Market

This is Why Coinbase is Considering Deribit Acquisition

Coinbase is reportedly in talks to acquire Deribit, but nothing is certain yet. If the deal goes through, it could turn Coinbase into a “crypto empire,” thanks to the lucrative derivatives market.

Last year, Deribit posted nearly $1.2 trillion in options, futures, and spot trading. Coinbase has comparatively little derivatives volume, and this merger could supercharge the firm.

Will Coinbase Acquire Deribit

Coinbase, one of the world’s largest crypto exchanges, has gone through a few changes recently. Since the SEC dropped its lawsuit against the company, it’s been able to expand its services. According to a new report from Bloomberg, Coinbase is currently in talks to acquire Deribit.

Deribit is the world’s largest crypto derivatives exchange, an industry sector that isn’t Coinbase’s strong suit. The firm first filed to offer these services in 2021, but Coinbase Derivatives hasn’t been a huge share of its trade volume. Granted, it sought approval for new futures contracts in January, but this is not a primary source of revenue.

However, since the crypto market has suffered from lasting doldrums, there may be an opportunity for future growth. Earlier this month, Coinbase traffic dropped 29%, and a Deribit acquisition may give it huge new revenue streams. Bloomberg claimed that Deribit’s total trade volume last year was nearly $1.2 trillion, which could be a huge asset:

“Anyone else notice how Coinbase is quietly becoming a crypto empire? They’re about to buy Deribit – one of the biggest crypto derivatives exchanges out there. They’re turning into a global powerhouse. Smart move targeting derivatives – that’s where the real volume is,” Zach Humphries claimed in a social media post.

The report had no clear stance on how likely a deal between Coinbase and Deribit might be nor how much it might cost. In January, Deribit considered an offer to get acquired by Kraken for $5 billion, but the deal fell through. If Coinbase pulled the trigger on it, it could become one of the most important business deals in crypto history.

Until we have more information, it’s difficult to make any firm statements about likely outcomes. For example, Deribit was forced out of one of its largest markets last month due to EU sanctions, but a Coinbase acquisition may not change that equation. If a deal does happen, Coinbase will have a real chance to dominate a very lucrative market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

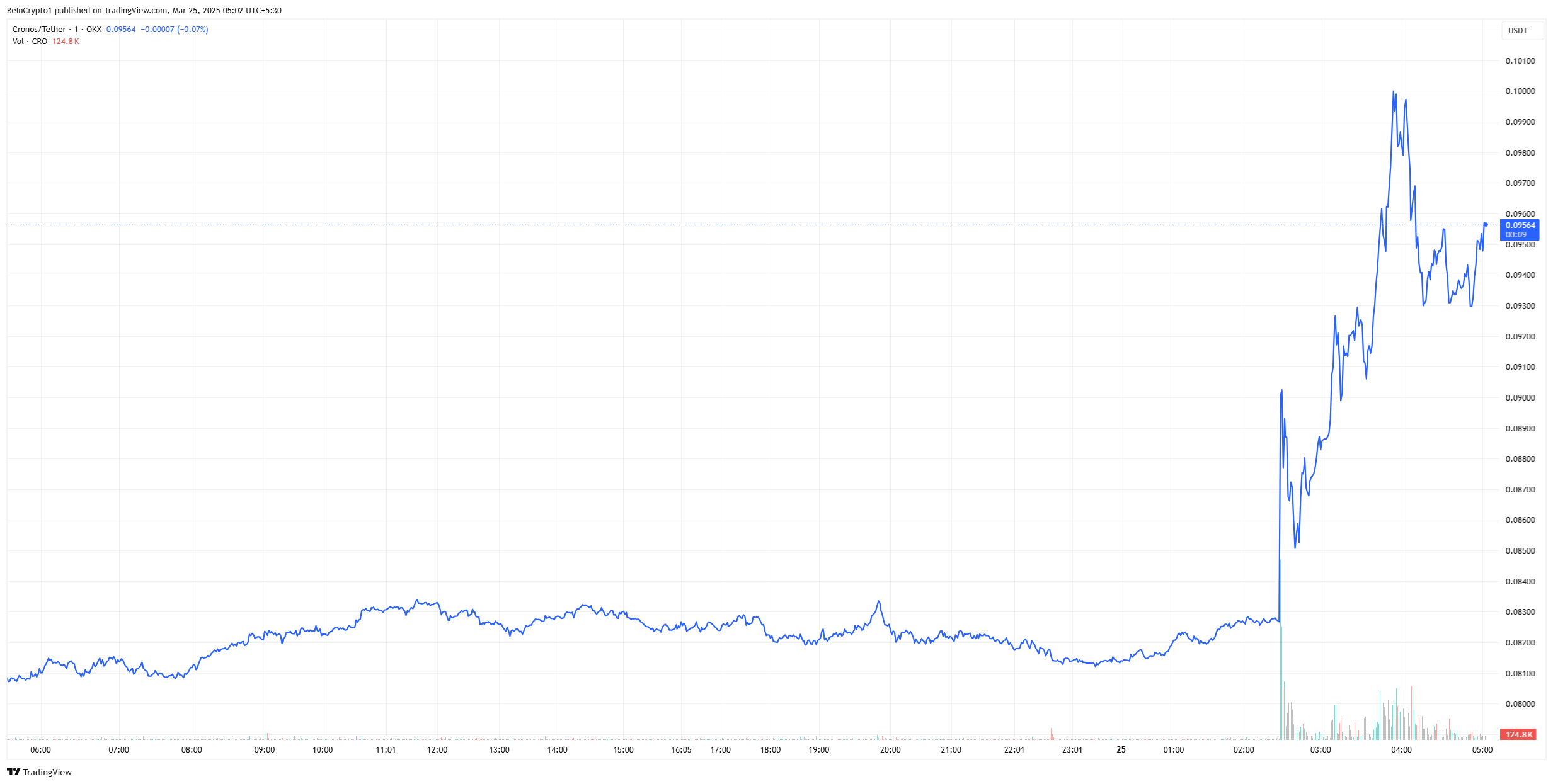

Trump Media Partners With Crypto.com, Cronos Jumps By 18%

Trump Media and Crypto.com announced a partnership to launch new ETFs based on Cronos, Bitcoin, and other assets. The resolution is non-binding, and a Cronos ETF would need SEC approval.

Even though there are serious obstacles to implementing the stated program, Cronos surged by over 18% due to speculative interest and bullish momentum.

Crypto.com, a major exchange and issuer of the Cronos token, has been through a few changes recently. Although CRO fell dramatically at the end of 2024, the exchange has ventured into new markets.

Today’s partnership with Trump Media Group triggered a bullish cycle for the CRO token, as the announcement hinted at a potential Cronos ETF.

“Trump Media and Technology Group Corp has signed a non-binding agreement to partner with Crypto.com to launch a series of ETFs and ETPs. The ETFs are expected to comprise digital assets as well as securities with a Made in America focus spanning diverse industries such as energy [and] cryptocurrencies incorporating Bitcoin, Cronos, and others,” a press release stated.

The announcement clarified that these ETFs still require regulatory approval. Also, Crypto.com and Trump Media haven’t finalized a “definitive” agreement, even if the resultant ETFs will include Cronos.

Meanwhile, Cronos reached a yearly high in December after reports of the Crypto.com CEO and the US President’s meet-up and its legal resolution with the SEC. However, CRO has suffered a 30% drop since then. Today’s news brought fresh liquidity into the altcoin.

The SEC may be looking favorably on altcoin ETFs, but one based on Cronos is totally out of left field. Even if Trump personally intervenes, a Cronos ETF may still be months away. There haven’t been any ETF applications for the altcoin yet.

Another concern, of course, is the “Made in America” angle. Although the statement discusses US-based products, Crypto.com is currently headquartered in Singapore. The US is still the exchange’s primary target market.

The biggest problem, however, is that a Cronos ETF could be the biggest political crypto scandal since the TRUMP token. US Presidents are not supposed to conduct private business in any capacity, especially with foreigners.

Could Trump’s firm expect to win the SEC’s highest stamp of approval? Even if it did, wouldn’t that impact the Commission’s own legitimacy?

Overall, it’s evident that Trump Media is venturing deeper into the crypto industry and looking to extend its investment avenues. Such a partnership will also help the exchange increase its market share in the US and challenge Coinbase’s dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Did World Liberty Financial Launch a Stablecoin on BNB Chain?

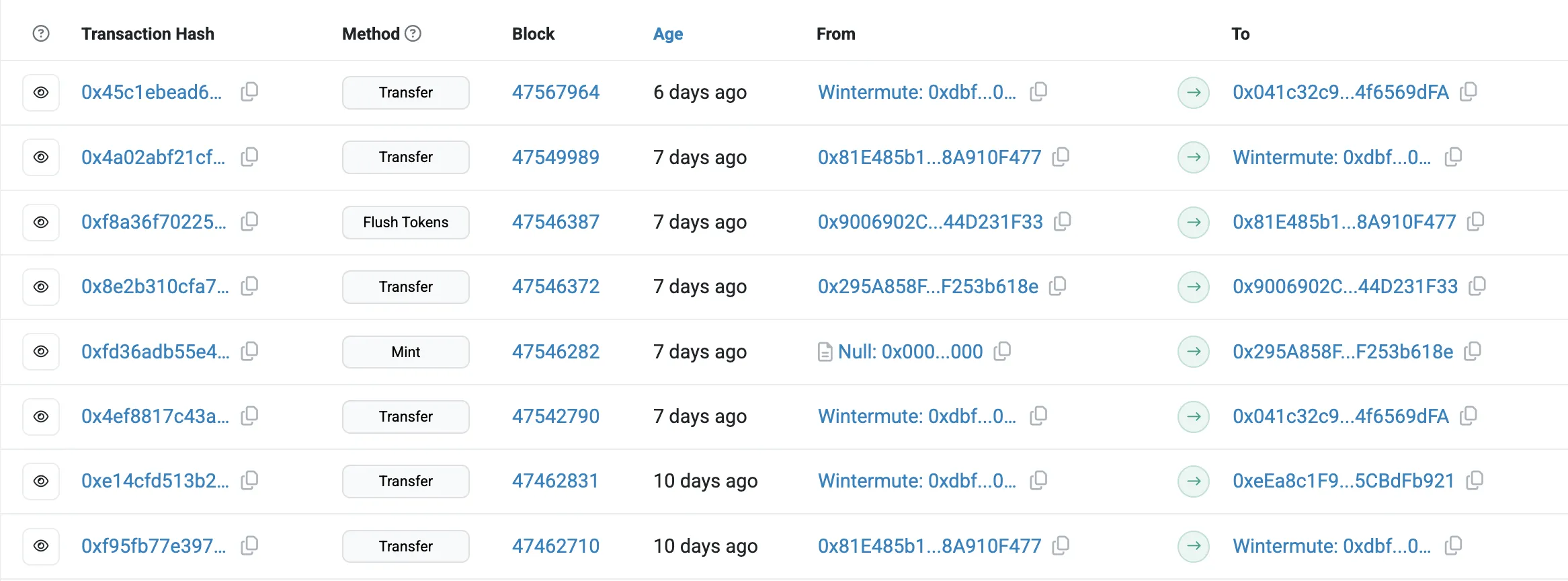

USD1, a self-proclaimed “World Liberty Financial USD” stablecoin, launched on BSC today. While there has been no official announcement from the Trump Family-linked project itself, leading market maker Wintermute interacted with this stablecoin.

Former Binance CEO Changpeng “CZ” Zhao commented on this asset, but only in minimal detail. So far, there’s no clear proof of an actual Trump connection.

Is World Liberty Financial Launching a Stablecoin?

Binance, the world’s largest crypto exchange, may be on the verge of a big business move. Last week, reports alleged that the firm was in talks with WLFI to launch a new USD-backed stablecoin while the Trump family would buy a stake in it.

Today, the crypto community first noticed USD1, an alleged WLFI stablecoin on Binance Smart Chain (BSC):

“The Trump Family Foundation just issued a stablecoin on BSC, and the market-making agency Wintermute also participated in it. I guess the Trump Family Foundation found that stablecoins are still profitable and wanted to make stablecoins, so it would be perfect to set up an exchange and invest in it!” claimed Old Driver.

This Wintermute angle made the issue particularly enticing. Wintermute is a high-profile crypto market maker with a daily trading volume of over $2.24 billion.

Earlier this year, it did business with Binance and previously invested in Ethena Labs. Given Wintermute’s reputation, the crypto community is speculating that World Liberty Financial might be involved with this stablecoin.

Changpeng “CZ” Zhao, former CEO of Binance, noted that USD1’s smart contract was first deployed 20 days ago and welcomed the token to BNB Chain.

Shortly afterward, however, he warned the community that the USD1 name was being used in scams.

“I was told since this post, a lot of scammers created coins with the same name. The official USD1 is not tradable yet. Please do not fall for the scams,” CZ added.

Despite referring to “the official USD1,” CZ’s statement isn’t a clear indicator of any official partnership between Binance and World Liberty Financial.

Several social media commentators with substantial followings responded to his posts, warning that the market may take his spontaneous posts completely out of context. CZ’s “off the cuff” posting style could create misunderstandings.

“You still don’t understand the influence of your tweet. Most people actually don’t know that you’re just spontaneous with your tweets,” Ben Todar,

Neither WLFI nor Binance has officially commented on this stablecoin or acknowledged any kind of partnership and pushed back on previous allegations that one exists.

For now, the space will have to keep a close eye on USD1 and await further developments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Breaks $140 Mark Despite Competition From BNB

Solana (SOL) is up nearly 9% in the last 24 hours, climbing above $140 for the first time since March 8, despite BNB surging to become the biggest chain in DEX volume last week.

While price action has strengthened, Solana’s market still shows mixed signals, with some large investors remaining cautious. Traders are now watching key resistance and support levels to gauge whether SOL can sustain its rally or face a potential pullback.

Solana RSI Rise Above 70 For The First Time Since March 2

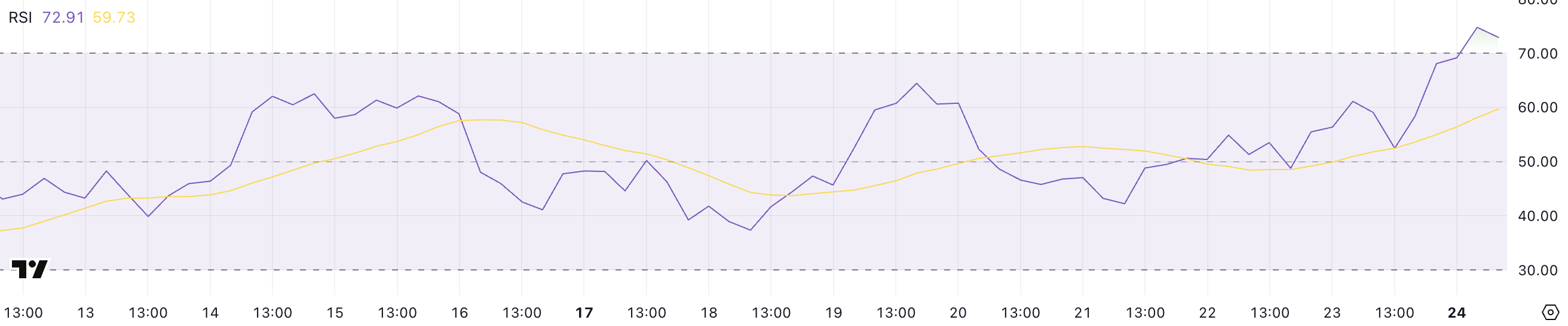

Solana’s RSI has surged from 52.46 yesterday to 72.91 today, marking the first time it has entered overbought territory since March 2.

This sharp rise signals a sudden acceleration in buying momentum after nearly two weeks of neutral readings hovering around the mid-50s.

The breakout above the 70 level suggests a notable shift in sentiment, as traders have pushed SOL into a more aggressive bullish stance.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It helps traders identify potential overbought or oversold conditions.

Typically, an RSI value above 70 is considered overbought, indicating that an asset may be due for a corrective pullback. Readings below 30 are viewed as oversold, suggesting possible upside reversals. Solana’s RSI, currently at 72.91, highlights a strong bullish push but also raises caution about a potential short-term correction as BNB overtakes Solana in DEX volume.

Given that SOL had been trading in a neutral zone for the past 12 days, this sudden spike could either mark the start of a stronger rally or signal a temporary overheating in price momentum.

SOL Whales Are Still Hesitant

The number of Solana whales – wallets holding at least 10,000 SOL – is currently at 5,019, slightly down from the recent peak of 5,041 recorded on March 18.

This fluctuation highlights ongoing shifts in large-holder behavior, as whale activity has yet to stabilize fully. While the recent whale count remains elevated compared to earlier levels this month, it still suggests hesitation among large investors to re-enter the market fully.

Tracking whale activity is crucial because these large holders often significantly influence market trends and liquidity. An increase in whale addresses can indicate accumulation and growing confidence, while a decline may signal distribution or caution.

With the current whale count showing signs of volatility and retreating slightly from recent highs, it suggests that major players are still uncertain about Solana’s short-term direction.

Until this number shows more consistent growth, it could imply that SOL’s price may remain sensitive to fluctuations and lack the solid backing typically seen during stronger bullish trends.

Can Solana Sustain The Current Levels?

Solana’s EMA lines recently confirmed a golden cross, signaling the potential for a bullish continuation. Further golden crosses may form soon.

If the current uptrend strengthens, Solana’s price could rise to challenge the resistance at $152.90 and, if momentum persists, extend gains toward the $180 mark.

Despite concerns within the community regarding the competition between PumpFun and Raydium, Chris Chung, founder of Solana-based swap platform Titan, argues that this rivalry could actually benefit Solana’s broader ecosystem:

“Pump.fun launching its own DEX was inevitable as they believe they have a strong enough brand now to eliminate the Raydium tech stack and collect AMM fees themselves. In addition, Raydium announced plans for its own launchpad, showing that competition in the Solana ecosystem is heating up – and fast. It’s great to see new players enter with ideas to improve the speed and usability of end users. This type of competitive behavior helps build robust financial products and DeFi protocols and simply makes Solana’s activity grow,” Chung told BeInCrypto.

However, if bullish momentum weakens and the uptrend reverses, SOL could retest key support at $136.71.

A break below this level could expose Solana to further downside, with a target of $120 and potentially $112 if selling pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoStablecoin Market Cap Hits $220 Billion

-

Bitcoin15 hours ago

Bitcoin15 hours agoUS Economic Data This Week: Key Events Shaping Bitcoin

-

Market11 hours ago

Market11 hours agoSPX Rebound Drives 148% Increase, Eyes New Gains

-

Altcoin16 hours ago

Altcoin16 hours agoWhy Is Solana Price Up 7% Today?

-

Altcoin11 hours ago

Altcoin11 hours agoRipple Coin and Bitcoin Dominate the $644M Weekly Inflow

-

Market16 hours ago

Market16 hours agoWhy “Easy Money” in Crypto is Gone

-

Market10 hours ago

Market10 hours agoWhy 2025 Will Redefine Crypto Acquisitions: Experts Weigh In

-

Altcoin15 hours ago

Altcoin15 hours agoXRP For Real Estate? Big Company in Japan Says Yes!