Market

Shiba Inu Developer Urges Trump to Appoint a Blockchain Advisor

Shytoshi Kusama, the pseudonymous lead developer of Shiba Inu, has called on President-elect Donald Trump to appoint a blockchain advisor in his administration.

The suggestion comes as the newly created Department of Government Efficiency (DOGE) reportedly explores implementing a blockchain-based election system.

Kusama Explains Why Trump Should Hire a Blockchain Advisor

On November 15, Kusama shared concerns about the rumored blockchain election platform reportedly under review by Trump’s team. The rumored system, dubbed “eVote,” is said to involve partnerships with prominent blockchain platforms like Cardano, Hyperledger, Hedera, and X (formerly Twitter). It aims to create a nationwide electronic voting and identity verification solution.

The eVote initiative seeks to combat election fraud by requiring its adoption across all US states. Analysts believe this aligns with Trump’s long-standing emphasis on ensuring election integrity, particularly in light of controversies surrounding past electoral processes.

While the idea has gained traction, Kusama insists that its success depends on integrating Fully Homomorphic Encryption (FHE). This advanced encryption ensures voter data remains secure both on the blockchain and against external threats.

Kusama warned that without FHE, sensitive voter information, such as identities and preferences, could be exposed to decryption attempts by malicious actors. This vulnerability could lead to widespread disruption. He emphasized that encryption must be robust enough to resist quantum computing threats, ensuring both on-chain and off-chain security.

“Without FHE, this concept fails. Here is why. Votes to be protected, not just on chain… encrypted in a way that is quantum proof. Otherwise, bad actor country decodes the votes and publishes wallets & who voted for whom. Chaos ensues,” Kusama explained.

Due to this, the Shiba Inu developer called on Trump to appoint a dedicated blockchain advisor to tackle these challenges. Such an appointment could bridge the gap between technology and public policy.

Notably, industry leaders like Cardano’s founder, Charles Hoskinson, have shown interest in collaborating with government policymakers to develop regulatory clarity and foster blockchain innovation.

If Trump follows through, this move would align with his growing engagement with crypto-focused figures. Recently, he appointed crypto advocates Elon Musk and Vivek Ramaswamy to lead DOGE and nominated Florida Congressman Matt Gaetz, a Bitcoin supporter, as Attorney General. Additionally, Robert F. Kennedy Jr., known for his pro-Bitcoin stance, is set to become the Secretary of Health and Human Services.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

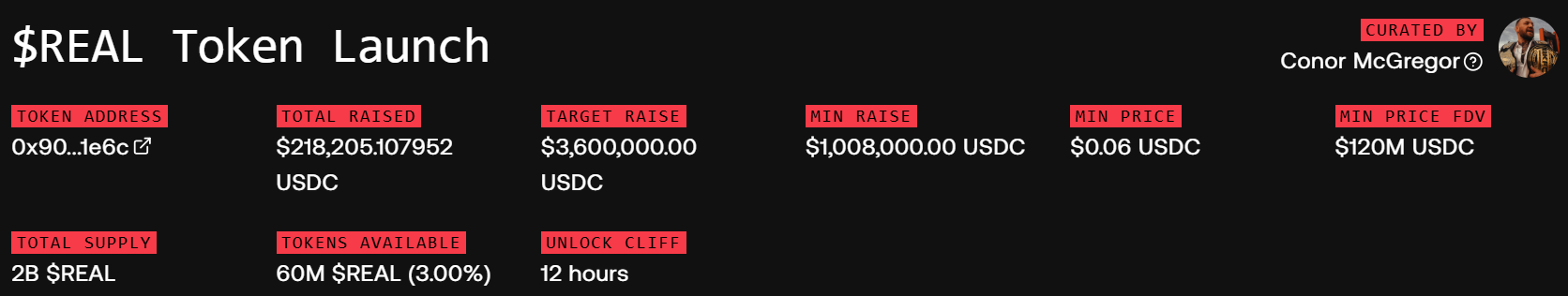

Conor McGregor’s Crypto Token REAL Tanks After Launch

Conor McGregor, the former UFC champion, has entered the crypto scene with the launch of a new memecoin dubbed REAL.

Despite the star power behind it, REAL is off to a sluggish start, struggling to attract investor interest in a memecoin market that is still reeling from recent scandals.

Conor McGregor’s REAL Token Raises Just $218,000

Announced on April 5, McGregor unveiled his plans to disrupt the digital asset space, claiming he had already changed the fight, whiskey, and stout industries.

“I changed the FIGHT game. I changed the WHISKEY game. I changed the STOUT game. Now it’s time to change the CRYPTO game. This is just the beginning. This is REAL,” McGregor announced on X.

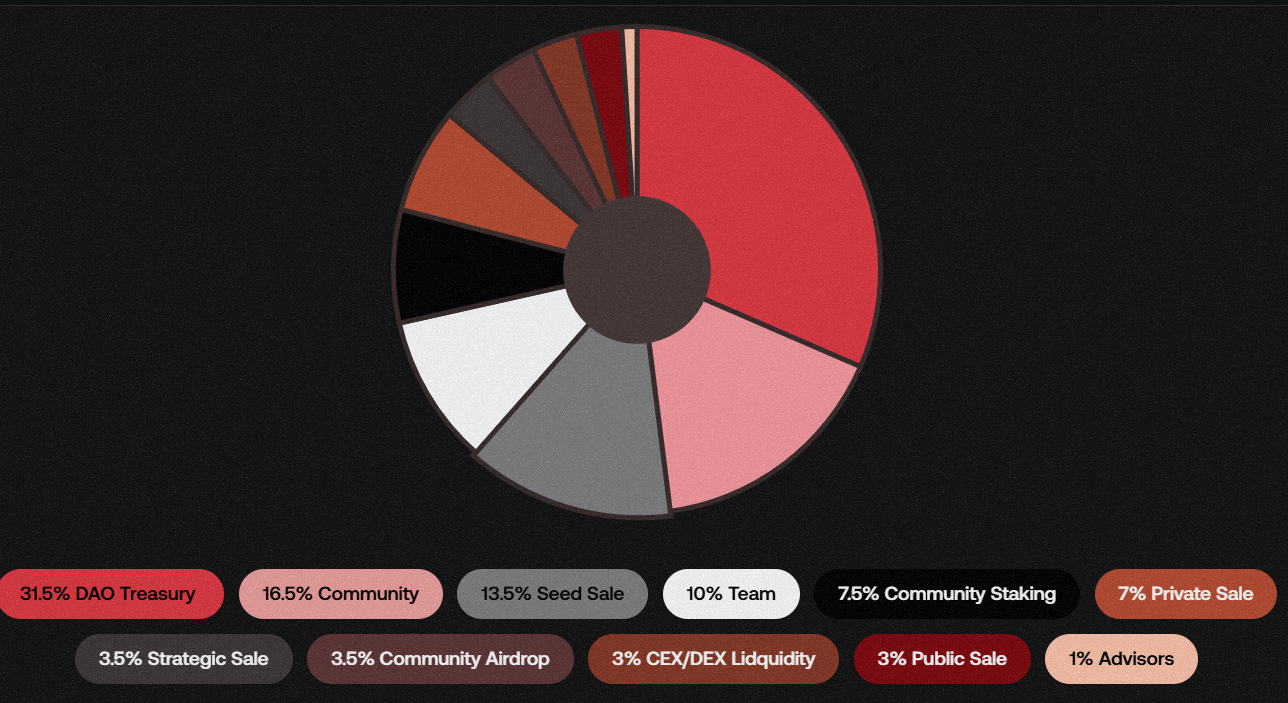

His latest move involves a partnership with Real World Gaming DAO to launch REAL. The token promises staking rewards and governance rights through a decentralized autonomous organization.

According to the project’s website, the team opted for a sealed-bid auction model to launch the token, aiming to prevent bot manipulation and create fairer pricing.

Under this system, participants submitted bids using USDC. Successful bidders would receive REAL tokens based on a clearing price, while those who didn’t meet the mark would be refunded.

“The auction will be open for 28 hours, after which a single clearing price will be determined. Tokens will be locked for 12 hours after auction close to facilitate a snipe-free deployment of on-chain liquidity. Proceeds from the auction will seed this pool and fund the DAO treasury,” the project added.

However, the community’s response to the project has been underwhelming. The team aimed to raise $3.6 million, with a minimum threshold of $1 million. As of press time, the auction has raised just $218,000, far below expectations.

Several issues appear to be fueling investor hesitation. Critics have called out the token’s short unlock window, warning that it creates ideal conditions for rapid sell-offs.

Others raised concerns about the project’s use of third-party logos on its site, hinting at misleading promotional tactics.

Moreover, community feedback about the project has also been overwhelmingly negative. Many users labeled the tokenomics as flawed and accused the team of focusing on short-term hype rather than sustainable value.

“If you’re buying REAL token, prepare to get dumped on. The tokenomics are absolute trash, and the unlock cliff is only 12 hours. You’re essentially giving your money away if you buy this token,” Crypto Rug Muncher wrote.

Meanwhile, the dismal launch reflects broader exhaustion in the meme coin sector, which has been rattled by recent scandals involving other celebrity-backed tokens.

Tokens tied to Donald Trump and Melania, for instance, have seen sharp declines that have caused investors significant losses.

“Celebrity coins like McGregor’s REAL and Trumps’ are toxic for crypto! Driven by hype, they lack utility, $Trump crashed 81%, $Melania 92%. These [tokens] hurt investors and crypto’s reputation. We need utility tokens for real value and growth,” Maragkos Petros, the founder of MetadudesX said on social media platform X.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

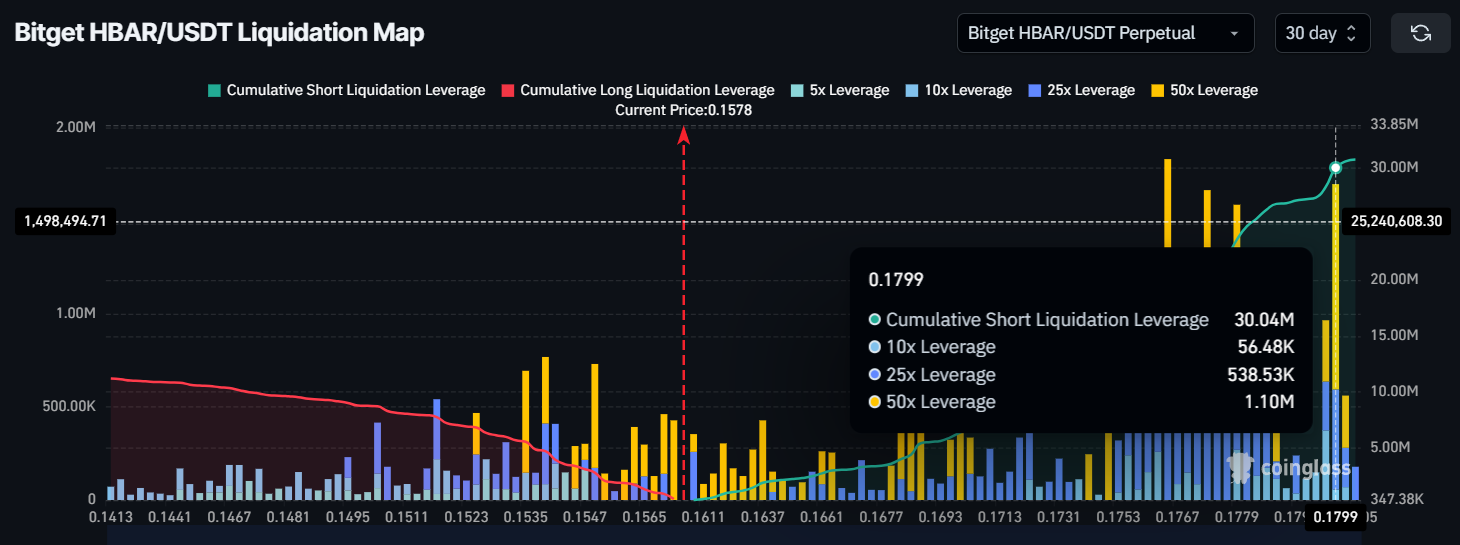

HBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

HBAR has recently experienced a significant price correction, pulling the altcoin to a critical support level. As the market conditions continue to show weakness, the price action has left HBAR vulnerable.

However, this downside movement might be offering short traders a chance to avoid heavy liquidation losses.

Hedera Traders Stand To Lose A Lot

The liquidation map indicates a situation of concern for short traders. Approximately $30 million worth of short contracts are poised for liquidation if the HBAR price rises to $0.18. This could cause massive losses for traders who are betting against the asset. However, the current price range near $0.157 has provided some relief as the market struggles to breach lower support levels.

If HBAR maintains its position above key levels, these traders may be spared the liquidation risk for now. Despite the challenging market conditions, this scenario actually provides a buffer for traders, helping them avoid significant losses.

The overall macro momentum for HBAR shows signs of potential downside pressure as the cryptocurrency approaches a Death Cross. The 200-day exponential moving average (EMA) is just over 3% away from crossing the 50-day EMA.

This technical formation, when confirmed, signals a possible continuation of the bearish trend and could push HBAR further down in the coming days.

The close proximity of these two EMAs has increased the chances of the Death Cross, which could result in further losses for HBAR holders. The market’s lack of substantial improvement and the growing uncertainty surrounding price action contribute to the likelihood of the Death Cross forming.

HBAR Price Holds Above Support

HBAR is currently trading at $0.157, holding just above the critical support level of $0.154. While it has managed to stay above this support for now, it remains vulnerable to falling through it if bearish sentiment intensifies. A break below $0.154 would likely trigger a deeper decline, with the next support level at $0.143.

If HBAR fails to hold the $0.154 support, a further drop could confirm the Death Cross formation. Should this scenario unfold, the price might continue downward toward $0.143, and further declines could follow, pushing HBAR toward $0.12 or lower.

On the other hand, if HBAR can bounce back from $0.154, a recovery rally is possible. Successfully flipping the $0.165 resistance into support could push the price toward $0.177. This movement would bring the liquidation scenario closer to reality, as short traders could face significant losses in a reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Reconsiders Howey Test Use in Crypto Oversight

The US Securities and Exchange Commission (SEC) is preparing to review several internal staff directives that influence how the regulator oversees the crypto industry.

This move aligns with President Donald Trump’s latest Executive Order on deregulation. It also follows guidance from the Department of Government Efficiency (DOGE), currently led by Elon Musk.

SEC to Review Howey Test and Investment Contract Framework Application

On April 5, Acting SEC Chair Mark Uyeda noted that the upcoming reviews could result in changes or full withdrawal of some statements. He emphasized that the agency’s objective is to ensure its guidance remains relevant and consistent with its current priorities.

“The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities,” the Commission stated.

One of the main targets of this reassessment is the SEC’s current framework for determining whether a digital asset qualifies as a security. This guideline relies heavily on the decades-old Howey Test.

It also reflects the views of former SEC official Bill Hinman, shared during a 2018 speech. Hinman argued that the degree of decentralization behind a token should matter more than how it was originally sold.

This view has influenced several enforcement decisions, including the legal battle with Ripple over XRP. However, many in the industry argue that the Howey Test is no longer suitable for modern blockchain technologies.

This development may pave the way for a dramatic shift in how crypto assets are evaluated. Crypto analyst Jesus Martinez believes that removing or revising the current framework could be a major turning point for retail investors in the US.

He argues that regulatory constraints have long blocked everyday users from participating in projects like launchpads and node operations. These platforms are often only accessible to those with foreign identification or institutional workarounds.

Martinez says that dismantling such outdated rules could help level the playing field for American investors.

“It’s been hurting retail for the longest time & we need to prioritize American citizens, this is a big step in that direction,” Martinez concluded.

Beyond the Howey-based framework, the SEC is also reviewing several other documents. One of these is a bulletin outlining regulatory concerns around mutual funds investing in Bitcoin futures.

The financial regulator is also reviewing a risk alert from the Division of Examination. This alert warns that digital assets pose unique investor risks, including regulatory uncertainty and cybersecurity threats.

Additionally, the Commission is reassessing whether state-chartered banks and trust companies can act as qualified custodians under the SEC’s Custody Rule.

The crypto community believes the SEC’s broad reassessment points to a shift toward a more modern and flexible regulatory approach. This shift could reshape the crypto landscape for both retail investors and institutional participants

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Market19 hours ago

Market19 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off

-

Market22 hours ago

Market22 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin21 hours ago

Bitcoin21 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Ethereum21 hours ago

Ethereum21 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market20 hours ago

Market20 hours agoSEC’s Guidance Raises Questions About Tether’s USDT

-

Market18 hours ago

Market18 hours agoKey Levels To Watch For Potential Breakout