Market

This Is Why Stepping Away From Bitcoin Cash (BCH) Is Ideal

Bitcoin Cash (BCH) witnessed considerable growth in April, which placed it among some of the best-performing assets.

However, the recent decline not only undid all of it but also extended the losses to a point where BCH has become untouchable.

Bitcoin Cash Growth Invalidated

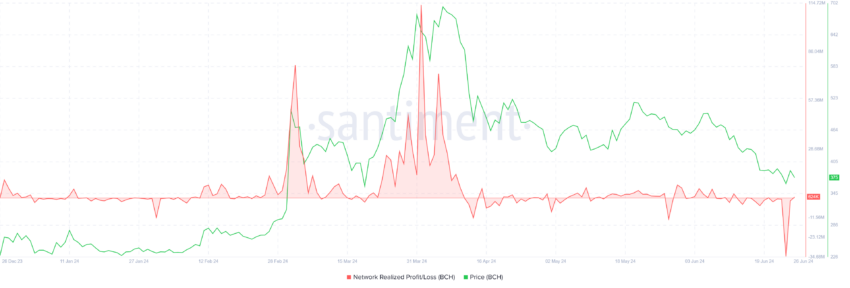

As Bitcoin Cash’s price fell, investors realized significant losses, which is evident in the Network Realized Profit/Loss indicator. This will likely discourage them from selling at a loss and could prompt many to hold onto their investments until market conditions improve.

This strategy reflects a common approach among investors looking to recover losses rather than crystallize them in a declining market environment.

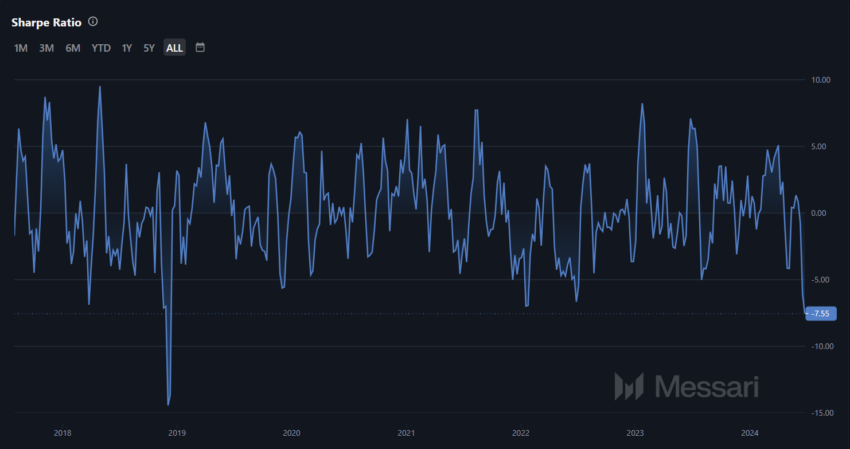

Additionally, Bitcoin Cash’s Sharpe Ratio has reached a five-year low of -7.55. This highlights its diminished attractiveness as an investment option compared to other assets.

The Sharpe Ratio, a measure of risk-adjusted returns, suggests that BCH has underperformed relative to its risk profile over the past five years. This indicator may further dissuade potential investors who prioritize stable returns against the backdrop of significant volatility.

Thus, while Bitcoin Cash faces considerable hurdles, such as high realized losses and a low Sharpe Ratio, investor sentiment remains divided. Some view the current market conditions as a chance to acquire assets at a discount, while others may be deterred by the asset’s risk-adjusted performance metrics.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

The majority, however, will stick with the idea of waiting until the market improves before entering again.

BCH Price Prediction: Another Banal Chart

While unfortunate, Bitcoin Cash’s price had a spectacular fall, dropping from $501 to $375 at the time of writing. Although the Bitcoin namesake did manage to recover slightly from the lows of $350, it still has a long way to go.

Considering the conditions of the altcoin, it would be wise to stay away from the asset at present. While recovery is afoot, confirmation of the same will be received once BCH crosses $429.

Flipping it into support would be a definite sign of bullish conditions, making the altcoin a decent investment option.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

However, if market conditions do not improve, Bitcoin Cash could fall to $344. Consolidation within this level and $379 would invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.