Market

Starknet (STRK) Climbs up Market Cap Rankings as Price Jumps

The past week saw a significant surge in the value of Layer 2 (L2) tokens. Leading assets such as Optimism (OP) and Arbitrum (ARB) experienced double-digit price increases. Still witnessing an uptick at press time, their values have grown by 29% and 16%, respectively, in the past seven days.

The rally has also extended to Starknet (STRK), another L2 token, whose price has increased by 10% during the same period.

Starknet Is Now Among the Top 100 Coins

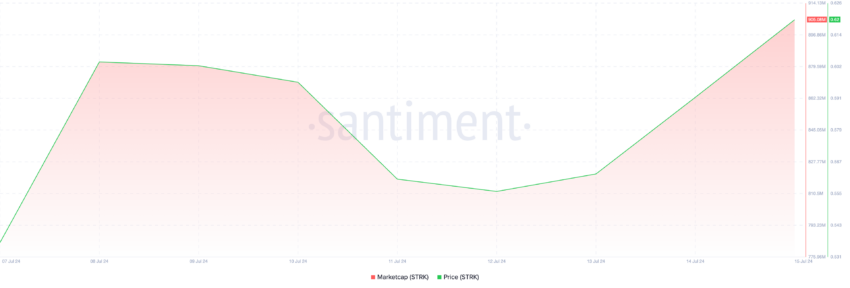

The surge in Starknet’s (STRK) trading activity and price during the period in review has led to an uptick in its market capitalization.

As of this writing, the altcoin’s market capitalization is $905 million, representing its highest in the last seven days. It is now the 71st cryptocurrency asset with the highest market capitalization.

An asset’s market capitalization measures the total value of its tokens/coins in circulation. When it surges, the total value of these tokens is increasing. This is a positive sign which highlights a price rally and increased demand for an asset.

STRK’s price uptick in the past week has led to a growth in activity in its derivatives market. This can be gleaned from its rising futures open interest. At $51 million as of this writing, the token’s futures open interest has increased by 9% in the last week.

Read More: A Deep Dive Into Starkware, StarkNet, and StarkEx

An asset’s futures open interest refers to the total number of outstanding futures contracts that have not been settled. When it spikes, it means that more traders are entering into new positions.

However, many derivatives traders are not convinced that STRK’s current rally is sustainable. This has caused them to demand more short positions. This is based on the readings from the token’s funding rate, which has been predominantly negative during the period under review.

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are negative, it means more traders are buying the asset expecting a price decline than those buying and hoping for a rally.

STRK Price Prediction: The Rally Will Continue

As assessed on a one-day chart, some of STRK’s leading technical indicators hint at the possibility of an extended rally. For example, its Chaikin Money Flow (CMF) has trended upward with its price.

This indicator measures the flow of money into and out of an asset. When it surges, it means liquidity is being supplied to the market. When an asset’s price and CMF trend upward, it is a positive sign showing that the price rally is backed by actual demand for the asset.

Also, STRK’s Accumulation/Distribution (A/D) line is experiencing an uptrend at press time. This indicator measures the cumulative flow of money into and out of an asset.

As with STRK, when both the price and the A/D Line are rising, it confirms a strong uptrend, suggesting that the buying pressure is strong.

If this buying pressure remains, the token’s price may climb to $0.63.

Read More: Best Upcoming Airdrops in 2024

However, if profit-taking activity commences, STRK’s price might drop to the $0.5 price level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.