Market

Tether Buys $33 Billion US Bonds Amid Forthcoming Regulation

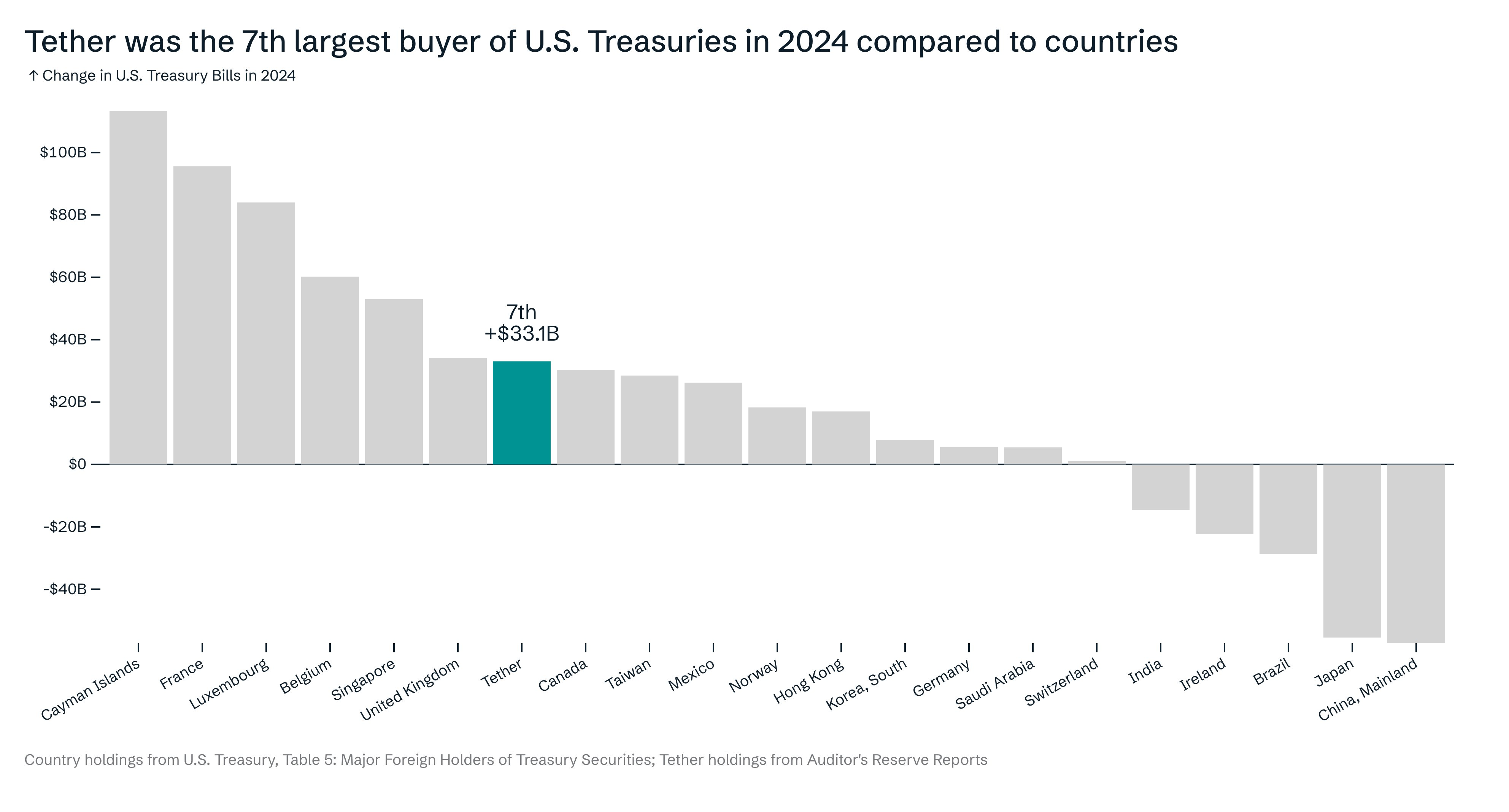

Tether surprised the market by announcing that it purchased over $33 billion in Treasury bonds last year. This makes Tether the seventh-largest buyer of US bonds, ahead of countries like Canada, Mexico, and Germany.

In a speech today, President Trump claimed that stablecoins will be used to promote dollar dominance worldwide. By purchasing these bonds, Tether could be securing an incredibly valuable partnership.

Why is Tether Buying US Treasury Bonds?

Tether, the world’s largest stablecoin issuer, might have a significant opportunity on its hands soon. At the Digital Assets Summit earlier today, President Trump alluded to some big plans for future stablecoin policies in the US.

An important factor in these plans may be that Tether is now one of the world’s largest purchasers of US Treasury bonds:

“Tether was the 7th largest buyer of US Treasuries in 2024, compared to countries. Tether brings the US dollar to more than 400 million people predominantly in emerging markets and developing countries. Without a doubt, Tether built the biggest distribution network for the US Dollar,” Tether CEO Paolo Ardoino said in a pair of social media posts.

This could potentially boost USDT compliance efforts with the forthcoming stablecoin regulation. The proposed GENIUS Act, which is pending congressional approval, requires stablecoin issuers to hold reserve assets in the US, denominated in the US treasury.

So, this purchase could allow Tether to comply with the upcoming US regulation, unlike the EU’s MiCA.

“Insane. Tether has become an essential partner to the United States in less than a decade,” wrote Anthony Pompliano.

In his speech today, President Trump didn’t make many firm commitments about future stablecoin policy. He did, however, claim that dollar-backed stablecoins will “expand the dominance of the US dollar” for years in the future.

If the US government substantially influences the stablecoin market, Tether could be a good conduit for Trump’s partnership.

Could Tether and Trump Drive USD Dominance?

All the proposed stablecoin regulations in the US include a clear demand: issuers must be subject to third-party audits. Tether has never allowed one, although its new CFO supports an audit.

This speed bump has already moved Coinbase to state that it would remove Tether’s products if asked, just like it was pushed out of the EU last December.

However, Tether may be able to solve many of these problems by purchasing Treasury bonds. Among other requirements, the GENIUS Act mandates that stablecoin issuers hold much of their reserves in US Treasuries.

It was previously theorized that Tether may need to sell its Bitcoin due to this regulation, but the fact that the company has been buying treasury bonds changes the speculations.

“Should Congress pass the GENIUS Act, the regulatory clarity might also attract traditional banking firms into the stablecoin ecosystem, fueling healthy competition. The stablecoin market can potentially hit $3 trillion in the next 5 years, a sign that the asset class can dominate the global payment ecosystem in the coming years. The essence of these regulations will be to preserve the hegemony of the US dollar, albeit in a tokenized form such as stablecoins. In the long run, the regulatory clarity will mutually benefit the crypto industry and the US economy,” Agne Linge, Head of Growth at WeFi told BeInCrypto.

Tether has purchased a staggering amount of Treasury bonds in the last year, but this might not guarantee a partnership with Trump and the US government.

Several major banks are eyeing stablecoin launches, and several people in Trump’s orbit allegedly discussed partnering with Binance to launch one, too. So far, there’s no evidence Tether had a similar deal.

Still, Tether purchased over $33 billion in US Treasury bonds in one year, and that’s bound to make an impact. If Trump’s administration decides to use Tether to promote dollar dominance, it could change everything.

It’s too soon to confidently state that such predictions will come true. Tether may still need a third-party audit despite buying these Treasury bonds. Still, if the stars align, its dominant position in the stablecoin market could be supercharged.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock Expands Bitcoin ETPs to Europe After US ETF Success

BlackRock, the world’s largest asset manager, is launching its first Bitcoin ETP (exchange-traded product) in Europe, expanding its presence in the crypto investment space.

This move follows the success of its US-listed spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), which has accumulated $50.6 billion in assets under management (AUM).

BlackRock to List Bitcoin ETP in Europe

The new iShares Bitcoin ETP will be available for trading on Xetra and Euronext Paris under the ticker IB1T and on Euronext Amsterdam as BTCN.

The expansion into Europe marks BlackRock’s first crypto-backed ETP offering outside North America. This suggests growing institutional interest in digital assets.

To encourage early adoption, BlackRock is offering a temporary fee waiver, reducing the expense ratio of the ETP to 0.15% until the end of the year. This makes the product one of the most cost-effective Bitcoin ETPs in the European market. It could attract both retail and institutional investors looking for exposure to digital assets at a competitive price.

Europe has been a pioneer in crypto ETPs, with over 160 digital asset-tracking products available. However, its overall market size remains relatively small compared to the US.

Bloomberg ETF analyst Eric Balchunas pointed out that US spot Bitcoin ETFs dominate the global market. Specifically, the US holds approximately 91% of total assets despite being introduced only a year ago.

“Europe barely on leaderboard of spot bitcoin ETFs by size. US spot ETFs only year old and have 91% share of world,” Balchunas said in a February post.

Balchunas also noted that Europe has struggled to compete with the US in terms of liquidity and cost efficiency. He speculated that BlackRock’s entry into the European market could provide a significant boost. Specifically, the asset manager could replicate the cost-effectiveness and trading volume seen in the US.

“If BlackRock brings even some of the US Terrordome over there, it should see success, although Europeans are generally less into ‘hot sauce’ than US and certain Asian investors,” he added.

Notwithstanding, BlackRock’s Bitcoin ETP in Europe is a game-changer for institutional adoption. As access broadens, it could increase BTC demand.

Despite the news, however, the impact on Bitcoin’s price remains muted. BTC was down by 0.55% in the last 24 hours. As of this writing, Bitcoin was trading for $86,601.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Consolidates—Breakout Incoming or More Choppy Moves?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Will the Treasury Reimpose Sanctions Against Tornado Cash?

The US Treasury recently lifted its sanctions on Tornado Cash, the controversial cryptocurrency mixer blocked over allegations of facilitating North Korean money laundering.

While this reversal marked a significant development, Coinbase’s Chief Legal Officer Paul Grewal warns that the move does not guarantee long-term freedom for Tornado Cash. Based on his opinion as a legal expert, the US Treasury left the door open for imposing similar restrictions in the future.

Paul Grewal Says Future Sanctions Still a Possibility

The decision to delist Tornado Cash follows months of legal battles and criticism from the crypto community. The Treasury’s original sanctions accused the mixing service of enabling illicit transactions, particularly those tied to North Korea’s hacking groups.

However, legal challenges led to increased scrutiny of the Treasury’s actions, ultimately prompting it to remove the restrictions. Despite this, Grewal argues that the Treasury’s actions attempt to bypass the court’s authority rather than a genuine acknowledgment of wrongdoing.

He believes the reversal does not prevent the government from re-imposing sanctions whenever it sees fit.

“Power does not recede voluntarily. It gasps and it gasps until it no longer can,” Grewal wrote.

Grewal contends that the Treasury’s withdrawal does not legally nullify existing claims. He cites the voluntary cessation doctrine—a defendant’s decision to end a challenged practice does not necessarily moot a case unless it is proven that the practice will not be reinstated.

The Coinbase exchange executive referenced past legal cases, including Friends of the Earth, Inc. v. Laidlaw Environmental Services (TOC), Inc. In this case, the Supreme Court ruled that a voluntary withdrawal does not eliminate the possibility of future enforcement.

Grewal also cited FBI v. Fikre, where the court held that the FBI’s removal of a plaintiff from the No Fly List did not moot a case. As it happened, there was no assurance the plaintiff would not be relisted.

These legal precedents demonstrate why the Treasury’s move to lift Tornado Cash sanctions does not guarantee lasting protection.

“Here, Treasury has likewise removed the Tornado Cash entities from the SDN, but has provided no assurance that it will not re-list Tornado Cash again,” Grewal argued.

Coinbase CLO Calls for a Final Court Ruling

Based on this, Grewal is urging the district court to take decisive action to prevent potential Treasury overreach. He insists that the court must grant the plaintiffs’ motion for partial summary judgment, which means formally invalidating the Treasury’s designation of Tornado Cash as a sanctioned entity.

“The US Treasury’s response to the unambiguous mandate of the Fifth Circuit on Tornado Cash has been a study in chaos. It is time for the district court to do what was ordered months ago. Plaintiffs’ motion for partial summary judgment on Count 1 must be granted, and TC’s designation must be held unlawful and set aside,” Grewal articulated.

The removal of sanctions is a positive step for Tornado Cash users and the broader crypto community. However, the risk of renewed regulatory action looms large. The legal battle may not be over yet, and the case outcome could set a significant precedent for decentralized finance (DeFi) platforms and privacy-focused technologies.

Grewal and other industry advocates continue to push for a clear judicial ruling. The core objective is to prevent the Treasury from arbitrarily sanctioning Tornado Cash again. Until such a ruling is secured, Tornado Cash remains uncertain legal territory.

“Yes we see this often with the 2a [Second Amendment litigation], they either drop the case or try to settle it so they don’t get a precedent they don’t want set,” Badbrothers, a popular account on X, added.

Badbrothers on X suggests a pattern where government agencies strategically avoid judicial rulings that could limit their authority.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoEthereum Supply Dips as Leverage Rises – What It Means for ETH

-

Altcoin22 hours ago

Altcoin22 hours agoRipple Coin and Bitcoin Dominate the $644M Weekly Inflow

-

Altcoin24 hours ago

Altcoin24 hours agoHere’s How Pi Coin May Retain The $1 Mark

-

Altcoin23 hours ago

Altcoin23 hours agoWhy Trump’s World Liberty Financial Stacked 6 Million MNT?

-

Market21 hours ago

Market21 hours agoWhy 2025 Will Redefine Crypto Acquisitions: Experts Weigh In

-

Bitcoin20 hours ago

Bitcoin20 hours agoCrypto Inflows Return with $644 Million Boost, Bitcoin Leads

-

Market20 hours ago

Market20 hours agoCan Tron Compete with Solana?

-

Market19 hours ago

Market19 hours agoXRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit