Market

Token Unlocks to Watch Next Week: TIA, SUI and OP

Token unlock involves releasing tokens that were previously blocked under fundraising terms. Projects carefully schedule these releases to avoid market pressure and prevent a drop in token prices.

Here are five major token unlocks to keep an eye on next week.

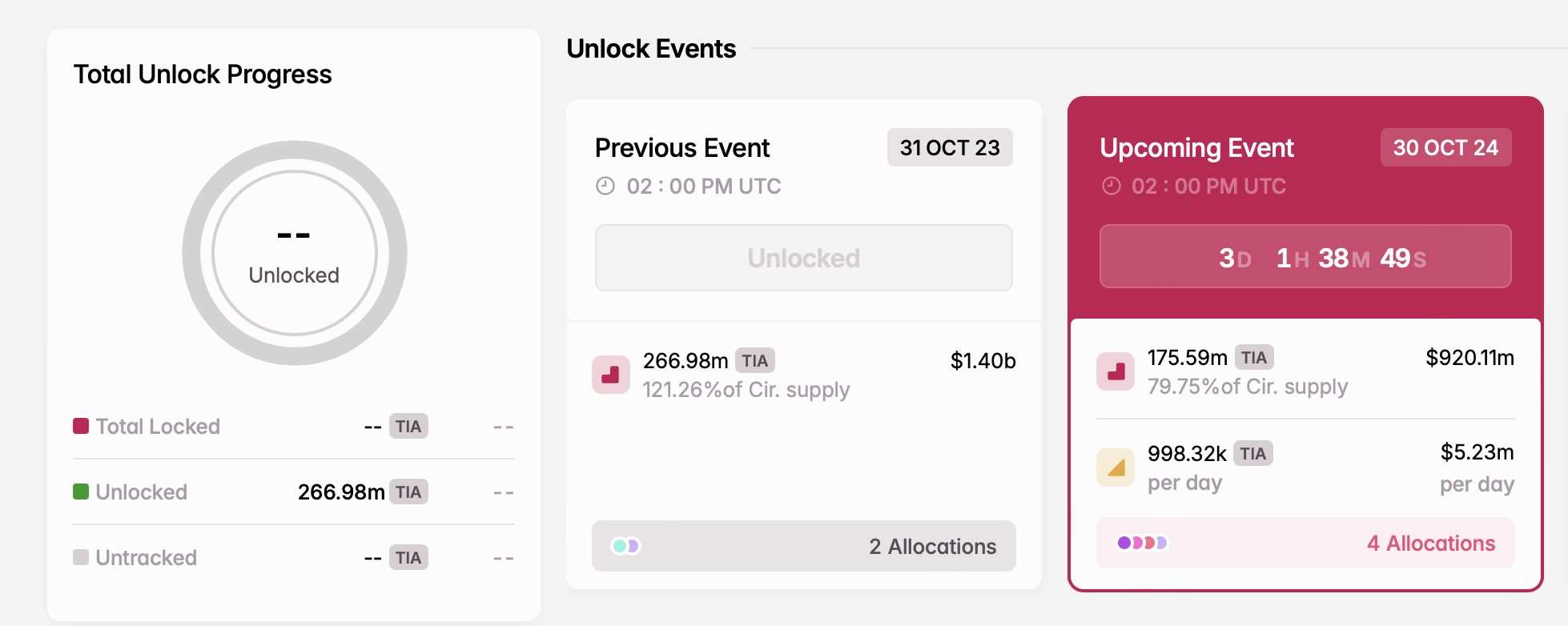

Celestia (TIA)

- Unlock date: October 30

- Number of tokens unlocked: 175.59 million TIA

- Current circulating supply: 220.16 million TIA

Celestia, a modular data availability network, simplifies blockchain launches. On October 30, Celestia will unlock 175.56 million TIA tokens, valued at $920 million, and allocate these coins to early backers and initial core contributors. This massive unlock has sparked concerns about potential selling pressure.

“While some argue for a “bullish unlock” due to OTC activities, simple market dynamics tell a different story. The tokenomics design shows concerning flaws that can’t be ignored. TIA has potential for 3-digits IF the tokenomics weren’t so manipulated. But with VCs having such enormous profit margins and this aggressive unlock structure, we’re looking at significant downward pressure,” one X user wrote.

Read more: What Is Blockchain and How Does it Work?

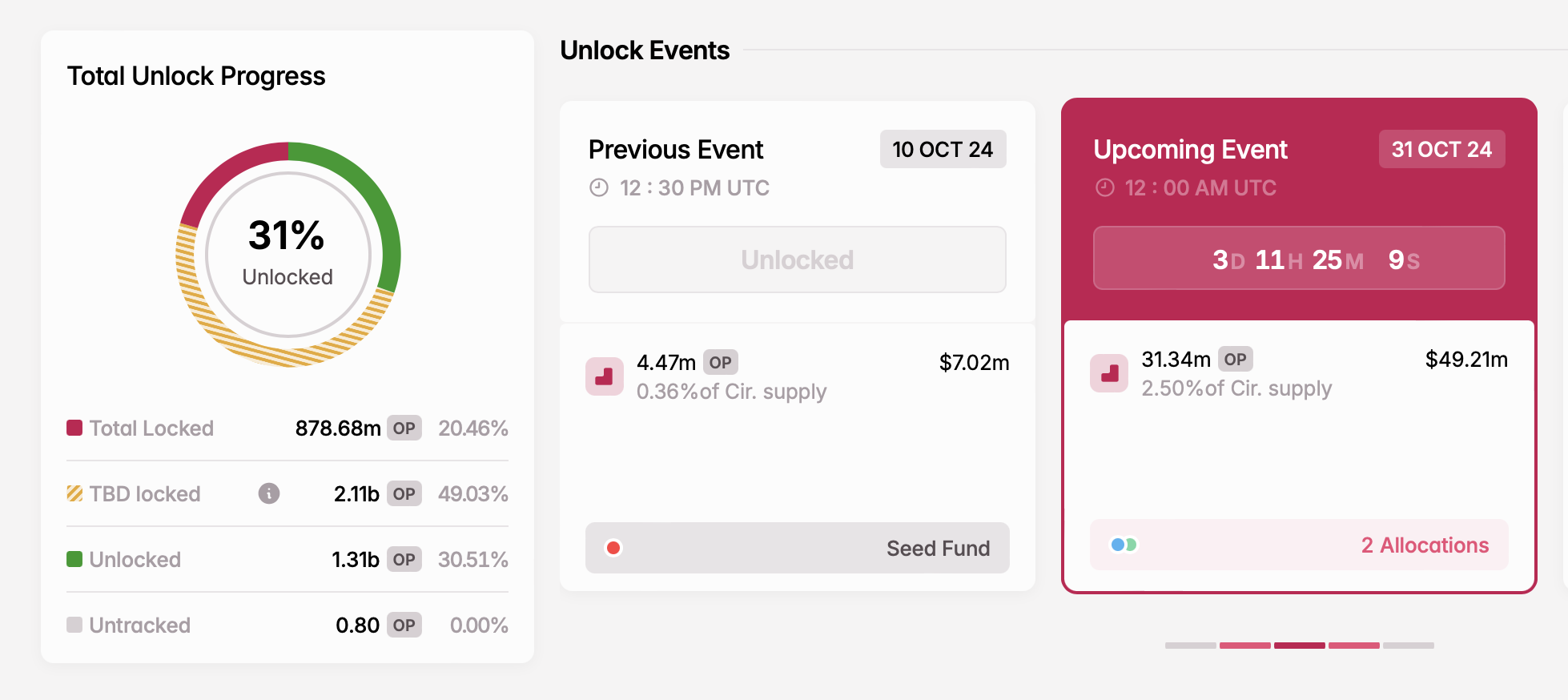

Optimism (OP)

- Unlock date: October 31

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.25 billion OP

Optimism is a Layer-2 scaling solution designed to improve the speed and lower the costs of transactions on the Ethereum mainnet. The OP token plays a crucial role in governance, allowing holders to vote on proposals and decisions that shape the network’s development and management.

On October 31, Optimism will increase its circulating supply by 31.34 million OP. According to Tokenomist (formerly TokenUnlocks), the project will allocate these tokens to core contributors and investors.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

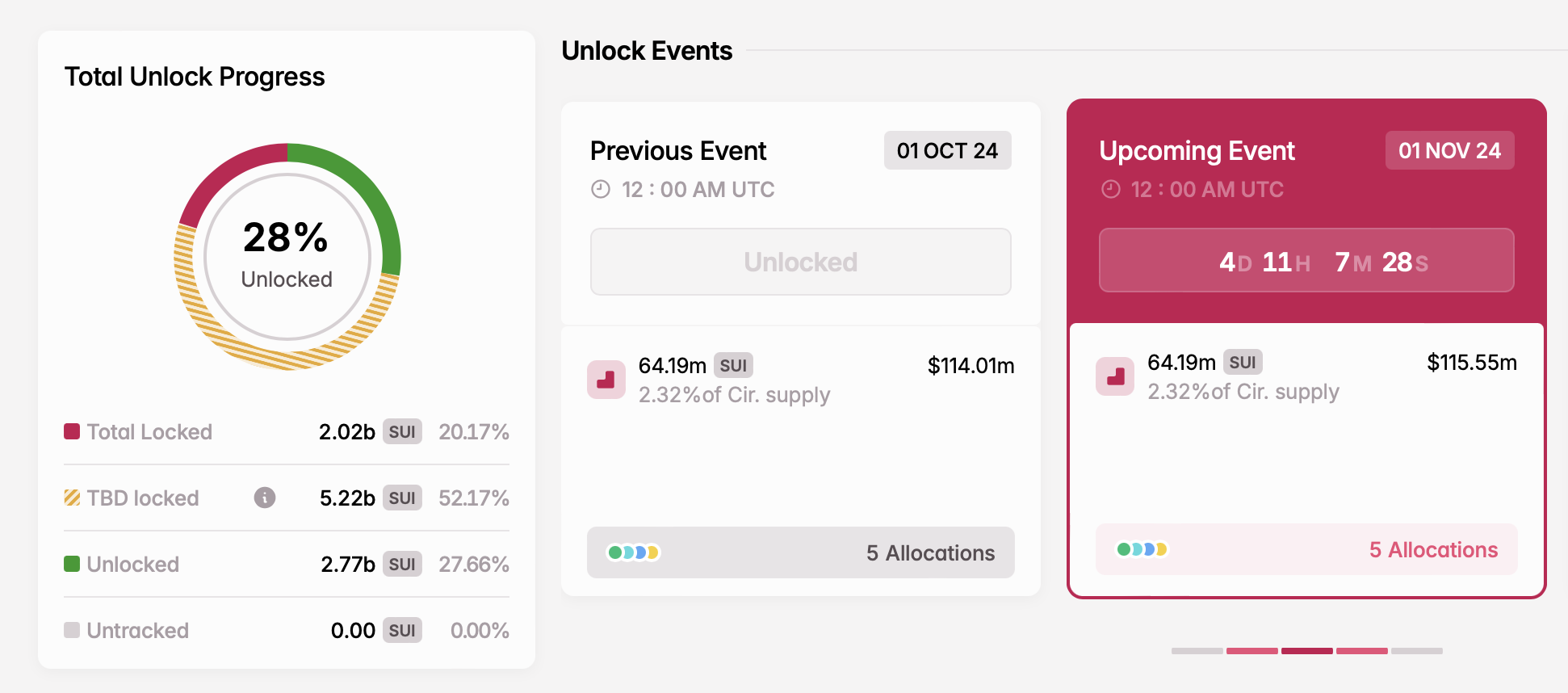

Sui (SUI)

- Unlock date: November 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 2.76 billion SUI

Sui is a high-performance Layer-1 blockchain that utilizes a Proof-of-Stake consensus to increase network operation and security. The project was developed by Mysten Labs, a company founded in 2021 by former Novi Research employees who created the Diem blockchain and the Move programming language.

The SUI token facilitates governance, enabling token holders to vote on important proposals and shape the platform’s future. The next unlock will happen on November 1, releasing a large portion of tokens set aside for Series A and B participants, community reserve, and the Mysten Labs treasury.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

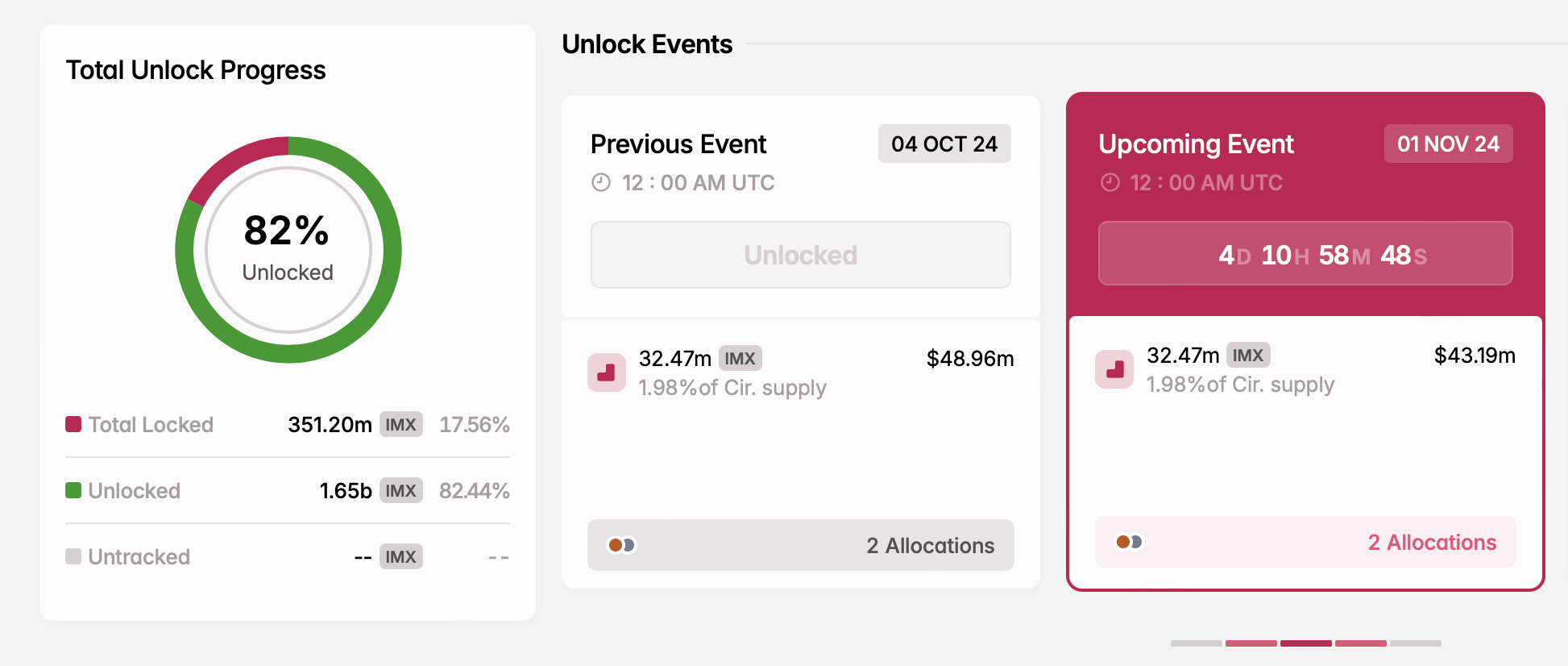

Immutable (IMX)

- Unlock date: November 1

- Number of tokens unlocked: 32.47 million IMX

- Current circulating supply: 1.63 billion IMX

Immutable is a Layer-2 solution for scaling NFTs on the Ethereum blockchain. In September 2021, the project raised $12.5 million during the IMX token sale on the CoinList platform in just one hour. In March 2022, it closed a $60 million investment round and secured an additional $200 million from investors, including ParaFi Capital, Declaration Partners, and Tencent Holdings.

On November 1, the circulating supply of IMX will increase by 32.47 million tokens. These newly unlocked coins will be allocated to the development of the project and the broader Immutable ecosystem.

Read more: What Is Immutable?

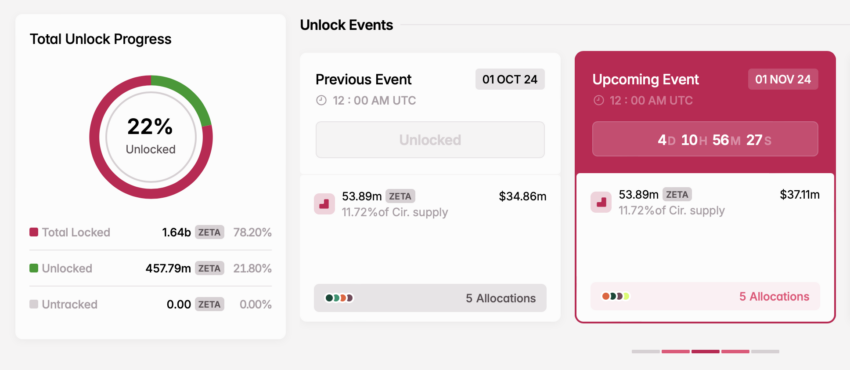

ZetaChain (ZETA)

- Unlock date: November 1

- Number of tokens unlocked: 53.89 million ZETA

- Current circulating supply: 459.59 million ZETA

ZetaChain is a decentralized blockchain platform that enables seamless interoperability across various blockchain networks. One of its main features is cross-chain communication, which allows for the exchange of tokens and data between different blockchains, such as Ethereum and Binance Smart Chain.

On November 1, it will unlock nearly 54 million ZETA tokens. The newly released coins will be allocated across several initiatives, including a user growth pool, an ecosystem growth fund, support for core contributors, advisory roles, and liquidity incentives.

Read more: What Is Blockchain Interoperability?

Next week’s smaller cliff unlocks include dYdX (DYDX), Galxe (GAL), Cardano (ADA), and Ethena (ENA), among others, with a combined value surpassing $1.24 billion.

While many see token unlocks as bearish, a well-structured schedule can actually support a project’s long-term success. Tied to key milestones and development, unlocks can motivate the team, engage the community, and drive ecosystem growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has staged an impressive recovery to reclaim the $2 price level after plunging to a weekly low of $1.657 in a steep midweek correction. The rebound comes at a crucial time for the cryptocurrency, with analysts paying closer attention to historical price behaviors and bullish technical patterns. Among them is EGRAG CRYPTO, a popular XRP analyst on X, who believes that the cryptocurrency could be on the cusp of a monumental surge reminiscent of its previous bull cycles in 2017 and 2021.

The Power Of Time Cycles And Exponential Moving Averages

EGRAG’s technical analysis focuses on a recurring structure seen in XRP’s past cycles, using the 21-period Exponential Moving Average (EMA) and 33-period Moving Average (MA) on the biweekly timeframe. According to his analysis, which was revealed on social media platform X, both the 2017 and 2021 rallies were preceded by similar technical setups: a sustained bottoming process lasting around 770 days followed by a bullish reversal.

Related Reading

These phases were marked by what he described as “blow-off tops,” where XRP posted parabolic gains after bouncing off the 21 and 33 exponential moving averages. The current market structure, EGRAG noted, aligns closely with those previous cycles. After a prolonged bearish trend and a second recorded “bearish cross” in 2022, XRP has once again moved above both the 21 EMA and 33 MA.

In his view, this sets the stage for a similar breakout scenario, one that could play out before the end of 2025. EGRAG uses this pattern to suggest a timeline of roughly 770 days from the last major crossover in early 2022, placing the projected breakout target around September 29, 2025.

XRP Can Surge To $45

Interestingly, EGRAG’s price prediction based on the premise of how a similar 2017 or 2021 movement can play out for XRP. In 2017, XRP posted a rally of approximately 2,700%, and in 2021, a slightly lower surge of about 1,050%. By mapping those gains onto the current price structure, EGRAG predicted two potential targets: a more conservative $19 level and a bold $45 level. Between these two targets is a mid-range target of $27 which he has previously favored.

Related Reading

However, the analyst warned that while chart patterns offer insight, they are not perfect predictors. In his own words, “Will it rhyme exactly? No, because if it were that easy, everyone would be a multimillionaire.” Still, the emotional patterns of market participants, human reactions and behaviors, tend to repeat to create opportunities where a previous price action might play out again, even if not 100%.

The analyst ended his analysis with a strategic note to long-term holders and short-term traders alike, consider a Dollar-Sell-Average (DSA) approach when the XRP price starts to climb.

At the time of writing, XRP is trading at $2.04, up by 2.6% in the past 24 hours.

Featured image from Adobe Stock, chart from Tradingview.com

Market

Solana Bulls Lead 17% Recovery, Targeting $138

Solana plunged to a 12-month low of $95.23 on April 7, marking a sharp decline amid broader market turbulence.

However, as the market embarked on a recovery this week, SOL has witnessed a rebound, with its price climbing as demand surges.

SOL Rebounds 17%, Eyes Further Gains

Since SOL began its current rally, its value has soared by 17%. At press time, the altcoin trades at $124.58, resting atop an ascending trend line.

This pattern emerges when the price of an asset consistently makes higher lows over a period of time. It represents an uptrend, indicating that SOL demand is gradually increasing, driving its prices higher. It suggests that the coin buyers are willing to pay more, and it serves as a support level during price corrections.

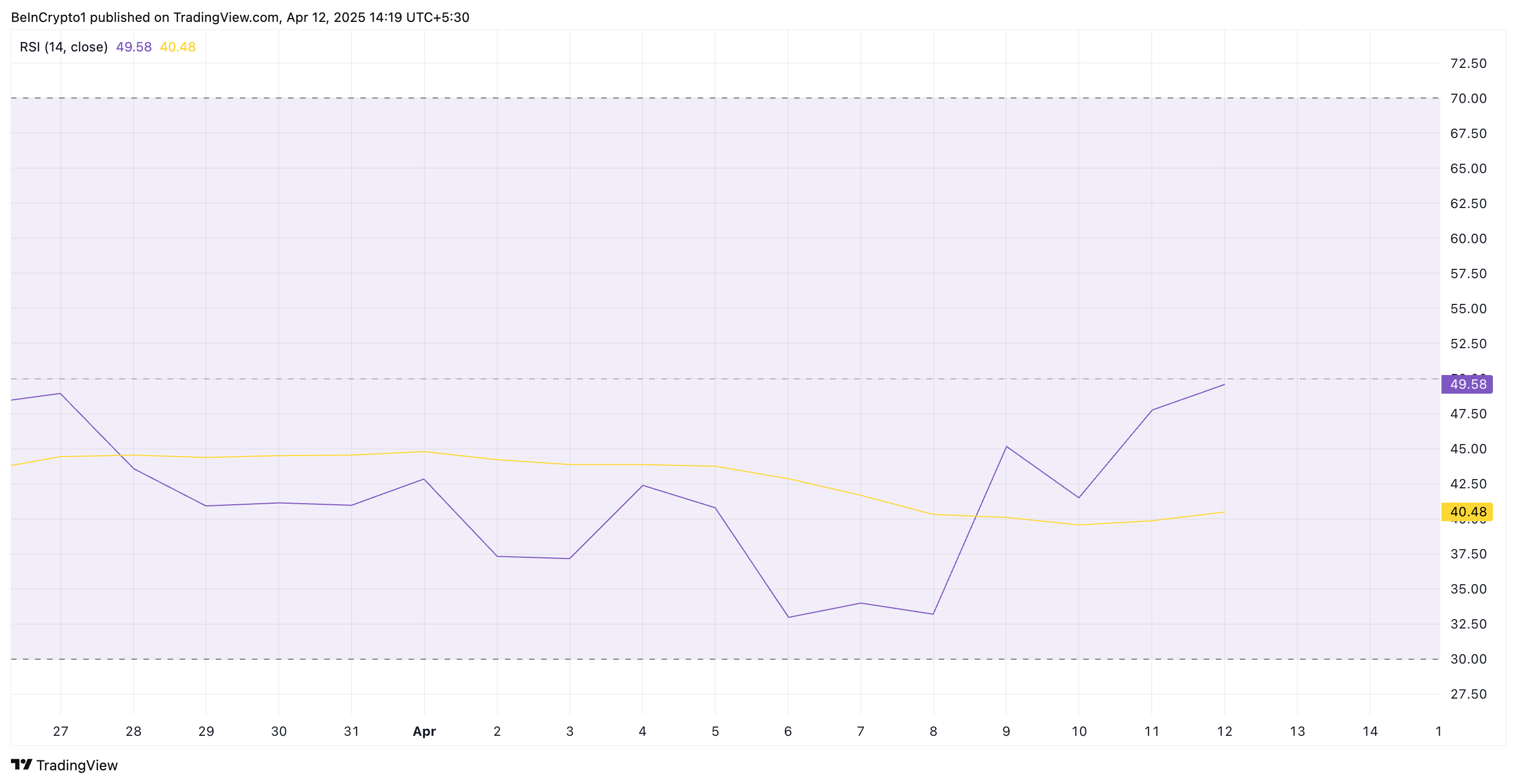

SOL’s recovery is further supported by its rising Relative Strength Index (RSI), indicating increasing buying interest. This momentum indicator is at 49.58 at press time, poised to break above the 50-neutral line.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.50 and climbing, SOL’s RSI signals a steady shift in momentum from bearish to bullish. A rise above 50 would confirm increasing buying pressure and a potential for a sustained upward price movement.

Solana Bulls Eye $138

SOL’s ascending trend line forms a solid support floor below its price at $120.74. If demand soars and the bullish presence with the SOL spot markets strengthens, the coin could continue its rally and climb to $138.41.

However, if profit-taking commences, the support at $120.74 would be breached, and the SOL’s price could revisit $95.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple May Settle SEC’s $50 Million Fine Using XRP

Ripple’s long-running legal clash with the US Securities and Exchange Commission (SEC) appears to be nearing its final chapter.

However, a surprising detail has emerged from the ongoing settlement talks, which could see Ripple pay its reduced $50 million penalty using its native token, XRP.

Ripple Could Use XRP Token to Pay SEC Fine

On April 11, Ripple CEO Brad Garlinghouse appeared on FOX Business. At the interview, he revealed that the idea of paying the penalty in XRP was floated during settlement discussions.

“The SEC is going to end up with $50 million and the US government gets $50 million and we talked about making that available in XRP,” Garlinghouse stated.

The ongoing negotiations follow Ripple’s and the SEC’s decision to drop their appeals, bringing the multi-year legal battle closer to closure.

“We’re moving past the SEC’s war on crypto and entering the next phase of the market – true institutional flows integrating with decentralized finance,” Garlinghouse added in a post on X.

Judge Analisa Torres originally set the fine at $125 million in 2024, linking it to Ripple’s unregistered XRP sales to institutional investors. Ripple complied by placing the funds in an interest-bearing account, but the appeals process delayed any further action.

With those appeals now abandoned, Ripple is expected to pay a reduced fine of $50 million.

A recent joint court filing confirms that both sides have reached a preliminary agreement. They are now seeking final approval from the SEC’s commissioners.

Once internal reviews are complete, the parties plan to request a formal ruling from the district court.

“There is good cause for the parties’ joint request that this Court put these appeals in abeyance. The parties have reached an agreement-in-principle, subject to Commission approval, to resolve the underlying case, the Commission’s appeal, and Ripple’s cross-appeal. The parties require additional time to obtain Commission approval for this agreement-in-principle, and if approved by the Commission, to seek an indicative ruling from the district court,” the filing stated.

If the commission votes in favor, this case could conclude one of the most closely watched regulatory battles in crypto history. More importantly, the use of XRP for the settlement could mark a significant shift in the SEC’s approach to digital assets.

This turnaround would represent a major regulatory shift and could trigger further bullish momentum for the token.

Since Donald Trump’s election victory in November 2024, investor confidence in XRP has grown sharply, pushing the token’s value up by more than 300%.

At the same time, institutional interest continues to rise, as seen in the wave of spot exchange-traded fund applications tied to the token

Market analysts have linked this performance to the friendlier political climate. They also point to the potential reclassification of XRP as a commodity as a key factor driving the asset’s rise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin14 hours ago

Altcoin14 hours agoBinance Issues Important Update On 10 Crypto, Here’s All

-

Market24 hours ago

Market24 hours agoBinance and the SEC File for Pause in Lawsuit

-

Market15 hours ago

Market15 hours agoArthur Hayes Expects Bitcoin Surge if Fed Injects Liquidity

-

Altcoin13 hours ago

Altcoin13 hours agoSolana Meme Coin Fartcoin Price Could Hit $1.29 If It Holds This Key Level

-

Altcoin16 hours ago

Altcoin16 hours agoShiba Inu Burn Rate Explodes 1000%, Can SHIB Price Hit $0.000015?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Leads Market-Wide Drawdown As Altcoin Correlation Spikes – Details

-

Market21 hours ago

Market21 hours agoYouHodler CEO Talks DeFi, Crypto Lending, and Web3 Innovations

-

Market13 hours ago

Market13 hours agoBinance Reportedly Seeks Reentry Into American Market