Market

Roaring Kitty’s Comeback Could Ignite a Dogecoin (DOGE) Rally

The financial markets witnessed a rally in meme stocks, marked by the re-emergence of Keith Gill, better known as Roaring Kitty, on social media.

Observers keenly anticipate this renewed interest for its potential to mirror effects on cryptocurrencies like Dogecoin (DOGE).

Dogecoin and the Return of the Meme Stock Mania

Roaring Kitty’s return saw GameStop and AMC stocks skyrocket by over 70%, reminiscent of the trading frenzy of 2021. This spark has reignited interest in meme coins, potentially signaling bullish outcomes for the $52 billion sector.

The connection between the resurgence of meme stocks and meme coins is based on historical market behavior. The monumental rise in meme tokens seen in 2021 was driven by a similar trading phenomenon. Back then, the increased trading activity in meme stocks led by Gill spilled over into the cryptocurrency market.

Dogecoin holders now hope for a strong upward trend similar to the 2021 bull rally.

“You remember what DOGE did in 2021 after the GameStop GME Squeeze?,” a Dogecoin aficionado said.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

Market analysts now observe Dogecoin’s trajectory as it approaches critical technical levels that could dictate its short-term movement.

For instance, the 20-day Exponential Moving Average (EMA) at $0.149 is a key level for investors to watch. Anchoring above this barrier could set the stage for a rally toward the 50-day Simple Moving Average (SMA) at $0.166. If the trend remains, the DOGE price could march toward $0.210.

However, falling to hold the crucial support at $0.149 will result in a price correction toward $0.120.

Investors must watch these levels closely because the excitement from 2021’s meme stock rallies can boost Dogecoin and other meme coins, possibly driving them to new highs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

No Rate Cut Soon, Crypto Banking Rules to Ease

Federal Reserve Chair Jerome Powell signaled on Tuesday that crypto banking regulations will be partially relaxed. He also made it seemingly clear that a near-term interest rate cut remains unlikely.

Speaking at the Economic Club of Chicago, Powell addressed mounting uncertainty stemming from trade policy and reinforced the central bank’s cautious stance.

Fed’s Powell Maitains a Hawkish Outlook

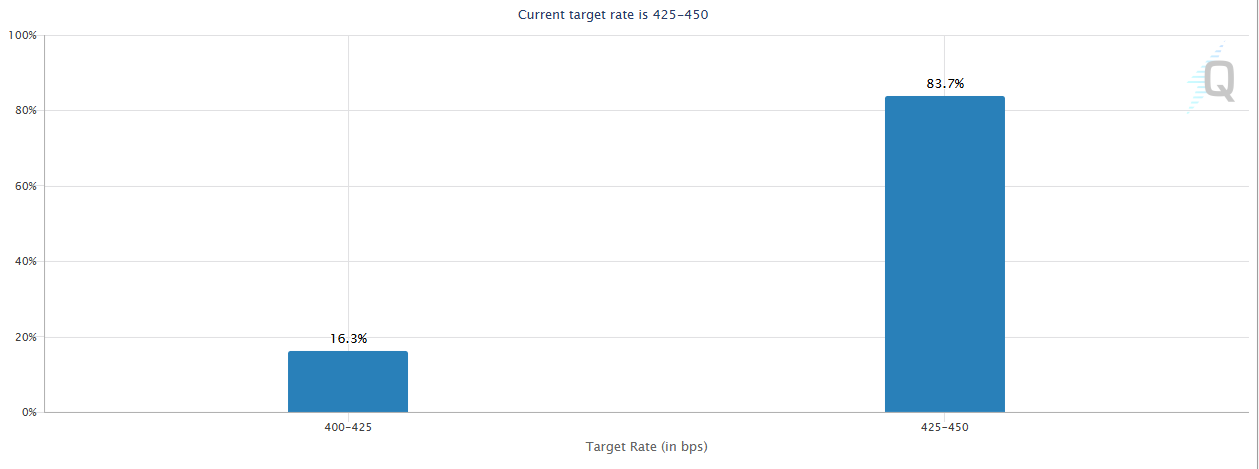

Powell’s remarks come as market expectations for a May rate cut have collapsed, with CME FedWatch data pricing in just a 16% chance. US equities dipped modestly following the speech. The equity market currently reflects investor disappointment over the lack of dovish signals.

“We should not rush to lower interest rates,” Powell said. “We have every reason to wait for more clarity before considering any changes to Fed policy.”

The crypto market, however, remained relatively steady. Rate cut optimism had already been priced out after last week’s hawkish FOMC minutes and cooler-than-expected CPI print.

Powell also offered direct comments on digital assets.

“Cryptocurrency is becoming more popular. A legal framework for stablecoins is a good idea.”

He added that the Federal Reserve supports relaxing certain banking regulations on crypto. The Feds agree that the sector is maturing and requires more defined oversight rather than constraint.

The dual message—no imminent policy easing but a positive outlook for crypto regulation—was met with a muted response across digital asset markets.

Bitcoin hovered near $84,500, showing resilience despite risk-off sentiment in equities. Powell acknowledged that economic growth had likely slowed at the start of 2025 and warned that Trump’s tariffs are a “key source of uncertainty.”

He also noted the Fed is not close to ending quantitative tightening and may need to make difficult policy choices if inflation resurges.

While the Fed reaffirmed its readiness to provide dollar liquidity to global central banks if needed, Powell dismissed the idea of a Fed “put.” He said the central bank’s independence is “a matter of law.”

For crypto markets, the regulatory tone was a silver lining in an otherwise hawkish macro environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Dips To $1.97 – A Golden Opportunity Before The Next Rally?

XRP recent surge appears to be entering a cooling phase as the price edges lower to the $1.97 level, an area acting as a pivotal support. After a strong upward move fueled by improved market sentiment, the current pullback signals a potential pause rather than a full reversal.

The $1.97 zone now stands as a critical support level, previously acting as resistance during XRP’s recent climb. If buyers step in with strength and volume begins to rise, this dip could prove to be a strategic entry point for those eyeing the next breakout.

Key Support Holds At $1.97 – Is XRP Building A Base?

XRP’s pullback to the $1.97 level has brought attention to the critical support zone that may serve as a foundation for the next leg up. Despite broader market fluctuations, price action has shown resilience around this area, with buyers stepping in to defend the level. Historically, $1.97 has acted as a pivotal point during previous rallies and corrections, increasing its significance as a potential accumulation zone.

The Moving Average Convergence Divergence (MACD) indicator is beginning to flash early signs of a potential bullish reversal for XRP. After the recent dip to $1.97, the MACD line is showing signs of converging toward the signal line, hinting that bearish momentum may be losing steam. This subtle shift often precedes a reversal and suggests that buyers are gradually regaining control.

Should the MACD complete a bullish crossover, where the MACD line crosses above the signal line, it will reinforce the argument for a rebound. When paired with XRP’s position above key support, such a signal could confirm that market sentiment is tilting in favor of the bulls. A strengthening MACD histogram, reflecting diminishing downside pressure, would further validate this shift and add weight to the case for an upward move in the coming sessions.

Bulls On Standby: What Needs To Happen For A Breakout

Several key conditions must be met before momentum shifts decisively in the bulls’ favor as XRP’s price action nears the $1.97 support zone. First, XRP needs to firmly establish $1.97 as a solid base, with multiple successful defenses of this level reinforcing buyer confidence. A rebound from this zone would signal underlying strength and provide the first step toward an upside breakout.

Secondly, volume needs to step in. A breakout without a noticeable increase in trading volume risks being a false move. Sustained buying pressure would confirm that market participants are positioned for a trend reversal. Additionally, a decisive break above nearby resistance levels such as $2.25 or higher would invalidate the current consolidation phase and open the door for further gains.

Lastly, indicators like the RSI and MACD must align with the bullish narrative. A rising RSI, without entering overbought territory, and a bullish MACD crossover would solidify the technical foundation for an upward move.

Market

XRP Slides Into Bearish Zone Amid Weak Trading Signals

XRP gained only 2% in the past week, signaling weak momentum and fading interest from buyers in the short term.Technical indicators like the RSI, Ichimoku Cloud, and EMA lines are all starting to reflect increased bearish pressure. Here’s a breakdown of what the charts are saying and what could come next for XRP.

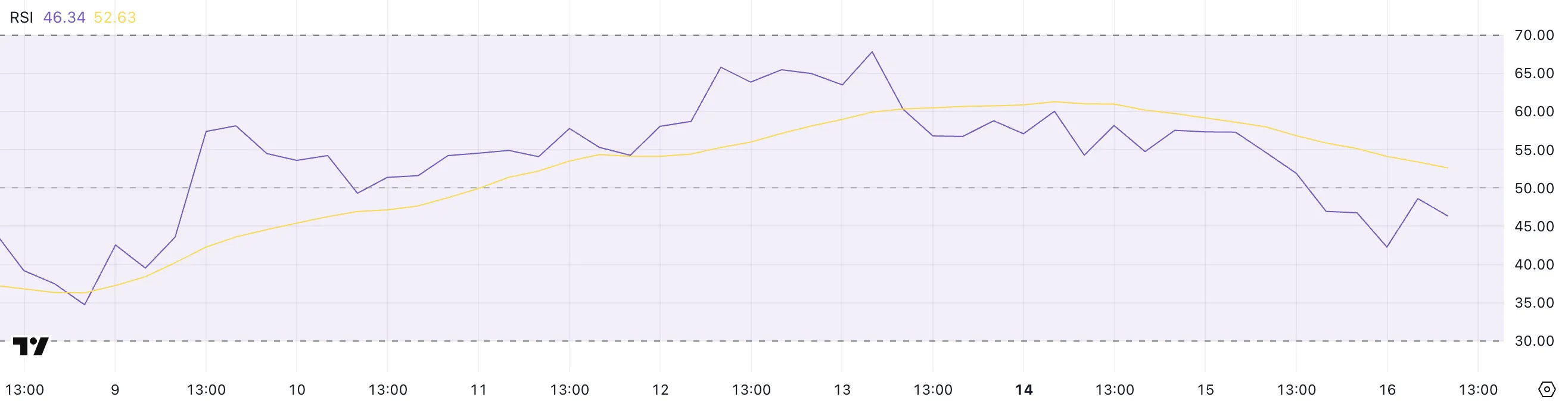

XRP RSI Shows Buyers Are Losing Control

XRP’s Relative Strength Index (RSI) has declined to 46.34, a noticeable drop from 57.30 just one day ago. This sharp move suggests a clear shift in momentum, with buying pressure cooling off significantly in the short term.

When the RSI drops this quickly, it can often indicate that traders are taking profits or beginning to rotate out of a position, especially after a period of modest gains.

While XRP hasn’t entered oversold territory yet, the drop below the 50 mark is typically viewed as a bearish signal, pointing to a potential shift in sentiment from bullish to neutral or bearish.

The RSI, or Relative Strength Index, is a widely used technical indicator that helps traders gauge the strength of a price trend. It ranges from 0 to 100, with readings above 70 considered overbought and readings below 30 considered oversold.

When the RSI is above 50, momentum is typically bullish, while levels below 50 reflect increasing bearishness. With XRP now sitting at 46.34, it suggests the asset is losing upward momentum and may be at risk of further downside unless buying interest returns soon.

If selling pressure continues and RSI trends lower, XRP could test key support levels in the near future.

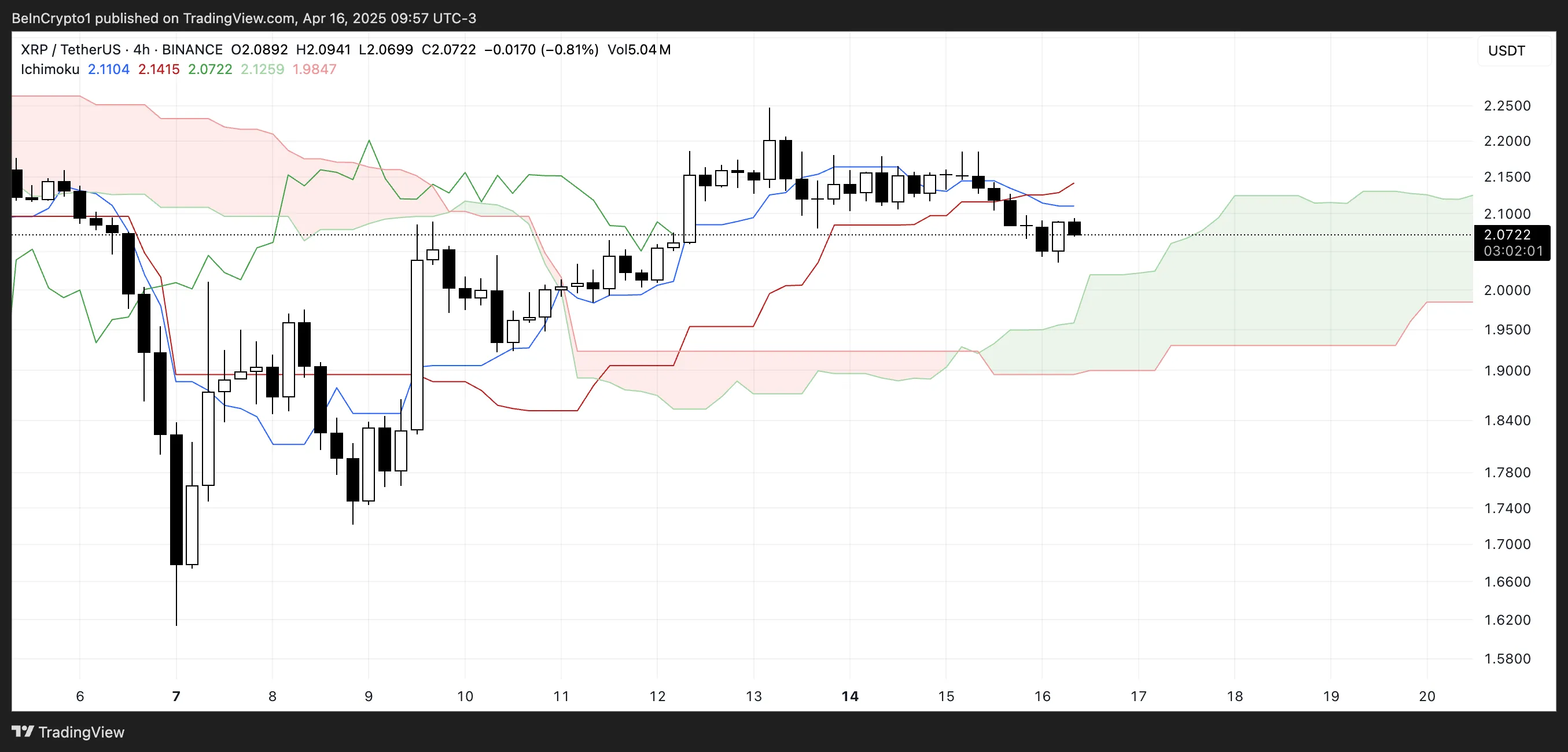

XRP Ichimoku Cloud Shows Momentum Is Shifting

XRP’s Ichimoku Cloud chart currently shows a shift toward short-term bearish momentum.

The price has fallen below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline), which is typically viewed as a bearish signal.

When the price trades beneath these two lines, it often suggests weakening momentum and increasing downside risk unless a quick recovery follows.

Additionally, the price is now entering the green cloud (Kumo), which represents a zone of uncertainty or consolidation. The cloud ahead is relatively flat and wide, indicating potential support but also a lack of strong upward momentum.

The green Senkou Span A (leading span A) remains above the red Senkou Span B (leading span B), signaling that the broader trend is still slightly bullish—but if price action stays inside or breaks below the cloud, that trend may begin to reverse.

Overall, the Ichimoku setup points to caution for bulls unless XRP reclaims the Tenkan and Kijun lines convincingly.

EMA Lines Suggest XRP Could Fall Below $2

XRP’s EMA lines are showing signs of weakness, with XRP price repeatedly failing to break through the resistance near $2.17—even amid speculation about a potential partnership with Swift.

This repeated rejection at the same level indicates strong selling pressure. The EMAs suggest momentum is fading as the shorter-term average is beginning to bend downward.

A potential death cross, where the short-term EMA crosses below the long-term EMA, appears to be forming. If confirmed, it could signal a deeper correction ahead, with XRP possibly retesting support levels at $2.02 and $1.96.

A breakdown below these levels could lead to a drop toward $1.61. However, if bulls manage to reclaim $2.17, the next resistance at $2.24 becomes the key target.

A clean break above that could trigger a stronger rally, potentially pushing XRP to $2.35 or even $2.50 if momentum accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin23 hours ago

Altcoin23 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market22 hours ago

Market22 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin21 hours ago

Bitcoin21 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Market19 hours ago

Market19 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market17 hours ago

Market17 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market21 hours ago

Market21 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?