Market

Polygon (MATIC) Poised for Breakout: Bullish Signals

As BeInCrypto highlighted in a previous analysis when MATIC was trading at $0.74. The price action remains bullish since the support levels have not been broken to the downside.

By examining critical indicators such as the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud, we can discern the potential for a significant bullish breakout.

Polygon (MATIC) Technical Outlook

Let’s analyze the price movements of Polygon (MATIC) using the 1-day chart, focusing on the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud.

The EMA 100, represented by the blue line, is a significant resistance level.

Over the past two months, Polygon’s price has consistently traded below the EMA 100, depicted by the blue line. This sustained trading below the EMA 100 underscores a bearish trend. Notably, the last significant attempt to break above the EMA 100 occurred on April 9. However, this attempt was met with substantial selling pressure, further reinforcing the bearish sentiment.

The Ichimoku Baseline, illustrated by the red line, is a dynamic support level. The price has repeatedly approached but failed to sustain below this baseline, indicating consistent buying activity at these price levels.

The price has entered the Ichimoku Cloud. The lower boundary of the cloud, currently acting as support, appears to be a challenging level to break. The price’s entry into the cloud suggests an increase in volatility. A breakout within the cloud is expected to heighten this volatility further.

Additionally, the 0.618 Fibonacci retracement level within the cloud is a critical resistance point.

Polygon’s price has been testing this level, and a sustained breakout above the 0.618 Fibonacci level could propel it higher.

This breakout can push the price towards the upper boundary of the cloud and potentially higher resistance levels, such as the EMA 100 and the 0.5 Fibonacci retracement line, situated around the $0.78 to $0.80 range.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Despite the prevailing bearish trend indicated by the EMA 100 and the Ichimoku Baseline, the recent entry into the Ichimoku Cloud introduces the potential for increased volatility and possible bullish movements.

Polygon Supply Shifting to Smart Contracts: A Positive Indicator

A smart contract is a self-executing contract with the terms of the agreement directly written into code. They run on blockchain networks like Ethereum and Polygon. When conditions specified in the code are met, the contract executes automatically.

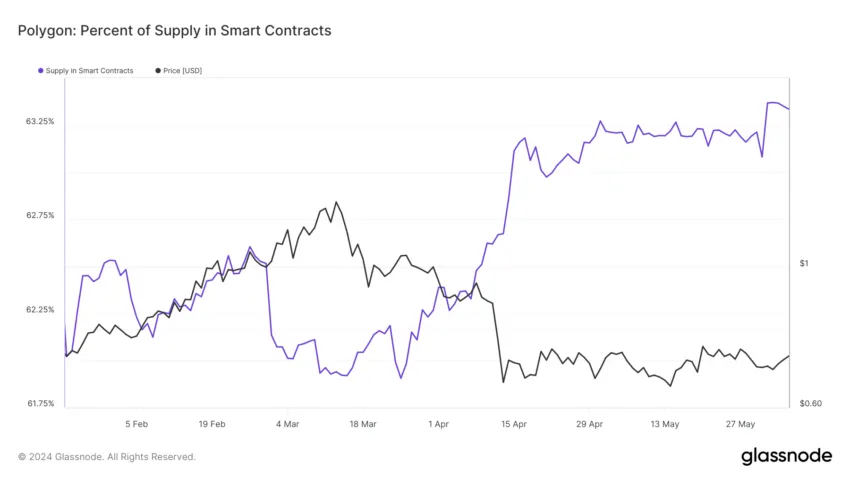

The purple line represents the percentage of the total MATIC tokens currently locked in smart contracts. These contracts could be related to decentralized finance (DeFi) applications, staking, or other blockchain-based services.

Over the given period, the percentage of MATIC in smart contracts fluctuates. There was a dip at the start of the period, followed by a steady increase. Around mid-April, there is a significant jump in the percentage, suggesting a surge in smart contract activity on the Polygon network.

A higher percentage of MATIC in smart contracts indicates more active network use. This could mean more people use MATIC for DeFi, staking, or other applications, showcasing the token’s utility and demand.

Over the past two months, nearly 2% of the total supply has been allocated to smart contracts.

Fewer are available in the market when more tokens are locked in smart contracts. This can reduce supply and, depending on demand, potentially lead to an increase in price.

Strategic Recommendations

The bullish to neutral outlook could shift to bearish if the price exits the cloud to the downside and breaks below the baseline at $0.70. Placing stops in this region could be a prudent strategy.

A breakout within the cloud will likely increase positive volatility. Pay close attention to how the price behaves around the 0.618 Fibonacci retracement level. A sustained move above this level could indicate a shift in momentum.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

If the price breaks above the EMA 100, it would signal a potential bullish reversal. This level has been a strong resistance, which could lead to significant upside potential.

Over the past two months, nearly 2% of the total supply has been allocated to smart contracts. This increase in smart contract activity suggests more active network use, which could positively impact the price. Monitoring this metric can provide insights into the network’s health and potential demand for MATIC.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple Labs has announced a major acquisition to shock the market out of an otherwise dreadful week. Taking to X (formerly Twitter), the crypto firm announced that it has acquired Hidden Road, a brokerage, clearing, and financing firm as it moves forward in its mission to become the leader for institutional investors moving into the digital assets space.

Ripple Acquires Hidden Road For $1.25 Billion

The Tuesday announcement by Ripple has further solidified the mission that the crypto firm has long put forward, and that is to provide instant and quick transfer of value for traditional and institutional investors coming into the digital assets space.

Related Reading

As CEO Brad Garlinghouse explained in a separate X post, the decision to acquire Hidden Road for $1.25 billion comes after a long-standing customer relationship with the company. Garlinghouse revealed that Ripple understands the breadth of Hidden Road’s expertise, making it a prime candidate for the acquisition.

The integration of the XRP Ledger by Hidden Road will allow for cheap and fast movement of value to the brokerage’s customers, which moves over $3 trillion annually. A portion of this massive value is expected to move through the ledger, as well as using the RLUSD stablecoin as collateral for brokerage services.

Additionally, Hidden Road will be able to expand its capacity for value transfer, allowing Ripple to process even more volume. “With this deal and the backing of Ripple’s significant balance sheet, Hidden Road will exponentially expand its capacity to service its pipeline and become the largest non-bank prime broker globally,” Garlinghouse’s post read.

This acquisition comes after Ripple acquired Standard Custody back in February 2024. Standard Custody provided an online platform offering clients digital asset custody solutions, enabling Ripple to move into the custody market as well.

XRP Price Responds

Despite the Ripple announcement, the XRP price has remained muted as it continues to struggle below $2, which has since turned to resistance. At the time of writing, XRP is still holding at $1.96, despite its almost 10% in the last 24 hours.

Related Reading

According to data from Coinmarketcap, the XRP daily trading volume has seen a notable decline, dropping approximately 24% in the last day. This suggests a decline in participation from investors, due to the bearish headwinds that continue to blow through the crypto market.

A recovery from here is highly dependent on Bitcoin, which continues to dominate the market and lead the charge.

Chart from Tradingview.com

Market

XCN Price’s Month-Long Bearishness Meets Whale Conviction

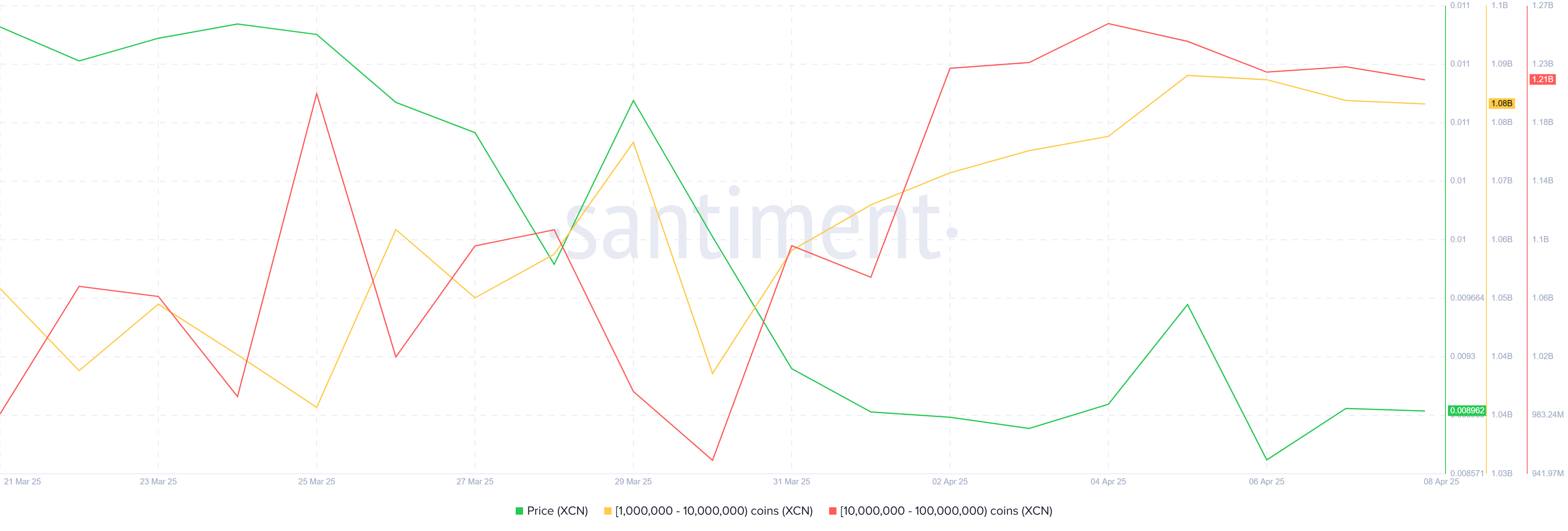

Onyxcoin (XCN) has experienced a month-long consolidation with little upward momentum, leaving the price largely stagnant. The altcoin has struggled to make significant gains, but this has not deterred key investors.

Whale addresses have continued to hold their positions, signaling optimism despite the market’s sluggishness.

Onyxcoin Whales Are Optimistic

Whale addresses, or holders with significant XCN holdings, have shown resilience amid the price decline. Over the past week, even with no growth in the altcoin’s value, these investors have refrained from selling sharply. This ongoing HODLing behavior suggests that they maintain a long-term bullish outlook for Onyxcoin, possibly expecting future gains once market conditions improve.

This conviction among large holders reflects a belief in Onyxcoin’s potential for recovery. Despite a lack of short-term gains, these investors appear focused on holding until the price begins to rise again. Their reluctance to sell even in a stagnant market is a positive indicator of potential upside when the market conditions shift.

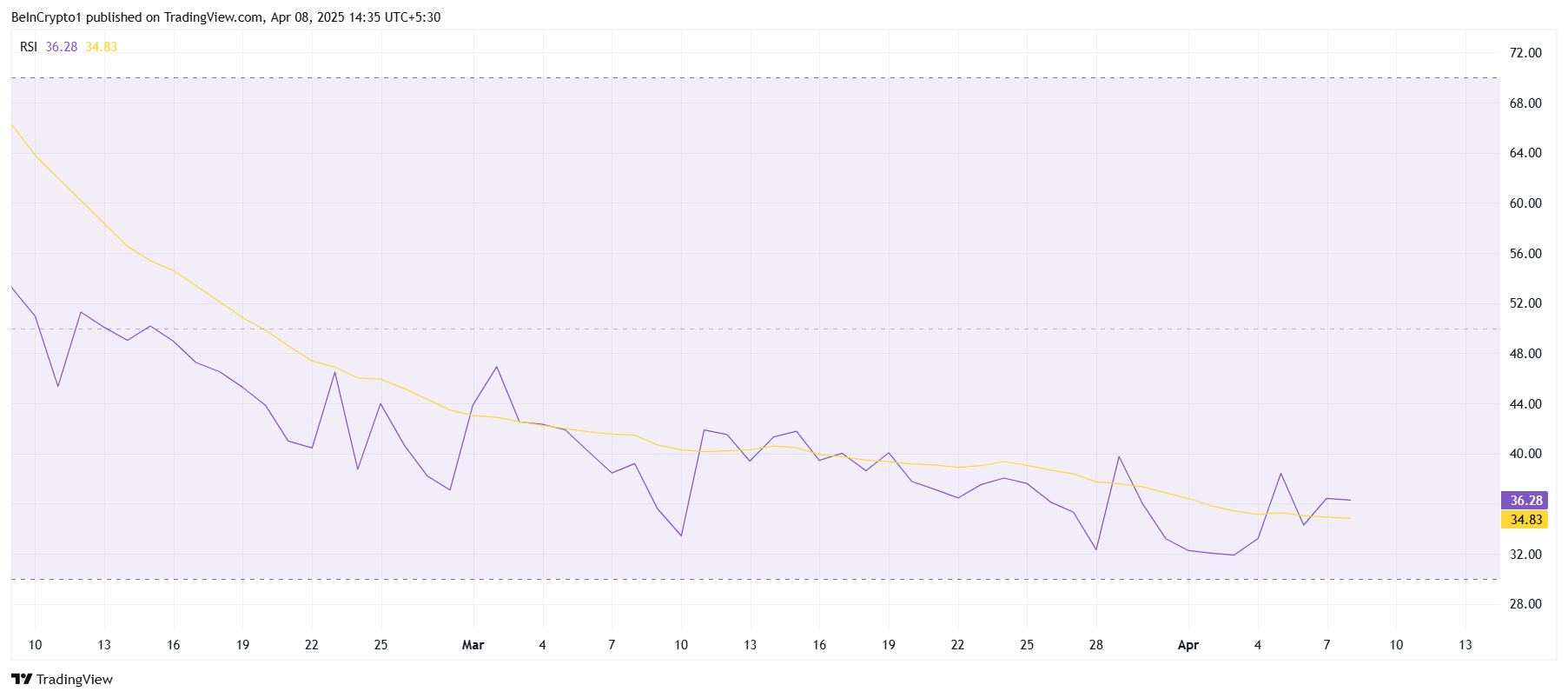

On the broader scale, technical indicators like the RSI have been showing a bearish trend for over a month, remaining stuck below the neutral line. The RSI’s positioning below 50.0 suggests that selling pressure still outweighs buying momentum, keeping the price suppressed. The indicator’s prolonged decline points to a sustained bearish market environment.

While this presents challenges for Onyxcoin in the short term, it also implies that the bearish momentum could eventually reach a saturation point. If the market shifts and buying pressure increases, XCN may experience a recovery rally, provided other macroeconomic factors align.

XCN Price Is Looking To Rise

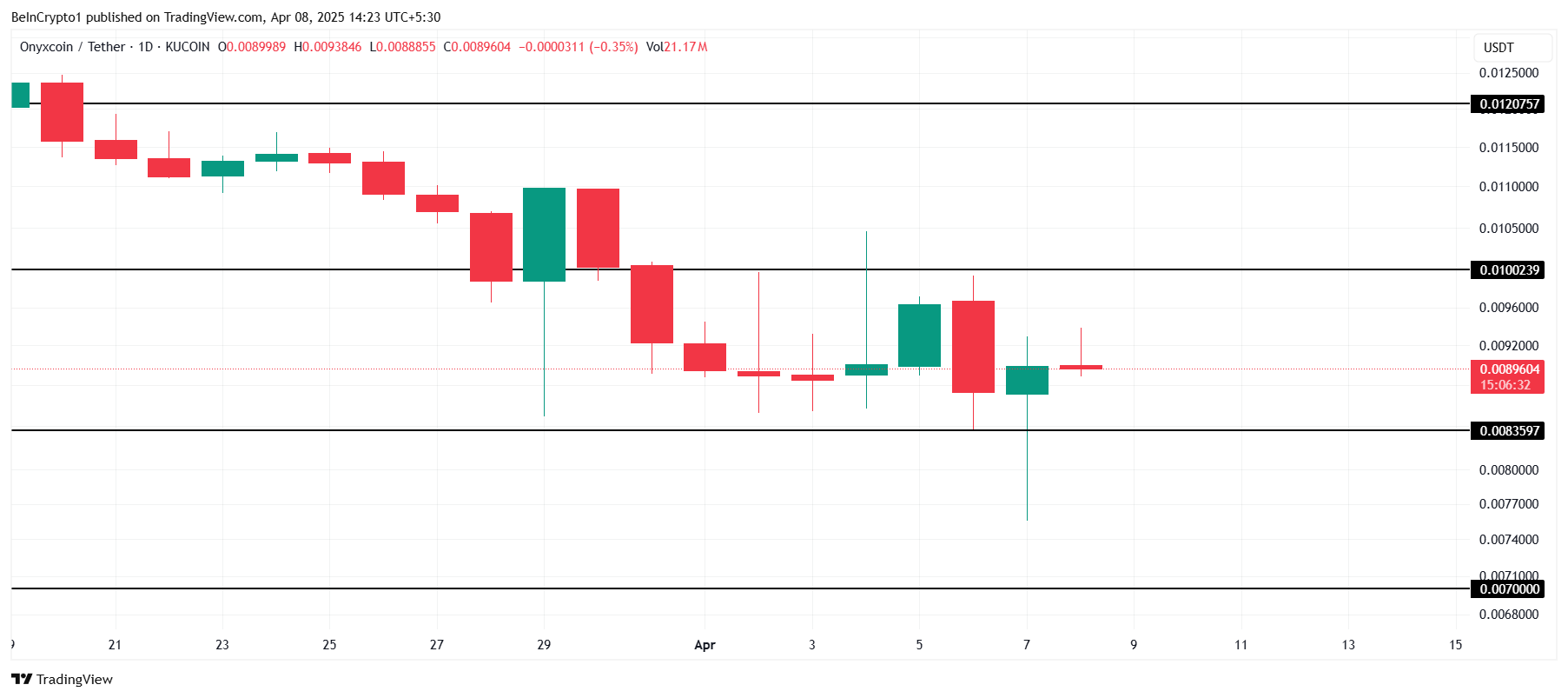

XCN is currently trading at $0.0089, staying within a narrow range between $0.0100 and $0.0083 for the past week. This consolidation is likely to continue unless market conditions improve. The altcoin’s price action has been largely dictated by the lack of positive market momentum, limiting any immediate breakthroughs.

If the broader crypto market sees improvement, XCN could break through the $0.0100 resistance and begin moving toward the $0.0120 level. This would mark a recovery of a portion of the recent losses, potentially restoring investor confidence and signaling a shift toward a more bullish trend.

However, if XCN fails to hold above $0.0083, the altcoin could face a further decline, potentially reaching $0.0070. This would invalidate the bullish outlook and deepen the losses, reinforcing the need for caution among investors awaiting market stabilization.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price, Traders Retreat Despite The US ETF Buzz

XRP has faced a challenging decline over the last 48 hours, falling below the $2.00 support level.

This drop came at an inopportune time, especially considering the excitement surrounding Teucrium’s launch of the leveraged US XRP ETF. The news had initially sparked optimism, but the recent decline has overshadowed it.

XRP Traders Change Their Stance

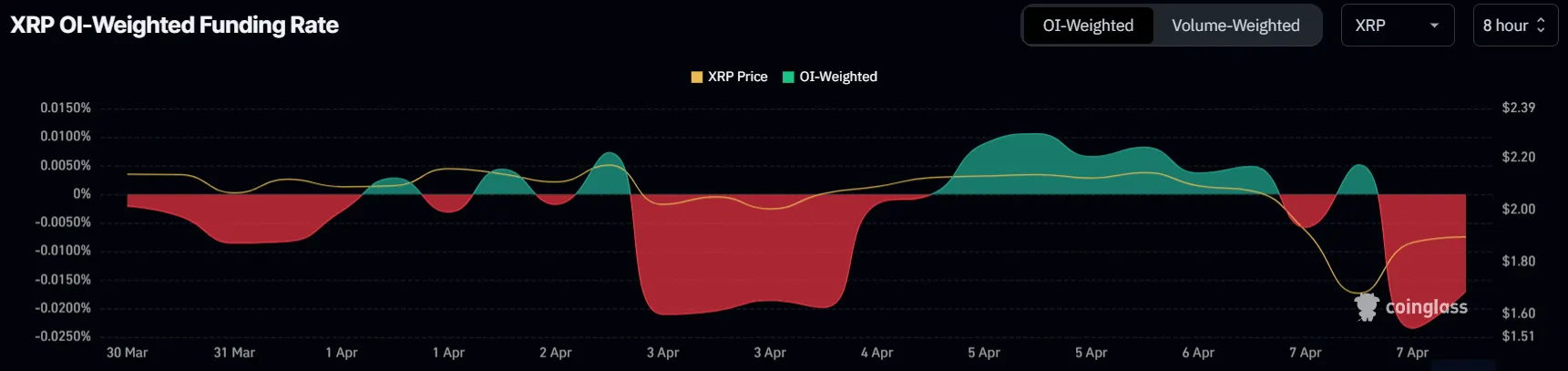

In the past 24 hours, the funding rate for XRP switched from positive to negative, indicating a shift in market sentiment. Traders have begun shorting the altcoin, likely in response to the recent price decline. This shift suggests that many traders are preparing for further drops in price, hoping to capitalize on any potential bearish momentum.

The negative funding rate further highlights the growing skepticism among traders about XRP’s short-term price performance. While the ETF launch initially created a buzz, the recent price action has shifted traders’ focus to the downside.

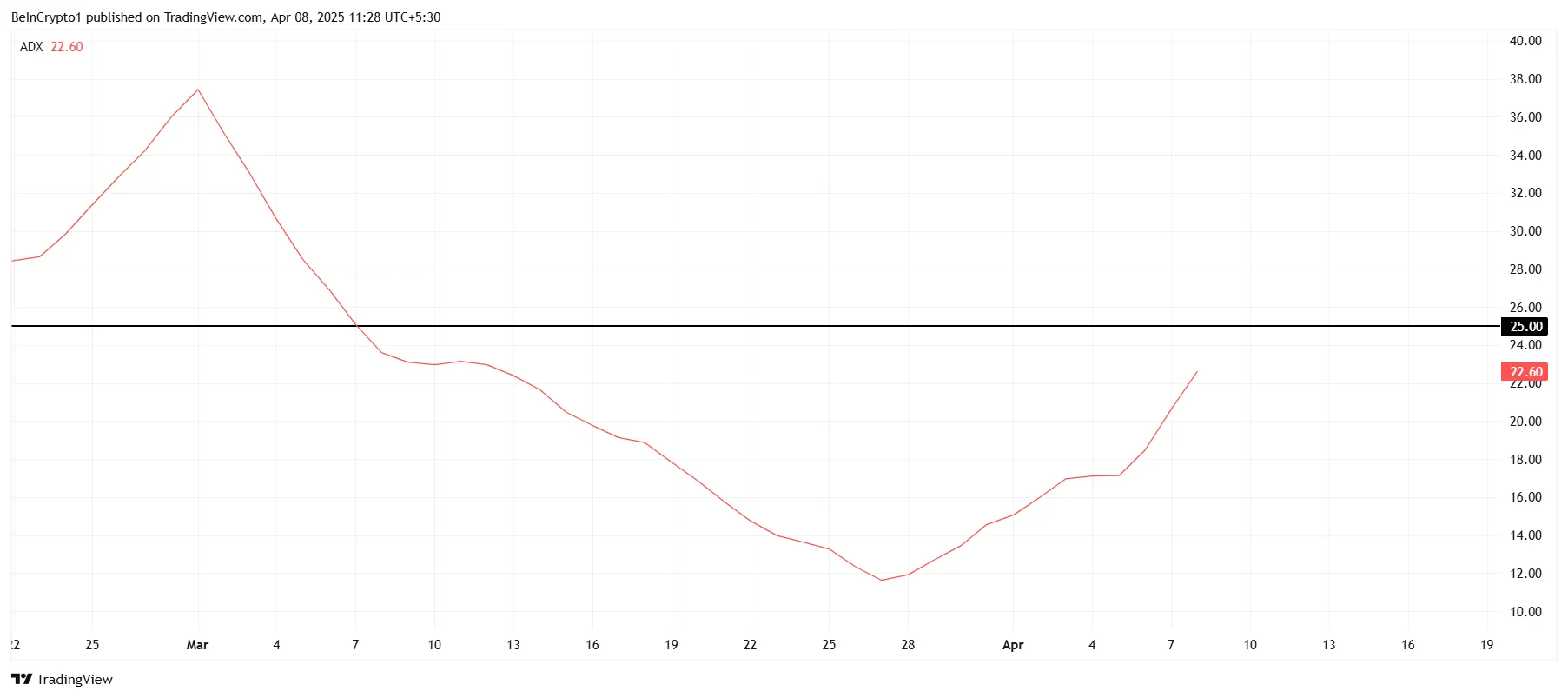

The overall macro momentum for XRP is currently weak, as indicated by technical indicators like the ADX. With the ADX reading of 22, just below the threshold of 25, it signals that the current downtrend may be gaining strength. If the ADX crosses the 25 threshold, it would confirm the strengthening downtrend, potentially leading to further declines in XRP’s price.

Given the current technical setup, XRP may struggle to reverse the trend unless key levels of support are reclaimed. The downtrend could persist as traders and investors react to broader market conditions, particularly as XRP faces negative sentiment and increasing selling pressure.

XRP Price Decline Continues

XRP’s price has dropped nearly 12% in the last 48 hours, trading at $1.88 at the time of writing. The bearish trend has already overshadowed any optimism surrounding the launch of the US XRP ETF by Teucrium. If this sentiment continues, XRP could face further downside pressure.

As the altcoin remains trapped under a declining trend line since early March, a further decline to $1.70 seems likely. This would extend the losses experienced over the past few days and put additional strain on the price of XRP.

However, if XRP manages to reclaim $2.02 as support, it could signal a reversal of the bearish trend. A successful bounce from this level could push XRP beyond $2.14, invalidating the current bearish outlook and allowing the altcoin to break free from its downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Capitulation May Be Nearing End – Will A Fed Pivot Spark A Recovery?

-

Market22 hours ago

Market22 hours agoMANTRA Launches $108 Million RWA Fund As OM Price Surges

-

Market21 hours ago

Market21 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Market23 hours ago

Market23 hours agoAAVE Buybacks & Key Events This Week

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Bears Loses Steam On Binance As Selling Pressure Weakens, Bulls Eyeing A Recovery?

-

Market19 hours ago

Market19 hours agoXRP Targets Rebound After Hitting Oversold Territory

-

Market20 hours ago

Market20 hours agoCan the Fed Rescue Crypto Markets With Interest Rate Cuts?

-

Altcoin16 hours ago

Altcoin16 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash