Market

THORWallet CEO Explains Why DeFi is Here to Stay

In an interview with BeInCrypto, Marcel Robert Harmann, the Founder and CEO of THORWallet, shares his journey from the early days of crypto to building a successful wallet. Despite the noise created by trends like meme coins and NFTs, Harmann’s belief in the transformative potential of decentralized finance (DeFi) remains steadfast, even as the industry faces challenges with regulation and reputation.

Harmann also delves into the complex relationship between crypto and traditional finance, particularly when it comes to regulation, privacy, and the future of financial services. He discusses how THORWallet is bridging the gap between DeFi and CeFi, offering users a seamless experience while adhering to the core principles of decentralization and transparency.

Reflecting on Crypto Journey: How Marcel Harmann’s View of the Crypto Industry Has Evolved

Those early days were definitely tough in terms of the hours worked, but looking back, it was all worth it. It was hard work, but it didn’t feel like a burden—I was driven to achieve and to build.

Four years later, we’re still here, profitable and growing. The average lifespan of a crypto startup is usually less than 12 months, so we’ve managed to defy the odds.

My view on crypto has remained the same. The industry still excites me, but I think you really need to cut through the noise. There’s a lot of distraction, like the NFT hype, which has lost value over time except for a few select projects. Then, there are meme coins—just noise.

They’re mostly money grabs from people who don’t fully understand the mechanics behind them. With any fast-growing market, especially one involving large amounts of money, scams are inevitable. It’s just part of the industry.

The key is to stay focused, stick to your core principles, and not get distracted by the noise. Crypto, in my view, is still a paradigm shift, particularly for the financial industry, and my belief in its potential hasn’t changed.

Views on the Balance Between Regulation, Criminality, and Reputation in Crypto

I believe that proper regulation is essential, but it needs to be implemented in the right way and at the right time. For example, MiCA (the Markets in Crypto-Assets Regulation) isn’t inherently bad. However, recently, we’ve seen instances of over-regulation, even in Switzerland.

Switzerland is traditionally less regulated than the EU, but even here, we’ve seen regulatory overreach, particularly concerning stablecoins. This led to pushback from the industry, and after a lot of pressure and education towards regulators, the regulations were softened, which is a positive outcome.

In essence, good regulation is beneficial, but over-regulation can stifle innovation. Currently, the first part of crypto, like MiCA, is regulated, and DeFi (decentralized finance) is still in the process of being addressed. In my opinion, true DeFi protocols don’t necessarily need regulation.

However, regulators must verify if protocols are genuinely decentralized to protect users. They need to ensure that users are engaging with a non-custodial, decentralized technology and not a protocol with a centralized team behind the scenes that could tamper with the code—like in the case of a rug pull, where access to the admin key could allow manipulation.

Risks to Retail Investors

Some protocols claim to be decentralized but aren’t truly so, which poses a risk to retail investors. Regulators must assess whether DeFi protocols are genuinely decentralized. If they are and are built on a blockchain like Ethereum, they cannot shut down as long as the blockchain exists.

However, when users move assets from DeFi to traditional finance, regulators need to oversee the on- and off-ramp processes. The blockchain ensures full transparency, making it possible to trace the origin of funds and verify they are not involved in illicit activity.

So, I’m comfortable with where we’re heading in terms of regulation as long as it’s done the right way. But I do worry, particularly about the European Union, either not fully understanding the technology or, in some cases, deliberately trying to undermine DeFi altogether.

How Recent Crypto Trends, Like Bitcoin ETFs and Meme Coin Cycles, Have Shaped Blockchain Adoption

These cycles are overall more net positive. For example, Bitcoin ETFs bring institutional adoption, offering a stamp of approval from larger companies that say, “Yes, Bitcoin is here to stay” as an asset class.

This is a good thing overall. However, with meme coins and NFTs, it’s harder to say whether they’re net positive or not. While they attract a lot of new users, a lot of money is extracted from those who believe they can get rich quickly, but in the end, it’s just like a casino—where the house always wins.

Personally, I don’t focus on these trends. They will bring in more users, sure, but those who enter crypto and end up buying things like Trump coin, for example, often leave with a bad taste. They may not return for years.

It’s like when people first connected to the internet and got viruses from downloading an MP3. They were so burned by the experience that they didn’t touch the internet again for a while. Eventually, though, they came back once they understood it better.

The same will happen with crypto—people may be burned, but they will return when they understand the real value.

DeFi vs. CeFi

That being said, I believe there are genuine projects building a truly decentralized financial system that will exist alongside the traditional financial system. Projects like Compound and the first wave of DeFi protocols were the first iteration to showcase true financial innovation.

Then you have projects like ThorWallet, which is building a Web3 neo-bank. With ThorWallet, you can have your own bank in your pocket, and interact with DeFi protocols while also incorporating CeFi parts for convenience, like easy on- and off-ramping. This is the kind of true innovation that will drive the future of finance.

In the end, there are real builders who are focused on creating a better financial system, and this mission remains unchanged. The core of DeFi is freedom of finance, just like the internet’s core is freedom of information. Despite all the noise and distractions, the true innovators will just keep building.

How Broader Developments in Crypto Impacted ThorChain and ThorWallet

Overall, the vision for ThorWallet hasn’t changed; if anything, it’s been confirmed. The vision has always been clear, and it’s something I present whenever I pitch.

ThorWallet aims to provide all the financial services a person needs, but based on open, fair, and transparent DeFi technology, with decentralized services and products. We’re talking about holding, sending, and receiving assets, but also trading, savings accounts, lending, borrowing, and even perpetual contracts. While most people may not need the latter, it exists and could be beneficial if used properly.

When it comes to perpetual contracts, the reality is that most people use them for speculation. However, they can also be used for hedging and other strategies.

The point is that we now have many financial services that are fully transparent, immutable, and accessible by anyone with a mobile phone and an internet connection. You don’t need a passport, and no one can tell you that you’re not allowed to open a bank account. It’s full freedom of finance, and that vision remains unchanged—it’s only been reinforced over time.

Of course, we’ve adapted as we’ve gone along, particularly when it comes to our partnerships. We’ve become more discerning in choosing which decentralized protocols we work with, ensuring they’re truly decentralized and not prone to issues like rug pulls. It’s our duty to do the due diligence.

Since regulation in this area is still developing, we handle that responsibility ourselves. We want to ensure that any protocol we expose our users to is trustworthy. Over the years, this process has become more refined and sharper.

The Balance Between Privacy in Crypto and Transparency in TradFi: ThorWallet’s Approach

I think privacy is a fundamental right for everyone. But of course, in cases involving bad actors, there should be a system where, with proper legal procedures, privacy can be lifted to ensure justice is served.

For example, access to financial statements might be necessary in criminal cases, but this should be done through a clear judicial process, like a court order, to prevent unnecessary violations of privacy.

Currently, we’re seeing a global trend where governments treat everyone with suspicion, especially regarding tax fraud. This approach is wrong. Everyone shouldn’t be presumed guilty.

If a country has high tax evasion rates, the focus should be on improving governmental processes, not violating citizens’ privacy. For instance, in Switzerland, I’m more than happy to pay my taxes because I can see the value they bring—public infrastructure, clean lakes, and efficient services.

But in other countries, when taxes are high and public services are poor, it’s harder to accept the amount being taken. That’s why people sometimes try to evade taxes, and this leads to a distorted narrative.

When it comes to DeFi, it’s somewhat pseudo-anonymous. Transactions are transparent, but the addresses are not directly tied to specific individuals, which provides some level of anonymity. However, if you want to off-ramp, KYC and AML are required, which means that, in the end, there’s full visibility regarding who owns what address. So, it’s not entirely private, except in the case of privacy coins.

Using Privacy Protocols

That said, using privacy tools can be perfectly reasonable. For instance, you might want to keep certain transactions private, especially if large sums of money are involved. You might not want the public to know you’re worth millions when you deposit into a lending protocol, for example.

It’s important to approach this calmly and rationally, and there’s no problem as long as it’s explained well.

I’m committed to supporting any chain that I believe is sufficiently decentralized, whether it’s a privacy coin or not—ThorWallet remains fully tech-neutral. I do believe that, eventually, it will be possible to interact with privacy coins in a way that effectively hides your trace.

This is especially useful in cases where privacy is justified. However, the system is still designed to catch bad actors. For example, if someone is depositing $100 million but has reported an income of $100,000, it raises immediate questions.

If the transaction involves a privacy coin, regulators will inquire further. If there’s no solid explanation, the funds may be frozen until the source is clarified, and in some cases, this could lead to uncovering illicit activities like stolen funds.

So, there’s no issue with implementing privacy protocols as long as the system remains robust enough to prevent misuse.

Overcoming Challenges in Mass Adoption and Web3 Integration: THORWallet’s Next Big Steps

We’re very close to achieving our goal. For example, with ThorWallet, we aim to simplify complex DeFi technology so that users don’t need to be exposed to it. They should have experience similar to centralized finance (CeFi) apps like Revolut, but in the backend, it will run on a fully decentralized network.

Building a decentralized version of a Revolut app is much more complex, but this is what we’re working on with ThorWallet.

A key issue we’re addressing is the need for gas tokens. Currently, if you want to send USDC on Avalanche, for example, you need AVAX tokens to cover the transaction fees.

This makes it unattractive and difficult to onboard a large number of users. We’re working on abstracting this away so users won’t need to worry about specific gas assets. You could top up your MasterCard without worrying about the gas fees at all, for example. We have several technical solutions in place to achieve this, which will ultimately provide a gasless experience similar to CeFi platforms.

Addressing Latency Issues

Additionally, certain blockchains, like Bitcoin, have latency issues, which are slower than others. But we are finding ways to improve that as well, ensuring a smoother user experience. Once we’ve achieved this, we’ll be ready to onboard 100 million users. That’s why we’re raising growth funds now, as we’re 95% of the way there and ready for the next phase.

You’ll still need to pay transaction fees, but the way it works will be different. For instance, when you perform a swap, the gas fee will be included in the swap fee itself. If you top up your MasterCard, we might cover the gas fee for you since it’s usually very small, often just a few cents.

Another option is to implement a “gas tank” feature, where users can top it up with whatever they prefer—Fiat, USDC, or another asset. This gas tank would be used for any required gas fees on different blockchains, like Base or Avalanche, and users would see a message when their gas tank is running low, prompting them to top it up again.

This could even be a premium feature, where premium users get their gas fees covered by a subscription while other users manage their own gas tanks. Either way, our goal is to make the user experience as seamless as possible.

THORWallet and YouHodler: Competitors or Potential Partners in Bridging DeFi and Traditional Finance?

At this moment, we don’t view YouHodler as a direct competitor. They’re a centralized entity with a strong focus on perpetuals, which is not currently our focus. While they do service blockchain users, and you could argue they are competitors in that sense, they aren’t competing with us directly right now.

That said, I’m aware that they’re now making the transition from CeFi to DeFi, which is really exciting, and that could put them in the competitive space in the future. However, since we don’t yet offer perpetuals (perps) in ThorWallet, this could actually lead to a potential partnership instead.

What’s great about the Web3 space is that its dynamic is different from traditional finance. We’re more open to collaboration here. In fact, I had a discussion yesterday with Ilya, the CEO of YouHodler, about how their upcoming DeFi perpetual protocol could potentially integrate with ThorWallet.

The key in this space is to focus on expanding the overall market rather than competing for what’s already there.

Crypto vs. Traditional Finance: Which Will Have a Bigger Impact in the Long Run?

I believe crypto finance will eventually overtake traditional finance, at least from an IT infrastructure perspective. While the financial products themselves will remain similar, the technology behind them will shift to blockchain.

This switch from the outdated tech stack of traditional finance to the more modern blockchain infrastructure will enable the creation of new financial products that simply weren’t possible before, such as Flash loans. So, in short, I believe crypto finance will surpass traditional finance in the long run.

It reminds me of the managers at Daimler Benz and Audi, maybe about seven years ago. They had their best year yet while laughing at Tesla and electric cars. Fast forward a few years, and Tesla’s stock was worth more than all of Germany’s car producers combined.

Suddenly, every major car manufacturer in Germany was scrambling to make electric cars. They were stubborn at first, but eventually, they had to adopt the new paradigm. This shift in the auto industry is exactly what I see happening with traditional finance and crypto.

Final Thoughts

I had an interesting discussion yesterday regarding the European Union’s new stablecoin initiative, and I want to share my expertise and personal thoughts on it with your audience.

I’m really concerned about what’s happening. There are two types of Central Bank Digital Currencies (CBDCs): wholesale and retail.

Switzerland is focusing on wholesale CBDCs, where only national banks have stablecoins for transactions between banks. This gives them the advantage of immediate settlement, efficiency, and doesn’t disrupt the existing banking hierarchy. In this setup, banks still issue money to retail users, which I think is the correct approach.

Risks with CBDCs

However, the European Union, like China, is pushing forward with retail CBDCs, where they would issue digital currency directly to retail users, bypassing banks. This is troubling for two main reasons.

First, the European Union and national banks haven’t exactly excelled at managing their financial systems over the past 20 years, so I’m skeptical of their ability to handle such a monumental shift, especially without working through banks that already have the necessary infrastructure and experience.

Secondly, retail CBDCs mean that governments would have full visibility into every transaction users make. They could monitor your spending habits, and if they didn’t like something, they could block you from the financial system with just a few keystrokes.

This is an incredibly powerful tool, akin to having control over the army—just through financial means. The US Dollar has long been the strongest weapon because of its role in global finance, and we’ve already seen instances where countries like Russia have been cut off from the system. What’s even more concerning is the hypocrisy surrounding these actions, as Russian oligarchs may be blocked in Europe but can still open bank accounts in places like Wyoming. But that’s a different issue.

What worries me about CBDCs is that they would essentially lead us into an observation state, where everything we do financially is visible to the government. This is a dangerous path, especially when it comes to privacy and financial freedom.

It would be a major disruption to individual freedoms, and it should not be adopted. Anyone who’s interested in this topic should really look into it, and politicians need to wake up to the dangers they’re walking toward.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETFs End Dry Spell with Fresh Capital

After seven straight days of outflows, institutional investors seem to have rekindled their love for Bitcoin ETFs. Since April 2, US-listed spot Bitcoin ETFs have posted net inflows for the first time, drawing $1.47 million in fresh capital on Monday.

While this figure is modest, it marks a notable shift in sentiment and the first sign of renewed institutional appetite for Bitcoin exposure through regulated funds.

Bitcoin ETFs End 7-Day Drought With Modest Inflows

Last week, Bitcoin investment funds recorded $713.30 million in net outflows as the broader cryptocurrency market struggled to stay afloat amid the growing impact of Donald Trump’s escalating trade war rhetoric.

But the tide may be starting to turn.

On Monday, U.S.-listed spot BTC ETFs recorded $1.47 million in net inflows, marking the first capital flow into these funds since April 2. While the amount is modest, it breaks a nearly two-week drought and could signal a gradual shift in institutional sentiment toward BTC.

The largest daily net inflow came from BlackRock’s IBIT, attracting $36.72 million. This brings its total cumulative net inflows to $39.60 billion.

On the other hand, Fidelity’s FBTC recorded the largest net outflow on Monday, shedding $35.25 million in a single day.

BTC Derivatives Market Heats Up Despite Cautious Options Flow

On the derivatives side, BTC’s futures open interest has edged higher over the past 24 hours, signaling increased derivatives activity.

At press time, this sits at $56 billion, rising by 2% in the past day. Notably, during the same period, BTC’s period has climbed by 1.22%.

BTC’s futures open interest refers to the total number of outstanding futures contracts that have yet to be settled. When it rises during a price uptick like this, it suggests that new money is entering the market to support the upward move, potentially reinforcing bullish momentum.

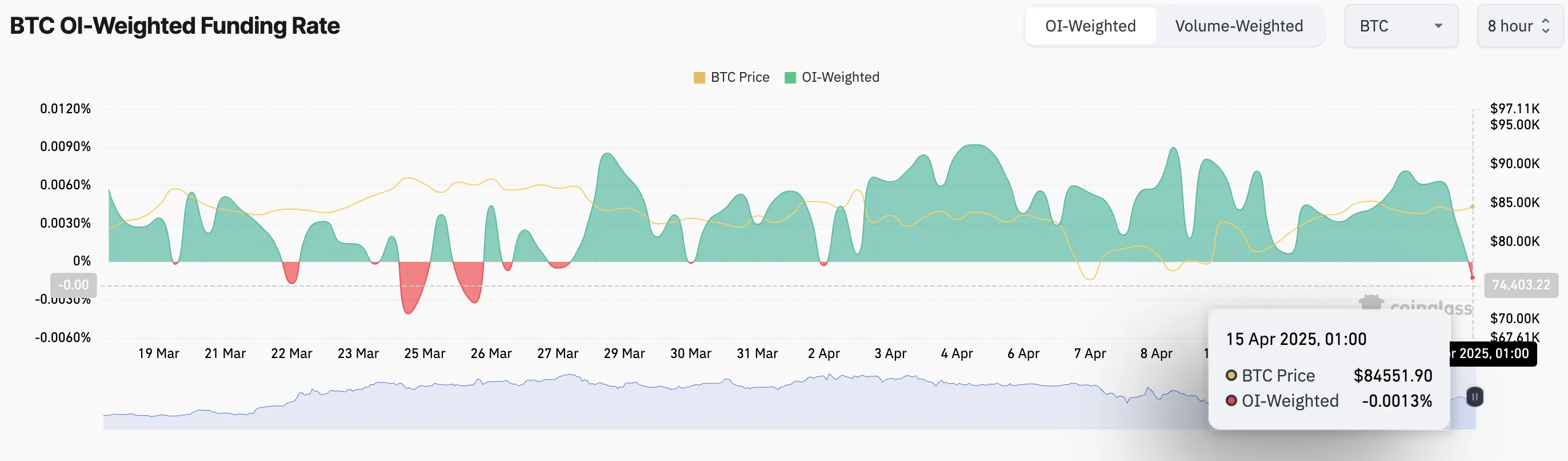

However, there’s a catch. While open interest in BTC futures has increased, the nature of these new positions appears to be bearish. This is evident in the coin’s funding rate, which has now flipped negative for the first time since April 2.

This means that more BTC traders are paying to hold short positions than longs, suggesting that a growing number of market participants are betting on a potential pullback despite the modest inflows into spot ETFs.

Moreover, the mood remains cautious on the options side. Today, there are more put contracts than calls, signaling that some traders may be hedging their bets or anticipating further downside, even as other indicators turn bullish.

Still, for BTC ETFs, any inflow after two weeks of silence feels like a win. With the broader market sentiment toward the coin turning increasingly bullish, it remains to be seen if this trend could persist for the remainder of the week.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Tariffs Spark Search for Jerome Powell’s Successor

The Trump administration is gearing up for significant economic shifts, with its proposed tariffs said to be setting the stage for a potential overhaul of the Federal Reserve’s (Fed) leadership.

Like Gary Gensler’s ouster at the SEC (Securities and Exchange Commission), reports indicate that Fed chair Jerome Powell may face a similar fate with discussions starting long before his term ends.

Jerome Powell’s Exit Planned As Trump Tariffs Spell Economic Hardship

Treasury Secretary Scott Bessent announced the Trump administration’s plans to interview candidates to replace Fed Chair Jerome Powell.

Notably, Powell’s term as Fed chair ends in May 2026, over a year out. With almost 13 months left, experts suggest the administration’s move may be a strategic response to the economic turbulence expected from Trump’s aggressive tariff policies in 2025.

The sentiment is that the Trump administration may pave the way for a new Fed Chair to steer the economy through 2026 with interest rate cuts and stimulus measures.

“The interest rates affect credit cards, they’ll affect auto loans, the bottom 50% of Americans over the past two years have gotten crushed by these high interest rates. We’re set on bringing interest rates down,” Bessent claimed in a televised interview.

Trump’s tariff proposals, including a 125% tax on Chinese imports, are projected to impact the US economy substantially. According to a Tax Foundation study published on April 11, 2025, these tariffs could reduce US GDP by 1.3% in the long run.

The study also estimates tariffs will amount to an average tax increase of $1,300 per US household in 2025. This adds pressure on consumers already grappling with inflationary concerns.

Combined with foreign retaliation affecting $330 billion of US exports, the overall GDP reduction could reach 1.0%. This highlights the economic challenges the administration anticipates in the coming year.

Trump Administration Prepares For 2026 Economic Recovery

This report comes a month after Bessent presented Fed Chair Jerome Powell as a significant obstacle. He alluded that Powell impeded the Trump administration’s determination to lower interest rates.

Indeed, the Federal Open Market Committee (FOMC), led by Powell, has rejected interest rate cuts. They maintain this stance until they are comfortable with inflation cooling.

The Fed also made significant downward revisions to its 2025 economic projections. They painted a picture of weaker growth and persistent inflation.

According to economists, the Trump Administration is bracing for “economic weakness” in 2025 due to the tariffs. However, it sees 2026 as a year of recovery through monetary policy adjustments.

“This sets up perfectly for 2026 to be the year of interest rate cuts and economic stimulus, with the newly appointed Fed Chair,” The Kobeissi Letter said.

Therefore, the timing of Powell’s replacement aligns with these economic projections. A new Fed Chair, potentially more aligned with Trump’s economic agenda, could facilitate interest rate cuts and stimulus to counteract the tariff-induced slowdown.

Jerome Powell has served as Fed Chair since 2018. He has maneuvered a complex economic environment, which included high inflation and the post-pandemic recovery.

His second term, confirmed in May 2022, has been characterized by efforts to balance the Fed’s dual mandate of stable prices and full employment. However, this has been met with criticism, including from President Trump, for not being accommodative enough.

“The Fed would be much better off cutting rates as US tariffs start to transition (ease) their way into the economy. Do the right thing,” Trump shared on Truth Social.

The early search for his successor indicates the administration’s desire for a Fed Chair who might be more amenable to its policy goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CoinGecko Conduct Survey on AI and Proof of Personhood

CoinGecko conducted a recent survey on AI user opinions, particularly centered around Proof of Personhood (PoP). The overwhelming majority of users want to distinguish humans from AI and are open to adopting PoP.

Proof of Personhood (PoP) is a mechanism designed to verify that a user is a unique human being—not a bot, not an AI, and not a duplicate identity. Many users feel it’s increasingly critical as generative AI and autonomous agents proliferate across digital platforms.

Is Personhood the Next Big Trend in AI?

AI projects have seen declining popularity over the past months, largely due to macroeconomic factors and other narratives dominating the Web3 space. Yet, AI agent development remains strong.

AI agents are now highly integrated into crypto Twitter and social media. They are driving conversations, changing narratives, and even creating dialog. So, the concept of personhood has become a critical discussion among the crypto community.

Most recently, CoinGecko conducted a survey on AI-related opinions and identifying personhood.

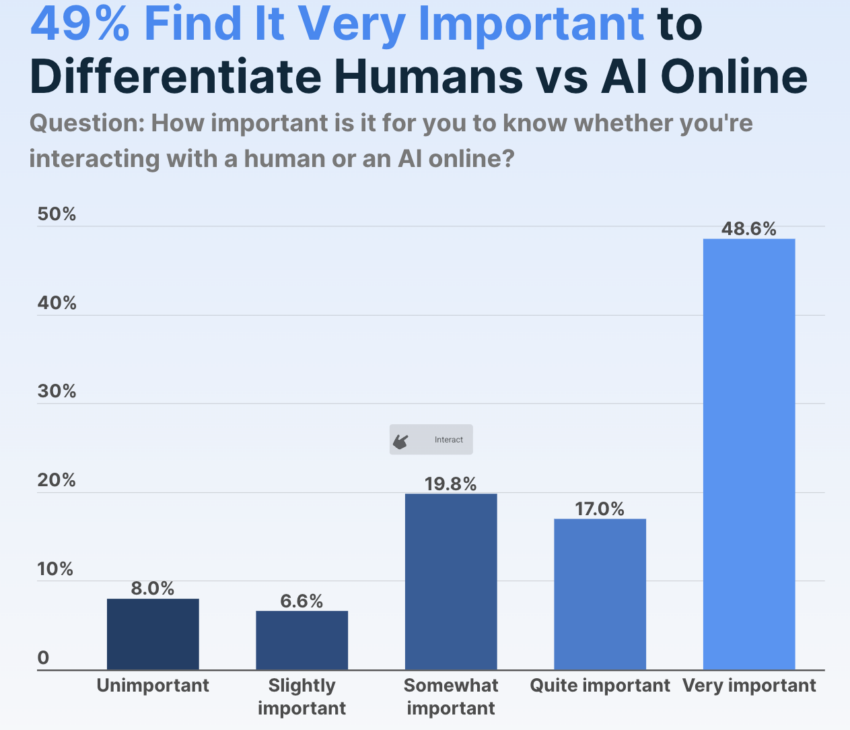

CoinGecko’s data shows that most AI users firmly believe that it’s important to know if they’re interacting with a human. Nearly half of respondents think this task is “very important,” and 92% think it’s at least somewhat important.

This can help explain why Proof of Personhood (PoP), a concept pioneered by Sam Altman’s Worldcoin, has remained an enduring idea in the AI space.

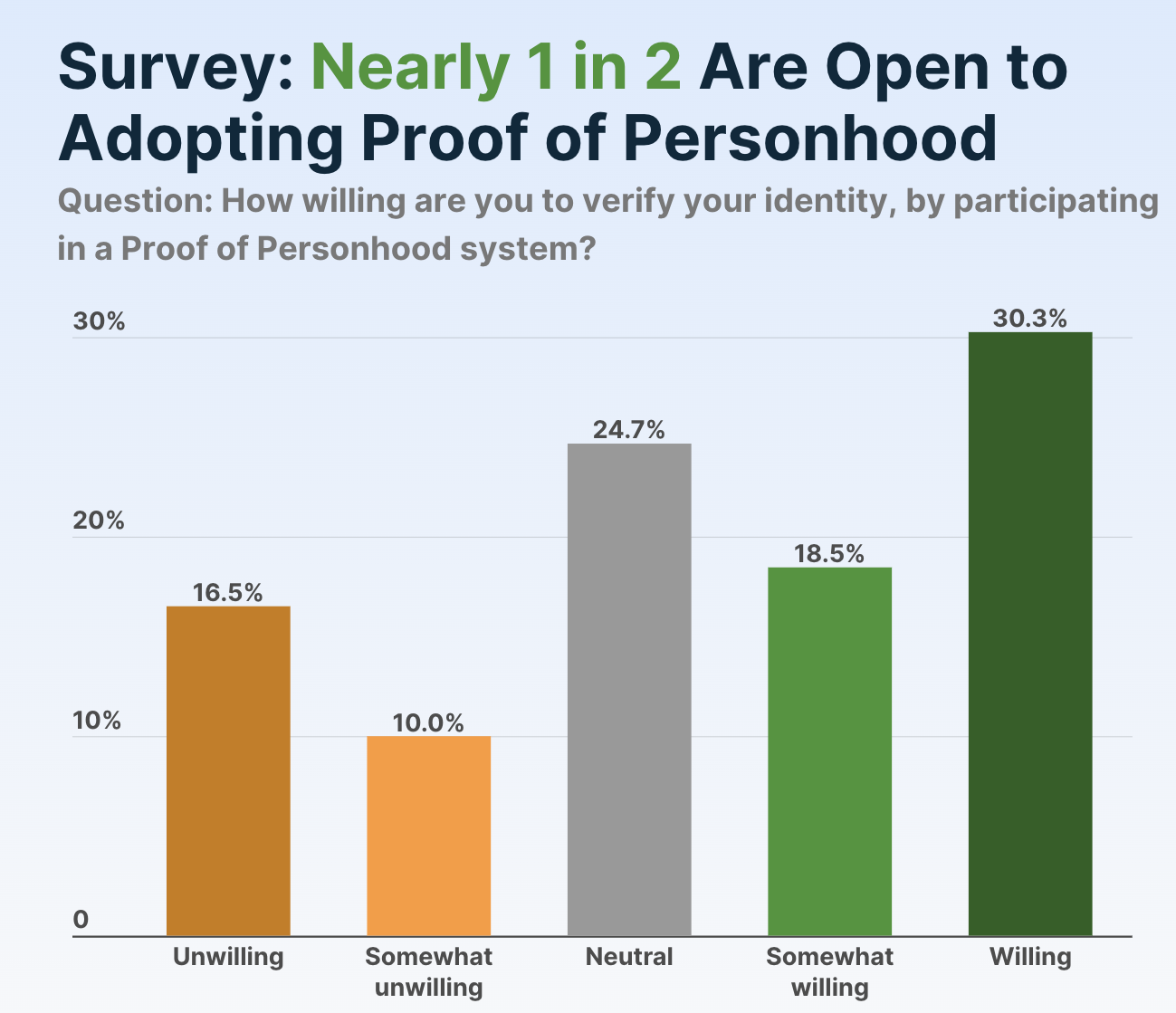

What’s the problem, then? Although this survey shows that AI users want to identify personhood, that doesn’t mean that everyone is willing to adopt PoP methods as currently devised or understood.

Nearly half of users were willing or somewhat willing to try them, but it was a far smaller margin than the other question.

Furthermore, the survey determined that only 30.3% of respondents believe that it’s very important to distinguish humans from AI and are also willing to adopt Proof of Personhood methods.

On the other hand, 18.3% thought identifying humans was important but were neutral or actively opposed to PoP.

The survey did not apparently describe specific PoP protocols from any one project. PoP generally involves using non-traditional forms of verification, such as biometric data, social media profiles, or other methods that are difficult to fake or replicate, but there isn’t a single industry standard yet.

Considering that another CoinGecko survey identified declining interest in AI investment, this polling discrepancy could present a problem. AI users are mostly unified as to what the issue is, but the proposed solutions are much more controversial.

A heavy-handed approach to the personhood question could turn users away from AI. This is far from ideal in the current market.

Still, it’s important not to overstate the level of controversy. Although less than half of AI users want to adopt Proof of Personhood, the pool of hostile respondents was comparatively small.

There’s a substantial number of ambivalent people, and they may respond well to new protocols, marketing campaigns, or other incentives.

Overall, it’s evident that PoP is becoming a key discussion point in the Web3 community. As autonomous agents gain influence, PoP might serve as a firewall between digital manipulation and genuine participation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin19 hours ago

Altcoin19 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market24 hours ago

Market24 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Market20 hours ago

Market20 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Bitcoin19 hours ago

Bitcoin19 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market19 hours ago

Market19 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds