Market

Polymarket Trader Activity Plummets 40% Due to CFTC Pressure

Polymarket is managing to hold its ground despite regulatory pressures on election-related prediction platforms.

The Commodities Futures Trading Commission (CFTC) recently introduced a proposed rule targeting prediction markets, which led to Kalshi becoming the latest platform affected. This uncertainty has begun to impact Polymarket, raising concerns about its future in the current regulatory environment.

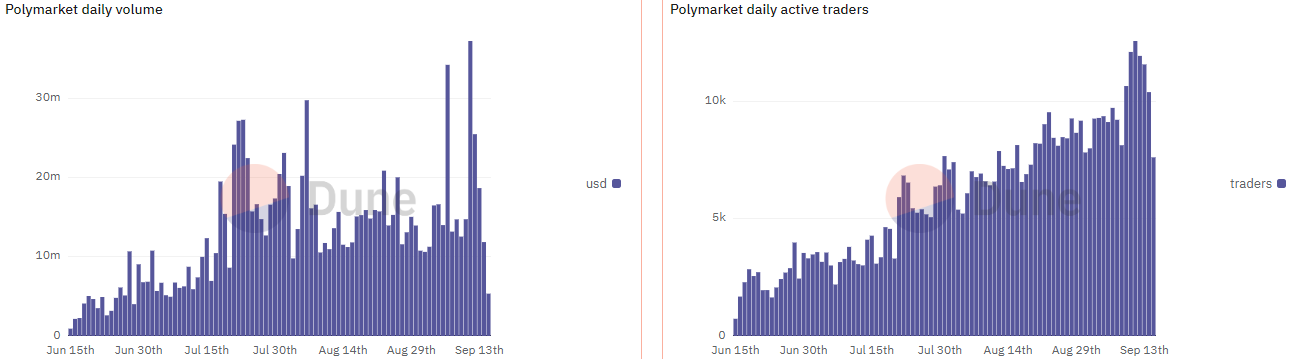

Polymarket Daily Active Traders Drop Nearly 40%

According to Dune, Polymarket has seen a significant drop in daily active traders, decreasing by 39.4% from 12,595 on Wednesday to 7,627 on Sunday. Similarly, daily trading volume plummeted 85.6%, falling from $37.2 million to $5.35 million over the same period.

The decline in activity mirrors the broader challenges facing election-related prediction platforms amid increased regulatory scrutiny. As reported by BeInCrypto, the Commodities Futures Trading Commission (CFTC) has proposed a rule to limit certain event contracts, particularly those tied to political events, contributing to the downturn in Polymarket’s metrics.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

According to the commodities regulator, event contracts like those offered by Polymarket carry risks associated with election-related gambling. Several crypto executives have resisted this attack, including Ethereum co-founder Vitalik Buterin, Gemini co-founders the Winklevoss twins and Coinbase CLO Paul Grewal.

However, the CFTC remains firm, as shown by its ongoing conflict with Kalshi, a US-based prediction market for event contracts. The CFTC argues that markets like Kalshi are vulnerable to manipulation, citing specific examples in its filings:

- Traders on Polymarket trying to manipulate contracts related to Kamala Harris’ potential victory in the 2024 US presidential election.

- A fabricated poll on PredictIt showed musician Kid Rock leading Senator Debbie Stabenow in a Senate race. Notably, this incident significantly affected the pricing of contracts for Stabenow’s reelection.

CFTC Wants Kalshi Prediction Market Blocked

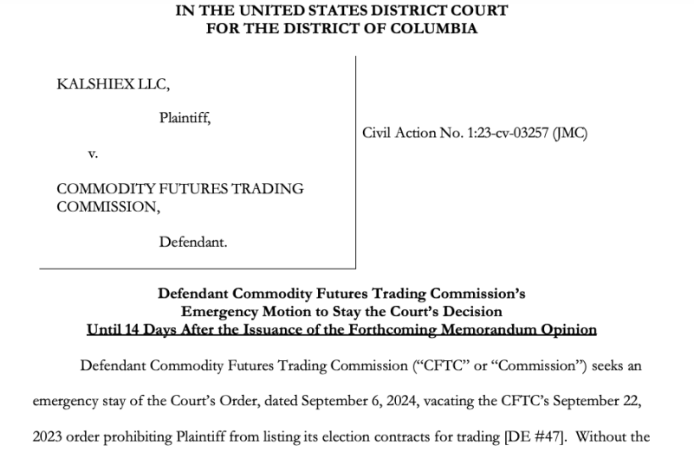

It is worth mentioning that this is not the first of Kalshi’s encounters with the CFTC. In November 2023, the platform filed a lawsuit against the regulator, challenging a decision to bar Kalshi from listing political event contracts on potential Congress chambers’ leaderships.

Fast-forward to September 6, District Court Judge Jia Cobb ruled in favor of Kalshi, partly allowing it to offer election-related betting.

“Kalshi just legalized trading on elections in the US. For the first time in 100 years, Americans will have access to legal election markets at scale. Historic moment for financial markets,” Kalshi’s founder, Tarek Mansour, shared on X.

However, the CFTC challenged this determination, filing an emergency motion for a 14-day stay on Kalshi’s election markets. The regulator also filed a notice to appeal the court’s decision, but Judge Cobb criticized the move, calling out the regulator for overstepping its authority by trying to shut down Kalshi’s election markets.

The regulator’s push to block Kalshi has made prediction market participants skeptical about Polymarket, with some saying it could be next. One user on X, however, advertising as an “iGaming regulation expert,” calls for a balance between innovation and democracy.

“It’s clear that the intersection of prediction markets and election integrity is a tightrope walk. The CFTC’s concerns highlight the need for rigorous oversight. But let’s ponder — can we strike a balance where innovation thrives without compromising democratic principles?” the user wrote.

Read more: How Can Blockchain Be Used for Voting in 2024?

Even as prediction markets face criticism from regulatory bodies, mainstream companies are interested in these event contracts. Recently, Bloomberg integrated Polymarket on its terminal. This suggests increasing recognition of the role of decentralized prediction platforms as the November elections approach.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Exchange Tokens to Keep An Eye For April 2025

Bitget (BGB), Cronos (CRO), and 1INCH are three of the top exchange tokens to watch in April 2025. BGB is down 4% this week after a massive rally in late 2024, while CRO has dropped nearly 10% amid broader market weakness tied to the tariff war.

1INCH has also fallen over 5%, impacted by Ethereum’s continued decline. Despite the pullbacks, each token has key catalysts ahead that could drive a reversal—or deepen the correction.

Bitget (BGB)

BGB token has drawn significant attention in recent months, rallying 434% between December 1 and December 27, 2024.

However, after reaching that peak, momentum began to cool, and the token is now down 12% over the last seven days. This pullback comes as traders reassess the token’s near-term potential following its explosive run.

Despite that correction, Bitget Token continues to be one of the biggest exchange tokens in the market, with a market cap of $4.8 billion.

In Q1 2025, Bitget burned 30 million BGB tokens, following a much larger 800 million burn in late 2024—cutting total supply by 40% in a move aimed at boosting long-term value through deflation. BGB has also expanded its utility, now supporting multi-chain gas fees and real-world payments, pushing its use cases beyond the Bitget ecosystem.

If the current correction reverses, Bitget Token could test resistance at $4.40, with a potential push to $4.69 if broken.

Conversely, if the selloff deepens, support around $3.72 could be tested, and a break below that would mark the token’s first drop beneath $3.70 since December 2024.

Cronos (CRO)

CRO, Crypto.com’s native token, is down nearly 22% over the past seven days, making it one of the worst performers among major exchange tokens this week.

The decline comes as broader crypto markets react sharply to the escalating tariff war, which has triggered a wave of risk-off sentiment across both traditional and digital assets.

Crypto.com had ambitious plans for 2025, including talk of a potential CRO ETF, but with market conditions deteriorating, the viability of these milestones remains uncertain.

Technically, Cronos’ EMA lines have formed two death crosses in recent days—a strong bearish signal. If the downtrend persists, CRO could fall to test support at $0.077, and if that level breaks, drop further to $0.073.

However, if market sentiment rebounds—especially if boosted by Crypto.com’s partnership with Trump Media—CRO could recover sharply, making it one of the most relevant exchange tokens in the market.

Key upside targets include $0.085, followed by $0.097, $0.108, and potentially $0.12 if bullish momentum strengthens.

1INCH

1INCH remains one of the most important DEX aggregators in the crypto space, even as it operates at a much smaller scale compared to rivals like Jupiter, which sees roughly five times more trading volume.

It also faces rising competition from newer players like CoWSwap, putting pressure on its dominance in the sector.

Despite its strong fundamentals and reputation, 1INCH has seen its token price drop more than 17% over the last seven days, bringing its market cap down to $221 million.

The ongoing downturn in the Ethereum ecosystem, with ETH now trading below $1,500 and at risk of dropping toward $1,000, has had a significant impact on aggregators like 1INCH.

If the correction deepens, 1INCH could test support near $0.148.

However, a rebound in Ethereum activity could quickly reverse the trend, potentially pushing 1INCH to retest resistance at $0.177 and, if broken, rally toward $0.198 and even $0.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

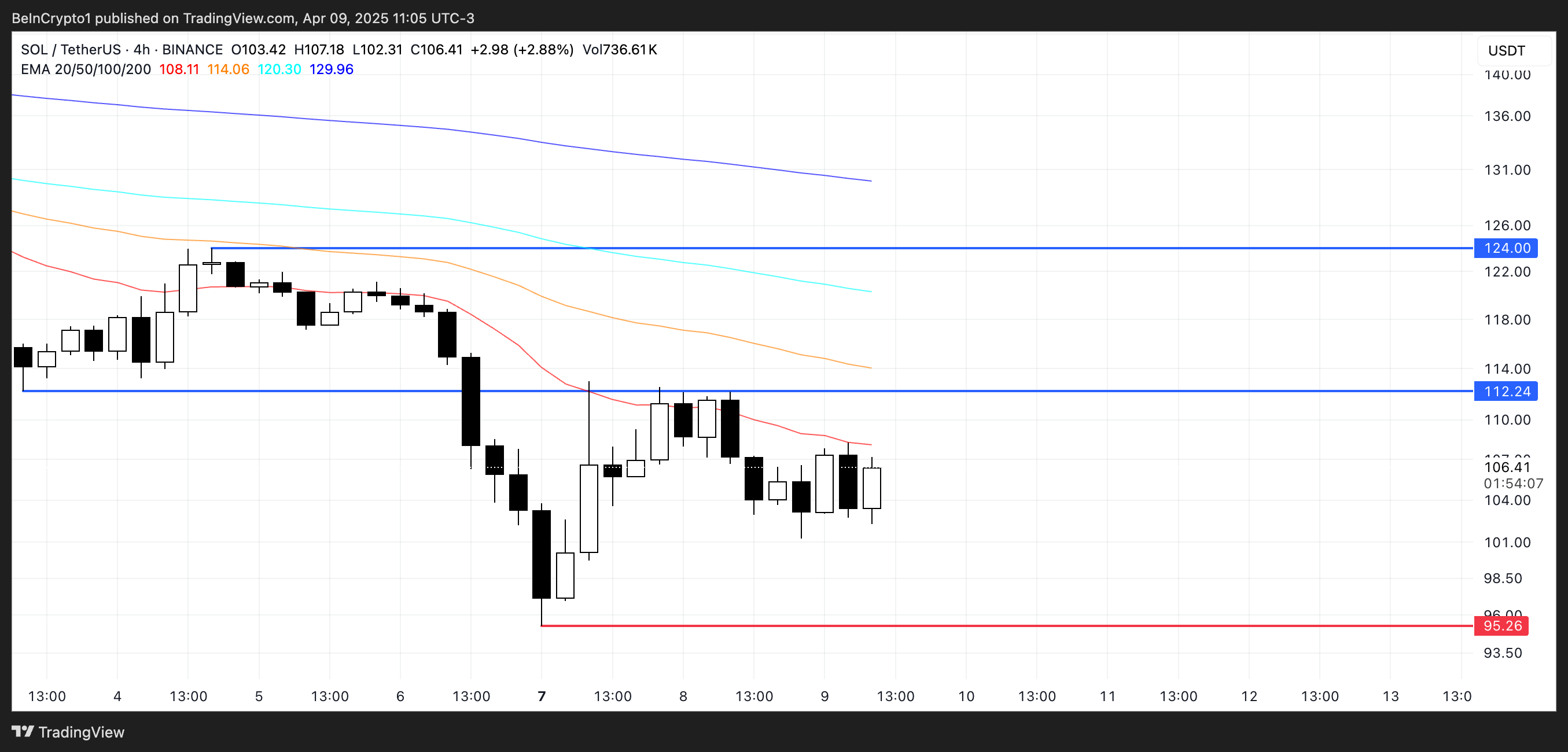

Solana (SOL) Drops 4% as Selling Pressure Intensifies

Solana (SOL) has recovered over 12% today after Trump announced a 90-day pause on tariffs. Despite the significant recovery, technical indicators continue flashing bearish warnings. Key indicators like the RSI, BBTrend, and EMA lines all point to weakening momentum and a lack of buyer conviction. While oversold conditions have started to stabilize, the broader structure still leans slightly in favor of sellers.

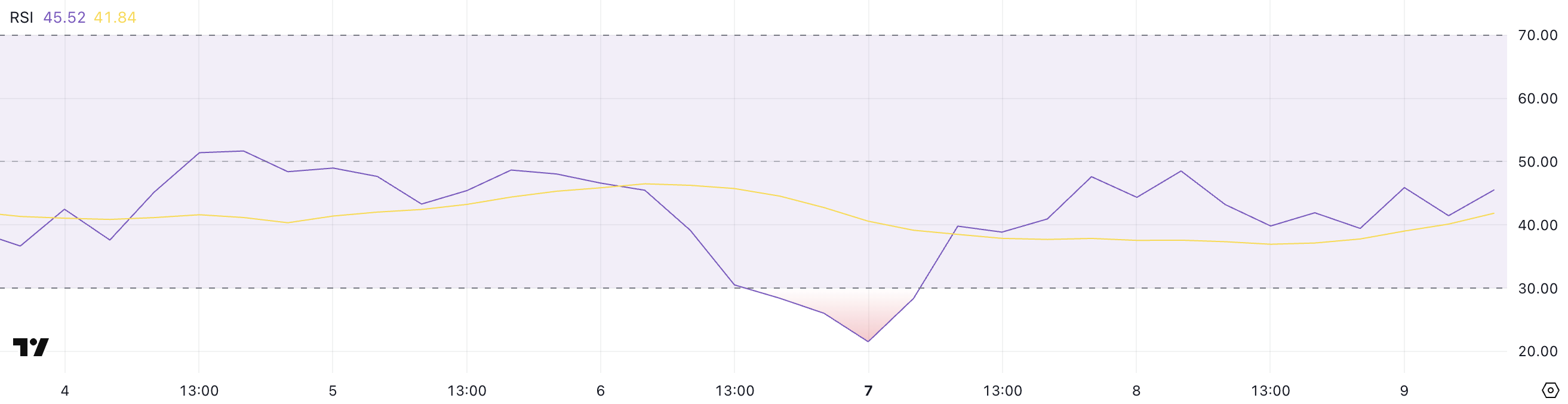

Solana RSI Shows The Lack Of Conviction Among Buyers

Solana’s Relative Strength Index (RSI) is currently sitting at 45.52, hovering in neutral territory but remaining below the midline of 50 for nearly two days.

This comes after the RSI briefly dipped to an oversold level of 21.53 two days ago, indicating that sellers had briefly dominated before demand began to stabilize.

The RSI’s slow climb back toward neutral suggests that while extreme selling pressure has eased, bullish momentum has not yet taken control.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price movements. It typically ranges from 0 to 100.

Readings above 70 are generally interpreted as overbought, signaling the potential for a pullback, while readings below 30 suggest oversold conditions and potential for a rebound.

Solana’s RSI at 45.52 indicates that the asset is in a recovery phase but lacks conviction. If the RSI fails to cross above 50 soon, it could imply continued hesitation among buyers and the potential for sideways price action or even another leg lower.

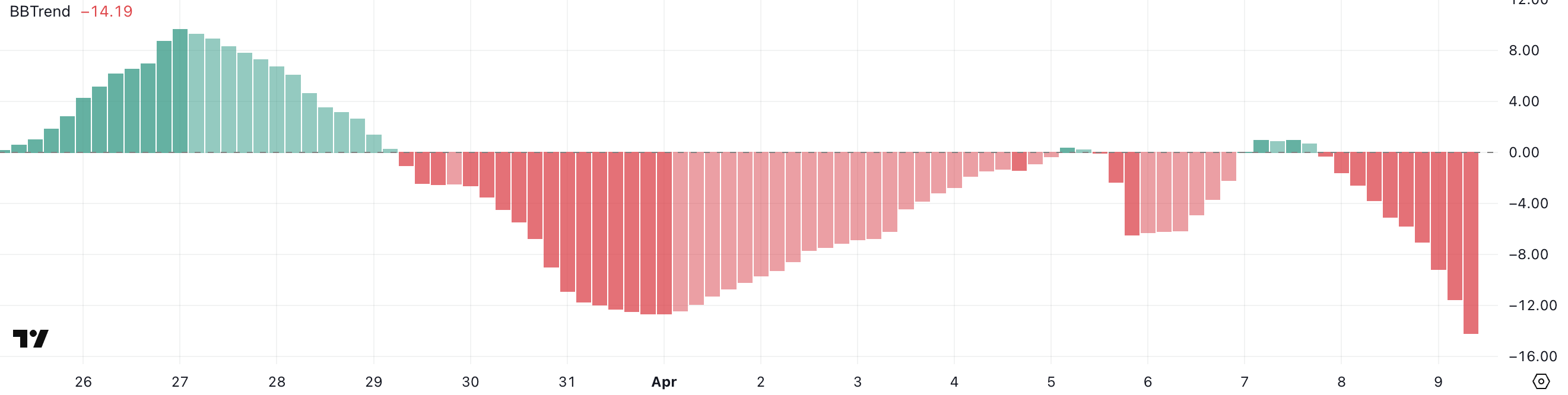

SOL BBTrend Has Reached Its Lowest Levels In Almost A Month

Solana’s BBTrend indicator is currently at -14.19, having turned negative since yesterday, and is at its lowest level since March 13—nearly a month ago.

This shift into deeper negative territory suggests that bearish momentum is building once again after a period of relative stability.

The return to these levels may indicate growing downside pressure, especially if follow-through selling continues in the short term.

The BBTrend (Bollinger Band Trend) is a volatility-based indicator that measures the strength and direction of a price trend using the distance between price and Bollinger Bands.

Positive BBTrend values generally reflect bullish momentum, while negative values signal bearish momentum. The deeper the reading into negative territory, the stronger the downward pressure is considered to be.

Solana’s BBTrend is now at -14.19, implying an intensifying bearish phase, which could mean further price declines unless sentiment or volume shifts quickly in favor of buyers.

Will Solana Dip Below $100 Again In April?

Solana’s EMA setup continues to reflect a strong bearish structure, with short-term moving averages remaining well below long-term ones.

This alignment confirms that downward momentum is still in control, keeping sellers in a dominant position.

However, if Solana price manages to sustain the current strength and buying interest, it could test resistance at $120. A break above that level may open the path toward the next target at $134.

On the downside, if the current bearish trend persists, Solana could revisit support near $95, a level that has previously acted as a short-term floor.

Losing this level would be technically significant, potentially pushing SOL below $90—territory not seen since January 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Paul Atkins Confirmed as SEC Chair, Crypto Rules to Ease

The US Senate has confirmed Paul Atkins as the new chair of the Securities and Exchange Commission. Senators approved the appointment on Wednesday with a 52-44 vote.

Atkins is expected to shift the agency’s approach to financial oversight. He plans to ease regulatory requirements, scale back corporate disclosure rules, and continue the commission’s new pro-crypto stance.

SEC Has a Pro-Crypto Chair

Since last week’s Senate hearing, there have been some doubts about Paul Atkins’ appointment. This was largely due to his significant crypto exposure as an investment leader.

However, the Senate has decided today with a tight vote.

The leadership change follows a period of major transition at the agency. Mark Uyeda, who served as acting chair after Gensler’s departure, launched a fast-paced overhaul of crypto policy.

“Confirmed, 52-44: Confirmation of Executive Calendar #61 Paul Atkins to be a Member of the Securities and Exchange Commission for the remainder of the term expiring June 5, 2026,” wrote the Senate Cloakroom.

Under Uyeda, the SEC dismissed several major enforcement actions tied to digital assets. The agency also declared that certain crypto sectors — including stablecoins, proof-of-work mining, and meme coins fall outside its jurisdiction.

Some of these areas have financial links to the Trump family. Their ventures include meme coin projects and connections to World Liberty Financial, a firm backing its own stablecoin.

Atkins is expected to formalize these regulatory shifts and oversee any new standards that may follow from pending legislation.

“Atkins may have made history tonight as the first SEC commissioner to get confirmed by the Senate three times. Once in 2002, then again in 2003, and now in 2025,” wrote Eleanor Terrett.

The SEC has already begun loosening several other rules. Uyeda delayed implementation deadlines for policies introduced during Gensler’s term.

He also revised rules on shareholder proposals, making it harder for activists to force issues onto corporate ballots.

The agency withdrew its defense of rules that required companies to disclose climate-related risks and emissions.

Atkins will take over a smaller agency. Around 500 staff have accepted voluntary resignations or buyouts. This has been part of the Trump administration’s broader effort to shrink federal agencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin21 hours ago

Bitcoin21 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Altcoin20 hours ago

Altcoin20 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Ethereum22 hours ago

Ethereum22 hours agoAnalyst Reveals What Could Come Next

-

Bitcoin16 hours ago

Bitcoin16 hours agoGoldman Sachs Raises US Recession Odds to 45%

-

Market9 hours ago

Market9 hours agoCrypto Market Rallies After Trump’s 90-Day Pause on Tariffs

-

Market22 hours ago

Market22 hours agoEthereum Price Hit Hard—10% Drop Sparks Selloff Fears

-

Market15 hours ago

Market15 hours agoHow Ripple’s $1.25 Billion Deal Could Surge XRP Demand

-

Market21 hours ago

Market21 hours agoFed Reverse Repo Facility Drains, Stealth Liquidity Injections Seen