Market

Solana Price Falls 19%; Losses Push Investors To Sell And Exit

Solana has faced significant price corrections recently, erasing gains made in mid-March. The altcoin is currently trading at $116, reflecting a 19% loss over the past ten days.

As the price continues to struggle, many investors are losing patience, pushing them to sell their holdings and exit the market.

Solana Losses Mount

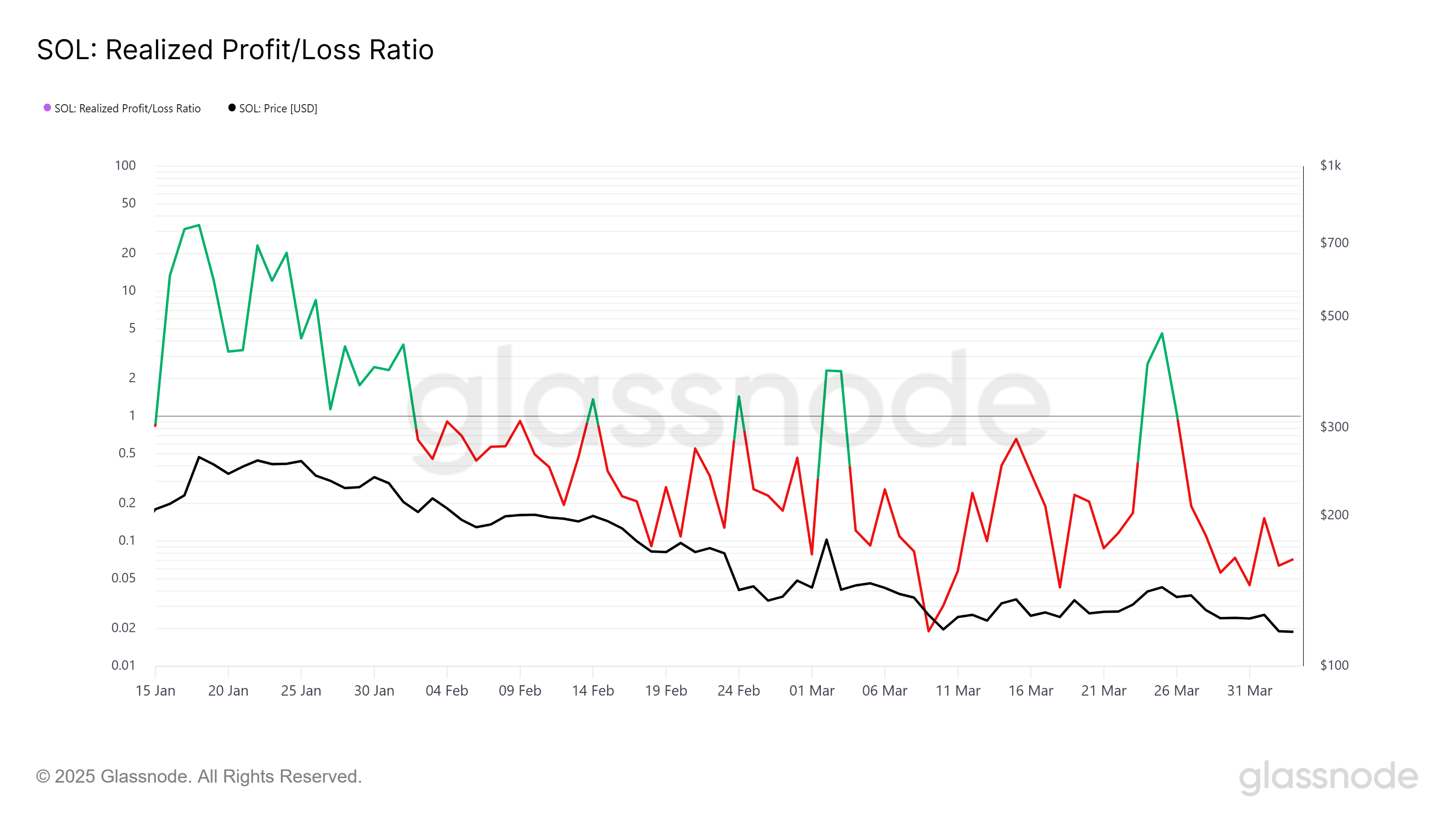

The Realized Profit/Loss (RPL) indicator shows that Solana has been underperforming for most of February and March. While there were brief moments of profit for short-term holders (STHs), the overall trend has been bearish.

These losses have contributed to mounting frustration among investors, leading many to consider selling their positions. The selling pressure is keeping the market from recovering as more and more investors choose to cut their losses.

As a result, investor sentiment has weakened, with many unwilling to hold onto their positions in the face of continued price declines. The Realized Profit/Loss data indicates that, in addition to the selling pressure from STHs, the broader market is also showing signs of caution.

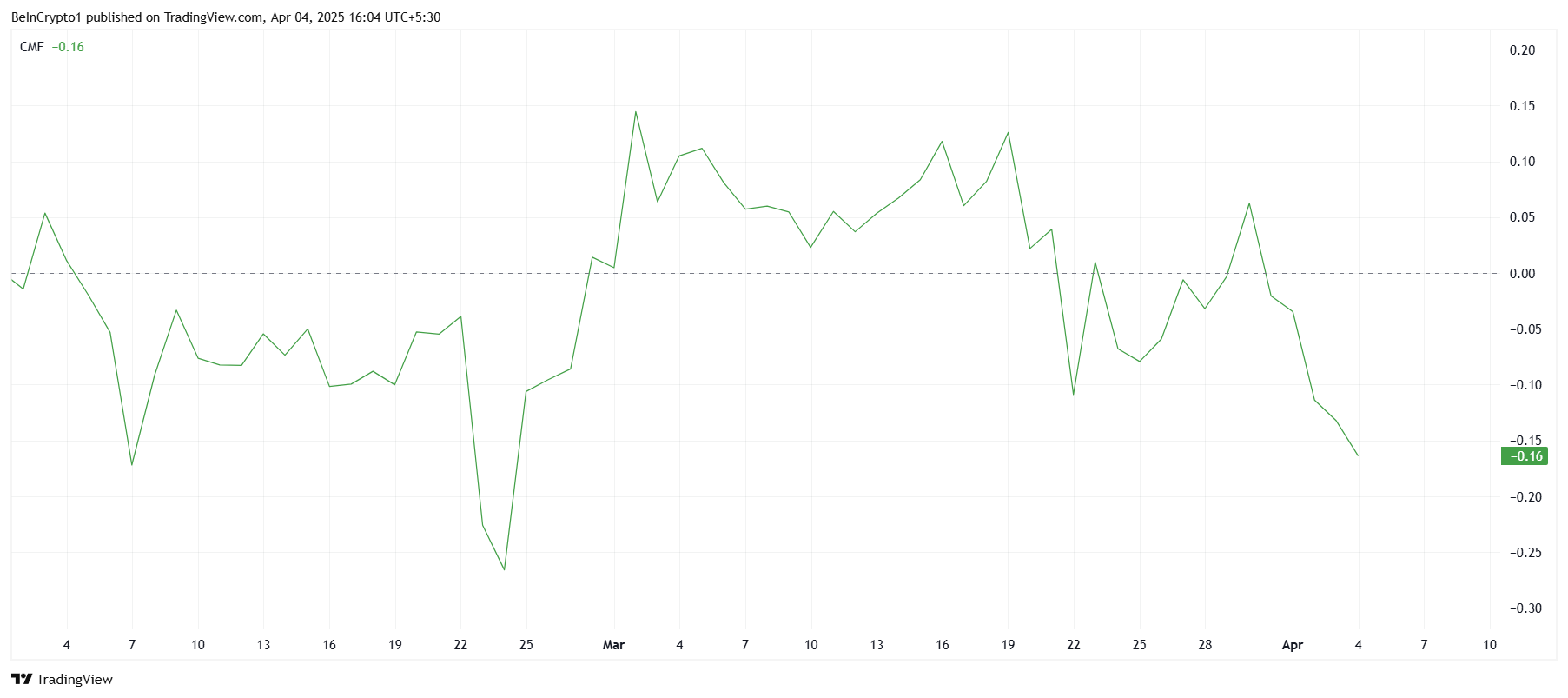

The Chaikin Money Flow (CMF) indicator also shows a concerning trend for Solana. Currently, at a monthly low, the CMF reflects that outflows are exceeding inflows, indicating that investors are pulling their money out of Solana. This lack of buying pressure is detrimental to the altcoin’s recovery prospects, as the outflows signal reduced confidence in the asset.

With the CMF in negative territory, Solana’s ability to rally appears limited, as the overall market sentiment remains subdued. The lack of investor conviction is further exacerbating the downward momentum.

SOL Price Could Witness Further Decline

At the time of writing, Solana’s price is at $116, and it is struggling to recover from the recent losses. Despite the slight uptick observed in the past 24 hours, the altcoin’s recovery remains uncertain. With investor confidence at a low, the price may continue to struggle in the short term.

The aforementioned factors suggest that Solana could dip further to $109, extending investors’ losses. If the bearish trend continues, SOL could test this support level before any potential signs of recovery emerge. This price action would keep investors on edge and delay any sustained rally.

However, if Solana can reclaim $118 as a support floor, it could spark a reversal. A breach of this level would push the altcoin toward $123, and flipping it into support would significantly bolster the bullish thesis. In this scenario, Solana could break through resistance levels and rise toward $135.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Yellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

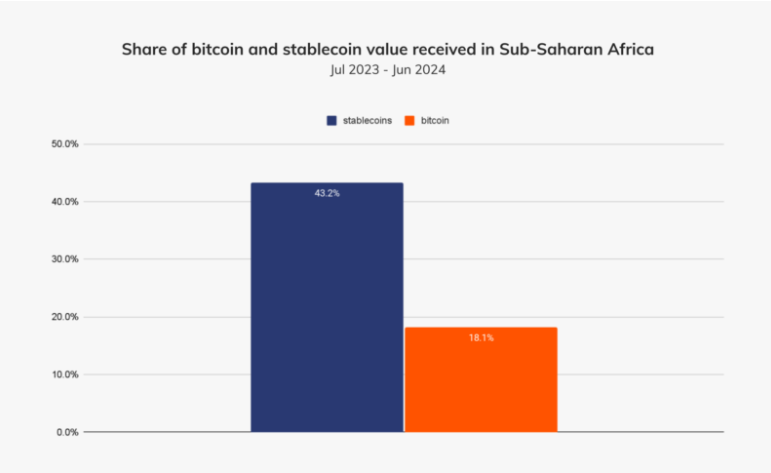

For years, crypto in Africa was synonymous with Bitcoin (BTC). Today, that narrative has flipped, with companies like Yellow Card, a crypto exchange operating in Africa, clearly reflecting this shift.

In an exclusive with BeInCrypto, Yellow Card co-founder and CEO Chris Maurice reveals how it is building a pan-African stablecoin network to leapfrog traditional finance (TradFi). This is amid growing regulatory clarity, collapsing fiat systems, and a remittance revolution.

Stablecoins Are Transforming Africa’s Financial Scene

The pan-African exchange operates in over 20 markets, and Maurice says stablecoins now account for over 99% of its transactions. This makes Yellow Card a bellwether for what might be the most transformative trend in emerging markets finance.

“When we first launched Yellow Card in 2019, people were exclusively buying Bitcoin. Now, the most popular asset is Tether (USDT),” Maurice told BeInCrypto.

As it happened, necessity, not speculation, has driven this evolution. Africa leads the world in peer-to-peer (P2P) crypto trading volume. However, unlike global crypto hubs chasing volatile returns, Africans are choosing stablecoins out of financial survival.

Local currencies are eroding under inflationary pressure in countries like Nigeria, which ranks second globally in crypto adoption (per Chainalysis). Stablecoins offer a reliable store of value and seamless means of cross-border payments.

This is especially critical in a continent with $48 billion annual remittances and persistent banking limitations.

“Stablecoins are solving practical financial services challenges in Africa. People aren’t in love with the tech. They need faster, cheaper ways to move money to survive and thrive,” Maurice added.

Infrastructure Built for the Unbanked

Yellow Card has gone beyond trading services. Its infrastructure integrates mobile money systems (like M-Pesa in Kenya) and local fiat currencies such as the Nigerian naira and Ghanaian cedi. According to the firm’s CEO, this helps onboard users without bank accounts.

By managing compliance, currency exchange, and payments internally, the firm enables businesses to operate without battling unreliable local rails.

“Our mission is to let companies invest, hire, and grow in emerging markets without needing to stress over infrastructure. We’ve built the back office [meaning] cybersecurity, AML, [and] data protection, so they can focus on growth,” he articulated.

The Regulatory Dam Has Broken

Maurice also observed that African regulators kept crypto in limbo for years. In Yellow Card’s view, 2024 marked a tipping point.

“There is regulatory momentum in Africa that is only accelerating. The dam has broken,” he said.

South Africa now classifies crypto as a financial product. It has licensed major exchanges like Luno and VALR. Countries in the Central African Economic and Monetary Community (CEMAC), Mauritius, Botswana, and Namibia have followed suit with licensing regimes.

Meanwhile, regulatory incubators are emerging in Kenya, Nigeria, Rwanda, and Tanzania. Against this backdrop, Maurice says Yellow Card has actively helped draft legislation in Kenya and supports crypto frameworks in Morocco.

Fighting the Informal Market

Still, challenges remain. In countries like Ethiopia, Cameroon, and Morocco, outright bans have driven users underground into high-risk P2P networks. Yellow Card pushes for frameworks that level the playing field for compliant players.

“We face a lot of competition from companies that don’t maintain high AML standards…A level playing field is all we seek,” he said.

With $85 million in venture funding, Yellow Card is deploying capital into compliance and partnerships. With this, the company positions itself as the go-to infrastructure provider for global firms looking to tap African markets.

From Africa to Emerging Markets Everywhere

Cross-border payments are perhaps Yellow Card’s most powerful use case. The company’s co-founder says its stablecoin-powered rails are helping businesses reduce working capital needs, expand to new regions, and hire faster.

“We’ve had clients tell us we’ve enabled them to scale into new countries and reduce their costs dramatically. That’s real economic impact,” said Maurice.

The company is not stopping at Africa. Its infrastructure extends into other frontier markets, with a wave of strategic partnerships expected in 2025.

“Yellow Card has built a series of easy buttons for developed world companies to expand into complicated, high-growth markets,” he noted.

The End of SWIFT?

Perhaps the boldest claim from Yellow Card is what it sees on the five-year horizon: the decline of SWIFT and traditional international transfers altogether.

“As we look out five years, SWIFT is in trouble. In ten, no one will be making international wires again,” Maurice chimed.

Backed by enterprise-grade security and regulatory rigor, Yellow Card attracts interest from blue-chip firms like PayPal and Coinbase exchange, which are looking for stablecoin partners in emerging markets.

“Stablecoins are already a standard part of the financial infrastructure in Africa. CFOs and treasurers in traditional industries are now routinely using them to store and transfer value,” he added.

Africa’s crypto market is still small compared to global giants. Nevertheless, as the world shifts from speculation to utility, the continent’s fragmented financial systems may offer a glimpse into crypto’s most impactful use case: economic empowerment. For Yellow Card, the mission is clear and increasingly urgent.

“We’ve built a company for longevity and scale. Crypto adoption in Africa is stablecoin adoption,” Maurice concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Analyst Correctly Called The XRP Price Crash, Here Are The Next Targets

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

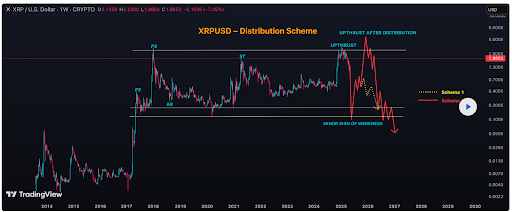

Crypto analyst Joao, who correctly predicted the XRP price crash, has revealed the altcoin’s next targets. Based on his latest prediction, more pain could lie ahead for XRP, which could still drop below $1.

What’s Next For The XRP Price After The Crash Below $2

In a TradingView post, Joao stated that a long-term distribution phase could be the “most chaotic scenario” for the XRP price following its crash below $2. Through his accompanying chart, the analyst illustrated a “radical distribution scheme” that could potentially extend into late 2025.

Related Reading

Joao remarked that the XRP price could first show a sign of weakness, dropping below the COVID dump levels, possibly close to $0.10. As that plays out, XRP could follow the Scheme 1 or 2 trajectory. For Scheme 1, the analyst predicts that XRP would drop to $0.1 and then bounce back to $0.4, which is the last point of supply.

On the other hand, if Scheme 2 plays out, he predicts that the XRP price could spike between $5 and $6.8, with an average peak around $5.5 to $5.7, which would likely trigger extreme euphoria. Joao warned that this is just one of the “insane” possibilities and that XRP’s price action will depend heavily on Bitcoin, market makers, supply and demand, public interest, and the macro market.

Crypto analyst John also recently warned that the XRP price retracement could deepen to mid-2024 levels, with the altcoin dropping to the Fib price level of $0.3827. The analyst highlighted a bearish engulfing that formed on XRP’s weekly chart in late March, which is why he believes that the altcoin could still drop to these lows.

Meanwhile, crypto analyst Egrag Crypto stated that based on an ascending broadening wedge, there is a 70% chance of a downside breakout and a 30% chance of a move to the upside. He claimed that the measured move for the downside breakout for the XRP price is $0.65.

$1.90 Has Become Resistance For The Altcoin

In an X post, crypto analyst CasiTrades revealed that $1.90 has become a major resistance to the XRP price. She noted that the altcoin’s price fell to around $1.61 following the Black Monday crash on April 7. This low is said to have made new extremes on the RSI across the market, and it was just shy of major support.

Related Reading

The XRP price has since rebounded to test the $1.90 level, which CasiTrades affirmed is a major resistance at this point. She remarked that the next support is $1.55, the golden .618 retracement. The analyst added that this price action is exactly what sets up the kind of Wave 3 that breaks through all-time highs (ATHs).

In line with this, CasiTrades claimed that if the XRP price bottoms near $1.55, it would actually strengthen the bullish case for a rally to between $8 and $13 this month. She believes that XRP would easily break the resistance around its ATH on this Wave 3 and possibly send it to as high as $13.

At the time of writing, the XRP price is trading at around $1.8, up over 10% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Medium, chart from Tradingview.com

Market

Is Ethereum Falling to $1,000 This April?

Ethereum (ETH) is down almost 6% in the last 24 hours, intensifying a week of sharp declines. With the price below $1,500, market watchers are increasingly questioning whether ETH could fall to $1,000 in April.

Mounting concerns around liquidations, declining network activity, and bearish technicals are fueling the debate. As investor sentiment wavers, the next few days could prove critical for Ethereum’s short-term trajectory.

If ETH Falls Below $1200, Nearly $342 Million Will Be Liquidated

Ethereum is currently hovering just above the $1,500 mark, down more than 15% over the past week as bearish pressure intensifies across the crypto market.

The recent downturn has sparked concern among traders, especially with ETH struggling to hold key support levels. Standard Chartered recently stated that XRP could overtake Ethereum by 2028.

The decline reflects broader risk-off sentiment and uncertainty surrounding altcoins, with Ethereum now teetering dangerously close to levels that could trigger a major wave of liquidations.

According to on-chain data, if ETH falls below $1,200, it could trigger liquidations totaling approximately $342 million across leveraged positions.

Liquidation occurs when traders who borrowed capital to go long on Ethereum are forced to sell their holdings due to falling prices. This effectively amplifies the downside and adds more selling pressure.

Weighing in on the situation, investor Peter Schiff took to X, warning that he doesn’t think it will take long before Ethereum crashes below $1,000 — a level not seen since January 2021.

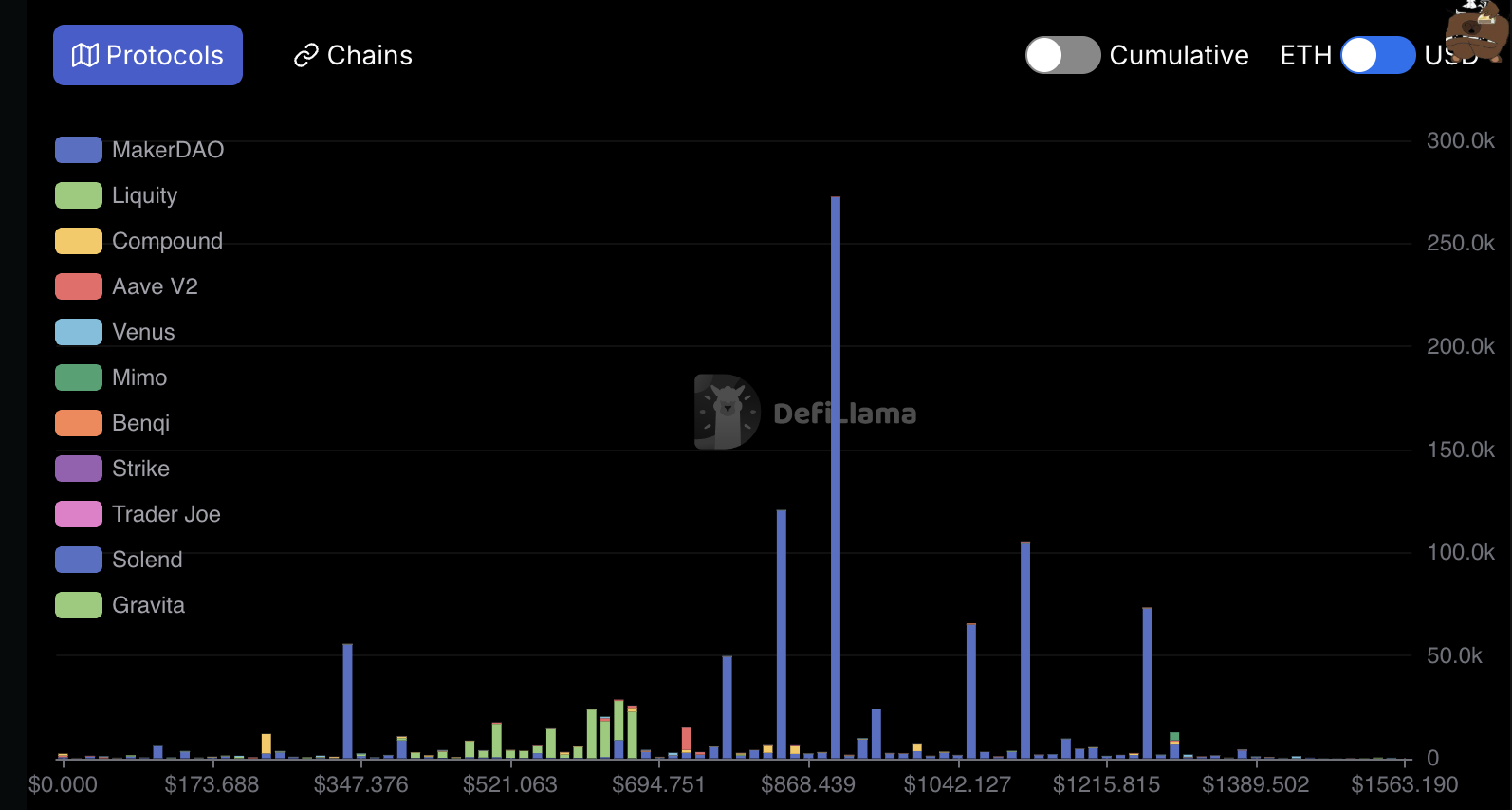

Ethereum TVL Is Down 43% Since December

Ethereum’s total value locked (TVL) has been in sharp decline since peaking at $86.6 billion in December — its highest level since mid-2022.

As of now, Ethereum’s TVL has dropped to $49.34 billion, marking a steep 43% decrease in just a few months.

This decline highlights waning user activity and capital outflows from Ethereum-based protocols, raising fresh concerns about the network’s short-term momentum.

TVL measures the total capital deposited into decentralized finance (DeFi) protocols on a blockchain and serves as a key indicator of ecosystem health and investor confidence.

A rising TVL generally signals growing trust and usage of DeFi applications, while a falling TVL suggests declining demand and reduced engagement.

Ethereum’s TVL is now hovering at multi-month lows, which could be a bearish signal for ETH’s price. This reflects reduced utility and less capital circulating through the network, both of which could put further downward pressure on the asset if the trend continues.

Ethereum Is Currently 70% Down From Its All-Time High

Ethereum’s price has been trading below $2,000 since March 26, and its technical indicators don’t look promising.

The current setup of its Exponential Moving Averages (EMAs) shows a bearish formation, with short-term EMAs positioned below the longer-term ones — a classic signal of ongoing downside momentum.

This suggests that sellers are still in control, and the market could be bracing for further correction.

If bearish momentum continues, Ethereum may retest support near $1,400. A breakdown below that level could trigger a deeper sell-off, with Ethereum price potentially sliding toward $1,000 in April — a key psychological and historical level.

However, if bulls regain control and reverse the trend, ETH could first challenge resistance at $1,749.

A breakout above that would open the door for a test of $1,954, and if momentum stays strong, Ethereum could push past the $2,000 barrier and aim for $2,104.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours ago3 Altcoins to Watch in the Second Week of April 2025

-

Altcoin21 hours ago

Altcoin21 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Market22 hours ago

Market22 hours agoWEEX Lists AB (AB) under the RWA and Blockchain Infrastructure Category

-

Market21 hours ago

Market21 hours agoCrypto Pundit Reveals What Will Happen If XRP Price Does Not Break $2.3

-

Altcoin20 hours ago

Altcoin20 hours agoSolana’s Fartcoin Jumps 20% Despite Market Selloff

-

Market17 hours ago

Market17 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Bitcoin22 hours ago

Bitcoin22 hours agoWhy Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

-

Altcoin22 hours ago

Altcoin22 hours agoRipple Whale Moves $355 Million To Binance, XRP Price To Dip Further?