Market

Stablecoin Regulation Bill Passes US House as Market Heats Up

The US House Financial Services Committee voted 32-17 to pass the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act of 2025, aimed at stablecoin regulation.

This legislative milestone comes amid growing activity in the stablecoin market. Competition is heating up as major traditional financial institutions prepare to enter the space.

STABLE Act Passes Committee Vote

Chairman French Hill and Representative Bryan Steil spearheaded the legislation (H.R. 2392). It seeks to establish a robust framework for stablecoin issuance, mandating 1:1 reserve backing, monthly audits, and AML requirements.

“This legislation is a foundational step toward securing the future of financial payments in the United States and solidifying the dollar’s continued dominance as a world reserve currency,” Representative Steil remarked.

The bill’s passage saw bipartisan support, with six Democrats voting in favor. Notably, this comes shortly after the US Senate Committee on Banking, Housing, and Urban Affairs greenlit the GENIUS Act. The bill passed in a bipartisan 18-6 vote.

“The bills await debate time on the floor and a vote in their respective chambers,” Journalist and Host of Crypto In America, Eleanor Terrett, noted.

According to Terrett, efforts are underway to align the two bills closely over the next few weeks. The aim is to address differences between the bills. Aligning them will make it easier to proceed without creating additional complications.

“If they can get them to be in relatively the same place on their own, it will avoid having to set up a so-called conference committee which is formed so members from both chambers can negotiate to create a final version of the bill everyone agrees on,” she added.

Stablecoin Competition Heats Up, but Are There Signs of a Purge?

The drive for legislation occurs alongside rising activity in the stablecoin market. Global players are joining the fray.

For instance, in Japan, Sumitomo Mitsui Banking Corporation (SMBC) and major entities have signed a Memorandum of Understanding (MoU). The MoU initiates joint discussions on the potential use of stablecoins for future commercialization.

“This Agreement will see SMBC, Fireblocks, Ava Labs, and TIS collaborate to develop a framework for stablecoin issuance and circulation, including exploring key technical, regulatory, and market infrastructure requirements both in Japan and further afield. This Joint Discussion will not only focus on pilot projects but will aim to concretely define use cases for ongoing business applications,” the notice read.

In addition, Bank of America’s CEO previously revealed plans to launch a stablecoin once proper regulation is in place. Notably, BeInCrypto reported last month that the Office of the Comptroller of the Currency (OCC) had granted national banks and federal savings associations permission to provide crypto custody and certain stablecoin services.

That’s not all. The state of Wyoming is set to launch its own stablecoin, WYST, in July. Fidelity has also announced similar plans. Moreover, President Trump-backed World Liberty Financial officially launched its USD1 stablecoin in late March. This highlights continued interest in stablecoin adoption across both private and public sectors.

Meanwhile, Ripple announced the integration of its Ripple USD (RLUSD) into Ripple Payments. Changpeng Zhao (CZ), former CEO of Binance, reacted to the development on X.

“Stablecoin war, I mean healthy competition, just getting started,” CZ said.

As competition intensifies, the stablecoin market is also facing growing pains. Despite new entrants gaining traction, some players face heightened scrutiny.

Justin Sun, founder of Tron (TRX), recently accused First Digital Trust of insolvency. Following Sun’s allegations, First Digital USD (FDUSD) temporarily depegged.

The market’s future may hinge on the survival of only the most compliant and resilient stablecoins. This leads to a potential “purge” where weaker players fail to meet the increasing regulatory and market demands.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Long-Term Holders Fuel Surge, Could BTC Hit $85,000?

Leading coin Bitcoin has had a turbulent past few weeks, with its price troubles prompting many short-term investors—often referred to as “paper hands”—to exit the market.

However, amidst the price volatility, the coin’s long-term holders (LTHs) remain resolute and show no signs of backing down as they attempt to push BTC back above $85,000. How soon can they realize this?

Bitcoin Long-Term Holders Shift From Selling to Stacking

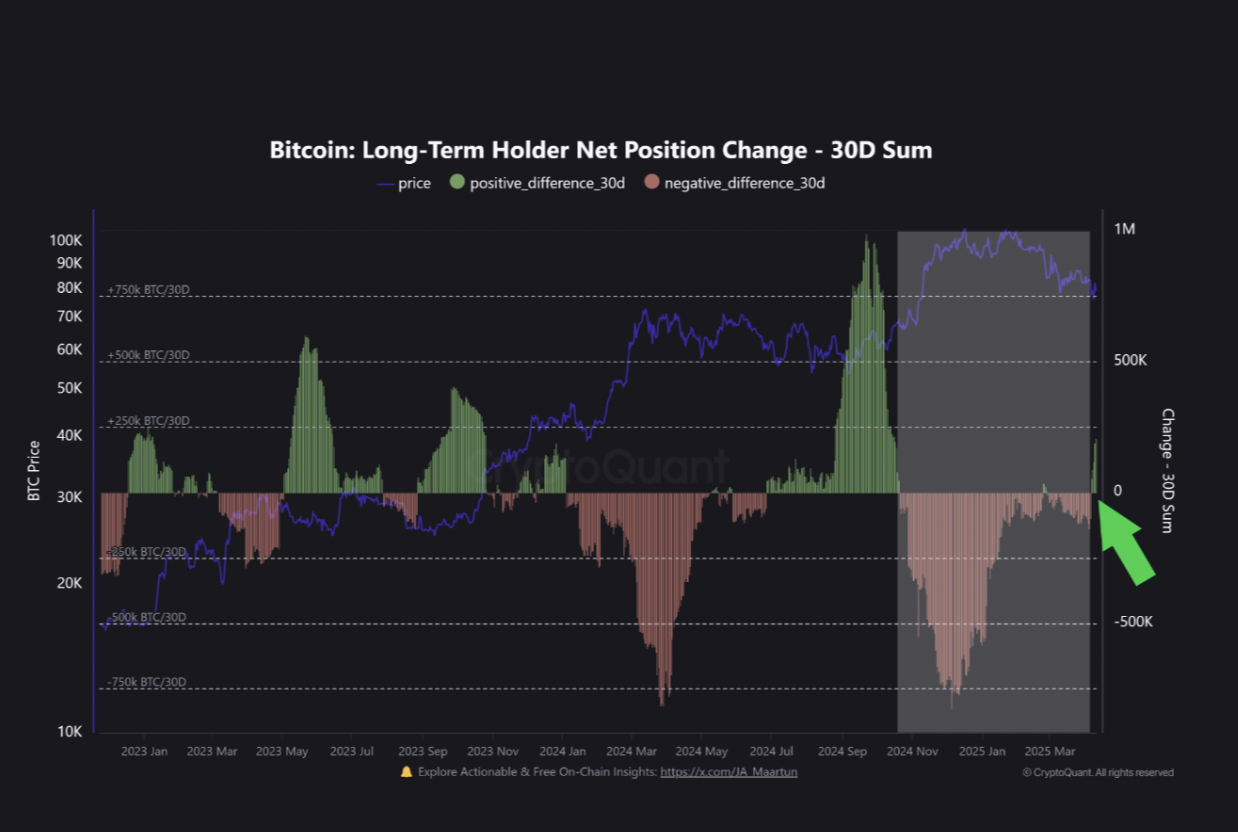

In a recent report, CryptoQuant analyst Burak Kesmeci assessed BTC’s Long-Term Holder Net Position Change (30d sum) and found that since April 6, the metric has turned positive, showing clear upward momentum. As a result, Kesmeci wrote, BTC has risen by approximately 12%.

BTC’s Long-Term Holder Net Position Change tracks the buying and selling behavior of LTHs (those who have held their assets for at least 155 days) to measure the shift in the number of coins held by these investors over a specific period.

When its value is positive, it indicates that LTHs are not selling, and remain optimistic about BTC’s future price performance. Conversely, when it turns negative, it suggests that these holders are selling or distributing their coins, often in response to market pressures, which is a bearish signal.

According to Kesmeci, BTC’s Long-Term Holder Net Position Change (30d sum) flipping positive is notable. This metric had remained below zero since October last week, signaling that LTHs were consistently selling their BTCs.

The sellofs reached their lowest point on December 5, prompting a 32% dip in BTC’s price and marking the peak of a 6-month period of distribution by LTHs.

However, this trend has changed since April 6. The metric now sits above zero and is in an uptrend. Speaking on what this means, Kemesci added:

“While it’s too early to say definitively, the growing positive momentum in this metric could be a sign that long-term conviction is returning to the market.”

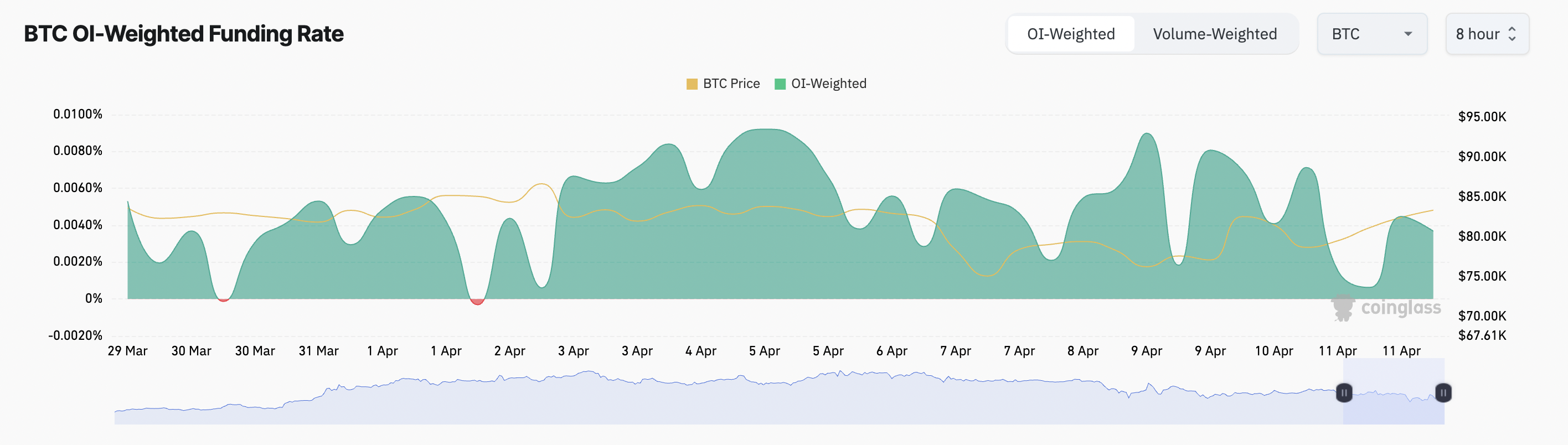

Moreover, BTC’s funding rate has remained positive amid its price troubles, confirming the bullish outlook above. At press time, this is at 0.0037%.

The funding rate is the periodic payment exchanged between long and short traders in perpetual futures markets. It is designed to keep the futures price close to the underlying asset’s spot price.

When it is positive like this, long traders are paying short traders. This indicates a bullish market sentiment, as more traders are betting on BTC’s price to climb.

Long-Term Holders Set the Stage for $87,000 Run

The surge in accumulation from BTC LTHs has pushed the coin’s price above the key resistance at $81,863. At press time, the king coin trades at $83,665.

As the market responds to these sustained buying pressures from LTHs, the coin’s price may be primed for a significant rally in the near future.

If retail traders follow suit and increase their coin demand, BTC could break above $85,000 to $87,730.

However, if the accumulation trend ends and these LTHs begin to sell for gains, BTC could resume its decline, fall below $81,863, and drop toward $74,389.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Luno is Shaping Africa’s Crypto Future

Africa’s crypto narrative is maturing from informal peer-to-peer (P2P) trading to institution-ready infrastructure. BeInCrypto contacted Luno, a crypto exchange headquartered in South Africa that operates across over 40 global markets.

Luno’s general manager for Africa and Europe, Marius Reitz, tells BeInCrypto how the crypto exchange is positioning itself as a regional powerhouse in Africa.

Luno As Africa’s Pragmatic Pioneer

Reitz started by revealing that Luno has outlived the boom-and-bust cycles that have come to define crypto since its establishment in 2013.

Its early focus on regulatory alignment and user-friendly experiences set it apart in an industry often plagued by volatility and regulatory whiplash.

In Africa, 57% of the population remains unbanked. Based on this, Luno’s mission goes beyond trading. The exchange crafts access to a modern financial system many have been locked out of.

“We’re driven by a bold vision to upgrade Africa and the world to a better financial system. After our launch in Kenya in 2024, we’re just getting started,” Reitz told BeInCrypto.

Stablecoin Surge and Real-World Demand

While much of the West obsesses over meme coins and ETF (exchange-traded fund) speculation, Africa’s crypto story is rooted in pragmatism.

In South Africa, stablecoins like Tether’s USDT have now surpassed Bitcoin in trading volume. According to Reitz, this surge is driven by the demand for inflation-resistant, dollar-pegged assets amid local currency devaluation.

Luno, already a major on-ramp for fiat-to-crypto conversions in the region, is adapting fast.

“Over the last 12 months, we’ve seen significant demand for stablecoins on Luno. We now offer low-cost USDT transfers across Ethereum and Tron, with competitive fees and bulk trade options for professionals via our Trade Desk,” Reitz shared.

Additionally, Luno’s retail-oriented Luno Pay app integrates crypto into everyday life. South African users can now spend USDT and USDC at thousands of merchants, earning crypto-back rewards.

Regulation as a Catalyst, Not a Constraint

Unlike many exchanges that shun regulatory scrutiny, Luno embraces it. In South Africa, where crypto assets are now classified as financial products by the FSCA, Luno has secured its operating license and helped shape its framework.

“Crypto bans force the industry underground. We’ve observed that markets with regulatory clarity foster responsible innovation and consumer protection,” he explained.

However, challenges remain. If misaligned with market realities, South Africa’s upcoming classification of crypto assets as foreign or domestic investments could hinder institutional flows.

Meanwhile, the FATF Travel Rule poses technical and operational hurdles due to fragmented provider ecosystems. Still, Luno is prepared.

“As a regulated business, we’ve implemented the Travel Rule in other jurisdictions. We anticipate friction, but we’re ready,” Reitz articulated.

The FATF Travel Rule is set to take effect in May 2025, barely a month away.

Adapting to Fragmented African Realities

Across the continent, crypto adoption is outpacing infrastructure. Nigeria ranked second globally for crypto adoption, but this remains paradoxical as the country restricts naira P2P trading while fast-tracking exchange approvals under its ARIP framework.

For Luno, this means taking a hyper-local approach to compliance, education, and user experience.

“Africa faces significant challenges: regulatory fragmentation, limited banking infrastructure, and crypto-related scams. We address these with educational content, strong KYC/AML, and strong banking partnerships,” Reitz explained.

Mobile money is dominant in countries like Kenya and Nigeria. Luno’s mobile-native design and stablecoin access offer a compelling value proposition for both retail users and remittance providers.

Financial Inclusion, One Partnership at a Time

Beyond individual users, Luno is also becoming a key partner for fintechs and payment firms. Its custody and liquidity services now support cross-border on- and off-ramping for traditional and crypto-native partners.

“We receive inquiries from large multinationals wanting to shift part of their payments to crypto. Our infrastructure allows them to do so securely, compliantly, and efficiently Luno confirmed,” Reitz stated.

This is pivotal for Africa’s $48 billion annual remittance market, where stablecoins offer faster, cheaper alternatives to legacy systems.

What does the next five years look like for African crypto markets? For Luno, it’s a convergence of retail empowerment and institutional maturity.

“We expect crypto to become as ubiquitous as banks—used to save, invest, and transact. Stablecoins will anchor trade settlements, while ETFs and bank-based crypto products will dominate mature markets like South Africa,” the Luno executive told BeInCrypto.

Luno is already laying the groundwork. Its Trade Desk, custody solutions, and upcoming stablecoin expansions suggest an exchange ready to grow from a user-friendly app to an institutional-grade platform.

In a region often overlooked by global players, Luno’s longevity is compelling. While challenges around regulation and infrastructure persist, its blend of compliance, innovation, and education positions it among notable actors in Africa’s crypto arena.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN Soars 250%—Can It Break $1 Soon?

FARTCOIN has been one of the standout performers in the meme coin space, with its price soaring nearly 250% over the last 30 days. After weeks of consistent gains, the token is now trading just below a key resistance level as technical indicators continue to support the bullish trend.

Momentum remains strong, with on-chain metrics and chart patterns signaling that buyers are firmly in control. However, with such rapid gains, the risk of a sharp correction is also rising—making the coming days crucial for FARTCOIN’s next move.

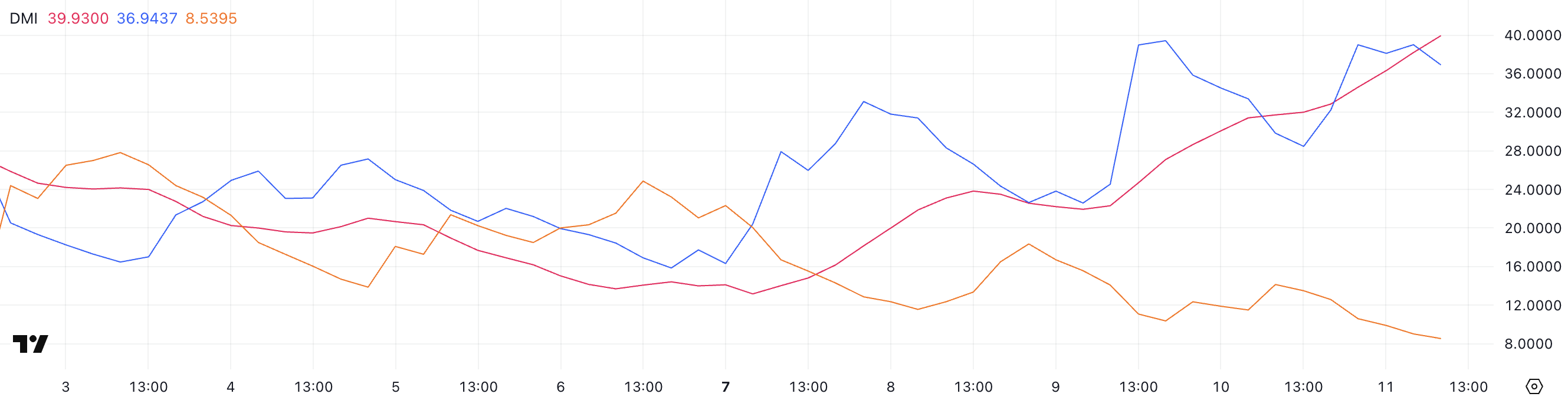

FARTCOIN DMI Shows Buyers Are In Full Control

FARTCOIN’s DMI chart shows a strong surge in trend strength, with the ADX rising from 22.3 to 39.93 over the past two days.

The Average Directional Index (ADX) measures the strength of a trend, regardless of direction—readings above 25 signal a strong trend, while anything below 20 suggests a weak or nonexistent one.

FARTCOIN’s current ADX level indicates that a powerful trend is now firmly in place.

Looking at the directional indicators, the +DI climbed to 36.94 from 28.46 yesterday, recovering after a brief dip from 39.43 two days ago.

Meanwhile, the -DI has dropped further to 8.53 from 14.14, showing that bearish pressure continues to fade.

This widening gap between +DI and -DI, combined with a rising ADX, signals strong bullish momentum, suggesting that FARTCOIN’s price could continue climbing if the current trend holds.

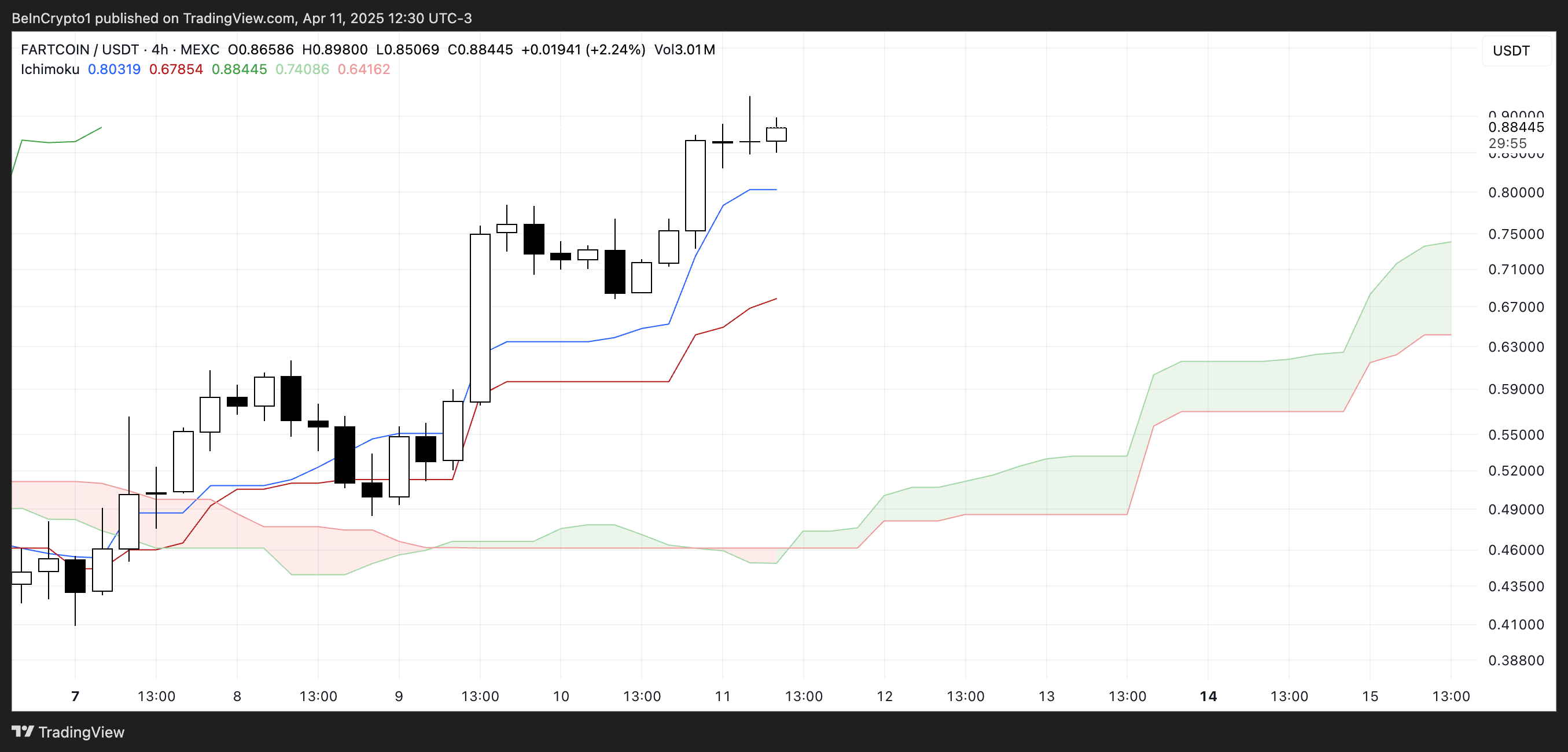

FARTCOIN Ichimoku Cloud Shows A Bullish Setup

FARTCOIN’s Ichimoku Cloud chart is currently showing a strong bullish setup. With its market cap close to $900 million, it is the biggest meme coin ever launched on PumpFun.

The price action is well above both the Tenkan-sen (blue line) and Kijun-sen (red line), which are also trending upward—an indication of solid short-term momentum.

The cloud (Kumo) ahead is thick and green, with Leading Span A well above Leading Span B. This suggests strong support for the ongoing uptrend.

Additionally, the wide distance between the price and the cloud base reinforces the strength of the current bullish momentum. Unless a sharp reversal occurs, the trend remains clearly in favor of the bulls.

Will FARTCOIN Break Above $1?

FARTCOIN’s price chart currently displays a bullish EMA structure, with short-term moving averages positioned above long-term ones—indicating that momentum remains in favor of the bulls.

The price is now approaching a critical resistance of around $0.90. If this level is successfully broken, the uptrend could accelerate further, with price targets at $1.29 and $1.99 coming into view.

On the flip side, if the current momentum stalls and buyers lose control, the meme coin may begin to retrace. The first support to watch lies at $0.639.

A drop below this level could trigger a deeper correction toward $0.538 and $0.408. If that final support also fails and bearish pressure strengthens, the price could fall as low as $0.26—marking a full reversal of the recent rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady

-

Market21 hours ago

Market21 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

-

Market23 hours ago

Market23 hours agoHow Vitalik Buterin Plans to Enhance Ethereum’s Privacy

-

Market22 hours ago

Market22 hours agoMiCA Boosts Gemini’s Expansion Plans Across Europe

-

Bitcoin21 hours ago

Bitcoin21 hours agoIs Bitcoin Ready for Another Surge?

-

Market19 hours ago

Market19 hours agoBinance, Trade Wars, Ripple and SEC

-

Altcoin23 hours ago

Altcoin23 hours agoWhy Pi Network Price Should Hit $10, Or Its Over for Pi Coin

-

Regulation16 hours ago

Regulation16 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms