Market

Solana (SOL) Flashes Breakdown Signs: Will Support Hold?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

SEC Signals Readiness to Rethink Crypto Trading Oversight

Mark Uyeda, Acting Chair of the US Securities and Exchange Commission (SEC), has encouraged crypto industry participants to offer input on a proposed framework. The initiative is designed to ease regulatory pressure on digital asset trading.

Speaking at the SEC’s April 11 Crypto Task Force roundtable, Uyeda highlighted the growing disconnect between current regulations and the realities of blockchain innovation.

SEC Considers Federal Licensing Model to Streamline Crypto Compliance

Uyeda likened the evolution of crypto markets to the early days of US securities trading, which began under a buttonwood tree in New York City.

He argued that early brokers created rules that suited the needs of their time. In the same way, modern regulators must now consider frameworks that align with the distinct structure of crypto platforms.

Unlike traditional exchanges, crypto trading systems often combine custody, execution, and clearing into one platform. Blockchain technology makes this integration possible.

Uyeda pointed out that this setup can improve transparency, efficiency, and trading speed. He also highlighted benefits like 24/7 trading through smart contracts and streamlined collateral management via tokenization.

“Blockchain technology offers the potential to execute and clear securities transactions in ways that may be more efficient and reliable than current processes,” Uyeda said.

Still, Uyeda acknowledged that the architects of US securities laws never anticipated blockchain technology or decentralized systems. As a result, compliance challenges have emerged as many tokenized securities remain unregistered and ineligible for national exchanges.

Besides that, existing rules, such as the order protection rule, are also difficult to apply in hybrid trading environments where assets move between on-chain and off-chain systems.

Uyeda also criticized the current patchwork of state-by-state licensing requirements, which create barriers for crypto firms aiming to operate nationwide.

To address these gaps, Uyeda proposed a conditional relief framework that could support experimentation while maintaining investor protections. He also suggested that a unified federal licensing model under the SEC could simplify compliance and enhance market consistency.

“Under an accommodating federal regulatory framework, some market participants would likely prefer to offer trading in both tokenized securities and non-security crypto assets under a single SEC license rather than offer trading solely in non-security crypto assets under fifty different state licenses,” Uyeda said.

Nonetheless, he invited industry experts to recommend specific areas where such relief would unlock practical use cases without undermining market integrity.

Uyeda’s remarks signal the SEC’s growing awareness that digital asset regulation must evolve. While long-term reform may take time, the proposed relief framework could create room for innovation without compromising market safeguards

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Position for Gains with DOGE, WLD and ONDO

Despite lingering market uncertainty fueled by Donald Trump’s escalating trade war, the cryptocurrency market showed signs of recovery this week.

On-chain data reveals that crypto whales took advantage of the volatility to accumulate select altcoins, signaling growing confidence in specific digital assets.

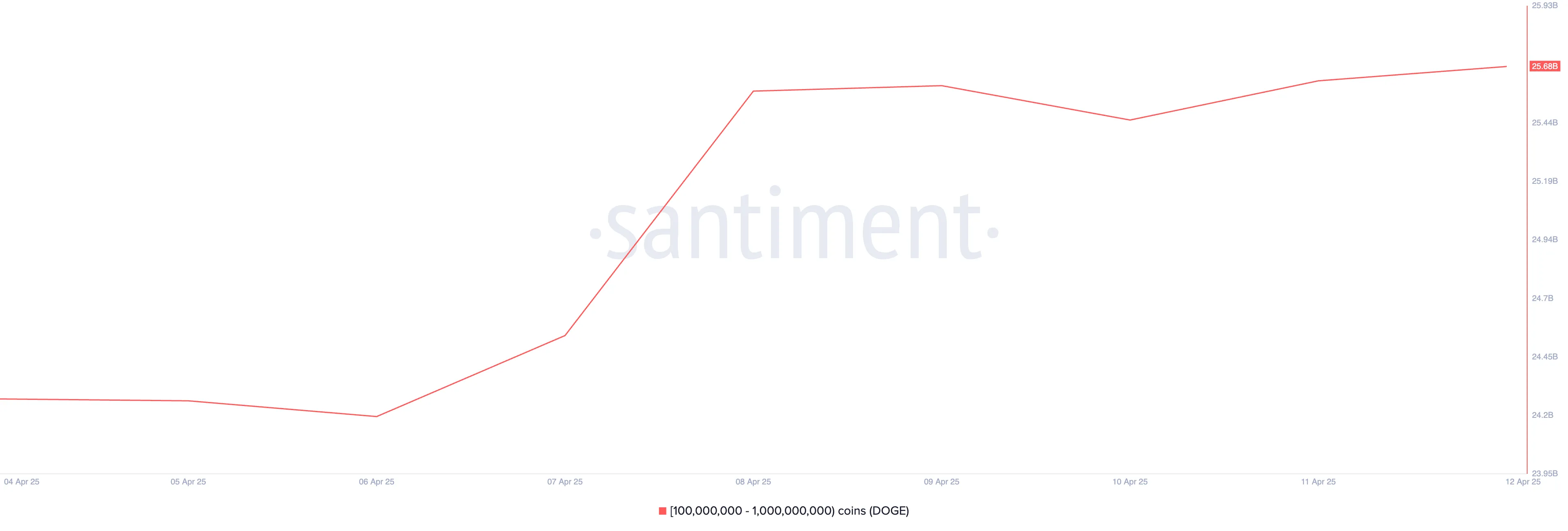

Dogecoin (DOGE)

Leading meme coin Dogecoin (DOGE) has received significant attention from crypto whales this week. This is reflected by the spike in the number of coins purchased over the past seven days by DOGE whale addresses that hold between 100 million and 1 billion coins.

According to data from Santiment, these DOGE holders have accumulated 1.41 billion coins worth over $220 million during the review period. As of press time, their total holdings have surged to 25.68 billion DOGE, marking the highest level since December last year.

When an asset’s large holders increase their accumulation like this, it suggests increased confidence or anticipation of future price gains. If this continues, DOGE could break above the resistance at $0.17 in the near term and climb toward $0.23.

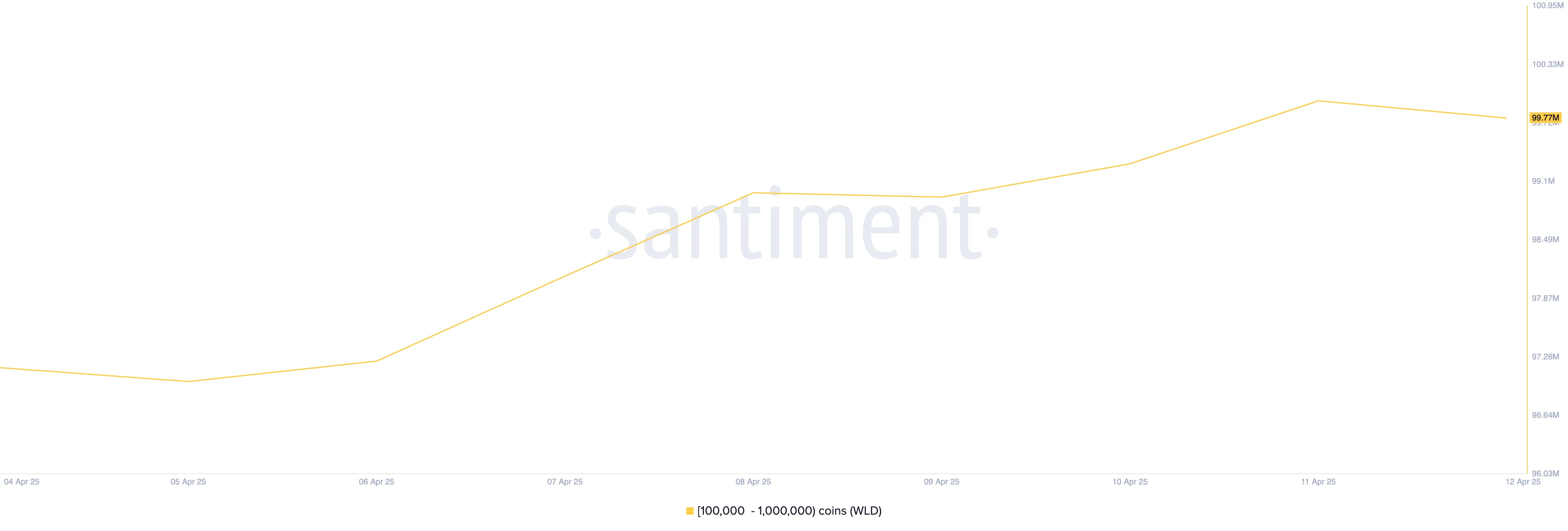

Worldcoin (WLD)

WLD is another altcoin that has caught whales’ attention this week. The Sam Altman-linked token currently trades at $0.74, shedding 1% of its value over the past week.

During that period, whales holding between 100,000 and 1,000,000 WLD have accumulated 2.63 million tokens valued above $1.94 million.

If whale accumulation persists, it could make WLD buck the broader market downtrend to record gains.

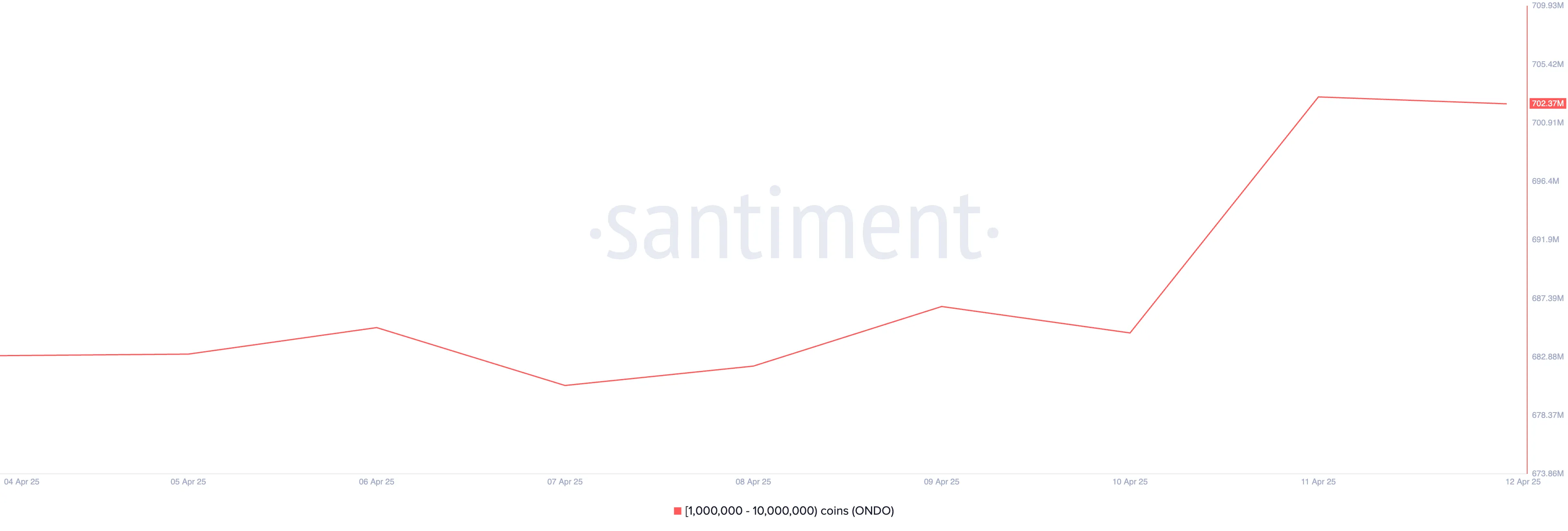

Ondo (ONDO)

The real-world asset-based (RWA) token ONDO is also on this week’s crypto whales’ list. According to Santiment, in the past seven days, whales holding between 1 million and 10 million ONDO have purchased 19.41 million, valued at approximately $17 million.

This cohort of ONDO investors currently holds 702.37 million coins.

Should this prompt a market-wide ONDO accumulation phase, it could signal the resurgence of interest in RWA-based assets and drive further price momentum in the coming weeks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Reportedly Seeks Reentry Into American Market

Binance has drawn renewed attention after reports emerged that its executives met privately with officials from the US Treasury in March.

The meetings, first reported by The Wall Street Journal, allegedly focused on easing regulatory pressure as the exchange seeks a fresh path into the American market.

Zhao Denies Report Linking Him to Investigation Into Justin Sun

This development follows Binance’s $4.3 billion settlement with the US Department of Justice in 2023, which centered on past violations of anti-money laundering laws.

Meanwhile, speculation is mounting that former Binance CEO Changpeng Zhao may be cooperating with US authorities—potentially in investigations related to TRON founder Justin Sun.

While no official confirmation has surfaced, the idea of Zhao assisting in a case against Sun has raised eyebrows. Sun has previously faced scrutiny over alleged securities violations and financial misconduct.

Zhao, however, has dismissed the WSJ article as sensationalist, suggesting it was crafted to generate clicks. He also hinted at fresh lobbying efforts against Binance but did not elaborate.

“Multiple people have told me again WSJ is writing another baseless hit piece about me,” Zhao stated.

In response, Justin Sun released a statement denying any wrongdoing. He emphasized that his communications with US authorities have remained open and cooperative.

“The US Department of Justice has been one of T3FCU’s closest and most trusted partners. Together, we’ve collaborated on numerous cases aimed at protecting users around the world. Whether it’s CZ or our partners at the DOJ, we maintain direct, honest communication at all times. I have full trust in each and every one of them,” Sun stressed.

Sun also underscored his confidence in Zhao’s leadership and the potential for US crypto policy to evolve under a more supportive regulatory environment.

“CZ is both my mentor and a close friend—he has played a crucial role in supporting me during my entrepreneurial journey. To this day, his conduct and principles remain the highest standard I strive to follow as a founder,” Sun stated.

Binance Eyes Stablecoin Partnership With WLFI

In a separate but equally notable move, Binance is reportedly exploring a partnership with World Liberty Financial (WLFI), a decentralized finance project said to have ties to President Donald Trump’s family.

At the center of the talks is the DeFi venture’s recently released stablecoin called USD1, which WLFI aims to list on Binance.

If the deal goes through, it could mark a significant strategic gain for both parties. WLFI would secure a global platform for USD1, while Binance could regain political goodwill as it eyes reentry into the US market.

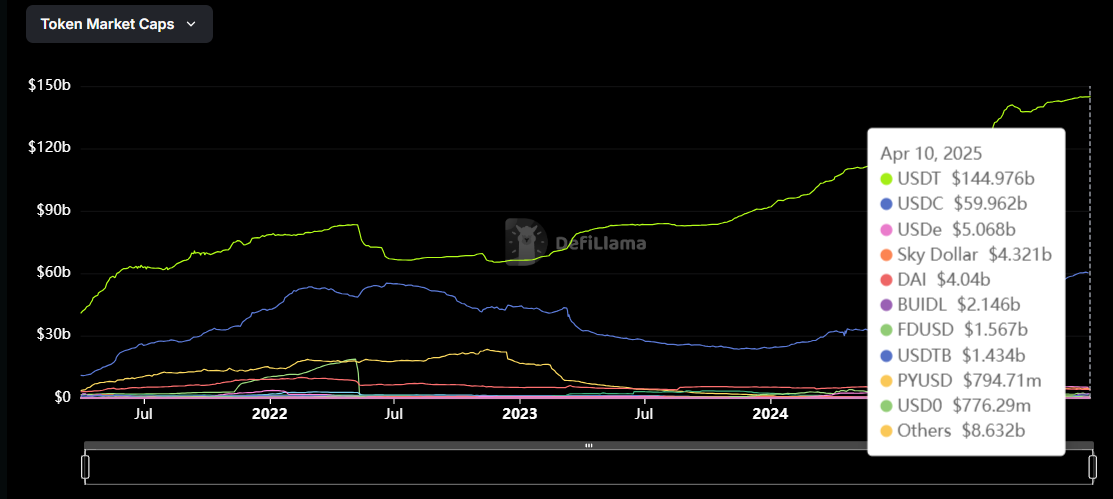

Market analysts say Binance’s infrastructure could fast-track USD1’s adoption, particularly as stablecoin demand grows amid shifting US regulations.

Moreover, the move may also position WLFI to challenge stablecoin leaders like Tether (USDT) and Circle (USDC), potentially reshaping the competitive landscape of dollar-backed digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoUS Senators Reintroduce PROOF Act To Set Reserve Standards for Crypto Firms

-

Market20 hours ago

Market20 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market18 hours ago

Market18 hours agoLawmakers Propose the PROOF Act to Avoid Another FTX Incident

-

Market17 hours ago

Market17 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market22 hours ago

Market22 hours agoInvestors Shift to Crypto, Gold, and Equities Amid Tariff Volatility

-

Market15 hours ago

Market15 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

-

Market14 hours ago

Market14 hours agoBinance and the SEC File for Pause in Lawsuit

-

Market23 hours ago

Market23 hours agoHow You Can Find Altcoin Winners Early