Market

Solana (SOL) Faces Many Challenges—Can Bulls Hold the Line?

Solana started a recovery wave above the $120 resistance zone. SOL price is now consolidating and might struggle to recover above the $132 resistance.

- SOL price started a fresh decline below the $150 and $140 levels against the US Dollar.

- The price is now trading below $130 and the 100-hourly simple moving average.

- There is a short-term rising channel forming with support at $124 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $132 zone.

Solana Price Faces Resistance

Solana price struggled to clear the $155 resistance and started a fresh decline, like Bitcoin and Ethereum. SOL declined below the $140 and $132 support levels.

It even dived below the $120 level. The recent low was formed at $114 before the price recovered some losses. It climbed above the $120 and $122 levels. The price surpassed the 23.6% Fib retracement level of the downward move from the $151 swing high to the $114 swing low.

Solana is now trading below $130 and the 100-hourly simple moving average. There is also a short-term rising channel forming with support at $124 on the hourly chart of the SOL/USD pair.

On the upside, the price is facing resistance near the $128 level. The next major resistance is near the $130 level. The main resistance could be $132 and the 50% Fib retracement level of the downward move from the $151 swing high to the $114 swing low.

A successful close above the $132 resistance zone could set the pace for another steady increase. The next key resistance is $140. Any more gains might send the price toward the $150 level.

Another Decline in SOL?

If SOL fails to rise above the $132 resistance, it could start another decline. Initial support on the downside is near the $124 zone. The first major support is near the $120 level.

A break below the $120 level might send the price toward the $114 zone. If there is a close below the $114 support, the price could decline toward the $100 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is near the 50 level.

Major Support Levels – $124 and $120.

Major Resistance Levels – $128 and $132.

Market

Celestia TIA) Price Nears Consolidation After 31% Rally

Celestia (TIA) has shown a recent recovery, reaching $3.60 after a 31% rise in the past 48 hours. This price action helped the altcoin recover most of its recent losses.

However, despite the positive movement, further gains might be challenging as signs point to potential consolidation in the near future.

Celestia Is Heading In No Direction

The Bollinger Bands are closing in on a squeeze, signaling that volatility in Celestia’s price could be coming to an end. Historically, such squeezes have often been followed by periods of price stabilization, where the price moves sideways.

This suggests that while TIA has seen some positive movement, it may struggle to pick a clear direction in the short term. During this time, TIA might hover between the support and resistance levels, awaiting stronger market cues to spark a breakout in either direction.

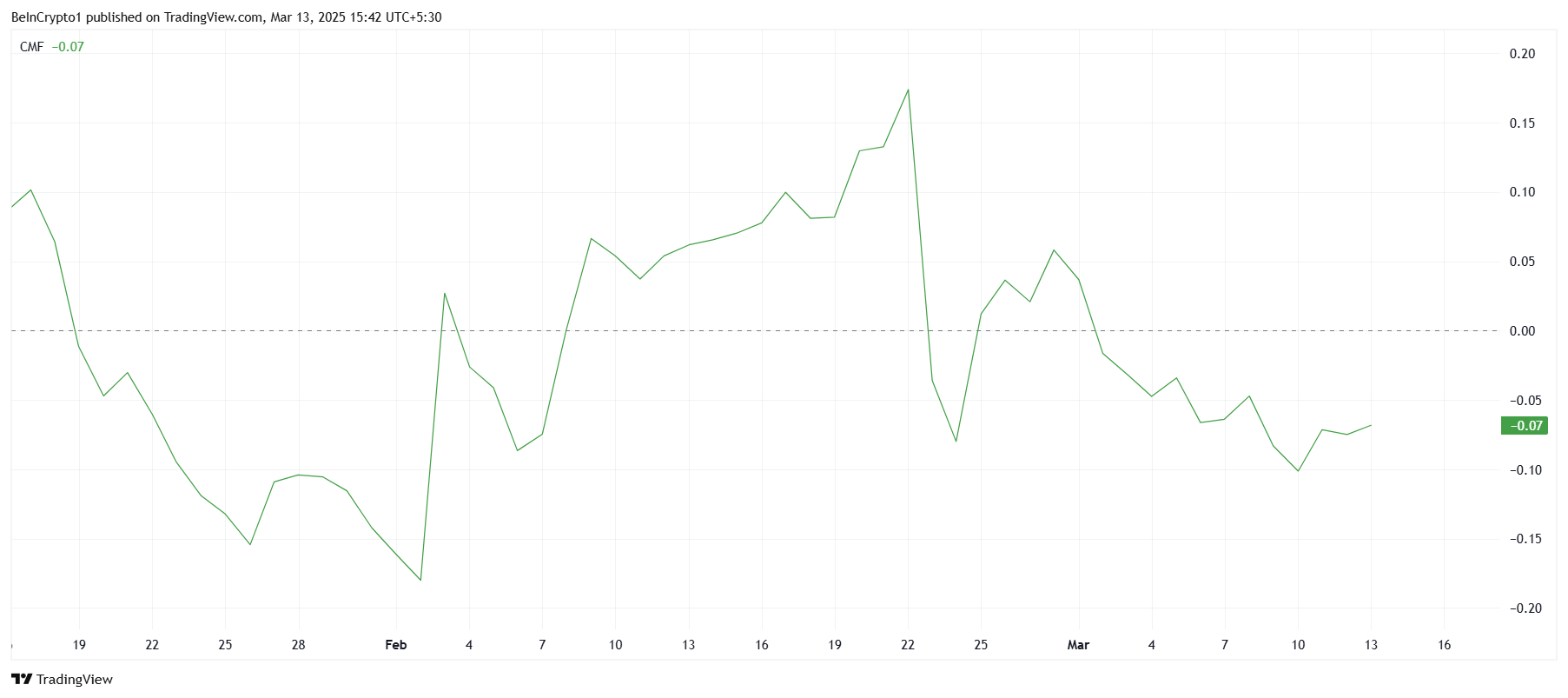

In terms of macro momentum, Celestia’s market sentiment is being influenced by the Chaikin Money Flow (CMF), which has remained below the zero line for the past few days. This indicator shows that capital inflows into Celestia have been relatively weak.

While the CMF’s position below the zero line typically signals bearish sentiment, the absence of strong volatility could prevent further declines. This lack of momentum may keep TIA from experiencing a sharp drop, but it also limits its ability to build on recent gains.

TIA Price Needs A Push

At the time of writing, Celestia’s price is holding steady at $3.60, comfortably above the $3.50 support level. However, it is still under the resistance of $3.83, which has historically been a challenging barrier for the altcoin. Despite the 31% rise over the last 48 hours, this resistance may continue to pose challenges for Celestia’s upward movement.

Given the current market conditions, Celestia is likely to face some struggle beneath the $3.83 resistance. The price could consolidate within a range between $3.83 and $3.50 until stronger market signals prompt a breakout. The consolidation phase may keep the price contained, delaying further price movement for the time being.

On the other hand, if Celestia successfully breaches the $3.83 resistance level, it could pave the way for further recovery, potentially driving the price to $4.50. A successful breakout beyond this level would invalidate the bearish-neutral outlook and could trigger a new phase of growth for Celestia.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

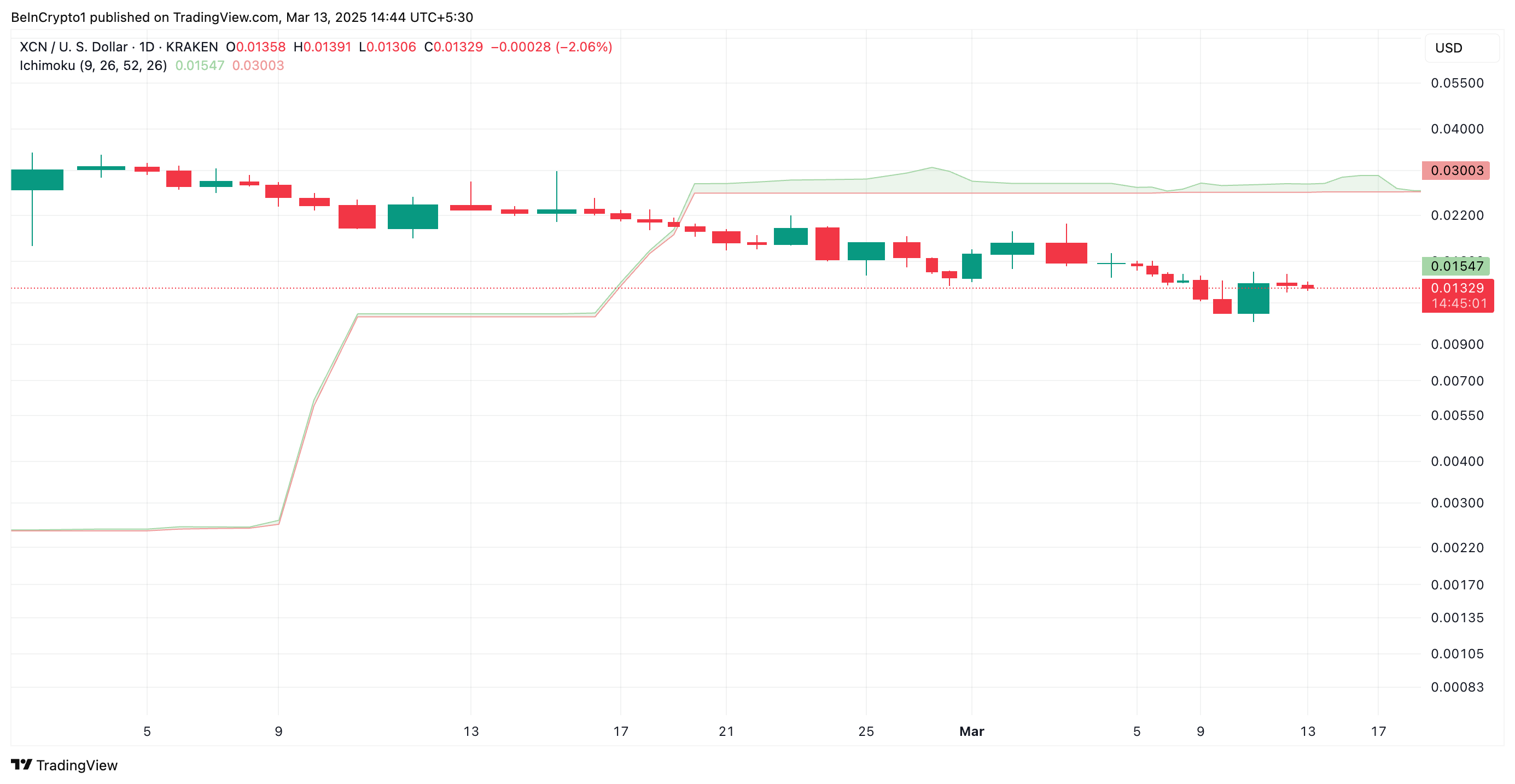

XCN Dip Signals More Downside as Bearish Indicators Intensify

Onyxcoin has taken a significant hit, plunging 15% over the past week amid broader market volatility. At press time, the altcoin exchanges hands at $0.0132, noting a 1% price dip amid the general market rally.

While other assets attempt to recover, XCN remains trapped in a strong bearish cycle, with technical indicators pointing to the possibility of further losses.

XCN Bears Dominate as Price Trades Under Major Resistance Zones

Readings from the XCN/USD one-day chart show the altcoin trading below its 20-day exponential moving average (EMA). This forms resistance above its price at $0.0137.

The 20-day EMA measures an asset’s average trading price over the past 20 days, giving more weight to recent prices for a smoother trend analysis.

When the price falls below this key moving average, it signals weakening momentum and a downtrend as sellers gain control. This indicates that XCN could face further losses unless strong buying pressure reverses the decline.

Furthermore, the altcoin trades significantly below the Leading Spans A and B of its Ichimoku Cloud, supporting this bearish outlook.

This indicator measures the momentum of an asset’s market trends and identifies potential support/resistance levels. When the price falls below this cloud, the asset in question is witnessing a downtrend. In this scenario, the cloud also acts as a dynamic resistance zone, reinforcing the downtrend.

For XCN, its Ichimoku Cloud forms dynamic resistance above its price at $0.0154 and $0.0300, highlighting the strong downward pressure on the coin’s price.

XCN Bears in Control – Breakout or Breakdown Next?

XCN’s price has remained within a descending parallel channel that has kept its price in decline since January 25. With strengthening selling activity, the altcoin may stay in this bearish pattern and extend its decline.

If this happens, XCN’s price could plunge to $0.0117.

However, if buying pressure gains momentum, XCN’s price could rally past the $0.0137 resistance of its 20-day EMA and attempt to cross $0.0154.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aave Horizon RWA Product To Unlock Trillions in Tokenized Assets

Horizon, an initiative by Aave Labs, proposed a new financial product to bring real-world assets (RWAs) into decentralized finance (DeFi) under a regulatory framework.

The initiative is expected to generate new revenue streams for the Aave DAO, accelerate GHO adoption, and strengthen Aave’s role as a key player in the growing tokenized asset space. Amid accelerating institutional adoption, projections suggest that RWAs on blockchain networks could reach $16 trillion over the next decade.

Horizon Proposes RWA Product as Licensed Instance of Aave Protocol

In a press release shared with BeInCrypto, Aave Labs’ Horizon proposed launching an RWA product as a licensed instance of the Aave Protocol. This initiative aims to enable institutions to use tokenized money market funds (MMFs) as collateral to borrow stablecoins like USDC and Aave’s GHO.

The move is expected to unlock liquidity for stablecoins and expand institutional access to DeFi. Specifically, it would make DeFi more accessible to regulated financial entities while benefiting the Aave ecosystem.

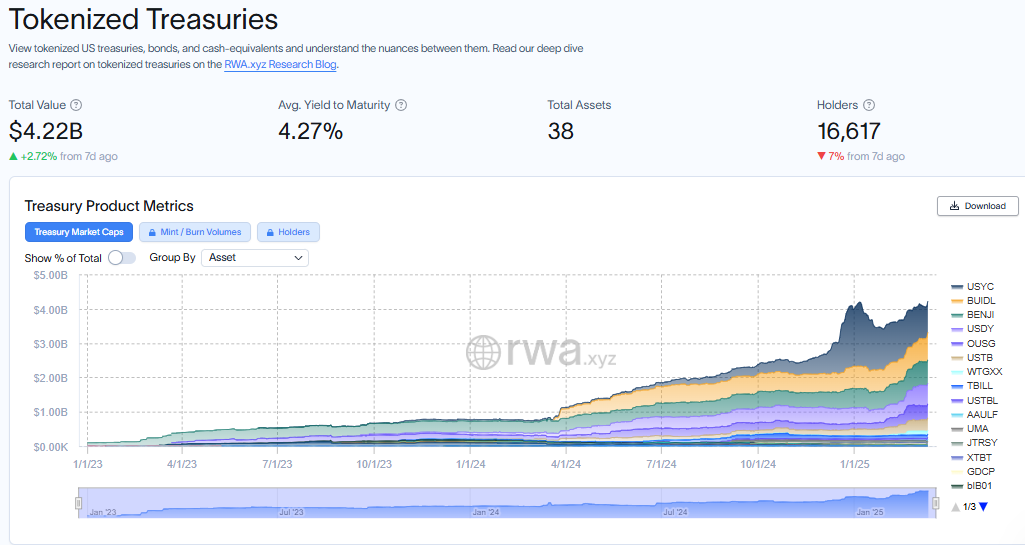

The interest comes amid growing demand for tokenized real-world assets. Blockchain technology enhances liquidity, reduces costs, and enables programmable transactions.

Furthermore, tokenization on blockchain has made traditional assets more accessible on-chain, with tokenized US Treasuries growing by 408% year-over-year to reach $4 billion.

Subject to approval by the Aave DAO, Horizon’s RWA product will initially launch as a licensed instance of Aave V3. Later, it would transition to a custom deployment of Aave V4 when it becomes available. Horizon has proposed a structured profit-sharing mechanism to ensure long-term alignment with the Aave DAO.

“…a 50% revenue share to Aave DAO in Year 1, alongside strategic incentives to drive ecosystem growth,” Horizon told BeInCrypto.

Additionally, if Horizon launches its token, 15% of its supply will be allocated to the Aave DAO treasury and ecosystem incentives. A portion will also be set aside for staked AAVE holders.

Meanwhile, the rise of RWAs is transforming the financial playing field, and institutions are taking note. Tokenized assets are emerging as a bridge between traditional finance (TradFi) and DeFi, providing investors new opportunities to access yield-bearing assets. Key players include BlackRock (BUILD), Franklin Templeton, and Grayscale.

Institutions To Access Regulated But Permissionless Stablecoin Liquidity

However, DeFi’s open and permissionless nature poses regulatory challenges. It lacks the compliance frameworks required for large-scale institutional participation.

Institutional adoption remains limited without tailored solutions, and integrating RWAs into DeFi at scale remains a significant challenge.

Horizon seeks to bridge this gap by allowing institutions to access permissionless stablecoin liquidity. It will also meet the compliance and risk management requirements of asset issuers.

Tokenized asset issuers can enforce transfer restrictions and maintain asset-level controls. According to the announcement, this would ensure only qualified users can borrow USDC and GHO.

“…separate GHO Facilitator will enable GHO minting with RWA collateral, offering predictable borrowing rates optimized for institutions. This enhances security, scalability, and institutional adoption of RWAs in DeFi,” Horizon added.

The proposed product builds on the institutional framework established by Aave Arc. To ensure a smooth integration, Horizon will implement a permissioned token supply. It will also feature withdrawal mechanisms, stablecoin borrowing for qualified users, and permissioned liquidation workflows.

The initiative is expected to enhance the security, scalability, and institutional adoption of RWAs within DeFi.

However, despite Aave’s permissionless design being one of its greatest strengths, integrating RWAs presents challenges beyond smart contract development.

A licensed instance of Aave’s protocol will require an off-chain legal structure, regulatory coordination, and active supervision. It is imperative to note that the Aave DAO is not designed to handle these functions independently.

Operationally, the Aave DAO and its service providers will oversee the functionality of Horizon’s RWA product. However, Horizon will retain independence in configuring the instance and steering its strategic direction.

The proposal now calls on the Aave DAO to approve Horizon’s RWA product as the protocol’s licensed instance.

The next steps involve refining the proposal with the Aave community and service providers. If there is a consensus on moving forward, the proposal will proceed to a Snapshot vote.

If the vote is in favor, the proposal will advance to the final governance stage for approval.

BeInCrypto data shows that the AAVE price was trading at $173.44 as of this writing, down by 0.24% since Thursday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Reveals When The XRP Price Will Hit Double & Triple Digits

-

Market23 hours ago

Market23 hours agoADA Long-Term Holders Show Confidence Amid 22% Price Decline

-

Market22 hours ago

Market22 hours agoEthereum Price Below $2,000 Triggers Bullish Signal After 2 Years

-

Altcoin16 hours ago

Altcoin16 hours agoSolana Price At Risk As Alameda Unstakes $23 Million SOL

-

Market21 hours ago

Market21 hours agoWhy Bitcoin Reserve Bills Fail: VeChain Executive Weighs In

-

Market24 hours ago

Market24 hours agoBitcoin ETF Holdings Dip Below Satoshi As Outflows Continue

-

Market8 hours ago

Market8 hours agoXRP Bulls Ready to Charge—Upside Break May Spark Rally

-

Ethereum20 hours ago

Ethereum20 hours agoThis Ethereum Monthly RSI Chart Just Crashed To New Lows To Break 2022 Records, What Happened Last Time?