Market

Shiba Inu Faces Weakening Bitcoin Link—Can Price Rebound?

Shiba Inu (SHIB) price has struggled to break past $0.00001961 since mid-June, with repeated attempts at this resistance level falling short, including another failed attempt in the last seven days.

As Bitcoin edges closer to forming a new all-time high, SHIB’s decoupling from BTC’s influence is becoming more apparent. The meme coin’s divergence from Bitcoin’s trend poses challenges for its near-term price outlook.

Shiba Inu Investors Are Positive

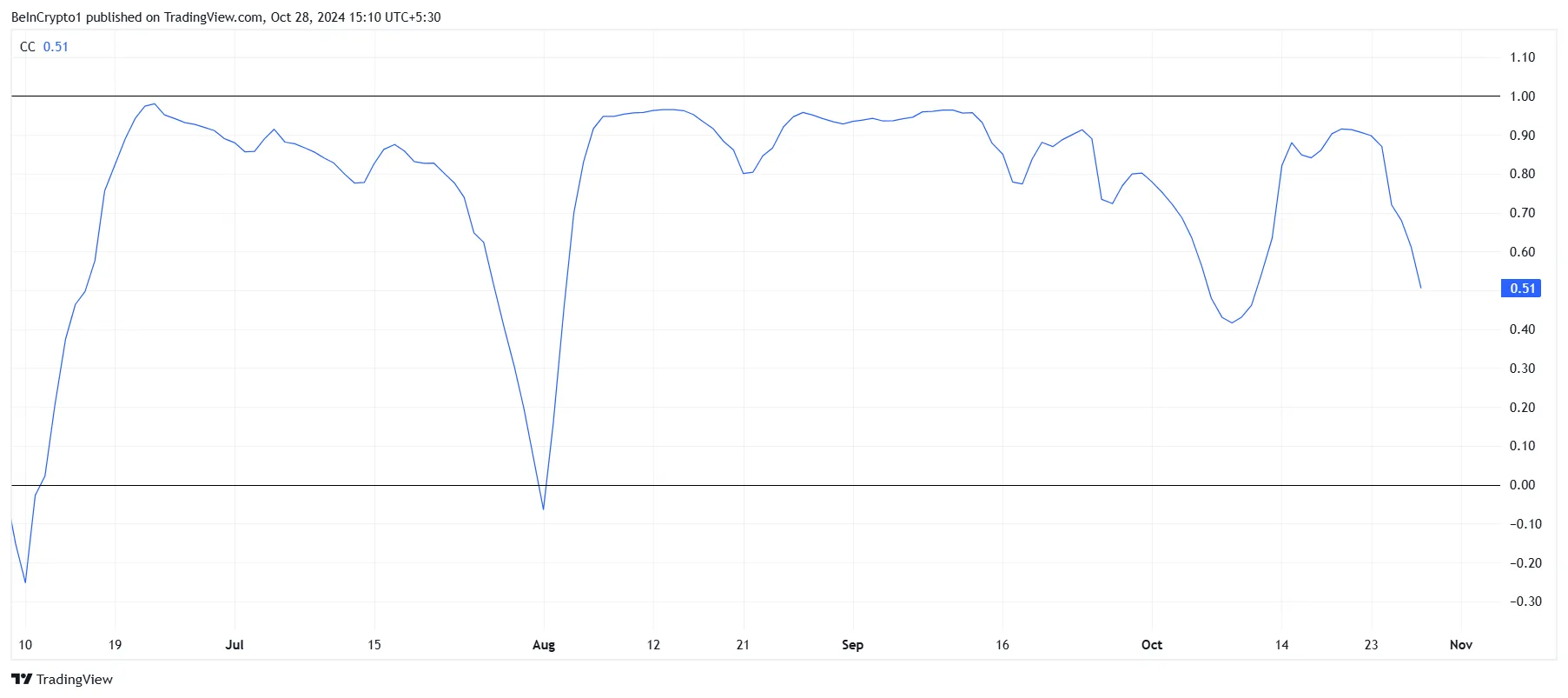

Shiba Inu’s correlation with Bitcoin, currently at 0.51, has significantly dropped, a sign of weakening alignment between the two assets. A declining correlation with Bitcoin may limit SHIB’s capacity to benefit from BTC’s potential gains, which could negatively impact its price trajectory. With Bitcoin nearing a historical high, the decoupling suggests SHIB may not share in the broader market’s upward momentum, reducing the likelihood of a rally.

While BTC’s bullish outlook typically influences altcoins, Shiba Inu’s reduced dependence on Bitcoin’s price cues introduces uncertainty. Should this divergence continue, SHIB’s price could struggle to find significant support or upward traction.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

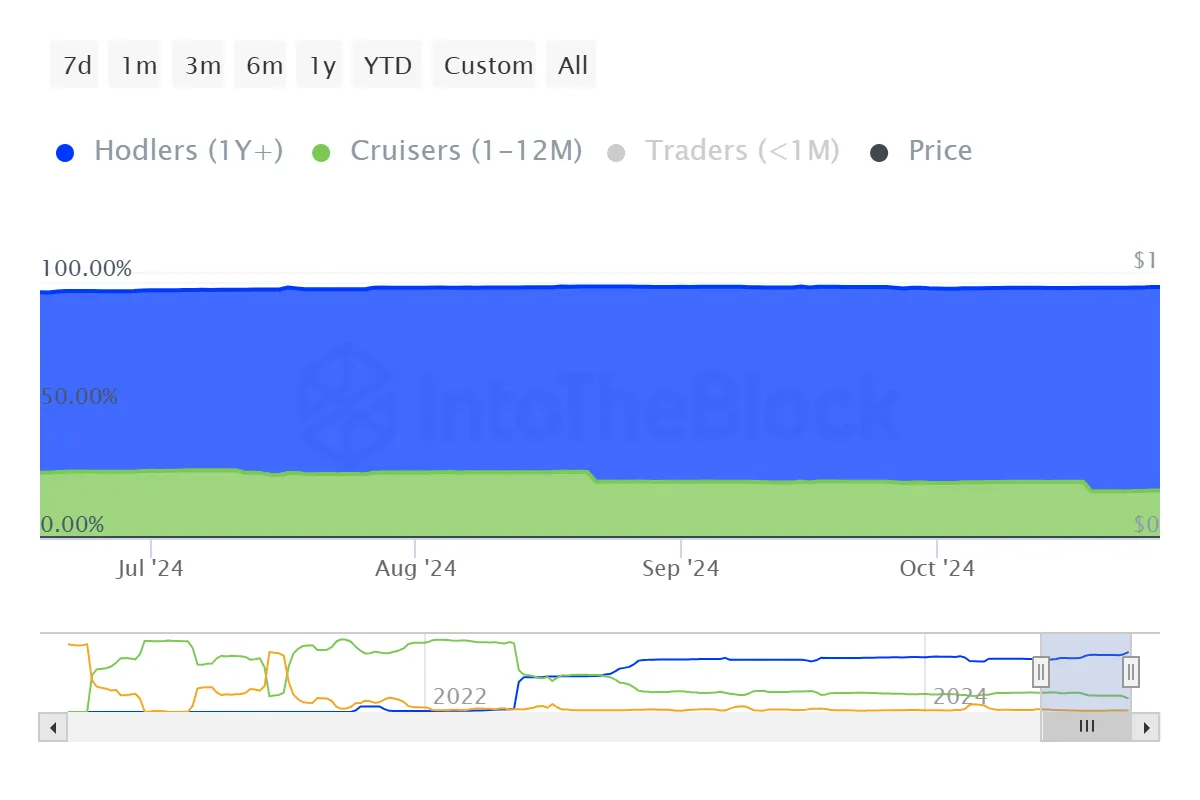

Despite current price challenges, Shiba Inu’s investor base shows positive signs, with a notable shift from short-term holders (STHs) to long-term holders (LTHs). Approximately 4% of SHIB holders have transitioned into the LTH category, having held the asset for over a year. This shift indicates a growing level of commitment, suggesting investors retain confidence in SHIB’s potential despite recent price fluctuations.

This transition from STHs to LTHs demonstrates an underlying conviction that could stabilize Shiba Inu’s price in the face of market volatility. As more investors commit to holding SHIB for extended periods, the asset may see reduced sell pressure, potentially buffering it from sharper declines. This shift supports a more sustainable growth outlook, even if short-term gains remain limited.

SHIB Price Prediction: Failure Ahead

Shiba Inu’s price dropped by 11% this week yet remains above the local support level of $0.00001676. The meme coin’s inability to breach the resistance levels at $0.00001961 and $0.00002093 has stunted potential gains. Without surpassing these barriers, SHIB may continue to struggle with upward momentum, limiting short-term gains.

Given mixed cues from the aforementioned factors, SHIB may stay in a consolidation phase under $0.00001961. With investor sentiment showing both confidence and caution, the meme coin’s price action could remain range-bound in the near term. This period of consolidation may give the asset time to stabilize before attempting further upward movement.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

If Shiba Inu drops below the $0.00001676 support level, it could test the next support at $0.00001462. A breach here might invalidate any bullish-neutral outlook, pushing SHIB’s price further down to $0.00001271, which would mark a more significant pullback for the meme coin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Price Recovery in Motion—Uphill Battle Ahead Near Crucial $600 Level

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

BTC ETF Outflows Continue Amid Institutional Caution,

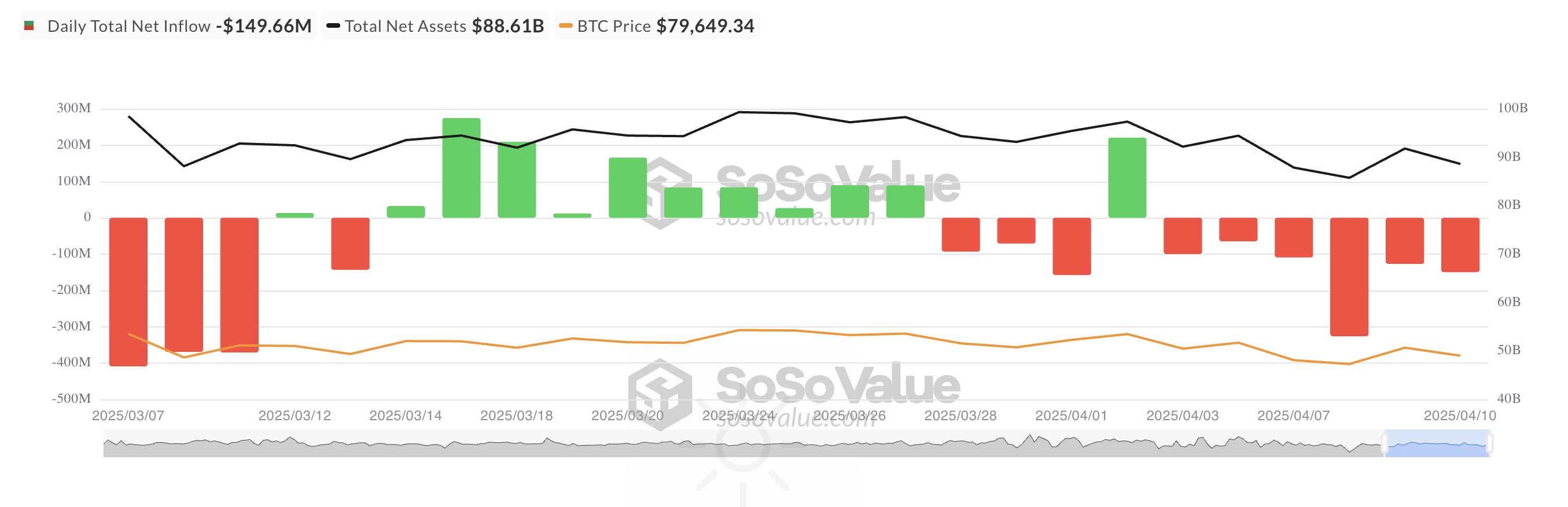

Even as crypto markets try to put on a brave face this week, institutional investors clearly are not buying it. Yesterday, Bitcoin spot ETFs recorded another round of outflows, marking the sixth straight day of capital flight from these funds.

Despite the broader market’s attempt at a short-term rebound, the continued withdrawals suggest that institutional sentiment remains cautious. The consistent outflows paint a picture of investors seeking safety or perhaps just sitting on the sidelines while volatility does its thing.

Bitcoin ETFs Continue Losing Streak

On Thursday, net outflows from BTC ETFs totaled $149.66 million, reflecting a 17% increase from the $127.12 million in outflows seen on Wednesday.

This marked the sixth consecutive day of withdrawals from spot Bitcoin ETF funds, highlighting the growing caution and weakening sentiment among institutional BTC investors.

According to SosoValue, Grayscale Bitcoin Mini Trust ETF $BTC recorded the highest net inflow on that day, totaling $9.87 million, bringing the fund’s historical net inflow to $1.15 billion.

On the other hand, Fidelity’s ETF FBTC witnessed the highest net outflow on Wednesday, totaling $74.67 million. As of this writing, its total historical net inflow is $11.40 billion.

Derivatives Market Remain Optimistic

Meanwhile, BTC futures open interest has taken a modest hit, in line with the broader market dip. At press time, it stands at $51.73 billion, falling by 7% over the past day. This comes amid the decline in broader cryptocurrency market activity over the past 24 hours, during which BTC’s value has dipped by 2%.

A drop in open interest during a price decline suggests that traders are closing out positions rather than opening new ones. This indicates a possible bottoming phase or reduced volatility ahead.

But the story doesn’t end there.

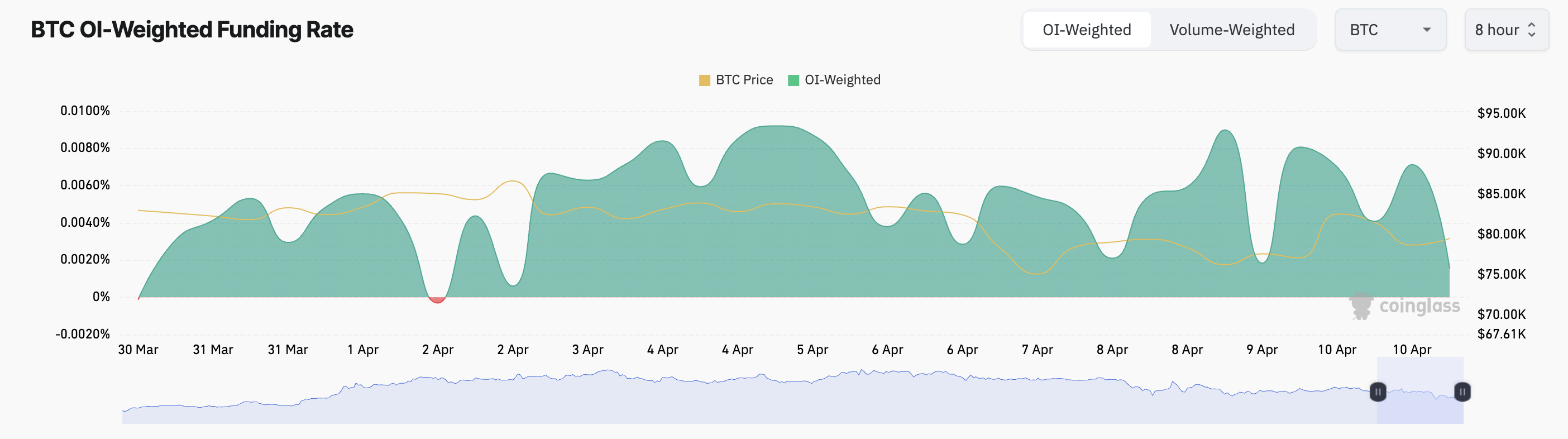

Funding rates remain positive, and call options are in high demand, both considered bullish signals.

At press time, BTC’s funding rate stands at 0.0015%. The funding rate is a recurring payment exchanged between long and short traders in perpetual futures markets to keep contract prices aligned with the spot market. A positive funding rate like this indicates that long traders pay short traders, signaling that bullish sentiment is dominant.

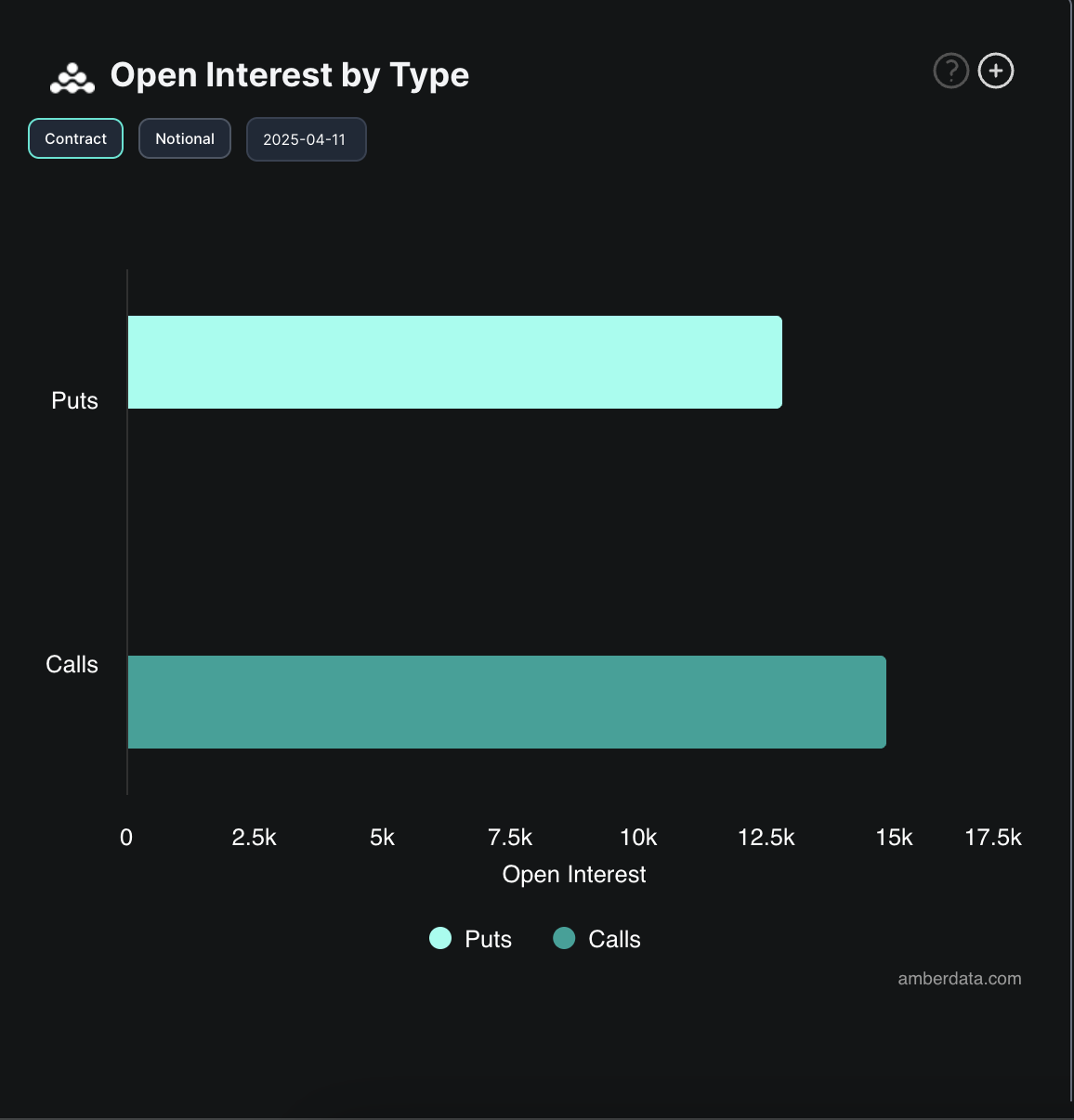

In the options market, there is a high demand for calls over puts, further reflecting a bullish bias toward BTC.

The divergence between ETF flows and derivatives activity recorded this week suggests that while traditional institutions may be scaling back exposure, retail and leveraged traders continue to bet on rebounds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin23 hours ago

Altcoin23 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

-

Market21 hours ago

Market21 hours agoSolana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

-

Market20 hours ago

Market20 hours agoOnyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Lists BABY As Bitcoin Protocol Babylon Goes Live

-

Bitcoin21 hours ago

Bitcoin21 hours agoBullish Signal for Bitcoin in 2025?

-

Market18 hours ago

Market18 hours agoSolana Price Attempts Recovery, Nears $120, But Needs A Push

-

Market23 hours ago

Market23 hours agoXRP Price Forms Rounded Bottom Within Descending Channel, Target Set Above $3