Market

Standard Chartered Calls for Bitcoin Push Above $88,500

Standard Chartered has predicted that Bitcoin (BTC) will likely break above $88,500 this weekend following a strong performance in the tech sector.

The bank’s Global Head of Digital Assets Research, Geoff Kendrick, shared these expectations in an exclusive with BeInCrypto.

What Standard Chartered Says About Bitcoin This Weekend

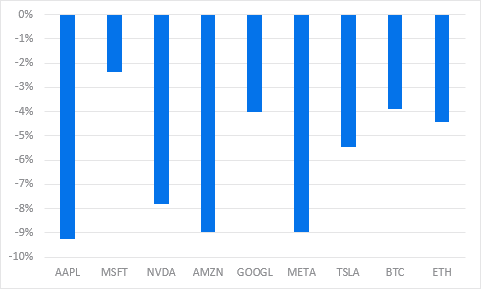

In an email to BeInCrypto, Kendrick pointed to recent price action among major technology stocks, including Microsoft, as an indicator of Bitcoin’s short-term trajectory.

“Strongest performers were MSFT and BTC. Same again so for today in Bitcoin spot and tech futures,” Kendrick said.

He explained that a decisive break above the critical $85,000 level appears likely post-US non-farm payrolls. The Standard Chartered executive explained that such an outcome would pave the way for a return to Wednesday’s pre-tariff level of $88,500.

However, China’s retaliatory tariffs could increase market uncertainty, driving prices down in the short term. This volatility might dampen investor confidence, overshadowing any weekend gains.

Kendrick’s assertions come ahead of the much-anticipated US employment report, Non-Farm Payrolls (NFP). The report would present a comprehensive labor market update, including jobs added, the unemployment rate, and wage growth.

A strong report could bolster faith in the economy, particularly if it comes in higher than the previous reading of 151,000 jobs. This is more so if accompanied by a steady 4.1% unemployment rate. Such an outcome could curb crypto gains if the dollar rallies.

Conversely, a disappointing tally, potentially below the median forecast of 140,000 jobs with unemployment ticking beyond 4.1%, could ignite recession worries. This would send investors flocking to Bitcoin and crypto.

Standard Chartered may be pivoting to the latter outcome, with Kendrick emphasizing Bitcoin’s growing role as a key asset.

“Bitcoin is proving itself to be the best of tech upside when stocks go up and also as a hedge in multiple scenarios…I argued that Bitcoin trades more like tech stocks than it does gold most of the time. At other times, and structurally, Bitcoin is useful as a TradFi hedge,” he added.

Standard Chartered has increasingly highlighted Bitcoin’s strategic importance within financial markets. The bank recently identified Bitcoin and Avalanche (AVAX) as likely beneficiaries of a potential post-Liberation Day crypto surge. BeInCrypto reported the forecast, which now aligns with the latest one, that institutional investors could be preparing for a market upswing.

Additionally, the bank has positioned Bitcoin as a growing hedge against inflation. It argued that its limited supply and decentralized nature make it an attractive alternative to traditional safe-haven assets.

Standard Chartered Calls to HODL Bitcoin

Amid Bitcoin’s growing role in traditional finance (TradFi), Kendrick advised investors to maintain their holdings.

“Over the last 36 hours, I think we can also add ‘US isolation’ hedge to the list of Bitcoin uses,” he added.

This suggests that Bitcoin could serve as a protective asset in geopolitical and macroeconomic uncertainty.

Meanwhile, the BTC/USDT daily chart shows a critical technical setup, with Bitcoin’s price currently trading around $82,643. A former support level of $85,000 now stands as resistance, limiting the pioneer crypto’s upside potential. The supply zone near $86,508 adds further selling pressure.

On the downside, a key demand zone between $77,500 and $80,708 provides support. Despite price consolidation, the Relative Strength Index (RSI) is forming higher lows, indicating sustained growing momentum and a potential reversal.

If BTC successfully reclaims $85,000, it could trigger a move toward $87,480. However, to confirm the continuation of the uptrend, BTC must record a daily candlestick close above the midline of the supply zone at $86,508.

The bullish volume profile (blue) supports this thesis, showing that bulls are waiting to interact with the Bitcoin price above the midline of the supply zone.

Failure to breach the immediate resistance at $85,000 might lead to a retest of the demand zone, potentially breaking lower. In such a directional bias, a break and close below the midline of this zone at $79,186 could exacerbate the downtrend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s Why Ethereum Price Below $1,500 is an Opportunity

Ethereum has experienced a significant downtrend since the start of the year, causing the altcoin to fall below the $1,500 level.

While this recent decline may seem concerning to some, many investors view this as an opportunity. The low price is tempting new entrants and fueling optimism for a potential recovery.

Ethereum Investors Find Opportunity

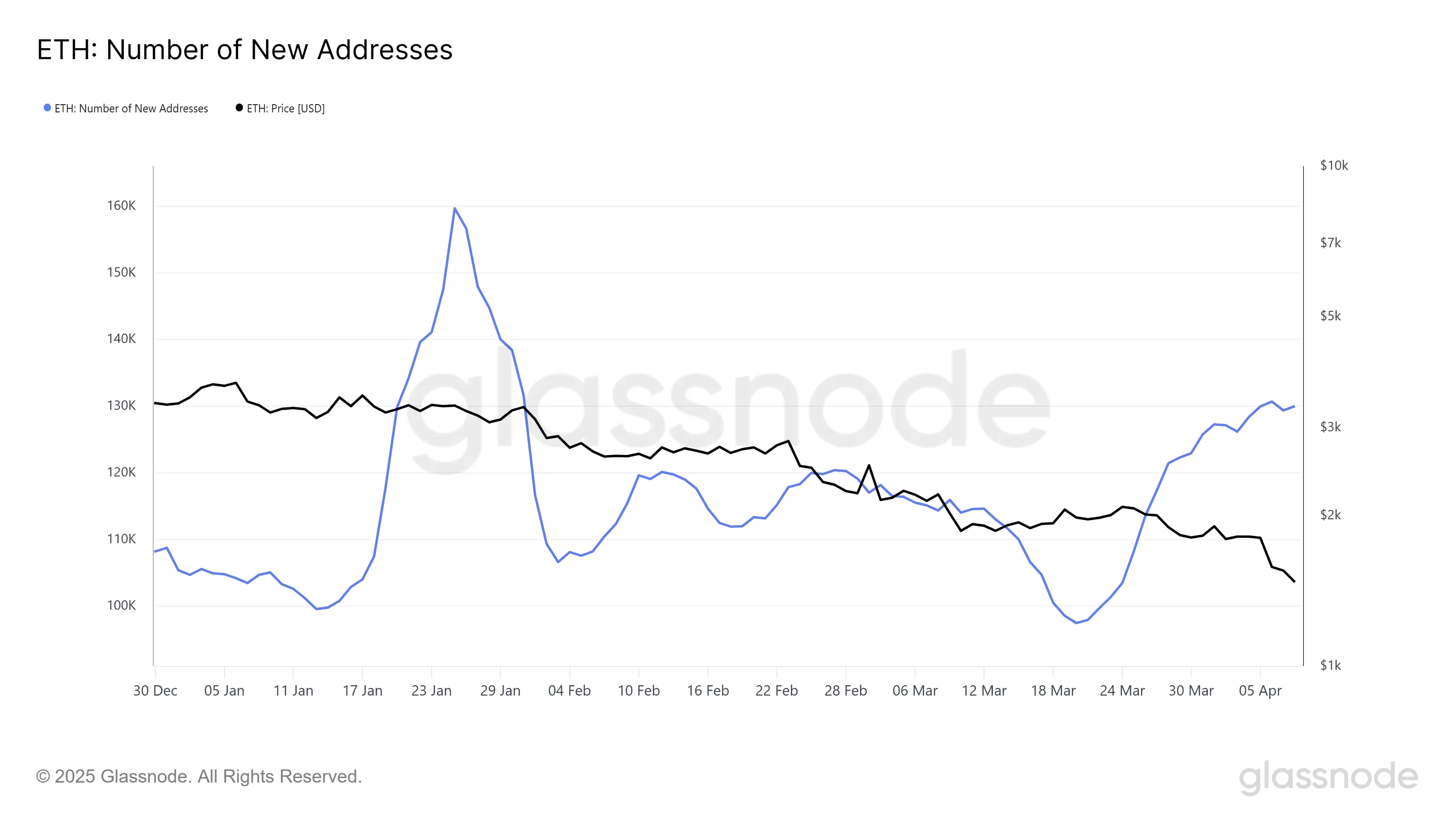

Ethereum’s price dip below $1,500 has resulted in a surge of new addresses, reaching a two-month high. This uptick in new investors suggests growing confidence in Ethereum’s future, especially at these lower price levels. The recent price decline has made Ethereum more accessible, which may be encouraging fresh investment.

The increase in new addresses also indicates that investors are positioning themselves for a potential rebound. With prices currently lower than earlier in the year, some see this as a buying opportunity.

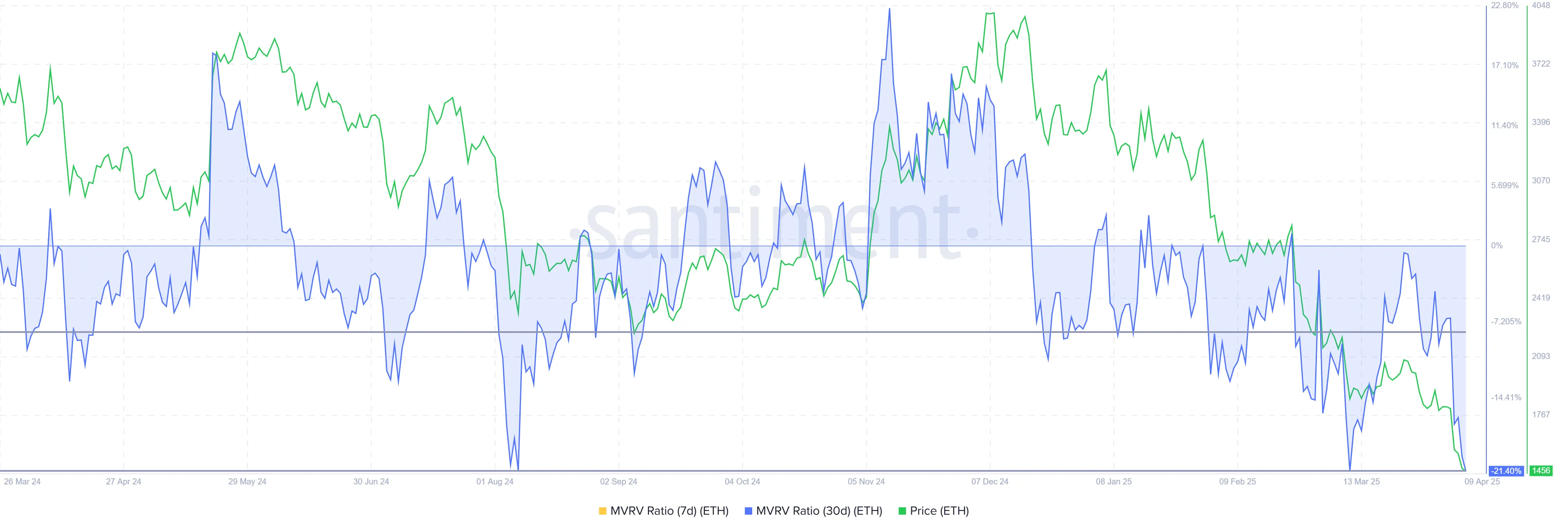

The MVRV Ratio, which measures the market value relative to the realized value, is currently in the “opportunity zone,” ranging from -8% to -21%. This range signals that Ethereum is undervalued, as prices have dipped to levels where investors typically step in. Historically, such conditions have led to reversals in price trends.

This low MVRV ratio reinforces the belief that Ethereum is in a prime accumulation phase. When the MVRV Ratio is in this zone, it indicates that investors who purchase during this period are likely to see positive returns in the future.

ETH Price Aims To Recover

Ethereum’s price has dropped by nearly 19% over the last 48 hours, reaching a yearly low of $1,375. As of writing, the altcoin is trading at $1,467. It has lost the crucial support of $1,533, which pushed it below $1,500. Despite the losses, Ethereum is likely to recover, given its resilient historical performance and renewed investor interest.

If Ethereum manages to reclaim the $1,533 support level, it could pave the way for a recovery towards $1,745. A break above $1,745 would confirm the reversal, ending the 4-month-long downtrend.

However, if the bearish trend continues, Ethereum could fall further, testing support levels below $1,429. Should it break through $1,375, the bearish thesis would be validated, and the altcoin could experience a prolonged period of decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Paul Atkins SEC Confirmation Vote

The US Senate will decide tomorrow the fate of Paul Atkins, President Donald Trump’s nominee to lead the SEC (Securities and Exchange Commission).

The cloture vote, scheduled for 11:30 AM ET, April 10, will end the debate, followed by a confirmation vote that could reshape financial oversight.

Will Paul Atkins Be Confirmed As SEC Chair?

After serving as SEC Commissioner between 2002 and 2008, Atkins is poised to replace Gary Gensler as chair of the commission. His predecessor stepped down on January 20 amid a contentious tenure and returned to MIT, where he now focuses on AI and fintech.

As the clock ticks toward the vote, investors are bracing for a potential shift toward deregulation and a seismic jolt to the crypto market.

The Senate Banking Committee advanced Atkins’ nomination on April 3 in a razor-thin 13-11 vote, split along party lines. Republicans rallied behind his vision of a leaner SEC, while Democrats, led by Senator Elizabeth Warren, decried his past record and ties to Wall Street.

“Mr. Atkins championed policies that fueled the 2008 financial crisis,” Warren charged.

This remark came during his March 27 confirmation hearing, pointing to his 2004 vote to loosen capital rules for firms like Lehman Brothers.

Ahead of the hearing, the SEC Chair nominee disclosed $327 million in assets. Among them were up to $6 million in crypto, holding stakes in Anchorage Digital and Off the Chain Capital, and up to $500,000 in call options.

Nevertheless, with Republicans holding a 53-47 Senate majority, Atkins’ confirmation seems likely.

What Paul Atkins As SEC Chair Means for Crypto Investors

If confirmed, Atkins would take the SEC’s reins at a pivotal moment. He promised to reset priorities and return common sense to an agency he claims has strayed under Gensler’s enforcement-heavy leadership.

“Mr. Atkins affirmed his commitment to an SEC that works transparently, with industry and consumer input…emphasized that digital assets are a top priority this year…addressed debanking and committed to end this undemocratic practice for good…,” Coinbase CLO Paul Grewal reported.

Known for his light-touch regulatory philosophy, Atkins has criticized “overly politicized and burdensome” rules that choke capital formation. Senate Banking Committee Chairman Tim Scott praised Atkins as a leader who will “promote capital formation and provide clarity for digital assets,” a nod to his potential to ease compliance burdens.

A deregulated SEC could spark more IPOs (initial public offerings), expanding options for retail and institutional investors.

Yet, critics warn that Atkins’ pre-2008 tenure could leave markets exposed if economic headwinds return. This refers to when he resisted tighter oversight.

“Paul Atkins dismissed calls for stronger regulations before the 2008 crash—then told Senator Warren he STILL thinks he was right. Even after millions lost their homes, jobs, and savings. This is who Trump wants to run the SEC,” wrote Accountable.US.

Nevertheless, no sector will gain more than crypto if Atkins takes the helm. A vocal advocate for digital assets since advising the Chamber of Digital Commerce, Atkins has pledged “a firm regulatory foundation” for an industry battered by Gensler’s crackdowns.

His confirmation could set the tone for new opportunities, including altcoin ETFs (exchange-traded funds) in the US or a rollback of hard-won protections.

Altcoin-based exchange-traded funds, such as spot Solana (SOL) and XRP ETFs, would unlock institutional investment and mainstream adoption for these tokens.

“SEC has delayed decisions on +60 crypto ETF applications including: Ripple (XRP), Solana (SOL), Litecoin (LTC), and Dogecoin (DOGE). Approvals hinge on the confirmation of President Trump’s SEC chair nominee, Paul Atkins,” Block News noted.

Markets at a Crossroads: Innovation vs Protection

However, the stakes are high. Atkins’ past consulting for the collapsed FTX exchange has drawn scrutiny. Senator Warren questioned his judgment on digital asset oversight.

A lighter regulatory touch might bolster innovation and embolden fraudsters in the $2 trillion crypto market. Such an outcome would leave retail investors to bear the risk.

Beyond crypto, Atkins’ agenda could redraw the lines of market oversight. He has called current disclosures “inefficient” and signaled skepticism toward environmental, social, and governance (ESG) mandates, potentially sidelining sustainable investors.

Enforcement would likely narrow to retail fraud, including penny stock scams, rather than broad regulatory sweeps. While such a shift could ease pressures on companies, it would loosen scrutiny of bad actors.

The outcome remains a cliffhanger as senators prepare to cast their votes today.

If confirmed, Atkins will be the next SEC chair as early as 7:00 PM today and assume office by mid-April. He would then serve out Gensler’s term until June 5, 2026, with a possible re-nomination thereafter.

His first moves, whether clarifying crypto rules or unwinding Gensler’s legacy, will signal whether the SEC tilts toward Wall Street or Main Street.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Braces for FOMC Hit as Trade Worries Mount

Welcome to the US Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see where Bitcoin may be headed next, ahead of today’s release of the Federal Reserve’s March FOMC meeting, how global trade tensions are rippling through crypto markets, why recession fears are climbing, and what Wall Street and Washington are doing behind the scenes. We’ve also got ETF flows, mining risks, whale behavior, and the chart that’s got everyone talking.

FOMC, Trade Tensions, and Bitcoin: Key Market Levels to Watch

With global markets on edge ahead of today’s 2 p.m. ET release of the FOMC minutes, traders will be closely watching for signs of potential emergency rate cuts in Q2, updates on US trade negotiations, and any signals that could hint at easing financial conditions.

Meanwhile, geopolitical risk is intensifying as the Russia-Ukraine war takes a new turn with reports of captured Chinese POWs, raising fears of a broader conflict.

Amid this backdrop, Bitcoin continues to test critical support levels, and analysts are parsing technical signals to predict what could happen next.

BRN Analyst Darren Chu, speaking exclusively to BeInCrypto US Morning Briefing, shared an in-depth view of the current macro and crypto ecosystem ahead of today’s release of US FOMC meeting minutes from March:

“Risky assets are trying to mount a short covering rebound in the Wednesday Asia afternoon (going into the London open) ahead of today’s highly anticipated FOMC at 2pm EST. Anticipation is growing for an emergency Fed rate cut along with positive developments over US trading partners coming to an agreement with the Trump administration on lifting their tariffs and trade barriers.

US earnings releasing this week meanwhile are playing second fiddle to the global macro, geopolitical backdrop, with the Russia-Ukraine conflict further complicated by yesterday’s revelation that Chinese POWs have been captured (which suggests a potential widening of the war as opposed to a hopes for a ceasefire and peace treaty this year).

Returning to tariffs, China’s countermeasures in response to the US’ escalation have weighed on market sentiment, with expectations growing for a currency war as depreciation pressures weigh on the Yuan, which could lead other Asian regional exporters to following suit in weakening their currencies.”

On Bitcoin’s price action, Chu highlighted critical levels and potential scenarios following the FOMC:

“By shortly after the FOMC, to the relief of bulls or those playing a short-term bounce, BTCUSD should be approaching tentative support around the 38.2% Fib retrace of the massive December 2022 to January 2025 bull market coinciding roughly with the highs of March and June 2024.

Regardless of the short covering that may begin in the next day or so, BTCUSD appears to want to slide further to an uptrend support connecting the October 2023, August 2024 and September 2024 lows (on the weekly chart) by May sometime.

A base, conservative scenario by year end is for BTCUSD to test the 50% Fib retrace of the late 2022–early 2025 bull market (coinciding roughly with the peaks of April and November 2021).

There is a medium to low probability for now of testing within the same period, the 61.8% Fib at just above the 2024 low of psychologically key 50,000 whole figure level.”

According to Chu, Odds are rising for a short-term dead cat bounce—a brief rebound in a larger downtrend—to start today at 2 pm EST with the FOMC minutes or later this week with CPI, PPI, and sentiment data.

This bounce could align with a Fibonacci retracement, where prices temporarily move up to key levels (e.g., 38.2%, 50%, 61.8%) before continuing the downtrend.

“BTCUSD is now nearing the 61.8% Fib retrace of last August to February’s Bull Market extension, which it could slide to in the day or so following the FOMC.” Chu told BeInCrypto.

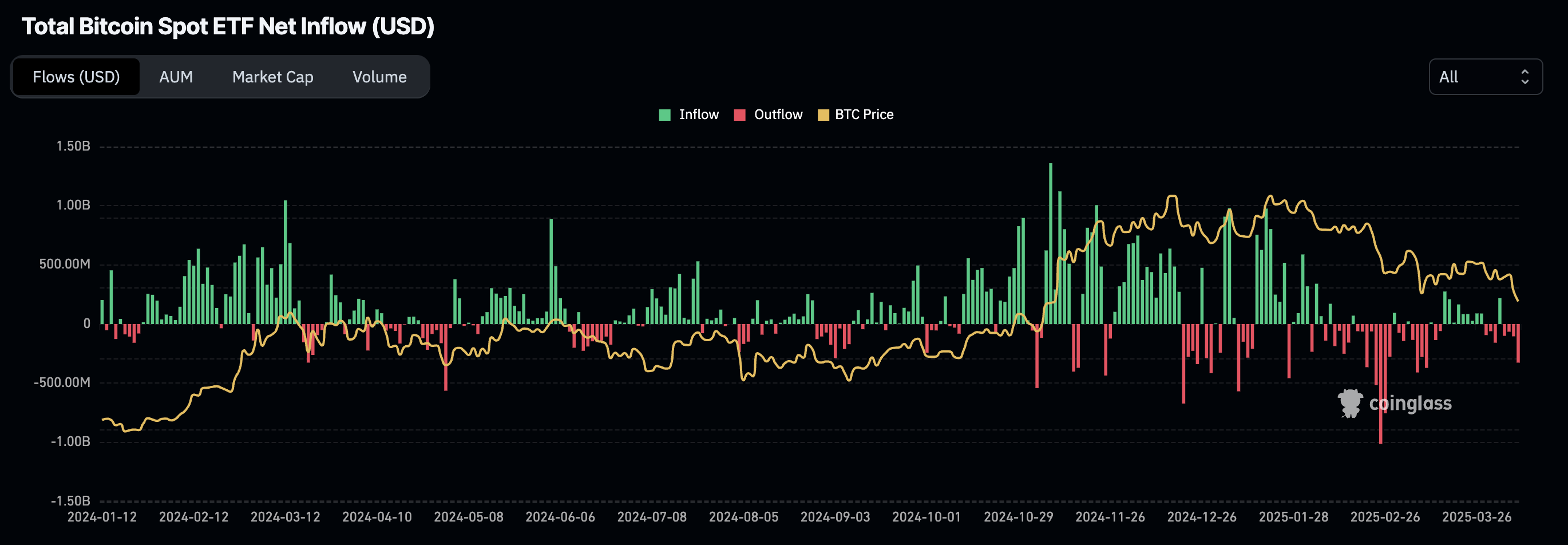

Crypto Chart of the Day

Bitcoin Spot ETFs had the biggest daily outflows ($326 million) since March 11.

Byte-Sized Alpha

– Goldman Sachs now sees a 45% chance of a US recession in 2025 but is doubling down on Bitcoin, holding $1.5 billion via ETFs.

– Analyst Ben Sigman says rising trade war tensions could fuel Bitcoin’s growth as investors turn to scarce, inflation-hedging assets outside traditional financial systems.

– As tariffs rattle global markets, crypto whales split—some dumping assets amid panic, others quietly buying in anticipation of a rebound.

– Analysts warn the Fed may be quietly injecting liquidity as RRP balances plunge, raising fears of stealth QE amid rising trade tensions and a $500 billion Bitcoin market hit.

– Bitcoin ETFs faced $326 million in outflows—the largest since March—as institutional investors pulled back, led by BlackRock’s $252 million exit and rising demand for bearish put options.

– Trump’s new tariffs threaten US Bitcoin mining dominance by driving up equipment costs, potentially shrinking America’s 36% share of the global hashrate.

Crypto stocks tumbled as Trump’s 104% China tariffs kicked in, triggering $300 million in liquidations, but rising Bitcoin long positions hint at hopes for a rebound.

– The US DOJ will no longer pursue crypto exchanges and wallets for user actions, sparking debate over reduced oversight and potential risks of enabling illicit activity.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoIs Ethereum Falling to $1,000 This April?

-

Market20 hours ago

Market20 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Market19 hours ago

Market19 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Altcoin19 hours ago

Altcoin19 hours agoWhy Is XRP Price Falling After ETF Hype?

-

Market18 hours ago

Market18 hours agoCardano (ADA) Surges 8% as Bulls Push for Breakout

-

Market17 hours ago

Market17 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows

-

Market24 hours ago

Market24 hours agoBitcoin Briefly Recovers 5% Due To US-China Tariff Deal Optimism