Market

STX Investors’ Weak Conviction Might Extend 12% Weekly Drop

Stacks (STX) price is observing bearishness despite dropping by a little over 12% in four days.

This bearishness is due to the lack of conviction among STX holders, who are already favoring a decline.

Stacks Investors Turn Pessimistic.

STX price is bearing the brunt of the declining conviction among investors who switched their loyalty at the slightest drop. The negative funding rate indicates that STX holders anticipate a decline and have started placing short bets. This suggests a bearish sentiment among traders, expecting the price to fall.

The shift in funding rate over the last 12 hours was surprising, considering no negative rates had been registered in the last two weeks.

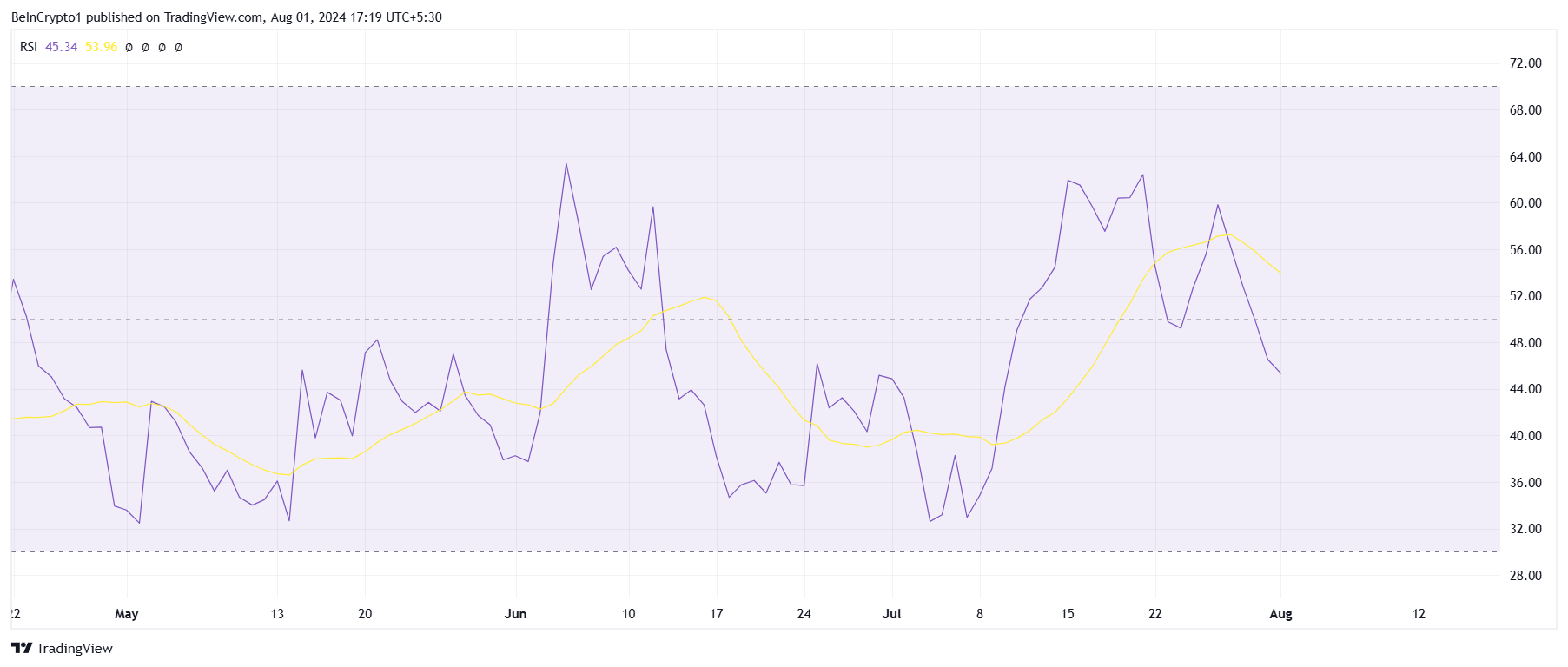

The relative strength index (RSI) further substantiates this lack of bullishness. Over the past 72 hours, the STX RSI has slipped below the neutral line. The RSI is a momentum oscillator that measures the speed and change of price movements.

Falling below the neutral line signals weakening momentum, with selling pressure outweighing buying interest. This can lead to a self-fulfilling cycle where increased selling pressure leads to even lower prices, attracting more sellers.

Read more: What Are Decentralized Exchanges and Why Should You Try Them?

STX Price Prediction: Aiming for Support

STX price at $1.70 is well below the previous support of $1.80 and is now most likely aiming to cushion its drawdown at $1.53. The altcoin has tested this line as support in the past, so there is a chance STX will bounce back from it.

If the support is not sustained, a further price drop will lead to Stacks reaching $1.24. This would wipe out the 47% gain noted by the cryptocurrency in the two weeks of mid-July.

Read more: Top 10 Aspiring Crypto Coins for 2024

But if the bounce back from $1.53 is successful, STX could end up rising to $1.80 again. This would warrant strong bullish cues from the broader market. Breaching this resistance could also invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.