Market

This is Why Dogecoin Price May Drop By 41%

Dogecoin (DOGE) holders who have clung to their coins for a significant period might now be preparing to cash in. There has been a notable movement in DOGE coins held for extended periods, suggesting a shift in sentiment among these long-term investors.

In this analysis, BeInCrypto explores the potential outcomes arising from the movements of these previously dormant coins.

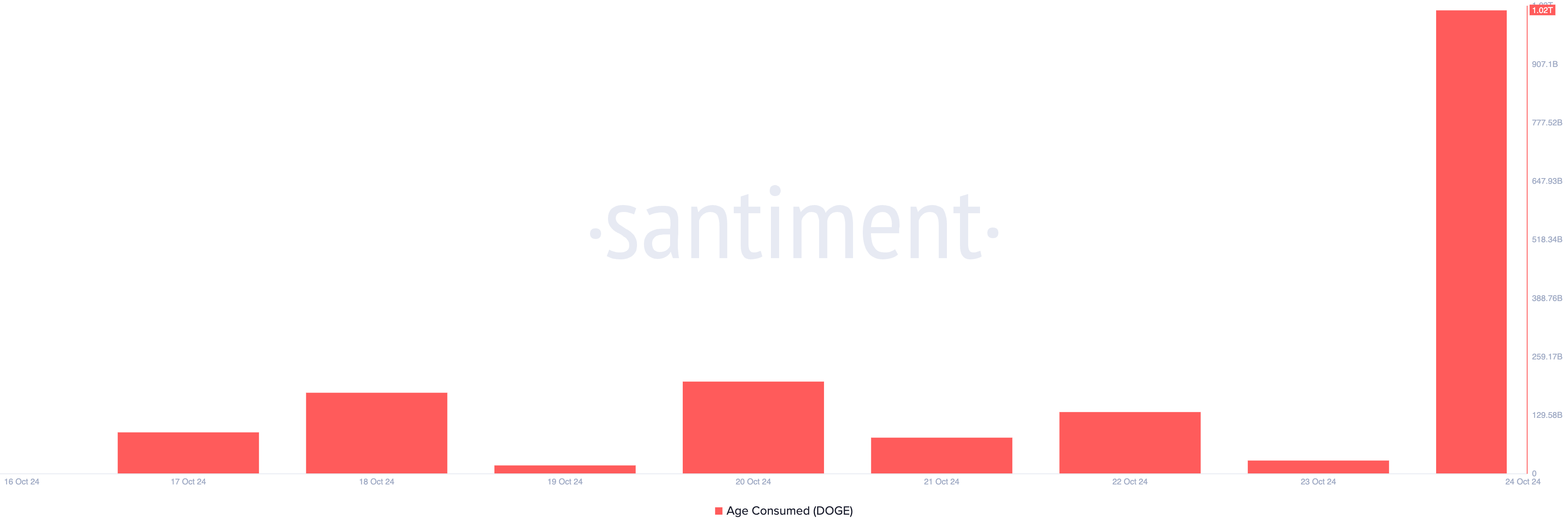

Dogecoin’s Age-Consumed Spikes To 16-Month High

On-chain data shows that Dogecoin’s Age Consumed, which tracks the movement of long-held coins, skyrocketed by over 3,000% on Thursday, reaching 1.02 trillion —its highest since June 2023.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

When an asset’s age consumed spikes, it indicates that long-inactive coins or tokens have recently been moved or traded.

Typically, the reactivation of dormant coins signals renewed interest from long-term holders, which many consider a bullish indicator. However, for this bullish trend to play out, the influx of newly circulated coins must be met with sufficient demand to absorb the increased supply.

Yet, an assessment of the DOGE/USD 12-hour chart reveals that no such demand is present in the market. As of this writing, its on-balance volume (OBV), which measures buying and selling volume in the market, is in a downtrend and is positioned at 507.90 billion. When an asset’s OBV is in a downtrend, it typically indicates that the selling pressure exceeds the buying pressure.

Additionally, the meme coin’s negative Balance of Power (BoP) confirms that demand for DOGE is low. This indicator, which measures the strength of buyers versus sellers in the market, is at -0.34 at press time. A negative BoP suggests sellers are in control and attempting to push the asset’s price downward.

DOGE Price Prediction: 41% Decline?

As of this writing, Dogecoin’s price sits at the support line formed at $0.13 and may fall below this level as selling pressure strengthens. A decline below this level will shift the meme coin’s focus to the next major support formed at $0.11. If this level fails to hold, Dogecoin’s price may drop to $0.08, representing a 41% decline from its current price.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

However, rising demand may absorb the new coins in circulation, holding the $0.13 support level. This could potentially set the stage for Dogecoin’s price to rally toward $0.15.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FBI Ran Dark Web Money Laundering to Track Crypto Criminals

After a long undercover investigation, the FBI identified a massive Dark Web money laundering network. The Bureau arrested its founder, Anurag Pramod Murarka, a year ago but kept running the business to identify clients.

This allowed the FBI to make subsequent arrests as Muraka laundered funds from drug traffickers, crypto hackers, and more. Still, its methods attracted criticism about government overreach.

Dark Web Money Laundering Remains a Major Concern for Crypto

After the Bybit hack, the largest theft in crypto history, the perpetrators successfully laundered all the stolen funds. This dramatic incident highlighted a growing concern in the community, as criminal operations can launder huge volumes of money.

Recently, the FBI managed to break open a major Dark Web money laundering operation through a long-term investigation.

The agency arrested one specific Dark Web money launderer, ElonMuskWHM (real name Anurag Pramod Murarka), after he came to the US for medical treatment.

From there, the FBI continued to run its operations for over a year. This allowed it to track Murarka’s customers from varying criminal enterprises, such as hacking, drug trafficking, and outright armed robbery.

“Using the internet, the defendant provided his assistance to countless other criminals as they tried to conceal their stolen money and illegal drug proceeds. This case highlights the global scope of cybercrime, as well as the demand for diligence and collaboration in fighting money laundering,” said Carlton S. Shier, IV, a US attorney involved in the case.

The Bureau made significant progress in identifying Muraka by using his cash mules as confidential informants. Soon after, it escalated to more invasive methods.

For example, the FBI sent a few YouTube videos with low view counts to ElonMuskWHM via Telegram, then asked Google to turn over data on everyone who watched these videos.

In total, the FBI estimated that Muraka laundered more than $24 million over the Dark Web in less than two years. For these crimes, he was sentenced to 121 months in prison.

Although the FBI was able to arrest several more clients of Muraka’s Dark Web money laundering operation, its methods also attracted criticism.

Still, it’s important to remember the necessity of these enforcement actions. As crypto sleuth ZachXBT recently pointed out, there is an epidemic of sophisticated money laundering efforts in the DeFi ecosystem.

Additionally, the Department of Justice announced yesterday that it’s planning to cease enforcement actions and active investigations against crypto exchanges, wallets, and tumblers.

Although the DOJ claims that it will still pursue criminals, this would shut off long-term sting operations like the one that tracked ElonMuskWHM.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Web3 Projects Adjust to Market Chaos

Crypto and global markets are reeling from the escalating trade war sparked by President Trump’s latest tariffs. Bitcoin, Ethereum, and Solana have plummeted this week, sending Web3 projects into a tailspin.

BeInCrypto contacted Shane Molidor, founder of Forgd, which has shepherded over 1,000 token launches. The former Gemini business development associate explains how fledgling ventures that once relied on a 2025 bull market adjust strategies and survival tactics.

Market Turmoil Forces Web3 Projects to Rethink Token Launches

Molidor unpacked how Web3 teams are rethinking everything from airdrops to tokenomics. Citing retail exhaustion that has collided with this week’s crypto market panic, he says demand for new tokens is dimming.

“Launching in these conditions risks a flop, and that’s a death knell for projects needing momentum,” he started.

Most projects try to time their token generation events (TGEs) with a bull market to ride speculative retail demand. When the macro market tanks, like it has this week, they hesitate to list.

Poor price performance scares off future investors. Token launches, which once drew excitement, are now becoming high-risk gambles. The market conditions are forcing many to delay or reconsider their approaches.

“The pressure is building, and with major cryptocurrencies like Bitcoin and Ethereum taking a hit, teams are wary of entering the market with new tokens,” Molidor adds.

Airdrops Under Fire: From Hype Machine to Risky Proposition

Crypto airdrops, once a go-to for user acquisition and buzz, are also under fire. Molidor notes that founders have become more cautious.

“Big airdrops often trigger sell pressure that kills TGE buzz,” he says.

Exceptions like Solana-based Jito (JTO) airdrop aligned well with market timing and community engagement, passing as outlier successes. Amidst prevailing bearish sentiment, however, the trend is shifting toward more targeted reward mechanisms that focus on filtering out speculative traders.

“Founders are moving toward methods like vesting periods, Sybil resistance, and eligibility filters to route tokens to crypto-native users rather than to people just looking to cash out immediately,” Molidor adds.

This suggests utility is crucial now, with the Forgd executive articulating that airdrops without a clear narrative and use case will fall flat.

Tokenomics: The Return of Low Float, High FDV Models

Tokenomics is also undergoing a makeover. Molidor notes that low float, high fully diluted valuation (FDV) strategies are back in fashion as projects attempt to curb sell-offs from airdrop dumpers. These models limit the circulating supply at launch, giving the impression of high value.

“It’s an illusion of strength. Early price pops distort market caps, but thin liquidity and front-loaded unlocks alienate both retail and institutional investors,” Molidor cautions.

This approach can appear predatory, enticing retail investors only to leave them with little liquidity and big insider exits.

However, Molidor notes that the market is wise to these games now. Projects must ensure that tokenomics are well-designed to foster long-term growth and avoid manipulation. Instead of chasing short-term hype, Molidor urges founders to focus on strategies that promote real user adoption.

“The key is balance. You want tokenomics that encourage long-term engagement while still protecting against early sell pressure,” he explained.

The Funding Drought: Crowd Funding and Angel Investors Step In

Molidor also demonstrated cognizance that the venture capital playing field has shifted dramatically. With funding tightening over the last 12 months, many Web3 projects are turning to alternative sources of capital.

Crowdfunding platforms like Legion and Echo are gaining traction among perceptive retail investors. They offer smaller, more flexible funding rounds. However, these rounds often cannot replace the scale of traditional venture capital.

“Crowdfunding is definitely on the rise, especially for earlier-stage projects. However, while crowd-funding platforms are becoming a vital tool, they are not a one-stop shop. Projects will still need larger rounds of VC funding to scale and deliver on their long-term visions,” he noted.

In response, venture capitalists are doubling down on early-stage equity and token stakes to offset dilution from later crowdfunding efforts.

According to Molidor, this strategy is creating an interesting dynamic in the funding arena, with VCs pushing for larger ownership stakes earlier in the process.

Compared to previous bear markets, he says this adjustment is a return to fundamentals but with more sophistication. In past bear markets, projects would typically delay their launches or aggressively cut costs. However, Molidor says that founders are taking a more nuanced approach.

“Delays and cost-cutting are still part of the playbook, but what’s different now is the level of sophistication in how teams manage their tokenomics, airdrops, and launch strategies. The cost of a mispriced launch is brutal reputationally and economically. Retail is fatigued, VCs are more hands-on, and communities are quicker to call out misaligned interests,” he explained.

Based on these, Molidor and his team at Forgd advise projects to take a surgical approach. The most successful projects take the time to understand their community, create value, and resist the urge to chase short-term hype.

“Narrative-driven airdrops, intentional community sales, and valuations built to last,” he advises.

A Market Test of Web3’s Resilience

Molidor says that the next six months will test Web3’s resilience. The sharpest projects will weather the storm as Trump’s tariffs upend the early-2025 bull market dreams.

“Token design is like capital structure now. It’s deliberate, contextual, and enduring—that’s what wins,” Molidor concludes.

For founders, it is adapt or die. For investors and users, it is a front-row seat to crypto’s latest crucible. Only the most thoughtful and strategic projects will succeed in this challenging market environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN Jumps 160% in 30 Days but Momentum Fades

FARTCOIN has surged more than 40% in the last seven days and is up around 250% over the past 30 days, making it one of the top-performing assets among the largest meme coins.

The explosive rally has caught the attention of traders, but recent indicators suggest momentum may be shifting. While the uptrend remains intact, signs of cooling buying pressure are starting to emerge.

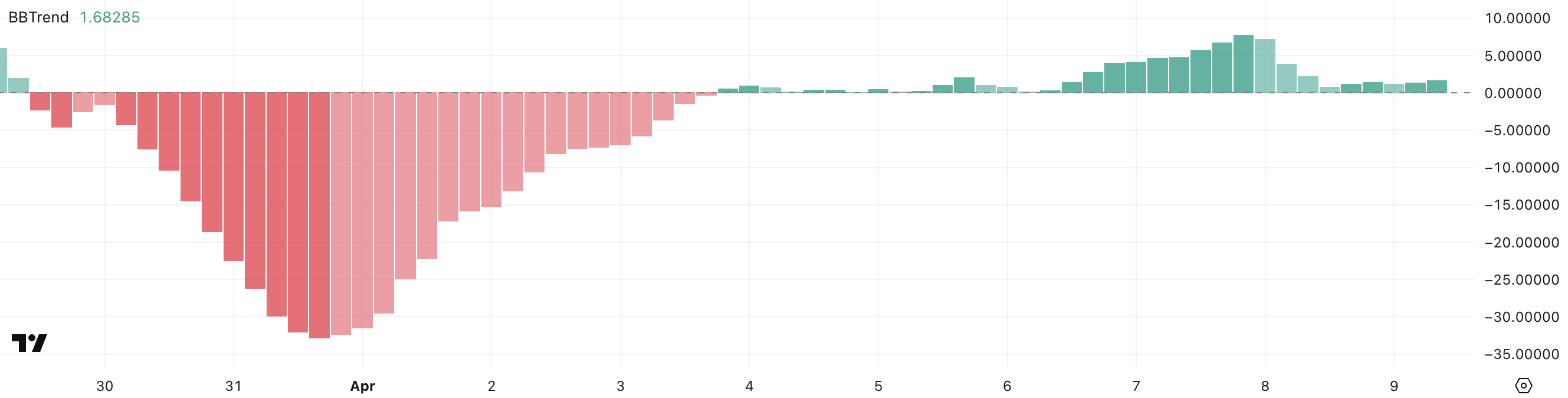

FARTCOIN BBTrend Shows Buying Pressure Could Be Easing

FARTCOIN’s BBTrend indicator is currently at 1.68, a sharp drop from 7.79 just two days ago, when the token experienced a nearly 43% price surge and became one of the top performers among meme coins.

This steep decline in BBTrend reflects a significant cooling in bullish momentum following the explosive rally.

While BBTrend values above zero still suggest upward pressure, the sharp drop signals that the trend is losing strength and that the recent hype may be fading.

The BBTrend (Bollinger Band Trend) is a volatility-based indicator that gauges the strength and direction of a trend by analyzing price positioning relative to the Bollinger Bands.

Positive values indicate bullish momentum, while negative readings point to bearish momentum; the farther the number from zero, the stronger the trend.

With FARTCOIN’s BBTrend falling from elevated levels to near-flat territory, it suggests that price action is becoming more range-bound and potentially vulnerable to a pullback if buying interest doesn’t return soon.

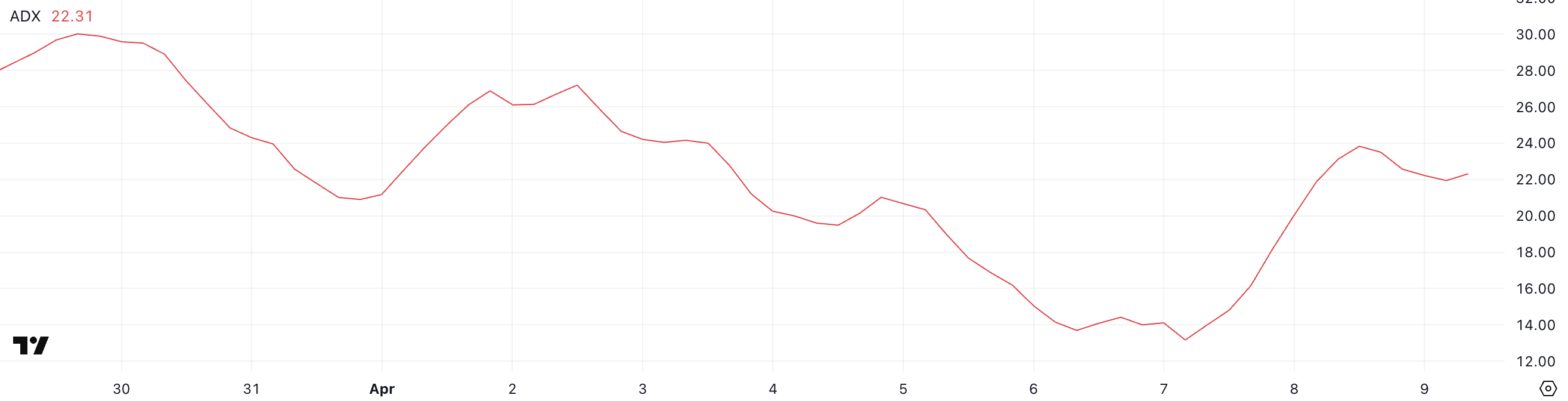

FARTCOIN ADX Shows The Uptrend Is Still Here

FARTCOIN’s ADX is currently at 22.31, up significantly from 13.16 just two days ago, though slightly below yesterday’s peak of 23.83.

This steady rise in the Average Directional Index suggests that the strength of FARTCOIN’s uptrend is building, even if momentum briefly peaked.

The move from a low-trend environment into the low-20s range indicates growing conviction behind the recent bullish move despite some near-term fluctuations.

The ADX (Average Directional Index) is a widely used indicator that measures the strength of a trend, regardless of its direction.

Values below 20 typically signal a weak or non-existent trend, while values above 25 are associated with strong and sustained directional movement. With FARTCOIN’s ADX now climbing into the low-20s, it’s approaching the threshold where breakouts can gain traction.

If this trend strength continues to build, it could support further upside price action, but bulls will want to see the ADX push decisively above 25 to confirm momentum is strong enough to sustain the uptrend.

Will FARTCOIN Break Above $0.80?

FARTCOIN price is currently riding an uptrend, and if bullish momentum holds, it could soon test resistance at $0.75.

A breakout above that level would be significant, potentially paving the way for a move toward $1 for the first time since February.

Such a breakout could attract renewed attention and volume, reinforcing the bullish case in the short term.

However, the uptrend remains fragile, especially as meme coins sector has been struggling in the last months.

If FARTCOIN loses steam and slips below immediate support at $0.538, it could quickly descend to test the next critical zones at $0.38 and $0.35—two tightly packed support levels that may provide temporary relief.

Should both fail to hold, the selloff could accelerate toward $0.26 and even $0.19, though such a move would likely require a steep and sustained bearish reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows

-

Market23 hours ago

Market23 hours agoCardano (ADA) Surges 8% as Bulls Push for Breakout

-

Market22 hours ago

Market22 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China

-

Altcoin15 hours ago

Altcoin15 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Market21 hours ago

Market21 hours agoBittensor’s Subnet Ecosystem Grows Despite Market Uncertainty

-

Market20 hours ago

Market20 hours ago5 RWA Altcoins to Watch In April 2025

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Crashes Below $75,000 As Asian Stock Markets Bleed

-

Bitcoin15 hours ago

Bitcoin15 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US