Market

Telegram is Generating 40% of its Revenue From Crypto

Telegram, the popular social messaging app, is increasingly dependent on cryptocurrency, particularly through its integration with TON blockchain. This crypto activity now drives a significant portion of the platform’s revenue.

This revelation comes as its founder and CEO, Pavel Durov, faces legal scrutiny in France. Last week, a French court charged him over allegations that the app was used to facilitate illicit activities.

Telegram’s Revenue Heavily Reliant on Crypto

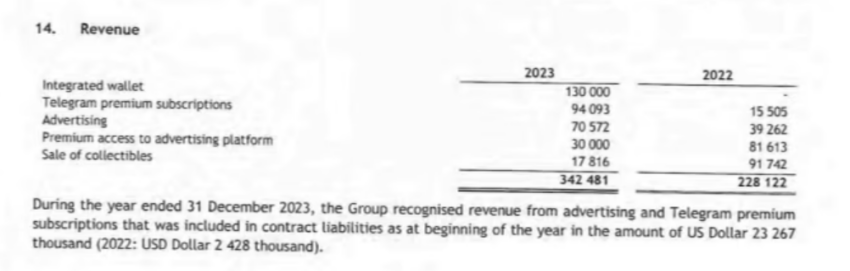

A recent Financial Times report reveals that Telegram generated $130 million from its integrated wallet services. This amount surpasses its earnings from advertising and premium subscriptions.

In September 2023, Telegram introduced a self-custodial wallet targeting crypto enthusiasts. This feature enables users to store, send, receive, and trade crypto assets within the app, bypassing other popular wallet providers like MetaMask.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Further, the company also earned $17.8 million from selling digital collectibles, such as usernames and virtual phone numbers, with payments made in Toncoin, the native token of the TON blockchain. Together, these crypto-related activities brought in nearly $148 million, accounting for around 40% of Telegram’s annual revenue.

“Aside from purchasing $64 million of Telegram’s convertible bonds last year, Durov also purchased $300,000 worth of Telegram Premium subscriptions for a giveaway, paying the company in Toncoin,” the report added.

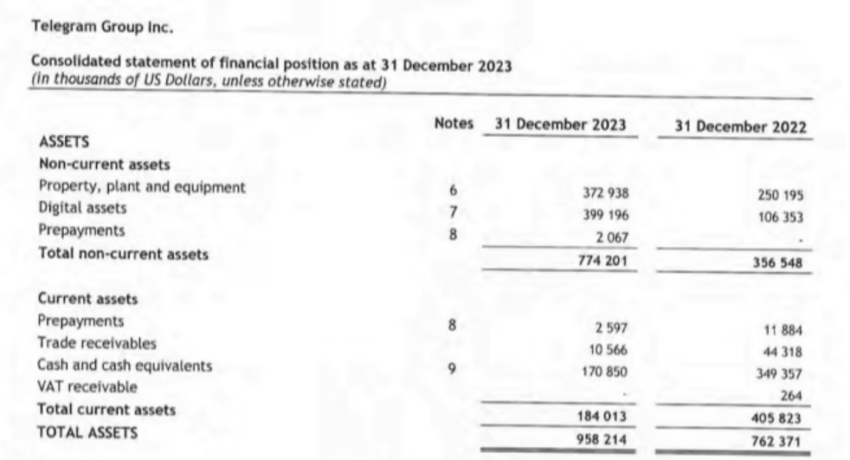

Telegram’s financial reports also show that the company holds $399.2 million in crypto assets, a sharp increase from $106.35 million in 2022. In contrast, its cash and cash equivalents for 2023 amounted to only $170.85 million, while real estate and equipment assets were valued at $372.94 million. This data suggests that crypto is now Telegram’s most valuable asset.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Meanwhile, the report did not specify which cryptocurrencies Telegram holds, but community speculation points to Toncoin as the primary asset due to its central role in the platform.

Despite its substantial crypto holdings and revenue, Telegram is operating at a loss. The company reported $108 million in losses for 2023 despite generating $342.5 million in revenue, indicating that its expenses reached $450.5 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Reconsiders Howey Test Use in Crypto Oversight

The US Securities and Exchange Commission (SEC) is preparing to review several internal staff directives that influence how the regulator oversees the crypto industry.

This move aligns with President Donald Trump’s latest Executive Order on deregulation. It also follows guidance from the Department of Government Efficiency (DOGE), currently led by Elon Musk.

SEC to Review Howey Test and Investment Contract Framework Application

On April 5, Acting SEC Chair Mark Uyeda noted that the upcoming reviews could result in changes or full withdrawal of some statements. He emphasized that the agency’s objective is to ensure its guidance remains relevant and consistent with its current priorities.

“The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities,” the Commission stated.

One of the main targets of this reassessment is the SEC’s current framework for determining whether a digital asset qualifies as a security. This guideline relies heavily on the decades-old Howey Test.

It also reflects the views of former SEC official Bill Hinman, shared during a 2018 speech. Hinman argued that the degree of decentralization behind a token should matter more than how it was originally sold.

This view has influenced several enforcement decisions, including the legal battle with Ripple over XRP. However, many in the industry argue that the Howey Test is no longer suitable for modern blockchain technologies.

This development may pave the way for a dramatic shift in how crypto assets are evaluated. Crypto analyst Jesus Martinez believes that removing or revising the current framework could be a major turning point for retail investors in the US.

He argues that regulatory constraints have long blocked everyday users from participating in projects like launchpads and node operations. These platforms are often only accessible to those with foreign identification or institutional workarounds.

Martinez says that dismantling such outdated rules could help level the playing field for American investors.

“It’s been hurting retail for the longest time & we need to prioritize American citizens, this is a big step in that direction,” Martinez concluded.

Beyond the Howey-based framework, the SEC is also reviewing several other documents. One of these is a bulletin outlining regulatory concerns around mutual funds investing in Bitcoin futures.

The financial regulator is also reviewing a risk alert from the Division of Examination. This alert warns that digital assets pose unique investor risks, including regulatory uncertainty and cybersecurity threats.

Additionally, the Commission is reassessing whether state-chartered banks and trust companies can act as qualified custodians under the SEC’s Custody Rule.

The crypto community believes the SEC’s broad reassessment points to a shift toward a more modern and flexible regulatory approach. This shift could reshape the crypto landscape for both retail investors and institutional participants

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

Renowned market analyst Egrag Crypto has shared another puzzling XRP price prediction stating the altcoin is at a major technical crossroads. This development follows a resilient price performance in the past week during which XRP gained by 2.07% as the broader crypto market stands bullish despite the announcement of new US trade tariffs.

Ascending Wedge Signals Incoming Volatility — Which Way Will XRP Break?

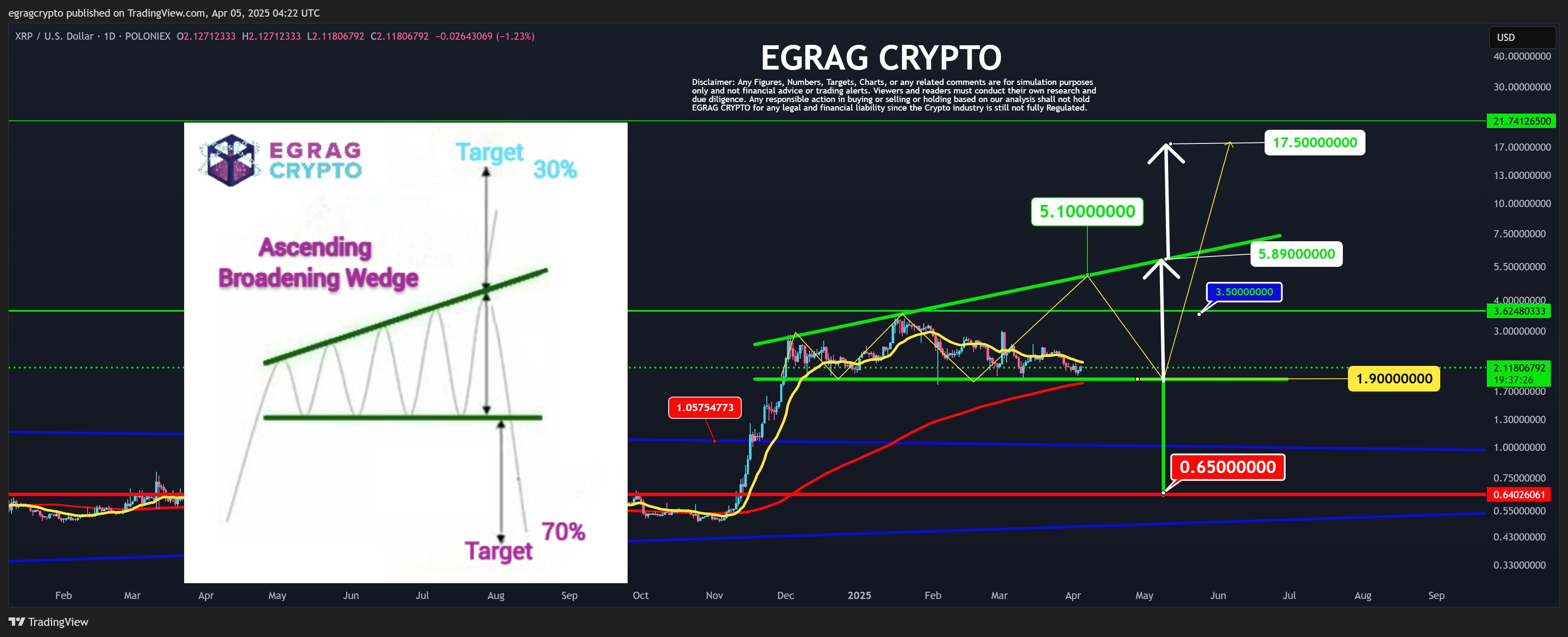

In an X post on April 5, Egrag Crypto issued a dual price forecast on the XRP market based on the potential implications of a forming Ascending Broadening Wedge pattern. Also known as the megaphone pattern, the chart formation signals increasing volatility and investor indecisions. It looks like a widening triangle with two diverging trendlines, as seen in the chart below.

The Ascending Broadening Wedge presents high unpredictability and offers a 70% chance of a downside breakout and a 30% probability of an upside breakout. However, despite this statistical bias, the analyst postulates the chances of an upside remain valid if certain conditions are met.

According to the analyst, XRP must first close above $3.50 for a bullish scenario to start taking shape. In doing so, the altcoin would surpass the local peak of the current bull cycle and confirm intentions of an upward momentum. Following this move, XRP bulls should then aim for the $5 range—another key resistance level that could determine the asset’s next major move.

Interestingly, Egrag explains that a failure to convincingly close above $5 would only be a critical development that completes the formation of the Ascending Wedge Pattern and increases the likelihood of a breakout. If this rejection occurs, XRP is expected to retest the $1.90 area and make a second push toward the $5, this time breaking through and closing above $6.

Egrag states the breakout above $6 would validate the bullish run and likely spark a surge toward double-digit territory with a potential target at $17.50 based on the Ascending Wedge Pattern. However, should XRP bulls fail to meet these conditions or follow this sequence, the historical 70% chance of a breakdown points to a downside target of around $0.65.

XRP Price Overview

At the time of writing, XRP trades at $2.14 reflecting a price gain of 0.60% in the past day. Meanwhile, the token’s trading volume is down by 62.92% in the past day indicating a fall in market engagement and a declining buying pressure following the recent market gain. In making any significant uptrend, XRP bulls must first reclaim the following resistances at $2.47 and $2.61 while avoiding any slip below the $2 support zone.

Market

Solana Altcoin Saros Rallies 1000% Since March, Hits New High

Saros, the Solana-based altcoin, has been on an impressive uptrend over the past month. The token’s price has formed new all-time highs (ATHs) nearly every day throughout March.

However, with the momentum showing signs of slowing, investors are wondering if this rally is nearing its end.

SAROS Refrains From Following Bitcoin

The correlation between Saros and Bitcoin (BTC) is currently negative, sitting at -0.43. This negative correlation has worked in Saros’ favor, as it allowed the altcoin to perform well during Bitcoin’s struggles throughout March. While Bitcoin faced significant declines, Saros was able to rally largely due to this inverse relationship.

The shifting dynamics between Bitcoin and Saros will be key to the future price movement of the altcoin. Should Bitcoin regain its upward momentum, Saros may face increased selling pressure. This is because the negative correlation that has benefited Saros may reverse, impacting the altcoin’s ability to maintain its upward trajectory.

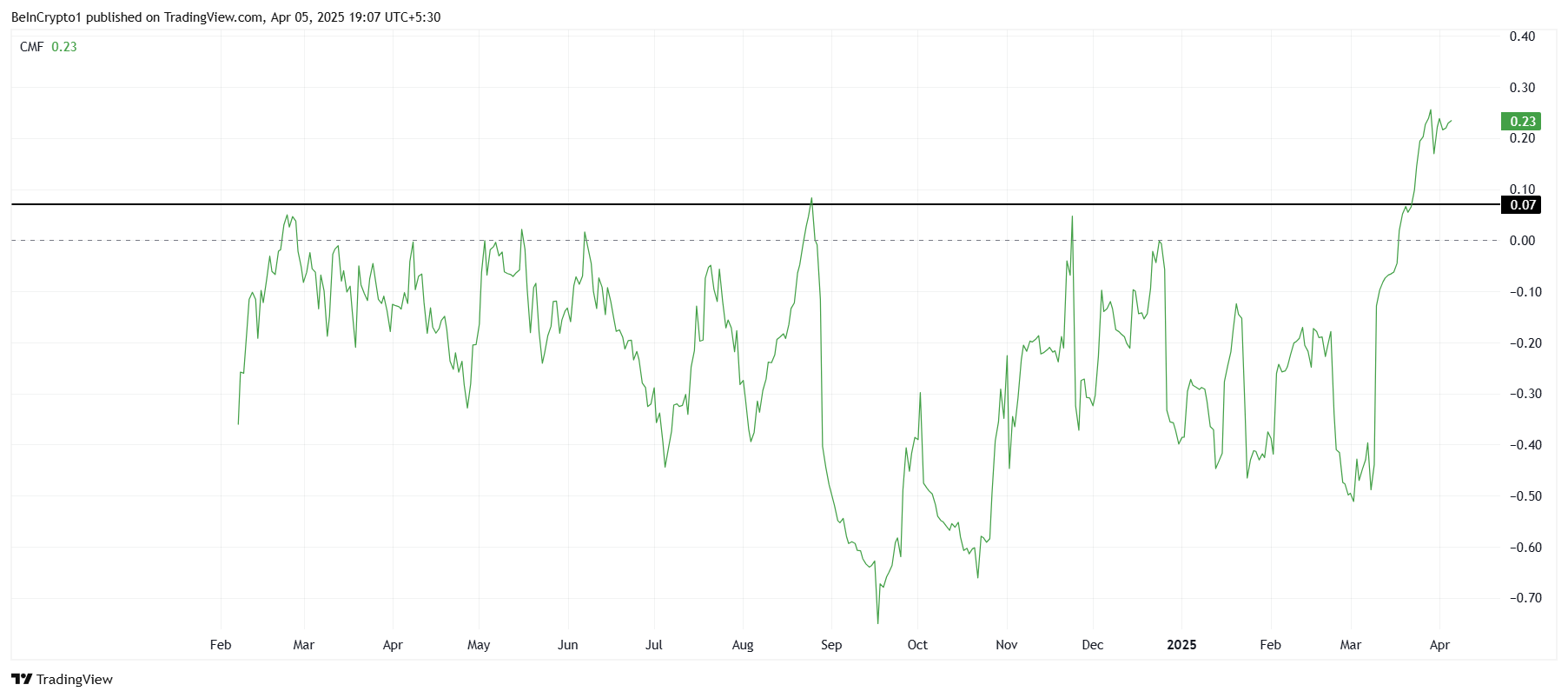

The overall macro momentum of Saros shows that investor interest has remained strong. The Chaikin Money Flow (CMF) indicator has been increasing steadily over the past month, signaling consistent inflows.

Recently, it crossed the saturation threshold of 0.7, a level that has historically led to price corrections. This suggests that while Saros has experienced significant gains, the market may be nearing an overbought condition. If profit-taking begins, a price pullback is highly probable for the altcoin.

SAROS Price Rise Continues

Saros has surged by an astounding 1,024% since the beginning of March, trading at $0.153 as of now. Throughout March, the altcoin has formed new ATHs almost daily, reflecting strong investor sentiment and demand.

The current ATH stands at $0.163, and the momentum could continue pushing the price upwards, potentially reaching $0.200 if the uptrend remains intact. However, as the price continues to rise, the risk of profit-taking increases.

If Saros faces such a pullback, it could fall back towards the $0.100 support level. If the altcoin loses this key support, the price could drop further to $0.055, invalidating the bullish outlook. Investors should keep an eye on these levels as they will help determine whether the current rally is sustainable.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoEthereum Transaction Fees Hit Lowest Level Since 2020

-

Market19 hours ago

Market19 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Ethereum19 hours ago

Ethereum19 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market20 hours ago

Market20 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin20 hours ago

Bitcoin20 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Market18 hours ago

Market18 hours agoSEC’s Guidance Raises Questions About Tether’s USDT

-

Market17 hours ago

Market17 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off