Market

Top 3 Bullish AI Coins From This Week

RSS3, JAM, and ALI are the top-performing AI coins of the third week of March 2025. RSS3 and JAM have both surged 78% in the past seven days, while ALI is up 48%.

Combined, they stand out for their strong price action and growing market caps. Here’s a breakdown of why these AI coins are making headlines this week.

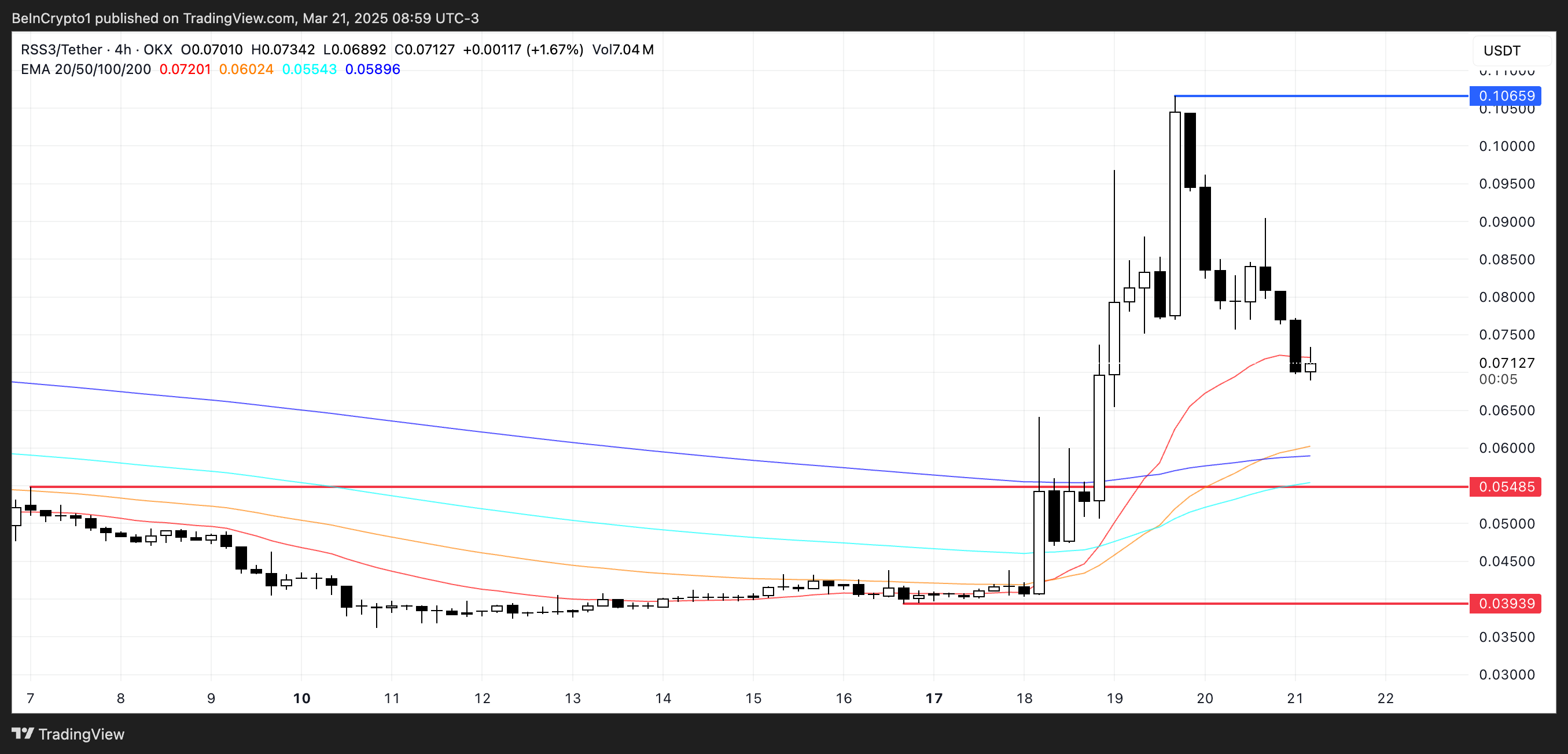

RSS3 has surged over 78% in the past week, pushing its market cap to $51 million.

The strong rally has made it one of the top performers among AI coins, despite the general correction in that sector.

RSS3 is a decentralized network that indexes and structures open information. Inspired by the original RSS, it supports the Open Information Initiative, aiming to power the Open Web and open artificial intelligence.

If momentum continues, RSS3 could retest resistance at $0.106, possibly reaching $0.11 for the first time since January 17. If momentum fades, support sits at $0.054, with further downside risk to $0.039.

JAM

JAM is one of the hottest AI coins on the Base network. It has soared 78% over the past week and reached a market cap of $18 million.

JAM powers JamAI, a platform where users can create AI agents with unique personalities. It combines elements of an AI agents platform and a crypto launchpad, with roots as a creator community on Farcaster.

JAM has been setting fresh all-time highs, and if momentum holds, it could break above $0.0050 and aim for $0.0075. If momentum fades, key support levels sit at $0.0039 and $0.0026.

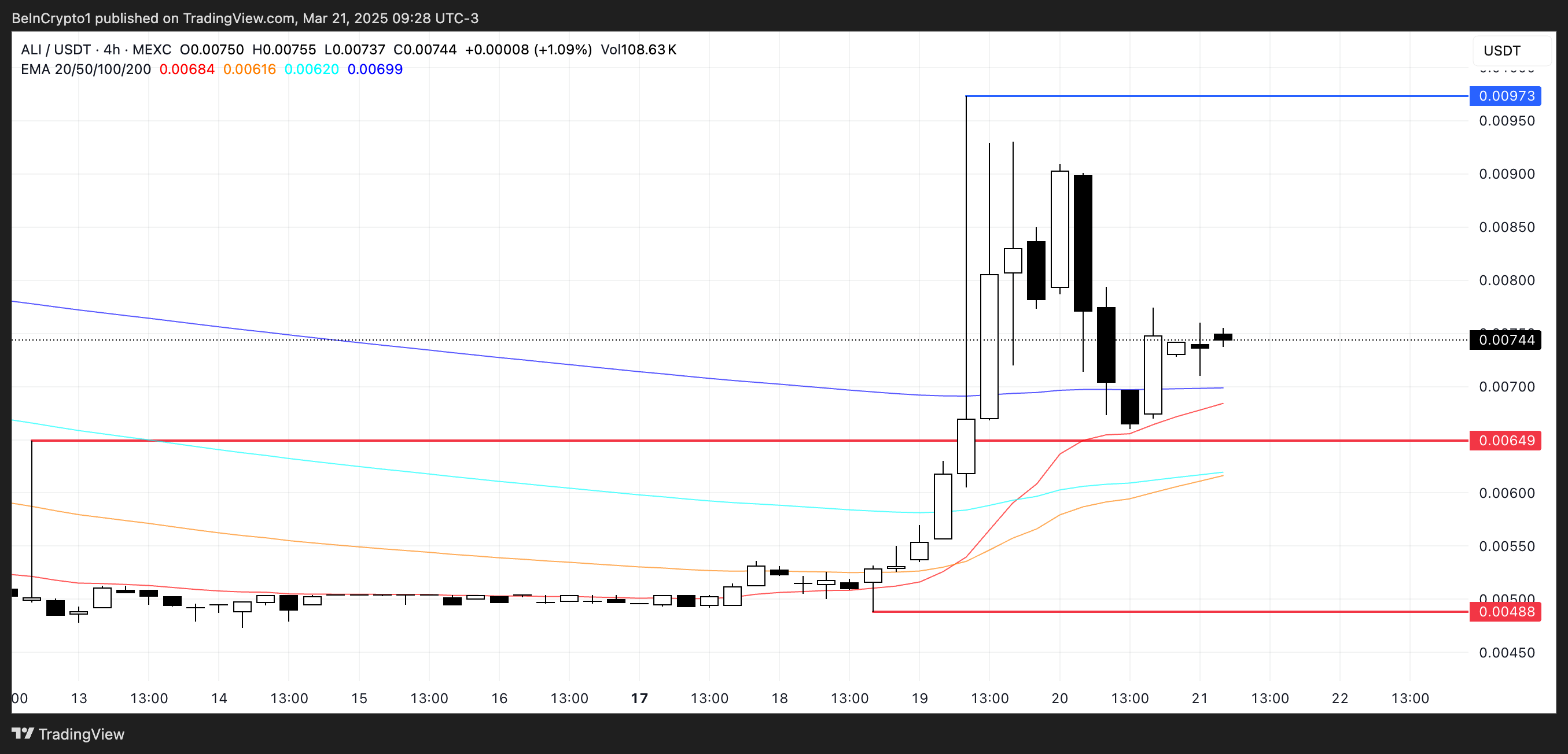

Artificial Liquid Intelligence (ALI)

Artificial Liquid Intelligence is driving several AI-focused crypto projects, including the AI Protocol, which builds a decentralized infrastructure for tokenized AI systems.

The company is also behind Alethea AI and its on-chain agentic AI characters, blending AI with blockchain to create interactive digital personas. Additionally, its ALI Agents Beta is set to launch soon, featuring staking, rewards, and upgraded AI functions.

ALI has gained over 48% in the past week, making it one of the best-performing crypto AI agents coins.

If momentum continues, ALI could push toward $0.0097, with a chance to break above $0.010. However, if a pullback occurs, support levels sit at $0.0064 and $0.0048.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Will List and Airdrop Particle Network’s PARTI Token

Binance announced that the Particle Networks PARTI token will be in its HODLer Airdrops program. The PARTI token generation event (TGE) will take place tomorrow, March 25, followed by airdrops and listing on several centralized exchanges.

OKX is also going to list PARTI. The launch price is still unclear, but Particle Network has strong community support on social media.

Binance to List Particle Network’s PARTI Token

Binance, the world’s largest crypto exchange, has been substantially boosting token projects with its HODLer Airdrops program. Last week, it caused Bubblemaps’ BMT token to spike 100%, and it’s now adding another asset to the program.

According to its announcement, Binance is hosting an airdrop for Particle Network’s new token tomorrow at 13:00 (UTC), followed by an official listing.

Particle Network is a blockchain infrastructure project dedicated to simplifying the Web3 experience. Last July, it also joined the Peaq DePIN ecosystem.

Since 2022, the network has helped create over 17 million wallets and processed more than 10 million user operations.

Unlike Bubblemaps, Particle Network’s token hasn’t seen a price spike from Binance’s airdrop announcement. This is because PARTI has not had a token generation event (TGE) yet.

According to data from CoinMarketCap, PART will be hosted on the BNB Chain, and several exchanges, including OKX, KuCoin, and Binance, will list the token at launch time.

Meanwhile, tokenomics reveals that PARTI will have a maximum supply of 1 billion tokens. 3% of this will go to HODLer Airdrop participants, and 23.3% will be listed for trading on Binance.

Another 3% will be allocated to the other marketing campaigns six months after spot listing, but there aren’t any specific details yet.

Ultimately, it’s difficult to predict how well PARTI will perform after its TGE. Particle Network’s post about the airdrop had over 100,000 views, and Binance token listings typically do quite well.

Hopefully, this trend will continue with a fruitful launch that encourages further Web3 innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

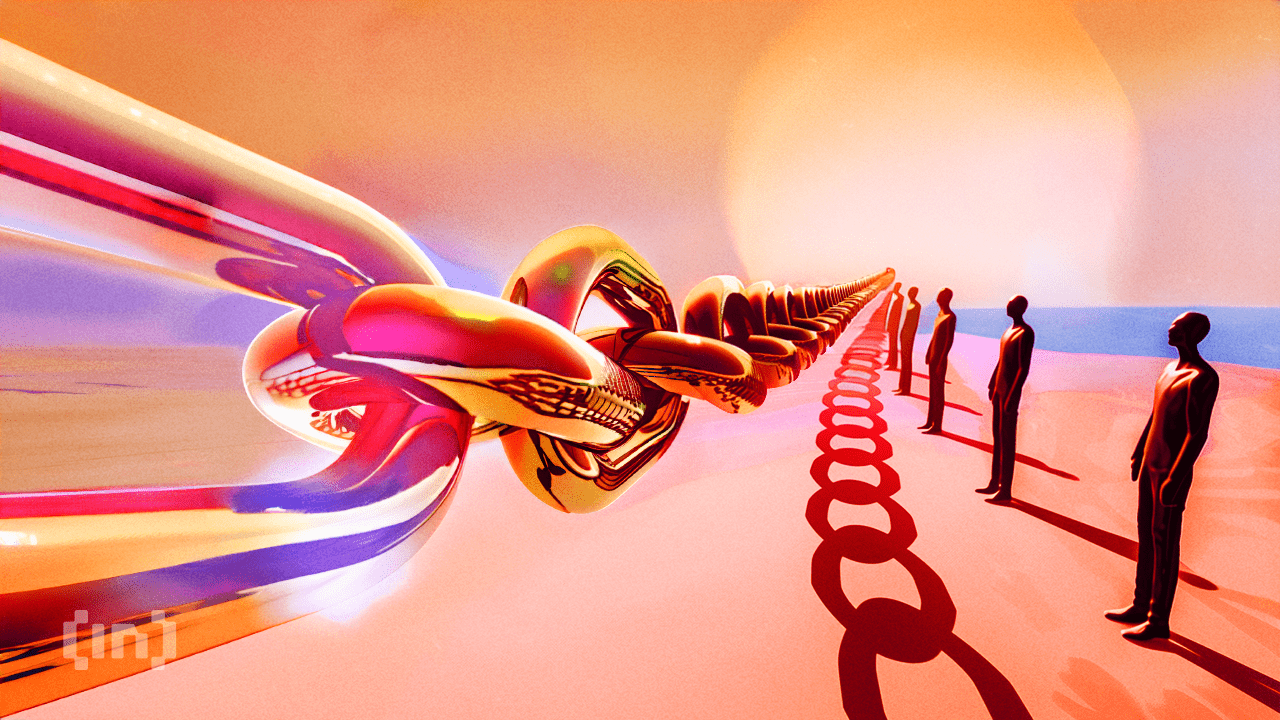

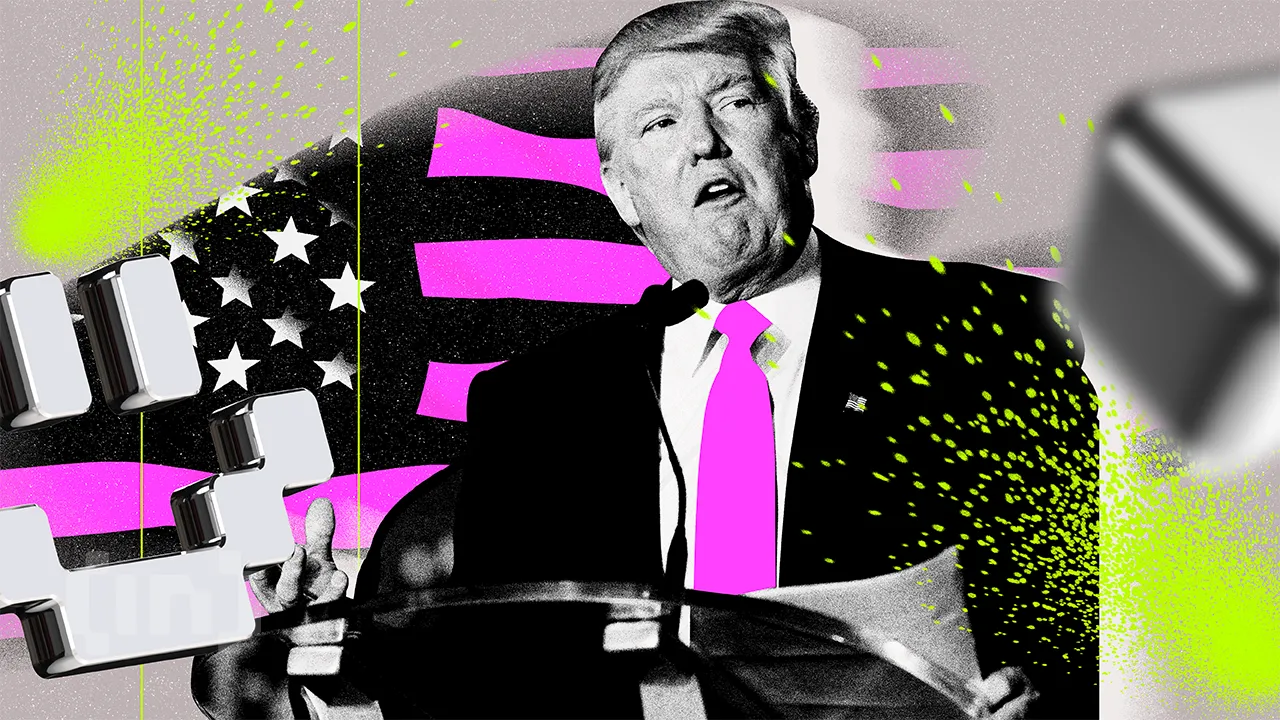

Trump Media Partners With Crypto.com, Cronos Jumps By 18%

Trump Media and Crypto.com announced a partnership to launch new ETFs based on Cronos, Bitcoin, and other assets. The resolution is non-binding, and a Cronos ETF would need SEC approval.

Even though there are serious obstacles to implementing the stated program, Cronos surged by over 18% due to speculative interest and bullish momentum.

Crypto.com, a major exchange and issuer of the Cronos token, has been through a few changes recently. Although CRO fell dramatically at the end of 2024, the exchange has ventured into new markets.

Today’s partnership with Trump Media Group triggered a bullish cycle for the CRO token, as the announcement hinted at a potential Cronos ETF.

“Trump Media and Technology Group Corp has signed a non-binding agreement to partner with Crypto.com to launch a series of ETFs and ETPs. The ETFs are expected to comprise digital assets as well as securities with a Made in America focus spanning diverse industries such as energy [and] cryptocurrencies incorporating Bitcoin, Cronos, and others,” a press release stated.

The announcement clarified that these ETFs still require regulatory approval. Also, Crypto.com and Trump Media haven’t finalized a “definitive” agreement, even if the resultant ETFs will include Cronos.

Meanwhile, Cronos reached a yearly high in December after reports of the Crypto.com CEO and the US President’s meet-up and its legal resolution with the SEC. However, CRO has suffered a 30% drop since then. Today’s news brought fresh liquidity into the altcoin.

The SEC may be looking favorably on altcoin ETFs, but one based on Cronos is totally out of left field. Even if Trump personally intervenes, a Cronos ETF may still be months away. There haven’t been any ETF applications for the altcoin yet.

Another concern, of course, is the “Made in America” angle. Although the statement discusses US-based products, Crypto.com is currently headquartered in Singapore. The US is still the exchange’s primary target market.

The biggest problem, however, is that a Cronos ETF could be the biggest political crypto scandal since the TRUMP token. US Presidents are not supposed to conduct private business in any capacity, especially with foreigners.

Could Trump’s firm expect to win the SEC’s highest stamp of approval? Even if it did, wouldn’t that impact the Commission’s own legitimacy?

Overall, it’s evident that Trump Media is venturing deeper into the crypto industry and looking to extend its investment avenues. Such a partnership will also help the exchange increase its market share in the US and challenge Coinbase’s dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Did World Liberty Financial Launch a Stablecoin on BNB Chain?

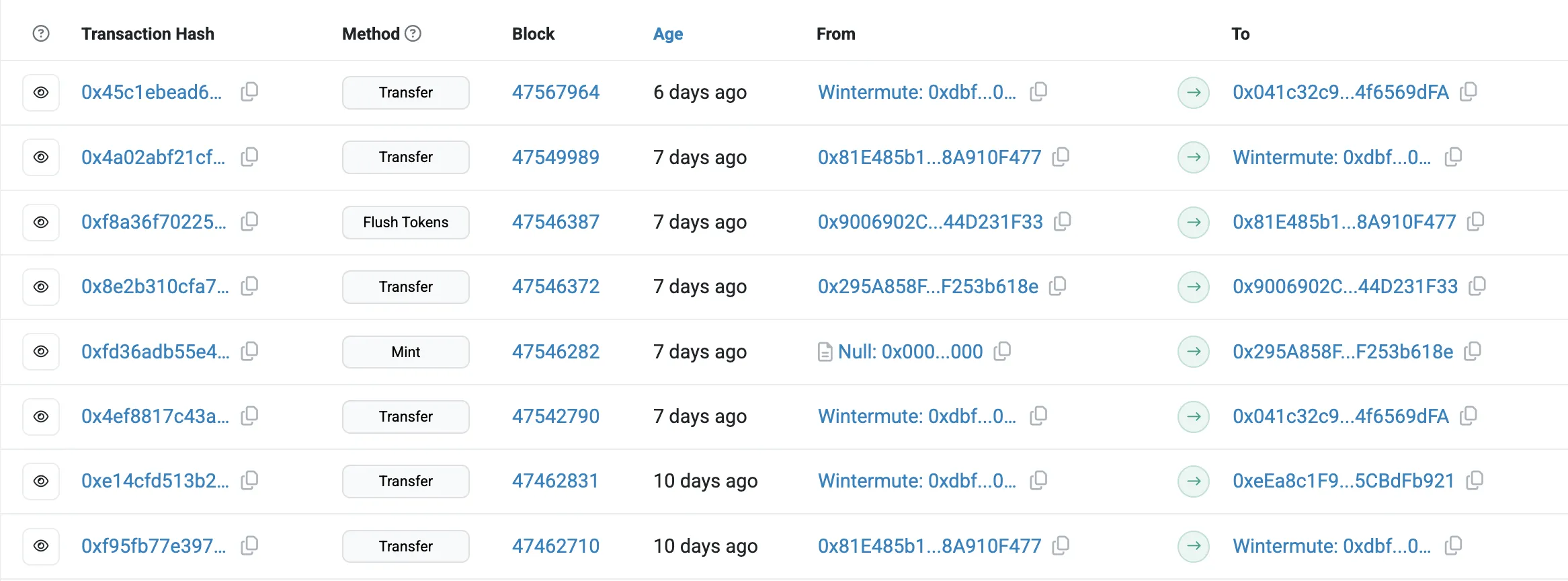

USD1, a self-proclaimed “World Liberty Financial USD” stablecoin, launched on BSC today. While there has been no official announcement from the Trump Family-linked project itself, leading market maker Wintermute interacted with this stablecoin.

Former Binance CEO Changpeng “CZ” Zhao commented on this asset, but only in minimal detail. So far, there’s no clear proof of an actual Trump connection.

Is World Liberty Financial Launching a Stablecoin?

Binance, the world’s largest crypto exchange, may be on the verge of a big business move. Last week, reports alleged that the firm was in talks with WLFI to launch a new USD-backed stablecoin while the Trump family would buy a stake in it.

Today, the crypto community first noticed USD1, an alleged WLFI stablecoin on Binance Smart Chain (BSC):

“The Trump Family Foundation just issued a stablecoin on BSC, and the market-making agency Wintermute also participated in it. I guess the Trump Family Foundation found that stablecoins are still profitable and wanted to make stablecoins, so it would be perfect to set up an exchange and invest in it!” claimed Old Driver.

This Wintermute angle made the issue particularly enticing. Wintermute is a high-profile crypto market maker with a daily trading volume of over $2.24 billion.

Earlier this year, it did business with Binance and previously invested in Ethena Labs. Given Wintermute’s reputation, the crypto community is speculating that World Liberty Financial might be involved with this stablecoin.

Changpeng “CZ” Zhao, former CEO of Binance, noted that USD1’s smart contract was first deployed 20 days ago and welcomed the token to BNB Chain.

Shortly afterward, however, he warned the community that the USD1 name was being used in scams.

“I was told since this post, a lot of scammers created coins with the same name. The official USD1 is not tradable yet. Please do not fall for the scams,” CZ added.

Despite referring to “the official USD1,” CZ’s statement isn’t a clear indicator of any official partnership between Binance and World Liberty Financial.

Several social media commentators with substantial followings responded to his posts, warning that the market may take his spontaneous posts completely out of context. CZ’s “off the cuff” posting style could create misunderstandings.

“You still don’t understand the influence of your tweet. Most people actually don’t know that you’re just spontaneous with your tweets,” Ben Todar,

Neither WLFI nor Binance has officially commented on this stablecoin or acknowledged any kind of partnership and pushed back on previous allegations that one exists.

For now, the space will have to keep a close eye on USD1 and await further developments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoStablecoin Market Cap Hits $220 Billion

-

Bitcoin16 hours ago

Bitcoin16 hours agoUS Economic Data This Week: Key Events Shaping Bitcoin

-

Market21 hours ago

Market21 hours agoBitcoin Price Shows Stronger Recovery Signs—Upside Move in Focus

-

Market16 hours ago

Market16 hours agoEthereum Price Teases a Breakout—Can This Spark a Momentum Shift

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Reveals Key Update On UNI, ALGO, CRV, & These 3 Crypto, Here’s All

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin’s Short-Term Holders Near Capitulation With $7B Losses, Yet Remain Within Bull Market Bounds

-

Market15 hours ago

Market15 hours agoEthereum Supply Dips as Leverage Rises – What It Means for ETH

-

Market20 hours ago

Market20 hours agoXRP Price Reclaims Ground—Is a Bigger Push Just Getting Started?