Market

Top 3 BNB Meme Coins to Watch Closely This Week

BNB meme coins are gaining traction as the BNB ecosystem experiences a surge. PancakeSwap has been leading DEX volumes globally over the past seven days, surpassing both Raydium and Uniswap.

Among the top contenders making waves are Mubarak, Palu, and FairMint, each capturing significant attention in this fast-moving space. Mubarak is leading the pack with explosive early growth, while Palu is emerging as a potential flagship meme coin. Meanwhile, FairMint is positioning itself as a unique launchpad, aiming to become BNB’s version of Pumpfun.

Mubarak

Mubarak has quickly become one of the most talked-about meme coins in the BNB ecosystem over the past few days. Yesterday, its market cap briefly approached the $200 million mark before pulling back to around $112 million today.

The project surged onto the scene with remarkable traction, fueled by growing hype and speculative interest in BNB-based assets.

In just a short period, Mubarak has gained over 20,000 holders, recorded daily volumes of $66 million, and witnessed nearly 35,000 transactions per day. However, despite this initial momentum, the token is now undergoing a sharp correction, down 25% in the past 24 hours.

Even so, with the BNB ecosystem continuing to attract fresh capital and broader market attention, there is still potential for Mubarak to rebound and possibly retest its previous highs near the $200 million market cap level if buying interest returns.

Binance’s Palu (Palu)

As BNB meme coins continue to dominate the spotlight, several projects are competing to become the face of the ecosystem, much like Shiba Inu did with Ethereum and Bonk with Solana.

One of the contenders is Palu, a relatively new token launched just under six days ago. Palu has already attracted nearly 5,000 holders and reached a market cap of $864,000, slightly down from its recent high of almost $900,000.

The project is positioning itself to potentially fill the role of a flagship meme coin within the BNB chain.

Despite suffering a sharp 75% correction over the past 24 hours – a scenario not uncommon among meme coins across various blockchains – Palu is still maintaining solid activity, with daily trading volumes near $4 million.

If sentiment in the BNB meme coins sector stabilizes and Palu regains its momentum, the project could attempt to climb back toward key psychological milestones, with market cap targets of around $1 million and possibly even $2 million in the near term.

FairMint FAIR (FAIR)

FairMint is a newly launched BNB meme coins launchpad that has been live for less than three days.

Trying to differentiate itself from other platforms such as Pumpfun, FairMint introduces distinctive mechanics.

For example, it enables all users to mint tokens at the same price while also ensuring that 95% of tokens maintain liquidity at the mint price via single-sided liquidity provisioning.

Currently, FairMint has gathered close to 3,500 holders, boasts a daily trading volume of $11.7 million, and records over 24,000 transactions per day.

While Pumpfun has established itself as the leading launchpad on Solana, the BNB chain still lacks a dominant player in this niche.

If FairMint can sustain its strong early momentum and community engagement, FairMint could be poised to push toward market cap milestones of $5 million and potentially even $10 million in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Falls 4% as Bears Dominate: What’s Next for HBAR?

Hedera (HBAR) is showing signs of weakness after dropping 4% on Thursday. Its market cap is now hovering close to the $8 billion mark. Recent technical indicators suggest that sellers may be gaining control, especially as directional strength begins to shift.

The DMI and Ichimoku Cloud both point to a market caught in consolidation but leaning slightly bearish. With key resistance holding firm and bearish patterns threatening to develop, HBAR’s next move could be critical.

HBAR DMI Shows Sellers Are in Control

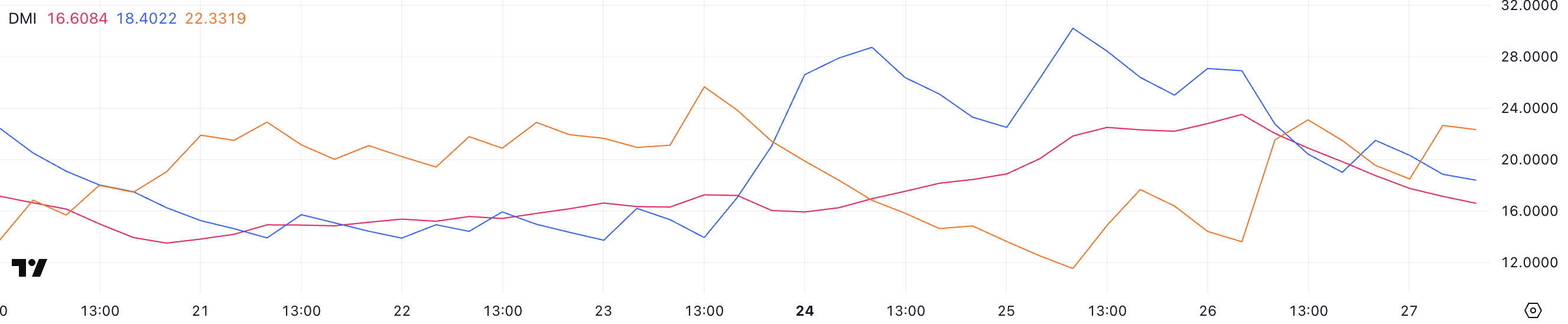

Hedera’s Directional Movement Index (DMI) chart shows that the Average Directional Index (ADX) is currently sitting at 16.6, a notable decline from yesterday’s 23.5.

The ADX is a key indicator used to gauge the strength of a trend, and a drop like this suggests that the momentum behind any recent move—bullish or bearish—is weakening.

An ADX below 20 typically points to a lack of a clear trend or the presence of sideways movement, which aligns with HBAR’s recent consolidation phase observed over the last few days.

The ADX itself doesn’t indicate the direction of the trend, only its strength. Generally, values below 20 signal a weak or non-existent trend, 20–25 indicate a potential emerging trend, and values above 25 suggest a strong trend.

Alongside the ADX, the DMI’s +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator) give insight into direction. Currently, +DI is at 18.4, falling from 26.9 yesterday, while -DI has climbed to 22.33 from 13.61.

This flip in directional strength suggests bearish momentum is increasing while bullish momentum fades.

Coupled with a low ADX, this could imply that although sellers are gaining the upper hand, the overall trend still lacks conviction. This reinforces the idea that HBAR is likely to remain range-bound unless a breakout confirms a new direction.

Hedera Ichimoku Cloud Indicates a Bearish Trend Could Arise Soon

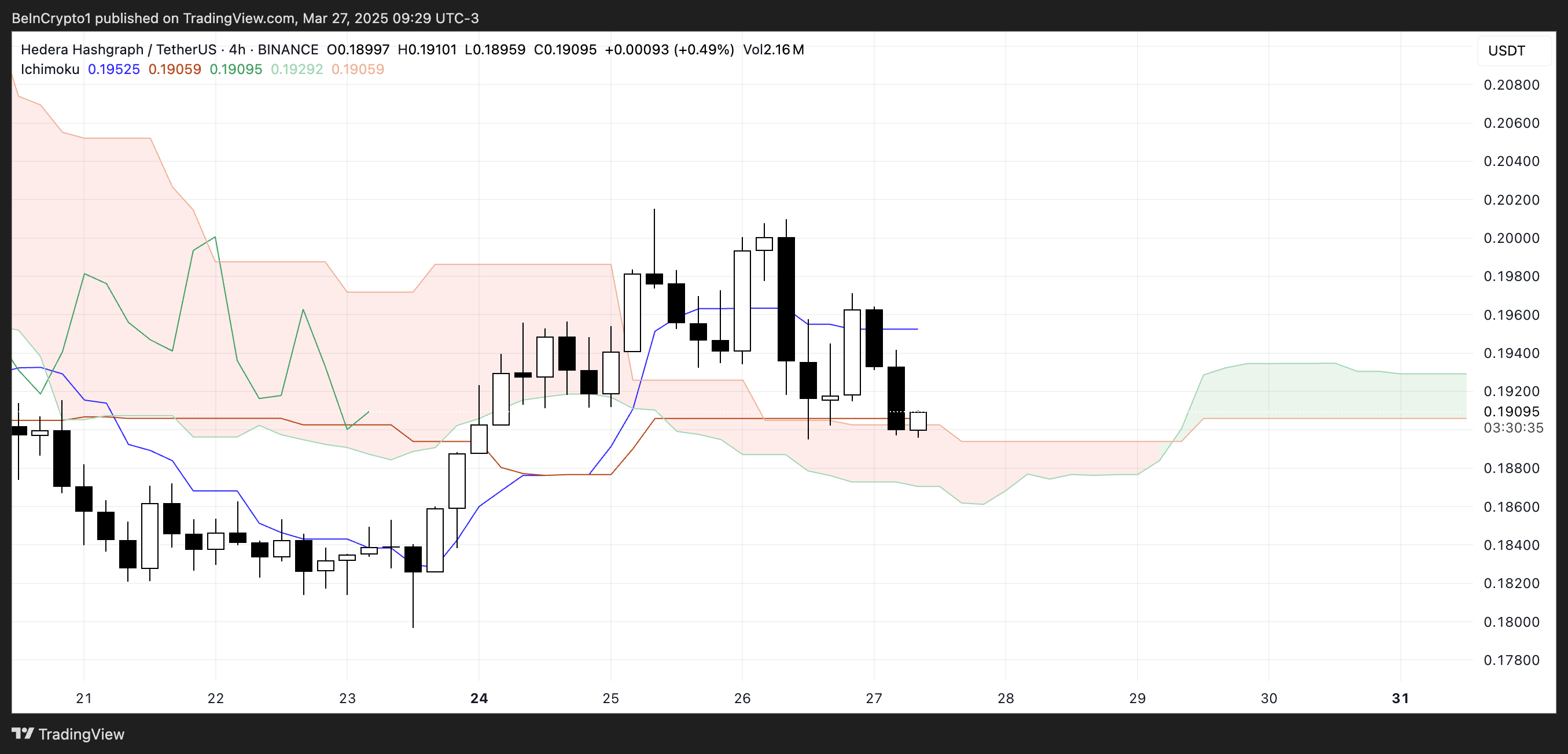

Hedera’s Ichimoku Cloud chart reveals a market in equilibrium, with price hovering near the lower boundary of the cloud. The recent candlesticks show a clear hesitation around this area, reflecting the ongoing consolidation.

The Kijun-sen (blue line) has turned flat, indicating a loss of momentum and a potential pause in trend direction. Similarly, the Tenkan-sen (red line) is sloping downward, suggesting short-term bearish pressure.

Despite this, the forward cloud has flipped to a bullish twist, signaling a possible shift in sentiment—but that outlook remains unconfirmed unless HBAR can establish clear separation above the cloud.

The cloud itself—the Kumo—remains relatively flat and thin, reinforcing the current consolidation phase.

A thin cloud typically indicates weak support or resistance, making it easier for price to move through but harder to trust any breakout unless accompanied by strong volume and momentum. The Chikou Span (lagging line) appears to be tangled within past price action, which also suggests a lack of trend clarity.

Overall, the Ichimoku signals point to indecision in the market, with a slight bearish lean in the short term and a potential for trend development if buyers can gain control.

Can Hedera Break Above $0.20?

Hedera has recently faced strong resistance, struggling to break past the $0.199 level—failing twice over the past few days. This repeated rejection has created a ceiling that’s proving tough to breach.

Meanwhile, its EMA lines are tightening, and there’s the looming possibility of a death cross forming, which would signal a potential bearish shift. If that crossover is confirmed, it could accelerate downward pressure. This would lead HBAR to retest its next key support level near $0.184.

A breakdown below would open the door for further downside, potentially extending the move toward the lower support region around $0.179. If that support is also lost, HBAR could go below $0.17 for the first time since November 2024.

However, if momentum can flip, the bulls still have a case. Should the Hedera price manage to regain strength and form a sustainable uptrend, a third challenge of the $0.199 resistance could be on the table.

A successful breakout above that level would likely trigger a move toward the next resistance zone around $0.21.

And if the bullish momentum continues to build, there’s potential for an extended rally toward the $0.258 level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

Bitcoin has long been regarded as a store of value, often compared to digital gold. However, with the rapid advancements in decentralized finance (DeFi) and blockchain infrastructure, the demand for new ways to utilize Bitcoin beyond passive holding has surged.

SatLayer, a pioneering Bitcoin-based infrastructure provider, is at the forefront of this transformation. Through restaking and Bitcoin Validated Services (BVS), SatLayer aims to unlock new use cases for Bitcoin (BTC), ensuring its integration into the changing financial ecosystem. BeInCrypto spoke exclusively with SatLayer’s Co-Founder and CEO, Luke Xie, to explore how Bitcoin’s role expands and what the future holds for Bitcoin-based infrastructure.

Beyond a Store of Value: Bitcoin’s Next Evolution

According to Xie, Bitcoin has transitioned through multiple phases—from an experimental digital currency to a widely recognized store of value. Now, as the broader crypto ecosystem has evolved with smart contract capabilities, Bitcoin holders have sought new opportunities beyond simply holding their assets.

Xie highlights that Bitcoiners have observed Ethereum (ETH) and other chains, including Solana (SOL), offering staking and yield-generating opportunities. Meanwhile, Bitcoin itself has remained largely passive.

According to Xie, SatLayer’s mission is to change that by introducing restaking. In doing so, it enables Bitcoin holders to generate yield while securing decentralized applications (dApps).

“Naturally Bitcoiners, who’ve watched this innovation occur while they’ve been hodling hard, want a piece of that action: the yield, the use cases, the onchain opportunities. As we all know, the Bitcoin network was not built for that sort of stuff, but developers have painstakingly assembled the infrastructure for Bitcoin DeFi on Layer 2. The fees are low, the throughput is high, and the sort of primitives you’d hope to find – for trading, borrowing, and much more – are all in place,” Xie told BeInCrypto.

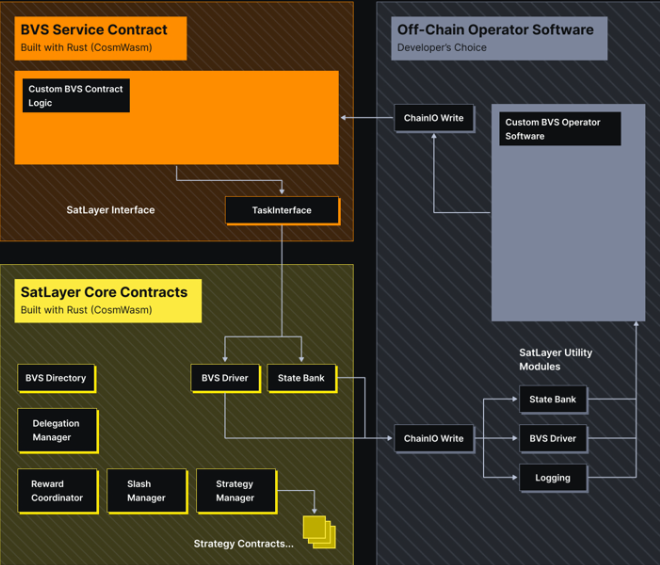

Bitcoin Validated Services (BVS): Enhancing Security and Utility

At the core of SatLayer’s vision is Bitcoin Validated Services (BVS). This concept allows dApps to be secured by restaked BTC. Unlike native tokens, which may lack liquidity and stability, Bitcoin’s unmatched value and liquidity make it the ideal asset for securing DeFi protocols.

BVS enables Bitcoin holders to collateralize their assets while simultaneously earning staking rewards. Xie explained how BVS enhances the security and utility of dApps.

“BVS describes any decentralized application or protocol that uses restaked BTC to secure its network. In real terms, this means that participants will use restaked BTC as collateral in return for having the right to validate network transactions. Because Bitcoin is valuable, this effectively eliminates the incentive for validators to act dishonestly,” Xie noted.

Any crypto asset, such as a native token, could serve as collateral for this purpose. However, it will be less liquid, valuable, and stable than BTC.

Restaking on Bitcoin: Unlocking Yield and Security

Further, Xie shared that SatLayer’s restaking mechanism is designed to be user-friendly and secure. By leveraging Wrapped Bitcoin (WBTC) or BTC Liquid Staking Tokens (LSTs), users can participate in restaking through the SatLayer platform, selecting protocols like Lombard, Lorenzo, or SolvBTC to restake with.

This process allows BTC holders to earn rewards while actively participating in securing emerging Bitcoin-based applications. The system mirrors the success of Ethereum-based restaking protocols like EigenLayer (EIGEN). It allows Bitcoin holders to contribute to network security without custodial risk.

Binance’s recent integration with Babylon, a major staking infrastructure provider, is a significant boost to this ecosystem. BeInCrypto reported that Binance has incorporated Babylon’s BTC staking solutions into its offerings. This marks a major step in legitimizing Bitcoin staking at scale.

This integration provides Bitcoin holders on Binance seamless access to staking and restaking services, further driving institutional and retail adoption. Likewise, with partnerships like Babylon, SatLayer enhances Bitcoin’s staking ecosystem.

“It’s a symbiotic relationship in which everyone benefits – Babylon, SatLayer, and most importantly Bitcoin holders,” he added.

By collaborating with Babylon, SatLayer strengthens Bitcoin’s DeFi presence. It creates a strong framework where BTC can be staked and restaked without compromising security. The synergy between these platforms accelerates Bitcoin’s growth from a passive store of value into an active financial instrument within the broader crypto economy.

Security and Future Innovations

Security remains a top priority for SatLayer. Xie emphasizes that rigorous audits and careful protocol design ensure that Bitcoin restaking maintains the security and decentralization that Bitcoin is known for.

Looking ahead, SatLayer plans to introduce AI-powered yield optimization. The firm also anticipates on-chain insurance backed by Bitcoin collateral and streamlined restaking services. Xie also sees Bitcoin infrastructure growing rapidly over the next five years.

“It’s still very early for restaking, so the obvious answer is a massive increase in TVL and the number of active users. It’s a self-fulfilling Simpsons nuclear power plant ‘days without incident’ narrative: the longer that Bitcoin restaking operates successfully, the greater the trust it will gain,” Xie concluded.

As Bitcoin grows, SatLayer’s innovations could be crucial in transforming the world’s most valuable cryptocurrency into a yield-generating asset. With Bitcoin’s infrastructure expanding, coupled with these developments, the pioneer crypto could go beyond its role as digital gold and transition into a fully integrated, yield-generating asset within the broader crypto economy.

Its dominance in the digital economy is poised to grow beyond being just a store of value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase to Rival Binance With BNB Perpetual Futures

Coinbase International Exchange and Coinbase Advanced will introduce support for BNB perpetual futures starting next week.

This development marks a significant expansion of Coinbase’s derivatives offerings. The BNB-PERP market will launch on or after 9:30 AM UTC on April 3, 2025.

Coinbase Will Support BNB Perpetual Contracts

In an official statement, Coinbase International Exchange confirmed the move and revealed plans to add support for BNB perpetual futures starting next week.

“We will add support for BNB perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our BNB-PERP market will begin on or after 9:30 am UTC 3 APRIL 2025,” read the announcement.

Coinbase Traders, the official account for advanced trading on the platform, echoed the announcement in a post on X (Twitter). Introducing BNB perpetual futures on Coinbase’s international platforms presents new opportunities for traders.

For Coinbase users, this means access to perpetual futures contracts, a type of derivative that does not have an expiration date. It allows traders to hold positions indefinitely. The feature will be available on Coinbase International Exchange, catering to non-US users, and Coinbase Advanced, which is tailored for experienced traders.

This move strengthens Coinbase’s derivatives market and positions the exchange as a competitor to Binance, which already supports BNB futures. Expanding its futures offerings allows Coinbase to attract more traders looking for diversified investment opportunities.

For BNB users, the listing on a major global exchange like Coinbase International expands market reach and trading opportunities. This increased exposure could influence BNB’s market value due to heightened demand and trading volume.

Changpeng Zhao’s Reaction Sparks Criticism

For BNB, listing on a prominent exchange like Coinbase enhances its accessibility and credibility. This increased availability could boost adoption, though traders should remain cautious of speculative price movements and volatility surrounding the launch. Binance founder Changpeng Zhao (CZ) commented on the development.

“No one applied for this. Focus on building. Listing comes naturally. BNB,” CZ chimed.

His remark suggests the strength of the Binance ecosystem, rather than direct listing applications, drives BNB’s growth and adoption.

Market sentiment remains mixed, with some traders expressing optimism about BNB’s future. Meanwhile, others challenge Coinbase’s “natural listing” of BNB perpetual futures, questioning the transparency and fairness of the selection process.

“Listing comes naturally? Doors that open naturally are often already open for some and locked for others. If there’s no application, who decides who gets “naturally” listed? True decentralization isn’t about not knocking — it’s about removing the doorman,” one user remarked.

This critique aligns with broader blockchain debates on true decentralization, which is expected to reduce trust and control disparities, not create new gatekeepers.

Nevertheless, with perpetual futures, leverage opportunities become a key factor. BNB traders on Coinbase can control larger positions with less capital. Notably, while leverage can amplify potential gains, it also increases the risk of significant losses.

Meanwhile, BeInCrypto data shows BNB was trading for $628.40 as of this writing, down by almost 2% in the last 24 hours. The listing is also expected to increase liquidity and volatility for BNB, particularly around the launch date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure

-

Market21 hours ago

Market21 hours agoWill Bitcoin Hit $90,000 in April? Analysts Weigh In

-

Market23 hours ago

Market23 hours agoHow the LIBRA Scandal is Undermining Milei’s Trust in Argentina

-

Altcoin23 hours ago

Altcoin23 hours agoBonk Inu Acquires Exchange Art Marketplace, BONK Price To Rally?

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Chair Nominee Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry

-

Market24 hours ago

Market24 hours ago4 Altcoins That Could Hit New All-Time Highs in April 2025

-

Market16 hours ago

Market16 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3