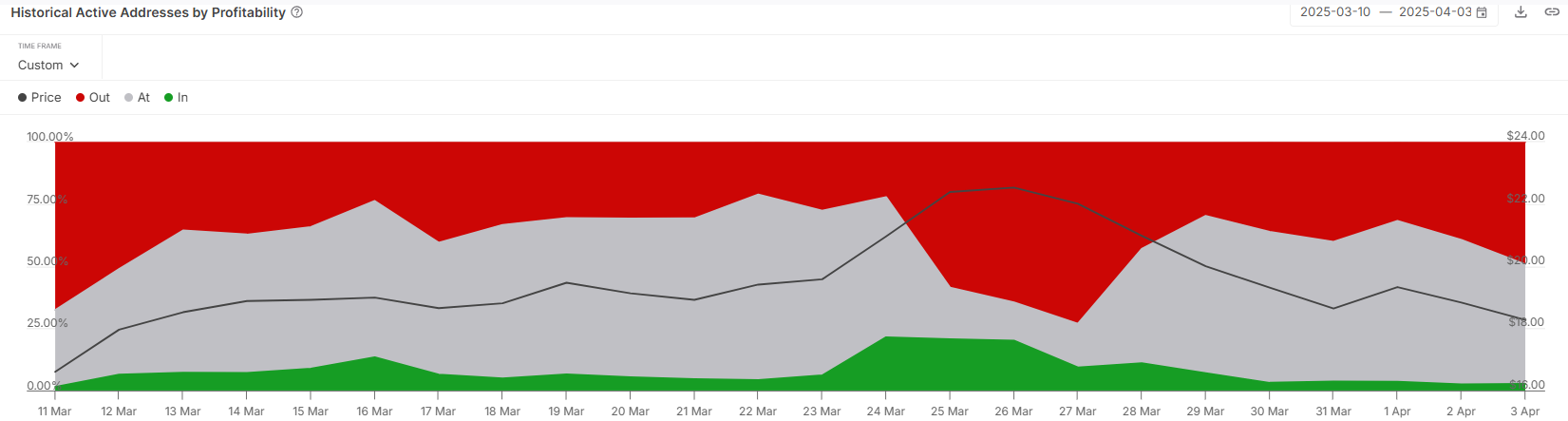

Avalanche Investors Are Not Selling

Analyzing the active address profitability reveals that less than 3% of current participants are in profit. This data highlights a crucial detail: most AVAX holders are unwilling to sell at a loss. Instead, they appear to be HODLing in anticipation of a recovery. This lack of selling is a bullish indicator.

The patience shown by investors during this downturn could help Avalanche establish a stronger base once broader market conditions stabilize. As fewer holders are actively selling, downward pressure on AVAX’s price is reduced. Given the right market catalysts, this opens a window for the altcoin to bounce back.

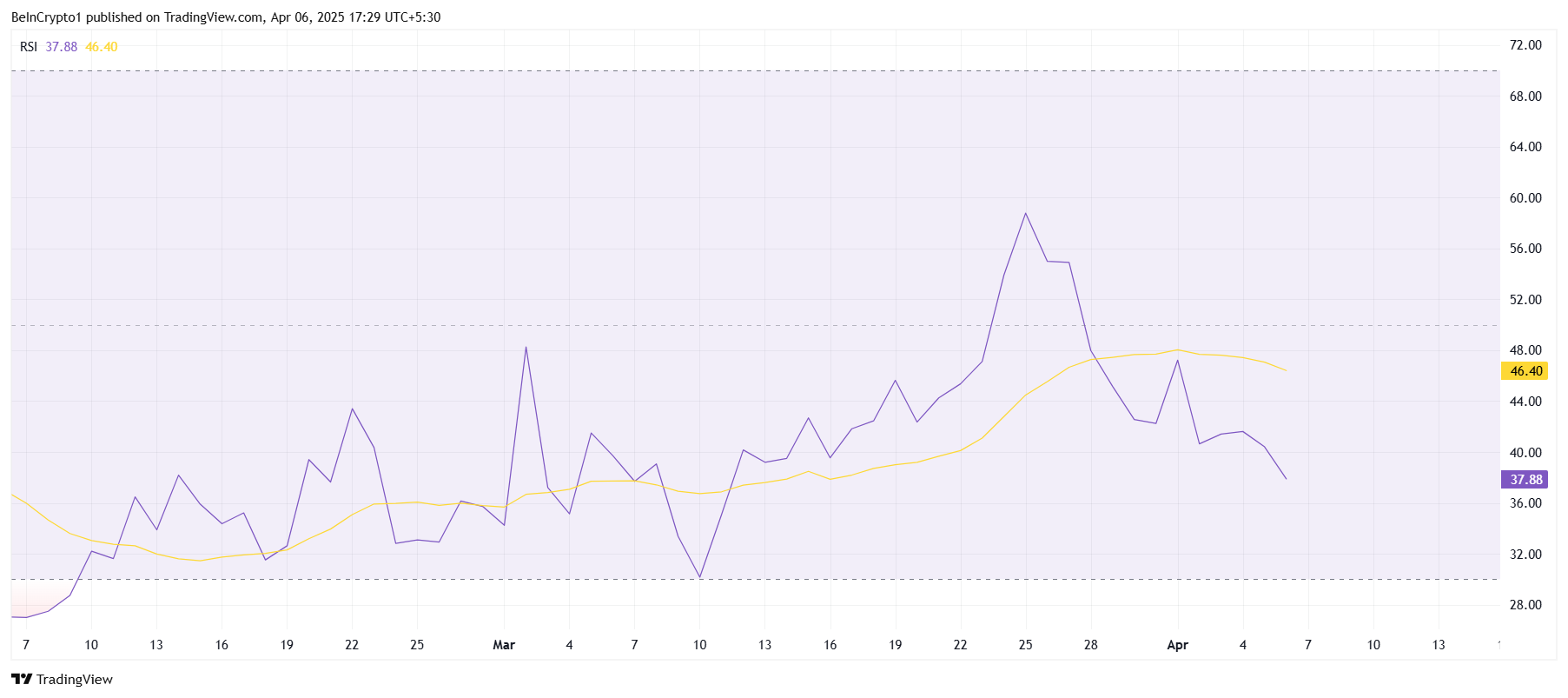

Despite low selling activity, the technical indicators continue to signal weakness. The Relative Strength Index (RSI) has dropped back into the bearish zone after a brief recovery attempt. This suggests a lack of buying pressure and continued uncertainty among investors.

Market support has been lacking for AVAX in recent sessions, preventing a meaningful rebound. The altcoin is facing consistent resistance and has failed to generate strong upward momentum.

The RSI trend reinforces that the macro environment is still leaning bearish, keeping Avalanche subdued.

AVAX Price Is Vulnerable

Avalanche is currently priced at $17.19, marking a 25% decline over the past two weeks. The sharp drop came after AVAX failed to break through the $22.87 resistance level. This rejection led to the current consolidation below $20.00, with bulls unable to reverse the trend.

Given the existing market cues, Avalanche may struggle to reclaim $18.27 as a support level. If the altcoin fails to secure this level, it risks dropping further to $16.25. This would deepen investor losses and delay any chances of recovery.

On the upside, a key shift would occur if AVAX can flip $19.86 into support. This would suggest strengthening bullish sentiment and open the door for a rally toward $22.87. Reclaiming this level could allow Avalanche to recover some recent losses and restore investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoBitcoin Holds $83K Despite Macro Heat, What’s Happening?

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Whales Dump 500,000 ETH In 48 Hours: On-Chain Data

-

Market19 hours ago

Market19 hours agoXRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

-

Market17 hours ago

Market17 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Ethereum22 hours ago

Ethereum22 hours agoIs Ethereum Price Nearing A Bottom? This Bullish Divergence Suggests So

-

Altcoin21 hours ago

Altcoin21 hours agoHas The Dogecoin Price Bottomed Out? Analyst Points Out ‘Critical Decision Zone’

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Whale Activity Fades Since Late February – Details

-

Bitcoin17 hours ago

Bitcoin17 hours agoAltseason Dead On Arrival? Data Shows Bitcoin Outperforming All Categories