Market

SEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

Since US President Donald Trump assumed office, the Securities and Exchange Commission (SEC) has dropped, settled, or paused lawsuits against prominent crypto entities left and right. In stark contrast to the previous administration’s leadership under Chair Gary Gensler, the SEC seems to be parting from its previous crackdown on digital assets.

In an interview with BeInCrypto, Nick Puckrin, Founder of The Coin Bureau, and Hank Huang, Chief Executive Officer at Kronos Research, highlighted the substantial election influence the crypto industry had over Trump’s candidacy as a contributing factor to the SEC’s looser stance on crypto.

The SEC’s Approach Under Trump

The SEC has experienced a clear shift in its approach to crypto lawsuits under Trump’s presidency. Its move away from the aggressive enforcement tactics of its previous leadership has largely characterized this shift.

“When President Donald Trump won the US election, the crypto industry rejoiced. Finally, the ‘regulation by enforcement’ era, which the SEC under the leadership of Gary Gensler was so famous for, was about to come to an end. And the new administration didn’t disappoint. Within just a couple of weeks of Trump’s inauguration, the revamped SEC started dropping lawsuits against crypto firms left, right and center,” Puckrin said.

Two weeks ago, the SEC officially dropped its appeal and XRP lawsuit against Ripple Labs, ending a five-year legal battle. The Commission had originally accused Ripple of conducting an unregistered securities offering worth $1.3 billion through XRP sales.

“After more than four years in limbo, the SEC has officially decided that XRP is not a security (though what it is instead remains to be seen). This case has been weighing heavily on XRP – the fourth largest cryptocurrency with a market cap of roughly $130 billion– so its resolution is a major win,” Puckrin added.

The wider crypto community celebrated the outcome, with many arguing that it will set a precedent for how digital assets are classified in the US. This prediction is warranted, given that the SEC has been on a lawsuit-dropping spree.

Ripple and Coinbase Cases Mark Significant Wins

Shortly before ending the Ripple lawsuit, the SEC dropped its legal battle against Coinbase. The case also centered on whether Coinbase should be classified as a security.

“The SEC is clearly retreating from its once-aggressive stance on crypto, as seen in its 2025 dismissal of lawsuits against Ripple, Coinbase, and others. This shift, driven by the crypto-friendly and pro-business Trump administration, signals a future of more streamlined and transparent US crypto regulation,” Huang told BeInCrypto.

The SEC has also dropped several ongoing investigations against OpenSea, Robinhood, Uniswap Labs, Kraken, and Gemini. It has also asked a federal court to issue a 60-day pause over its litigation against Binance. Meanwhile, the Commission settled its investigation into ConsenSys over its Ethereum software products.

These lawsuits surfaced in parallel to a series of crypto-friendly measures meant to foster greater innovation and curb potential regulatory suffocation that had existed during the Biden era.

Will New Leadership Define Clear Crypto Regulations?

A day after Trump assumed office, SEC Acting Chairman Mark Uyeda announced the creation of a dedicated crypto task force led by Commissioner Hester Peirce. The task force was reportedly designed to resolve long-standing ambiguities in the regulatory treatment of digital assets.

In all SEC crypto lawsuits, Commissioner Uyeda has implemented a strategy prioritizing industry engagement to develop regulatory frameworks that balance innovation and investor protection.

Meanwhile, Trump strategically nominated Paul Atkins, a crypto-curious, regulation-light candidate, to replace Gensler as head of the SEC. Just this week, the Senate Banking Committee voted to advance Atkins’ nomination to the full Senate.

“Driven by Republican principles, the SEC under Trump could implement clearer crypto guidelines by 2025, reduce regulatory burdens, and roll back Biden-era policies that have stifled innovation by 2027. This could mark the beginning of treating most digital assets as commodities,” Huang said.

Now, only a stone’s throw away from becoming SEC Chair, Atkins is expected to loosen regulatory oversight on crypto.

“With the establishment of a new Task Force and key appointees like Paul Atkins fostering innovation, Trump’s strategic move to create a Bitcoin reserve within the government further underscores his commitment to supporting the industry. The future of crypto regulations will be focused on less oversight and the beginning of a delicate but promising thaw in the regulatory landscape,” Huang added.

Though some say Trump’s handling of crypto affairs has resulted in a never-before-seen triumph, others are weary that his increasing involvement in the industry has turned out to be a recipe for disaster.

The Impact of Crypto Donations on Regulations

Several industry leaders went to great lengths to ensure that Trump became America’s 47th president. Millions of dollars in donations from crypto firms throughout Trump’s campaign illustrated these efforts.

According to a Public Citizen report, over $119 million from crypto corporations went into influencing the 2024 federal elections, largely through Fairshake, a non-partisan super PAC backing pro-crypto candidates and opposing skeptics.

Coinbase and Ripple, among others who stand to profit, directly provided over half of Fairshake’s funding. The remaining funds mostly came from billionaire crypto executives and venture capitalists. Notable contributions included $44 million from the founders of Andreessen Horowitz, $5 million from the Winklevoss twins, and $1 million from Coinbase CEO Brian Armstrong.

So far, big crypto’s spending strategy is paying off with a more favorable environment.

“Political donations from the crypto industry during the 2024 election, particularly to pro-crypto candidates like Trump, played a significant role in shaping the SEC’s 2025 decision to drop lawsuits against crypto firms. These contributions helped align the administration with the industry’s interests and influenced Congress, driving about 50-60% of the shift,” Huang told BeInCrypto.

Without a clear framework to guide the crypto industry following these dropped lawsuits, this lax approach risks being short-lived. Ultimately, this could tarnish long-term crypto adoption.

Meme Coin Scams Highlight Deregulation Dangers

According to Puckrin, the success of the dropped lawsuits was obscured by the lack of regulations that have led to the proliferation of high-profile meme coin scams.

“Somehow, all these victories feel somewhat hollow after the reputation of the crypto industry has been tarnished by the billions of dollars in combined losses from meme coin scams. Meanwhile, Hayden Davis, the mastermind behind LIBRA, continues to launch fraudulent meme tokens, despite being on the Interpol wanted list,” he said.

A 2024 report by Web3 intelligence platform Merkle Science revealed that meme coin rug pulls cost investors over $500 million. The February LIBRA incident showed how this trend was carried over to 2025. Nansen data revealed that 86% of investors lost $251 million, while insiders pocketed $180 million in profits.

Though crypto scammers may be charged with related crimes like wire fraud or money laundering, rug pulling is legal. Better said, it’s unaccounted for. No regulation holds crypto insiders responsible for meme coin scams.

“As crypto becomes an ever more mainstream asset class, consumers need to be protected against those who choose to use it for nefarious purposes. One way to do this is through education, and that’s our job as an industry. But deterring scams and extractive behavior is the job of the regulators. And it’s time they stepped up to the task,” Puckrin told BeInCrypto.

If the SEC doesn’t take advantage of this opportunity to curb the consequences that meme coin scams can produce, it will result in an enormous setback for the industry.

Comprehensive Regulation Beyond Dropped Lawsuits

Puckrin illustrated the need for heightened regulatory clarity in crypto by drawing attention to the way the SEC penalizes insider trading in the context of traditional investing.

“In traditional investing, insider trading is a serious crime. In the US, it’s punishable by fines of up to $5 million for individuals and prison sentences up to 20 years. Similarly, federal penalties for engaging with illegal gambling activities include up to five years in prison. Perpetrators of memecoin scams must be punished with the same level of severity, because the result is the same: manipulating markets and cheating unsuspecting investors out of their savings,” he said.

Puckrin clarified, however, that the issue isn’t solely about penalizing fraudsters. Just as the SEC’s past overregulation hindered the industry, the current lack of meme coin rules creates an environment where new scams and exploitative schemes can easily flourish.

“Yes, the removal of lawsuits is great news for blockchain innovation, but something needs to replace it. Indeed, serious cryptocurrency firms have never advocated for an unregulated Wild West. What they want is clarity and rules that are fit for the nascent blockchain industry – not just a copy-and-paste of existing financial regulations that simply don’t work for crypto,” he said.

Although the Trump administration has only been in place for four months, the clock is ticking, and meaningful change takes time.

Unanswered Questions Loom

Puckrin expressed concern over the current administration’s prioritization of lawsuit dismissals instead of working faster to implement transcendental crypto regulation.

“My concern is that regulators will keep kicking the can down the road with crypto regulation, having gained the approval of the industry for dropping the many lawsuits that were stifling its growth. And this is incredibly dangerous,” he told BeInCrypto.

Meanwhile, critical questions that only the SEC can define remain unanswered.

“What are memecoins and who will ensure another LIBRA fiasco doesn’t happen? Are utility altcoins now commodities and if so, will the Commodities Futures Trading Commission (CFTC) regulate them? And, importantly, what do we do about compensating investors who have lost billions to crypto fraud?” Puckrin concluded.

The SEC’s current direction promises a regulated renaissance or a breeding ground for future crises.

With billions lost and critical questions unanswered, the future of crypto hinges on whether the regulatory body will translate its recent shift into a lasting framework that fosters innovation without sacrificing investor protection.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Rallies After Trump’s 90-Day Pause on Tariffs

Donald Trump announced today that he’s instituting a 90-day pause on all tariffs except those on China. Bitcoin has surged over $80,000, while altcoins like XRP, Solana, and Cardano surged more than 10% in just minutes of the announcement.

The Dow Jones and stock market reacted similarly, surging by 2,000 points after the news. The US President has now added a total of 125% tariff on China, while pausing others.

Trump Reverses Tariff Plan

Since Donald Trump has made huge tariffs a cornerstone of his financial policy, the markets have reacted with a huge amount of uncertainty. After imposing 104% tariffs against China last night, however, Trump has made a shocking reversal. Although the tariffs against China will still stand, he is repealing those on all other nations.

This news immediately caused a substantial rally in the markets. The Dow Jones responded at 1:30 PM Eastern Time by shooting upwards over 2000 points, and this was mirrored in other high-profile stocks. The markets have been desperate for a form of relief, and it looks like it’s here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Futures To Launch LDUSDT Reward-Bearing Margin Asset

Binance Futures is launching LDUSDT, a reward-bearing margin asset based on Tether’s popular stablecoin. This product will focus on offering flexibility to the user, who can trade LDUSDT while reaping APR rewards.

This is the second product of this nature that Binance Futures has offered following its BFUSD launch last November. LDUSDT is scheduled to launch this month, and its success may encourage similar margin offerings in the future.

Binance Futures To Launch LDUSDT

Binance, the world’s largest crypto exchange, continues to expand its product offerings. It dominates crypto trading and the vast majority of staking rewards, but it also offers several margin assets.

Binance Futures added another such asset today: LDUSDT, a reward-bearing margin asset that lets users earn APR rewards from Simple Earn USDT Flexible Products.

“After the launch of our first reward-bearing margin asset BFUSD was positively received by users, we are pleased to introduce yet another product to bring more utility to our users. LDUSDT increases capital efficiency for users and lets users put their assets to work for them,” Jeff Li, VP of Product at Binance, said in an exclusive press release shared with BeInCrypto.

Binance’s new asset is based on Tether’s USDT, the world’s leading stablecoin, but LDUSDT is a totally different asset. Its main focus is on giving Binance users more flexibility, as they can trade this asset while continuing to reap passive income from APR.

This option is available to all users that have USDT on Binance Earn’s Simple Earn Flexible Products. LDUSDT is Binance’s second reward-bearing non-stablecoin margin asset, following BFUSD, which was launched last November.

Although the firm recently delisted USDT from its European operations due to regulatory concerns, this product is centered around the popular stablecoin.

According to the announcement, the exchange will launch LDUSDT “soon” without a specific release date. The exclusive press release claimed that the asset will be released sometime this April.

The company did not indicate whether it would offer more margin assets like this in the future. However, LDUSDT gives Binance Futures’ users a huge level of flexibility, which will hopefully encourage users to experiment.

A success here could encourage the firm to follow this up with similar products in the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s Why Ethereum Price Below $1,500 is an Opportunity

Ethereum has experienced a significant downtrend since the start of the year, causing the altcoin to fall below the $1,500 level.

While this recent decline may seem concerning to some, many investors view this as an opportunity. The low price is tempting new entrants and fueling optimism for a potential recovery.

Ethereum Investors Find Opportunity

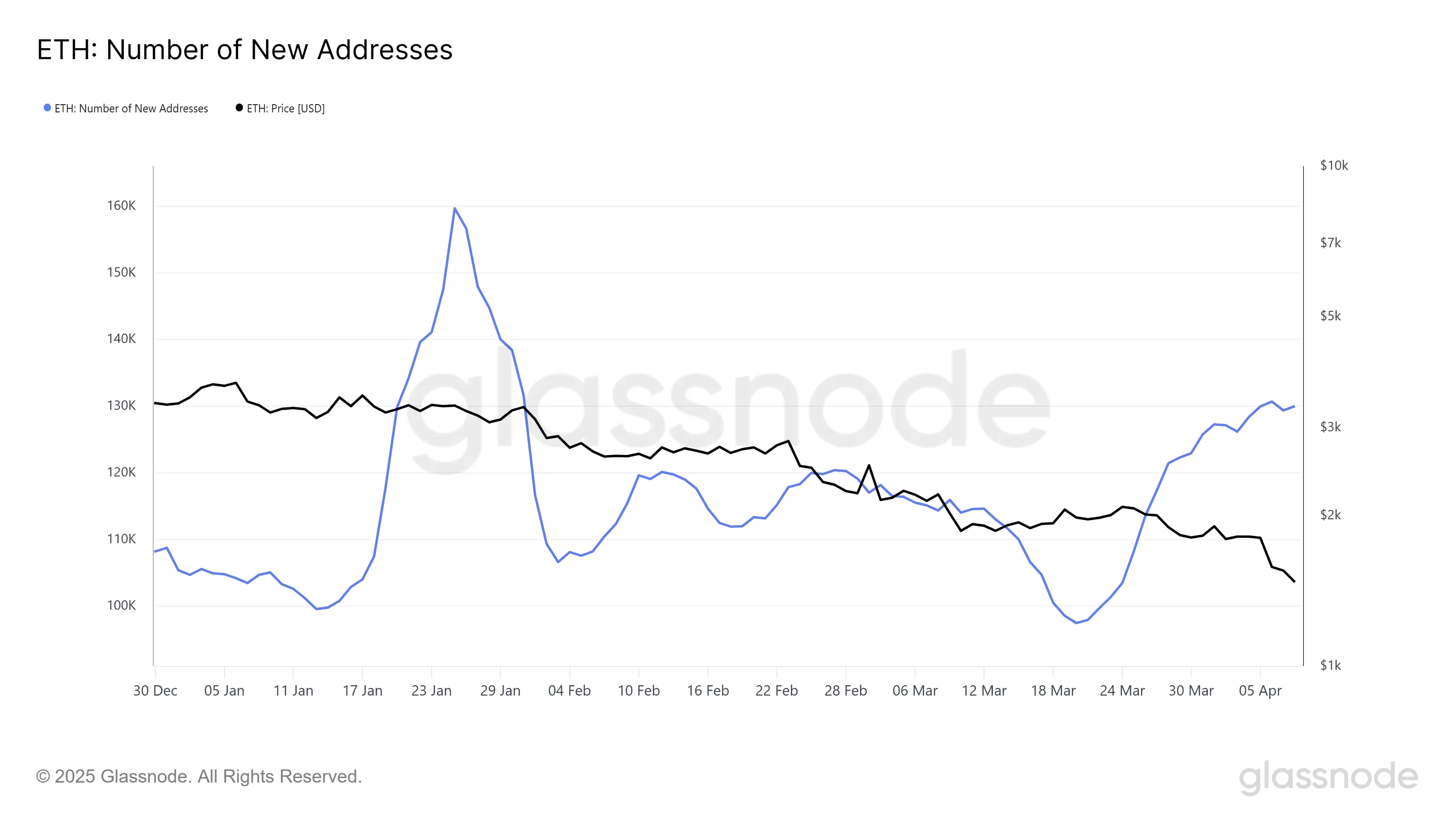

Ethereum’s price dip below $1,500 has resulted in a surge of new addresses, reaching a two-month high. This uptick in new investors suggests growing confidence in Ethereum’s future, especially at these lower price levels. The recent price decline has made Ethereum more accessible, which may be encouraging fresh investment.

The increase in new addresses also indicates that investors are positioning themselves for a potential rebound. With prices currently lower than earlier in the year, some see this as a buying opportunity.

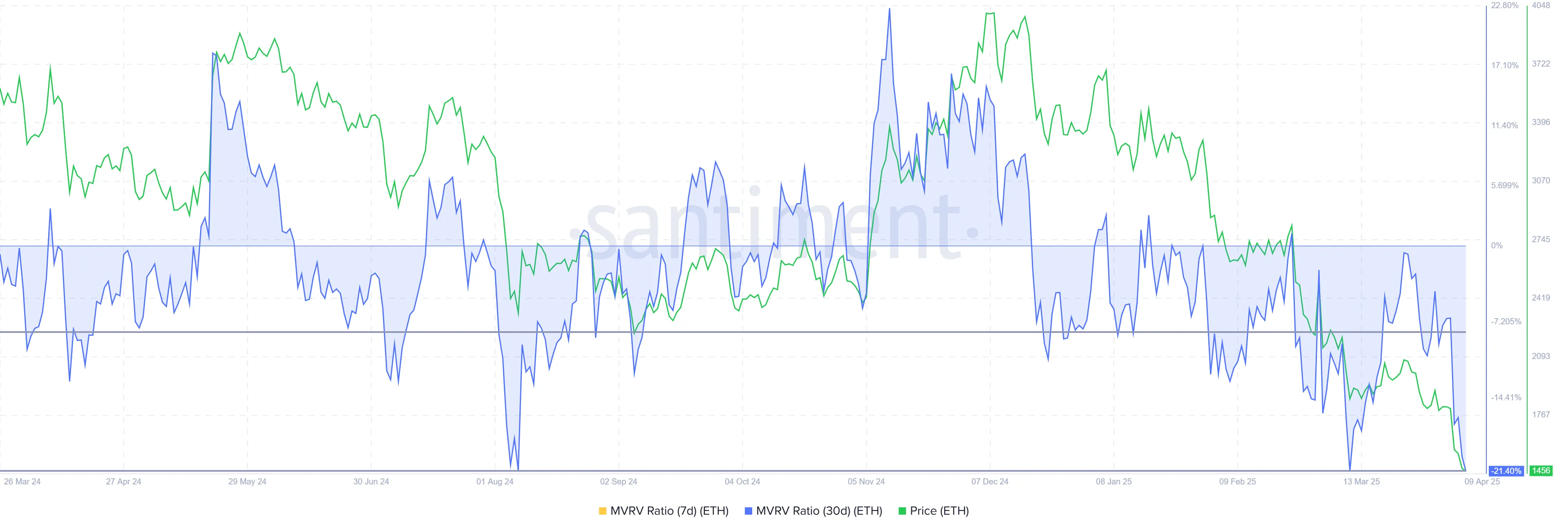

The MVRV Ratio, which measures the market value relative to the realized value, is currently in the “opportunity zone,” ranging from -8% to -21%. This range signals that Ethereum is undervalued, as prices have dipped to levels where investors typically step in. Historically, such conditions have led to reversals in price trends.

This low MVRV ratio reinforces the belief that Ethereum is in a prime accumulation phase. When the MVRV Ratio is in this zone, it indicates that investors who purchase during this period are likely to see positive returns in the future.

ETH Price Aims To Recover

Ethereum’s price has dropped by nearly 19% over the last 48 hours, reaching a yearly low of $1,375. As of writing, the altcoin is trading at $1,467. It has lost the crucial support of $1,533, which pushed it below $1,500. Despite the losses, Ethereum is likely to recover, given its resilient historical performance and renewed investor interest.

If Ethereum manages to reclaim the $1,533 support level, it could pave the way for a recovery towards $1,745. A break above $1,745 would confirm the reversal, ending the 4-month-long downtrend.

However, if the bearish trend continues, Ethereum could fall further, testing support levels below $1,429. Should it break through $1,375, the bearish thesis would be validated, and the altcoin could experience a prolonged period of decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoIs Ethereum Falling to $1,000 This April?

-

Market20 hours ago

Market20 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Market19 hours ago

Market19 hours agoCardano (ADA) Surges 8% as Bulls Push for Breakout

-

Market18 hours ago

Market18 hours agoCrypto Stocks Suffer As Trump Confirms 104% Tariffs on China

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Network Performance Tumbles As Total Transaction Fees Drops To New Lows

-

Market21 hours ago

Market21 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Altcoin20 hours ago

Altcoin20 hours agoWhy Is XRP Price Falling After ETF Hype?

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Makes Important Move in Ripple Case, Here’s All