Market

SOL Price Rally at Risk as Solana Market Dominance Declines

Like many altcoins in the market, Solana’s (SOL) price jumped in the last 24 hours. This is a positive development for the token, which has increased 13% in the last seven days.

However, on-chain indicators suggest that this rally could be short-lived.

A Huge Warning for Solana Bulls

At press time, SOL’s price sits at $158, marking its highest point since August 11. Despite this surge, Solana’s social dominance has dropped.

Social dominance measures how much attention a cryptocurrency receives compared to others. A high percentage suggests increased discussions about Solana, which can be key to sustaining its upward momentum.

However, SOL’s social dominance declined from 4.50% on August 19 to 2.58%. This drop hints that the market’s enthusiasm for the token may be fading.

If social dominance continues to fall, SOL’s rally could lose steam. In the worst case, its price might slide much lower than the gains it has had in recent days.

As seen above, whenever social dominance drops during an uptrend, the rally typically halts. If history repeats itself, SOL could be headed for a decline.

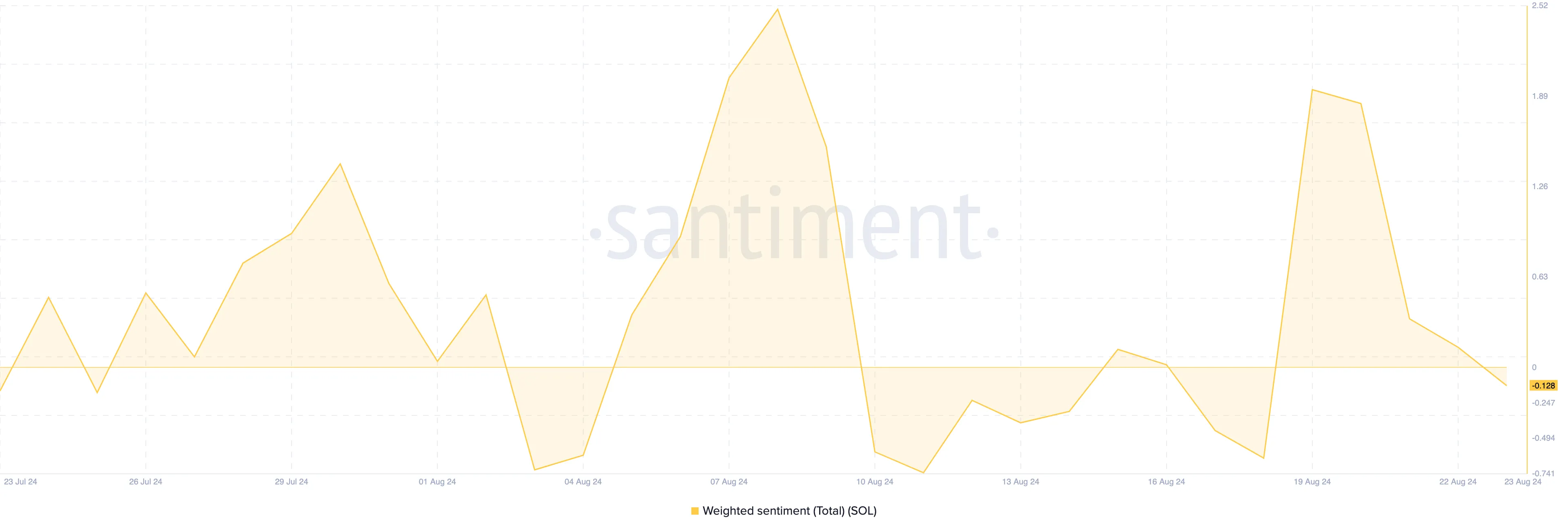

In addition to social dominance, Solana’s Weighted Sentiment has also turned negative. According to Santiment, this metric tracks the overall sentiment toward a cryptocurrency across social media platforms.

When sentiment is positive, social media comments lean bullish. On the flip side, negative sentiment reflects a pessimistic outlook, which is now the case with SOL.

Read more: Solana vs. Ethereum: An Ultimate Comparison

This shift in sentiment suggests that despite the recent price gains, market participants may be losing confidence in sustained growth.

SOL Price Prediction: Mixed Signals on Different Charts

According to the daily chart, SOL’s price could face resistance at the upper points of interest around $163.93.

Should the token’s uptrend be rejected at this point, it could face a drawdown, possibly falling to $150.84. In this region, bulls appear to have formed a strong support system that could prevent another downturn.

Meanwhile, on the 4-hour chart, SOL price formed a bullish Adam and Eve pattern. This pattern is in the form of a V-shaped bottom (Adam) followed by a U-shaped consolidation period, signaling the start of a new uptrend.

As shown below, SOL’s price has broken above the neckline of the technical pattern. If this uptrend continues, the bearish bias analyzed on the daily chart could be invalidated.

Read more: 13 Best Solana (SOL) Wallets To Consider in August 2024

Specifically, a continued upswing could see the token increase by 10% to $172.83. In a highly bullish scenario, the Solana native token might hit $187.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

VanEck Sets Stage for BNB ETF with Official Trust Filing

Global investment management firm VanEck has officially registered a statutory trust in Delaware for Binance’s BNB (BNB) exchange-traded fund (ETF).

This move marks the first attempt to launch a spot BNB ETF in the United States. It could potentially open new avenues for institutional and retail investors to gain exposure to the asset through a regulated investment vehicle.

VanEck Moves Forward with BNB ETF

The trust was registered on March 31 under the name “VanEck BNB ETF” with filing number 10148820. It was recorded on Delaware’s official state website.

The proposed BNB ETF would track the price of BNB. It is the native cryptocurrency of the BNB Chain ecosystem, developed by the cryptocurrency exchange Binance.

As per the latest data, BNB ranks as the fifth-largest cryptocurrency by market capitalization at $87.1 billion. Despite its significant market position, both BNB’s price and the broader cryptocurrency market have faced some challenges recently.

Over the past month, the altcoin’s value has declined 2.2%. At the time of writing, BNB was trading at $598. This represented a 1.7% dip in the last 24 hours, according to data from BeInCrypto.

While the trust filing hasn’t yet led to a price uptick, the community remains optimistic about the prospects of BNB, especially with this new development.

“Send BNB to the moon now,” an analyst posted on X (formerly Twitter).

The filing comes just weeks after VanEck made a similar move for Avalanche (AVAX). On March 10, VanEck registered a trust for an AVAX-focused ETF.

This was quickly followed by the filing of an S-1 registration statement with the US Securities and Exchange Commission (SEC). Given this precedent, a similar S-1 filing for a BNB ETF could follow soon.

“A big step toward bringing BNB to US institutional investors!” another analyst wrote.

Meanwhile, the industry has seen an influx of crypto fund applications at the SEC following the election of a pro-crypto administration. In fact, a recent survey revealed that 71% of ETF investors are bullish on crypto and plan to increase their allocations to cryptocurrency ETFs in the next 12 months.

“Three-quarters of allocators expect to increase their investment in cryptocurrency-focused ETFs over the next 12 months, with demand highest in Asia (80%), and the US (76%), in contrast to Europe (59%),” the survey revealed.

This growing interest in crypto ETFs could drive further demand for assets like BNB, making the VanEck BNB ETF a potentially significant product in the market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Recovery Stalls—Are Bears Still In Control?

XRP price started a fresh decline from the $2.20 zone. The price is now consolidating and might face hurdles near the $2.120 level.

- XRP price started a fresh decline after it failed to clear the $2.20 resistance zone.

- The price is now trading below $2.150 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if it fails to clear the $2.20 resistance zone.

XRP Price Faces Rejection

XRP price failed to continue higher above the $2.20 resistance zone and reacted to the downside, like Bitcoin and Ethereum. The price declined below the $2.150 and $2.120 levels.

The bears were able to push the price below the 50% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high. There is also a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair.

The price is now trading below $2.150 and the 100-hourly Simple Moving Average. However, the bulls are now active near the $2.10 support level. They are protecting the 61.8% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high.

On the upside, the price might face resistance near the $2.120 level and the trend line zone. The first major resistance is near the $2.150 level. The next resistance is $2.20. A clear move above the $2.20 resistance might send the price toward the $2.240 resistance. Any more gains might send the price toward the $2.2650 resistance or even $2.2880 in the near term. The next major hurdle for the bulls might be $2.320.

Another Decline?

If XRP fails to clear the $2.150 resistance zone, it could start another decline. Initial support on the downside is near the $2.10 level. The next major support is near the $2.0650 level.

If there is a downside break and a close below the $2.0650 level, the price might continue to decline toward the $2.020 support. The next major support sits near the $2.00 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.10 and $2.050.

Major Resistance Levels – $2.120 and $2.20.

Market

Experts Raise Red Flags Over Finances

Circle’s initial public offering (IPO) filing has raised concerns among industry experts, who are sounding alarms over the company’s financial health, distribution costs, and valuation.

While the move marks a significant step toward mainstream financial integration, experts’ skepticism casts doubt on the company’s long-term prospects.

Analysts Highlight Red Flags With Circle IPO

On April 1, BeInCrypto reported that Circle had filed for an IPO. The company plans to list its Class A common stock on the New York Stock Exchange (NYSE) under “CRCL.”

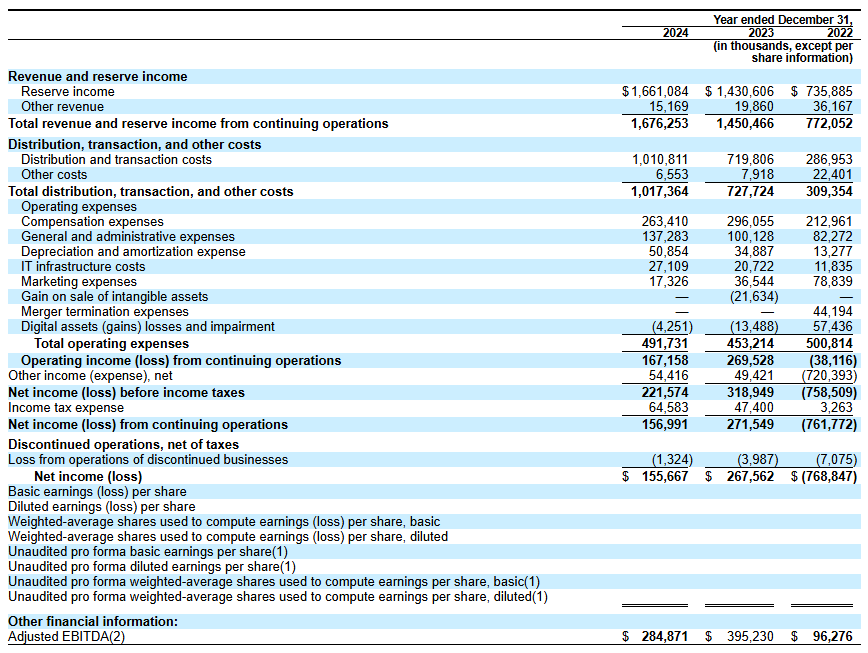

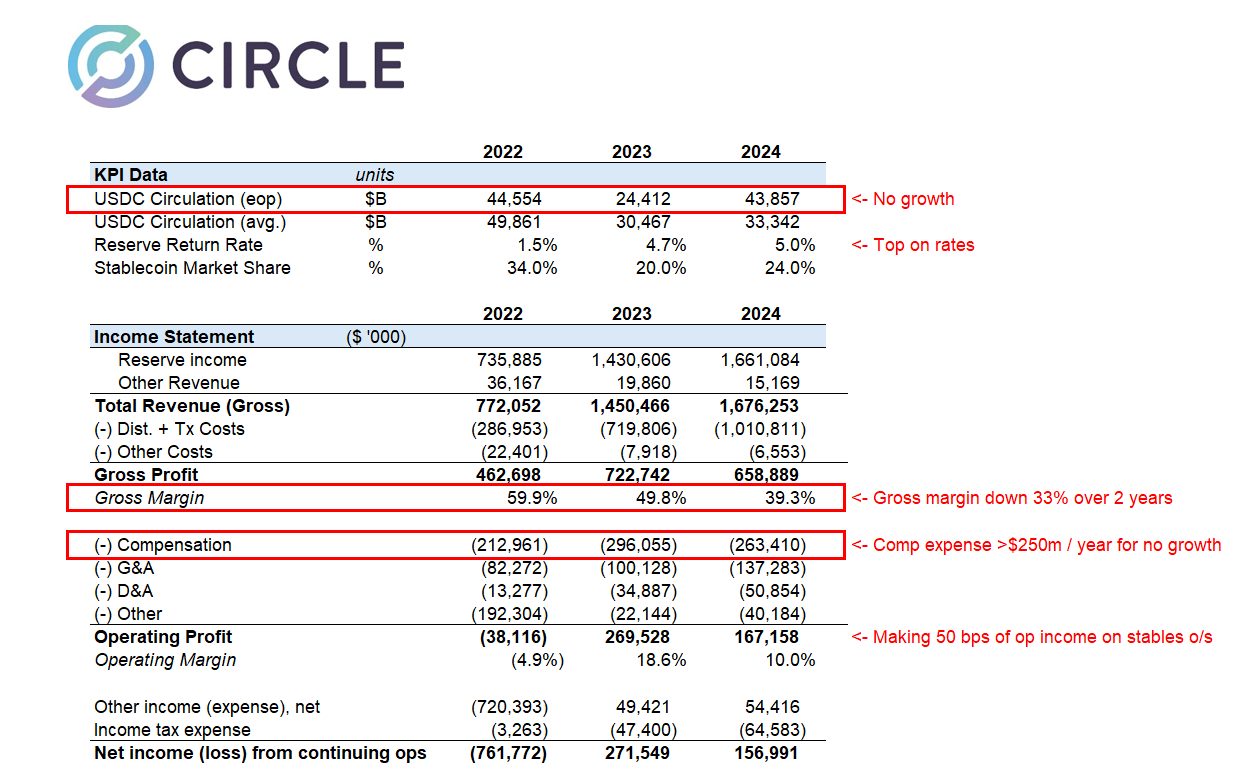

Circle’s IPO filing reveals revenue of $1.67 billion in 2024, a notable increase from previous years. However, a closer examination of the company’s financials has uncovered some challenges.

Matthew Sigel, Head of Digital Assets Research at VanEck, noted that revenue increased 16% year over year. Yet, at the same time, the company reported a 29% decrease in EBITDA year over year, indicating a decline in operational profitability. Additionally, net income fell by 42%, reflecting a significant drop in overall profitability.

Sigel pointed out four factors contributing to the decline in these financial metrics. He explained that the company’s rapid expansion and new service integrations negatively impacted net income.

Furthermore, the discontinuation of services like Circle Yield reduced other revenue streams. This, in turn, exacerbated the decline in profitability.

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel added.

Importantly, he focused on Circle’s increased distribution and transaction costs. Sigel revealed that the cost rose due to higher fees paid to partners like Coinbase and Binance.

A related post by Farside Investors on X (formerly Twitter) shed further light on these expenses.

“In 2024, the company spent over $1 billion on “distribution and transaction costs,” probably much higher than Tether as a % of revenue,” the post read.

This prompts speculation that Circle may be overspending to maintain its market share in the competitive stablecoin sector. The company’s historical performance further fuels skepticism.

Farside Investors added that in 2022, Circle recorded a staggering $720 million loss. Notably, the year was marked by significant turmoil in the crypto industry, including the high-profile collapses of FTX and Three Arrows Capital (3AC).

This suggests that Circle may be vulnerable to market shocks. Thus, it calls into question the company’s risk management capabilities—especially in the inherently volatile crypto market.

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

In addition, analyst Omar expressed doubts about Circle’s $5 billion valuation.

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he questioned.

He drew attention to several concerns, including the company’s gross margins being severely impacted by high distribution costs. The analyst also pointed out that the deregulation of the US market is poised to disrupt Circle’s position.

Additionally, Omar stressed that Circle spends over $250 million annually on compensation and another $140 million on general and administrative costs, raising questions about its financial efficiency. He also noted that interest rates—core income drivers for Circle—will likely decline, presenting additional challenges.

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar said.

Ultimately, the analyst concluded that the IPO filing was a desperate attempt to secure liquidity before facing serious market difficulties.

Meanwhile, Wyatt Lonergan, General Partner at VanEck, shared his predictions for Circle’s IPO, outlining four potential scenarios. In the base case, he forecasted that Circle would capitalize on the stablecoin narrative and secure key partnerships to drive growth.

In a bear case, Lonergan speculated that poor market conditions might lead to a Coinbase buyout.

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan claimed.

Lastly, he outlined a probable scenario where Ripple bids up Circle’s valuation to a staggering $15 to $20 billion and acquires the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin21 hours ago

Bitcoin21 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Bitcoin22 hours ago

Bitcoin22 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market20 hours ago

Market20 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Altcoin19 hours ago

Altcoin19 hours agoWill XRP, SOL, ADA Make the List?

-

Market18 hours ago

Market18 hours agoTrump’s USD1 Stablecoin Eyes Trust Recovery in Crypto

-

Altcoin18 hours ago

Altcoin18 hours agoBTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

-

Altcoin17 hours ago

Altcoin17 hours agoBinance Update Sparks 50% Decline For Solana Meme Coin ACT: Details