Market

SEC Delays Approval of Ethereum ETF Options Until November

On September 23, 2024, the US Securities and Exchange Commission (SEC) published two separate notices announcing the extension of its review periods for multiple Ethereum ETFs.

BlackRock’s iShares Ethereum Trust (ETHA), Bitwise’s Ethereum ETF (ETHW), along with Grayscale’s Ethereum Trust (ETHE), and Ethereum Mini Trust (ETH) are among the funds awaiting the regulatory body’s approval for options trading.

These funds had initially faced a decision deadline of September 26 and 27, 2024, respectively. The SEC has now extended this deadline to November 10 and 11, 2024.

The decision to delay comes under Section 19(b)(2) of the Securities Exchange Act. This rule allows the SEC to extend its review period if additional time is needed to evaluate the implications of approving such financial products. In the case of BlackRock’s ETHA, the SEC explained that it required “sufficient time to consider the proposed rule change.”

Read more: An Introduction to Crypto Options Trading

BeInCrypto reported that BlackRock filed the proposal of options trading for its ETHA product via Nasdaq ISE in July 2024. In a similar filing by NYSE American LLC, Bitwise and Grayscale also sought approval for options trading on their Ethereum-based ETFs.

The SEC’s cautious approach to Ethereum ETFs comes on the heels of its approval of options trading for Bitcoin ETFs. Last week, BlackRock received approval for options trading on its iShares Bitcoin Trust (IBIT). However, the SEC’s green light came with strict limits to reduce market manipulation risks.

The proposals to introduce options trading for both spot Bitcoin and Ethereum ETFs exemplify significant interest from investors in these products. Options trading allows traders to speculate on an asset’s price movements or hedge against potential losses.

Read more: Ethereum ETF Explained: What It Is and How It Works

Options trading on spot ETFs will give investors more flexibility and risk management tools in a volatile market. Previously, Catherine Clay, Executive Vice President and Global Head of Derivatives at CBOE Global Markets, highlighted the utility of options trading in the crypto market.

“We believe that the utility of the options, what they provide to the end investor in terms of downside hedging, risk-defined exposures into Bitcoin, really would help the end investor and the ecosystem,” she explained.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

Market

This is Why The Federal Reserve Might Not Cutting Interest Rates

Several crypto-related social media accounts are circulating rumors that the Federal Reserve will cut interest rates soon. These center around an out-of-context quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis.

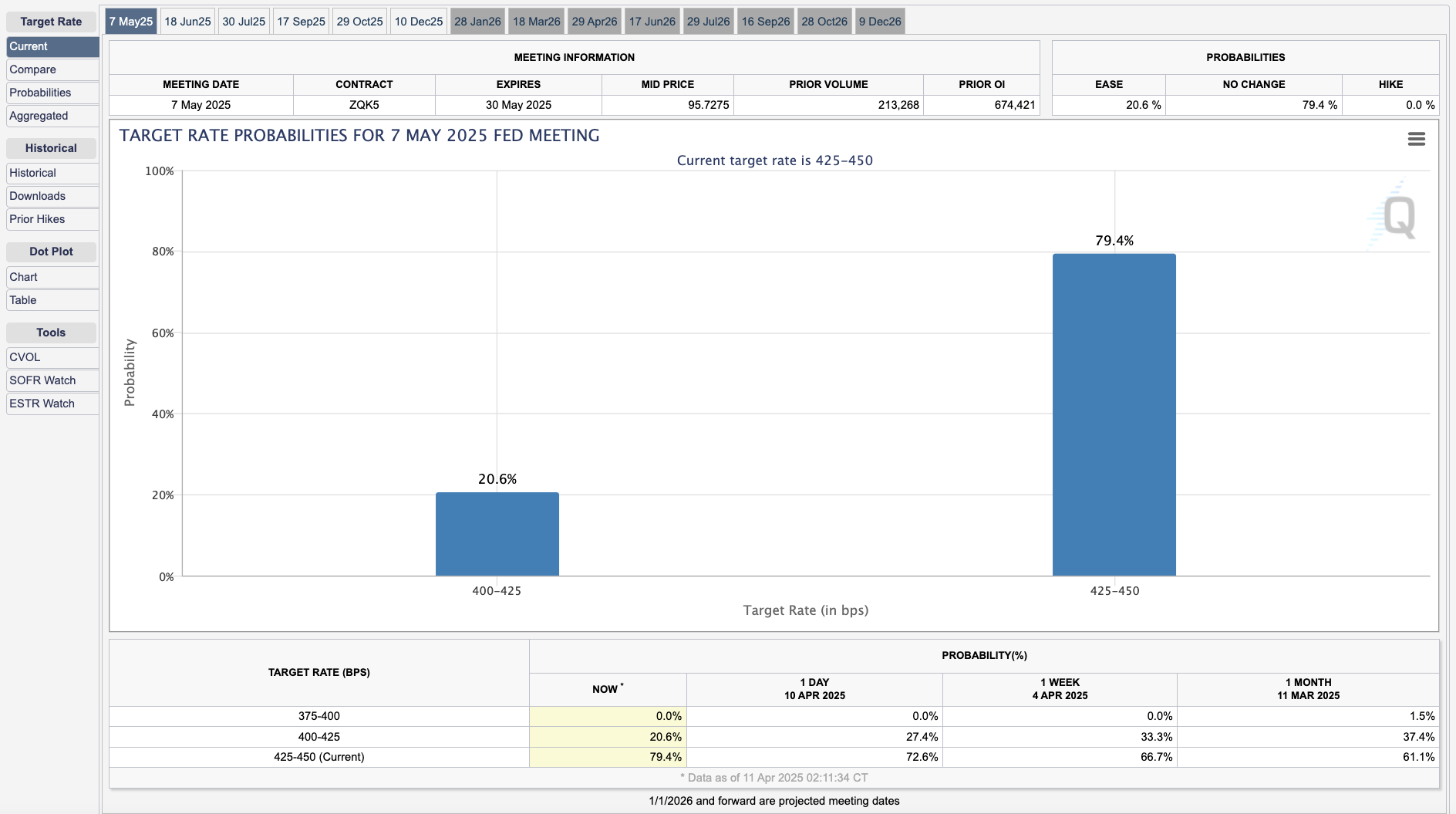

Susan Collins, President of another regional Fed bank, reiterated the low likelihood of any rate cuts. Currently, the CME Group estimates a 20.6% chance of them happening in the next month.

Federal Reserve Rate Cut Rumors Go Wild

As Trump’s tariffs have caused a huge amount of market instability, the crypto space has been desperate for a bullish narrative. A recurring hope has been that the Federal Reserve would cut interest rates, which seems highly unlikely.

Today, in a CNBC interview, a quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, fueled new rumors:

“There are tools there to provide more liquidity to the markets on an automatic basis that market participants can access, in addition to the swap lines you talked about for global financial institutions. Those tools are absolutely there,” Kashkari claimed.

Soon after this interview, several prominent crypto accounts began circulating pieces of this quote out of context. They implied that the Federal Reserve was on the brink of lowering interest rates to stave off potential economic turmoil.

Some of these erroneous claims managed to accumulate thousands of views and reposts on the idea that the Fed will “print money.”

However, in the full interview, Kashkari clearly stated what he meant by “tools.” He emphasized that the Fed is not concerned with global trade and that its “dual mandate” is to focus on inflation and employment within the US.

In other words, the tariff situation does not change the Federal Reserve’s low probability of cutting interest rates.

After these rumors began circulating, another higher-up discussed the Federal Reserve’s tools regarding interest rates.

In a subsequent interview with the Financial Times, Susan Collins, President of the Federal Reserve Bank of Boston, stated the Fed’s policy in very direct language:

“We have had to deploy quite quickly, various tools [to address the situation.] We would absolutely be prepared to do that as needed. The core interest rate tool we use for monetary policy is certainly not the only tool in the toolkit, and probably not the best way to address challenges of liquidity or market functioning,” Collins claimed.

Both Collins and Kashkari have roughly equivalent positions, heading one of the 12 Federal Reserve Banks distributed throughout the country. Both tried to clearly communicate that the Federal Reserve is not considering cutting interest rates at this time.

Despite this, social media rumors can quickly get out of hand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Lawmakers Propose the PROOF Act to Avoid Another FTX Incident

US Senators introduced the PROOF Act, which would require crypto exchanges to submit to monthly reserve audits and stop co-mingling consumer funds. These safeguards would help prevent another incident like the FTX collapse.

Two senators, Republican Thom Tillis and Democrat John Hickenlooper, introduced the bill. This joint effort represents a growing bipartisan consensus that pro-crypto regulation is a top priority.

How Will the PROOF Act Impact Crypto Exchanges?

Since President Trump’s election, the US government’s attitude towards crypto regulation has changed dramatically. Although many of these changes center around loosening restrictions on businesses, there is also a major concern for consumer protection.

To that end, the aforementioned Senators introduced the PROOF Act, a bill that would regulate crypto exchanges:

“The PROOF Act would establish regulatory standards on how digital asset institutions can hold customer assets, including a prohibition of the co-mingling of customer funds [and] require any institution that provides exchange or custodial services of digital assets to submit to a monthly Proof of Reserves inspection by a neutral third-party firm,” the text reads.

If passed, the bill would prohibit crypto exchanges from mixing customer assets with institutional or proprietary funds. The US Department of the Treasury would require monthly audits for exchanges and custodians. This would be then made publicly available.

Most importantly, the bill would require exchanges to use a cryptographic method such as Merkle trees or zero-knowledge proofs to prove they have sufficient assets to cover user balances.

All of these measures would, in theory, prevent any exchanges today from replicating the FTX collapse.

Also, the fact that this bill was proposed by a Republican and Democrat represents the growing effort for bipartisan crypto support, which has been instrumental in recent victories.

Although Hickenlooper has not been a vocal crypto advocate, Tillis recently praised SEC Chair Paul Atkins‘ new regulatory approach.

At this early stage, it’s difficult to assess the bill’s chances of passing, but this bipartisan support is a strong start. If the PROOF Act becomes law, it could significantly increase consumer protections on crypto exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market16 hours ago

Market16 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market18 hours ago

Market18 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Altcoin16 hours ago

Altcoin16 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market23 hours ago

Market23 hours agoControversy Follows Babylon’s BABY Token Launch and Airdrop

-

Market13 hours ago

Market13 hours agoHow Vitalik Buterin Plans to Enhance Ethereum’s Privacy

-

Market11 hours ago

Market11 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside