Market

Pepe (PEPE) Whales Have No Skin in the Game

The meme coin market has witnessed a decline in value over the past month. This has impacted the performance of the frog-themed asset Pepe (PEPE), whose price has maintained a downtrend since it climbed to a monthly peak of $0.0000096 on August 24.

Due to this, daily transactions involving the meme coin have mostly ended in losses, spurring PEPE whales to reduce their trading activity.

Pepe Holders Run Away From Losses

As of this writing, PEPE is trading at $0.0000071, reflecting a 26% price drop over the past two weeks. This decline has led to many daily transactions resulting in losses.

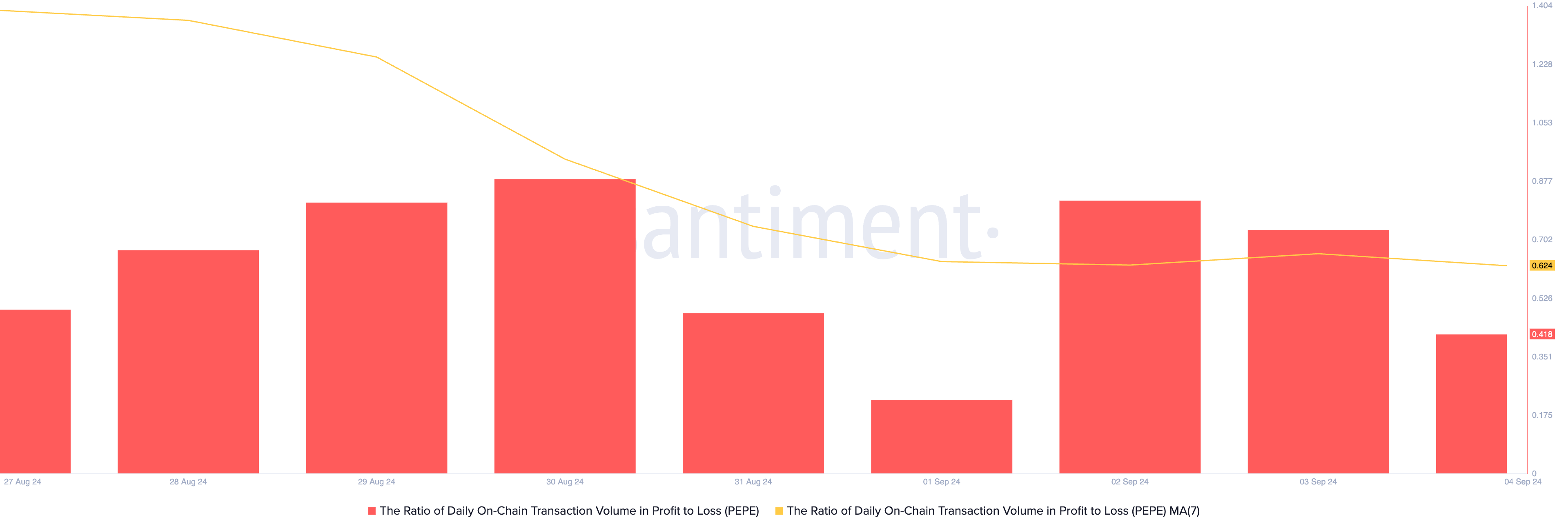

BeInCrypto has found that PEPE’s daily transaction volume ratio of profit to loss, based on a 7-day moving average, has remained below one since August 29. Currently, the ratio stands at 0.62, meaning that for every transaction ending in a loss, only 0.62 transactions are profitable.

The decline in PEPE’s price and the low profitability of its daily transactions have led its large holders to reduce their exposure gradually. This can be gleaned from the drop in the daily count of large transactions involving the altcoin.

IntoTheBlock’s data shows that the daily count of PEPE transactions worth between $100,000 and $1 million has dropped by 86% over the past 30 days. During the same period, the number of larger transactions worth between $1 million and $10 million completed daily has decreased by 90%.

Additionally, PEPE’s large holders’ netflow has dropped by 90% over the past month, indicating substantial offloading by whales. Large holders, defined as addresses controlling more than 0.1% of the asset’s circulating supply, have been reducing their positions. Netflow tracks the difference between the amount of coins acquired and those moved out during a specific period, highlighting this downward trend.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

When their netflow drops, it means they are selling their holdings. It is a bearish sign that can trigger a wave of market-wide coin distribution, putting downward pressure on an asset’s price.

PEPE Price Prediction: Meme Coin Seeks To Extend Losses

PEPE’s one-day chart suggests further short-term decline, as its MACD line (blue) recently crossed below its signal line (orange). The MACD is a key indicator that tracks trend direction, potential reversals, and momentum changes.

When the MACD line drops below the signal line, it signals weakening momentum and a likely continuation of the downward trend. If this pattern holds, PEPE’s price could fall to the lower boundary of its falling wedge at $0.0000062.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

If bulls fail to defend this support level, the price might dip further to $0.0000059. However, a surge in demand could push PEPE’s value up to $0.0000086.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vitalik Buterin Proposes to Replace EVM with RISC-V

Ethereum (ETH) co-founder Vitalik Buterin has proposed overhauling the blockchain’s smart contract infrastructure by replacing the Ethereum Virtual Machine (EVM) with RISC-V, a widely adopted open-source instruction set architecture.

This shift aims to address one of Ethereum’s key scaling bottlenecks by dramatically improving the efficiency and simplicity of smart contract execution.

Buterin Proposes Ditching EVM for RISC-V

The proposal was detailed in a post on the Ethereum Magicians forum. In it, Buterin suggested that smart contracts could eventually be compiled to RISC-V rather than EVM bytecode.

According to Buterin, this shift addresses long-term scalability challenges. This particularly includes keeping block production competitive and improving zero-knowledge (ZK) EVM-proof efficiency.

“It aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer’s simplicity – in fact, it is perhaps the only way to do so,” he wrote.

Current ZK-EVM implementations spend around half of their proving cycles on EVM execution. By switching to a native RISC-V VM, Ethereum could potentially achieve up to 100x efficiency gains.

Importantly, many fundamental aspects of Ethereum’s architecture would remain unchanged, preserving continuity for developers and users. Core abstractions such as accounts, smart contract storage, ETH balances, and cross-contract calls would function exactly as they do today.

Developers would still write contracts in familiar languages like Solidity or Vyper. These would simply be compiled to RISC-V rather than EVM bytecode. Tooling and workflows would remain largely intact, ensuring a smooth transition.

Crucially, the proposal ensures backward compatibility. Existing EVM contracts will remain fully operational and interoperable with new RISC-V contracts.

Buterin outlines several potential implementation paths forward. The first would support both EVM and RISC-V smart contracts natively. The second suggests wrapping EVM contracts to run via an interpreter written in RISC-V. Thus, it would enable a full transition without breaking compatibility.

The third, more modular approach, builds on the second by formally enshrining interpreters as part of the Ethereum protocol. This would allow the EVM and the future virtual machines to be supported in a standardized way.

Buterin stated that the idea is “equally as ambitious as the beam chain effort.”

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum. But for the execution layer to see similar gains, this kind of radical change may be the only viable path,” Buterin added.

For context, the Ethereum Beam Chain is a redesign of Ethereum’s consensus layer (Beacon Chain). It focuses on faster block times, faster finality, chain snarkification, and quantum resistance. The development will likely begin in 2026.

This proposal fits into Ethereum’s broader vision of modularity, simplicity, and long-term scalability. Previously, BeInCrypto reported on Buterin’s privacy-centric plans for the blockchain.

The proposal focused on integrating privacy-preserving technologies. Moreover, the Pectra upgrade is also nearing, with the launch expected on May 7.

Meanwhile, ETH continues to face market headwinds, trading at March 2023 lows. This year has been quite hard for the altcoin, as it saw a decline of 50.8%. In fact, Ethereum dominance hit a 5-year low last week.

Nonetheless, BeInCrypto data showed a slight recovery over the last 14 days. ETH rose by 6.1%. Over the past day alone, it saw modest gains of 1.7%. At the time of writing, ETH was trading at $1,639.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

Solana started a fresh increase from the $120 support zone. SOL price is now consolidating and might climb further above the $142 resistance zone.

- SOL price started a fresh increase above the $125 and $132 levels against the US Dollar.

- The price is now trading above $130 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $142 resistance zone.

Solana Price Gains Over 5%

Solana price formed a base above the $120 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $125 and $132 resistance levels.

The pair even spiked toward the $145 resistance zone. A high was formed at $143.06 and the price is now retreating lower. There was a move below the 23.6% Fib retracement level of the upward move from the $135 swing low to the $143 high.

Solana is now trading above $130 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $137 on the hourly chart of the SOL/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $135 swing low to the $143 high.

On the upside, the price is facing resistance near the $142 level. The next major resistance is near the $145 level. The main resistance could be $150. A successful close above the $150 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

Pullback in SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $138.50 zone. The first major support is near the $137 level and the trend line.

A break below the $137 level might send the price toward the $132 zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $137 and $132.

Major Resistance Levels – $142 and $145.

Market

Bitcoin Price Breakout In Progress—Momentum Builds Above Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $86,500 zone. BTC is gaining pace and might continue higher in the near term.

- Bitcoin found support at $84,200 and started a recovery wave.

- The price is trading above $85,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 zone.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $83,200 level and started a fresh increase. BTC was able to climb above the $84,200 and $85,000 resistance levels.

There was a break above a connecting bearish trend line with resistance at $85,000 on the hourly chart of the BTC/USD pair. The bulls were able to pump the price above the $86,500 resistance. It even spiked above $87,000. A high is formed near $87,562 and the price might continue to rise unless there is a move below the 23.6% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high.

Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $87,500 level. The first key resistance is near the $88,000 level.

The next key resistance could be $88,800. A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $87,000 level. The first major support is near the $86,750 level.

The next support is now near the $86,000 zone. Any more losses might send the price toward the $85,750 support or the 50% Fib retracement level of the upward move from the $84,007 swing low to the $87,562 high in the near term. The main support sits at $84,850.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $86,750, followed by $86,000.

Major Resistance Levels – $87,500 and $88,000.

-

Market14 hours ago

Market14 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market20 hours ago

Market20 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market18 hours ago

Market18 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market19 hours ago

Market19 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Market15 hours ago

Market15 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point