Market

Top 3 AI Coins of the Fourth Week of June 2024

The Artificial Intelligence (AI) landscape is vast and continues to grow. As a result, every week, a new token emerges, performing better than all the others. For the fourth and final week of June, it happens to be Matrix AI Network (MAN), LimeWire (LMWR), and PAAL AI (PAAL).

The biggest news of the week, on the other hand, is the collaboration between Google and Gemini. Announced during the Google I/O 2024 Conference on Tuesday, the collaboration will introduce a Gemini AI side panel in Gmail that will assist users in writing emails and summarizing threads.

This feature is expected to be rolled out to all of Google’s products, including Docs, Sheets, Drive, and Slides.

MAN Did Not Fail to Impress

Matrix AI Network (MAN) price had a pretty good run this past week, rising by more than 40% in the span of a week. The AI token bounced back from the critical support at $0.027 to change hands at $0.041 at the time of writing.

The sharp increase also revived investor bullishness, which was visible in the increasingly intense bullish crossover noted on the Moving Average Convergence Divergence (MACD) indicator. The rising green bars on the indicator highlight a continued increase in the future.

Read More: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

The MAN price could reach $0.050, provided it can flip the resistance at $0.042 into a support floor. But if this fails and the altcoin slips below $0.037, a drawdown to $0.027 is likely.

LimeWire Has a Lot to Cover

While LimeWire’s price rose 36% this week, impressing investors, it has barely escaped the massive crash noted by the altcoin. Throughout May and June, LMWR fell by more than 77%, bringing the price down from $1.3 to $0.34.

The Artificial Intelligence token is currently trading at $0.40, and it seems to be on the path to recovery. However, the altcoin would need to breach two crucial resistances at $0.49 and $0.64.

Once these are flipped into support, the altcoin could rise back up to $0.80 and regain about half of the profits it lost.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

But the rise could take a while, and if the hype around LMWR fizzles out in a few days, this could become significantly difficult. Failure to breach $0.49 could result in consolidation, invalidating the bullish thesis.

Good Job PAAL

PAAL AI (PAAL) witnessed a 22% rise over the past week as the altcoin inched close to the barrier at $0.30. Trading at $0.27, PAAL could take a shot at reclaiming the losses noted since mid-May to the last week.

In order to completely recover the lost gains, the altcoin would need to chart a rise to $0.51. This resistance level also happens to be the critical barrier for PAAL, as the altcoin has failed to breach it twice in the last two months.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

A successful breach would enable a rally for PAAL AI, but if the Artificial Intelligence token loses momentum before then, the rise could halt mid-way. The likely decline will bring PAAL back to the support at $0.21, and losing it could invalidate the bullish thesis altogether.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Surges 8% as Bulls Push for Breakout

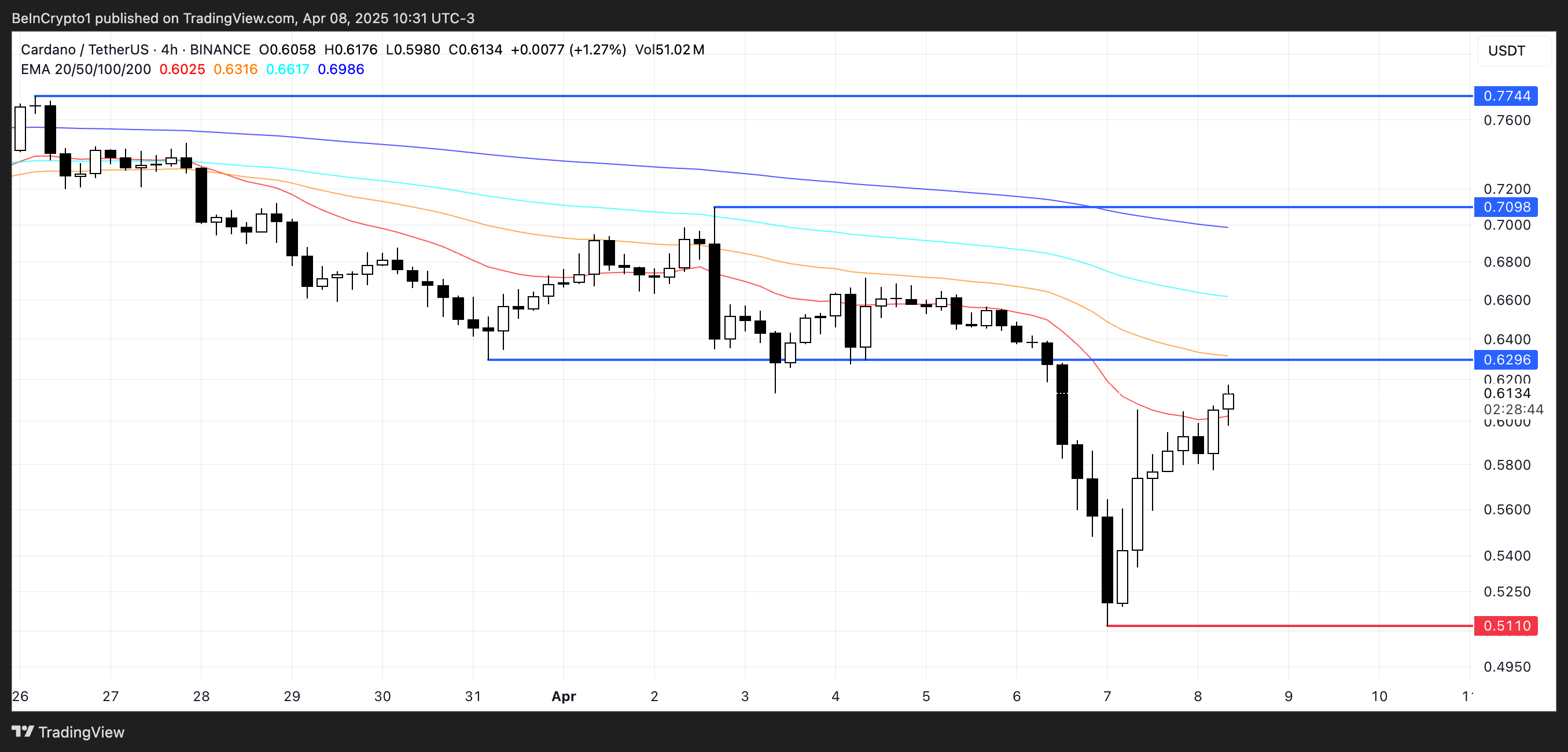

Cardano (ADA) is showing signs of life despite dropping 3% in the past 24 hours as traders weigh the possibility of a broader recovery. Technical indicators like BBTrend and DMI are flashing mixed signals, hinting that momentum may be fading after a brief surge.

ADA’s BBTrend has flipped into negative territory, while its DMI suggests bulls are gaining ground but haven’t fully taken control. With ADA hovering just above key support levels, the next few sessions will be crucial in determining whether this rally has legs or if another correction is around the corner.

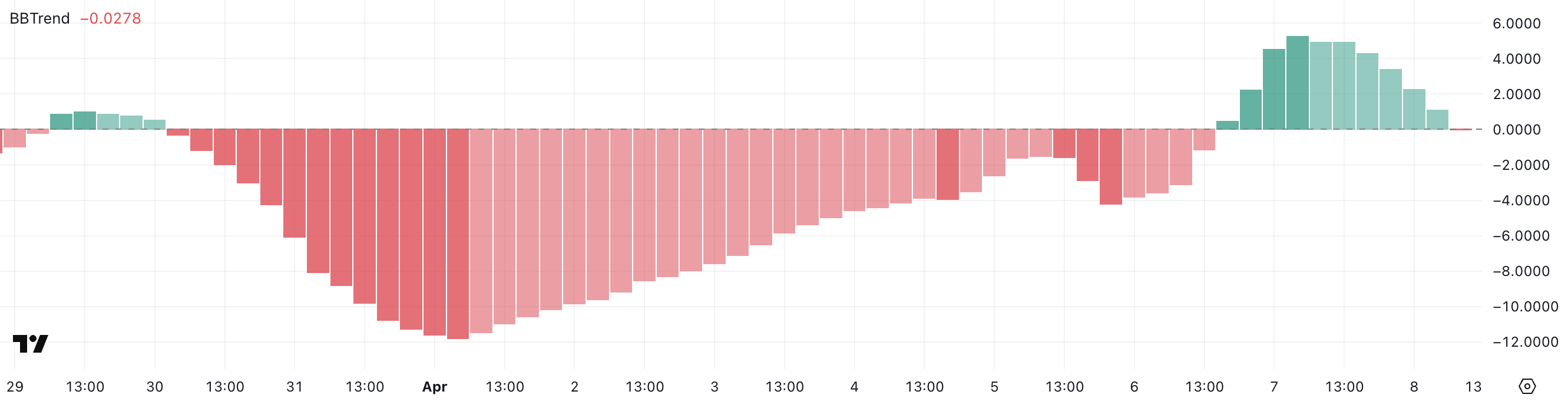

ADA BBTrend Is Fading After Reaching Levels Above 5 Yesterday

Cardano’s BBTrend indicator has flipped into negative territory, currently sitting at -0.02 after reaching a positive peak of 5.28 just a day earlier.

This sharp reversal highlights a potential shift in market sentiment, suggesting that bullish momentum may be losing strength.

The abrupt drop adds to growing concerns among ADA holders, especially with the broader altcoin market showing signs of weakness.

The BBTrend (Bull and Bear Trend) indicator measures the strength and direction of a price trend. Values above +1 typically indicate a strong bullish trend, while readings below -1 signal a strong bearish trend.

A value near zero, like the current -0.02, suggests indecision or a possible trend reversal.

For Cardano, this neutral-to-negative reading could mean that upward momentum is fading, increasing the risk of further downside if selling pressure builds in the coming sessions.

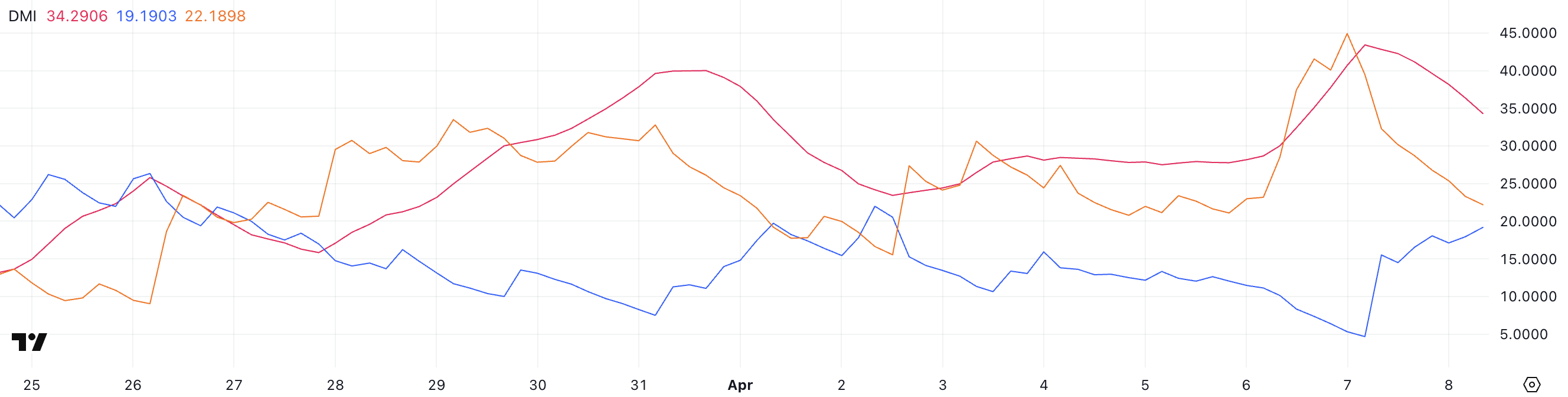

Cardano DMI Shows Buyers Are Almost Taking Control

Cardano’s DMI (Directional Movement Index) chart shows that its ADX, which measures trend strength, has dropped to 34.29 from 43.41 yesterday.

While this indicates that the current trend is weakening, the ADX is still well above the key 25 threshold, meaning the market remains in a strong directional move.

The shift suggests that although momentum is cooling, the currently bearish trend hasn’t lost control just yet.

The ADX is part of the DMI system, which includes the +DI (positive directional index) and -DI (negative directional index).

The +DI has climbed from 4.68 to 19.19, showing growing bullish interest, while the -DI has sharply dropped from 44.92 to 22.18. This narrowing gap hints at a potential trend reversal or at least a slowing of bearish momentum.

However, since -DI is still slightly above +DI and ADX remains elevated, ADA is technically still in a downtrend — though bulls may be starting to regain some ground.

Is Cardano Getting Ready For A Recovery?

Cardano price is currently attempting a recovery after dipping below the $0.52 mark, a key support level in recent weeks. If buyers manage to confirm their strength and sustain upward momentum, ADA could first test resistance at $0.629.

A successful breakout above that could open the path toward $0.70, and if bullish pressure continues, a further rally to $0.77 may be on the table — levels not seen since early 2024.

However, if ADA fails to hold its current ground and bearish momentum returns, the token risks sliding back below $0.52.

A move toward $0.51 would be the first critical test, and losing that level could push Cardano below the $0.50 threshold for the first time since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

US DOJ Will No Longer Investigate Crypto Exchanges

The US DOJ just published a new directive claiming it will stop investigating and criminally charging crypto exchanges, mixers, and offline wallets.

This has produced a mixed response from the crypto community. Some sectors are jubilant about the potential freedom for business, while others fear the growing problem of fraud and criminal money laundering.

DOJ is Moving On From Crypto

The US financial regulatory apparatus has been much more friendly to crypto since President Trump took office. The SEC is reviewing its guidelines, the FDIC is working to prevent future debanking, and the entire political climate is changing.

Today, the Department of Justice (DOJ) released a statement claiming it will no longer investigate crypto entities.

“The Justice Department will stop participating in regulation by prosecution in this space. Specifically, the Department will no longer target virtual currency exchanges, mixing and tumbling services, and offline wallets for the acts of their end users or unwitting violations of regulations,” the DOJ’s statement claimed.

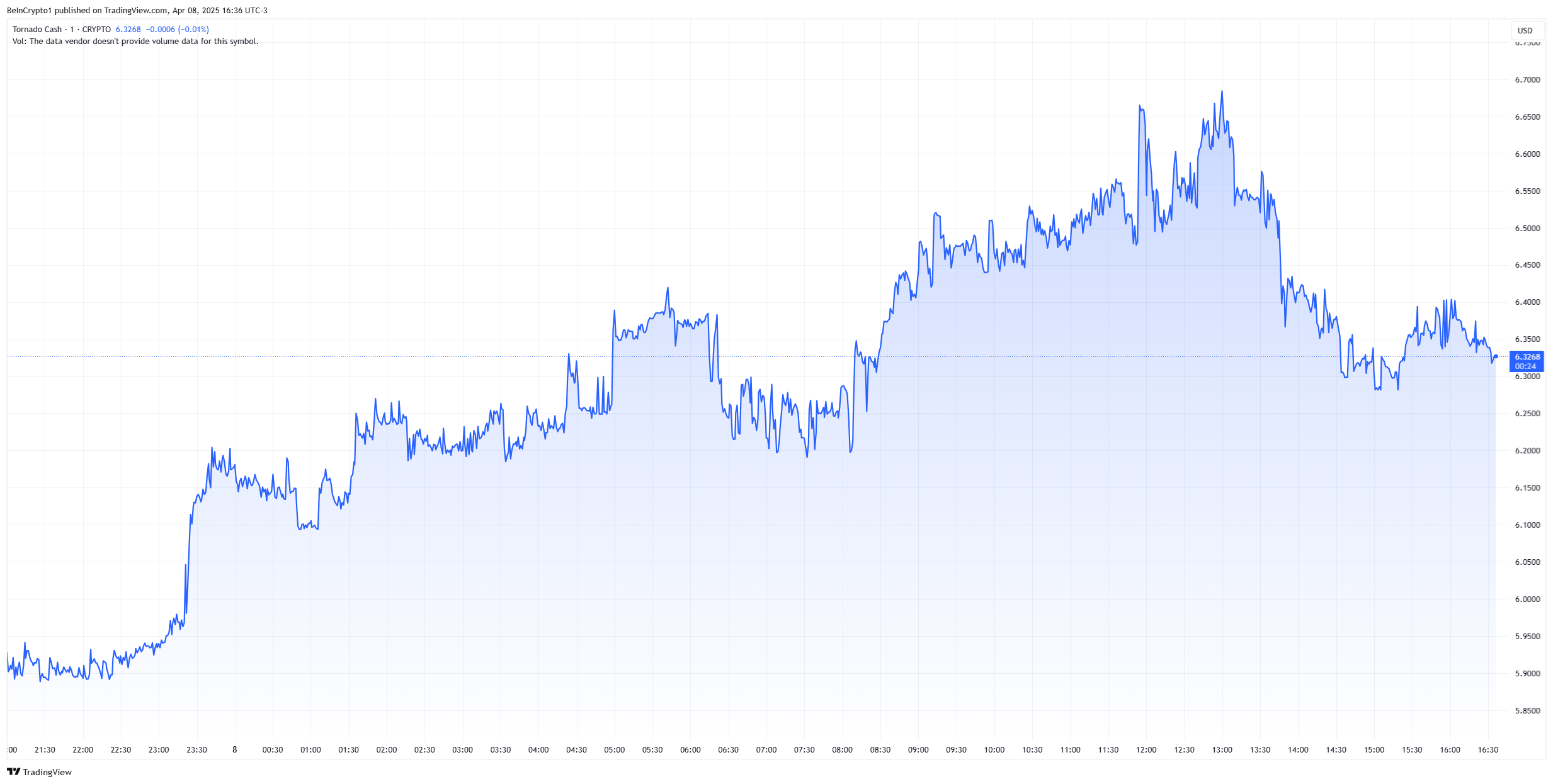

The DOJ’s statement applies to cryptocurrency exchanges, wallets, and crypto mixers like Tornado Cash. It builds on the Department’s previous announcement today, claiming that it disbanded the National Cryptocurrency Enforcement Team.

The department gives itself room to prosecute individual bad actors, but only in specific circumstances.

The US DOJ has been notorious for leading some of the biggest criminal investigations against crypto exchanges, such as Binance and KuCoin. Its critical investigation and charges against Binance led to the record $4.3 billion settlement in 2023.

However, the department is now moving on from crypto. According to today’s announcement, it will even drop any ongoing investigations against such entities immediately.

Also, it will not pursue legal liability for developers whose code is used by others to commit crimes, and it has closed all active investigations.

While it was expected that the department would lower its crypto enforcement under Trump, the complete laissez-faire decision has caught the crypto by surprise. Following the news, Tornado Cash (TORN) surged nearly 10% today.

The Department also asked regulators to review victim compensation laws. Although this is arguably a victory for crypto, it may also enable future finance crimes.

Will Crypto Crime Run Riot?

Crypto sleuth ZachXBT recently claimed that there is an “eye-opening” level of North Korean activity in DeFi. If the department turns a blind eye to major criminal operations on these exchanges and mixers, it may enable serious violations.

After the announcement first broke, crypto Twitter was filled with users declaring that “crime is legal now.”

Additionally, the industry may be pushing its luck with a dramatic move like this. Crypto scams are at an epidemic level right now, and the market is very uncertain.

The DOJ is disabling its ability to target criminals on exchanges and mixers, with little guarantee that it can enforce the law. In other words, it may be removing critical guardrails to prevent future disasters.

“Crypto lobby: ‘Sure, Trump nixed the Crypto Enforcement Team, directed Major Fraud prosecutors to stop prosecuting crypto cases, and is trying to exempt crypto platforms from the Bank Secrecy Act, but they wrote right here that they care about stopping crypto crime! Reject the evidence of your eyes and ears!’” claimed crypto researcher Molly White.

Overall, it’ll be difficult to fully predict the implications of the department’s new policy on exchanges. For now, this directive will give many crypto-related businesses the freedom to conduct operations as they see fit.

Hopefully, business will proceed as usual without any serious controversies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Yellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

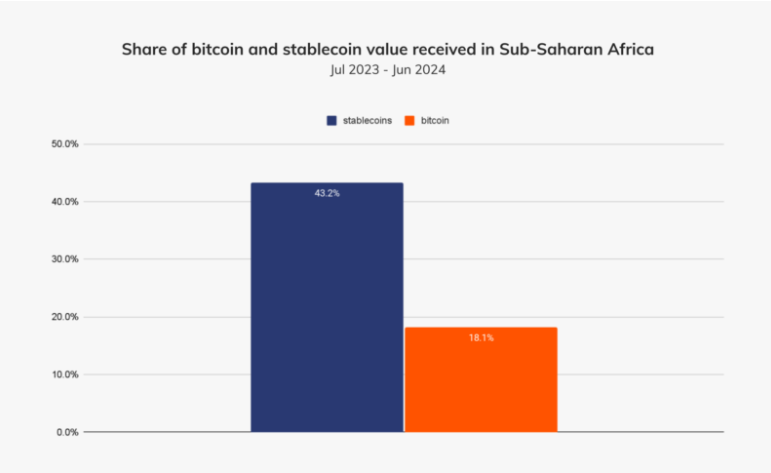

For years, crypto in Africa was synonymous with Bitcoin (BTC). Today, that narrative has flipped, with companies like Yellow Card, a crypto exchange operating in Africa, clearly reflecting this shift.

In an exclusive with BeInCrypto, Yellow Card co-founder and CEO Chris Maurice reveals how it is building a pan-African stablecoin network to leapfrog traditional finance (TradFi). This is amid growing regulatory clarity, collapsing fiat systems, and a remittance revolution.

Stablecoins Are Transforming Africa’s Financial Scene

The pan-African exchange operates in over 20 markets, and Maurice says stablecoins now account for over 99% of its transactions. This makes Yellow Card a bellwether for what might be the most transformative trend in emerging markets finance.

“When we first launched Yellow Card in 2019, people were exclusively buying Bitcoin. Now, the most popular asset is Tether (USDT),” Maurice told BeInCrypto.

As it happened, necessity, not speculation, has driven this evolution. Africa leads the world in peer-to-peer (P2P) crypto trading volume. However, unlike global crypto hubs chasing volatile returns, Africans are choosing stablecoins out of financial survival.

Local currencies are eroding under inflationary pressure in countries like Nigeria, which ranks second globally in crypto adoption (per Chainalysis). Stablecoins offer a reliable store of value and seamless means of cross-border payments.

This is especially critical in a continent with $48 billion annual remittances and persistent banking limitations.

“Stablecoins are solving practical financial services challenges in Africa. People aren’t in love with the tech. They need faster, cheaper ways to move money to survive and thrive,” Maurice added.

Infrastructure Built for the Unbanked

Yellow Card has gone beyond trading services. Its infrastructure integrates mobile money systems (like M-Pesa in Kenya) and local fiat currencies such as the Nigerian naira and Ghanaian cedi. According to the firm’s CEO, this helps onboard users without bank accounts.

By managing compliance, currency exchange, and payments internally, the firm enables businesses to operate without battling unreliable local rails.

“Our mission is to let companies invest, hire, and grow in emerging markets without needing to stress over infrastructure. We’ve built the back office [meaning] cybersecurity, AML, [and] data protection, so they can focus on growth,” he articulated.

The Regulatory Dam Has Broken

Maurice also observed that African regulators kept crypto in limbo for years. In Yellow Card’s view, 2024 marked a tipping point.

“There is regulatory momentum in Africa that is only accelerating. The dam has broken,” he said.

South Africa now classifies crypto as a financial product. It has licensed major exchanges like Luno and VALR. Countries in the Central African Economic and Monetary Community (CEMAC), Mauritius, Botswana, and Namibia have followed suit with licensing regimes.

Meanwhile, regulatory incubators are emerging in Kenya, Nigeria, Rwanda, and Tanzania. Against this backdrop, Maurice says Yellow Card has actively helped draft legislation in Kenya and supports crypto frameworks in Morocco.

Fighting the Informal Market

Still, challenges remain. In countries like Ethiopia, Cameroon, and Morocco, outright bans have driven users underground into high-risk P2P networks. Yellow Card pushes for frameworks that level the playing field for compliant players.

“We face a lot of competition from companies that don’t maintain high AML standards…A level playing field is all we seek,” he said.

With $85 million in venture funding, Yellow Card is deploying capital into compliance and partnerships. With this, the company positions itself as the go-to infrastructure provider for global firms looking to tap African markets.

From Africa to Emerging Markets Everywhere

Cross-border payments are perhaps Yellow Card’s most powerful use case. The company’s co-founder says its stablecoin-powered rails are helping businesses reduce working capital needs, expand to new regions, and hire faster.

“We’ve had clients tell us we’ve enabled them to scale into new countries and reduce their costs dramatically. That’s real economic impact,” said Maurice.

The company is not stopping at Africa. Its infrastructure extends into other frontier markets, with a wave of strategic partnerships expected in 2025.

“Yellow Card has built a series of easy buttons for developed world companies to expand into complicated, high-growth markets,” he noted.

The End of SWIFT?

Perhaps the boldest claim from Yellow Card is what it sees on the five-year horizon: the decline of SWIFT and traditional international transfers altogether.

“As we look out five years, SWIFT is in trouble. In ten, no one will be making international wires again,” Maurice chimed.

Backed by enterprise-grade security and regulatory rigor, Yellow Card attracts interest from blue-chip firms like PayPal and Coinbase exchange, which are looking for stablecoin partners in emerging markets.

“Stablecoins are already a standard part of the financial infrastructure in Africa. CFOs and treasurers in traditional industries are now routinely using them to store and transfer value,” he added.

Africa’s crypto market is still small compared to global giants. Nevertheless, as the world shifts from speculation to utility, the continent’s fragmented financial systems may offer a glimpse into crypto’s most impactful use case: economic empowerment. For Yellow Card, the mission is clear and increasingly urgent.

“We’ve built a company for longevity and scale. Crypto adoption in Africa is stablecoin adoption,” Maurice concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoSolana’s Fartcoin Jumps 20% Despite Market Selloff

-

Market18 hours ago

Market18 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Market24 hours ago

Market24 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Altcoin22 hours ago

Altcoin22 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Market22 hours ago

Market22 hours agoRWA Tokens Outperform Bitcoin During Tariffs

-

Market21 hours ago

Market21 hours agoRWA Tokenization Takes Center Stage in Hong Kong

-

Market13 hours ago

Market13 hours agoBitcoin Price Recovery In Play—But Major Hurdles Loom Large

-

Market19 hours ago

Market19 hours agoHedera (HBAR) Drops 8% as Market Signals Remain Mixed