Market

Pi Network To Launch PiDaoSwap Decentralized Exchange (DEX)

The Pi Network community is taking a significant step toward financial independence, developing its decentralized exchange (DEX), PiDaoSwap.

According to social media reports, the initiative will aim to curb alleged price manipulation by external exchanges.

PiDaoSwap to Launch on the Pi Network Ecosystem

Reportedly, PiDaoSwap is in the final stages of launching a multi-functional DEX on the Pi Network mainnet. The platform will ensure that the PI coin price reflects the actual market value of the token rather than being distorted by third-party platforms.

The announcement cited price manipulation by outside entities, a malpractice that impedes Pi Network’s growth and development.

“Once completed, the Pi price will be reflected at its true value and will no longer be manipulated by current external exchanges,” Pi Network VietNames claimed.

Pi Network VietNames is a community-driven profile that shares updates, opinions, and news about Pi Network.

Although in the final stages of development, PiDaoSwap specified that it was awaiting Know Your Business (KYB) approval from the Pi core team before launching.

For now, the prospective platform has secured Twitter’s organizational verification, signaling progress in its development.

Meanwhile, Pi Network’s imminent PiDaoSwap launch comes amid escalating frustrations within the PI community. Certain platforms reportedly use bots to alter Pi’s valuation artificially, affecting community sentiment.

Similarly, there are also allegations of fake price listings by external exchanges.

A recent BeInCrypto report echoes this sentiment amid allegations of bot activity on CoinMarketCap. This fueled skepticism about centralized price tracking mechanisms on the platform.

According to Pi Network VietNames, these manipulations have severely impacted the project’s credibility and adoption.

Meanwhile, Binance remains evasive when listing Pi coins. Despite community support, Pi Coin’s Binance listing decision remains unresolved, leading to frustration among fans.

Meanwhile, other concerns emerge regarding restrictions on using “Pi-related” branding. These are related to the intellectual property (IP) and trademark policies outlined by the Pi Network.

“As a community-driven ecosystem project under PIDao, with DAO as our core focus, would this still be prohibited? Or do we need to modify our project name and domain accordingly,” PiDaoSwap wrote.

Pi Network’s official documentation prohibits using “Pi-related” branding without approval. Therefore, this suggests modifications could be necessary before the prospected PiDaoSwap debuts.

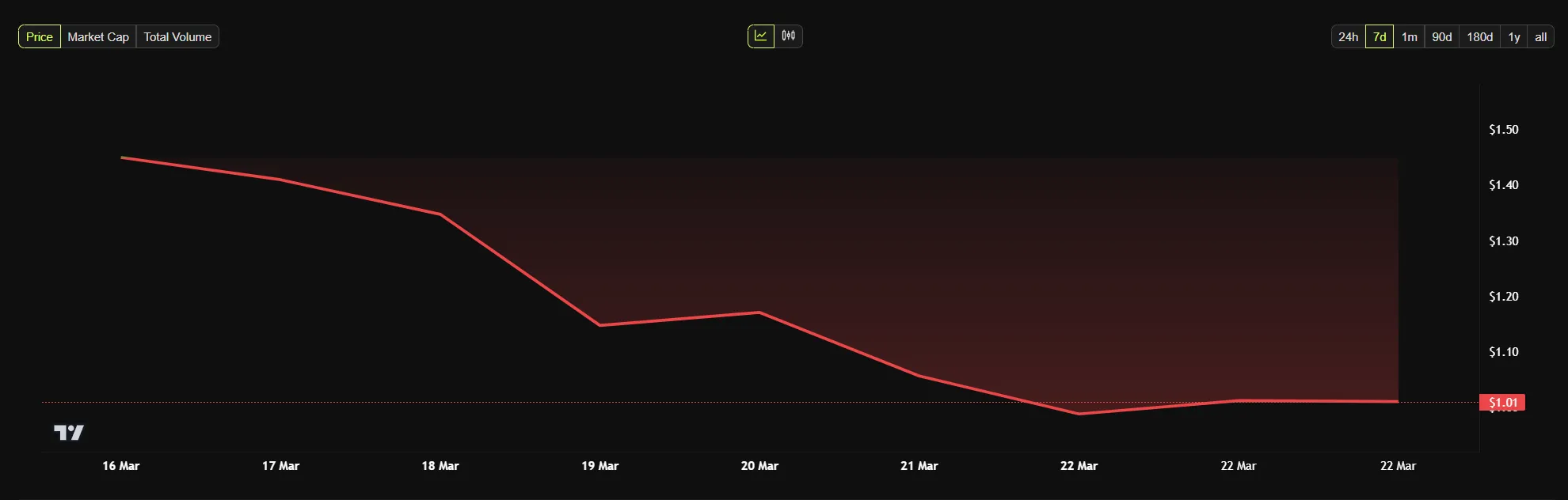

Meanwhile, PI fell below $1 on Saturday, down by over 30% in the past week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Should You Buy Movement (MOVE) For April 2025?

Movement Network (MOVE) has been gaining attention after announcing a $38 million buyback in response to improper activity by a Binance market maker. Despite the corrective phase that followed its sharp price spike, MOVE is still up over 13% in the last seven days.

Key indicators like RSI and DMI suggest that bullish momentum is cooling off. However, depending on market sentiment, a new trend could still develop.

Is MOVE Overbought in the Market?

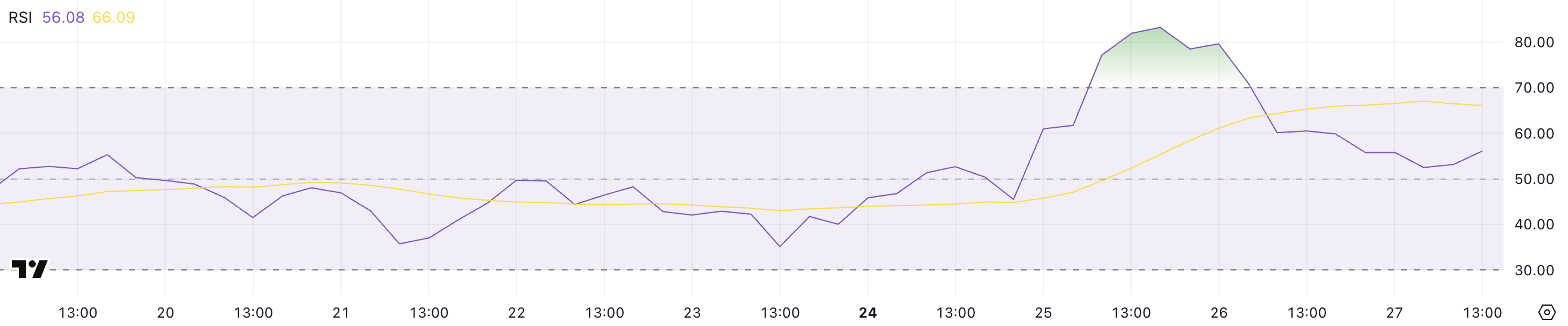

MOVE’s Relative Strength Index (RSI) is currently at 56, down significantly from 83 just two days ago when its price experienced a sharp spike. That happened after the company behind it announced a $38 million buyback after discovering improper activity by a Binance market maker.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 indicate overbought conditions that could lead to a pullback. Readings below 30 suggest oversold conditions that may precede a bounce. Values between 30 and 70 are considered neutral, with 50 acting as the midpoint.

Prior to its recent surge, MOVE’s RSI hovered in the neutral zone for 23 consecutive days. That reflects a period of low momentum and price stability.

The sudden spike that pushed RSI into overbought territory was followed by this pullback to 56. That signals that the extreme bullish momentum is cooling off.

While 56 remains in neutral territory, it still leans slightly bullish and suggests that the altcoin may be consolidating before its next move. If buying interest returns, the current RSI level gives it room to push higher without being technically overbought.

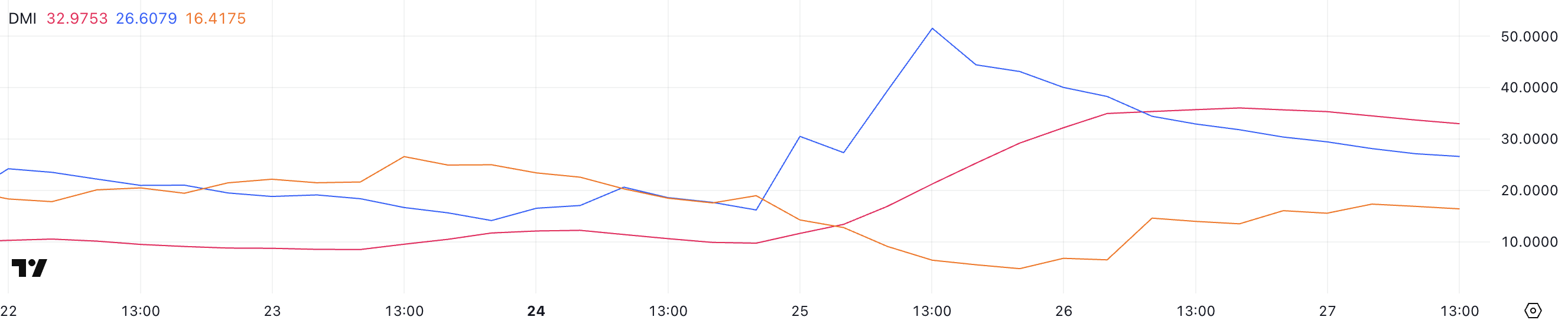

Movement DMI Shows Buyers Could Lose Control In The Next Days

MOVE’s DMI chart shows that its Average Directional Index (ADX) is currently at 32.97, holding steady since yesterday after surging from just 9.74 two days ago.

The ADX is a key indicator used to measure the strength of a trend on a scale from 0 to 100. Readings below 20 suggest a weak or nonexistent trend. Values between 20 and 25 hint at a trend starting to form, and anything above 25 confirms a strong trend.

With MOVE’s ADX now firmly above 30, it signals that the recent price movement has established a solid trend.

Alongside the ADX, the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator) offer insight into the direction of that trend.

Currently, +DI is at 26.6, falling from 51 two days ago. On the other hand, -DI has climbed to 16.41 from 6.43 in the same period.

This indicates that bullish momentum has cooled off after the recent surge, while bearish pressure is gradually increasing. Despite the strong trend strength indicated by the ADX, the shrinking gap between +DI and -DI suggests that the bullish momentum is fading. That means the trend may be weakening or transitioning.

Based on these indicators, MOVE could now enter a period of consolidation or face a pullback unless new buying pressure emerges.

Will MOVE Drop Below $0.40 In April?

Following its sharp 30% price surge on March 25, which made it one of the best-performing altcoins of that day, MOVE has entered a corrective phase. The altcoin is now trading 11% below its recent peak.

This kind of pullback is not uncommon after such an aggressive move, as traders take profits and momentum cools off. The ongoing correction focuses on several key support levels—$0.479 is the first.

If that level fails to hold, MOVE could decline further toward $0.433 and $0.409. Also, a deeper drop toward $0.37 is possible if bearish momentum extends into April.

However, if sentiment around the MOVE ecosystem improves and confidence returns, the current pullback could be short-lived.

A rebound could see MOVE retest the resistance at $0.539. A successful breakout above that could open the path to $0.55, which wasn’t broken yesterday, and even $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Cardano (ADA) Reach Back to $1 in April?

Cardano (ADA) is facing renewed pressure, dropping nearly 5% on Wednesday. ADA trading volume has also slipped 19% to $751 million. Despite this pullback, some indicators are beginning to flash early signs of potential trend shifts.

The BBTrend has turned positive for the first time in over a week, hinting at a possible change in momentum, while the DMI shows that ADA may be consolidating after a sharp move.

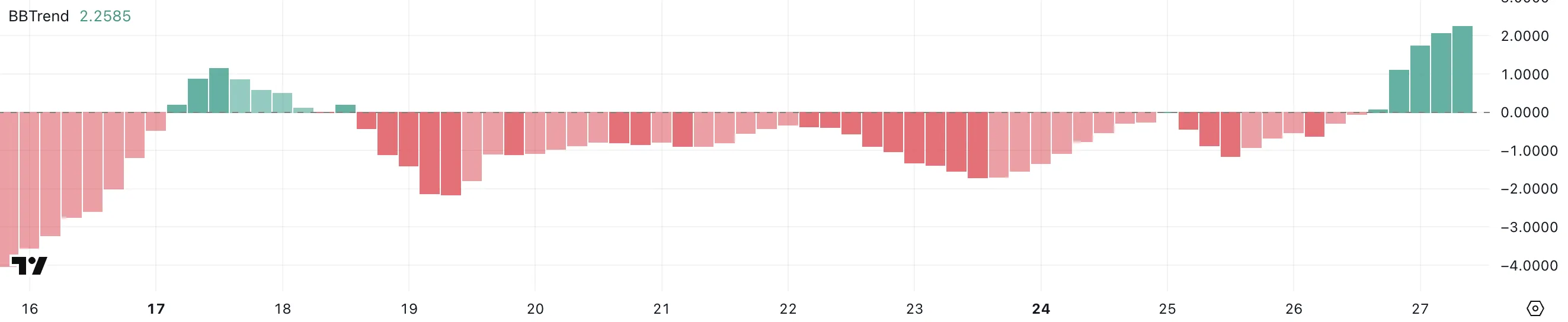

Cardano BBTrend Is Now Positive, But Still At Low Levels

Cardano’s BBTrend indicator is currently at 2.25, marking its highest reading since March 8. For the past nine days, since March 18, the BBTrend remained negative or hovered near zero, even reaching a low of -2.14 on March 19.

This recent uptick suggests a shift in market behavior, as the indicator moves out of neutral-to-bearish territory and into a more positive trend structure.

While 2.25 isn’t an extreme reading, it does signal that momentum is beginning to tilt in favor of buyers after a prolonged period of indecision or weakness.

The BBTrend, or Bollinger Band Trend indicator, measures the strength and direction of a trend based on price behavior relative to the Bollinger Bands.

Values above zero generally point to bullish conditions, while values below zero suggest bearish sentiment. A reading of 2.25 indicates that price is starting to trend upward with growing volatility expansion—though not yet at strong trend levels, it marks a notable improvement.

If the BBTrend continues to rise, it could support the development of a more sustained uptrend for ADA, especially if accompanied by increased volume and a break above key resistance levels.

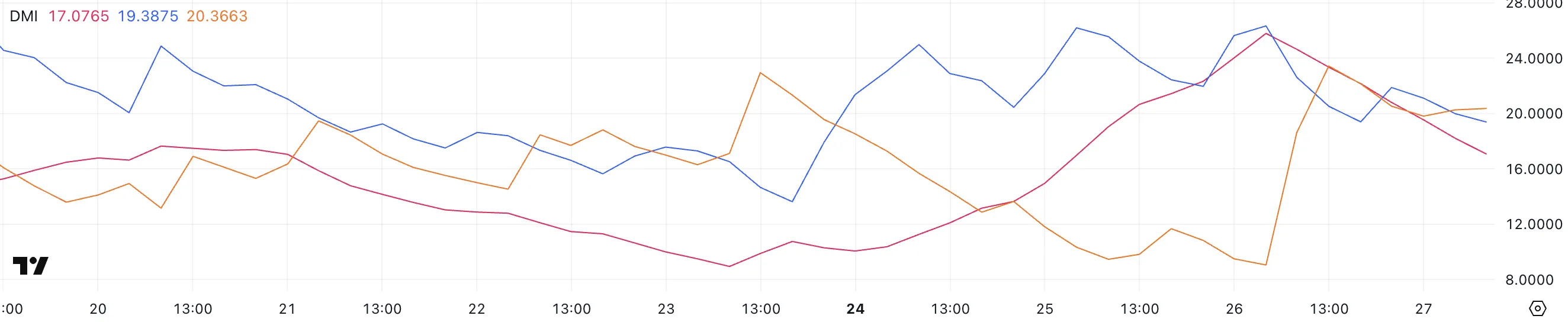

ADA DMI Shows The Consolidation Could End Soon

Cardano’s DMI chart shows that the Average Directional Index (ADX) has dropped to 17, a sharp decline from 25.79 just a day earlier. This suggests a significant weakening in trend strength following yesterday’s rapid price surge and subsequent drop.

The ADX is a key component of the DMI system and is used to gauge the strength of a trend—regardless of direction.

Typically, an ADX below 20 signals a lack of strong trend or consolidation, while readings above 25 indicate a more established trend gaining traction.

Alongside the ADX, the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator) provide insight into the direction of momentum. Currently, +DI has fallen to 19.38 from 26.33, while -DI has surged to 20.36 from 9.

This crossover suggests that sellers are beginning to take control, even as the overall trend weakens.

With both the ADX trending downward and the DI lines crossing in favor of the bears, this suggests a market in consolidation but with increasing downside pressure. Unless momentum shifts again, ADA may struggle to regain upward traction in the short term.

Can Cardano Return To $1 Before April?

Cardano’s DMI lines suggest the asset is undergoing a correction following a failed attempt to break above the key resistance level at $0.77.

This rejection has shifted momentum, and if Cardano’s price continues to drop, the next area to watch is the support around $0.69. Should that level fail to hold, it could trigger further downside movement, potentially pushing ADA down to the $0.64 range.

The DMI’s directional shift supports this short-term bearish view, with sellers gradually gaining strength as buyers lose momentum.

However, if ADA can reclaim its upward momentum, there’s still room for a bullish reversal. A renewed push toward the $0.77 resistance level could bring a breakout scenario back into play.

If that level is breached with strong volume, it could open the door for a rally toward the $1.02 region—taking Cardano above the $1 mark for the first time since early March.

Such a breakout would likely be supported by a bullish crossover in the DMI lines and a strengthening ADX, confirming a new upward trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins Poised for a Move on Trump’s Liberation Day

Trump’s ‘Liberation Day’ on April 2 is expected to bring major announcements around tariff policies that could impact the crypto market. XRP stands out after underperforming other major coins, potentially setting up for a sharper move if sentiment shifts.

Dogecoin (DOGE), the leading meme coin, is known for amplifying market reactions and could surge—or tumble—depending on how the market digests the news. RENDER, a top AI coin, could rebound strongly if the event sparks renewed interest in the AI sector, which has been under pressure in recent months.

XRP

XRP has underperformed the broader crypto market over the past week. The altcoin fell 6%, while major assets like Bitcoin, Ethereum, BNB, and Solana have posted slight gains.

This divergence suggests a short-term detachment of XRP from the momentum seen in other top coins, possibly positioning it as an oversold outlier.

With this underperformance, XRP price may be primed for a sharper move—up or down—depending on how market sentiment evolves in the coming days, positioning it as one of the most important altcoins to watch in the next few days.

Much of the crypto market is currently reacting to macroeconomic developments, particularly news surrounding Trump’s tariff policies with the upcoming “Liberation Day” on April 2.

If these headlines translate into a more bullish outlook for the crypto industry, XRP could benefit disproportionately. In that case, XRP may test and potentially break resistance levels at $2.47 and $2.59, paving the way for a push toward $2.74 and even $2.99.

However, if the market turns bearish, XRP could revisit the $2.22 support level. A break below that could accelerate losses down to $1.90.

Dogecoin (DOGE)

Meme coins are known for their bigger price movements compared to major cryptocurrencies. They often surge higher during bullish trends or suffer sharper corrections during downturns.

Dogecoin, the leading meme coin by market cap, is especially sensitive to shifts in market sentiment. It often amplifies broader crypto trends.

If the upcoming “Liberation Day” tariff news sparks a bullish reaction across the crypto space, Dogecoin could capitalize on the momentum, potentially testing resistance levels at $0.22, $0.24, and $0.26.

However, if the broader market responds negatively, meme coins like DOGE are likely to see outsized losses. In that case, DOGE could drop toward the $0.179 support, and if that level breaks, further declines toward $0.16 and even $0.14 would be on the table.

RENDER

Like meme coins, AI coins have shown a tendency to move more aggressively than other sectors. They often experience sharper rallies or steeper corrections.

Over the past few months, many AI coins have been in a strong downtrend. That makes them particularly sensitive to shifts in broader market sentiment.

With the market closely watching the “Liberation Day” developments, a bullish outcome could trigger a strong rebound across AI coins. RENDER—one of the leading names in the space—may be well-positioned to benefit, making it one of the most relevant altcoins to watch before “Liberation Day.”

If positive momentum returns, RENDER could test resistance levels at $4.17 and $4.63.

However, if the announcements fail to inspire confidence in the sector, continued selling pressure could drag RENDER down to test support at $3.42. Further downside is possible toward $2.83 and $2.52 in the event of a broader AI coin correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoEthereum Price Eyes $10,000 Breakout Amid Supply Squeeze

-

Market23 hours ago

Market23 hours agoHYPE Falls 14% After JELLY Saga —Is Hyperliquid Still Safe?

-

Altcoin23 hours ago

Altcoin23 hours agoInteractive Brokers Lists SOL, ADA, XRP, DOGE Following White House Interest

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is Bitcoin, Ethereum, Solana & Dogecoin Price Falling Today?

-

Market21 hours ago

Market21 hours agoBitcoin (BTC) Looks to Reclaim $100,000 In April as Whales Surge

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Bullish Breakout Aims For $0.8 ATH This Cycle

-

Market20 hours ago

Market20 hours agoMantra (OM) Price Risks Further Drop as Death Cross Nears

-

Altcoin20 hours ago

Altcoin20 hours agoCrypto Price Today: BTC, ETH, SOL, XRP, SHIB, DOGE, LINK, PEPE, ADA