Market

Redstone (RED) Shows Mixed Market Signals: Will It Hit $1?

Redstone (RED) has experienced a volatile week, climbing 25% over the past seven days despite pulling back 20% in the last three days.

This mixed performance reflects the current uncertainty surrounding RED’s price action. Technical indicators point to a market caught between consolidation and lingering bearish sentiment. While momentum indicators like RSI and ADX suggest weakening trend strength and growing indecision, price action continues to hold above key support levels.

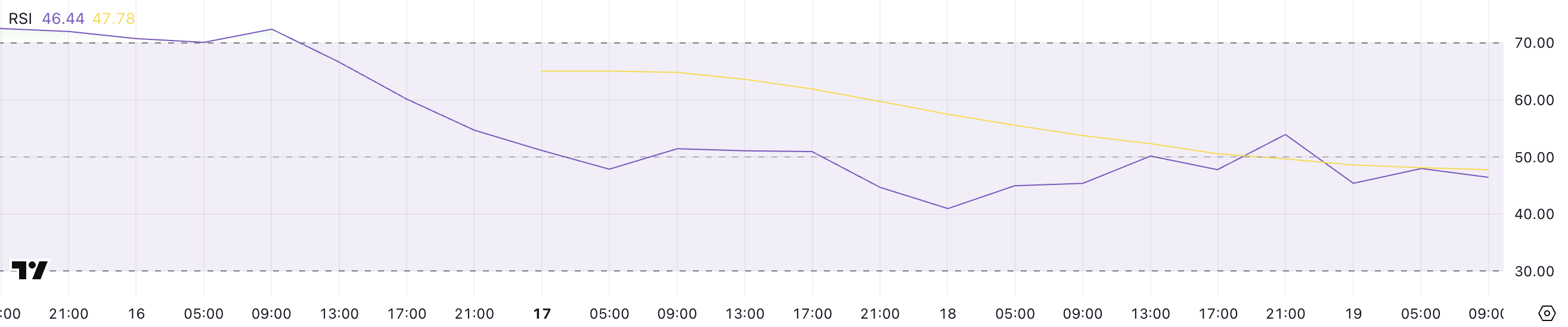

RED RSI Has Been Neutral For The Past Two Days

Redstone’s RSI (Relative Strength Index) has slipped to 46.44, down from 53.93 just a day ago. This recent decline suggests that bearish pressure has been increasing, pulling momentum away from the bulls.

For the past two days, RSI has been hovering around the 50 level, which typically signals indecision in the market, as neither buyers nor sellers have had clear control.

However, the move below 50 today signals that bearish momentum is starting to tilt the scales.

The RSI is a momentum oscillator that measures the speed and change of price movements. It typically ranges from 0 to 100. Values above 70 often indicate overbought conditions, while readings below 30 suggest oversold conditions.

The 50 mark acts as a midline that traders watch to gauge shifts in momentum—above 50 imply a bullish bias, while below 50 leans bearish.

Redstone’s RSI is now sitting at 46.44 after hovering near 50, which could mean the market is gradually tipping in favor of sellers as Redstone tries to establish itself as one of the most relevant leaders in the Oracle sector.

This shift may indicate further downside potential unless bulls regain control and push RSI back above 50 to reestablish bullish momentum.

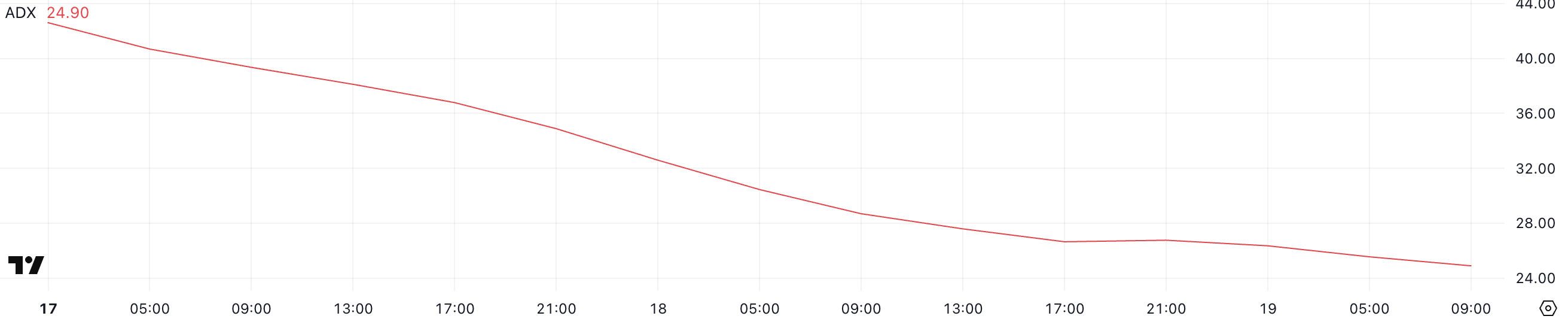

Redstone ADX Shows The Current Downtrend Is Fading Away

Redstone’s ADX (Average Directional Index) has dropped significantly to 24.9, down from 42.6 just two days ago. This sharp decline suggests a noticeable weakening in the strength of the current trend.

Previously, with ADX at 42.6, the market experienced strong directional movement, but the drop to the current level implies that the momentum behind that trend is fading.

Despite this, Redstone is still maintaining its position within a broader downtrend, indicating that bearish conditions have not yet reversed but may be losing steam.

The ADX is a technical indicator used to quantify the strength of a trend without indicating its direction. Typically, ADX values above 25 suggest a strong trend, while values below 20 often indicate a weak or non-trending market.

Readings between 20 and 25 are generally considered a gray area, where the trend might be losing conviction. With Redstone’s ADX now sitting at 24.9, it points to a market where the downtrend is still present but lacks the strong momentum it recently had.

This weakening trend could lead to potential price stabilization or even a short-term bounce, but as long as the downtrend structure remains intact, caution is warranted.

Will Redstone Rise Above $1 In The Next Days?

Redstone’s EMA (Exponential Moving Average) lines continue to suggest that the asset is in a consolidation phase. Its price action is moving sideways rather than trending strongly in either direction.

A key support level has been identified at $0.65, which is currently acting as a floor for price movement. If this support is tested and broken, Redstone could potentially fall further, with downside targets around $0.50.

Conversely, if the price starts to build bullish momentum, Redstone could attempt to break through resistance at $0.77. A successful breakout above this level could open the path toward $0.90 and $0.95, with the possibility of finally reclaiming the $1 mark for the first time since March 3, potentially making it one of the most trending altcoins in the market.

In Redstone’s case, the EMA lines reflecting sideways movement point to indecision among market participants. For now, the $0.65 support is pivotal – holding it could give bulls room to stage a rally while losing it could invite stronger selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase to Rival Binance With BNB Perpetual Futures

Coinbase International Exchange and Coinbase Advanced will introduce support for BNB perpetual futures starting next week.

This development marks a significant expansion of Coinbase’s derivatives offerings. The BNB-PERP market will launch on or after 9:30 AM UTC on April 3, 2025.

Coinbase Will Support BNB Perpetual Contracts

In an official statement, Coinbase International Exchange confirmed the move and revealed plans to add support for BNB perpetual futures starting next week.

“We will add support for BNB perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our BNB-PERP market will begin on or after 9:30 am UTC 3 APRIL 2025,” read the announcement.

Coinbase Traders, the official account for advanced trading on the platform, echoed the announcement in a post on X (Twitter). Introducing BNB perpetual futures on Coinbase’s international platforms presents new opportunities for traders.

For Coinbase users, this means access to perpetual futures contracts, a type of derivative that does not have an expiration date. It allows traders to hold positions indefinitely. The feature will be available on Coinbase International Exchange, catering to non-US users, and Coinbase Advanced, which is tailored for experienced traders.

This move strengthens Coinbase’s derivatives market and positions the exchange as a competitor to Binance, which already supports BNB futures. Expanding its futures offerings allows Coinbase to attract more traders looking for diversified investment opportunities.

For BNB users, the listing on a major global exchange like Coinbase International expands market reach and trading opportunities. This increased exposure could influence BNB’s market value due to heightened demand and trading volume.

Changpeng Zhao’s Reaction Sparks Criticism

For BNB, listing on a prominent exchange like Coinbase enhances its accessibility and credibility. This increased availability could boost adoption, though traders should remain cautious of speculative price movements and volatility surrounding the launch. Binance founder Changpeng Zhao (CZ) commented on the development.

“No one applied for this. Focus on building. Listing comes naturally. BNB,” CZ chimed.

His remark suggests the strength of the Binance ecosystem, rather than direct listing applications, drives BNB’s growth and adoption.

Market sentiment remains mixed, with some traders expressing optimism about BNB’s future. Meanwhile, others challenge Coinbase’s “natural listing” of BNB perpetual futures, questioning the transparency and fairness of the selection process.

“Listing comes naturally? Doors that open naturally are often already open for some and locked for others. If there’s no application, who decides who gets “naturally” listed? True decentralization isn’t about not knocking — it’s about removing the doorman,” one user remarked.

This critique aligns with broader blockchain debates on true decentralization, which is expected to reduce trust and control disparities, not create new gatekeepers.

Nevertheless, with perpetual futures, leverage opportunities become a key factor. BNB traders on Coinbase can control larger positions with less capital. Notably, while leverage can amplify potential gains, it also increases the risk of significant losses.

Meanwhile, BeInCrypto data shows BNB was trading for $628.40 as of this writing, down by almost 2% in the last 24 hours. The listing is also expected to increase liquidity and volatility for BNB, particularly around the launch date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Open Interest Surges 50%, Death Cross Could Fade Quickly

SUI has shown signs of recovery, and the crypto token’s price is trading at $2.65, which is just below the crucial resistance level of $2.77. This resistance stands as the last hurdle before the altcoin can reach the $3.00 mark.

Supported by improved market conditions and trader sentiment, SUI has been gaining momentum recently.

SUI Traders Are Optimistic

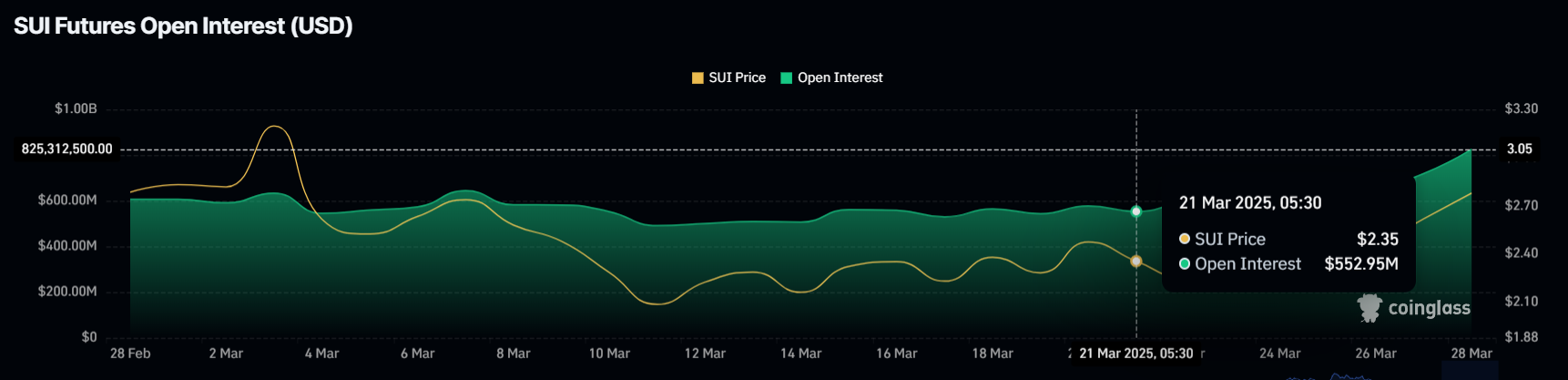

SUI’s Open Interest has surged by $273 million over the past week, increasing by 50%. The current Open Interest now stands at $825 million, signaling strong confidence. This rise in Open Interest indicates that more traders are actively participating in the market, and many are optimistic about the altcoin’s future prospects.

The positive funding rate also reinforces this sentiment, suggesting that long contracts dominate the market. With a majority of traders betting on upward movement, the market sentiment remains bullish for SUI.

Despite the recent formation of a Death Cross nine days ago, the macro momentum for SUI remains strong. A Death Cross, where the 50-day EMA crosses below the 200-day EMA, is typically a bearish signal, often indicating a potential price decline.

However, given the improving market conditions and strong investor support, the expected bearish decline may not materialize as strongly as it traditionally would. SUI’s price action suggests that the Death Cross may fade quickly, as it does not align with the current market environment.

SUI Price Is In For A Rise

SUI is currently trading at $2.65, just below the key resistance level of $2.77. Breaching this barrier could trigger a rally toward $3.00. If the altcoin successfully breaks above $2.77, it will likely continue its path toward $3.00, marking a strong recovery and potential for further growth.

Given the increasing market confidence and the positive Open Interest, SUI could aim to breach the next critical resistance at $3.18. Achieving this would help recover recent losses and potentially send SUI to new highs. A breakthrough $3.18 would indicate that the altcoin is poised for a significant rally.

However, if SUI fails to maintain its upward momentum and falls back to the support of $2.47, it could be vulnerable to further declines. A drop below $2.47 would likely strengthen the bearish implications of the Death Cross. This could potentially push the price down to $2.22 or lower, delaying recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market21 hours ago

Market21 hours agoHow the LIBRA Scandal is Undermining Milei’s Trust in Argentina

-

Market20 hours ago

Market20 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure

-

Market19 hours ago

Market19 hours agoWill Bitcoin Hit $90,000 in April? Analysts Weigh In

-

Market22 hours ago

Market22 hours ago4 Altcoins That Could Hit New All-Time Highs in April 2025

-

Market15 hours ago

Market15 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin15 hours ago

Altcoin15 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Altcoin21 hours ago

Altcoin21 hours agoBonk Inu Acquires Exchange Art Marketplace, BONK Price To Rally?

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Chair Nominee Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry