Market

PENDLE Token Outperforms BTC and ETH with a 10% Rally

PENDLE has surged by 10% in the past 24 hours, making it the market’s top gainer during this period. The altcoin has even outperformed major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

With buying activity still underway, the PENDLE token is poised to extend its uptrend in the short term.

PENDLE Soars 43% After March Lows

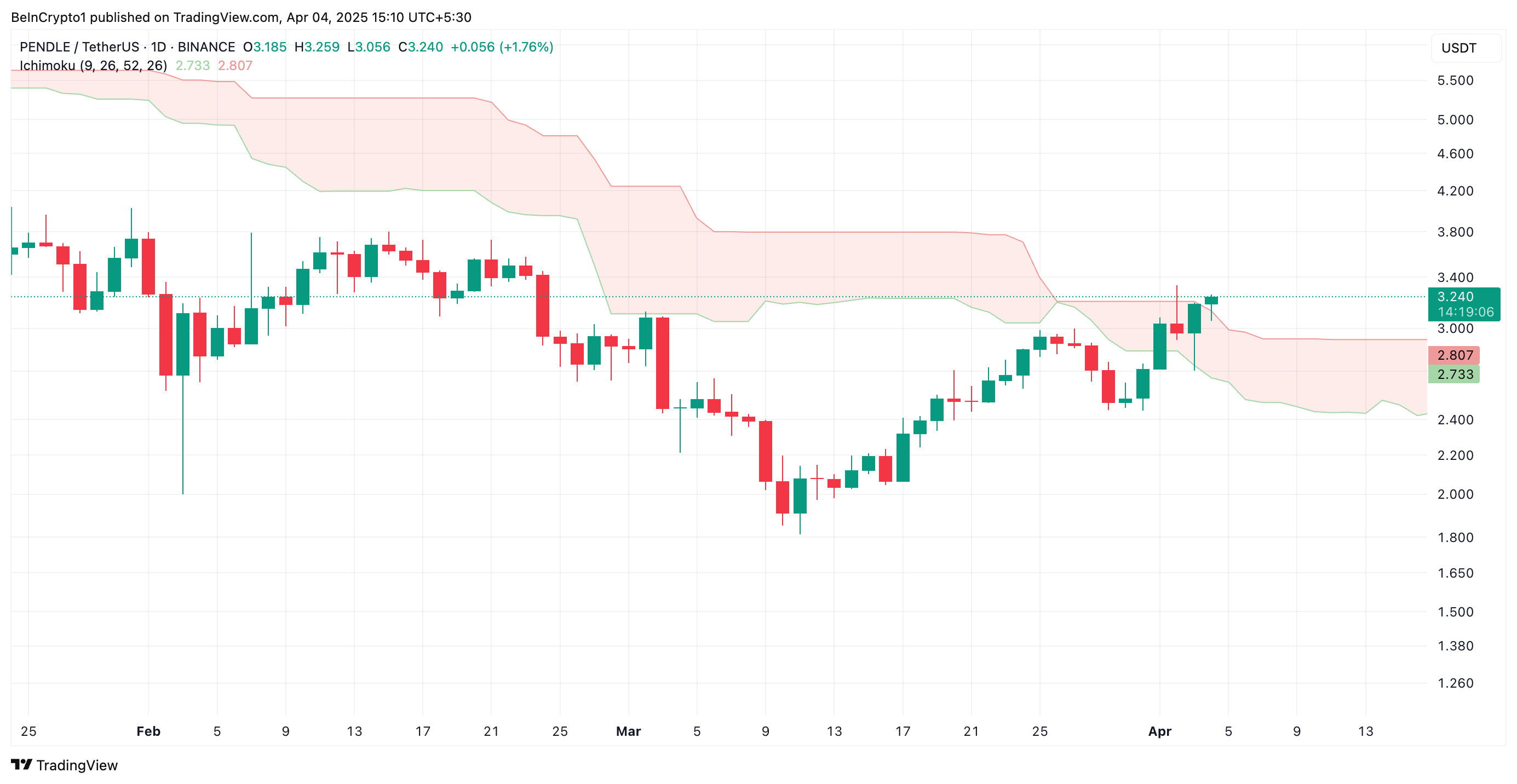

PENDLE cratered to a seven-month low of $1.81 on March 11. As sellers got exhausted, the token’s buyers regained dominance and drove a rally. Trading at $3.24 at press time, PENDLE’s value has since climbed 43%.

The double-digit surge in the altcoin’s price has pushed it above the Leading Spans A and B of its Ichimoku Cloud indicator. They now form dynamic support levels below PENDLE’s price at $2.73 and $2.80, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades above the leading spans A and B of this indicator, its price is in a strong bullish trend. The area above the Cloud is considered a “bullish zone,” indicating that market sentiment is positive, with PENDLE buyers in control.

This pattern suggests that the token’s price could continue to rise, with the Cloud acting as a support level if prices pull back.

In addition, PENDLE currently trades above its Super Trend indicator, confirming the likelihood of extended gains.

The Super Trend indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is above this line, it signals bullish momentum in the market. In this scenario, this line represents a support level that will prevent the price from any significant dips. For PENDLE, this is formed at $2.34.

PENDLE Holds Above Key Trendline

Since its rally began on March 11, PENDLE has traded above an ascending trendline. This pattern forms when a series of higher lows connect, indicating that the price of an asset is consistently rising over time.

It represents a bullish trend, showing that PENDLE demand exceeds supply, with buyers pushing prices higher.

This trendline acts as a support level. With the token’s price bouncing off the trendline, it signals that the asset is in an uptrend and likely to continue. In this scenario, PENDLE could rally to $3.60.

However, if selloffs commence, the PENDLE token could lose some of its recent gains and fall to $3.06.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China’s M2 Surge Could Send Bitcoin to $90,000

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s (BTC) price, with $90,000 in sight. Global and regional liquidity is expanding, a trend that has historically proven bullish for risk assets like crypto.

Will Bitcoin Follow As China’s M2 Money Supply Rises?

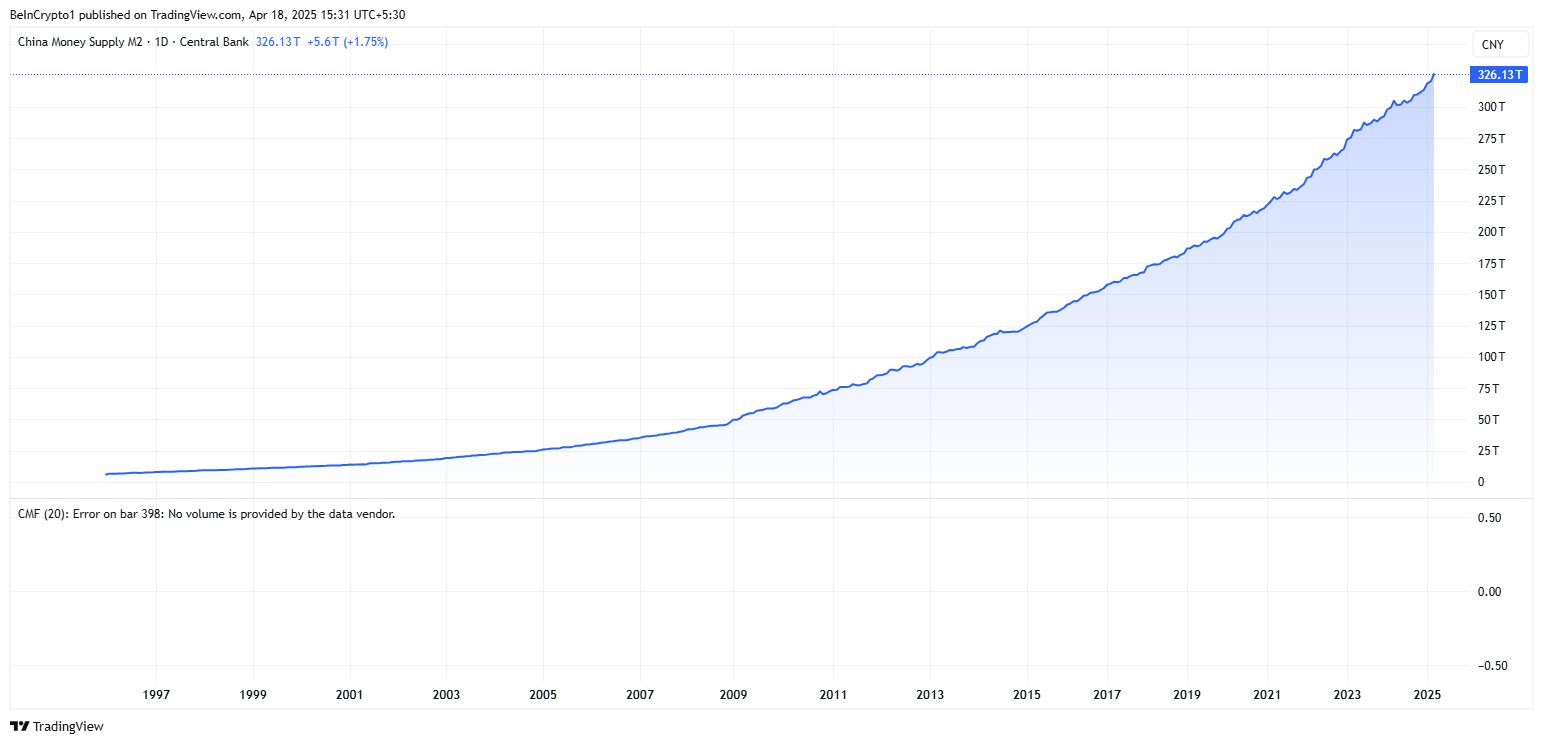

According to data on TradingView, China’s M2 money supply has reached a record $326.13 trillion, steadily surging to new record highs.

A rise in M2 signals greater liquidity in the financial system, suggesting more money is often seeking returns in riskier assets like Bitcoin and altcoins or others, such as equities and real estate.

“China’s M2 money supply just hit 326 trillion. The money printers are back on. Risk assets are about to go parabolic.,” analyst Kong Trading remarked.

Data on BGeometrics show that the global M2 is rising, a trend similar to that seen in China’s M2 money supply. Recent spikes have taken both metrics to their respective peaks.

Against this backdrop, analysts suggest a strong upside may be imminent for Bitcoin and altcoins. BeInCrypto contacted Brickken market analyst Enmanuel Cardozo D’Armas, who said Bitcoin could retest $90,000 soon.

“If China’s M2 keeps growing, it could give Bitcoin a push upwards, based on what we’ve seen before. Right now, Bitcoin’s at $85,000, and if M2 keeps increasing, we could potentially see a retest of $90,000,” Enmanuel Cardozo D’Armas told BeInCrypto.

This target aligns with yesterday’s US crypto news, where Blockhead Research Network (BRN) analyst Valentin Fournier highlighted the $90,000 target for Bitcoin price.

Meanwhile, Cardozo D’Armas articulated that China’s M2 money supply is projected to hit record levels by the end of 2025. In his opinion, more money floating around in China could mean more people willing to invest their cash into riskier assets like crypto, especially now that China’s stance is shifting positively.

According to the analyst, the $90,000 threshold is an important resistance level, necessary to conquer before a run-up to the $100,000 milestone. However, whether this is attainable by mid-year remains debatable amid macroeconomic jitters.

“But it’s not a sure bet, as there are a lot of things that could affect the markets at the moment. If the Fed cuts rates in May or June, as some expect, that could add more fuel. On the flip side, if trade tensions with China or crypto regulations tighten again, we might not see those targets hit,” the Brickken market analyst added.

Indeed, there remain concerns about Trump’s tariff chaos and China’s retaliatory stance. Amidst these uncertainties, investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

The macro context also includes a hawkish Federal Reserve (Fed) stance from Jerome Powell, which ruled out any imminent rate cuts.

Reports also indicate that China is liquidating seized cryptocurrencies through private firms to support local government finances amid economic struggles.

Cognizant of these factors, Cardozo D’Armas explained that while China’s M2 can contribute to Bitcoin’s upward momentum, especially in bullish times, it is not the only thing crypto market participants should pay attention to.

Despite the bullish prediction, traders and investors should brace for macroeconomic headwinds, among other elements, which could temper any near-term gains.

Charts of the Day

This chart suggests Bitcoin may follow China’s M2 trend toward a price surge.

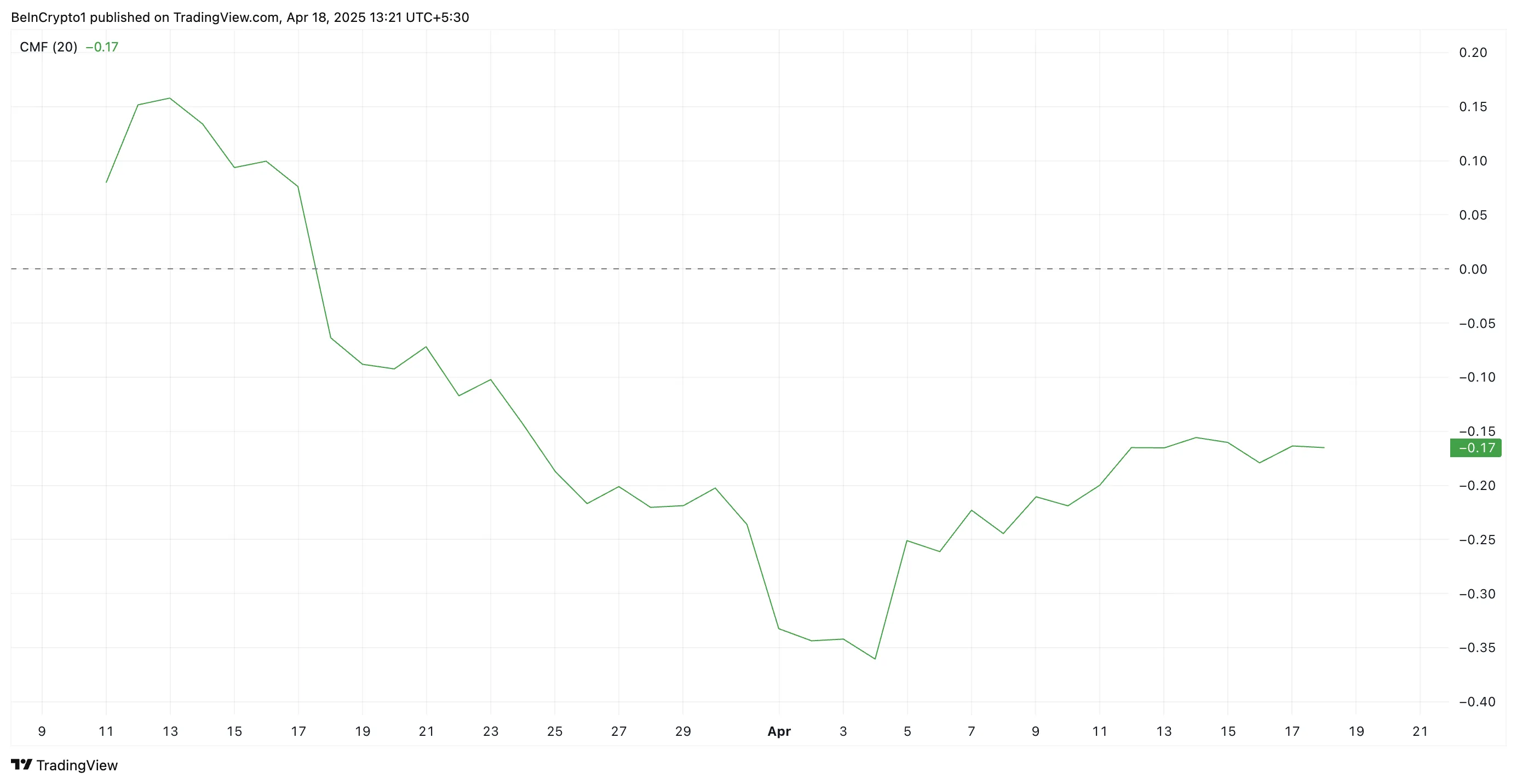

This chart shows a historical correlation where rising M2 often precedes altcoin price surges.

“Altcoins don’t run until liquidity breaks out. It’s time,” crypto analyst TechDev quipped.

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $316.25 (-0.30%) |

| Coinbase Global (COIN) | $175.03 | $175.02 (-0.009%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.51%) |

| MARA Holdings (MARA) | $12.66 | $12.68 (+0.16%) |

| Riot Platforms (RIOT) | $6.46 | $6.46 (+0.009%) |

| Core Scientific (CORZ) | $6.63 | $6.65 (+0.29%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

100 Million Tokens Could Trigger Decline

One hundred million Pi Network (PI) tokens, valued at approximately $60 million, is about to be unlocked through the remainder of April.

This may intensify the already bearish momentum that has plagued the token in recent weeks, raising concerns of a further slide toward its all-time low.

PI Struggles Under Bearish Sentiment

According to PiScan, 9.5 million tokens worth $5.76 million at current market prices are due to be released into circulation today. This is part of a broader schedule that will see over 1.56 billion PI tokens released over the next 12 months.

With recent broader market headwinds, this month’s tranche of tokens to be unlocked could trigger heightened selling activity, especially given the current lack of strong demand for the altcoin.

Meanwhile, technical indicators suggest weakening support. For example, PI’s Balance of Power (BoP) is declining at press time, and it is currently below zero at 0.75.

This indicator measures an asset’s buying and selling pressures. When it falls like this, it indicates that sellers are currently in control, exerting more influence over price action than buyers. This confirms the bearish trend in the PI spot markets and signals continued downward pressure on its price.

Moreover, PI’s Chaikin Money Flow (CMF) remains firmly below the center line, and has been so positioned since its price decline began on February 26. This momentum indicator currently stands at -0.17.

PI’s negative CMF indicates more selling pressure than buying pressure, meaning money flows out of the asset. This also confirms the bearish sentiment and points to potential further price declines.

PI Could Fall to All-Time Low

PI currently trades below its 20-day Exponential Moving Average, which forms dynamic resistance above its price at $0.70.

The 20-day EMA measures PI’s average price over the past 20 trading days, giving more weight to recent prices. With PI currently trading below this key moving average, it indicates bearish short-term momentum.

It suggests that sellers dominate, and the asset could face continued downward pressure. If the decline persists, PI could revisit its all-time low of $0.40.

Conversely, a resurgence in demand for the altcoin could invalidate this bearish thesis. PI could break above its 20-day EMA and rally toward $0.95 in this scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vietnam Partners with Bybit to Launch Legal Crypto Exchange

Vietnam’s Finance Minister Nguyen Van Thang met with Bybit CEO Ben Zhou on April 17 at the Ministry’s headquarters to discuss potential cooperation in the digital asset space.

The meeting marked a significant step forward in fostering cooperation to build a legal framework for digital assets. It also advanced the plan to establish Vietnam’s first virtual asset exchange.

Bybit and Vietnam Explore Crypto Opportunities

According to the official portal of the Ministry of Finance, Ben Zhou, co-founder of Bybit, and his delegation met with leaders from various departments of the Ministry on the morning of April 17.

The Ministry reported that Zhou is currently exploring Vietnam’s digital asset market and expressed his desire to cooperate with and invest in the country.

During the meeting, Zhou also addressed a recent security breach, in which Bybit lost approximately $1.5 billion due to a hack. However, he emphasized that all investors on the platform were fully reimbursed.

The CEO said the incident did not affect users or cause any major disruption. This outcome, according to Zhou, was possible due to Bybit’s transparency and uninterrupted withdrawal services. He noted that user assets on Bybit are backed on a 1:1 basis.

Meanwhile, Minister Nguyen Van Thang appreciated Bybit’s cooperative intentions. He acknowledged the rapid global growth of blockchain technology and digital assets, including in Vietnam, where the market is expanding quickly and shows great potential.

The Minister also highlighted Vietnam’s efforts to submit a pilot resolution to the government. This resolution aims to establish a regulated exchange for digital assets in Vietnam. The Ministry welcomed Bybit’s proposal to support training, operational process development, risk control, and legal framework design in the country.

“The Ministry of Finance highly appreciates Bybit’s goodwill in proposing cooperation and support in areas such as training, developing risk control systems, building operational procedures for exchanges, and establishing a legal framework. These are all critical issues that require serious attention and thorough implementation,” Minister Thang stated during the meeting.

In addition to his meeting with the Ministry of Finance, Ben Zhou met privately with Nguyen Duy Hung, CEO of SSI Securities Corporation. They discussed the future of finance and digital assets. SSI is one of the oldest securities firms operating in Vietnam’s stock market.

Recently, SSI partnered with Tether and KuCoin to promote blockchain startups in Vietnam. The company also announced the launch of SSI Digital Ventures, an investment arm with an initial capital of $200 million. This fund may grow to $500 million as SSI continues collaborating with more partners to support blockchain startups in Vietnam.

“Different generations, different journeys — I’ve spent my life in traditional finance, while Ben is one of the pioneers shaping the world of crypto. Tonight, we sat down at my home and shared stories about the future of finance — where tradition and innovation meet to create lasting value,” Nguyen Duy Hung said.

Vietnam Races to Build Legal Framework for Crypto

The Vietnamese government is currently accelerating efforts to regulate digital assets.

In January 2025, the Prime Minister instructed officials to classify different types of digital assets. The government also proposed piloting digital asset exchanges in Ho Chi Minh City and Da Nang. The goal is to create a transparent trading environment, reduce investor risk, and prevent illegal activities such as money laundering.

Additionally, General Secretary To Lam officially assigned One Mount Group to develop a Layer 1 blockchain network, “Make in Vietnam,” with an investment of up to $500 million.

The meetings between Bybit, the Ministry of Finance, and SSI represent a rare moment of engagement between the Vietnamese government and a major crypto company. This comes at a time when crypto trading still operates in a legal gray area.

According to Chainalysis, Vietnam ranked 5th globally in the 2024 Global Crypto Adoption Index. The country now has over 17 million crypto asset holders, and blockchain-related capital flows reached more than $105 billion between 2023 and 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoWhy XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge

-

Market19 hours ago

Market19 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin19 hours ago

Altcoin19 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market22 hours ago

Market22 hours agoBitcoin Price Poised for $90,000 Surge

-

Altcoin22 hours ago

Altcoin22 hours agoXRP Continues To Outpace ETH For 5 Months; What Lies Ahead?

-

Market20 hours ago

Market20 hours agoXRP Price Finds Stability Above $2 As Opposing Forces Collide

-

Altcoin20 hours ago

Altcoin20 hours agoCoinbase Reveals Efforts To Make Its Solana Infrastructure Faster, Here’s All

-

Market15 hours ago

Market15 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence