Market

Solana (SOL) Breaks $140 Mark Despite Competition From BNB

Solana (SOL) is up nearly 9% in the last 24 hours, climbing above $140 for the first time since March 8, despite BNB surging to become the biggest chain in DEX volume last week.

While price action has strengthened, Solana’s market still shows mixed signals, with some large investors remaining cautious. Traders are now watching key resistance and support levels to gauge whether SOL can sustain its rally or face a potential pullback.

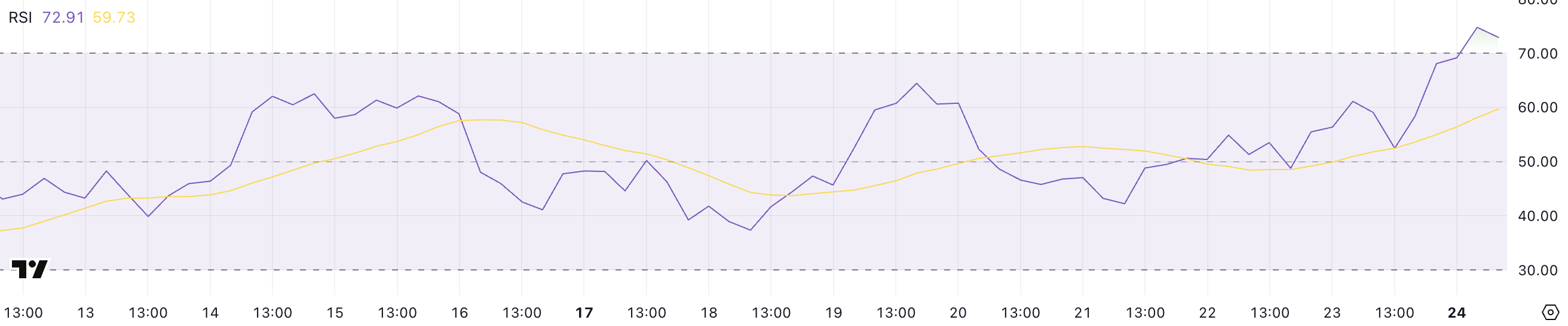

Solana RSI Rise Above 70 For The First Time Since March 2

Solana’s RSI has surged from 52.46 yesterday to 72.91 today, marking the first time it has entered overbought territory since March 2.

This sharp rise signals a sudden acceleration in buying momentum after nearly two weeks of neutral readings hovering around the mid-50s.

The breakout above the 70 level suggests a notable shift in sentiment, as traders have pushed SOL into a more aggressive bullish stance.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It helps traders identify potential overbought or oversold conditions.

Typically, an RSI value above 70 is considered overbought, indicating that an asset may be due for a corrective pullback. Readings below 30 are viewed as oversold, suggesting possible upside reversals. Solana’s RSI, currently at 72.91, highlights a strong bullish push but also raises caution about a potential short-term correction as BNB overtakes Solana in DEX volume.

Given that SOL had been trading in a neutral zone for the past 12 days, this sudden spike could either mark the start of a stronger rally or signal a temporary overheating in price momentum.

SOL Whales Are Still Hesitant

The number of Solana whales – wallets holding at least 10,000 SOL – is currently at 5,019, slightly down from the recent peak of 5,041 recorded on March 18.

This fluctuation highlights ongoing shifts in large-holder behavior, as whale activity has yet to stabilize fully. While the recent whale count remains elevated compared to earlier levels this month, it still suggests hesitation among large investors to re-enter the market fully.

Tracking whale activity is crucial because these large holders often significantly influence market trends and liquidity. An increase in whale addresses can indicate accumulation and growing confidence, while a decline may signal distribution or caution.

With the current whale count showing signs of volatility and retreating slightly from recent highs, it suggests that major players are still uncertain about Solana’s short-term direction.

Until this number shows more consistent growth, it could imply that SOL’s price may remain sensitive to fluctuations and lack the solid backing typically seen during stronger bullish trends.

Can Solana Sustain The Current Levels?

Solana’s EMA lines recently confirmed a golden cross, signaling the potential for a bullish continuation. Further golden crosses may form soon.

If the current uptrend strengthens, Solana’s price could rise to challenge the resistance at $152.90 and, if momentum persists, extend gains toward the $180 mark.

Despite concerns within the community regarding the competition between PumpFun and Raydium, Chris Chung, founder of Solana-based swap platform Titan, argues that this rivalry could actually benefit Solana’s broader ecosystem:

“Pump.fun launching its own DEX was inevitable as they believe they have a strong enough brand now to eliminate the Raydium tech stack and collect AMM fees themselves. In addition, Raydium announced plans for its own launchpad, showing that competition in the Solana ecosystem is heating up – and fast. It’s great to see new players enter with ideas to improve the speed and usability of end users. This type of competitive behavior helps build robust financial products and DeFi protocols and simply makes Solana’s activity grow,” Chung told BeInCrypto.

However, if bullish momentum weakens and the uptrend reverses, SOL could retest key support at $136.71.

A break below this level could expose Solana to further downside, with a target of $120 and potentially $112 if selling pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

South Carolina Could Spend 10% of Funds on Bitcoin Reserve

Representative Jordan Pace introduced legislation to create a Bitcoin Reserve for South Carolina, joining a nationwide effort. Currently, nearly half of all US states have an active bill to create a similar Reserve.

However, the talking point that this bill “allows 10% of state funds” in Bitcoin investments is taking off like wildfire. It may scare off fiscal conservatives, which contributed to recent failures.

South Carolina Joins the Bitcoin Reserve Race

Since President Trump announced his intention to create a US Bitcoin Reserve, many state governments have attempted to create smaller models.

In the last month, these efforts have been intensifying, with more and more states joining the effort. Today, South Carolina filed its own Bitcoin Reserve bill, allowing the state to make substantial purchases:

“The State Treasurer may invest in digital assets including, but not limited to, Bitcoin with money that is unexpended, unencumbered, or uncommitted. The amount of money that the State Treasurer may invest in digital assets from a fund specified in this section may not exceed ten precent of the total funds under management,” it reads.

State Representative Jordan Pace proposed South Carolina’s Bitcoin Reserve legislation. He claimed that this bill “gives the Treasurer new tools to protect taxpayer dollars from inflation,” one of crypto’s most well-known use cases. Pace is currently the bill’s only sponsor, and it’s unclear what chances it has of passing.

Still, there may be challenges ahead. Similar proposals in other Republican-led states—like Montana and Wyoming—have already failed. This was largely due to concerns over using public funds to buy cryptocurrency.

Even though Trump backs the idea on a national level, not all GOP lawmakers are convinced at the state level.

That said, there are some signs of progress elsewhere. For example, Texas has advanced its Bitcoin Reserve bill, achieving bipartisan support. A key reason for its success is that the bill doesn’t require the state to make crypto purchases; it simply allows them at the Treasurer’s discretion.

Likewise, South Carolina’s bill wouldn’t force the state to invest 10% of its funds into Bitcoin. It just opens the door for that possibility, giving the state financial flexibility rather than a mandate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FDIC and CFTC Rescind Old Crypto Guidelines

The FDIC and CFTC have both been working to change previous crypto guidelines. As federal regulators reconcile with the industry, they are removing old rules that specifically target crypto.

The former institution is removing the requirement that banks report crypto business, while the latter holds crypto to the same standards as other industries.

FDIC and CFTC Change Crypto Policies

The FDIC is one of the top financial regulators in the US, and it’s turning over a new leaf. After being one of the principal architects of Operation Choke Point 2.0, it recently began declassifying documents and changing rules that allowed crypto debanking.

Today, the agency is revoking a 2022 directive that impacted banks’ interactions with crypto:

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years. I expect this to be one of several steps the FDIC will take to lay out a new approach for how banks can engage in crypto- and blockchain-related activities in accordance with safety and soundness standards,” said FDIC Acting Chairman Travis Hill.

Specifically, it rescinded a rule that mandated that all banks and institutions under its supervision notify the FDIC of any crypto involvement. The new guideline claims that banks “may engage in permissible crypto-related activities without receiving prior FDIC approval” without enacting any other policies.

Since Gary Gensler left the SEC, all the top US financial regulators have been trying to rework their relationship with crypto. In an apparent coincidence, the CFTC made a very similar move to the FDIC by rescinding two crypto guidelines.

Both of these actions did not establish a new policy; they merely removed the old ones.

Essentially, both of the CFTC’s rule changes are set to ensure that crypto-related derivatives are subject to the same requirements as non-crypto ones. This is somewhat surprising, considering that the industry has typically tried to insist that it necessitates specific regulations.

However, this is largely beside the point. The FDIC and CFTC are both working to remove previous guidelines that opposed the crypto industry.

These institutions will undoubtedly be amenable to creating new ones in the spirit of cooperation. In the meantime, this olive branch can help build a lot of goodwill.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network (PI) Drops Further Despite Telegram Wallet Deal

Pi Network (PI) has been under heavy selling pressure, with its price down more than 61% over the last 30 days. Despite a recent partnership with the Telegram Crypto Wallet, PI has struggled to regain momentum, as technical indicators remain mostly bearish.

Its BBTrend has been negative for 12 consecutive days, and although the RSI has recovered slightly from oversold levels, it still sits below the neutral 50 mark. With the downtrend firmly intact and critical support levels approaching, PI’s next move will likely depend on whether buyers can step in and reverse the current trajectory.

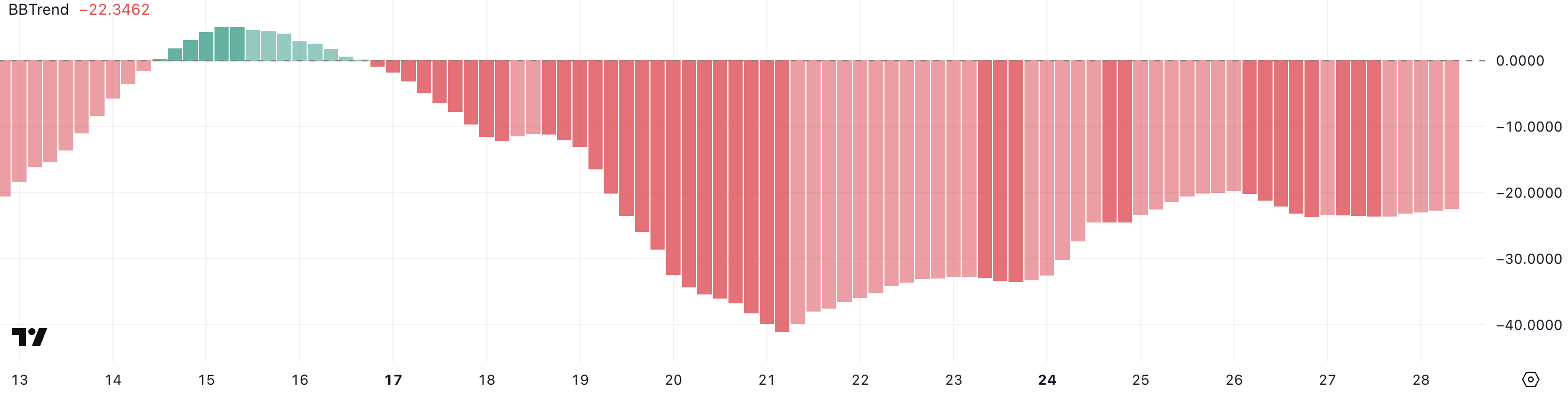

PI BBTrend Has Been Negative For 12 Days

Pi Network (PI) continues to face bearish pressure, as reflected in its BBTrend indicator, which remains deep in negative territory at -22.34.

This is despite recent headlines about the Telegram Crypto Wallet integrating Pi Network, news that has yet to translate into sustained upward momentum.

The BBTrend hit a recent low of -41 on March 21 and has stayed negative since March 16, marking twelve consecutive days of bearish trend signals. This prolonged weakness highlights the ongoing struggle for buyers to regain control of the market.

BBTrend, or Bollinger Band Trend, is a momentum-based indicator that helps gauge the strength and direction of a trend. Positive BBTrend values indicate bullish momentum, while negative values point to bearish sentiment—the further from zero, the stronger the trend.

With PI’s BBTrend sitting at -22.34, the market remains firmly under bearish influence, even if the worst of the recent downtrend may be easing slightly from its extreme lows.

Unless this trend flips back into positive territory soon, PI’s price could remain under pressure, with buyers staying cautious despite the recent integration news.

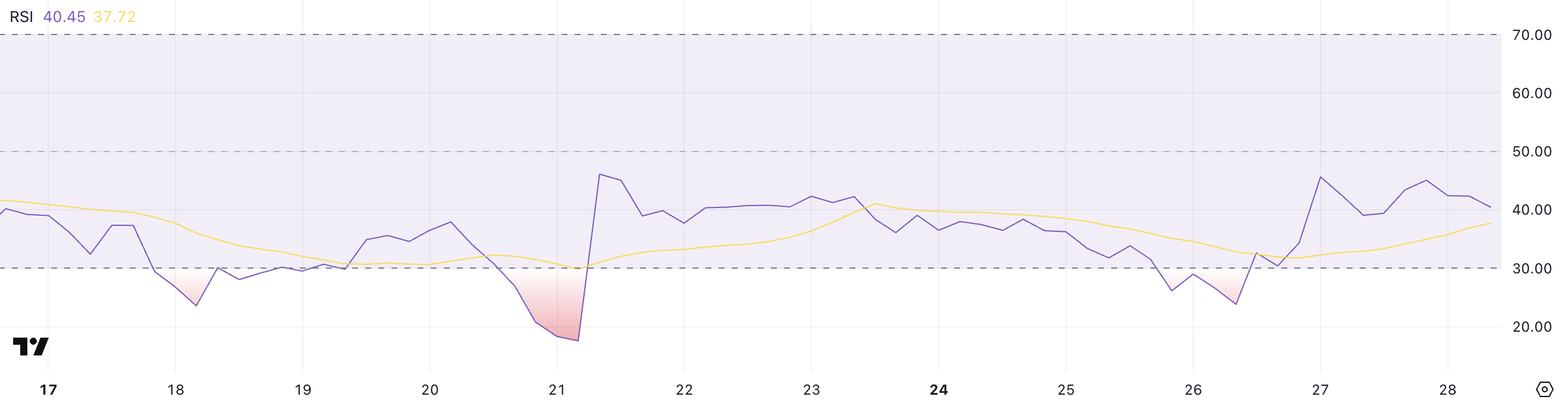

Pi Network RSI Has Recovered From Oversold But Still Lacks Bullish Momentum

Pi Network is showing early signs of recovery in momentum, with its Relative Strength Index (RSI) rising to 40.45 after hitting 23.8 just two days ago.

While this rebound suggests a reduction in overselling pressure, PI’s RSI hasn’t crossed above the neutral 50 mark in the past two weeks—highlighting ongoing weakness in bullish conviction.

Despite the slight uptick, the market has yet to see enough strength to shift sentiment meaningfully in favor of buyers. This cautious climb could either lead to a breakout or stall into continued consolidation.

The RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and those below 30 suggesting the asset is oversold.

With PI’s RSI currently at 40.45, it’s in a neutral-to-bearish zone—no longer extremely oversold but still lacking strong buying pressure.

For a clearer trend reversal, the RSI would likely need to break above 50, which hasn’t happened in two weeks. Thus, the current move is more of a potential bottoming attempt rather than a confirmed shift.

Will PI Continue Its Correction?

PI price is currently trading within a well-established downtrend, as indicated by the alignment of its EMA (Exponential Moving Average) lines—where shorter-term EMAs remain firmly below longer-term ones.

This setup reflects persistent selling pressure, and if the correction continues, PI could revisit key support levels at $0.718, with a potential drop to $0.62 if that floor fails to hold.

However, recent signs of life in the RSI hint that a short-term rebound might be brewing, offering some hope for a recovery.

If bullish momentum builds, PI could challenge resistance at $1.05 in the near term. A breakout above that level would shift sentiment and open the door for further gains, with $1.23 and even $1.79 as potential targets if the uptrend strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin23 hours ago

Bitcoin23 hours agoStrategic Bitcoin Reserve Proposed by Brazil’s VP Advisor

-

Market21 hours ago

Market21 hours agoXRP Price Slides Slowly—Is a Bigger Drop Coming?

-

Market23 hours ago

Market23 hours agoDogecoin (DOGE) Faces Market Correction—Will Buyers Step Back In?

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Fails To Break $2,100 Resistance – Growing Downside Risk?

-

Market16 hours ago

Market16 hours agoAnalysts Reveal Q2 Crypto Market Outlook: BTC at $200,000?

-

Market11 hours ago

Market11 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Market22 hours ago

Market22 hours agoTerra’s Crypto Claims Portal Opens Soon: Key Dates and Info

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns