Market

PayPal Adds Support for Solana and Chainlink

PayPal has expanded its cryptocurrency offerings in the US by adding support for Solana (SOL) and Chainlink (LINK).

These tokens join PayPal’s existing lineup, which includes Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and its native stablecoin, PYUSD.

PayPal’s Crypto Expansion Highlights Rising Demand for Solana and Chainlink

Both Solana and Chainlink play critical roles in the blockchain space. Solana supports fast, low-cost transactions and is widely used in decentralized finance (DeFi), gaming, and Web3 applications.

Chainlink, on the other hand, is essential for enabling smart contracts to access real-world data through decentralized oracles.

According to BeInCrypto data, the two assets currently rank among the top fifteen cryptocurrencies by market capitalization. This makes them strategic additions to PayPal’s crypto offering.

May Zabaneh, PayPal’s Vice President of Blockchain and Digital Currencies, explained that the update reflects strong user demand for more crypto options.

According to Zabaneh, the goal is to give users greater flexibility and more ways to interact with digital assets across PayPal’s ecosystem.

“Since we initially made cryptocurrencies available on PayPal and Venmo, we’ve been listening to our users about what they want to do with crypto on our platforms. One piece of feedback we’ve heard is to make additional tokens available that align with our mission of revolutionizing payments,” Zabaneh stated.

Meanwhile, PayPal’s latest move comes as the company strengthens its presence in the digital asset space. With over 434 million active users and a 45% share of the global online payments market, PayPal is in a strong position to influence how mainstream users engage with crypto.

Moreover, industry experts see this integration as a logical next step. Max Hamilton, an investment researcher at Foresight Ventures, noted that legacy companies like PayPal enjoy deep trust, regulatory experience, and extensive networks. These advantages make them well-positioned to incorporate crypto without losing ground to newer competitors.

“Established giants like [PayPal] wield an unparalleled advantage in distribution, a moat built over decades of customer acquisition, merchant relationships, and regulatory compliance And we continue to see them co-opting crypto offerings into their ecosystems so as to not be displaced by them,” Hamilton stated.

PayPal first entered the crypto space in 2020, allowing users to buy and hold Bitcoin and Ethereum.

Since then, the company has deepened its involvement in the emerging sector by launching PYUSD, a dollar-pegged stablecoin, on Ethereum in 2023.

In 2024, it expanded PYUSD to the Solana network. This move helped boost the stablecoin’s circulating supply to $733 million as of press time.

Earlier this year, the company revealed plans to embed PYUSD more deeply into its ecosystem. This includes enabling merchants to accept it for payments and expanding use cases across its platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Bitget’s BGB Burns and Utility Match Binance’s BNB Boom?

Bitget is ramping up its deflationary strategy for the BGB token by initiating large-scale token burns.

In today’s fiercely competitive centralized exchange market, could token burning become a key tool to enhance the intrinsic value of exchange-native tokens?

Bitget’s Token Burn Strategy

According to Bitget’s latest announcement, the exchange burned 30 million BGB tokens in Q1 2025. The BGB circulating supply decreased from 1.2 billion to approximately 1.17 billion tokens, a 2.5% drop.

On December 30, 2024, Bitget completed a massive burn of 800 million BGB, representing 40% of the token’s original total supply. This move reduced the BGB supply from 2 billion to 1.2 billion tokens.

Looking ahead, Bitget has outlined a long-term tokenomics roadmap beginning in 2025. The exchange will allocate 20% of profits from both the Bitget Exchange and Bitget Wallet to buy back and burn BGB every quarter—a strategic shift aimed at boosting the long-term value of BGB.

One of the most successful examples of token burns is Binance. According to BNB Burn Info, Binance has burned over 59 million BNB to date. This deflationary model has helped BNB surge from under $1 in 2017 to over $600 in 2024.

The ongoing reduction in BNB’s supply, paired with the strong ecosystem of Binance Smart Chain (BSC), has positioned BNB as one of the world’s most valuable exchange tokens. Bitget appears to be following in these footsteps—but the key question remains: Can BGB replicate BNB’s success story?

Is Burning BGB Enough to Boost Price Like BNB?

According to CoinGecko, BGB reached its all-time high (ATH) of $8.45 earlier in 2025. The burn of 800 million tokens at the end of 2024 created immediate scarcity, helping drive this price surge.

However, this figure still pales in comparison to BNB’s performance. To sustain and increase value, Bitget must go beyond reducing supply and significantly expand BGB’s real-world utility.

Starting in January 2025, BGB has become the primary token for multi-chain gas payments via Bitget Wallet’s GetGas feature. This allows users to pay gas fees on major blockchains like Ethereum, Solana, and BNB Chain using BGB, USDT, or USDC—eliminating the need for chain-specific gas tokens.

Additionally, Bitget integrates BGB into real-world payment scenarios through PayFi and the Bitget Card. The PayFi initiative aims to make BGB a practical payment method for daily expenses like dining, travel, and shopping.

This effort expands BGB’s utility beyond the blockchain and positions it as a bridge between decentralized finance (DeFi) and everyday life—echoing Binance’s ambitions for BNB.

While Bitget is on the right track, achieving BNB-level growth still poses significant challenges. First, Bitget’s ecosystem is smaller and less developed than Binance’s. Second, the actual adoption rate of new features like multi-chain gas payments and PayFi will directly influence BGB’s real-world demand.

Finally, while Binance has spent years building brand trust and a loyal user base, Bitget is still establishing its position in the market. To sustain long-term growth, Bitget must balance reducing supply and boosting demand through practical, real-world applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

JasmyCoin Surge Defies “Dead Cat Bounce” Fears

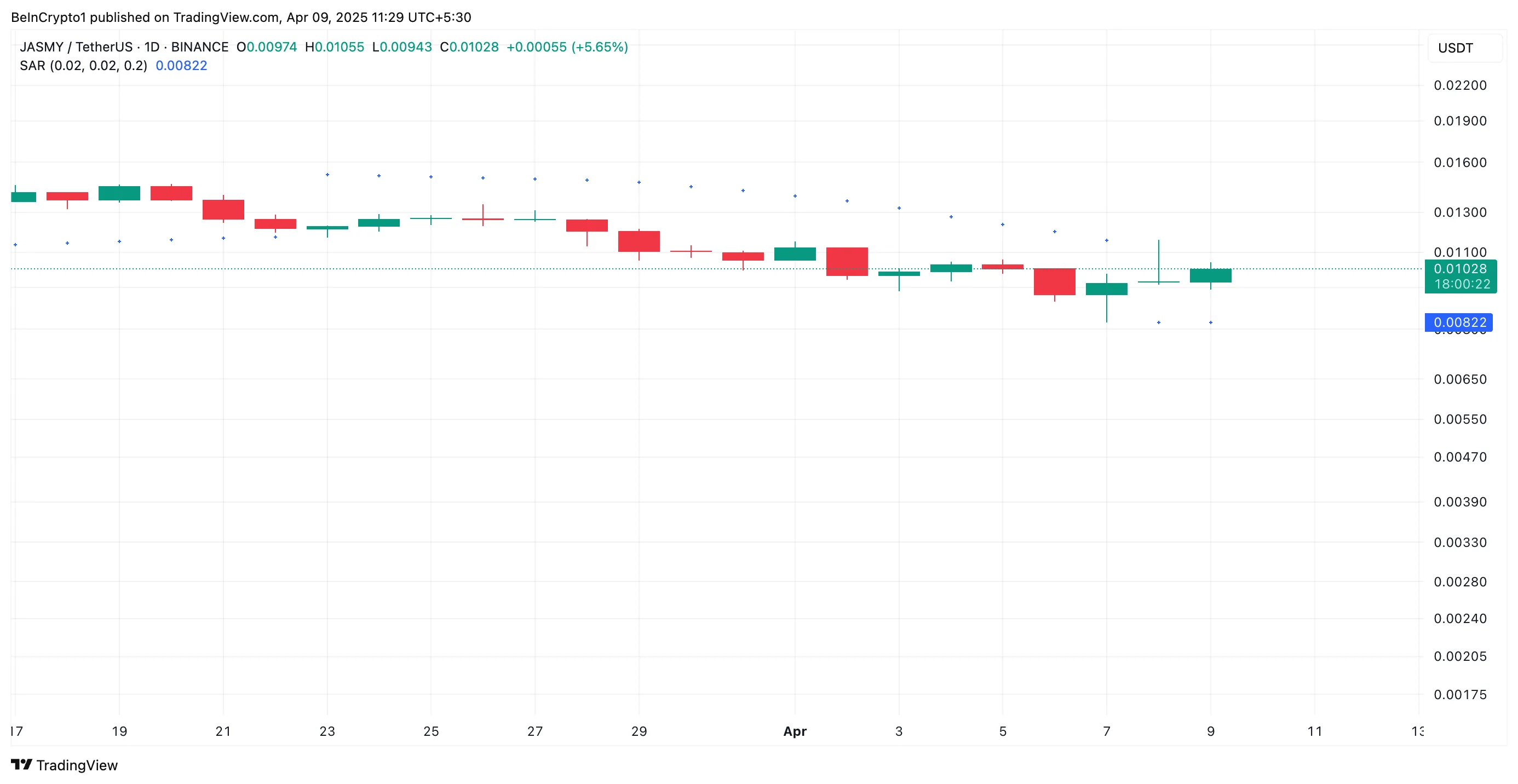

JasmyCoin has emerged as today’s top gainer, registering a 4% price increase over the past 24 hours. This surge comes after a sharp drop earlier this week when the altcoin plunged to a 12-month low on Monday.

While the sudden surge has sparked concerns that it could be a temporary “dead cat bounce,” on-chain and technical indicators suggest that the rally is likely supported by genuine new demand for JASMY.

JASMY Shows Sustained Strength

A dead cat bounce occurs when an asset’s declining price recovers temporarily before resuming its downward trend. It is typically driven by short-term market optimism but lacks strong underlying demand.

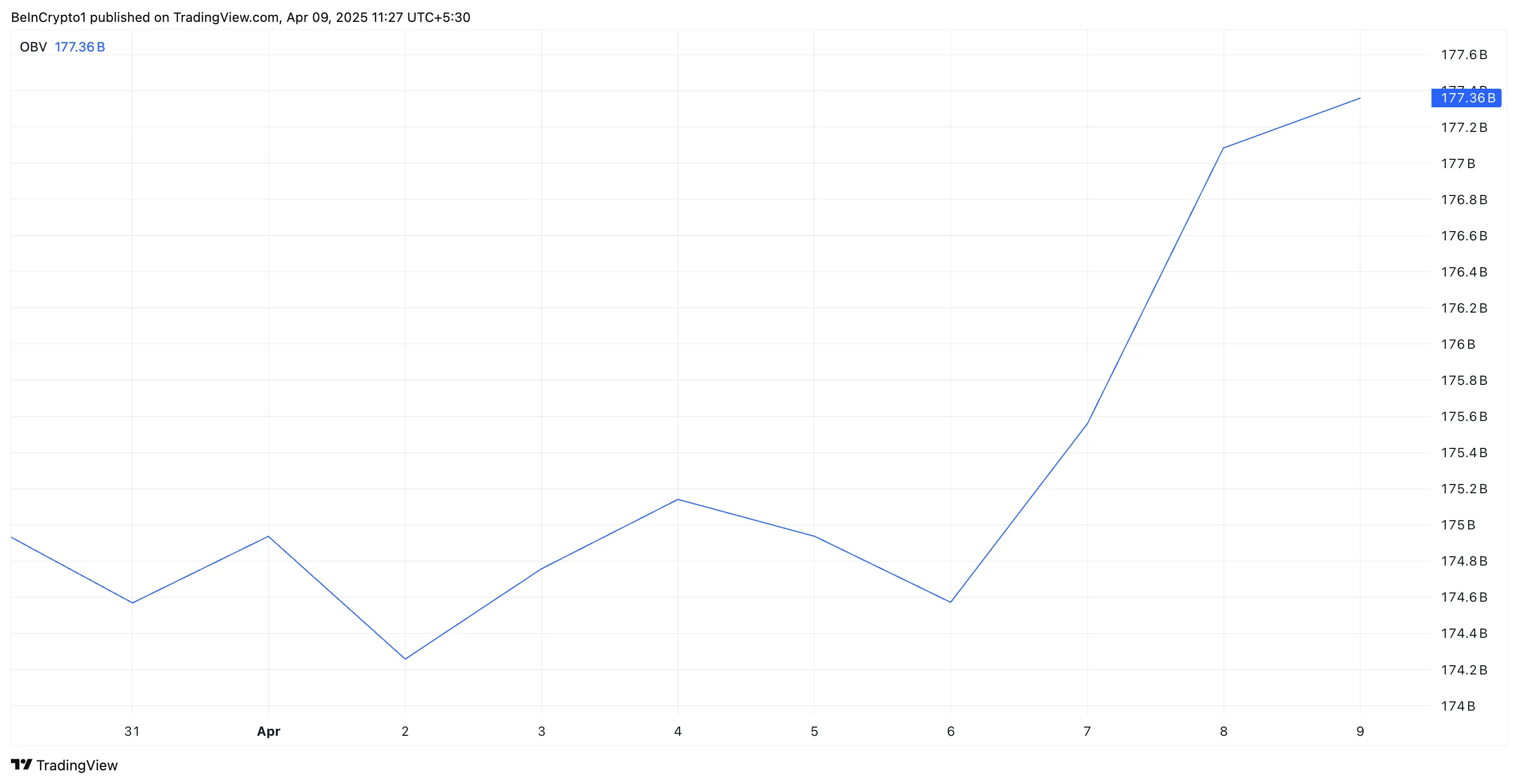

This is not the case for JASMY, whose technical and on-chain indicators reflect a resurgence in new demand for the altcoin. For example, its climbing on-balance-volume (OBV) highlights this.

As of this writing, this indicator, which measures an asset’s cumulative flow of volume, is in an uptrend at $177.36 billion. For context, since JASMY fell to a one-year low of $0.0082 on Monday, its OBV has rallied 2%, indicating an uptick in new demand for the altcoin.

Further, JASMY now trades above the dots of its Parabolic Stop and Reverse (SAR) indicator, confirming the bullish shift in the market’s momentum.

This indicator measures an asset’s price trends and identifies potential entry and exit points. When an asset’s price trades above the SAR, it indicates an uptrend. It suggests that the market is in a bullish phase, with the potential for further price increases.

Can JASMY Buyers Hold the Line?

At press time, JASMY trades at $0.010. It remains below the major resistance formed at $0.012. If buying pressure strengthens, the altcoin could flip this price zone into a support floor.

If succesful, it could propel JASMY’s value toward $0.017.

However, this bullish projection will be invalidated if profit-taking makes a comeback. In that scenario, JASMY’s price could revisit its 12-month low of $0.0082.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Whale Activity Peaks Amid Market Uncertainty

-

Market17 hours ago

Market17 hours agoIs Ethereum Falling to $1,000 This April?

-

Market24 hours ago

Market24 hours agoTrump-Backed WLFI Proposes Airdrop Test for USD1 Stablecoin

-

Market23 hours ago

Market23 hours agoRipple Buys Hidden Road for $1.25 Billion to Boost XRP Ledger

-

Altcoin23 hours ago

Altcoin23 hours agoRipple To Acquire Hidden Road For $1.25 Billion

-

Market22 hours ago

Market22 hours agoXRP Price, Traders Retreat Despite The US ETF Buzz

-

Market20 hours ago

Market20 hours agoRipple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

-

Altcoin20 hours ago

Altcoin20 hours agoDeveloper Advocates For Pi Network Community To Launch Liquidity Pool To Stablilize Pi Coin Price