Market

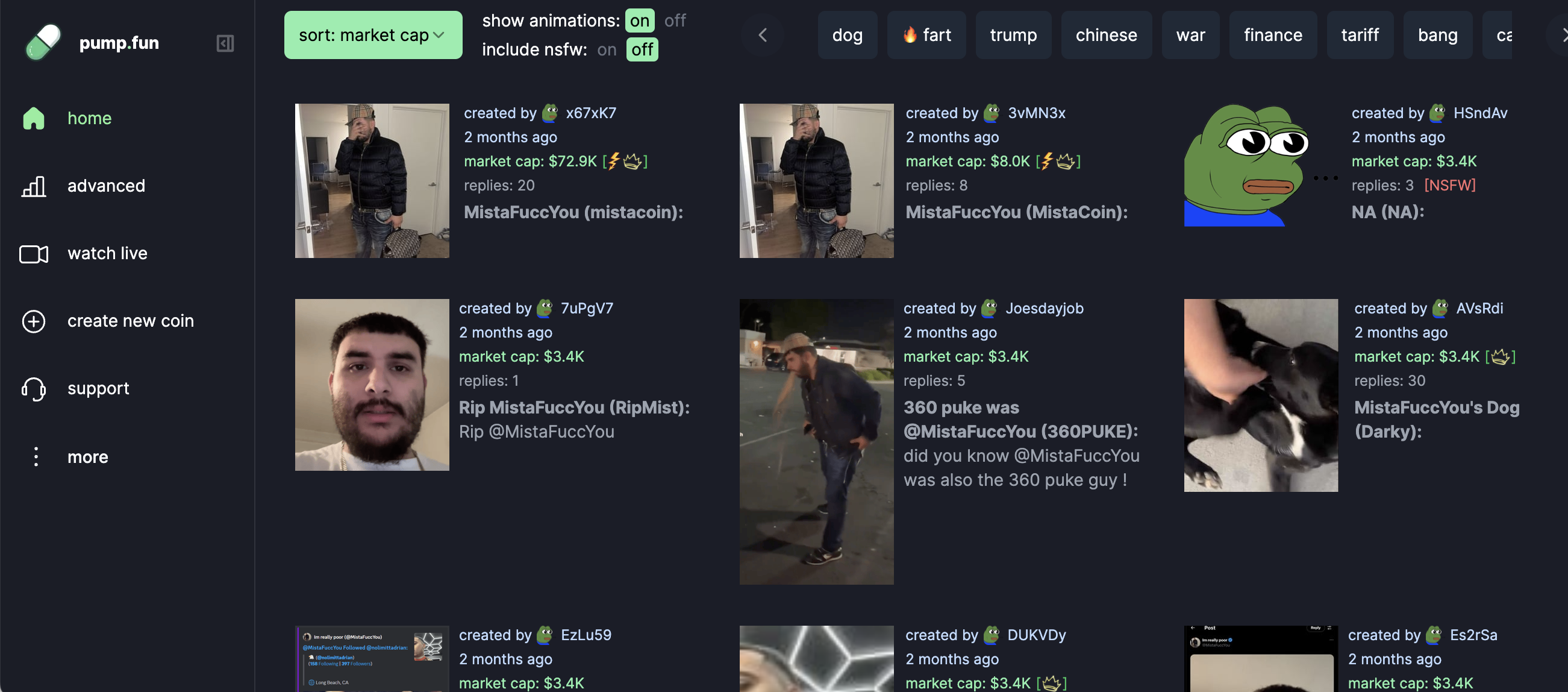

Pump.fun Reopens Livestreams with Strict Moderation

Pump.fun reopened its livestreams today for all users. The platform is now applying proactive guardrails and imposing strict rules around violence, criminal misconduct, and other actions.

Although streaming helped launch Pump.fun’s popularity, it quickly grew to a darker side. Streamers manipulated the market, threatened violence, and escalated to tragic outcomes.

Pump.fun Opens Livestreams Under New Rules

Pump.fun, the meme coin launchpad, has been at the center of a few controversies. Still, the platform enjoys broad popularity, and it’s officially trying to relaunch one of the things that first boosted its notoriety.

After several months of disabling them, Pump.fun is fully enabling livestreams for all the platform’s users:

“Pump.fun livestreaming has been rolled out to 100% of users with industry standard moderation systems in place and transparent guidelines. If you’re a creator and are looking for any support, feel free to message us,” the platform claimed in its official announcement.

Livestreams on Pump.fun might be the most controversial feature of the platform’s history. This function was initially created to help meme coin creators promote their tokens, but it soon faced intense backlash.

Token promoters would use live streams to sell complete scams and engage in market manipulation. However, these were far from the worst offenders.

As these Pump.fun live streams got out of hand, scammers engaged in dangerous and illegal stunts to achieve notoriety. Sexually explicit material and other unlawful activities were just a prelude to further escalation. The most egregious streamers demanded users buy their tokens or threatened violent actions.

These threats included animal abuse, self-harm, and suicide. Thankfully, no one carried through with the most extreme threats. Pump.fun closed down their livestreams last November after a user called “Beni” threatened one such false suicide stunt.

Reputation Hits Continue Despite Platform Closure

Unfortunately, ending the service didn’t stop further incidents. In February, after streaming had been closed, user “MistaFuccYou” livestreamed his genuine suicide on a different platform.

Before taking his life, he encouraged viewers to launch meme coins in his name. Dozens of these products soon went live on Pump.fun, further tarnishing its reputation.

This sordid incident attracted extensive mainstream coverage and may have kept Pump.fun’s livestream service closed even longer. Now, however, it’s ready to try again.

Earlier this week, it quietly rolled out the function to 5% of users, including strict new content guidelines. Today, it was relaunched with full functionality to 100% of the users.

Positively, the platform’s new livestream moderation rules are much stricter, with eight prohibited categories. These include violence, harassment, sexual content, and several types of illegal activity.

Users who violate the policy may have their livestreaming privileges revoked, accounts disabled, and content reported to law enforcement where applicable.

So far, this rollout has received a positive response from the community. Livestreams helped make Pump.fun famous, and it was a great disappointment that bad actors ruined it for everyone.

Hopefully, these new moderations can keep a fun and lighthearted environment, avoiding both “clean” pump and dump schemes and these darker criminal actions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Deploys Hashrate in OCEAN Bitcoin Mining Pool

Tether is deploying its existing and future hashrate on OCEAN, a decentralized Bitcoin mining protocol. It will focus on delivering high-performance operations to undeveloped areas, particularly in Africa.

Tether is showing increased commitment to keeping the Bitcoin ecosystem sustainable. This initiative also builds on the company’s previous investments in Africa.

Tether and OCEAN Team Up

Tether, the world’s leading stablecoin issuer, has been diversifying its interests lately. It’s preparing to make major internal changes, investing in a few different sectors, and considering a major stablecoin launch.

Today, Tether is working to advance decentralized mining infrastructure by deploying both its existing and future hashrate on OCEAN.

“As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity. Deploying hashrate to OCEAN aligns with both our mining investments and our broader mission to fortify Bitcoin against centralizing forces,” said Paolo Ardoino, CEO of Tether.

OCEAN is a decentralized Bitcoin mining pool, and despite the naming similarities, it’s not related to the popular AI token. It was founded by Bitcoin Core developer Luke Dashjr in response to centralization fears in BTC mining.

Tether’s hashrate will be able to help OCEAN in a few key ways. Critically, it highlights Tether’s commitment to the long-term viability of Bitcoin, as it is a major holder.

The company will deploy this hashrate through OCEAN’s DATUM Gateway service, which helps miners create high-performance operations in low-bandwidth areas.

Most notably, Tether will prioritize rolling out these services in rural and underdeveloped regions, particularly in Africa. This reflects Tether’s growing business commitments in the continent.

Tether obviously has self-interested reasons to deploy its hashrate on OCEAN, as it benefits from potential stablecoin users in new regions.

Moreover, the firm cast Bitcoin’s independence as a key motivator in itself. Tether is a major component of the global crypto economy, and it recognizes the importance of BTC beyond its desire to custody the asset.

In short, this operation gives a few insights into Tether’s plans for the future. By deploying hashrate on OCEAN, Tether is working to strengthen Bitcoin’s network and put more of the world on the blockchain.

Eventually, both of these aims can directly benefit the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MENAKI Leads Cat Themed Tokens

Meme coins have garnered investors’ interest today more than any other category of crypto assets. Leading the joke tokens was Maneki, who continued the momentum from the previous week.

BeInCrypto has analyzed two other meme coins for investors to watch and the direction in which they are taking.

Maneki (MANEKI)

- Launch Date – April 2024

- Total Circulating Supply – 8.85 Billion MANEKI

- Maximum Supply – 8.85 Billion MANEKI

- Fully Diluted Valuation (FDV) – $25.32 Million

MANEKI price surged by nearly 28% over the last 24 hours, reaching $0.0028. This significant rise marks a continuation of the altcoin’s rally from the previous week.

The meme coin is expected to maintain its upward trajectory, aiming to breach the $0.0036 barrier in the coming days. A successful breach could attract more investors, sparking inflows and potentially propelling the price even higher. This would enhance the altcoin’s visibility and fuel its growing popularity.

However, if MANEKI fails to hold its support at $0.0022, it could fall to $0.0017. A drop to this level would invalidate the bullish outlook and extend the recent losses, halting its upward momentum.

Keyboard Cat (KEYCAT)

- Launch Date – January 2024

- Total Circulating Supply – 10 Billion KEYCAT

- Maximum Supply – 10 Billion KEYCAT

- Fully Diluted Valuation (FDV) – $35.39 Million

KEYCAT’s price saw a modest 11% increase today, reaching $0.0035, continuing its rally from the previous week, which now totals 64%. Despite not performing as well as MANEKI, this consistent upward trend could attract investors’ attention.

The next resistance level for KEYCAT is at $0.0040, and to breach this level, the altcoin will likely need broader market support. If successful, this could propel the meme coin toward $0.0053, solidify the current bullish outlook, and fuel further price action, drawing in more investors.

However, if KEYCAT fails to break through $0.0040, it may drop to $0.0030, with further declines possible if this support is lost. Such a fall would invalidate the bullish thesis and signal a potential reversal in price.

Popcat (SOL) (POPCAT)

- Launch Date – December 2023

- Total Circulating Supply – 979.97 Million POPCAT

- Maximum Supply – 979.97 Million POPCAT

- Fully Diluted Valuation (FDV) – $262.19 Million

POPCAT saw an impressive 115% rise over the past week, positioning it as one of the best-performing tokens. However, despite this surge, the meme coin faced a slight decline in the last 24 hours. The volatility signals a possible shift, though the outlook remains generally positive.

While the recent decline has almost been recovered, POPCAT’s momentum seems to be waning. Currently holding above the $0.244 support, the coin looks poised to bounce back and potentially rise to $0.342. Continued support from the market could allow for a more sustained recovery in price.

However, if POPCAT fails to maintain support at $0.244, the price could fall to $0.205, significantly invalidating the bullish outlook. A break below this support would suggest further price erosion, reversing the recent gains and potentially setting the coin on a downward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

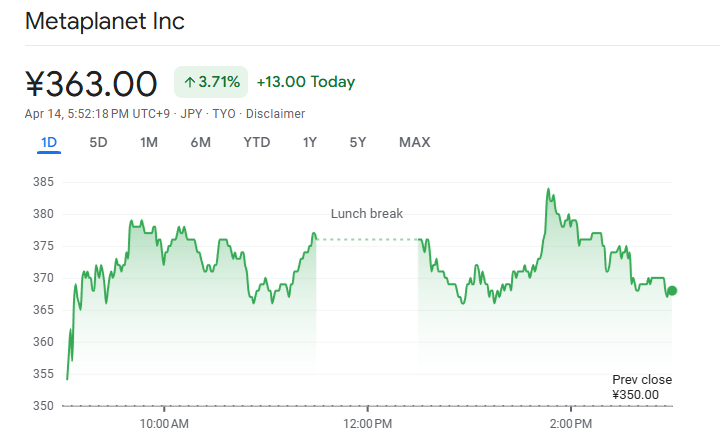

Strategy and Metaplanet Buy Bitcoin Despite Recession Fears

Despite recent chaos and fears of a recession, public companies Strategy and Metaplanet are doubling down on new Bitcoin purchases. Strategy purchased BTC worth $285 million, while Metaplanet spent $26.3 million.

Metaplanet’s activity is particularly noteworthy because Japan’s 30-year treasury yields are soaring. For public companies in Japan, conventional economic practice is to pull back from the dollar, but committing to Bitcoin is a bold strategy.

Strategy (formerly MicroStrategy) is one of the world’s largest Bitcoin holders, and it’s been going through a chaotic period. In recent weeks, it has alternated between massive BTC purchases and abrupt acquisition pauses, prompting a great deal of speculation.

Today, however, its Chair, Michael Saylor, announced a major new Bitcoin buy at $285 million:

“Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Strategy holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor claimed via social media.

A lot of this chaos is due to fears of a US recession, which has made the price of Bitcoin swing wildly. When Bitcoin was down, it prompted speculation that MicroStrategy may have to dump its assets.

However, since BTC has started to recover, Michael Saylor’s firm is back on the market.

Critically, Strategy isn’t alone in its Bitcoin acquisitions. Metaplanet is a Japanese firm with substantial BTC holdings and ambitions to acquire even more.

Two days before Strategy made its own major purchase, Metaplanet CEO Simon Gerovich announced a similar investment:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich claimed.

Metaplanet’s commitment here is particularly noteworthy because it contradicts near-term macroeconomic headwinds. The global market is filled with risk-averse behavior right now, and Japan’s 30-year bond yields surged to the highest level in over two decades.

Despite this clear signal, the Japanese Metaplanet is continuing to make major Bitcoin investments. The latest purchases also had a positive impact on the company’s stock market. It’s currently up by 3% today, after suffering notable losses the past month.

In short, major corporate Bitcoin holders like Strategy and Metaplanet aren’t interested in tapering off yet. Despite the recent chaos, there is serious confidence that BTC will either gain in price or represent a stable store of value.

Either way, when public firms like this publicly take a bullish stance, it can shore up confidence across the entire market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum Price Eyes Rally To $4,800 After Breaking Key Resistance

-

Market17 hours ago

Market17 hours agoMANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

-

Market11 hours ago

Market11 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Altcoin6 hours ago

Altcoin6 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin5 hours ago

Altcoin5 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market10 hours ago

Market10 hours agoBitcoin Price Rises Steadily—But Can the Rally Hold This Time??